Pepperstone vs Plus500: Which One Is Best?

Let’s all take a look into our in-depth comparison of Pepperstone and Plus500, where we analyze crucial aspects such as trading costs, Forex trading platforms, and regulatory standards. Our goal is to guide you in selecting the ideal Forex broker for your trading requirements. Curious about which option is better suited for you? Read on for more insights.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

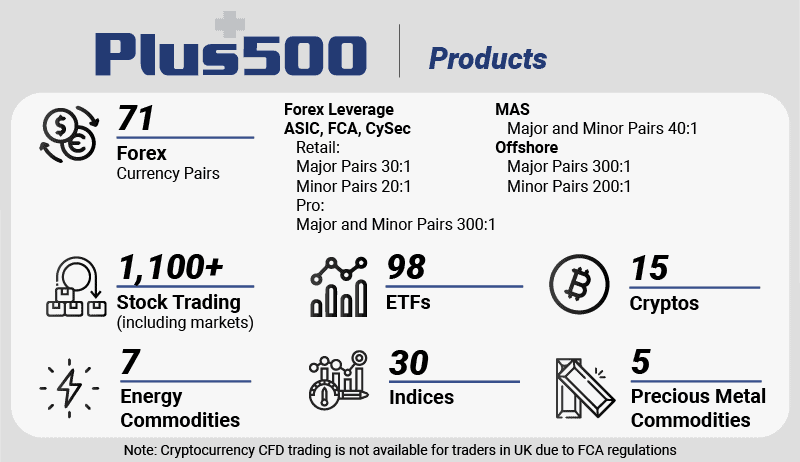

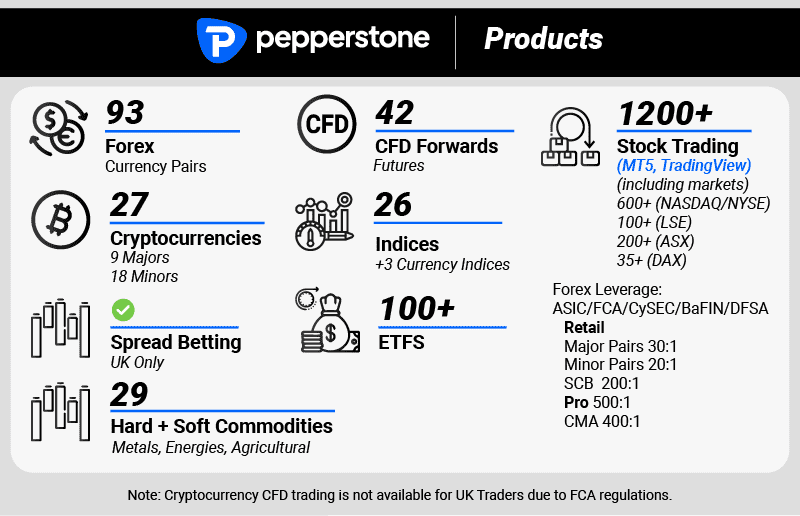

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and Plus500:

- Pepperstone offers tight no-commission spreads.

- Pepperstone provides MetaTrader 4, MetaTrader 5, and cTrader platforms.

- Pepperstone offers multiple funding methods without fees for most.

1. Lowest Spreads And Fees – Pepperstone

In forex trading, having lowest spreads and fees is truly important, as it significantly affects trading costs. Lower spreads minimize the gap between the buying and selling prices of currency pairs, thereby decreasing the expense associated with each trade. This advantage is particularly valuable for active traders, as it allows them to reduce transaction costs and enhance their overall profitability. In this case, we will compare Pepperstone and Plus500 spreads.

Spreads

When comparing spreads, Pepperstone offers a 1.1 pips spread for EUR/USD, while Plus500’s spread is 1.2 pips, both within the industry standard of 1.2 pips. For AUD/USD, Pepperstone’s spread is 1.2 pips, whereas Plus500 offers a slightly tighter spread at 1.1 pips, both well below the industry average of 1.5 pips. On the whole, Pepperstone’s average spread is 1.35 pips, significantly lower than Plus500’s 1.75 pips, which exceeds the industry standard of 1.6 pips.

Pepperstone consistently offers reasonable spreads across all major currencies, providing a cost-effective trading environment. In contrast, Plus500’s spreads tend to be higher or just within the minimum average industry spreads, affecting overall trading costs. This highlights Pepperstone’s competitive edge in offering lower spreads, ensuring traders can maximize their profits.

| Standard Account | Pepperstone Spreads | Plus500 Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.75 | 1.6 |

| EUR/USD | 1.1 | 1.2 | 1.2 |

| USD/JPY | 1.3 | 2 | 1.4 |

| GBP/USD | 1.3 | 1.7 | 1.6 |

| AUD/USD | 1.2 | 1.1 | 1.5 |

| USD/CAD | 1.4 | 2 | 1.8 |

| EUR/GBP | 1.2 | 1.5 | 1.5 |

| EUR/JPY | 1.8 | 2.5 | 1.9 |

| AUD/JPY | 1.5 | 2 | 2.1 |

Commission Levels

In the fast-paced environment of forex trading, understanding the commission structures and fee landscapes of different brokers is crucial. This analysis focuses on the commission levels, minimum deposit requirements, funding fees, and methods offered by two prominent brokers: Pepperstone and Plus500. By examining these factors, we aim to provide traders with clear insights into how these brokers stack up against industry standards and each other. Whether you’re a seasoned trader or just starting out, this information will help you make informed decisions about which broker best suits your trading needs. Let’s dive in and explore the details.

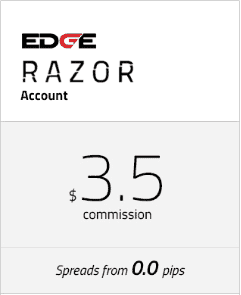

- Pepperstone: Charges a commission fee of $3.50 per lot on Razor accounts.

