Best Forex Brokers For Beginners

I’ve tested and selected the best forex brokers for beginners in Australia. For my 2026 list, I prioritised aspects important to novice traders, such as platform user-friendliness, educational resources, low trading costs, and quality of customer service.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

My list of the best forex brokers in Australia for novice traders is:

- OANDA - The Best Forex Broker For Beginner Traders

- Pepperstone - Best Choice of Trading Platforms

- IC Markets - Best Forex Trading Platform with Low Spreads

- ThinkMarkets - Best Selection of Beginner Trading Tools

- FP Markets - The Best Demo Account for a New Trader

- Plus500 - Best Trading Platform for Beginner Forex Traders

- eToro - Best Broker for Social and Copy Trading

- FxPro - Best for Beginner cTrader Trading Platform Users

- CMC Markets - Best Mobile Trading App for Beginners

What Are The Best Forex Brokers For Beginners In Australia?

OANDA stands out as the best beginner forex broker in Australia, requiring no minimum deposit while offering unlimited practice accounts and protective trading features like guaranteed stop-losses. We selected additional brokers based on their user-friendly platforms, competitive pricing and round-the-clock support services.

1. OANDA - The Best Forex Broker For Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 0.94 GBP/USD = 1.68 AUD/USD = 1.48

Trading Platforms

MT4, TradingView,

OANDA Trade

Minimum Deposit

$0

Why We Recommend OANDA

OANDA is my top choice for beginners thanks to its excellent OANDA Trade platform. The platform’s features make it easy to get into forex trading.

You can trade with lot sizes as small as 1 unit, much lower than the default micro-lots offered by other brokers. I find this helps you start small before risking larger sums of money. You can also apply the guaranteed stop-loss to protect your funds against slippage.

I gave OANDA 91/100 in my broker reviews, as the broker provides a secure trading environment with regulation from 5 Tier-1 authorities. The low spreads were another plus point – they average 0.92 pips on the Standard account.

Pros & Cons

- Trade partial lots on OANDA Trade

- Three beginner-friendly platforms

- No minimum deposit

- Customer support is not 24/7

- Guaranteed stop loss order only on OANDA Trade

- No CFD shares

Broker Details

Best Beginner Trading Platform

I found OANDA had the best features for beginners, primarily due to its OANDA Trade platform. This platform leverages TradingView’s charting and 110+ technical indicators, while also providing decent trading tools.

For example, you can use trade sizes starting from 1 unit. This means you can open a position for AUD $0.06. A trade size like this lets smaller trading accounts open positions with less funding – ideal if you’re starting out.

In contrast, other brokers only offer micro-lots as their smallest position size – 1,000 times bigger than OANDA’s single unit trades.

I also like that OANDA offers professional technical analysis from Autochartist. This generates trading ideas throughout the day. You can use these signals to trade, or as educational material to help you see how chart patterns like wedges play out in real time.

Most Trusted Forex Broker

Trust is another factor I consider when recommending a broker. OANDA scored 100/100 for trust, thanks to its five Tier-1 regulators, including ASIC. This ensures you’ll have negative balance protection, so your losses will never exceed your account balance.

