Pepperstone UK Review 2026

Pepperstone is one of the more prominent Forex Brokers in the market. They offer spreads on the EUR/USD from 0.0 pips and commissions of £2.25 per lot along with popular trading CFD platforms such as MT4, MT5, cTrader and TradingView.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

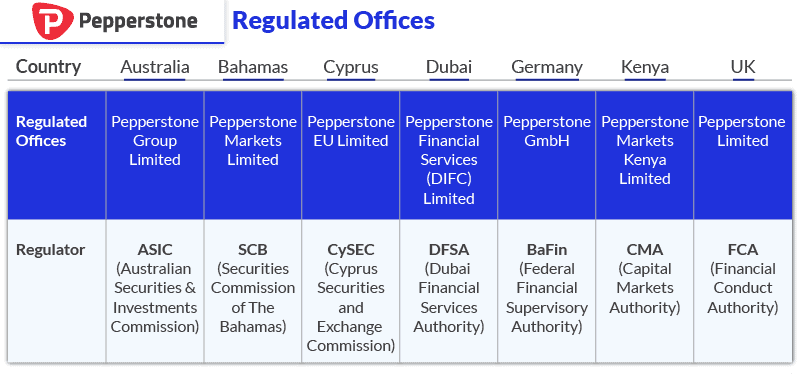

| 🗺️ Country Regulation | Australia, Bahamas, Cyprus, Dubai, Germany, Kenya, UK |

| 💰 Trading Fees | Lowest Variable Spreads |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView, Social Trading |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ CFDs Offered | Forex,, Gold/Silver, Commodities, Shares, Indices |

| 💳 Credit Card Deposit | Yes |

Why Is Pepperstone The Best Forex Broker in UK?

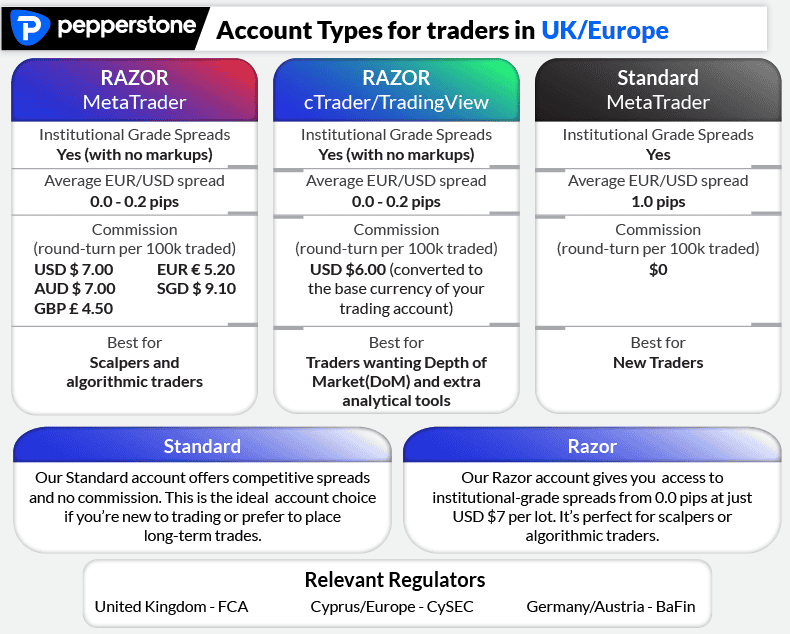

With a score of 98/100, Pepperstone was the clear winner when it came to execution speed, spreads, range of markets and forex trading platforms. The broker is almost one fo the most trusted with not just FCA regulation in the UK but also CySEC, BaFin and ASIC.

Why Choose Pepperstone

In 2026, we reviewed Pepperstone and found that the broker has several compelling features that stand out from the pack. In the UK, where no commission trading is prevalent, you should take note of the broker’s industry-leading spreads, which start from 1.0 pips. Experienced traders and scalpers will take want to take note of the broker’s Razor account, which has 0.0 pips spreads.

