HYCM Review Of 2026

Our team has conducted a comprehensive HYCM broker review assessing all the trading features. It includes the range of trading platforms, account tiers, list of CFD products offered, customer service, demo accounts, and regulatory status.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

HYCM Summary

| 🗺️ Tier 1 Regulation | FCA, CySEC |

| 🗺️ Tier 2 Regulation | DFSA |

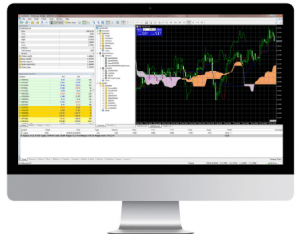

| 📊 Trading Platforms | MT4, MT5 Trading Platform, HYCM Mobile Apps |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $50 |

| 🛍️ Instruments Offered | Forex, Stocks, Indices, Crypto, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose HYCM

As a Forex broker with 40 years of experience, HYCM has offices in 5 leading financial centres across the globe, including London, Limassol (Cyprus), Dubai, Kuwait and Hong Kong, provides services for institutional and retail customers in 140 countries and holds over 20 Global awards, including Best Forex Broker, Best Trading Platform and Best Customer Service.

HYCM is not an ECN broker, but a market maker, which matches client orders internally without the need to connect to a liquidity provider. Thus, it operates a Dealing Desk model and as such, it may take the other side of its clients’ trades.

HYCM Pros and Cons

- Tight spreads

- Multiple account types

- Regulated in multiple regions

- Limited educational tools

- MetaTrader only platforms

- No cryptocurrency trading

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

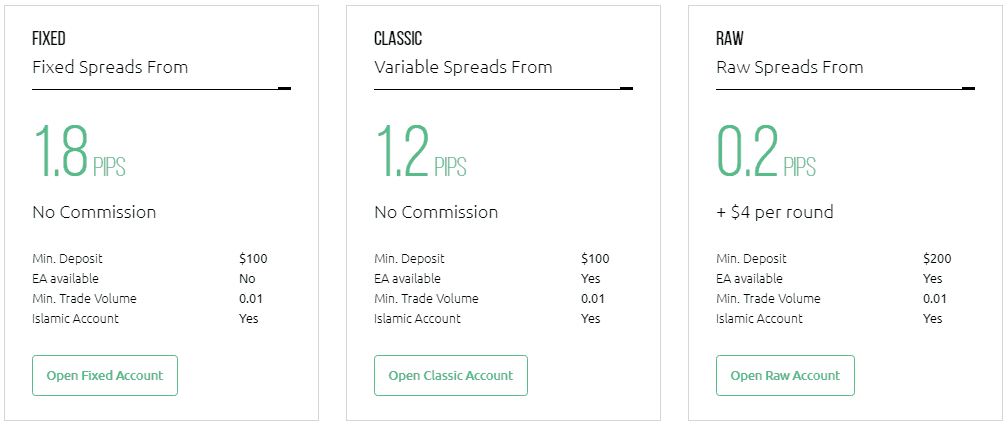

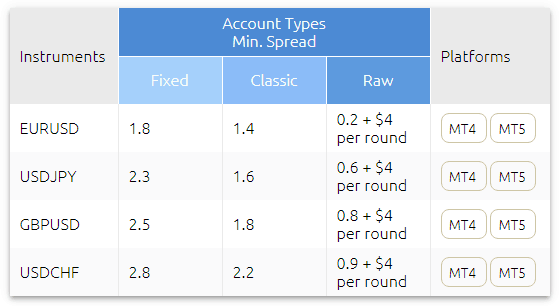

Depending on HYCM’s clients’ trading experience and investment objectives, this UAE-based forex broker offers three types of trading accounts:

- Fixed Spread Account

- Classic Account

- Raw Account

HYCM will not impose restrictions on customers to open only one live account. Several accounts can be operated simultaneously by HYCM customers, though the broker does not recommend such a practice, as trading activities may not be handled with efficiency.

Our team of experts will outline for UAE-based traders the trading conditions that come with the different account types offered by HYCM.

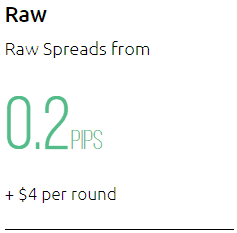

1. Raw Account Spreads

Dubai professional traders with sufficient trading experience can opt to open an HYCM Raw account. One notable feature of this account type is the tight spread, starting from 0.2 pips. Similar to classic accounts, on a raw account, you can trade with the use of expert advisors and are able to set this account to run either on the MetaTrader 4 or the MetaTrader 5.