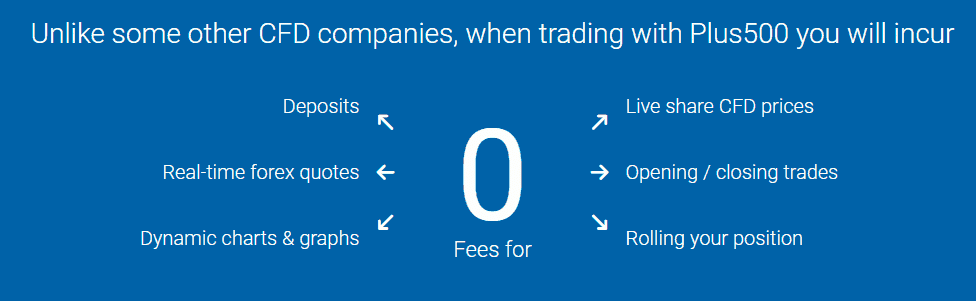

Plus500: Does not charge any commission fees. - Minimum Deposits:

Pepperstone: No minimum deposit required, but a recommended deposit of $200 is suggested for better trading opportunities.

Plus500: Minimum deposit of $100, with the same amount recommended for optimal trading.

Funding Fees:

- Both Pepperstone and Plus500 do not charge any funding fees.

Funding Methods:

- Pepperstone: Offers 16+ funding methods, providing traders with various options to deposit funds.

- Plus500: Provides 3+ funding methods, allowing for flexibility in depositing funds InvestinGoal](https://investingoal.com/plus500-minimum-deposit/).

SWAP-Free Accounts:

- Both brokers offer SWAP-free accounts, which are particularly beneficial for traders in Islamic states.

What really matters is the overall fee of the RAW account, considering both spreads and commissions. That’s why our dedicated team developed an exclusive fee calculator below, which demonstrates that in most scenarios, Pepperstone offers the lower fee RAW account type.

Standard Account Fees

When it comes to engaging in forex trading, having a thorough understanding of the various fee structures imposed by your broker is absolutely crucial for your success. These fees can significantly impact your overall profitability, as they may come in various forms such as spreads, commissions, or overnight financing fees. Therefore, before committing to a broker, it’s essential to carefully analyze and compare their fee structures to avoid any unpleasant surprises that could eat into your earnings. Ultimately, being well-informed about these costs will empower you to make strategic decisions and optimize your trading experience.

Let’s break down the fees for Pepperstone and Plus500:

Pepperstone Fees:

- EUR/USD: 1.10

- AUD/USD: 1.20

- EUR/GBP: 1.40

- GBP/USD: 1.40

- USD/JPY: 1.40

Plus500 Fees:

- EUR/USD: 1.70

- EUR/GBP: 1.70

- AUD/USD: 1.40

- GBP/USD: 2.30

- USD/JPY: 1.90

Key Takeaways:

- Pepperstone offers lower spreads for EUR/USD, EUR/GBP, and USD/JPY compared to Plus500.

- Plus500 has higher spreads for EUR/USD, GBP/USD, and USD/JPY, but offers competitive rates for AUD/USD.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

1.70 | 1.40 | 1.70 | 2.30 | 1.90 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Our Lowest Spreads and Fees Verdict

Apparently, Pepperstone takes the cake in this category thanks to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

In our discussions, in our previous reviews, about brokers offering better trading platforms, it’s essential to highlight the significance of this feature. A high-quality platform elevates the user experience by providing traders with sophisticated tools, quicker execution times, and dependable performance. These advantages attract more clients, boost trading volume, and improve the broker’s reputation. A strong platform helps traders make informed decisions, leading to greater success and satisfaction.

| Trading Platform | Pepperstone | Plus500 |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

We created a short questionnaire to help you find the best trading platform for your needs. Just answer six simple questions, and we’ll recommend the right trading software for you.

Metatrader

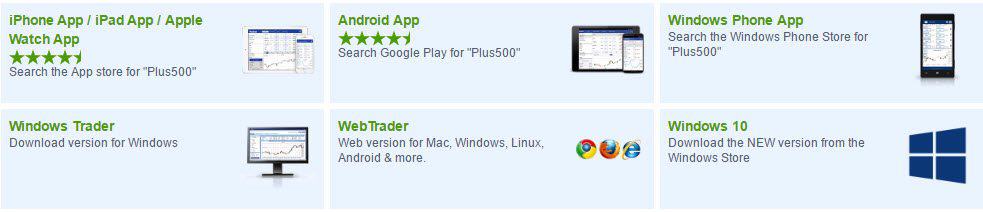

In our previous reviews, it becomes evident that each broker offers distinct trading platforms with various features. Pepperstone provides WebTrader for use in browsers, compatible with iOS and Android tablets and mobiles, as well as Mac and Windows PCs. This flexibility ensures that traders can access their accounts from virtually any device.

Platform Availability:

Pepperstone excels with its range of platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular platforms used by traders worldwide. Additionally, Pepperstone offers cTrader, TradingView, Automated Trading, and Social + Copy Trading. These platforms are known for their advanced features and usability, catering to both novice and experienced traders.

On the other hand, Plus500 offers the following platforms, which Pepperstone also provides:

– Proprietary Platforms

– Standard Stop Loss

– Guaranteed Stop Loss

– Demo Account

Despite Plus500’s offerings, it lacks several advanced trading platforms like cTrader and TradingView, which Pepperstone supports. Moreover, Pepperstone’s Automated Trading and Social + Copy Trading capabilities provide traders with enhanced tools for strategy execution and market analysis.

While both brokers offer robust trading environments, Pepperstone stands out with its extensive range of advanced platforms and tools, making it a strong contender for traders seeking comprehensive trading solutions. This comparison highlights Pepperstone’s competitive edge in platform diversity and functionality.