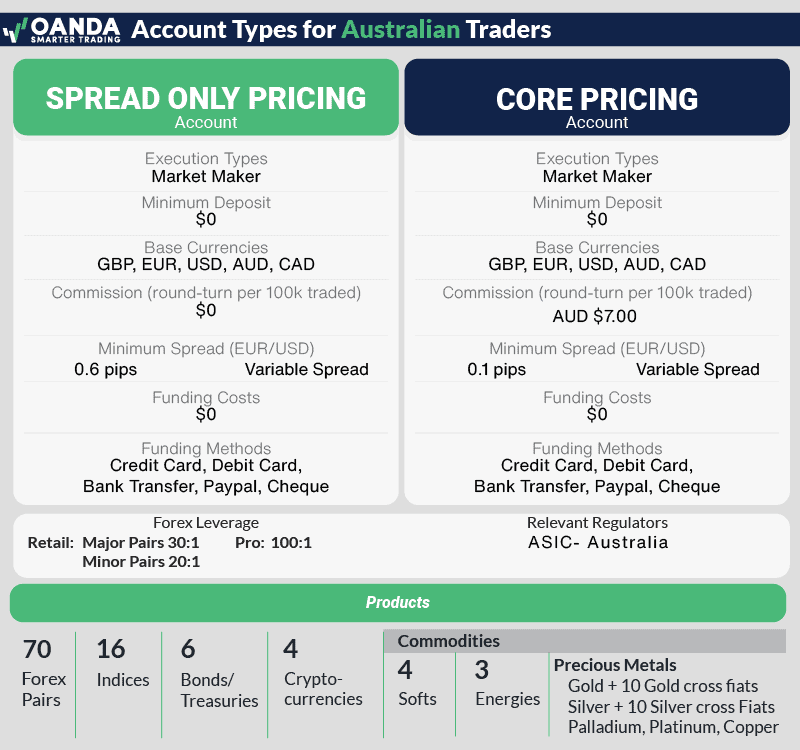

What also makes OANDA beginner-friendly is that they don’t confuse you with multiple account types and extra commissions. Instead, they provide a Standard account type where you pay the spread only.

Low Trading Costs With No Commissions

During my tests, I found the Standard account averages 0.92 pips on the EUR/USD, beating the industry average by 23%. As you can see in my findings below, OANDA is cheap for AUD/USD and USD/JPY, which are popular markets for beginner traders.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| OANDA | 0.92 | 1.2 | 0.9 | 1.1 | 1.5 | 1.16 | 1.5 | 1.3 | 1.20 |

| Industry Average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 | 1.6 |

Lower spreads make it easier for you to cover the spread, so you keep more of your potential profits.

2. Pepperstone - Best Choice of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader,

TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

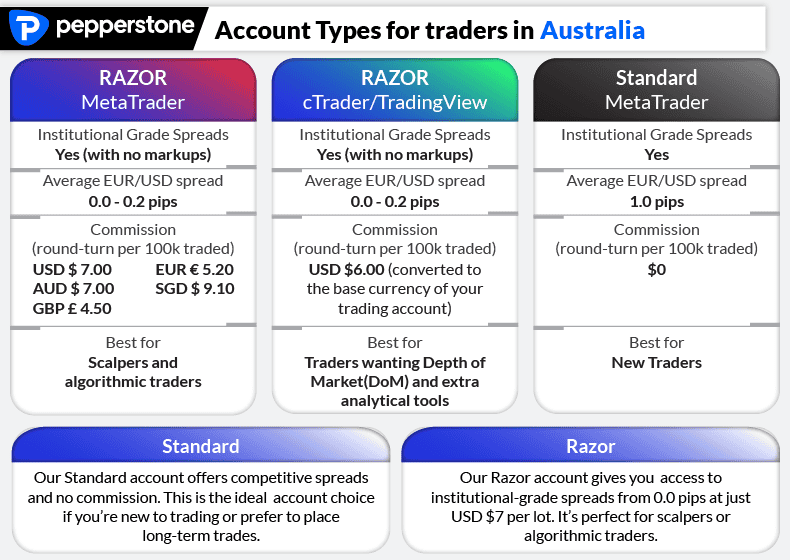

I rated Pepperstone 98/100 in my tests. Its choice of 5 trading platforms – TradingView, MT4, MT5, cTrader, and Pepperstone Trading Platform – contributed to the top marks. You’ve got 94 forex pairs and 1,200+ other markets, like share CFDs and 44 cryptocurrencies.

From my tests, the Razor account offers the best value, with 0 pip spreads and commissions from $3.50 per lot. On top of this, it also produced some of the fastest execution speeds I’ve seen. This combination means Pepperstone provides excellent trading conditions for beginners who want to cut costs.

Pros & Cons

- Excellent MetaTrader broker

- Winner of our execution speed testing

- Good range of markets

- Weekly educational webinars

- Lacks copy trading capabilities

- Demo account is limited to 30 days

- Limited crypto markets

Broker Details

Largest Choice Of Trading Platforms

Out of the brokers on this list, Pepperstone has the most trading platforms available for free. You’ve got TradingView, cTrader, MetaTrader 4, MT5, and the Pepperstone Trading platform.

I was able to test them all using the demo account. This is great, as I was able to see which platform suits my needs without having to open different accounts, or make any live trades.

TradingView is my top choice for technical analysis as it has a simple interface that focuses on charts. If you want to learn how to automate your trades, MetaTrader 4 and MT5 are great options – especially if you combine them with Capitalise.ai.

Capitalise.ai uses AI to transform your trading rules into automated trading strategies. You simply input your rules into the app, and it creates an Expert Advisor (EA) for you. There’s no coding, so it’s a beginner-friendly choice for automated trading.

100% Zero-pip Spreads On Razor Account

CompareForexBrokers analyst Ross Collins tested Pepperstone’s Razor account, and found that it offers 0 pip spreads 100% of the time, outside of rollover. This makes it one of the cheapest brokers in Australia.

As you can see from Ross’ test, the major pairs remain consistent across the trading session. This makes Pepperstone a reliable option for finding minimum spreads, no matter when you trade.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| CityIndex | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% | 98.55% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% | 97.83% |

| Admiral Markets | 100.00% | 99.57% | 79.13% | 95.22% | 100.00% | 100.00% | 95.65% |

| ThinkMarkets | 95.65% | 100.00% | 91.30% | 91.30% | 91.30% | 100.00% | 94.93% |

| Go Markets | 82.61% | 91.30% | 86.96% | 91.30% | 82.61% | 91.30% | 87.68% |

| Blackbull Markets | 100.00% | 100.00% | 95.65% | 95.65% | 65.22% | 65.22% | 86.96% |

| Tickmill | 100.00% | 100.00% | 26.09% | 100.00% | 95.65% | 95.65% | 86.23% |

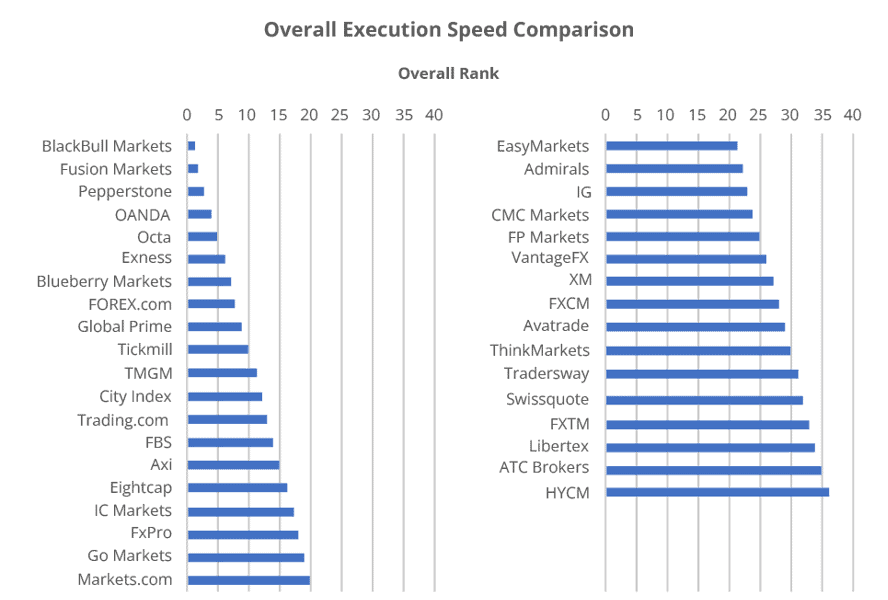

Fast Execution Speeds On All Platforms

Pepperstone also performed very well in our execution speed test. Ross used custom EAs to monitor the average execution speeds for limit and market orders on his MT4 account.

The results show that Pepperstone is one of the fastest execution brokers (coming 3rd overall). On limit order speeds, the broker came top with 77ms.

Execution speed is one of my priorities when choosing a broker because it can make or break your trading performance. Fast execution speeds (under 100ms) are less vulnerable to slippage, protecting you from unexpected extra trading costs.

3. IC Markets - Best Forex Trading Platform with Low Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why We Recommend IC Markets

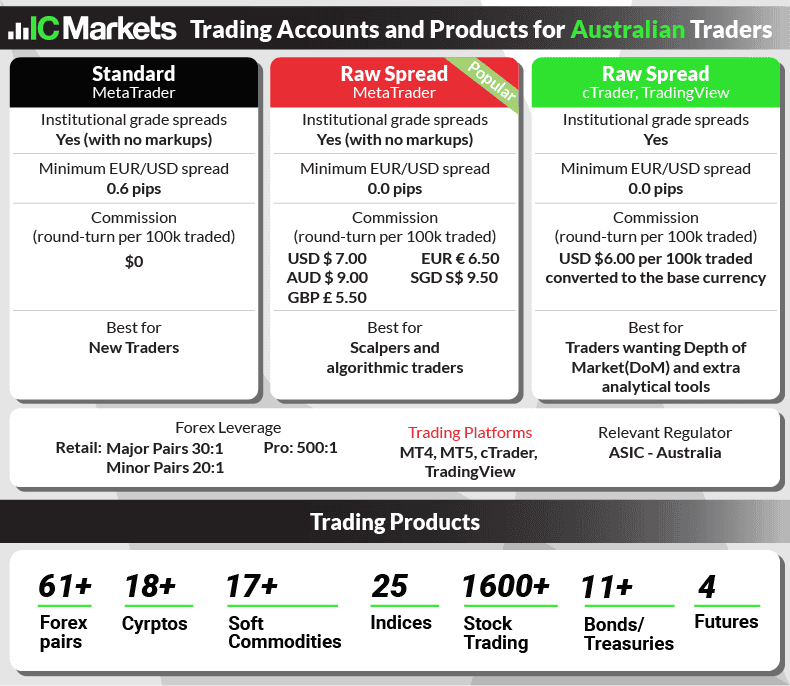

I rated IC Markets 93/100 after they produced the lowest standard account spreads in my tests. The broker averaged 0.73 pips on EUR/USD with no commissions. I also found top trading platforms in MT4, TradingView, cTrader, and MT5, giving you some of the best tools as you start trading forex.

Trading Central is also available for free, providing professional technical analysis across all the supported platforms. This tool scans the broker’s 2,250 markets to find intraday trading opportunities.

Pros & Cons

- Winner of our tests for lowest spreads

- Has MetaTrader 4 and 5 platforms (plus cTrader)

- Top customer support with TeamViewer

- Could have more social trading tools

- Lack of advanced charting tools

- Slow live chat support

Broker Details

Lowest Standard Account Spreads

Ross tested the forex broker’s spreads, using the IceFX SpreadMonitor to record the average spreads over a 24-hour period. This test showed that IC Markets has the lowest spreads on its Standard account, averaging 0.73 pips on EUR/USD and beating the industry average by 35%.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

The tests also found that the IC Market Raw account is also one of the cheapest for trading forex. The account averaged 0.32 pips across the top 5 major pairs, also 35% better than the industry average.

| Tested Raw Spreads | |

|---|---|

| Broker | Combined for major pairs we tested |

| Fusion Markets | 0.22 |

| City Index | 0.25 |

| IC Markets | 0.32 |

| TMGM | 0.32 |

| Pepperstone | 0.36 |

| FP Markets | 0.41 |

| Blueberry Markets | 0.43 |

| GO Markets | 0.46 |

| ThinkMarkets | 0.46 |

| Tickmill | 0.47 |

| Eightcap | 0.5 |

| BlackBull Markets | 0.94 |

| Tested Average | 0.49 |

Out of the two accounts, I think the Standard Account Spreads is the best option for beginners as you don’t pay a commission.

Excellent Trading Platforms With Advanced Tools

I like that the broker supports you with multiple trading platforms similar to Pepperstone, so you can benefit from IC Markets’ low spreads on a platform you are familiar with. You have MetaTrader 4, MT5, cTrader, and TradingView, which are all great for technical analysis.

What stood out in my review was the advanced trading tools from IC Markets, especially its access to Trading Central. This is one of my favourite professional signal services, as they use chart patterns and produce market commentary with each signal. You’ll understand the reasons behind their analysis, making it easy to understand and learn from.

4. ThinkMarkets - Best Selection of Beginner Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

I chose ThinkMarkets for its trading tools. These include trading signals and the Trader’s Gym tool. Trader’s Gym is particularly noteworthy, and I think it will speed up the learning curve while you practice your strategies.

The broker provides MT4 and MT5 for advanced technical analysis tools, while their ThinkTrader platform offers a beginner-friendly trading environment and leverages TradingView’s charting tools.

You can trade 4,000+ markets including 46 forex pairs and 27 cryptocurrencies. Standard account spreads are decent with the broker recording average spreads of 1.22 pips in our tests.

Pros & Cons

- Top backtesting software with Traders’ Gym

- Extensive educational content

- No minimum deposits

- ThinkTrader has great technical analysis

- Cannot use the ThinkZero on ThinkTrader

- Minimum balance of $500 required to access some services

- Trading tools are limited to the broker’s platform

Broker Details

Solid Trading Tools On ThinkMarkets

In my testing, I found ThinkMarkets provided some interesting trading tools, like the Trader’s Gym that I think will benefit beginners.

I like that Trader’s Gym provides historical prices, letting you simulate trading sessions in real time without relying on live price feeds like a demo account. This means you can practice trading the markets in your own time and rewind forex market sessions to “forward” test your strategy in a risk-free environment.

You can even increase the speed of the simulation up to 50x, making it faster for you to practice your strategies. I think this is one of the most effective ways to speed up your learning, and actually better than using a demo account.

Over 4,000+ Markets To Trade

ThinkMarkets gives you 4,000+ markets to practice with, so you can see which markets suit your trading strategy or are easiest to read. The bulk of these markets are share CFDs (3,700+), although they also offer 27 cryptocurrencies and 46 forex pairs. You’ll find all of the major pairs, which I recommend for beginners.

Low Spreads On Standard Account

You’ll get solid spreads on the Standard account, which averaged 1.22 pips across the top 5 major pairs in my tests. This made the ThinkMarkets Standard account 20% cheaper than the industry average of 1.53 pips, providing top value for beginners.

| Top 5 Most Traded Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| OANDA | 1.12 |

| IC Markets | 0.93 |

| Fusion Markets | 1.04 |

| Eightcap | 1.16 |

| ThinkMarkets | 1.22 |

| City Index | 1.24 |

| eToro | 1.30 |

| FP Markets | 1.36 |

| IG | 1.38 |

| Pepperstone | 1.26 |

| BlackBull Markets | 1.30 |

| Industry Average | 1.53 |

Broker Screenshots

5. FP Markets - The Best Demo Account for a New Trader

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$100

Why We Recommend FP Markets

I picked FP Markets as it offers demo accounts that do not expire and have unlimited virtual funds to practice with. You can open demo accounts on any of the broker’s platforms, which are TradingView, cTrader, MT4, and MetaTrader 5. You should certainly be able to find a platform that fits your needs.

FP Markets provides decent educational materials with an online trading course and weekly webinars. There’s also 24/7 customer support through live chat. I found the broker also provides solid trading conditions with fast execution speeds in our tests, and low spreads on its Raw account.

Pros & Cons

- Unlimited demo account access

- Has copy trading tools

- Solid range of trading products

- Fast account opening

- Time-limited demo accounts

- Basic mobile trading app

- IRESS platform is complicated for beginners

Broker Details

Most Generous Demo Accounts

Out of the demo accounts I’ve opened, FP Markets is the best. You get unlimited access, as the account only expires if inactive. There’s also the ability to top up your virtual funds whenever you need to.

You can open a demo account on any of the 4 trading platforms FP Markets offers – TradingView, cTrader, MetaTrader 4, and MetaTrader 5.

I found creating the demo accounts easy as they can be opened on your main account page. This makes it simple to track and switch between the platforms as you decide which one is best for you.

If you are unsure which trading platform to use, try my Trading Platform tool below:

Large Collection Of Educational Resources

Along with its demo account, I like that FP Markets has made a solid effort with its educational resources. There’s an online trading course to explore, which covers the basics and some intermediate topics like position sizing.

Fast Execution Speeds On FP Markets

FP Markets is a solid pick if you’re learning to scalp the markets as I find their execution speeds to be some of the fastest tested.

My analyst confirms this, In his tests, FP Markets recorded an average market order speed of 96ms. Anything below 100ms is enough to protect you from slippage, in my experience.

Broker Screenshots

6. Plus500 - Best Trading Platform for Beginner Forex Traders

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend PLUS500

I rated Plus500 as the best beginner platform for forex traders as it has a decent range of 100+ indicators for developing your trading strategies. The +insights tool is a top feature, giving you access to real-time market sentiment to view if a market is net-long or short – this is helpful for confirmation bias.

The platform also has guaranteed stop-loss orders (GSLOs) to protect from slippage. You can apply GSLOs across the broker’s full range of 2,800+ markets. This range includes 65 currency pairs, and spreads are fairly competitive on these. The EUR/USD pair, for example, averages 1.2 pips.

Pros & Cons

- Good proprietary trading platform

- Guaranteed stop-loss available

- Sentiment-based trading with +Insights tool

- Simple education videos

- Inactivity fees after three months of dormancy

- No MetaTrader 4 or Metatrader 5 available

- No automated or social trading

- No raw spread accounts

Broker Details

Solid Trading Platform For Beginners

When I signed up to Plus500, I received access to its web trading platform, which I think is one of the better proprietary trading platforms for beginners.

I was impressed to find 100+ indicators, including advanced ones like VWAP. There were also 20 chart types, which is more than MetaTrader 4, giving you decent tools for technical analysis.

What also stood out in my test was having access to the +Insights tool. Here, I found 9 different market sentiment categories based on Plus500’s customer activity in real time.

Top Risk Management and Analysis Tools

One of the options is to see the “most profit-making positions”, which shows you the top 10 assets making money for clients right now.

It even shows you the percentage of buyers and sellers. This makes it a useful tool for identifying and validating trading ideas as a beginner.

I also noticed you can set up guaranteed stop-loss orders on the platform, which is a good risk management tool to protect your open positions against slippage. I find this particularly valuable when trading around Non-farm payrolls or ISM report releases, as the volatility can quickly impact your trades.

Decent Range of Markets

As for its range of markets, Plus500 has 65 forex pairs with spreads from 1.2 pips on EUR/USD. The broker also offers other CFD markets, including 18 cryptocurrencies, 22 commodities, and 65 indices.

Broker Screenshots

7. eToro - Best Broker for Social and Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50 or $100

Why We Recommend eToro

eToro is the best broker for copy trading. I think their CopyTrader platform makes mirror trading simple – you can easily find traders that match your needs and apply automated risk management tools to protect your funds.

The broker is popular with 35 million traders, so it’s clear they provide a solid service. With more than 7,000 markets and spreads from 1 pip, the broker is a competitive choice for copy trading.

Pros & Cons

- User-friendly platform to copy trade

- 30M+ traders to choose to copy from

- Good selection of trading products

- Limited trading education

- Slightly more expensive to trade

- No MetaTrader 4

Broker Details

CopyTrader Simplifies Trading

eToro provides an excellent opportunity to copy experienced traders and hopefully profit from CFD markets. This is very good for beginners, as you won’t need to learn trading strategies yourself. But it’s also good for anyone who wants to save time and effort when they trade.

I found that the broker’s CopyTrader platform offers the best tools for copy trading. I found enhanced filtering features, comprehensive and transparent trading profiles, and built-in risk management.

The filter tool lets you search for copy traders across 14 metrics. This makes it much easier to find the right copy trading candidate, according to criteria like performance, frequency of trading, and most traded assets.

Safe and Secure Copy Trading With eToro

As it is the broker and platform owner, eToro provides the most transparent copy trading service available in my opinion. This set-up means it can verify every trade in real time, reducing scam opportunities.

You can also set a maximum loss for each copy trader. I think this is a solid beginner-friendly feature, as eToro will exit your trades and remove the copy trader from your portfolio if the loss exceeds your max. This automatically protects your funds when a trader underperforms.

Trade Socially Across 7,000+ Markets

If you prefer to manually trade, you can interact with 35 million traders, where you can view trading ideas and comment on them like a Facebook post. I think copy trading is the better option out of the two for new traders in my opinion.

Whether manually trading or copy trading, you can access all 7,000+ financial instruments. You’ll find low spreads from 1 pip on EUR/USD and no commissions, even on share CFDs.

Broker Screenshots

8. FxPro - Best for Beginner cTrader Trading Platform Users

Forex Panel Score

Average Spread

EUR/USD = 0.15 GBP/USD = 0.58 AUD/USD = 0.55

Trading Platforms

MT4, MT5, cTrader,

FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

FxPro is a no-deal-desk (NDD) broker, so I think it’s the best broker for beginners if you want to use cTrader. The NDD services allow you to get the most out of cTrader’s features.

These features include Level 2 pricing, volume-based indicators, and automated trading with the cBot tool.

You also get faster execution speeds, reducing the chance of slippage and requotes, and spreads from 0 pips.

Pros & Cons

- No minimum stop loss limits

- Lower spreads on cTrader

- Cleaner interface than MetaTrader platforms

- Fixed spread for selected currency pairs

- High spreads if you don’t use cTrader

- $100 minimum deposit required

- Not regulated by ASIC

Broker Details

No-Dealing Desk Broker With cTrader

In testing, I found FxPro provides decent trading conditions for the cTrader platform that lets you take advantage of the platform’s full features. If you’re learning how to scalp or use volume indicators, cTrader is a top platform for this.

One of cTrader’s top features is its Level II pricing, providing you with the liquidity provider’s order book to see where large and small orders are placed. I find this feature helpful as a day trader because you can use it to time your trades effectively. You can find volume-based support and resistance levels using the tool’s order blocks.

I find that no dealing desk (NDD) brokers like FxPro offer better execution speeds. This is because they pass your orders directly to another market participant on the opposite side of your trade. In most cases, this also helps eliminate requotes.

FxPro’s say that 99% of their instant orders were executed without requotes, which is a positive in my book.

FxPro Trading Costs

In my FxPro review, the broker’s spreads were on the expensive side. However, I found that the trading costs are a little cheaper with cTrader.

Combining FxPro with cTrader gave me low spreads and a $3.50 commission per lot. I recommend the commission-based account – it comes in a lot cheaper than the Standard account, with spreads of 1.40 pips on EUR/USD.

Broker Screenshots

9. CMC Markets - Best Mobile Trading App for Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.5 GBP/USD = 0.9 AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

In my opinion, CMC Markets’ NGEN mobile trading app is your best option if you want a fully-featured trading platform on your iOS or Android device. I like that the app has full charting features, including market sentiment, 25+ indicators, and drawing tools (including Fibonacci retracement) to perform analysis on its mobile-optimised charts.

My tests found the Standard account offers low spreads of 0.80 pips on EUR/USD. Meanwhile, the broker’s FX Active account offers 0 pip spreads and $2.50 commissions, making it one of the cheapest options I’ve seen. You can benefit from the low costs across 12,000+ instruments on CMC Markets, including an impressive 338 currency pairs.

Pros & Cons

- Mobile-optimised charts

- Charts sync between Mobile and Web App Platforms

- Low spreads with FX Active account

- Guaranteed stop loss order with NGEN Platform

- Limited social trading tools

- Lacks customer support via mobile app

- Too many FX pair variations may confuse beginners

Broker Details

NGEN Mobile Trading App

CMC Markets’ NextGen mobile trading app is one of the best handheld trading platforms I’ve seen, and it’s available on both iOS and Android. Most mobile trading apps I’ve used are very basic, with limited features designed to execute and manage traders – MT4’s app is a good example.

I found NGEN has full charting tools for technical analysis on the move. There are more than 25 technical indicators, such as Bollinger Bands. One feature I like is the market sentiment tool which shows you the net long/short sentiment of an asset, helpful for analysing trends and timing trades.

Low Trading Fees With CMC Markets

The spreads on CMC Markets are decent too, with EUR/USD averaging 0.80 pips on its Standard account. This was the third best in our tests.

If you want tighter spreads, I found the FX Active account has 0 pip spreads on 6 majors including EUR/USD, AUD/USD, and USD/JPY, but charges $2.50 commission per lot traded.

However, this commission rate is actually very good. Out of the brokers I tested, CMC Markets has one of the lowest commission fees. In fact, it beat the industry average of $3.25 by around 23%, improving your trading costs considerably.

| Commission Fees | |

|---|---|

| Broker | AUD |

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Go Markets | $3.00 |

| City Index (Web Trader) | $3.00 |

| City Index (MT4) | $3.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

| FP Markets | $3.50 |

| Blackbull Markets | $4.50 |

Most Forex Markets With NGEN Mobile App

While testing the NGEN mobile app, I found the broker offers 12,000 financial markets, including 338 forex pairs – the most from any broker I looked at. There are also 19 cryptocurrencies, 124 commodities, and 82 indices, but the bulk of the tradable instruments are found in the broker’s 10,000 share CFDs.

Broker Screenshots

Ask an Expert

Where can I find a trustworthy Broker for Forex Trading?

We only recommend regulated forex brokers. Being with a broker regulated by the country you are trading in means the broker complies the standards set by the regulator.

Is a demo account real money?

The major difference is that with Real accounts you will trade with real funds, while Demo accounts use virtual money with no real value to trade. Other than that, the market conditions for Demo accounts are exactly the same as they are for Real accounts, making them ideal for practicing your strategies

Are all Brokers regulated on this website?

Yes we only work with licensed and regulated brokers.

What should i look for in a broker?

There’s alot of factors you should consider but one the most important would have to be if they are regulated or not.

Do all brokers have customer support?

Yes they all have some kind of customer support like livechats email or tickets etc…

Which broker does the prop firm level up trading use?

Level up Trading work with Eightcap.

Who is a good broker for a beginner like myself?

Pepperstone is one of the best brokers with a high reputation in Australia.

Can i use the broker Eightcap in the UK?

Yes Eightcap are regulated in the UK.

what is a pip?

“Pip” is an acronym for percentage in point or price interest point. A pip is the smallest whole unit price move that an exchange rate can make, based on forex market convention. Most currency pairs are priced out to four decimal places and a single pip is in the fourth decimal place

Can i trade with a broker that is not based in my country ?

Where can I find a broker that i can trust and be 100% sure about their reputation?

How much money do I need to start forex trading?

In a technical sense, the amount you need will depend on the leverage you are using the lot size you trade with. These two factors will impact the margin requirements you need to open a trading position. Most brokers has a minimum $200 minimum deposit requirement to open an account which will get you started but this is closer to the minimum amount you should consider.

Is $500 enough to trade forex?

Yes, as long as it covers the margin requirement to open a trading position.

Are demo accounts unlimited or time-limited across these brokers?

Depends on the broker and trading platform. Generally MT4, MT5 are limited to 60 days but can be extended indefinitely if you sign up with the broker.

Just wanna ask — for beginners in Australia, is it better to start with MT4/MT5, or the broker’s own app is already fine?

Either is fine. Generally information for using MT4 and even MT5 is more readily available on the web. Being able to access such resources can be useful.