| Raw Account Spreads | HYCM | Average Spread |

|---|---|---|

| Overall | 1.02 | 0.74 |

| EUR/USD | 0.2 | 0.21 |

| USD/JPY | 0.3 | 0.39 |

| GBP/USD | 0.4 | 0.48 |

| AUD/USD | 0.5 | 0.39 |

| USD/CAD | 0.6 | 0.53 |

| EUR/GBP | 0.6 | 0.55 |

| EUR/JPY | 0.9 | 0.74 |

| AUD/JPY | 1.1 | 1.07 |

| USD/SGD | 4.62 | 2.34 |

Compare the raw spreads offered by HYCM below:

- EUR/USD raw spread of 0.11 pips + $4

- GBP/USD raw spread of 0.53 pips + $4

- AUD/USD raw spread of 0.57 pips + $4

HYCM’s Raw Account offers the following advantages for the Dubai forex traders:

- A specialised account for high-volume traders and active traders

- Dedicated account manager

- Reduced spreads compared to the other two account types offered by HYCM (but the average spread is still higher compared to other international forex brokers)

- A low minimum deposit of $200 – meaning it’s accessible to small traders as well

2. Raw Account Commission Rate

HYCM charges a $4 commission per $100,000 of volume traded per side or $8 round-turn commission. Our team of FX experts has placed HYCM side-by-side with the standard average, and we found this online CFD provider to have higher commissions.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| HYCM Commission Rate | $4.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Use the calculator below to compare HYCM’s trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

2. Standard Account Fees

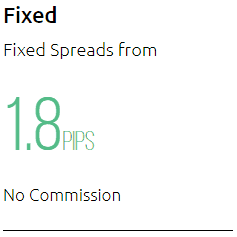

Fixed Spread Trading Accounts

Fixed Spread Trading Accounts

HYCM fixed spread account requires a minimum deposit of $100. Fixed Spread Accounts are an appropriate choice for UAE retail clients who prefer to trade smaller volumes. The broker will not charge any commissions and offers fixed spreads that start as low as 1.8 pips.

Compare the fixed spreads offered by HYCM below:

- EUR/USD fixed spread of 1.8 pips

- GBP/USD fixed spread of 2.5 pips

- AUD/USD fixed spread of 2.5 pips

Note* HYCM took a negative point in our validation process because Expert Advisors EAs are not available for this forex trading account.

Overall, the fixed account is comparable to the standard micro account.

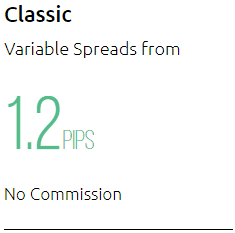

Classic Trading Accounts

Similar to fixed spread accounts, a standard account can be opened with an initial deposit of as low as $100, and the minimum trade volume allowed is 0.01 lots. However, unlike fixed spread accounts, classic accounts allow for more competitive variable spreads starting from 1.2 pips.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| HYCM Average Spread | 1.2 | 1.2 | 1.2 | 1.3 | 4 | 1.2 | 1.2 | 1.2 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

Compare the variable spreads offered by HYCM below:

- EUR/USD variable spread of 1.4 pips

- GBP/USD variable spread of 1.8 pips

- AUD/USD variable spread of 1.2 pips

UAE traders can open a classic account and also benefit from trading automatically with the use of Expert Advisors (EAs) while basing their trading decisions on timely technical analysis.

Additionally, HYCM offers the following advantages:

- No commission trading (the only fees comes in the form of the markup spreads)

- Fast order execution speed (12 milliseconds average execution speed)

- Variable spreads, which fluctuates according to the market liquidity

4. Swap-Free Account Fees

Fixed Spread Accounts also have a swap-free variation, thus, they can be a suitable choice for Islamic clients who are forbidden to earn or pay the interest due to their religious beliefs.

5. Other Fees

There are no fees for deposits and withdrawals. There is an inactivity fee of $10 per month after 90 days.

Verdict on HYCM Spreads

Active traders with large trading volumes can be better served through HYCM VIP account, which comes with lower spreads , dedicated account manager and all-inclusive market analytical tools.

Trading Platforms

| Trading Plaform | Available With HYCM |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Henyep Markets has not developed a proprietary trading platform but instead allows access to industry-leading software such as:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- HYCM Mobile Apps

HYCM has won several international awards for trading platforms offered:

- Forex Brokers In Australia, Middle East, 2019

- Best Mobile Trading Platform by Forex Awards, 2017

- Best Trading Platform, Dubai, 2017

- Best Retail Platform by FX Report Awards, 2015

- Best Retail Trading Platform by FX Report Awards, 2014

- Best Mobile Trading Platform by Foreign Exchange Awards, 2013

- Best Global Professional Trading Platform, 2014

MetaTrader 4

MetaTrader 4

Launched in 2005, MT4 is the most widely used electronic trading platform, while its cutting-edge technology has turned the platform into a standard for Forex trading. MT4 offers an array of trading tools for traders of all skill levels, along with:

- Advanced technical analysis

- A variety of flexible trading systems

- And Expert Advisors.

MT4 has a user-friendly interface and offers 3 types of forex charts, 9-time frames, 23 analytical objects, 30 built-in technical indicators, 4 asset classes and over 100 trading instruments. MT4 allows for lightning-fast order execution with an average execution time of 12 ms, while the probability for clients to experience slippage is kept at a minimum.

MT4 has a user-friendly interface and offers 3 types of forex charts, 9-time frames, 23 analytical objects, 30 built-in technical indicators, 4 asset classes and over 100 trading instruments. MT4 allows for lightning-fast order execution with an average execution time of 12 ms, while the probability for clients to experience slippage is kept at a minimum.

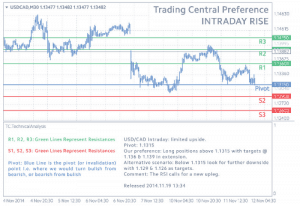

HYCM has also joined forces with Trading Central to provide its clients with extensive technical analysis, forecasts, daily newsletter, intraday trading signals as well as key levels of support, resistance, targets and stop pivots for an array of trading instruments.

Note* You can download MT4 on your desktop PC directly from HYCM’s website.

MetaTrader 5

Launched in 2010, MT5 is a powerful multi-functional, multi-asset platform, which offers advanced technical analysis tools, fundamental analysis and flexible trading systems, while it is compatible with automated trading apps such as Expert Advisors.

Built on a more advanced MQL5 code compared to its predecessor MT4, MetaTrader 5 is an appropriate choice for professionals willing to conduct extensive back-testing and trade complex derivative instruments.

MT5 comes with an arsenal of advanced technical analysis tools such as:

- 38 technical indicators

- 44 analytical objects

- 21-time frames

- As well as unlimited charts

Additionally, MetaTrader 5 allows traders to place 6 types of pending orders and take advantage of an integrated economic calendar for daily macroeconomic reports and other key events. The platform supports multiple languages, favouring a wider community of traders, and also allows access to the Trading Central tool.

Note* You can download MT5 on your desktop PC directly from HYCM’s website.

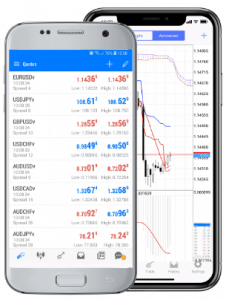

Mobile Trading Apps

Both MetaTrader 4 and MetaTrader 5 platforms can be downloaded free of charge on mobile devices (smartphones or tablets), which operate on Android and iOS. With HYCM’s mobile apps you will have the ability to open, manage and close trading positions on the go anywhere on the globe while having complete control over your trading account.

MT4 and MT5 mobile apps offer the same features as included on their desktop versions. Additionally, HYCM clients can access Primetrader – a mobile app build by HYCM experts with complete trading functionalities.

Is HYCM Safe?

HYCM has a trust score of 63, based on its regulation, reputation, and reviews.

1. Regulation

The brokerage meets regulatory requirements of three of the most highly respected jurisdictions across the globe. Business operations of Henyep Capital Markets (UK) Limited are authorised and supervised by the United Kingdom’s Financial Conduct Authority (FCA). The company obtained its UK license in 1998.

The brokerage meets regulatory requirements of three of the most highly respected jurisdictions across the globe. Business operations of Henyep Capital Markets (UK) Limited are authorised and supervised by the United Kingdom’s Financial Conduct Authority (FCA). The company obtained its UK license in 1998.

In 2014, HYCM (Europe) Ltd was granted a license by the Cyprus Securities and Exchange Commission (CySEC), allowing it to reach out to customers based in several European countries. HYCM is authorised to offer services to clientele based in Austria, Belgium, the Czech Republic, Denmark, Germany, Hungary, Italy, Poland, Spain and Sweden.

In 2014, HYCM (Europe) Ltd was granted a license by the Cyprus Securities and Exchange Commission (CySEC), allowing it to reach out to customers based in several European countries. HYCM is authorised to offer services to clientele based in Austria, Belgium, the Czech Republic, Denmark, Germany, Hungary, Italy, Poland, Spain and Sweden.

Also, HYCM Ltd falls under the regulation of the Cayman Islands Monetary Authority (CIMA).

As a regulated entity in these jurisdictions, HYCM is authorised to deal in CFDs, Rights to Interests in Investments, Rolling Spot Forex and Contracts for professional and retail customers.