Advanced Platforms

MetaTrader 4 (MT4) by Pepperstone remains the top choice for forex traders due to its user-friendly interface, advanced trading tools, and algorithmic trading capabilities. With features like one-click trading, 30 built-in indicators, multiple chart types, and expert advisors (EAs), it offers everything a trader needs for efficient execution. Pepperstone enhances MT4 with Smart Trader Tools, adding valuable features such as price alerts, sentiment tracking, and a trade terminal for improved market analysis. For those looking for an upgrade, MetaTrader 5 (MT5) provides advanced charting, superior testing capabilities, and additional order types, making it a future-ready platform.

For traders seeking an alternative, cTrader stands out with its sleek interface, advanced order protection, and superior backtesting tools. Its Level II pricing and cloud-based profile storage make it an excellent option for both beginners and experienced traders. On the other hand, Plus500 offers a simple, web-integrated trading experience, ideal for those focused on CFD trading. While it lacks advanced features like EAs and scalping, its clutter-free design makes it accessible to new traders. Choosing the right platform depends on your trading strategy, but for advanced trading tools and automation, MetaTrader platforms remain the top choice in the forex market.

Copy Trading

Copy trading allows investors to automatically replicate experienced traders’ trades, benefiting beginners without deep market knowledge. It reduces risks, saves time, and aids learning. This hands-free method supports diversification and can enhance decision-making, making it a key tool for both novice and passive income investors in forex trading.

During our team’s research, we have found out that Pepperstone offers a comprehensive copy trading experience by integrating with multiple third-party platforms, including MetaTrader Signals, Signal Start, and DupliTrade. This integration allows traders to automatically replicate the strategies of seasoned professionals across various markets. Pepperstone’s support for platforms like MetaTrader and cTrader enhances its appeal to algorithmic and copy traders. Additionally, Pepperstone provides access to TradingView, further broadening the tools available for traders. The broker’s commitment to offering diverse copy trading options has earned it recognition in the industry.

In contrast, Plus500 does not currently offer copy trading services. The platform is known for its user-friendly interface and is considered suitable for beginners. However, it lacks support for automated trading and advanced features like copy trading. This limitation may be a drawback for traders interested in leveraging the strategies of experienced investors through copy trading mechanisms. Citeturn0search16

We can easily surmise that for traders seeking robust copy trading functionalities, Pepperstone provides a more comprehensive suite of options compared to Plus500.

Our Trading Platform Verdict

Evidenlty, Pepperstone outperforms the challenger in this category owing it to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

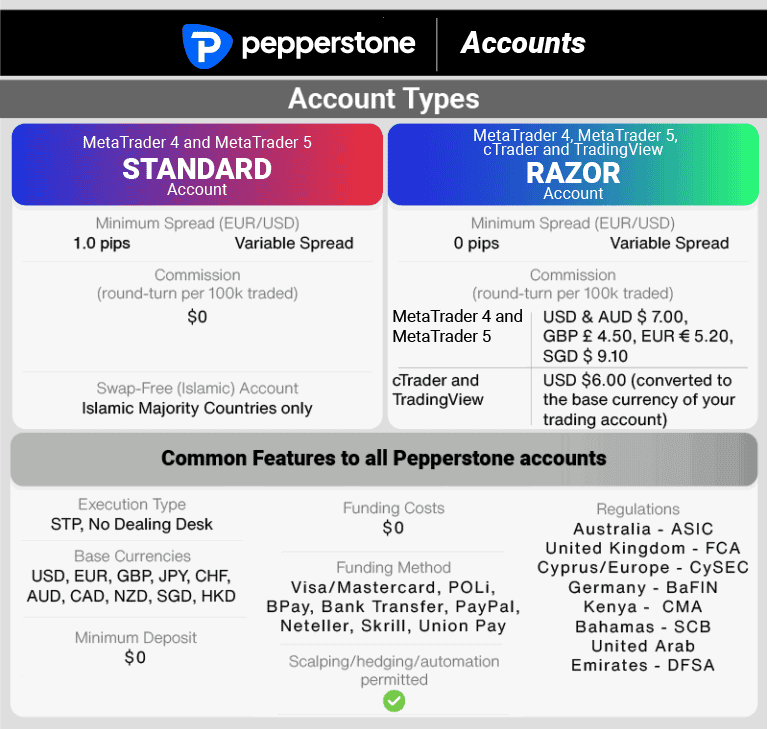

3. Superior Accounts And Features – Pepperstone

In the dynamic industry of forex trading, brokers need superior account options and advanced features to attract traders of all levels. Offering flexible account types, cutting-edge tools, and favorable trading conditions enhances the overall trading experience, making it easier for both beginners and professionals to succeed.

By providing a seamless and efficient trading environment, brokers can boost client satisfaction, encourage long-term loyalty, and increase trading volume. This not only strengthens their reputation but also helps them stay competitive in the ever-evolving forex market.

Pepperstone Razor Account

Features of the Pepperstone Razor Account include

Features of the Pepperstone Razor Account include

- Spreads starting at 0.0 pips for major currency pairs like the EURUSD and GBPUSD

- ECN + STP Style trading for ECN pricing

- Choice of MetaTrader 4, MetaTrader 5 and cTrader

- a minimum, maximum trade size of 0.01 per 100 lots traded

- Round-turn commission of USD $7.76 and AUD $7.00 when using MetaTrader 4 (MT4) per 100 lot traded

- Round-turn commission of USD and AUD $7.00 when using MetaTrader 5 (MT5) per 100 lot traded

- Commission costs are 0.0035% of the base currency being traded, i.e. for the EUR/AUD, you will pay €3.50 per every 100,000 units traded of the fx pair.