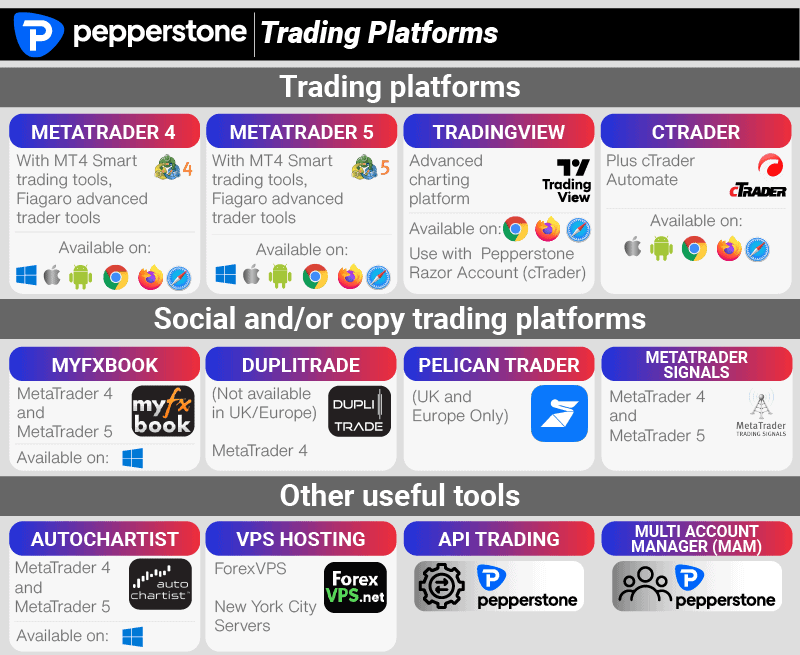

It’s not just the low costs that make Pepperstone stand out but their range of features. These include four trading platforms, including every popular MetaTrader 4 and the fast-growing charting platform TradingView. To help you with your trading, they provide trading software such as Smart Trader Tools, Figaro Advanced Trader Tools, and three social trading options in Pelican, Myfxbook, and MetaTrader Signals. Regardless of your platform, scalping, automation (including expert advisors), and mini and micro-lot trading are permitted.

Other notable features include over 92 currency pairs, crypto, shares, indices, ETF, and commodity trading. Award-winning customer service and free trading education tools are likewise available.

With such an excellent range of features, Pepperstone deserves the multiple awards we have bestowed, including the best broker in the UK, the best broker for MetaTrader 4, and the best standard account broker.

Pepperstone Pros And Cons

- Zero commission trading (from 0.6 PIPs)

- 5 of the best forex trading platforms

- Great 24/7 customer support

- No stock equities (CFD only)

- Limited risk management

- Lack e-Wallet options

Open a demo accountVisit Broker

Between 74–89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The overall rating is based on review by our experts

1. Pepperstone Has Market-Leading Spreads

Pepperstone is well-known as one of the best UK brokers for ultra-tight forex spreads. Pepperstone Account Types offer competitive spreads compared to other top UK forex brokers.

Standard Account

The standard account type is ideal for beginner traders as you pay no commission fees on top of the spread. Instead, you can trade no commission forex spreads that equals the raw spread + at least 1.0 pips increase (e.g. 0 pip spread plus 1.0 pip = 1.0 pip)

| 1.10 | 1.10 | 1.30 | 2.10 | 1.40 |

| 0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

| 1.90 | 2.00 | 2.40 | 2.30 | 2.50 |

| 1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

| 1.40 | 1.60 | 1.40 | 2.10 | 1.90 |

| 1.40 | 1.90 | 1.30 | 1.90 | 1.70 |

| 0.70 | 0.80 | 1.30 | 2.40 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

The table above compares Pepperstone’s commission-free standard spreads to other top brokers. As you can see, Pepperstone is a great option for UK traders with ultra-competitive average spreads for all major currency pairs.

Please note, average spreads are sourced directly from the broker’s websites and updated monthly.

Razor Account

Pepperstone’s Razor pricing is similar to an ECN account, with spreads starting from 0.0 pips plus commission fees. The commission fee you pay per trade depends on the trading platform you are using, plus the volume you are trading.

- MT4 & MT5: USD 3.50 / GBP 2.25 per side per 100,000 units traded (USD 7.00 / GBP 4.50 round-turn).

