Tickmill Review Of 2026

In my experience, Tickmill provides a streamlined yet somewhat limited trading environment. The broker offers two main account types, Classic and Raw; alongside just MetaTrader 4 and 5 platforms plus a mobile trading app. While decent, Tickmill’s product range feels narrow compared to competitors.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Tickmill Summary

| 🗺️ Country Regulation | UK, Europe, South Africa, Malaysia, Seychelles |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MT4 |

| 💰 Minimum Deposit | $100 |

| 💰 Deposit/Withdrawal Fee | $0 |

| 🛍️ Instruments Offered | Forex, CFDs, Bonds, Metals |

| 💳 Credit Card Deposit | Yes |

Why Choose Tickmill

In my opinion, Tickmill’s offering is best suited for forex-focused traders who prioritize tight spreads and low costs over a wide variety of assets. If you’re looking to trade beyond forex and indices, you might find the limited product range restrictive.

I think Tickmill will appeal for traders in the UK in particular. In the UK, the Tickmill has incredibly low commissions along with good spreads when using their RAW account.

Sadly, these features are not available outside the UK. In other countries, Tickmill is relatively generic, with standard commission cost with their Raw account, wide spreads on Classic account, no Futures account and just the MT4 and MT5 trading platform and a basic mobile trading app.

Tickmill Pros and Cons

- Relatively low fees

- Low funding charges

- Easy account opening

- Good educational content

- Mediocre newsfeed

- Basic platform functions

- Low leverage for some CFDs

*Your capital is at risk ‘75% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

Tickmill offers competitive spreads across a range of 62 currency pairs, stock indices, oil, metals, and bonds. The Classic Account offers slightly higher average spreads on the range of currency pairs. Typical spread data from the Pro Account and VIP Account shows an offering of 0.10 pips on the EUR/USD pair.

1. Raw Account Spreads

You can get started with a Pro Account with a minimum deposit of $100. This account offers the best pricing for retail traders, as it has ECN pricing – the most popular among traders because of the low commission rate and tight spreads. Tickmill shows tighter spreads among other brokers especially for the EUR/USD and AUD/USD.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.10 | 0.90 | 0.40 | 0.50 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.99 | 0.94 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

VIP Account

There is no minimum deposit required for the VIP Account, however, you will require a minimum account balance of $50,000 to trade. This makes this trading account more suitable for experienced traders. When compared with the average broker, Tickmill has indeed lower spreads.

| Raw Account Spreads | Tickmill | Average Spread |

|---|---|---|

| Overall | 0.5 | 0.74 |

| EUR/USD | 0.1 | 0.21 |

| USD/JPY | 0.1 | 0.39 |

| GBP/USD | 0.3 | 0.48 |

| AUD/USD | 0.1 | 0.39 |

| USD/CAD | 0.2 | 0.53 |

| EUR/GBP | 0.4 | 0.55 |

| EUR/JPY | 0.5 | 0.74 |

| AUD/JPY | 0.9 | 1.07 |

| USD/SGD | 1.9 | 2.34 |

2. Raw Account Commission Rate

The following table compares the average spreads across a range of commission-based account types, including the Pro Account and VIP Account from Tickmill. The Pro Account offers low spreads from 0.0 pips EUR/USD and charges commission fees of $2.00 per side ($4 round-turn) per lot. VIP Spreads start from 0.0 pips, and the commission fees are only $1.00 per side.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Tickmill Commission Rate | $3.00 | N/A | £2.00 | €2.00 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

The following table displays average spreads from non-commission accounts with the Classic Account from Tickmill. The Classic Account is more suitable for beginner traders with little experience. Spreads start from 1.6 pips – which can be quite higher than the average.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Tickmill Average Spread | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.9 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

4. Swap-Free Account Fees

Tickmill also offers Islamic Accounts for traders of the Muslim faith. You can select from a Pro Account, Classic Account, or VIP Account and convert it to an Islamic Account. Trading conditions remain the same as with the other trading accounts, along with compliance with Sharia law.

5. Other Fees

The only other fee to look out for is the withdrawal fee which is $5.

Tickmill may charge you a $10 inactivity fee if you are not trading for any prolonged periods.

My Verdict on Tickmill Trading Costs

Tickmill has outstanding spreads and low fees when compared to other brokers I reviewed, and they have great transparency as well. The only small downside I found when testing their services was the standard account spreads. Overall I give Tickmill a 10/10 score for their trading costs.

Based on our tests, Tickmill showcases tight spreads on their raw and standard accounts.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

Trading Platforms

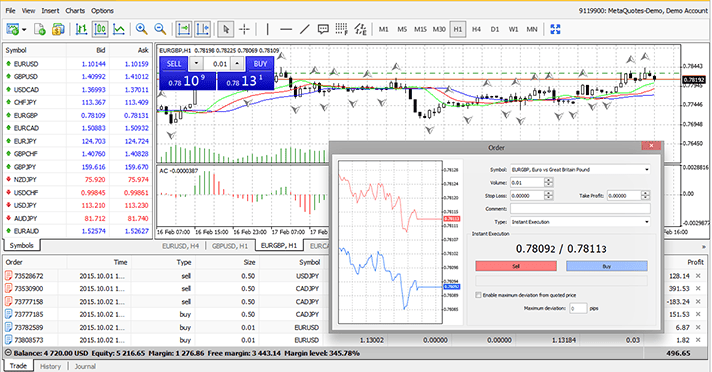

Tickmill only allows you to trade using the most popular trading platform: MetaTrader 4. Despite the minimal selection of trading platforms, MetaTrader 4 is the most commonly used system and provides a range of features to help you trade the financial markets.

If you are a UK-based trader, note that you can access more tradings platforms, such as Bookmap, AgendaTrader, Sierra Chart and more.

| Trading Platform | Available With Tickmill |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

Our CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform. Once done read the relevant section about how Tickmill performs when it comes to that software.

MetaTrader 4

Tickmill traders have the ability to use the widely trusted MetaTrader 4 (MT4), providing great flexibility and numerous options for trading setups. You can access MT4 as a standalone application on Windows, Mac, iOS, and Android, or directly through a web browser.

My Reasons to Try MT4 as a Long-Time User:

- Large EA Marketplace: MT4 offers a vast marketplace for ready-made Expert Advisors (EAs), making it easy to automate trading strategies. It also supports copy trading through the Signals feature.

- Popularity and Resources: As the most widely used trading platform, MT4 has an extensive range of free online resources, making it beginner-friendly.

- Technical Analysis Tools: The platform comes with a variety of built-in indicators, customizable charts, and automated trading capabilities.

- Third-Party Integrations: MT4 allows access to popular tools like Myfxbook for performance tracking. However, I was disappointed by the lack of native support for DupliTrade, which might be a drawback for social trading enthusiasts.

Why I Wouldn’t Suggest MT4

- Focus on Forex: MT4 is primarily designed for forex trading, so it lacks advanced features like sophisticated order types, which more experienced traders might miss.

- Might be fazed out in the future as MT5 could supersede it entirely.

In my opinion, MT4 is an excellent choice for beginners starting their forex trading journey. Its user-friendly interface, extensive resources, and automation capabilities make it easy to learn and use. However, as you advance, you might find its limitations, such as the lack of advanced order types and share trading functionality, a bit restrictive.

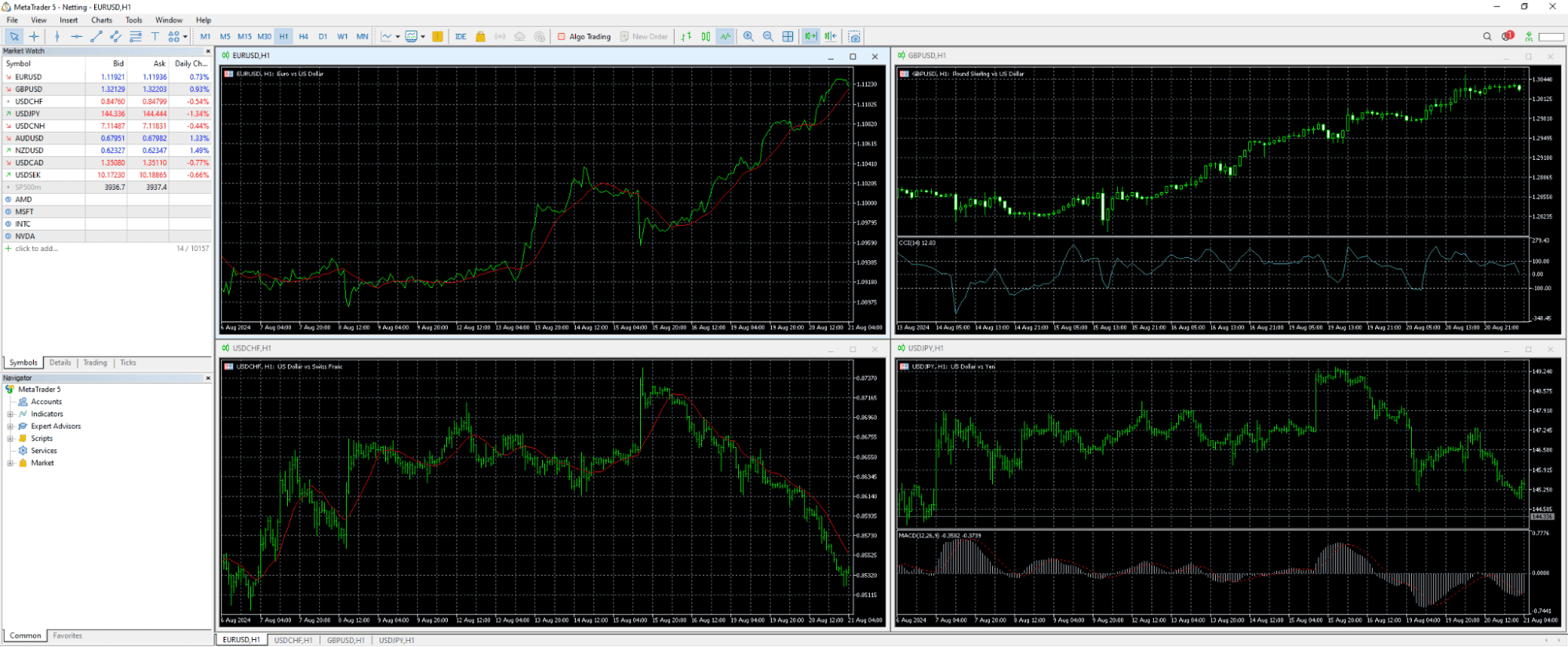

MetaTrader 5

Unlike MT4, MT5 can handle multiple asset classes and would be my default recommendation for more experienced traders. Having traded extensively on both MT4 and MT5, I found the expanded features of MT5-21 timeframes and MQL5’s advanced automation ideal for running complex strategies or algorithmic systems.

While the snappier execution and customization option for charts did improve my intraday trading, the steeper learning curve might be somewhat overwhelming if you are a more casual user.

What I liked about MT5:

- Its responsiveness as a platform: there was no lag during high volatility, doing scalps in EUR/USD, and the ability to backtest strategies across diversity in asset classes like Gold CFDs to German DAX futures-saved me so much time.

- MT5 extends beyond Forex and CFDs to stocks, commodities, futures, and options that trade on centralized exchanges.

- I got greater personalization of my charts and indicators with the added bonus of MQL5 to automate my trading.

MT5 vs. MT4 Key Differences:

Asset Support: MT5 allows trading in stocks, futures, and options; MT4 is forex/CFD-focused.

MT5’s hedging mode and Depth of Market feature gave me finer control, while MT4 had a more intuitive interface to make simpler and quicker trades in forex.

Who Should Avoid MT5?

- MT5 has more of a steep learning curve, and I would suggest if you are a beginner forex trader, learn to set up the trade on other platforms.

Generally speaking, MT5 will be worth switching to for more professional traders in the UK in cases of scalping, hedging, or multi-asset diversification, while for simpler trading and forex-only trading, MT4 is a better choice.

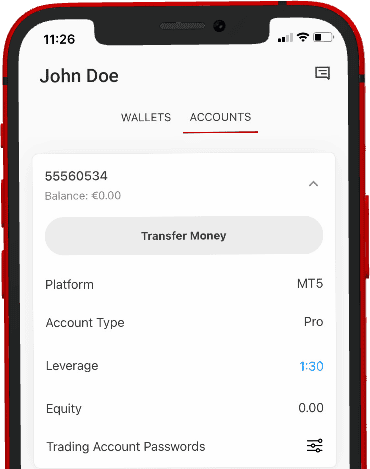

Tickmill Mobile App

With a rating of 3.8 out of 5 on their Google Play Store page for the mobile app, I saw many traders complaining that the app lacked refinement and malfunctioned. In my experience, this was the case, as some trades did not execute properly.

Here is what I liked about using the Tickmill Mobile App:

- I could deposit and withdraw funds from my phone and keep an eye on the Tickmill balance.

- I could access chat support through their app, which came in handy a few times.

- Uploading and managing documents on the go was much better using the app than having to log in through their webpage.

What I Didn’t Like:

- Limited charting compared to other platforms.

- Some features were unresponsive.

- App asked me for some permissions that I wasn’t comfortable giving out.

I would suggest that you use their mobile app only to check on your positions when on the go, and trade instead using MT4 or MT5.

Myfxbook Copy Trading

If you prefer to copy the trades of other successful traders, then Myfxbook is available within your MetaTrader 4 trading account.

Myfxbook works by providing you with tools to find and follow other traders in their social network. You can then use filters that will allow you to replicate their trades within the conditions you set. Social trading is popular for those that don’t have the experience or time to invest in trading themselves, instead, you can leave the work to other traders.

Third-Party Tools

Tickmill clients can access the third-party technical analysis tool Autochartist. This is one of the most comprehensive forex trading tools that can add some value to your trading. Autochartist uses advanced technology to analyse past market trends and identify real-time trading opportunities across a wide selection of CFD instruments.

Some of the best tools included in the Autochartist market analysis pack include:

- Automated trade alerts

- Volatility analysis for SL and TP optimisation

- Fibonacci patterns

- Market reports delivered 3 times per day

- Historical performance statistics

- The key support and resistance levels

- Customizable searches to only get the data you need

Autochartist is offered free of charge to all Tickmill live account holders. This tool is offered as an MT4 plugin as well as a standalone web application.

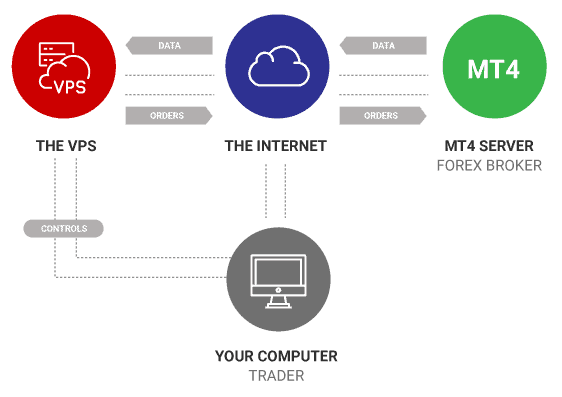

Tickmill VPS

In my opinion, Tickmill’s VPS service;powered by BeeksFX;is a must-try for traders relying on automated strategies, though it might not be worth the investment for everyone.

Having used the platform myself, I was impressed by how seamlessly it handled my Expert Advisors (EAs). Setting it up took mere minutes, and the 24/7 live chat support gave me peace of mind when I had a late-night question about server configurations.

What stood out most was the negligible latency. During testing, my trades executed almost instantaneously, likely thanks to the VPS servers being physically close to Tickmill’s trading infrastructure.

Who I’d recommend it to:

- Algorithmic traders who need uninterrupted execution for EAs or scalping strategies.

- High-frequency traders (HFT) prioritizing split-second order fills.

- Travelers or part-time traders who can’t monitor their setups 24/7 but want strategies running nonstop.

Who might want to skip it:

- Manual traders who don’t use EAs;there’s little benefit if you’re not automating.

- Casual traders on a budget;if you only trade occasionally, the cost (even discounted) might not justify the perk.

- Tech-savvy users who already manage their own servers and prefer full customization.

Overall, I never experienced downtime, and the “always-on” functionality meant my EAs kept running smoothly even when my laptop was off. I think if you can make use of the added benefits of running a VPS, then go for it, otherwise I’d suggest you give it a pass.

My Verdict on Tickmill Trading Platforms

Tickmill has a good range overall for their trading platforms, but they lack many of the other platforms offered by competing brokers such as cTrader or Tradingview. For this reason, I give Tickmill an overall score of 3/10 for the category of trading platforms.

Is TickMill Safe?

In my opinion, Tickmill’s safety profile is adequate but not flawless. While it’s regulated by reputable authorities like the UK’s FCA and Cyprus’ CySEC there are some downsides.

Though Tickmill offers negative balance protection, its global entities (like the Seychelles branch) operate under lighter oversight, which might concern traders prioritizing strict regulation.

1. Regulation

If you’re based in Australia or Dubai, Tickmill may not be ideal for your situation. The broker lacks ASIC or DFSA regulation, meaning your account would fall under offshore jurisdictions (e.g., Seychelles) with fewer safeguards. If you value more thorough regulations, I’d suggest picking a broker such as Pepperstone or IC Markets instead.

For traders prioritizing local regulatory protections, I’d suggest opting for an ASIC or DFSA-regulated broker instead. However, if low costs or specific features like high leverage matter more, Tickmill’s global entities could still be an option; just be aware of the trade-offs.

Tickmill has regulations in several countries including:

| Feature | Tickmill UK Ltd | Tickmill Europe LTD | Tickmill South Africa Ltd | Tickmill Ltd |

|---|---|---|---|---|

| Region / Country | United Kingdom (London), UAE, Dubai | Cyprus (Limassol) | South Africa (Cape Town) | Seychelles (Mahe) |

| Regulatory Entity | FCA, DFSA | CySEC | FSCA | FSA |

| Tier | 1,2 | 1 | 2 | 3 |

| Segregated Funds | Yes | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes | Yes |

| Maximum Leverage | 1:30 | 1:30 | 1:1000 | 1:1000 |

Tickmill Asia applies for clients in Malaysia, all clients outside Tickmill subsidiaries that have FCA, CySEC, LFSA and FSCA regulations will have FSA regulations.

As I noted already, while Tickmill policies for FSA will be in line with other regulators, you need to remember that FSA is an offshore regulator. So if you have any complaints, you may not have the protection you need to settle disputes in case of scams.

| Tickmill Safety | Regulator |

|---|---|

| Tier-1 | CySEC FCA |

| Tier-2 | DFSA |

| Tier-3 | FSA-S LFSA FSCA |

Risk Management Features Risks With Expert Advisor

In my opinion, Tickmill’s risk management tools strike a smart balance;protective but not overly restrictive. As someone who’s tested their live account, I appreciated the Negative Balance Protection firsthand.

Knowing I couldn’t lose more than my deposited funds (even during volatile spikes) removed a layer of stress, especially after a poorly timed EUR/USD trade left my account teetering near zero.

Their risk monitoring team also stood out. Early on, I experimented with aggressive leverage on a gold trade, and within hours, I received an email warning about “excessive risk exposure.”

That said, leverage caps split my feelings. The 1:30 limit for retail traders (vs. 1:500 for professionals) is sensible for curbing recklessness, but as a cautious trader, I rarely pushed beyond 1:10 anyway. Their margin calculator, though, was a lifesaver. I used it daily to visualize potential losses before entering trades;no guesswork, just cold, clear math.

Who I’d recommend Tickmill’s risk management for:

- New or nervous traders who need guardrails to avoid blowing accounts.

- Strategy testers refining systems on demo mode before risking real capital.

- Risk-averse investors prioritizing capital preservation over aggressive gains.

If you are a more advanced trader, and you find automated warnings patronizing, or are comfortable with self-managing leverage, feel free to skip this feature.

2. Reputation

Tickmill has been in the industry since 2014, with headquarters in London, UK. Their popularity maintains a mid-range presence in the global forex brokerage space. With approximately 49,500 monthly Google searches, it ranks as the 26th most popular forex broker among the 65 brokers analyzed. Similarweb data from February 2024 shows a consistent picture, positioning Tickmill as the 26th most visited broker with 614,000 global visits.

This broker has established a significant operational footprint. According to the company’s official website, Tickmill (across all subsidiaries combined) serves over 490,000 active clients with more than 940,000 registered accounts. The broker has executed over 668 million trades since its inception. Tickmill operates in more than 250 countries and territories worldwide, demonstrating its established global presence despite not ranking among the top 20 brokers by search visibility.

Tickmill is experiencing particularly strong growth in the MENA (Middle East and North Africa) region. Recent reports indicate that Tickmill’s trading volumes grew by 54%, surpassing $135 billion, while the total number of clients, including active ones, reached historic highs. This growth trajectory indicates Tickmill is expanding its market presence beyond its mid-tier search ranking position.

| Country | 2025 Monthly Searches |

|---|---|

| Brazil | 5,400 |

| Malaysia | 5,400 |

| India | 3,600 |

| South Africa | 2,900 |

| Indonesia | 1,900 |

| Thailand | 1,900 |

| United States | 1,600 |

| Colombia | 1,600 |

| Turkey | 1,600 |

| Vietnam | 1,600 |

| Argentina | 1,300 |

| United Kingdom | 1,000 |

| Germany | 1,000 |

| Philippines | 1,000 |

| United Arab Emirates | 880 |

| Egypt | 880 |

| Poland | 880 |

| Bangladesh | 880 |

| Algeria | 880 |

| Mexico | 720 |

| Peru | 720 |

| Pakistan | 720 |

| Singapore | 590 |

| Nigeria | 590 |

| Spain | 590 |

| Italy | 590 |

| Tanzania | 590 |

| Morocco | 480 |

| Cyprus | 480 |

| Hong Kong | 390 |

| Saudi Arabia | 390 |

| Venezuela | 390 |

| France | 320 |

| Uzbekistan | 320 |

| Ecuador | 320 |

| Canada | 260 |

| Australia | 260 |

| Netherlands | 260 |

| Japan | 210 |

| Chile | 210 |

| Portugal | 210 |

| Bolivia | 210 |

| Taiwan | 170 |

| Sri Lanka | 170 |

| Jordan | 170 |

| Dominican Republic | 140 |

| Kenya | 140 |

| Uruguay | 140 |

| Cambodia | 110 |

| Switzerland | 110 |

| Costa Rica | 110 |

| Sweden | 110 |

| Ghana | 110 |

| Uganda | 110 |

| Ethiopia | 110 |

| Botswana | 110 |

| Austria | 90 |

| Ireland | 50 |

| Greece | 50 |

| New Zealand | 50 |

| Mongolia | 50 |

| Panama | 20 |

| Mauritius | 10 |

5,400 1st | |

5,400 2nd | |

3,600 3rd | |

2,900 4th | |

1,900 5th | |

1,900 6th | |

1,600 7th | |

1,600 8th | |

1,600 9th | |

1,600 10th |

3. Reviews

With just below 1000 reviews as of 2026, Tickmill has a relatively good Trustpilot average review rating of 4.0 /5 stars. While I reviewed brokers with higher ratings, traders reported that they liked the stable performance, and customer support in particular.

After I examined the bad reviews, most of them were related to issues opening their account or deposit/withdrawal. However, most of these issues could be related to the user’s funding methods, rather than the broker itself.

My Verdict on Tickmill Trust & Safety

Tickmill has great reviews online, and a solid reputation, as they have established a broker for quite a few years. However, they lack some of the more thorough regulatory oversight that other brokers have, so I have to deduce some points here. For these reasons, I rate Tickmill 6/10 for their trust, safety and regulation.

Deposit and Withdrawal

What is the minimum deposit at Tickmill?

The minimum deposit requirement at Tickmill is $100. To open an account with Tickmill, you will require a minimum deposit of $100. To access a VIP Account, your balance will need to be $50,000 to open your position.

However, if you open your account from certain countries, Tickmill might have a minimum deposit requirement of $1,000 if you wish to trade futures & options.

Account Base Currencies

Tickmill accepts 5 different deposit currencies EUR, GBP, USD and PLN. Deposits made in unsupported currencies will be converted incurring a conversion fee to the previously mentioned currencies.

Deposit Options and Fees

Tickmill has a Zero Fees Policy for deposits and withdrawals. This means there are no costs from the brokers’ end for using when transferring funds. If your wire transfer and your deposit are greater than $5000, Tickmill will refund any fees up to $100 if you can provide a bank statement.

Withdrawal Options and Fees

Tickmill offers a range of deposit and withdrawal methods, and there is a minimum withdrawal requirement of $25. Fund transfer will be instant or up to 1 working day:

- Bank Transfer

- Visa and MasterCard

- Skrill

- Neteller

- DotPay

- PaySafeCard

- Sofort

- Rapid Transfer

- PayPal

- UnionPay

- FasaPay

- Qiwi

- Trustly

- Przelewy24

My Verdict on Tickmill Funding Options

Tickmil has surprisingly many funding options and they are very transparent about their fees, and even offer some fee refunds if you meet certain conditions. Although I’d like to see more funding methods, I give Tickmill a very high score of 8.5/10 for the category of Funding Options.

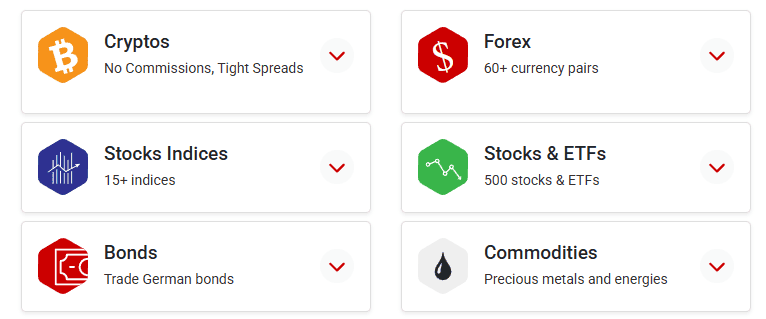

Product Range

Tickmill has a decent product range offering in my opinion, with 60+ forex pairs and around 500 stocks & ETFs. As of 2026 they also included some cryptocurrencies, which is always nice to see, as a few of them have already received their ETF.

Depending on your account and which country you pick, you can also trade some bonds, but this is usually limited for most traders.

CFDs

Tickmill does lack some diversity in the CFDs on offer. For example, you cannot trade popular CFDs such as cryptocurrencies, Stocks, ETFs or soft commodities (such as crops and livestock) through Tickmill. This can limit your ability to spread your risk through investment diversity.

Forex

Tickmill offers you as a trader 60+ forex pairs to choose from, including major and minor pairs. If you wish to trade forex exclusively, then Tickmill would be a great option due to their low spreads, especially on some currency pairs.

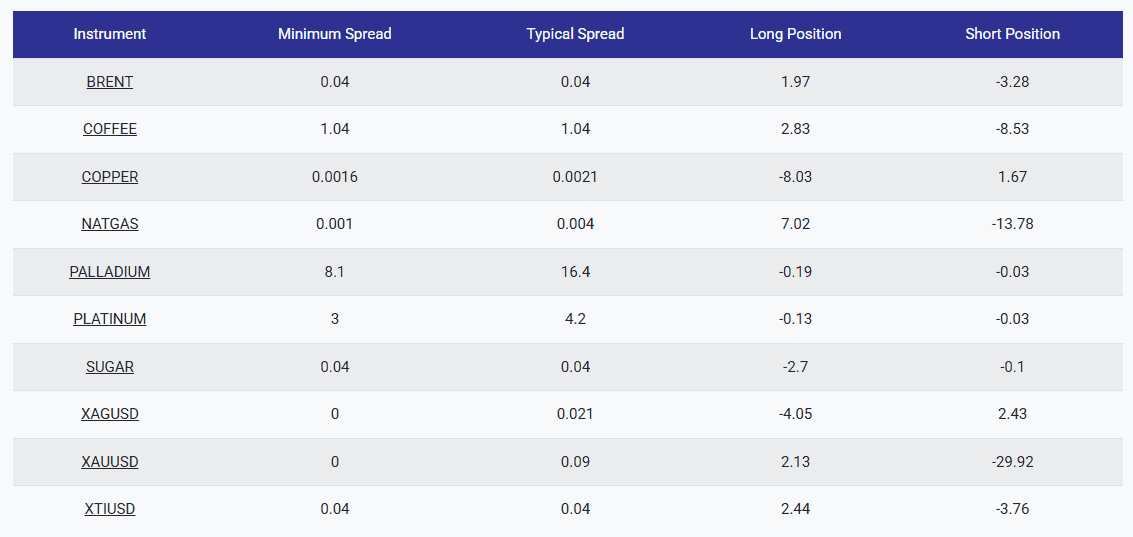

Stock Indices, Precious Metals and Oil

Tickmill has 15+ Indices and commodities with 24/5 trading available as usual. The spreads go very low and they all have a quick execution speed.

In terms of leverage, you can get up to 1:20 if you are a retail trader, and 1:500 if you have a professional account.

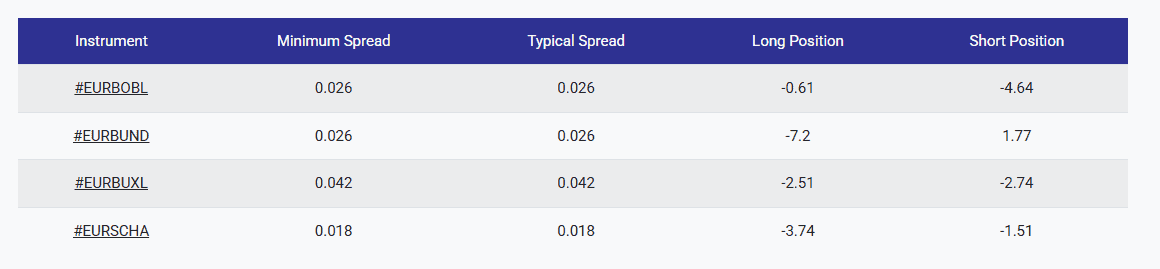

Bonds

For this review and testing purposes I opened an account in Europe to see which Bonds I could access.

I had the option of 1:5 leverage as a retail client, with up to 1:100 for retail accounts when trading bonds.

When trading German bonds for example, I could only access them at set GMT times, when their markets were open

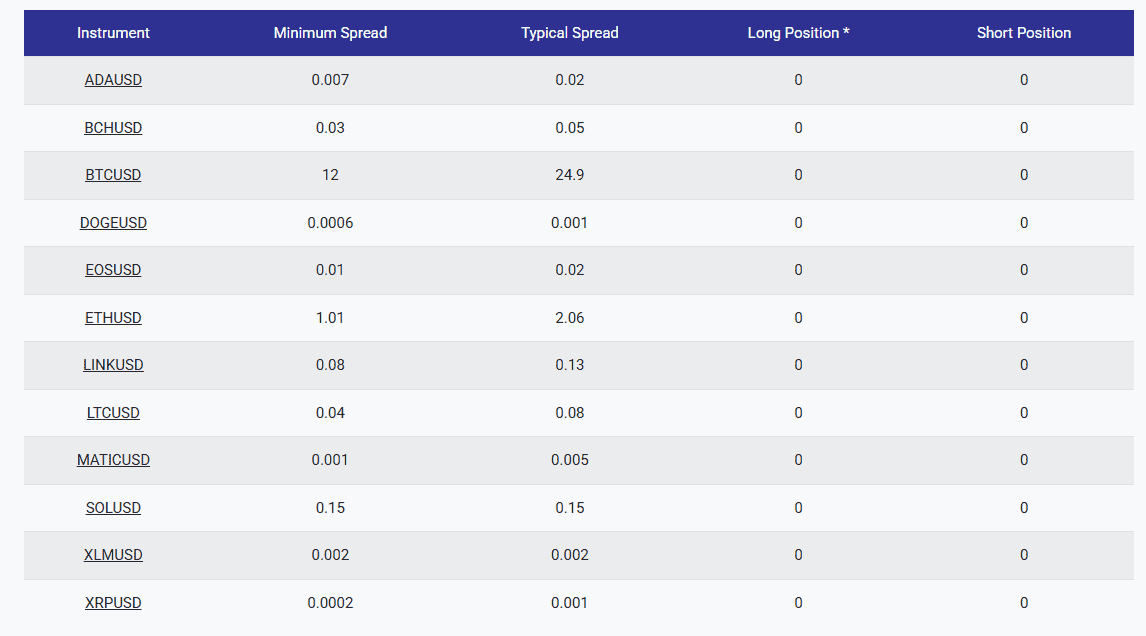

Crypto Currencies and Crypto ETFs

Tickmill greatly expanded on their Crypto and crypto ETF offerings in 2026, which is great to see, as it means the broker is keeping up to date with traders demands.

Something to note is if you are a UK-based trader, you can’t trade crypto on Tickmill.

They had 12 total CFDs, however with very limited leverage of just 1:2. This leverage, while decent, is much lower than what other brokers offer. So if you focus on trading this type of CFD it’s best you look at other brokers.

My Verdict on Tickmill Product Range

In terms of Range of Markets, I give Tickmill a good all-around score of 7.5 / 10. This is because while they have some variety, they lack the more substantial or exotic CFDs that other brokers have. The leverage was also workable, but not extraordinarily high for this industry standard.

Customer Service

In my experience testing Tickmill’s support, I’d rate their customer service as decent– functional but inconsistent. I reached out multiple times via live chat, email, and phone to gauge responsiveness. During weekday hours, the live chat team answered within 2-3 minutes, and agents were polite and knowledgeable about basic account queries (e.g., withdrawals, platform setup). However, when I asked complex questions about trade execution or regulatory specifics, responses felt scripted, and I was often redirected to email for “further investigation.”

Email support took 12-24 hours for replies, which is standard but frustrating during urgent issues. Phone support (available 24/5) worked smoothly, though I noticed regional numbers lacked local availability for some countries. For example, as a European trader, I had to dial their Cyprus office directly.

The biggest letdown? Weekend support. When I tested the live chat on a Saturday, wait times ballooned to 20+ minutes, and the agent couldn’t resolve my margin-related query, advising me to “check back Monday.” For a broker catering to global markets, this gap feels outdated.

My Verdict on TickMill Customer Support

Because of their decent channel variety to reach out, I gave Tickmil 6/10 for the category of customer service. I deducted some points for their consistency and slower response times, as well as the lack of an option to have a chat during certain times – even missing a basic AI chatbot.

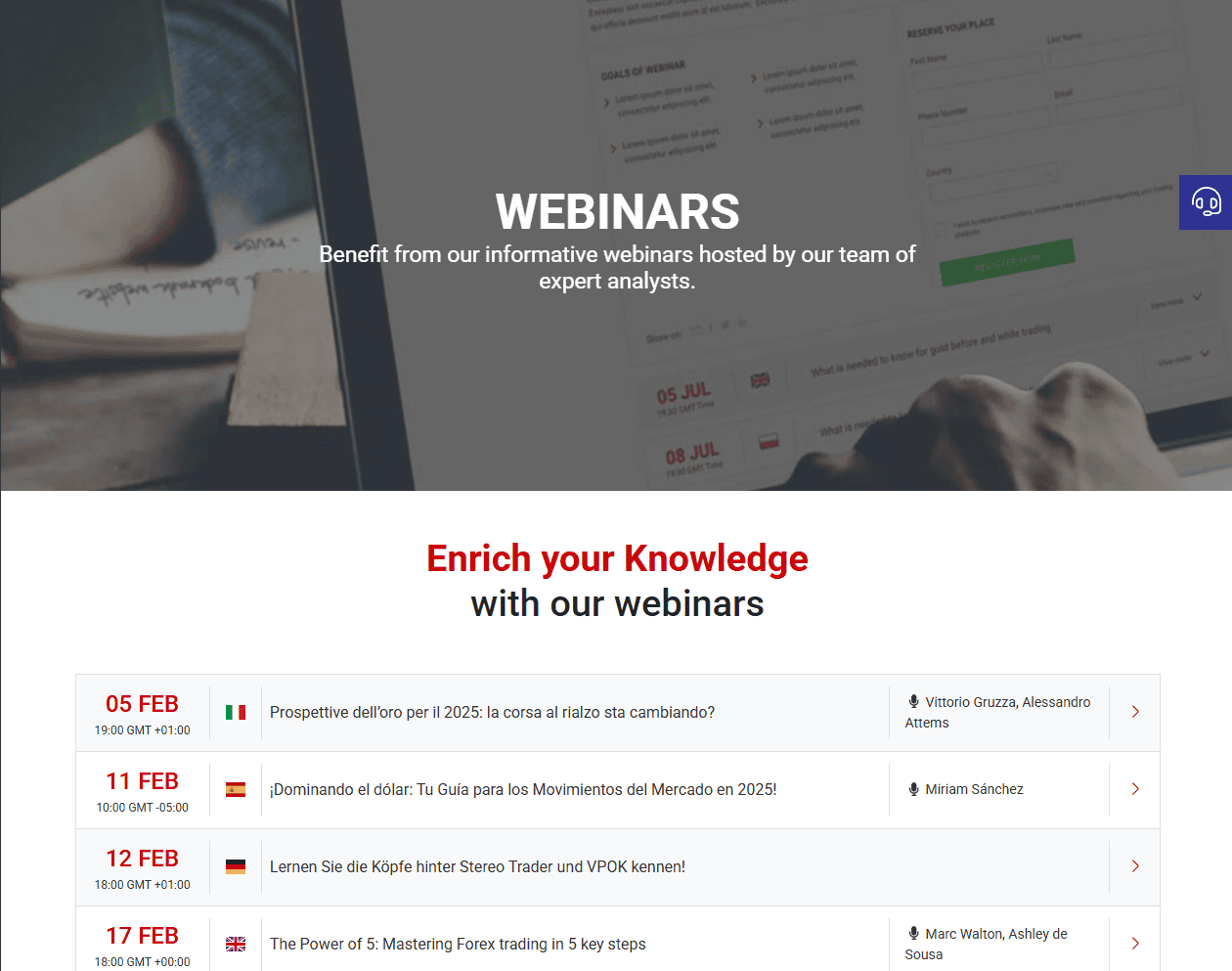

Education And Research

Tickmill surprised me pleasantly with its wide range of educational content. You can access anything from these categories:

- Webinars

- Seminars

- Video Tutorials

- eBooks (although their links led to a 404, so I couldn’t actually access it)

- Infographics

- Forex Glossary

While some categories were great, such as their content explaining forex terms, most of the content was badly organised or straight up didn’t work. One great thing however was that they have multiple languages to pick from, which is always good to see.

As an example of difficult-to-navigate content, I found the fore glossary too harsh. From a user experience standpoint, especially for new traders, it would be much better if this was separated into categories, rather than just letters.

My Verdict on Tickmill Education Content

I think that even though much of their content can be improved, in terms of organization, they still put a good effort into having a diverse educational segment. It’s also available in multiple different languages, so I have to give them a high score of 8.5/ 10 for the category of education.

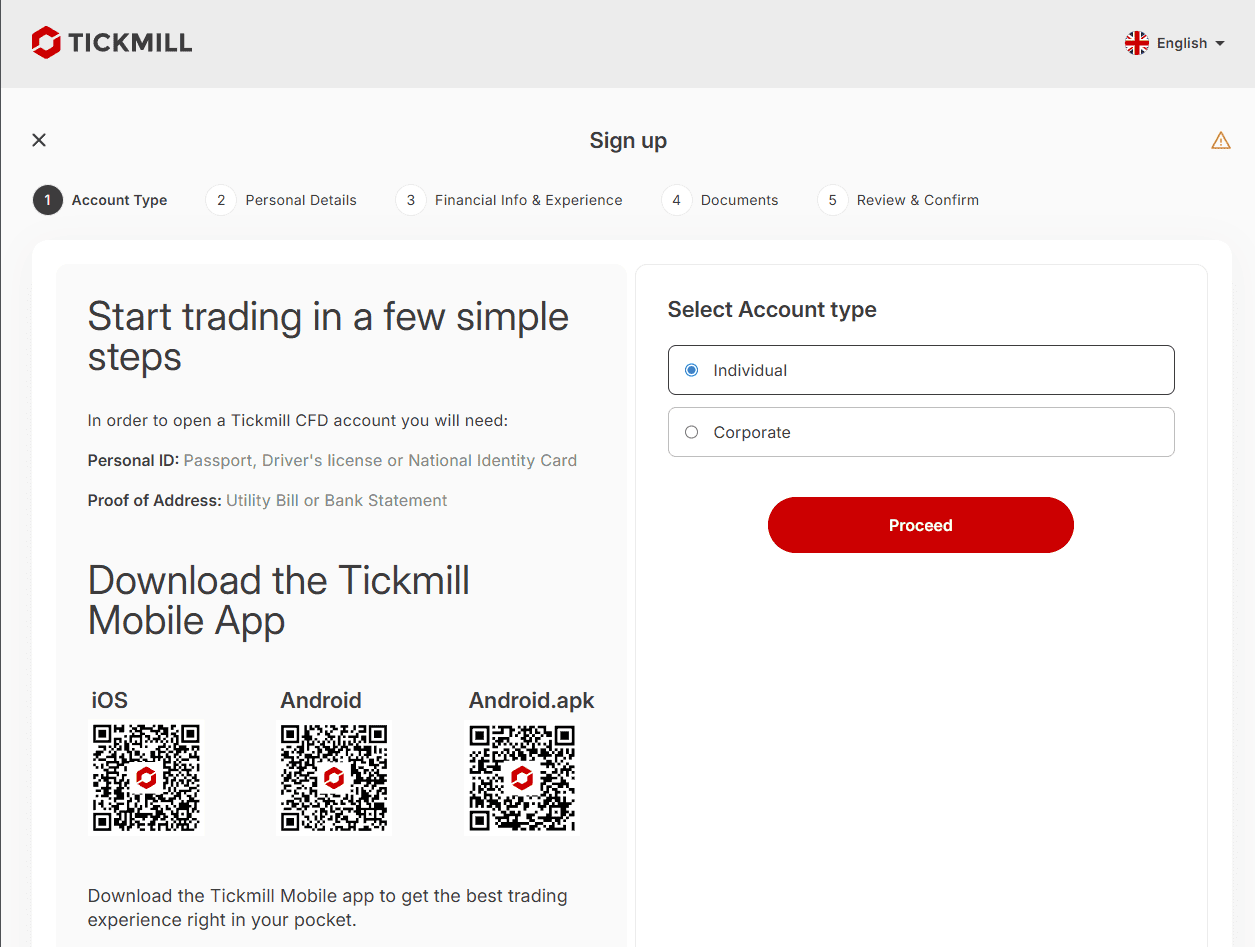

Account Opening

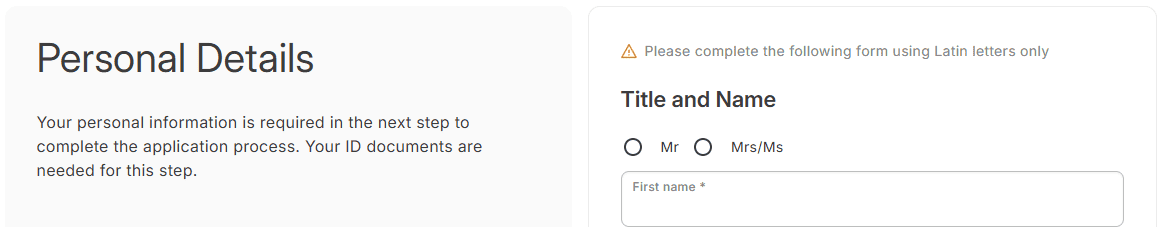

Opening my account at Tickmill was very straightforward. They have steps in the process, from picking between a corporate/individual account to giving personal details, documents and a confirmation.

After selecting my account type, I was asked for my name and date of birth.

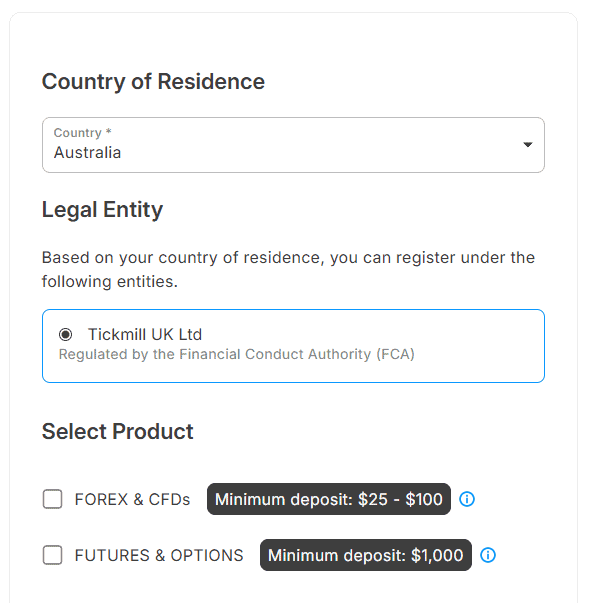

A great feature while opening my account was that Tickmill showed me which legal entity I would be registering under.

You can also play around with this tool to see which Countries are covered under certain entities, to ensure you are getting the legal coverage you desire.

What’s great is that they show you additional information, such as minimum deposits needed when asking you to pick your CFD of choice or forex. This is always welcome and adds to the credibility of the broker in my view.

My Verdict on Ease of Account Opening

I really enjoyed how Tickmill had the entire process organised, and also gave some additional information, such as the legal entity governing the given country. Overall I’d give Tickmil an excellent score for the ease and speed of opening a new account.

Final Verdict on Tickmill

In my opinion, Tickmill shines brightest for forex-focused traders who prioritize low costs and reliable execution;but its limitations in product diversity, regional restrictions, and customer service consistency hold it back from being a top-tier all-rounder. After extensively testing their platforms, fees, and features, I’d summarize Tickmill as a specialist broker with clear strengths and niche appeal.

I give Tickmill a score of 76/100 due to excelling in core areas like forex pricing and education while lagging in versatility.

For UK traders and forex/EA enthusiasts, it’s a compelling pick. But if you crave diverse assets, ironclad global regulation, or polished customer service, competitors like Pepperstone or IC Markets might suit you better. As always, weigh your priorities;Tickmill isn’t perfect, but it’s a sharp tool for the right trader.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

Compare Tickmill Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Does tickmill accept USDT?

Yes, you can deposit in USDT along with BTC and ETH