- $200 minimum deposit (though the broker does not enforce this)

- Retail traders 30:1, Professional traders 500:1 (ASIC, FCA, Cysec)

- 92 currency pairs, 700+ CFDs in total

- 50 deep pool of liquidity providers for industry-leading low spreads

- Scalping, hedging

- Expert Advisors or EAs are also supported.

As seen in the table above, Pepperstone’s Razor Account provides institutional-grade average spreads thanks to its ECN-like model with deep liquidity. Combined with low commission fees and fast execution, Pepperstone’s Razor Account is ideal for algorithmic trading with Expert Advisors.

Pepperstone offers a choice of two other accounts. These are:

Pepperstone Standard Account

Designed for newbie traders, this account offers all the same features as the Razor Account but without commission. In place of commission, at least 1.0 pips are added to the spread.

- No commissions

- Spreads from 1.0 pip GBP USD

- Available for MetaTrader 4, MetaTrader 5

- Best for novice traders who do not want commission costs

If you’re unsure what account is right for your circumstances, you can view the Pepperstone razor vs standard accounts comparison page.

Pepperstone Swap-Free Account

This account mirrors the Razor account but charges a small admin fee instead of overnight holding or rolling interest. It has no swap fee, making it Sharia-compliant for Muslims. Proof of Muslim identity is required for eligibility.

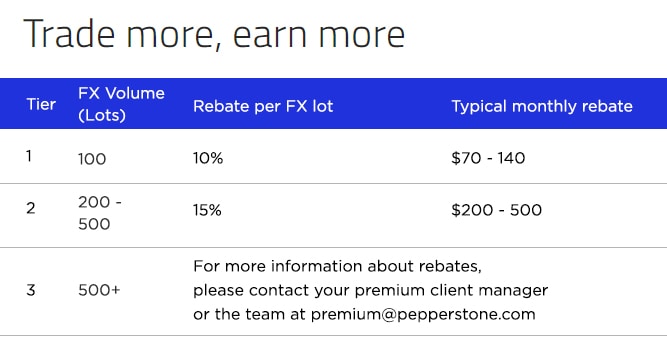

Active Trader – Savings Through Rebates

If you are a high-volume trader, Pepperstone can offer you rebates through their Active Trader program. If you trade at least 100 lots a month, then you can receive rebates which will be paid directly into your bank account.

Why Pepperstone Spreads Are Narrower

Pepperstone offers ECN pricing by connecting you to liquidity providers without a dealing desk, requotes, or price manipulation. However, as the issuer of its own products, it isn’t a true ECN broker.

We recommend the Razor account as this account offers the narrowest spreads.

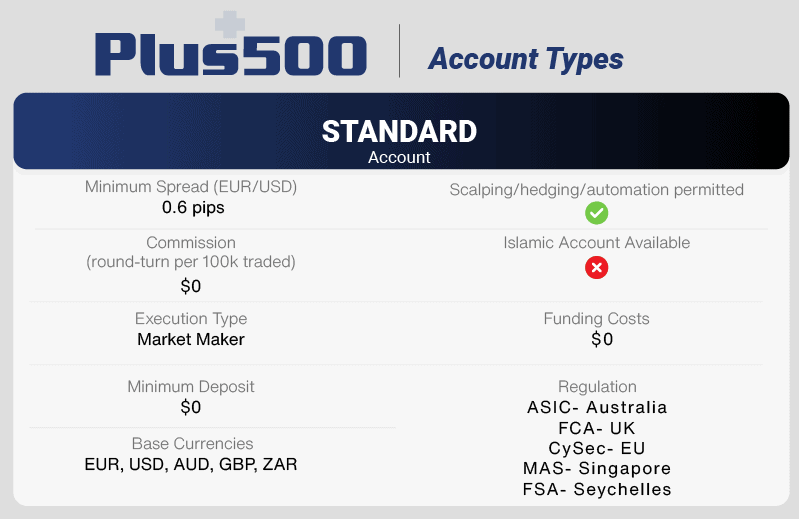

Plus500 Live/Pro Account

Plus500 only offers 1 type of Account with the following features:

- Plus500 is a Market Maker

- No minimum or maximum trade size in lots apply

- No Commission charged

- Minimum trading deposit of $100

- Spreads from 0.01

- Leverage of up to 30:1 with FCA and ASIC regulation

- Leverage of up to 300:1 for professional traders or retail traders using the broker’s offshore, FSA-regulated branch in Seychelles.

- Over 60 Currency Pairs to choose from and trade

Why Plus500 Spreads Are Wider

Plus500 is a market maker broker that sets its own prices for currency pairs. It holds securities to facilitate trades, selling to buyers and purchasing from sellers.

Spreads which are the difference between the buy and sell price of the currency pair, are wider because the broker will add 1-5 pips (percentage in point) into the spread for their services. This is how a market maker such as Plus500 makes a profit.

While Plus500 does not charge commission, there are other fees. These include:

- Plus500 Premium Fee (also called an overnight fee) – A fee is charged by the broker if traders hold onto their position when markets are closed.

- Plus500 Inactivity Fee – An account that has no activity over 3 months will incur a $10 USD fee

- Guaranteed Stop Order – We delve more into this lower down. If Guaranteed Stop Orders are used, it generally means a wider spread

Trading Spreads And Fees

When deciding between each account, you will need to consider 2 basic features that are:

- Spreads – Generally, high-volume traders will benefit more from tighter spreads combined with larger lot sizes despite the commissions. You will need to do the numbers, but wider spreads and lower lot sizes may end up with greater cost savings.

- Features – If you plan to use features such as scalping, hedging and EAs, then you will want to consider Pepperstone, as Plus500 don’t allow these.

| Pepperstone | Plus500 | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Clearly, we can see that Pepperstone takes the cake in this category thanks to their superior account and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – A Tie

A seamless forex trading experience depends on advanced platforms, fast execution speeds, and competitive spreads. These factors help traders make informed decisions, execute trades efficiently, and manage their accounts with ease.