- cTrader & TradingView: USD 6.00 per lot per 100,000 units traded (round-turn) converted to the nominated account currency

Likewise to their no commission spreads, Pepperstone’s Razor account pricing is among the best worldwide for retail traders. Regardless of the currency pair you want to focus your trading strategies on, Pepperstone offers tight spreads and low commission fees.

ECN Spread comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.10 | 0.20 | 1.10 | 0.40 |

| 0.08 | 0.35 | 3.50 | 0.73 | 0.65 |

| 0.10 | 0.20 | 0.30 | 1.00 | 0.50 |

| 0.16 | 0.29 | 0.54 | 0.68 | 0.70 |

| 0.20 | 0.40 | 0.50 | 0.70 | 0.70 |

| 0.10 | 0.40 | 0.50 | 0.90 | 1.40 |

| 0.10 | 0.50 | 0.60 | 0.40 | 0.60 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Razor account spreads to varying ECN trading account types can be reviewed below. The EUR/USD spread is the trendsetter, starting from 0 pips, with an average spread of 0.13* based on information from Nov – Nov 2019. Compared to the AUD/USD, spreads start from 0 pips and maintain an average spread of 0.14.

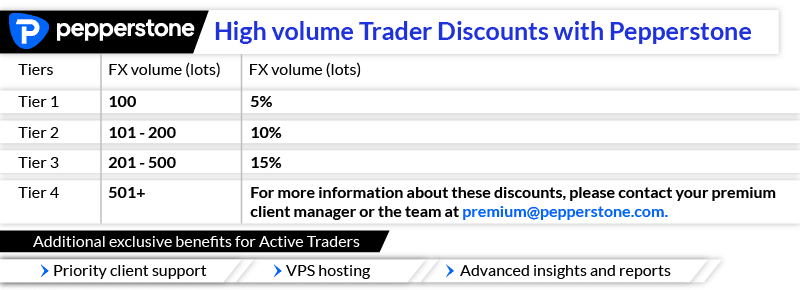

In 2019 the branded active trader program was initiated to reward traders who attained “frequent flyer” status when it came to trading. The program allows members to benefit from receiving a portion of the commission from their FX trades back into their trading accounts as rebates. Traders will earn GBP 1 rebate per FX lot traded up to 500 lots. That’s a typical monthly rebate of between GBP 200 – 500, paid into your account daily.

Pepperstone is highly recommended for high-volume traders as they offer the most competitive commission (i.e. lowest) of any retail Forex broker globally. The maximum level will mean a commission rate of up to 43% on a regular trading commission. Additionally, a swap-free account, aka Islamic Account, is available for those unable to make or receive payments derived from interest rates.

Spreads Are Even Lower Due To Price Improvement Technology

Price Improvement Technology (PIT) is another method in which Pepperstone can reduce brokerage fees. When a volatile market exists, PIT works in three major steps to enhance the benefit of large price movements.

- A trader makes a Forex or CFD Trade through one designated platform; MT4 or cTrader.

- Trade is then executed whilst a more favourable price movement is detected.

- PIT aims to fill the price at a greater benefit to the trader.

Zero Fees On Deposits And Withdrawals

Often, international institutions charge their own fees, which need to be paid by a client. Pepperstone prides itself on the notion that it doesn’t charge fees for deposits. Payments must be made by first-party bank accounts. Payments will only be accepted if bank accounts and names match.

- Visa – Instant funding through Verified By Visa is available at no charge.

- MasterCard – MasterCard SecureCode allows a deposit of fast funds similar to Visa; fees are not included.

- PayPal – Funding an account with PayPal means zero fees

- POLi & BPay – Traders who have eligible bank accounts can make transfers at any time

- China Union Pay – Offering funding at any time, plus no fees or charges

- Wire Transfer (Domestic & International) – These are available; however, they can be time-consuming

- Skrill (Moneybookers), Qiwi & Neteller – Instant deposit method, available 24/7 with no additional charge

- Fastapay – Deposit money instantly, with no fees

Any withdrawal requests received before 8:00 am GMT are processed on the day they are received. If made past the 8:00 am deadline, the deposit will be put through the next day. The Pepperstone account will receive funds via the bank account which has been linked to the relevant account. Third-party withdrawals are not allowed, as is the case for deposits. A credit card can be used for withdrawals if the withdrawn amount is equal to or is less than the deposited amount. If this isn’t the case – an alternative method will be required for the withdrawal.

