If you’re looking to understand the scale of the UK forex market or see how it compares to other financial hubs, our analysis below provides a clear snapshot of trading activity, liquidity, and trader demographics.

Top 5 UK Forex Facts

- London handles 37.8% of all forex trading worldwide

- $4.7 trillion is traded daily on UK forex markets

- London trades more per day than the USA and Singapore combined

- Global fx turnover grew 2x as fast from 2022-25 (28%) as it did 2019-22 (14%)

- EUR/USD and GBP/USD make up over 50% of the UK’s forex turnover

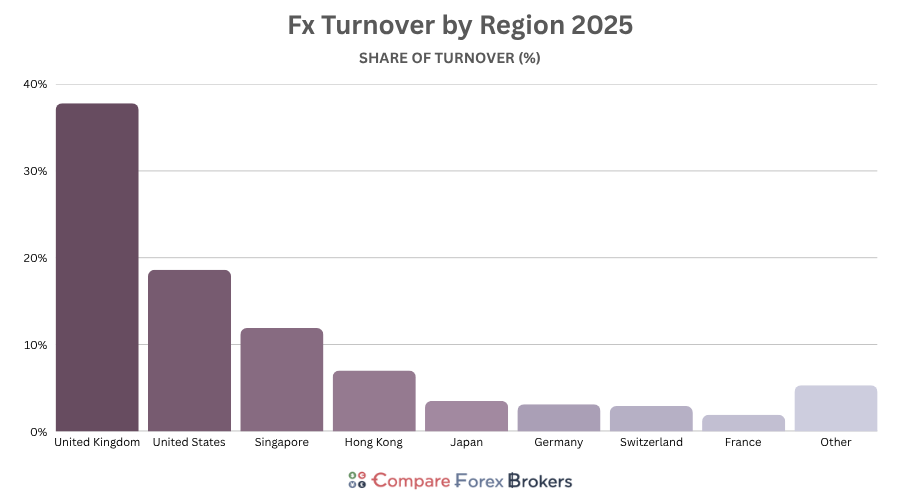

UK’s Role in Global Foreign Exchange

In 2025, the United Kingdom’s foreign exchange market is handling $4.7 trillion USD per day, equal to 37.8% of global turnover. That scale means more currency changes hands in London every single day than the UK’s annual GDP. With a 27.1% increase from 2022, annual forex turnover in UK markets is now $1,732.09 trillion.

London’s daily forex turnover exceeds the UK’s entire annual GDP by more than 1.5 times.

While many assume New York markets in the United States (US) turn over the most foreign exchange, they average $2.33 trillion daily or $852.17 trillion annually, which equates to a significantly lower 18.6% market share. The gap between the UK and US has actually widened since 2019, with London gaining ground while New York’s share has remained broadly stable. Together the two still account for more than half of all global forex activity, but London alone now processes nearly twice as much as its closest rival.

UK handles 37.8% of all FX trading, nearly double the US share of 18.6%

The UK’s larger share comes down to its time zones bridging Asia and US markets, meaning trading stays active through more of the day, and the fact London concentrates interdealer and prime broker flow that anchors pricing for the rest of the market. These factors mean forex spreads are low, and depth is high, so more orders are routed through UK markets.