With a user-friendly interface, educational resources, and diverse trading tools, brokers can create a more engaging and profitable environment for traders. This combination not only improves trading efficiency but also enhances overall satisfaction in the forex market.

When it comes to the best trading experience and ease, our team has researched deeply into the nitty-gritty of both Pepperstone and Plus500. From the user interface to the responsiveness of their platforms, we’ve tested it all. Our findings and our own testing reveal the following:

- Pepperstone stands out as the best MT4 broker, offering a seamless experience on this popular platform.

- For those who prefer automation in their trading, Pepperstone again shines with features like Capitalise.ai.

- Plus500, on the other hand, offers a unique experience with its proprietary platform, which some traders might find more intuitive.

- Both brokers have their strengths, and the choice often boils down to personal preference and trading style.

However, it’s worth noting that while Pepperstone offers a range of platforms, including MT4, MT5, and cTrader, Plus500 keeps it simple with its own platform. This might be a deciding factor for traders who have a specific platform preference.

Remember, the best trading experience is often subjective, and what works for one might not work for another. It’s always a good idea to test out platforms and see which one resonates with your trading style.

Our Best Trading Experience and Ease Verdict

We have a standoff in this category this is due to both Pepperstone and Plus500’s best trading experience and ease.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

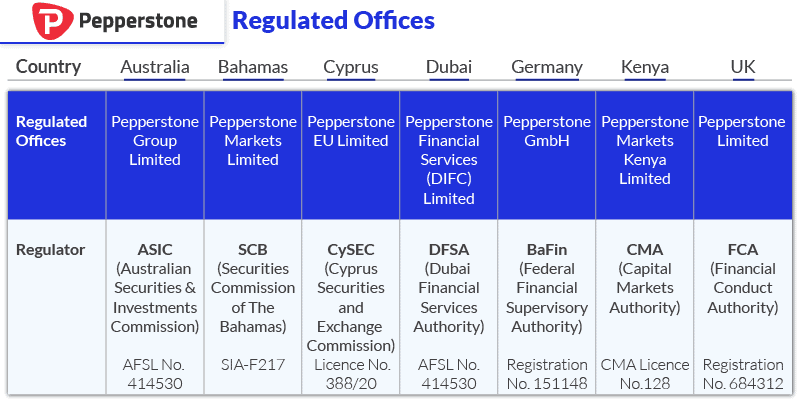

5. Stronger Trust And Regulation – A Tie

Trust and regulation are key to a secure and transparent forex trading environment. Regulated brokers follow strict standards, protecting traders from fraud and ensuring fair practices.

With strong regulatory oversight, brokers gain credibility, attract more clients, and foster trader confidence, ultimately strengthening their reputation and market presence.

Pepperstone Trust Score

Plus500 Trust Score

Pepperstone is regulated in the following regions:

- Australia with the Australian Securities and Investments Commission, also known as ASIC

- The United Kingdom with the Financial Conduct Authority, also known as FCA*

- Europe with the Cyprus Securities and Exchange Commission. The license number is 388/20

- In Germany by BAFIN with licence number 151148

- In Kenya by the Capital Markets Authority (CMA)

- In the Bahamas via the Securities Commission of the Bahamas (SCB)

*Under new FCA guidelines, UK traders are no longer able to trade cryptocurrencies.

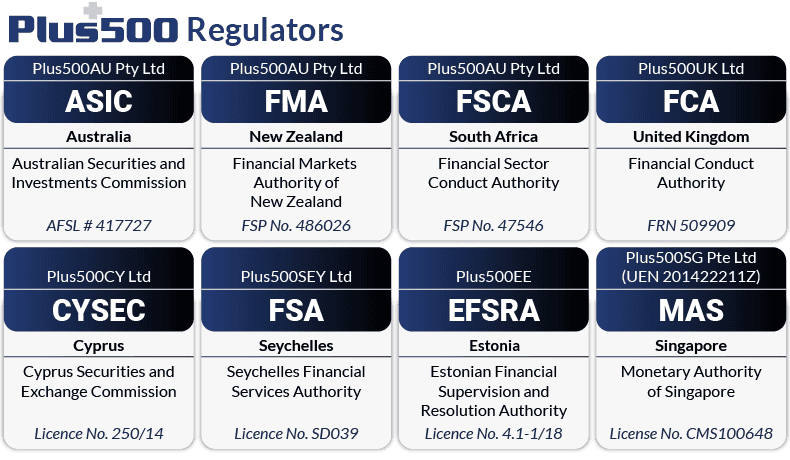

Plus500 has the following regulations:

- Australia (ASIC)

- Cyprus with Cyprus Securities and Exchange Commission, also known as yYSEC

- New Zealand with Financial Markets Authority, also known as FMA

- Singapore with the Monetary Authority of Singapore, also known as MAS

- UK (FCA)

- UAE (DFSA)

- South Africa (FSCA)

- The Seychelles (FSA)

- Estonia (EFSRA)

Trading with speculative stock can be high risk; it is therefore important to choose a broker that is regulated by a tier-one authority. These regulators can help protect your funds by requiring that the broker keep your funds in a tier-1 bank account, that the broker provides a product disclosure statement (PDS) and establish a complaints process.

| Pepperstone | Plus500 | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) BaFin (Germany) | FCA (UK) CYSEC (Cyprus) ASIC (Australia) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | DFSA (UAE) | DFSA (Dubai) EFSRA (Estonia) |

| Tier 3 Regulation | CMA (Kenya) SCB (Bahamas) | FSA-S (Seychelles) FSCA (South Africa) |

Our Stronger Trust and Regulation Verdict

Again, we have a deadlock here for both Pepperstone and Plus500, thanks to their stronger trust and regulation.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 gets searched on Google more than Pepperstone. On average, Plus500 sees around 270,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 59% fewer.