It’s important to note that when employing a bank wire transfer, the waiting period is often between three to five working days, whilst an International Telegraphic Transfer incurs a fee of approximately 10.5 pounds.

Trading with a Pepperstone Razor account provides a broker with low trading costs without a No Dealing Desk Brokers. Leading spreads in a multitude of markets as well as access to price improvement technology and low commissions.

Determined to understand and become better educated on all things Pepperstone? Learn more and view the complete Pepperstone Fees page.

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Pepperstone Review: Trading Platforms

The Pepperstone Group offers the two most popular Forex trading platforms globally:

The Pepperstone Group offers the two most popular Forex trading platforms globally:

1) MetaTrader Platforms

- MetaTrader 4 is the world’s most popular forex trading platform

- MetaTrader 5 is an upgrade on its predecessor with more powerful features

- Ideal for automated trading, day trading, scalping and hedging

- Keeps traders ahead of the market with up-to-date quotes, news and market analysis features

2) cTrader

- A trading platform made for traders by traders designed to replicate an institutional trading environment

- Personalised for each trader through pre-set & detachable charts

- Enables traders to code their own strategies in C# (seen in our cTrader review)

3) TradingView

- Advanced charting technology

- Trading directly through charts

- Ability to connect with the world’s largest social trading network

4) Capitalise.ai

- Automation with no code

- Backtesting to test strategies

- Automation through the use of Pine Script coding

Generally, it’s difficult to separate the Forex trading platforms that are offered by the CFD broker. The availability of resources, user-friendly platform, and interest in Forex automation (EAs) all indicate a preference for MetaTrader 4. However, MetaTrader 5 provides automation in a different code. View our Pepperstone MT4 vs MT5 guide to determine which MetaTrader forex platform best suits your trading habits.

cTrader, on the other hand, provides advanced trading platform customisation with cTrader Automate (formerly cAlgo) combined with advanced risk management and order functionality. With no need to download Webtrader, it can be used as a backup plan for the popular forex trading platforms for traders who access Pepperstone from a public computer.

Pepperstone Execution Speeds

The Pepperstone Razor account, better suited for scalpers and algorithmic traders, avoids forex trading dealer intervention, connecting you directly to the interbank market. The main difference between the Razor and the Standard accounts is the raw spreads and commissions made from the Razor account, allowing for a lower-cost setup.

As a true ECN broker, Pepperstone ECN offers the best spread betting platform combines fast global trading servers with the leading optic fibre network latency can be low as 0.05 of a second (50ms). Relative to other forex brokers, Pepperstone ranks fastest in terms of speed.

1) Fast Global Trading Servers

The Equinix servers, one of the leading firms at NASDAQ, recently partnered with Pepperstone. Equinix has servers set up at two strategic locations in terms of liquidity pools with London and Wall Street accessible to 60+ Exchanges, 400+ buy/sell firms and over 150 Financial Service Providers.

2) Optical Fibre From Australia To Wall Street

The utilisation of an optical fibre network from the Pepperstone head office in Sydney to the Equinox server in New York ensures that global traders can be confident regarding location. Potential remoteness issues are nonexistent. The optic fibre connection reduced the latency by up to 10 times!

3) Smart Trader Tools (MetaTrader Only)

A package of 16 trading tools and 15 custom indicators are on offer to traders that choose MT4 or MT5 trading platform. Some of the more sought-after features include:

Correlation Matrix, showing relationships between instruments

Correlation Matrix, showing relationships between instruments- Autochartist highlighting the statistically significant movements in the market

- Alarm Manager alerts trading of key price changes and market events

- Sentiment Trader showing the sentiment of past and live trading data

- Connect Feature delivering news, analysis as well as an economic calendar

- Excel RTD merging real-time data with excel

- Trade Simulator allows for the testing of strategies (only for MT4)

- Stealth Orders keep pending orders hidden from the market

- Session Map highlighting which currency markets are live and operational

- Mini Terminal still see markets whilst hiding MetaTrader

Pepperstone Trading Platform Conclusion

Fast execution speeds and enhanced, top-of-the-range features ensure that Pepperstone offers a pair of the most sought-after Forex platforms. Offering the quickest trading environment of the Forex brokers combined with outstanding options in the platform category, Pepperstone can only be awarded the maximum amount of points in this particular category, ticking every box when it comes to trading platforms.

