Pepperstone Minimum Deposit

Pepperstone’s minimum deposit to open a forex trading account is $0. The only deposit required will be the initial margin requirement and this can be funded using debit or credit cards or e-wallets like PayPal and Skrill.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Pepperstone is one of the most popular and well-trusted forex brokers, it’s a brokerage platform that comes with some excellent benefits for traders. If you’re looking to try its services, you’ve likely got plenty of questions about what Pepperstone offers, and we’re here to answer them.

One of the most common queries we get from users is to do with the minimum deposit requirements of Pepperstone. So, to answer this and much more, we’ve created this comprehensive guide to make sure you know exactly how deposits work with this broker. Keep reading for a complete explanation covering every detail worth knowing.

What’s the minimum deposit for an account with Pepperstone?

Zero. Unlike many top brokerage providers, there’s actually no minimum deposit required to hold a live account with Pepperstone. So, if it suits your goals, you can put in just a small amount into your account when you’re getting started.

Pepperstone does recommend that you deposit at least AUD/USD 200 or 500 GBP/EUR to make the most of its forex trading facilities. But, this is just a recommendation and you can there is no need to make a deposit if you don’t wish.

However, if you want to start forex trading, you will have to make sure there are enough funds deposited into your account to meet margin requirements. The more leverage you trade with, the more funds you will need in your account to meet the initial margin requirements.

The idea behind having no strict minimum deposit amount is that Pepperstone is confident you’ll enjoy using its platform after giving it a try.

Only needing to use a small deposit means that you’re not locked into the brokerage and you don’t have to make a big financial commitment if you just want to see what the platform is like. Or, if you’re just beginning to explore forex trading options and you only have a modest amount of capital to kick off your trading career.

Funding Methods With Pepperstone

To make sure you’re clear on how you can actually fund your live account with Pepperstone, below are all the details you need to know about the various funding methods, how long each method takes, and what currencies you can use on the trading platform.

Funding your account is done via the Pepperstone secure client area via Funds tab > Add Funds.

Pepperstone ReviewVisit Pepperstone

What methods can you use to make deposits?

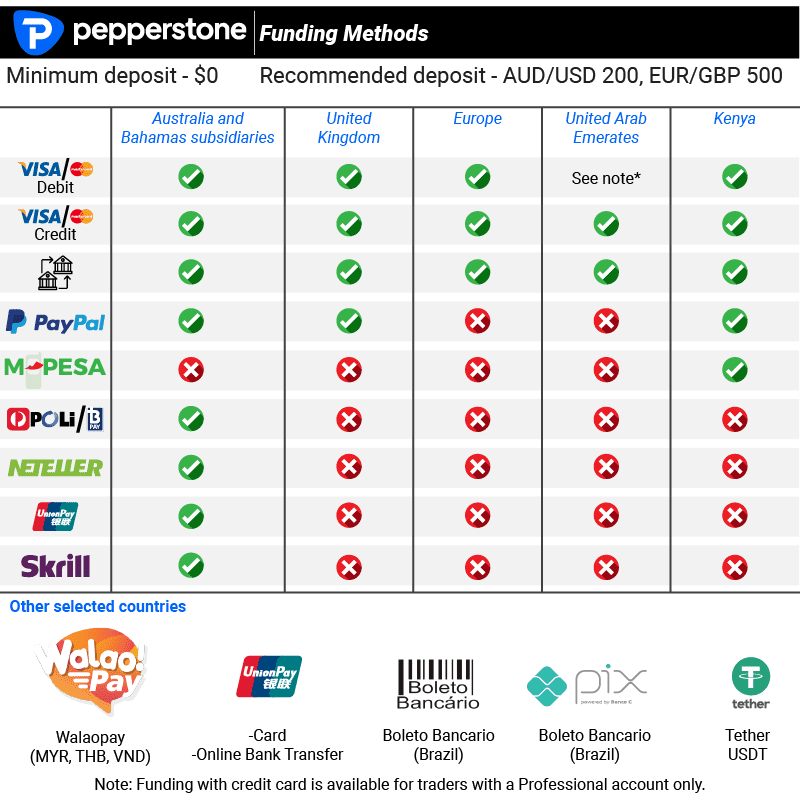

There are a number of deposit methods to choose from, which can give you some added flexibility. Here are the main methods you can use to make a minimum deposit of your choosing (keep in mind that some funding options are country-specific and depend on where you live):

- Debit card or credit (Visa/Mastercard)

- Bank transfer/wire transfer (domestic and international)

- POLi & BPay (Australia only)

- Fasapay

- PayPal

- Skrill (Moneybookers), Qiwi, and Neteller

- Union Pay

- China Union Pay

If you’ve not come across some of these payment methods before like POLi, BPay, PayPal, Neteller, Skrill, Fasapay, China Union Pay, and Union Pay – they are all essentially electronic wallets. The ones available to you will depend on your country.

Interestingly, no e-wallets are available in Europe with Pepperstone (Cyprus) and Pepperstone (Germany), and only PayPal in the UK with Pepperstone (UK). Traders in Australia will be able to use BPAY and POLi.

The other thing to note for clients in the UAE is that funding with credit cards is only available for clients with Professional accounts. Visa debit and Mastercard debit are fine.

Can you deposit funds with ease?

Yes, this is one of the best things about the Pepperstone brokerage. The platform accepts a variety of deposit methods, it doesn’t charge any fees for deposits, and in most cases – your funds will show in your balance immediately.

For peace of mind, Pepperstone also has a customer support team you can reach by live chat, email or phone if you need any help with your deposits.

What currencies can you use?

The base currencies available with a Pepperstone live account includes USD, AUD, NZD, CAD, HKD, SGD, GBP, EUR, JPY, and CHF.

When signing up, you get to choose a single base currency. Once you pick one, it can’t be changed but you are also able to open additional accounts with another base currency.

This is also worth taking note of because most trading defaults as USD and will need to be converted to your base currency, commissions with cTrader and TradingView are examples of this.

How long does it take?

The time it takes for a deposit to process will depend on the method you use, because some are quicker than others. Here’s what Pepperstone estimates deposit time to look like with each method:

| Deposit Method | Deposit Time |

|---|---|

| Debit Card or Credit Card | Immediate |

| Bank Transfer | Same Day - 3 Working Days |

| POLi, BPay, Fasapay, PayPal, Neteller, Skrill, Qiwi, Union Pay, China Union Pay | Immediate |

Are there any fees for making deposits with Pepperstone?

None at all. Pepperstone offers you the ability to fund your forex trading account in a variety of ways without any additional deposit costs or fees.

One thing that is worth being aware of, however, is that sometimes your bank will charge a fee, especially if you’re using a base currency that’s different from that of your home bank. Any fees like this from your bank (or Pepperstone’s bank) will be passed on to you.

So, always double-check what currency you’re using and you can always reach out to the Pepperstone customer support team if you have extra questions.

Everything worth knowing about withdrawals

We’ve covered all the essential points you need to know about deposits, but there are some worthwhile things to bear in mind about withdrawals on Pepperstone:

- Fees – there are no withdrawal fees to worry about.

- Admin – withdrawal forms received after 21:00 (GMT) are processed the following day. Forms received before 07:00 (AEST) will be processed on the same day.

- Time – the withdrawal times can depend on the method you’re using, but it’s normally 1-3 working days (there’s no option to pay a withdrawal fee for a faster turnaround). Withdrawal times can take longer around bank holidays.

- Withdrawals to 3rd parties – funds can only be withdrawn to an account in the same (or joint) name used for your forex trading account.

- Status – you can check on the status of your withdrawal in the ‘Funds’ tab. Just select ‘History’ and then ‘Withdrawals’ to get a complete overview.

- Bank charges – it’s not a withdrawal fee from Pepperstone, but be aware that any International Telegraphic Transfer (TT) fees charged by the bank are passed on and most international TTs cost roughly AUD$20.

If you live in the UK, you can also request that funds are transferred from another FCA regulated provider to your Pepperstone brokerage account.

So, you have heaps of flexibility when it comes to how you want to make deposits or withdrawals.

How to make deposits to a Pepperstone live account

All you need to do is log into your secure client area, go to the ‘Funds’ tab and then select ‘Add Funds’. This is where you’ll see all the different funding options to choose from (depending on your country) such as bank/wire transfer, debit/credit card, POLi, BPay, PayPal, Neteller, Skrill, and Union Pay.

Here’s a more detailed breakdown explaining the step-by-step process for making deposits into your live account:

- Login and head to your ‘Secure Client Area’.

- Select ‘Funds’ from the left hand side.

- Decide which trading account you want to make a deposit into and remember to take note of the currency.

- Choose how you want to fund your account (select a payment method and enter your relevant details).

- Think about how much you want to put into your account (remember there’s no minimum deposit with Pepperstone).

- Once you’re happy, hit the ‘Fund Now’ button and your deposit will be processed.

As mentioned, the Pepperstone customer support team are there to help you if you get stuck or need some additional guidance when using the brokerage.

Is there an inactivity fee?

No, there’s not. This is another excellent benefit of using the Pepperstone brokerage for forex trading. A lack of inactivity fees or charges means that you can dip your toes into forex trading at your own pace.

Another benefit of no inactivity fees is that you can always try Pepperstone to see what it offers, and then go and see how it compares to other forex trading providers. If you don’t like what you see elsewhere, you can always come back to your Pepperstone live account and continue using it with no penalties or additional charges.

It’s this kind of flexibility that makes Pepperstone an excellent place to ease yourself into forex trading.

The bottom line on Pepperstone deposits

Pepperstone is an affordable brokerage if you’re looking to start forex trading or try out a new platform. The simplicity and ease of use make it a great option for beginners, but it also has all the live account features more experienced traders would expect.

It’s one of the only providers that has no minimum deposit, no withdrawal fee, and zero inactivity fees. Pepperstone makes money through its spreads and commissions (which can be higher than some competitors). But, with plenty of funding options to choose from, Pepperstone offers a top-tier platform that has a deposit method to suit just about everyone.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.