| Country | Pepperstone | Plus500 |

|---|---|---|

| Italy | 1,900 | 22,200 |

| Germany | 3,600 | 18,100 |

| United Kingdom | 5,400 | 14,800 |

| Spain | 1,900 | 9,900 |

| Australia | 8,100 | 8,100 |

| Netherlands | 880 | 8,100 |

| Poland | 720 | 8,100 |

| United States | 4,400 | 5,400 |

| South Africa | 2,900 | 5,400 |

| Switzerland | 320 | 5,400 |

| United Arab Emirates | 1,000 | 4,400 |

| Portugal | 480 | 4,400 |

| Greece | 210 | 4,400 |

| Mexico | 3,600 | 2,900 |

| Sweden | 390 | 2,900 |

| Austria | 320 | 2,900 |

| Hong Kong | 3,600 | 2,400 |

| Singapore | 1,600 | 1,900 |

| France | 1,000 | 1,900 |

| Argentina | 1,300 | 1,600 |

| Colombia | 3,600 | 1,300 |

| Taiwan | 1,000 | 1,300 |

| New Zealand | 170 | 1,300 |

| India | 2,900 | 1,000 |

| Cyprus | 480 | 880 |

| Malaysia | 4,400 | 720 |

| Turkey | 1,600 | 720 |

| Saudi Arabia | 260 | 720 |

| Ireland | 260 | 720 |

| Chile | 1,000 | 590 |

| Japan | 480 | 390 |

| Egypt | 390 | 390 |

| Brazil | 6,600 | 320 |

| Thailand | 4,400 | 320 |

| Indonesia | 1,600 | 320 |

| Pakistan | 1,300 | 320 |

| Nigeria | 1,300 | 320 |

| Canada | 720 | 320 |

| Morocco | 720 | 210 |

| Philippines | 880 | 170 |

| Vietnam | 720 | 170 |

| Algeria | 390 | 170 |

| Bangladesh | 390 | 170 |

| Dominican Republic | 880 | 140 |

| Costa Rica | 480 | 140 |

| Jordan | 260 | 140 |

| Cambodia | 320 | 110 |

| Peru | 1,600 | 90 |

| Venezuela | 390 | 90 |

| Panama | 320 | 90 |

| Kenya | 4,400 | 70 |

| Ghana | 260 | 70 |

| Uzbekistan | 140 | 70 |

| Ecuador | 1,000 | 40 |

| Sri Lanka | 320 | 40 |

| Tanzania | 720 | 30 |

| Uganda | 390 | 30 |

| Ethiopia | 390 | 30 |

| Bolivia | 1,300 | 20 |

| Botswana | 390 | 20 |

| Mongolia | 1,900 | 10 |

| Mauritius | 110 | 10 |

2024 Monthly Searches For Each Brand

Pepperstone - Italy

Pepperstone - Italy

|

1,900

1st

|

Plus500 - Italy

Plus500 - Italy

|

22,200

2nd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

3rd

|

Plus500 - UK

Plus500 - UK

|

14,800

4th

|

Pepperstone - Spain

Pepperstone - Spain

|

1,900

5th

|

Plus500 - Spain

Plus500 - Spain

|

9,900

6th

|

Pepperstone - Australia

Pepperstone - Australia

|

8,100

7th

|

Plus500 - Australia

Plus500 - Australia

|

8,100

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Plus500 receiving 6,888,000 visits vs. 1,273,000 for Pepperstone.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Plus500

A diverse product range and extensive CFD markets are key to successful forex trading, allowing traders to diversify their portfolios and adapt to changing market conditions. Brokers that present a diverse array of assets—including forex pairs, commodities, indices, and cryptocurrencies—open up a wealth of profit-making opportunities. This variety not only enriches the trading experience but also offers greater flexibility and strategic choices.

Plus500 CFDs

Plus500 offers one of the most diverse ranges of CFDs among all foreign exchange brokers in the markets. Unique offerings when trading CFDs extend to soft commodities such as lean hogs, live cattle and feeder cattle. We have not seen other brokers allow you to buy and sell securities of these types.

They also offer several cryptocurrencies, Shares CFD, Options, and ETFs round out their trading suite, which is also not necessarily available with other brokers.

The diverse range of instruments is why Plus500 has specifically designed its platform so users can take advantage of all these instruments without being overwhelmed with data.

Pepperstone CFDs

Pepperstone offers a solid range of CFDs for trading. These include the following:

- Forex – Over 62+ currency pairs

- Cryptocurrency – 12 cryptos, including Bitcoin and baskets

- Indices – 23 Indices

- Soft commodities – 16 soft commodities like cotton and orange juice

- Major and precious metals – 13 crosses for Gold, Silver, Platinum, Palladium, and Copper

- Energies – 3 Energies

- Shares CFD – 900 plus shares from five global stock exchanges

- 3 Currency Index CFD – US Dollar Index (USDX), Euro Index (EURX), Japanese Yen Index (JPYX)

Cryptocurrencies CFD

Trading cryptocurrencies has emerged as a popular option for traders in recent years. Trading cryptocurrency is exciting because it is so volatile, which means opportunities for large rewards.

Plus500 Cryptos

Plus500 offers one of the largest ranges of cryptos of all online forex brokers. Not only do they offer the more common ones like Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin, but they also offer some rare ones like NEO, Monero, IOTA and EOS.

These cryptos are available with leverage from 1:2-1:20, depending on the Plus500 branch you are signed up to.

Pepperstone Cryptos

The collection of cryptocurrencies Pepperstone offers is also broad and includes Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin.

All Cryptos are available with leverage of 1:20 under FSA regulation or 2:1 under ASIC or CySEC.