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

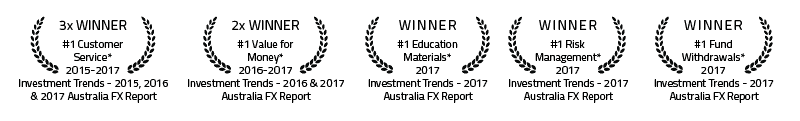

3. Pepperstone Has Award Winning Customer Service

Gaining a 3% rise in the market share comes with reasons. For Pepperstone, this remarkable increase within the retail forex trading market comes from its exceptional customer support. Pepperstone won the Investment Trends overall client satisfaction award, further making a statement that the assistance provided to brokers is simply unparalleled.

What core aspects have allowed Pepperstone to excel in its customer support division?

1) Personalised Customer Service

Having a team that holds years of expertise within the forex trading sector is the perfect place to start when building an award-winning department. These real traders can educate and assist in answering every Forex inquiry. Whether you are at the outset, in the middle, or even an expert in the trading arena – you can ask questions and seek guidance on any matter. In some high-volume trading cases, a dedicated account manager may be assigned to a specific forex trader, allowing Pepperstone to understand the trader’s trading needs better.

2) 24-Hour Support

Support is constantly available whenever forex markets are open around the globe. The five offices, located in strategic positions; (1) London, (2) Shanghai, (3) Dallas, (4) Bangkok, and (5) Melbourne, highlight Pepperstone’s desire to service all their clientele. This 24-hour support also extends Pepperstone’s reach beyond traders in the UK.

3) Customer Support Channels

Pepperstone possesses a strength, with its ability to engage in live chat, to provide a high level of support to traders. This feature, accessible around the clock, similar to their phone customer support (with respective national numbers for corresponding office locations), is brilliant in ensuring brokers can always reach out for assistance. Although notably less used, e-mail support is available.

Additionally, the CFD broker offers a range of educational resources to supplement their award-winning customer support, with materials such as webinars and trading platform tutorials available.

Pepperstone Broker Reviews Match Their Awards

Since launching in 2010, many review pages have generated positive feedback regarding Pepperstone and its services. In Nov 2019, Pepperstone’s overall score was 8.9 from over 450 reviews, placing them on the front foot when it came to trader satisfaction.

On reviewing content, there were a couple of issues concerning Pepperstone. The first was about ‘exotic pairings’, currency pairings outside the major global currencies. Another problem in the reviews pertained to the withdrawal of money from accounts. Overall, the overwhelming amount of reviews leaned towards positive features that Pepperstone possesses, including the speed of the VPS, being <5ms, quick deposits, and how accessible creating an account is.

Investment Trends, in their annual survey, asserted that Pepperstone was the best broker in terms of customer service, value for investment, relevant platforms, and execution speeds.

Pepperstone Customer Service Conclusion

It’s evident that Pepperstone provides outstanding support service to consumers based on the following:

- The well-versed and experienced customer service team has attained multiple awards

- A multitude of touch points open to guidance and assistance for brokers

- Overwhelmingly positive reviews from traders

The only broker that could top the excellent reviews Pepperstone received was OANDA – well-known for its determination to be the best in this category. See our Pepperstone vs OANDA comparison for more information.

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Pepperstone Offers Spread Betting

For UK and Irish clients spread betting is available from Pepperstone as an alternative to CFD trading.

Like CFD trading, spread betting lets you speculate on rising and falling financial markets without owning the underlying asset. You can also spread bet on the same range of instruments that Pepperstone offers as CFDs.

Pepperstone also lets you spread bet on margin, the same as leverage on CFDs. This allows you to spread bet on a large position while putting up just a small percentage of the trade’s full value.

However, the significant difference between CFDs and spread betting is the tax benefits (spread betting is free from capital gains tax and stamp duty). This lowers your costs and increases your profit potential.

To spread bet with Pepperstone, the broker offers an account much like its Standard Account, which offers spreads starting from 0.7 pips. While these are relatively low, spreads can widen as much as 1-2 pips from our experience, and there are lower-cost brokers out there.

When opening test CFD and spread betting accounts with Pepperstone, we rated it a perfect score of 15/15 due to how straightforward it was. We found the 4-step process is ultra-simple and takes minutes. It involves choosing your account type and platform, agreeing to the terms and conditions, and submitting.

You need to verify that you’re a UK resident, which is stipulated by the main UK regulatory body, the Financial Conduct Authority (FCA), to open a Pepperstone spread betting account. Once accepted, Pepperstone will contact you with an invitation to create a profile and open an account.

On our sister site (spread-bet.co.uk) you can view our full Pepperstone spread betting review where we compare the broker to the other 16 providers.

5. Pepperstone Offers Risk Management Features

CFDs are complicated instruments, so brokers must know that risks are involved when trading with such markets. Furthermore, using leverage heightens the chances of inexperienced brokers losing their capital in the blink of an eye. Brokers must understand the risks and are guarded with the tools to mitigate these risks. Pepperstone provides some of these tools. However, these only equip traders with part of the toolbox. Continue reading to determine further details of the risk management features on hand.

Currency Trading Orders Types

When faced with currency trading orders, Pepperstone presents brokers with three different order types. These include; a limit order and a stop-loss order which essentially withdraws from a trade upon achievement of a certain price. Such boundaries can be set as a price or the maximum you are willing to gain/lose in a particular trade. The final currency trading order moves with the market as it fluctuates – establishing itself as a trailing stop. This will activate only when the predetermined level has been attained.

Having understood the above limitations, you should note that Pepperstone does not offer guaranteed stop-loss orders. These are similar to ‘stop-loss’ orders with the slight difference that the maximum loss is locked in at a specific level, as opposed to losses that surpass it in a high-volatility market. Although guaranteed stop-loss orders may have caused a substantial fee hike, they are effective in risk management for traders who don’t want to expose themselves to risk.

Another risk management tool that Pepperstone does not provide is negative balance protection. Although there are measures created to prevent an exit from a CFD trade exceeding a trader’s deposit – this is not 100% foolproof. If a trader is averse to risk, it would be wise to consider a broker that offers Negative Balance Protection (i.e. easyMarkets).

Regulation Of Pepperstone

Pepperstone operates in the UK as Pepperstone Limited with company number 08965105 and is regulated by the Financial Conduct Authority (FCA) with licence number #684312.

Whilst not relevant if you are a trader in the UK, it is worth noting that Pepperstone is a highly regulated broker across the globe. This suggests that Pepperstone has a reputation of trust since the broker must comply with the local requirements of some of the most stringent financial regulators in the world.

| Pepperstone Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA BaFin CySEC |

| Tier-2 | DFSA |

| Tier-3 | SCB CMA |

Final Thoughts On Pepperstone

Based on this Pepperstone UK review, it would be recommended that the Pepperstone Razor Account should be used by:

- Traders on an intermediate level – those searching for the lowest fees and spreads as well as popular Forex Trading Platforms. Such traders will also choose their broker reading reviews. For this reason, Pepperstone’s Razor Account is the most appropriate.

- Traders with ample experience – those looking to test their skills and expertise with advanced features, including automated trading, higher leverage, and speedy execution on trades.

This award-winning combination of top-class customer service, the lowest fees, and a variety of successful features puts Pepperstone’s brand in the limelight among brokers in the UK.

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Pepperstone Offers A Variety Of Deposit And Withdraw Methods

In the UK, Pepperstone allows accounts to be funded using Visa debit and credit cards, Mastercard debit and credit cards, and PayPal. While other e-Wallet options such as Skill, NETELLER, UnionPay, BPAY, and Poli are available to clients of Pepperstone in other certain other countries such as Australia, UK clients are not so lucky.

There is no cost to make a deposit using PayPal. In fact, there is no cost for any of the funding methods except for bank transfers. Regardless of your payment method, deposits are immediate, with withdrawals taking 1 to 3 working days. Making deposits via Bank Transfer can reflect on the same day or take up to 3 days.

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

How Popular Is Pepperstone?