As we pointed out earlier, Henyep Capital Markets (DIFC) Limited is incorporated in the United Arab Emirates and falls under the regulation of the Dubai Financial Services Authority (DFSA). The company’s focus has been set particularly on high net worth clientele in the Middle East region and has enriched its spectrum of services to suit the preferences of this client segment. DFSA is a respected regulatory body in the Gulf area dedicated to preserving the welfare of local investors.

| HYCM Safety | Regulator |

|---|---|

| Tier-1 | FCA CySEC |

| Tier-2 | DFSA |

| Tier-3 | CIMA |

2. Reputation

HYCM is one of the oldest forex brokers commencing as HY Markets in 1977 with a worldwide presence including FCA, CYSEC and DFCA in Dubai.

HYCM represents the trading name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Limited and Henyep Capital Markets (DIFC) Limited, all of which operate under one parent company – the Henyep Capital Markets group. Headquartered in Hong Kong, the Henyep Group operates a diversified portfolio of businesses across Asia, Europe and the Middle East.

Henyep Group operates a mixture of businesses and has professional expertise in the following fields:

- Capital Markets and Securities

- Financial Services

- Direct Investment

- Property

This broker maintains a modest presence in the global forex and CFD trading landscape. With approximately 2,900 Google searches per month, it ranks as the 63rd most searched forex broker based on 2024 data. Similarly, Similarweb reports that in February 2024, HYCM was the 61st most visited broker, garnering 18,000 global website visits.

HYCM offers trading services to clients in over 140 countries. There is no publicly available data on HYCM’s exact number of clients or trading volume, making it difficult to benchmark its scale compared to more prominent brokers. These figures suggest HYCM operates on a relatively small scale in terms of retail visibility and engagement.

| Country | 2025 Monthly Searches |

|---|---|

| United Arab Emirates | 390 |

| United States | 170 |

| India | 170 |

| Germany | 140 |

| United Kingdom | 110 |

| Malaysia | 70 |

| Turkey | 50 |

| Pakistan | 50 |

| France | 50 |

| Netherlands | 50 |

| Vietnam | 40 |

| Egypt | 40 |

| Spain | 40 |

| Canada | 40 |

| South Africa | 30 |

| Indonesia | 30 |

| Japan | 30 |

| Brazil | 30 |

| Cyprus | 30 |

| Hong Kong | 30 |

| Saudi Arabia | 30 |

| Cambodia | 30 |

| Colombia | 20 |

| Italy | 20 |

| Mexico | 20 |

| Singapore | 20 |

| Australia | 20 |

| Jordan | 20 |

| Nigeria | 10 |

| Thailand | 10 |

| Argentina | 10 |

| Kenya | 10 |

| Tanzania | 10 |

| Peru | 10 |

| Ecuador | 10 |

| Venezuela | 10 |

| Morocco | 10 |

| Poland | 10 |

| Greece | 10 |

| Uzbekistan | 10 |

| Ghana | 10 |

| Uganda | 10 |

| Philippines | 10 |

| Chile | 10 |

| Algeria | 10 |

| Taiwan | 10 |

| Bangladesh | 10 |

| Dominican Republic | 10 |

| Portugal | 10 |

| Botswana | 10 |

| Bolivia | 10 |

| Sweden | 10 |

| Switzerland | 10 |

| Mauritius | 10 |

| Austria | 10 |

| Costa Rica | 10 |

| Panama | 10 |

| Ireland | 10 |

| New Zealand | 10 |

| Uruguay | 10 |

| Mongolia | 10 |

| Sri Lanka | 10 |

| Ethiopia | 10 |

390 1st | |

170 2nd | |

170 3rd | |

140 4th | |

110 5th | |

70 6th | |

50 7th | |

50 8th | |

50 9th | |

50 10th |

3. Reviews

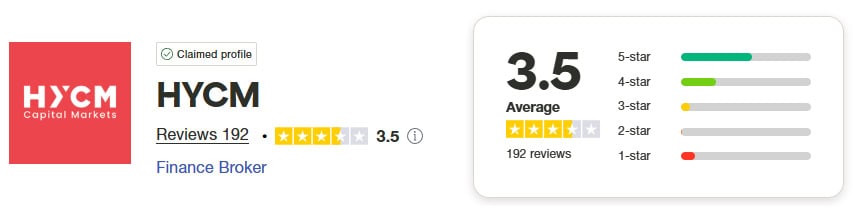

HYCM has a TrustPilot Score of 3.5 out of 5.0 from 192 reviews.

Verdict On Safety

On the other hand, because of local regulatory restrictions, HYCM cannot service customers with permanent residence in Afghanistan, Canada, Iceland, Japan, Panama, Turkey, the Bahamas and the United States. In conclusion, HYCM is a multi-regulated, award-winning Forex broker with rich business history, which offers a variety of instruments, good trading conditions, industry-leading trading platforms and outstanding customer support. You can also compare HYCM with some forex brokers that offer bonus deposits and a variety of forex trading accounts.

Deposit and Withdrawal

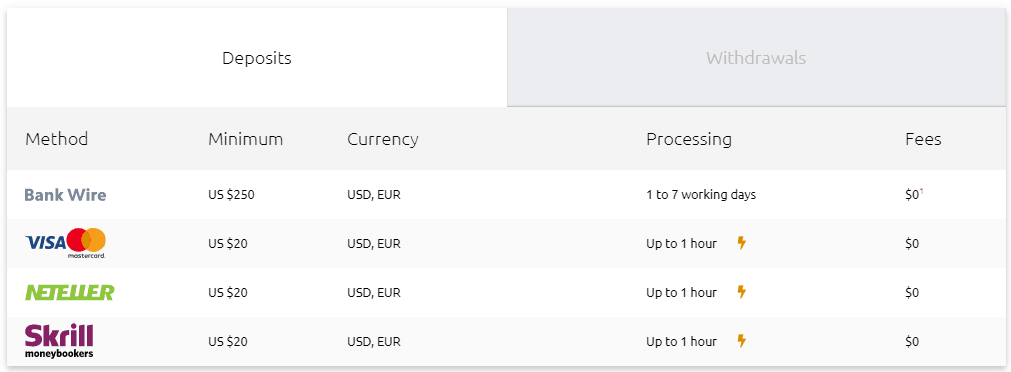

To fund your HYCM account, you can use the following payment options:

- Deposit via a debit card or a credit card (Mastercard, Visa)

- Deposit via Skrill, Neteller, Webmoney

- Deposit via wire transfer

Our team of industry experts has covered the three main advantages offered by HYCM to Dubai traders:

- Zero deposit fees

- Funds kept in segregated accounts with Tier-1 banks

- Quick deposit and withdrawal processing times

Deposit Options and Fees

If you choose to deposit via Mastercard or Visa, HYCM will ask you to provide a copy of the front of the card used as a funding source. On the other hand, if you do not wish to disclose card credentials, you can choose to make anonymous payments by using e-wallets such as Skrill or Neteller.

HYCM will not charge any commissions on deposits made via supported methods. However, there might be bank fees charged, for example, if you choose to conduct a bank wire transfer.

Note* HYCM doesn’t support PayPal, the most popular online payments system. This has weighted negatively into our star scoring system.

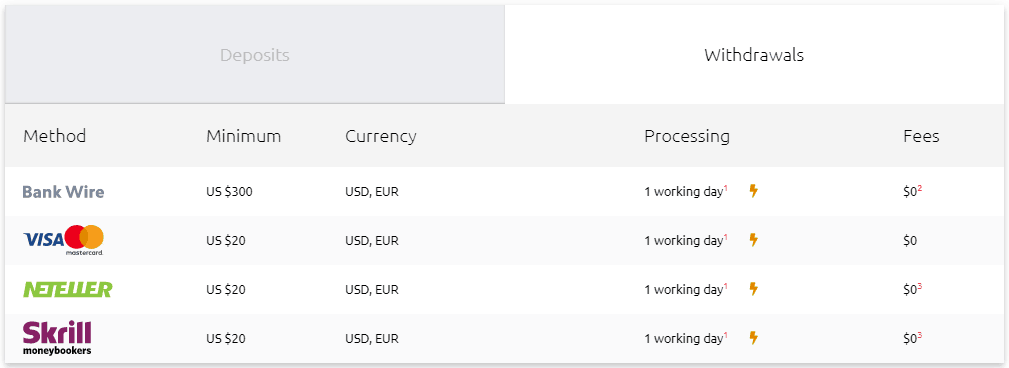

Withdrawal Options and Fees

Fund withdrawals can be processed by using the same payment methods as with deposits. Upon withdrawal, your funds will be transferred to the original source which you used to deposit. Though HYCM will process a withdrawal request within one business day, actual withdrawals may take between three and seven days to clear into your bank account, depending on the bank or credit card provider.

It is worth noting that if you withdraw less than $300 via wire transfer, HYCM will charge a handling fee of $30.

At HY Markets, UAE-based traders can choose from 6 base currencies including USD, EUR, GBP, RUB, AED, and CAD.

Note* Dubai FX traders can fund their accounts using the domestic currency United Arab Emirates Dirham AED. Deposits in local currency can help HYCM Dubai clients to save on the foreign exchange rate and the subsequent conversion fees.

Client Funds Protection and Security

Since HYCM is regulated by the FCA, the CySEC and the CIMA, it is committed to stern accounting and risk management frameworks. All client funds will be kept fully segregated into a special client account and will not be used to pay back creditors in case the brokerage goes bankrupt.

Since HYCM is regulated by the FCA, the CySEC and the CIMA, it is committed to stern accounting and risk management frameworks. All client funds will be kept fully segregated into a special client account and will not be used to pay back creditors in case the brokerage goes bankrupt.

Additionally, client funds of up to £50,000 are protected by the Financial Services Compensation Scheme (FSCS), while funds of up to €20,000 are safeguarded by the Investors Compensation Fund (ICF). The FSCS and ICF represent compensation funds of last resort for clients of FCA and CySEC respectively, in case the brokerage does not manage to settle claims against it.

Ease To Open An Account

For Dubai FX traders with little or no trading experience at all, the Demo Account offered by HY Markets is a suitable way to get your first feeling of financial markets. The broker will allow you to open a Demo Account on its MetaTrader 4 platform either in Euros or in US Dollars. The account will be funded with $50 000 in virtual money, which will remain active for 14 days.

The HYCM Demo Account allows access to the same market environment as the Live Account. The difference is that you risk no real money when you trade on a Demo.

How to Open a Demo Account with HYCM?

To open a Demo Account, you need to go through a brief registration process and log in to your Client Portal. In “Trading Account” section, simply go to “Create Demo Account”. HYCM will not require any documentation of you in order to trade via a Demo Account and you can use it for as long as you are willing to.

However, to open an HYCM live account you need to follow 3 simple steps:

- Complete the registration form and then fill out the broker’s Questionnaire

- Fund your trading account by using the method of your choice

- Submit the required documentation and you can start trading

The HYCM live trading account process can be done in three easy steps as highlighted in the figure below.

Product Range

With HYCM, clients are granted access to 5 asset classes:

With HYCM, clients are granted access to 5 asset classes:

- Forex CFDs

- Stocks CFDs

- Indices CFDs

- Commodities CFDs

- Cryptocurrencies CFDs

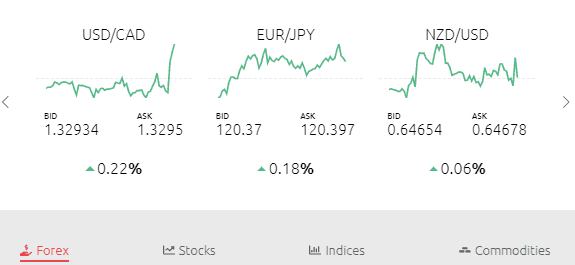

Trading Forex with HYCM

Due to its 24/5 activity, high liquidity, volatility and low costs of trading, the Foreign Exchange Market remains a preferred segment for many UAE-based traders. HYCM provides access to the Forex market through the use of derivative instruments known as Contracts for Difference (CFDs). You can choose to trade:

- 69 Forex currency pairs (major, minor and exotic currency pairs)

- Available both on MetaTrader 4 and MetaTrader 5 platforms

- Utilising maximum leverage of 1:500 via the broker’s offshore entity in the Cayman Islands.

The following snapshot visualises more detailed specifications of some of HYCM’s Forex trading products.

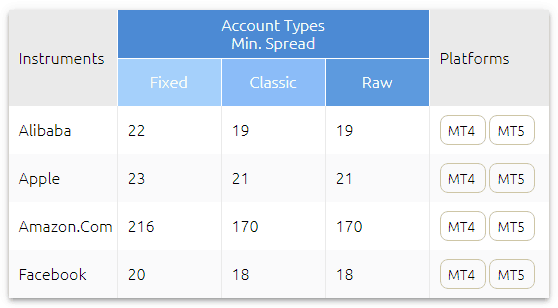

Trading CFD Stocks with HYCM

With this brokerage, UAE traders will be able to trade large-cap stocks both on MetaTrader 4 and MetaTrader 5 by using maximum leverage of 1:20. The following snapshot visualizes more detailed specifications of HYCM’s Stock trading products.

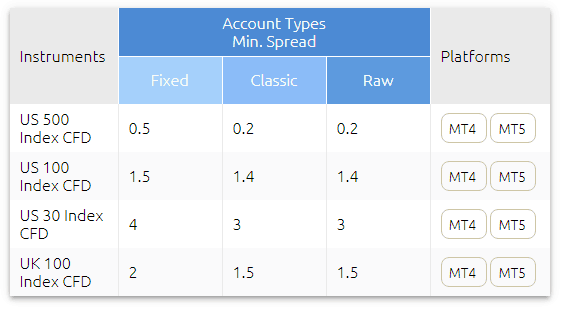

Trading CFD Indices with HYCM

Another asset class accessible for trade via CFDs includes global indices. HYCM grants access to major global stock indices from across 4 continents, including:

- 16 indices on the MetaTrader 4 trading platform

- 28 indices on the MetaTrader 5 trading platform

Note* HYCM clients can take advantage of maximum leverage of 1:100 on CFD indices.

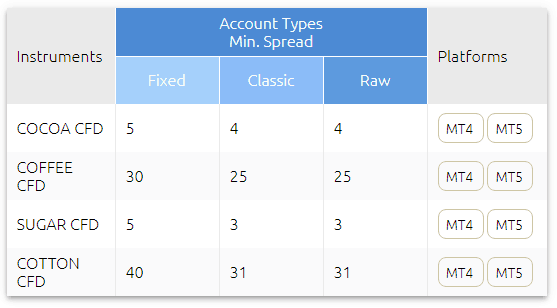

Trading CFD Commodities with HYCM

Commodity markets provide a good opportunity for UAE investors to diversify their portfolios, as they could play the role of a “safe haven segment” in times of economic and political turmoil or force majeure events.

With HYCM you will be able to trade 10 different commodities (metals, energies and soft) via CFDs by using maximum leverage of 1:133. The broker will charge no commissions on Fixed Spread and Classic accounts, while Raw account holders will be charged an additional fee on top of the bid-ask spread.

Cryptocurrency Trading

HYCM has expanded its product offering with the addition of four cryptocurrencies: Bitcoin, Litecoin, Ethereum and Ripple.

Please note: UK traders cannot trade cryptocurrency any longer, the FCA recently banned retail investor accounts from trading crypto products.

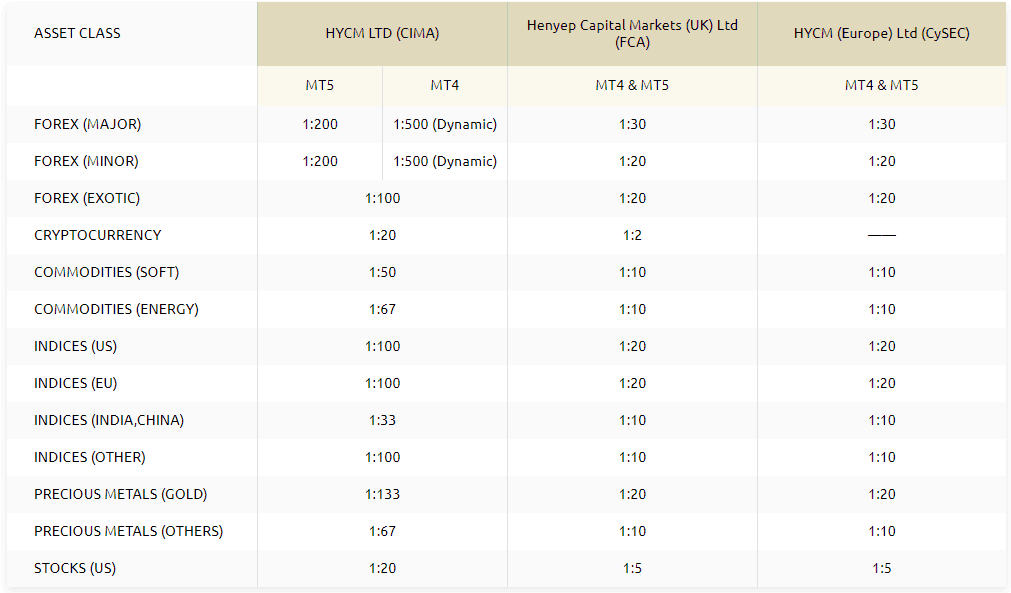

Leverage Offered by HYCM by Region

Leverage Offered by HYCM by Region

HYCM leverage offered is dependent on several factors:

- Local jurisdiction

- Trading instrument

- Trading platform

The maximum leverage is determined according to local jurisdiction:

- HYCM Ltd (CIMA) (for non-UK forex traders) offers leverage of up to 1:200 for major and minor currency pairs on MT5 and leverage of up to 1:500 for major and minor pairs on MT4.

- Henyep Capital Markets (UK) Ltd (FCA) (for UK-based forex traders) offers leverage of up to 1:30 for major currency pairs and up to 1:20 for minors and exotics traded on both MT4 and MT5 platforms.

- HYCM (Europe) Ltd (CySEC) (for EU-based forex traders) offers leverage of up to 1:30 for major currency pairs and up to 1:20 for minor and exotic pairs traded on both MT4 and MT5 platforms.

The different leverage ratios depending on the asset class, jurisdiction and trading platform are visualized below.

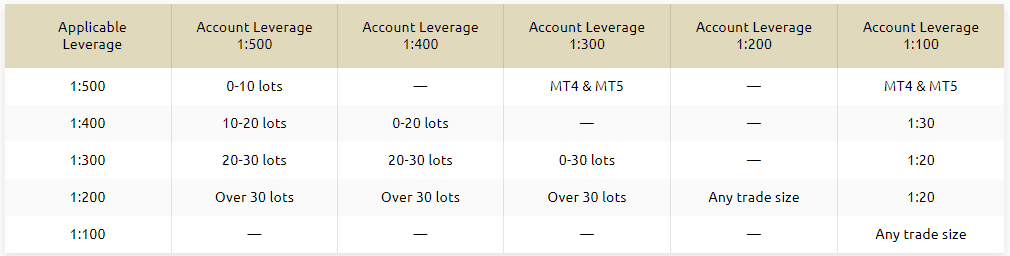

HYCM uses a dynamic forex leverage model, which is available only on the MetaTrader 4 platform. The general rule is that as the volume of a selected trading instrument increases, the client will be granted access to lower maximum leverage.

HYCM uses a dynamic forex leverage model, which is available only on the MetaTrader 4 platform. The general rule is that as the volume of a selected trading instrument increases, the client will be granted access to lower maximum leverage.

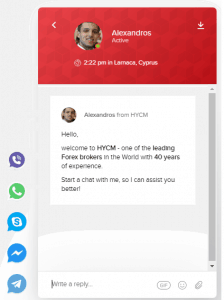

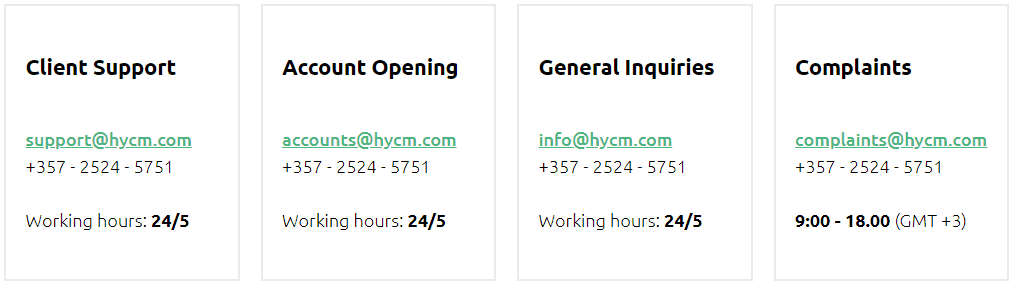

Customer Service

As a Forex broker with rich business history, HYCM provides professional customer support service available 24/5, five days a week. In 2012, the company was named Best Customer Service Provider by Forex Awards. HYCM delivers its client support service in 12 different languages:

- Arabic

- Czech

- German

- English

- Spanish

- Persian

- French

- Italian

- Polish

- Russian

- Swedish

- Chinese (Mandarin)

Perhaps the most convenient way to contact a representative from HYCM’s customer support team is via the Live Chat option. You can also contact the brokerage over the phone by dialling +357 25 24 5751. HYCM can deliver fast customer service via the live chat. The HYCM forex specialists can be contacted live via 5 secure instant messaging services including:

- Viber

- Skype

- Telegram

- Facebook Messenger

Depending on the matter, about which you contact HYCM’s team, the brokerage has provided the following emails for your convenience:

Research and Education

HYCM’s Help Center covers various topics, ranging from:

- Typically asked questions (FAQs)

- Forex basics

- And extensive educational materials

Final Verdict on HYCM

HYCM offers a well-rounded trading experience with strong regulatory oversight, a wide range of assets, and competitive spreads. With a choice between fixed and variable spreads, this broker accommodates various trading styles. Its user-friendly platforms, including MT4 and MT5, make it accessible for both beginners and experienced traders. While customer support is reliable, the limited range of account types and high inactivity fees could be a downside for some. Overall, HYCM is a reputable broker with a solid track record.

HYCM FAQs

Is HYCM a market maker?

Yes, HYCM operates a market maker execution model. However, on the Raw spread account, HYCM doesn’t run a proprietary trading book but sends clients’ orders directly to a network of liquidity providers for further execution. Because not all orders are hedged with the liquidity providers, HYCM can’t be considered a true ECN broker

For true ECN broker please review our guide here: Best ECN Forex Brokers for UK traders.

Is HYCM regulated?

Yes, HYCM is a regulated forex broker with licenses in two tier-one jurisdictions (FCA and CySEC). In other words, HYCM is considered a safe forex broker. Client funds are also protected via the Financial Services Compensation Scheme (FSCS) up to GBP 85,000 and the Investors Compensation Fund (ICF) up to EUR 20,000.

What is HYCM minimum deposit?

USD 100 is the minimum deposit at HYCM for both Fixed spread account and Classic spread account. HYCM clients who want to access interbank spreads through the Raw spread account are required to make a minimum first deposit of USD 200. As for the funding methods, HYCM accepts credit/debit cards, bank transfers, Skrill, Neteller and Webmoney with no additional deposit fees.

Compare HYCM Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to HYCM Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

How long does an HYCM withdrawal take?

Depends on what funding method you are using

What is the minimum deposit for HYCM?

The minimum deposit to open an account and start trading with HYCM is $20

Are HYCM trading conditions favorable or not for investment purposes?

HYCM offers favorable trading conditions, especially for experienced traders, with competitive spreads and fast execution speeds. The broker is well-regulated and provides a secure trading environment, though commission fees can be higher on certain accounts.