Note: Under new FCA guidelines, UK traders are no longer able to trade cryptocurrencies.

| CFDs | Pepperstone | Plus500 |

|---|---|---|

| Forex Pairs | 93 | 65 |

| Indices | 26 | 65 |

| Commodities | 29 Commodities 4 Metals, 4 Energies, 16 Softs, 5 Hard | 5 Metals 7 Energies 10 Softs |

| Cryptocurrencies | 27 | 18 (+ Crypto 10) |

| Share CFDs | 1,200+ | 11,000+ |

| ETFs | 108+ | 97 |

| Bonds | No | - |

| Futures | 42 Futures | No |

| Treasuries | No | - |

| Investments | No | No |

Our Top Product Range and CFD Markets Verdict

Clearly, Plus500 takes the lead in this portion, this is due to their top product range and CFD markets.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

In forex trading, continuous learning is crucial for long-term success. The dynamic market is influenced by global trends, geopolitical events, and trading technologies. Traders must refine strategies, adapt to changes, and stay informed. Ongoing education improves decision-making and risk management, empowering traders to navigate the market confidently.

Both Pepperstone and Plus500 understand this and have invested in educational resources to aid their traders. From our analysis and our own rigorous testing, here’s a comparison of the educational resources each broker offers:

- Pepperstone:

- Offers comprehensive webinars and seminars for traders of all levels.

- Provides detailed market analysis and insights.

- Features a rich library of educational articles and tutorials.

- Plus500:

- Focuses on beginner-friendly resources and guides.

- Provides a set of video tutorials covering various trading topics.

- Features an FAQ section that answers common trading queries.

Evidently, we see that both brokers have made commendable efforts to ensure their traders are well-equipped with knowledge. However, the depth and breadth of resources vary between the two.

Our Superior Educational Resources Verdict

Based on our team’s scoring, Pepperstone scores number one in this category, this is in light of their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

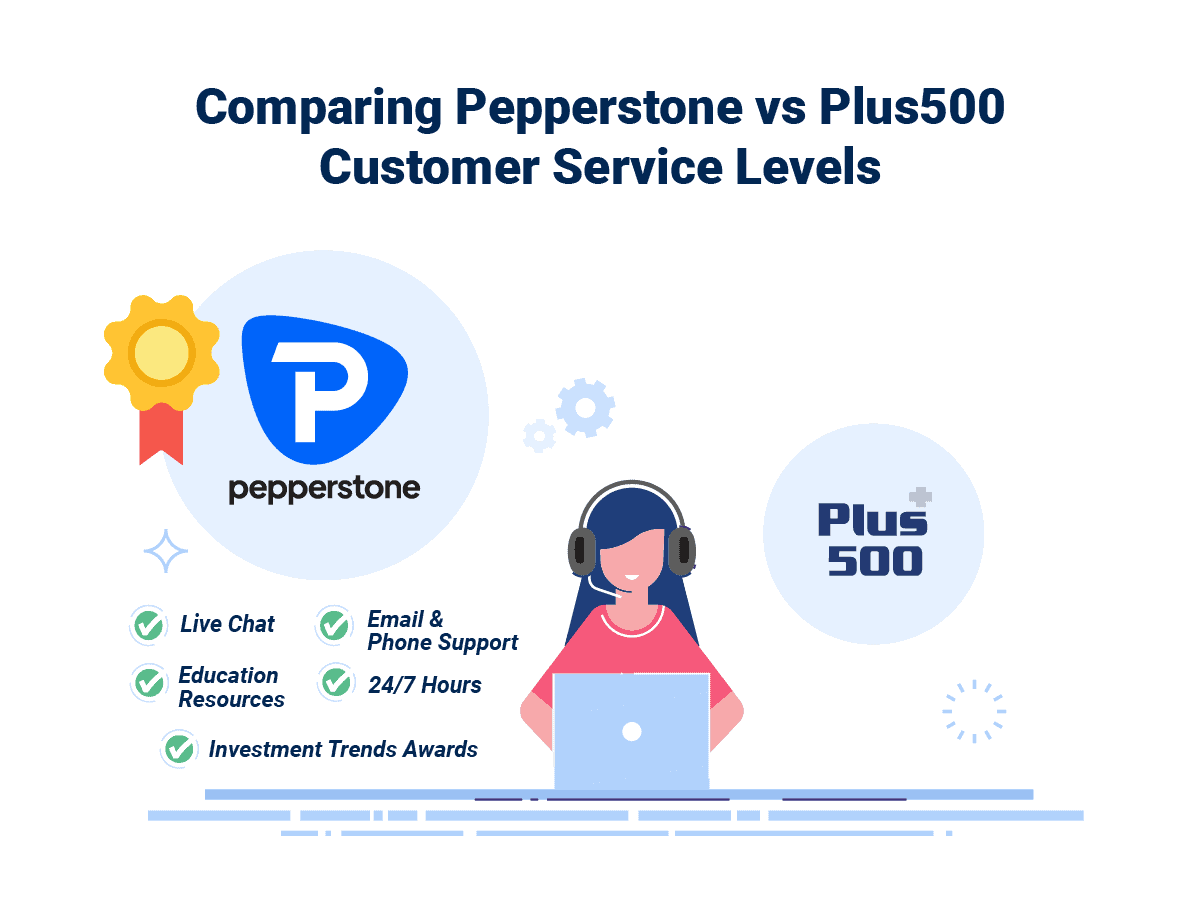

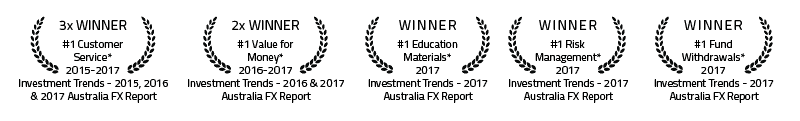

9. Superior Customer Service – Pepperstone

Exceptional customer service is crucial in forex trading for a smooth experience. Brokers providing 24/7 support through live chat, phone, and email, along with multilingual help, enhance satisfaction, build trust, and strengthen their reputation.