There are 135,000 monthly searches for Pepperstone each month on Google, making it the 19th most popular Forex Broker. Similarweb in February 2025 shows a similar story with the broker the 22nd most visited, receiving 1,474,000 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| Brazil | 9,900 |

| Australia | 8,100 |

| United Kingdom | 6,600 |

| Kenya | 6,600 |

| Germany | 5,400 |

| Colombia | 5,400 |

| United States | 4,400 |

| Mexico | 4,400 |

| Thailand | 4,400 |

| Malaysia | 4,400 |

| India | 3,600 |

| Hong Kong | 3,600 |

| Italy | 2,900 |

| South Africa | 2,900 |

| Indonesia | 2,900 |

| Spain | 2,400 |

| Singapore | 2,400 |

| Bolivia | 2,400 |

| Turkey | 1,900 |

| France | 1,600 |

| United Arab Emirates | 1,600 |

| Peru | 1,600 |

| Taiwan | 1,600 |

| Pakistan | 1,300 |

| Nigeria | 1,300 |

| Argentina | 1,300 |

| Chile | 1,300 |

| Ecuador | 1,300 |

| Netherlands | 1,000 |

| Philippines | 1,000 |

| Vietnam | 1,000 |

| Dominican Republic | 1,000 |

| Mongolia | 1,000 |

| Poland | 880 |

| Canada | 880 |

| Portugal | 720 |

| Sweden | 720 |

| Morocco | 720 |

| Cyprus | 590 |

| Uganda | 590 |

| Tanzania | 590 |

| Japan | 480 |

| Egypt | 480 |

| Saudi Arabia | 480 |

| Venezuela | 480 |

| Costa Rica | 480 |

| Ethiopia | 480 |

| Austria | 390 |

| Switzerland | 390 |

| Bangladesh | 390 |

| Algeria | 390 |

| Cambodia | 390 |

| Panama | 390 |

| Ghana | 320 |

| Sri Lanka | 320 |

| Botswana | 320 |

| Ireland | 260 |

| Greece | 260 |

| New Zealand | 210 |

| Uzbekistan | 210 |

| Jordan | 210 |

| Mauritius | 170 |

| Uruguay | 170 |

9,900 1st | |

8,100 2nd | |

6,600 3rd | |

6,600 4th | |

5,400 5th | |

5,400 6th | |

4,400 7th | |

4,400 8th | |

4,400 9th | |

4,400 10th |

Can You Trust Pepperstone?

Pepperstone is unlike many other foreign exchange brokers. They are based in Australia with management operations that have ample currency trading experience. The firm was established in 2010, with Australian regulations and holding the Australian Financial Services Licence 414530. Most recently, the Pepperstone Melbourne office Champ was given the title of a strategic investor in the company.

Being a regulated Forex Broker through ASIC implies several regulations that satisfy capital requirements. The staff at Pepperstone needed to undergo training and comply with industry risk management procedures, audits, and accounting standards. Most FX Broker scams arise when brokers pretend to be regulated traders. The National Australia Bank holds Pepperstone’s financial accounts as regulated brokers must keep client accounts with Australian financial institutions.

Traders on the Pepperstone YouTube channel can sift through information, training, and reviews on currency and forex-related topics. Pepperstone’s resource centre provides accessible information to traders. Although not relevant to UK traders, the Pepperstone offices in Melbourne offer on-site trading for specific traders.

National Australia Bank

Under FCA regulations, there is a requirement for Pepperstone to keep clients’ funds in a segregated bank account. One of the ‘big 4’ banks – National Australia Bank (NAB), is responsible for ensuring compliance. The Australian government bank guarantee allows NAB to be the best place as the segregated bank account for retail brokers.

Funds deposited into an account

There is no minimum deposit to open an account. However, £200 is recommended. Active Trader Program users will have a higher minimum deposit. In the UK, deposits can be made using Visa/MasterCard credit cards, Visa/MasterCard debit cards, wire transfers, and PayPal. Withdrawals can be made through similar channels.

Leverage Offered

When Forex Brokers offer a level of leverage, it pertains to the potential trade value of a trader’s deposit. Pepperstone provides its traders with a leverage of up to 30:1. This means that traders can trade up to 30 times the amount of their initial deposit, ensuring they can maximise their exposure to Pepperstone’s services. Learn more about the leverage levels of the broker.

Trading Risk

It is integral for traders with brokers like FXCM and Pepperstone to note that 79% of those who invest funds will lose their capital. You must have substantial knowledge and understanding of CFDs before entering the trading arena. CFD trading has its own set of risks; therefore, all traders, whether beginners or experienced, should only trade with amounts they can afford to lose. Check out our full FXCM vs Pepperstone comparison for more information.

Pepperstone Demo Accounts

Demo accounts exist both on the cTrader and MetaTrader platforms. Please see our article on the best demo forex accounts, which elaborates on the positives of a demo account – more specifically for traders new to the industry and the exchange of foreign currencies. Traders can still access demo accounts once they’ve embarked on a life journey – ensuring an opportunity to test trades and plan strategies that suit traders.

Technical Analysis Offered By Pepperstone

Pepperstone offers technical analysis, which assesses the trends of pricing over some time, with a focus on charting. For Pepperstone traders, there exist three types of charts:

(1) A line chart essentially connects one closing price to another. This assists in identifying the trend of a market over a given time.

(2) Bar charts provide forex traders with further guidance on the price action. The bars are plotted vertically and can be incorporated to predict future price movements.

(3) Candlestick charts, also informing on highs and lows over time. However, this generates data on reversals and pivot points in live markets.

Fundamental Analysis Offered By Pepperstone

Fundamental analysis is information on events, occurrences, and forces that sway foreign exchange markets. These include political, financial, and economic factors. The news and daily updates (provided by Reuters) are critical to the impact on currency markets. These alerts range from surplus and deficit information to political policies, trade trends, and inflation.

Mobile App

For a modern trader, it’s crucial to have access to a trading application that offers the core functions of a forex trading platform and combines them with the functionality of a mobile app. It is done through the MT4 or MT5 App for iPhone® and Android®. It enables buying and selling of currency pairs on the go. On the other hand, cTrader has a mobile trading platform allowing access to those who desire to trade as they run along with their busy life schedule.

Opening an account with Pepperstone

Once you decide that Pepperstone is for you, an account can be opened easily. You can access the Pepperstone site by clicking the ‘visit website’ button at the bottom of the article. It takes 5-10 minutes to complete the entire application, assuming all the correct information and details are conveniently at hand.

1. Complete The Form

Completing a form, which includes the type of application required: Are you an individual, trust, or company? Following this, the regular fields should be filled out (i.e. name, phone number, e-mail).

2. Provide Your Preferences

Further information will be required upon completing the form, including several other personal information. Here, you will be able to decide on what level of leverage you need and be asked your level of expertise by the broker.

3. Verify Your Identity

The broker will then require ID verification and proof of address (i.e. presentation of a utility bill). Providing a passport will assist in avoiding the need to prove an address.

4. Download The Trading Platform

You can then download the forex trading platform and begin your trading experience. It is, of course, on the assumption that the paperwork and relevant information have been provided. This procedure may sometimes take up to a week. If any issues arise, customer service channels will be open to support and provide assistance.

Once you’ve signed up for an account, you will also need to select a base currency. Pepperstone UK offers four base currency options, GBP, USD, CHF, or EUR. The account base currency is the currency you can deposit and withdraw funds with. The forex broker offers a good range of fee-free funding methods, including bank transfer and e-wallet payment options.

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

About CompareForexBrokers

Compare Forex Brokersapplied their knowledge and understanding to create broker comparison tables assisting traders in choosing the right broker for their investments. These comparisons range from various aspects, including leverage, customer service, spreads, and the popularity of forex platforms.

This Pepperstone UK review was based on information and data obtained from the Razor forex trading accounts and the UK’s . This review is quite standard and factored in spreads of other CFD providers at the time of the Pepperstone UK review. The broker was names the best forex broker in UK. If you see any issues with the content provided in this article, please let us know via ‘contact us’.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Account Types

Account Types  Spreads

Spreads  Leverage

Leverage  Trading Platforms

Trading Platforms  Minimum Deposit

Minimum Deposit  Regulation

Regulation  Customer Support

Customer Support

Ask an Expert

What is the benefit of a professional account?

The main benefit of a professional account is access to higher leverage. While retail traders can trade with 1:30, professional traders can trade with 1:500. Some brokers also include discount commission incentives.