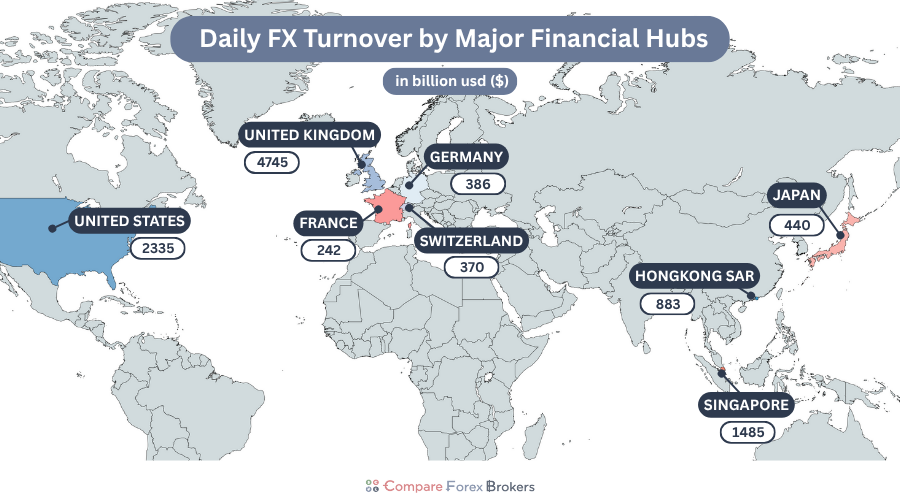

London vs Other Major Financial Hubs

London is the largest foreign exchange hub in the world, trading more each day than New York and Singapore combined. Its $4.7 trillion daily turnover gives it a scale unmatched by any other centre, a position it has held for decades.

Daily FX Turnover by Major Financial Hubs

London’s daily $4.7 trillion turnover is more than double New York’s $2.3 trillion and triple Singapore’s $1.5 trillion. Together, the UK and US account for over 60% of the world’s forex trading, confirming activity is still based around these two centres despite Asia’s growing share.

| Country/Hub | Daily turnover ($bn) |

|---|---|

| United Kingdom | 4,745 |

| United States | 2,335 |

| Singapore | 1,485 |

| Hong Kong SAR | 883 |

| Japan | 440 |

| Germany | 386 |

| Switzerland | 370 |

| France | 242 |

Singapore has seen the biggest shift among Asian hubs over the past 15 years. In 2010, it held less than 5% of global turnover, compared with 15.6% today. This rise has been driven by Asia’s economic expansion, the internationalisation of the Chinese yuan, and stronger regional hedging flows.

As a result, Singapore now handles more forex trading than Tokyo and Hong Kong combined, cementing its role as Asia’s main financial gateway.

Daily Turnover on Global Forex Markets

Foreign exchange is the largest financial market, turning over $9.6 trillion per day worldwide, or $3.5 quadrillion a year. Global trading volumes increased by 28% between 2022 and 2025, up from $7.5 trillion per day in 2022, roughly double the 14% increase seen in the 2019 – 2025 period prior.

The key factors influencing this positive growth are interest rate gaps reviving carry trading, companies and asset managers hedging more currency risk, and electronic platforms keeping liquidity available across more hours and more currency pairs.

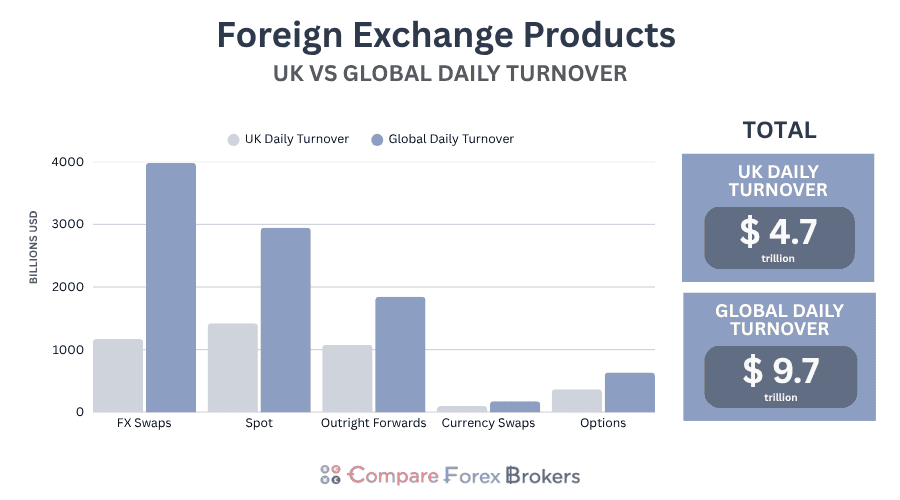

Market Share by Instrument in the UK

What are the most commonly traded fx products?

The most commonly traded FX products are swaps, spot, and outright forwards, which together account for nearly 90% of UK daily turnover. Swaps lead with 37.3% of trading, followed by spot at 29.9% and forwards at 22.8%.

- $1.77 trillion were FX swaps

- $1.42 trillion spot

- $1.08 trillion outright forwards

- $0.10 trillion currency swaps

- $0.37 trillion options

This mix shows London’s role in short dated funding and hedging, with swaps providing the pricing backbone for spot and forward markets

| Fx Product | UK Daily Turnover ($bn) | UK Share (%) | Global Daily Turnover ($bn) | Global Share (%) |

|---|---|---|---|---|

| FX Swaps | 1,770 | 37.3% | 3,980 | 41.5% |

| Spot | 1,420 | 29.9% | 2,946 | 30.8% |

| Outright Forwards | 1,080 | 22.8% | 1,843 | 19.2% |

| Currency Swaps | 100 | 2.1% | 176 | 1.8% |

| Options | 370 | 7.8% | 634 | 6.6% |

| Total | 4,745 | 9,579 |

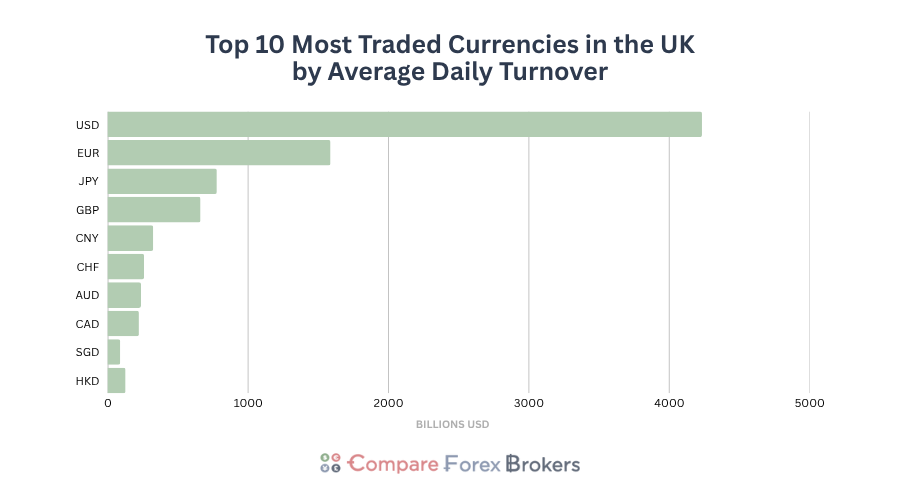

Top 10 Most Traded Currencies in the UK

The dollar is the most traded currency in the UK, and involved in almost every trade accounting for 89.2% of UK turnover (very close to its worldwide share). The euro is second most traded with a 33.5% share in the UK, slightly higher than the global average, showing London’s role as a hub for euro-dollar trading.

Sterling accounts for 14% of UK turnover, nearly double its 7.9% global share

Top 10 most traded currencies in the UK by average daily turnover are:

- US Dollar (USD) $4,233bn

- Euro (EUR) $1,587bn

- Japanese Yen (JPY) $777bn

- British Pound (GBP) $661bn

- Chinese Renminbi (CNY) $324bn

- Swizz Franc (CHF) $259bn

- Australian Dollar (AUD) $237bn

- Canadian Dollar (CAD) $222bn

- Singapore Dollar (SGD) $89bn

- Hong Kong Dollar (HKD) $127bn

The renminbi’s role has grown, with 6.8% of trading in London, compared with 4.7% worldwide, confirming the UK as the leading offshore centre for RMB by connecting Asian flows with global investors. By contrast, the Hong Kong dollar is relatively under-traded in the UK at 2.7%, less than half its global share, as most HKD liquidity stays in Asian centres.

The Singapore dollar is unusual in that it makes the UK top 10, even though it doesn’t feature in the global top 10.

SGD’s 1.9% share in London reflects hedging and interdealer flows that pass through UK markets in the Asian morning session.

| Country | USD | EUR | JPY | GBP | CNY | CHF | AUD | CAD | HKD | SGD |

|---|---|---|---|---|---|---|---|---|---|---|

| UK ($m) | 4,233,089 | 1,587,107 | 777,135 | 661,152 | 324,189 | 259,170 | 236,668 | 222,425 | 126,974 | 89,141 |

| UK (%) | 89.2% | 33.5% | 16.4% | 14.0% | 6.8% | 5.5% | 5.0% | 4.7% | 2.7% | 1.9% |

| USA ($m) | 2,121,323 | 639,687 | 368,917 | 244,642 | 156,067 | 156,067 | 177,146 | 222,425 | 53,367 | 52,956 |

| USA (%) | 90.9% | 27.4% | 15.8% | 10.5% | 6.7% | 6.7% | 7.6% | 9.5% | 2.3% | 2.3% |

| Germany ($m) | 268,650 | 260,761 | 32,921 | 36,855 | 7,649 | 34,608 | 386,077 | 8,718 | 4,368 | 2,645 |

| Germany (%) | 38.3% | 37.2% | 4.7% | 5.3% | 1.1% | 4.9% | 55.0% | 1.2% | 0.6% | 0.4% |

| France ($m) | 200,183 | 161,455 | 29,586 | 28,022 | 2,818 | 14,105 | 242,217 | 6,496 | 2,253 | 1,936 |

| France (%) | 40.9% | 33.0% | 6.0% | 5.7% | 0.6% | 2.9% | 49.5% | 1.3% | 0.5% | 0.4% |

| Singapore ($m) | 1,394,617 | 203,396 | 346,254 | 78,797 | 52,639 | 34,515 | 140,493 | 2,422 | 97,181 | 118,874 |

| Singapore (%) | 93.9% | 13.7% | 23.3% | 5.3% | 3.5% | 2.3% | 9.5% | 0.2% | 6.5% | 8.0% |

| Worldwide ($m) | 8,490,000 | 2,946,000 | 1,620,000 | 755,000 | 450,000 | 520,000 | 470,000 | 470,000 | 594,000 | 300,000 |

| Worldwide (%) | 88.9% | 30.8% | 16.9% | 7.9% | 4.7% | 5.4% | 4.9% | 4.9% | 6.2% | 3.1% |

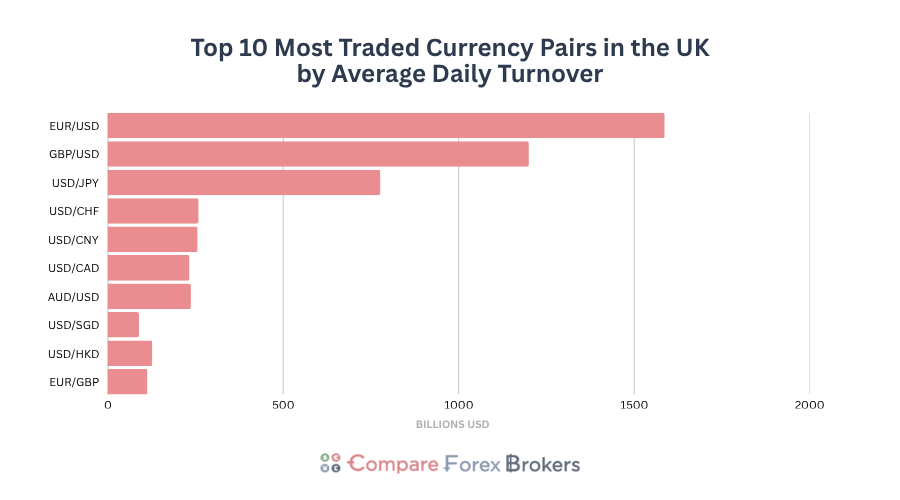

Most Traded Currency Pairs in UK

The most traded currency pair in the UK is EUR/USD, with over $1.59 trillion daily turnover, followed by GBP/USD at $1.20 trillion. Together, these two major forex pairs account for more than half of London’s total FX activity.

EUR/USD and GBP/USD together make up over 50% of UK FX turnover

The dominance of dollar pairs reflects the USD’s role as the world’s settlement currency, while London’s unique time zone position makes it a hub for trading both US and European currencies.

Top 10 most traded currency pairs in the UK by average daily turnover are:

- EUR/USD $1,587bn

- GBP/USD $1,200bn

- USD/JPY $777bn

- USD/CHF $259bn

- USD/CNY $256bn

- USD/CAD $233bn

- AUD/USD $237bn

- USD/SGD $89bn

- USD/HKD $127bn

- EUR/GBP $113bn

London’s trading profile shows some clear differences from our global forex statistics. GBP/USD ranks second in London but only fifth worldwide, underlining the home advantage of sterling trading.

EUR/GBP makes the UK top 10 but is not the global shortlist, showing sterling’s home bias

By contrast, USD/HKD ranks higher globally (thanks to Asian hubs) but is only 2.7% of UK turnover, since most liquidity in the Hong Kong dollar stays closer to its home market.

What are the Most Traded GBP Currency Pairs Worldwide?

The most traded GBP currency pairs worldwide are GBP/USD and EUR/GBP, which together account for 81.6% of sterling’s global turnover. GBP/USD averages over $500 billion in daily trading, reflecting its role as a bridge between US and UK markets.

EUR/GBP follows at around $113 billion per day, while other frequently traded sterling pairs include GBP/JPY, GBP/CHF, and GBP/AUD, often influenced by interest rate differences and overlapping trading hours.

Forex Traders in the UK

The UK has one of the most active retail trading populations in the world, but only a minority of adults actually trade foreign exchange. According to the Financial Conduct Authority’s Financial Lives 2024 survey, around 2.2 million UK adults, which is roughly 4% of the population, reported taking part in high risk investments such as CFDs, cryptocurrency, or spot fx.

75% of UK retail forex traders are men, with the highest participation among 25–34 year olds.

Participation peaks between the ages of 25 and 34, then falls away steadily with age, showing how heavily leveraged trading skews towards younger adults. The FCA also found that many of these traders are relatively well-educated and earn above average incomes, yet 41% still display at least one sign of financial vulnerability.

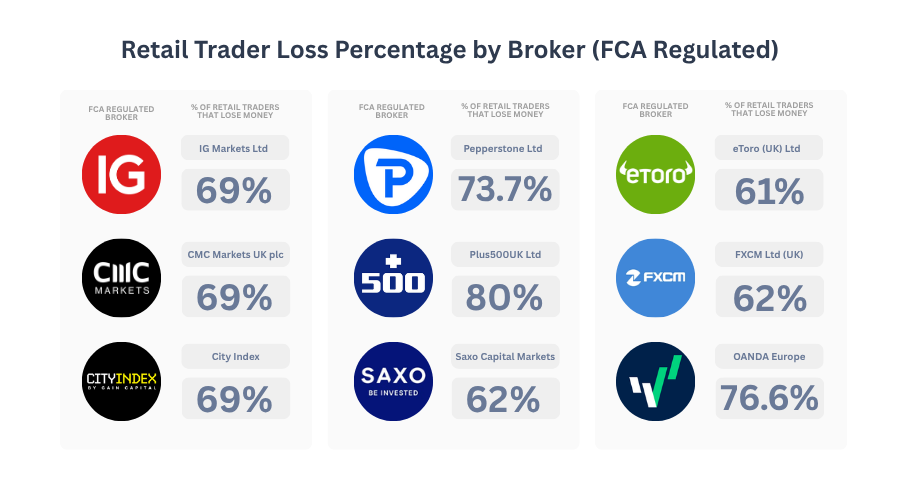

What percentage of forex traders are successful?

Most retail forex traders in the UK lose money, with data from the local regulator, the Financial Conduct Authority (FCA), showing 70 to 80% end up with net losses over time. The FCA’s Financial Lives 2024 survey pointed out that many traders underestimate risk and overestimate their ability to profit, with one in four high risk investors describing themselves as unwilling to take risks despite actively trading.

FCA data suggests only 20 to 30% of UK retail forex traders are profitable, meaning around three quarters lose money.

The few who succeed tend to trade with discipline, risk limits, and longer horizons, but they are in the minority.

| FCA Regulated Broker | % of Retail Traders That Lose Money |

|---|---|

| IG Markets Ltd | 69% |

| CMC Markets UK plc | 69% |

| City Index (GAIN Capital UK) | 69% |

| Pepperstone Ltd (UK) | 73.7% |

| Plus500UK Ltd | 80% |

| Saxo Capital Markets UK Ltd | 62% |

| eToro (UK) Ltd | 61% |

| FXCM Ltd (UK) | 62% |

| OANDA Europe (UK site) | 76.6% |

Our Methodology

The foreign exchange trading statistics in this article are mostly drawn from the Bank for International Settlements (BIS) Triennial Central Bank Survey 2025, the most comprehensive global review of foreign exchange and derivatives activity, which captures turnover by country, instrument, and currency.

UK retail trading insights are taken from the Financial Conduct Authority’s Financial Lives Survey 2024 and its Consumer Investments Data Review 2024, which provide detailed information on participation, demographics, and outcomes among UK traders.

Sources