In our review, we found Pepperstone offer superior Customer Service when we compare it with Plus500. Pepperstone customer service has won numerous awards from the CFD industry, a reflection of the excellent service they offer.

| Feature | Pepperstone | Plus500 |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | No |

Plus500 got the thumbs up from us because their live chat is available 24 hours a day, all 7 days of the week. Pepperstone only offers this service during business hours, Monday to Friday. We felt that Pepperstone customer support was superior in all other ways. For example, Pepperstone offers phone and email support in a range of different countries. Plus500, on the other hand, does not offer phone support at all. We found it surprising that Plus500 does not offer phone support, given this type of service is a basic expectation from clients.

Pepperstone provides email contacts for departments, while Plus500 integrates email into its portal, making it unclear who receives inquiries. Both offer live chat, but Pepperstone answered complex questions quickly and professionally, whereas Plus500 had longer wait times and struggled with technical questions. Pepperstone also has extensive educational resources, unlike Plus500. Both brokers offer unlimited free demo accounts for learning forex trading.

Our Superior Customer Service Verdict

We believe Pepperstone‘s customer service is among the best on offer in the industry. So, in this case, they come up trumps compared to the challenger.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

10. Better Funding Options – A Tie

Brokers with better funding options in forex trading provide flexibility and convenience. Methods like bank transfers, cards, digital wallets, and cryptocurrencies facilitate easy deposits and withdrawals. Multiple low-cost options improve account management and enhance the trading experience.

Funding With Pepperstone

Except for bank wire withdrawals, Pepperstone does not charge fees for its funding services. This means you can make deposits using a method such as debit cards and credit cards using Visa or MasterCard, Digital wallets such as Paypal, Neteller, Skrill, the Australian e-wallets BPAY and Poli and Chinese merchant Unionpay without any fees from the broker.

If you make your withdrawal before 7 am AEST, then you can receive your funds on the same day. After this time, you can receive your funds a day later. Your account must be in your name and linked with your Pepperstone account. If you are using bank wire, your fund can take 3-5 working days to show in your account. Bank wire withdrawals will incur a fee of USD $20.

Funding With Plus500

Making a deposit or withdrawal does not incur fees from Plus500; however, your payment merchant may charge fees.

With Plus500, you can deposit money with the following methods

- Debit/Credit card – Visa and Mastercard

- Paypal

- Skrill

- Bank transfer

Plus500 advises you can expect fees from the merchant for the following situations:

- Overseas credit cards

- Bank transfer

- Forex Conversions

Withdrawals generally take about 3-7 days to process, but this will vary depending on the method you have used for payment.

| Funding Option | Pepperstone | Plus500 |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

For the nth time, we have a tie for both Pepperstone and Plus500 because of their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

Brokers with a lower minimum deposit in forex trading enhances accessibility for beginners and traders with limited funds. By lowering financial barriers, it opens the market to a broader range of participants, enabling them to gain valuable experience and hone their skills with minimal risk. This inclusiveness not only encourages greater engagement but also creates more opportunities for learning in the world of forex trading.

Pepperstone has a lower minimum deposit of $0 vs $100 for Plus500. It should be noted that the Plus500 is based on the currency the trader deposits, so it can also be £100 or €100, for example. We feel it would be hard to trade with such a low deposit, and even Pepperstone recommends opening an account with at least $200.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Plus500 | $100 | $100 |

Our Lower Minimum Deposit Verdict

Finally, we have come to the last part of this review, and Pepperstone excels in some, if not all, categories this is in light of their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Is Pepperstone or Plus500 The Best Broker?

Pepperstone clearly leads the score here owing to their comprehensive offerings, superior educational resources, and flexibility in trading platforms and account types. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | Plus500 |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | No |

Pepperstone: Best For Beginner Traders

For those just starting out, Pepperstone offers a more beginner-friendly environment with its $0 minimum deposit and comprehensive educational resources.

Pepperstone: Best For Experienced Traders

For seasoned traders, Pepperstone remains the top choice due to its advanced trading platforms and diverse product range.

FAQs Comparing Pepperstone Vs Plus500

Does Plus500 or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to Plus500. They are renowned for their tight spreads, especially on major currency pairs. For instance, the EUR/USD spread starts from as low as 0.13 pips. For more detailed insights on low commissions and spreads, you can check out this comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

When it comes to MetaTrader 4, Pepperstone is the superior choice. They are often recognised as one of the best MT4 brokers globally. Their platform offers advanced tools and features tailored for both beginners and experienced traders. If you’re keen on exploring more about the best MT4 brokers, this detailed review might be of interest.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to copy strategies from seasoned professionals. This approach is beneficial for those who might not have the time or expertise to analyse the markets themselves. Social or copy trading has gained immense popularity in recent years, and if you’re looking to delve deeper into this topic, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Plus500 offers spread betting for traders, especially those based in the UK. This form of trading is tax-free in the UK and is a popular alternative to traditional forex trading. For traders interested in exploring spread betting further, especially on the MT4 platform, here’s a detailed guide on the best MT4 spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it’s also an Australian-founded company, ensuring a deep understanding of the local market. Plus500, on the other hand, is an international broker with a significant presence in Australia. Both brokers offer a range of services tailored to the Australian market, but the local roots and ASIC regulation give Pepperstone an edge. For a comprehensive overview of the best brokers in Australia, you can check out this guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Plus500 has a slight edge. They are FCA regulated, ensuring a high level of trust and security for UK-based traders. While Pepperstone also offers services in the UK and is FCA regulated, Plus500 has a more established presence in the region. Both brokers have their merits, but when considering factors like local support and tailored offerings, Plus500 shines a bit brighter for the UK audience. For more insights on the best platforms for UK traders, here’s a comprehensive review of the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert