Best MT4 ECN Platforms

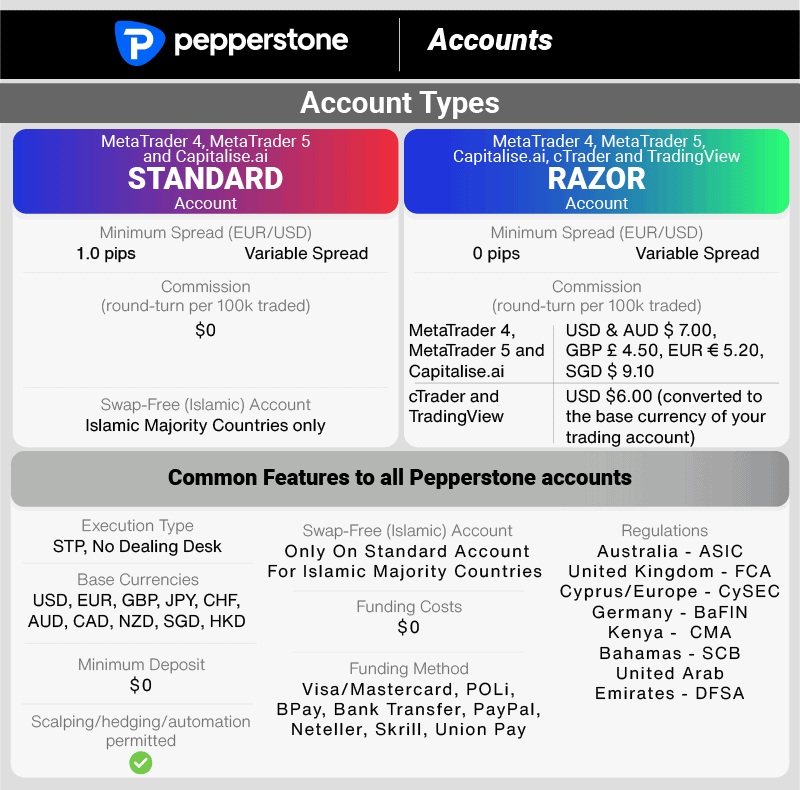

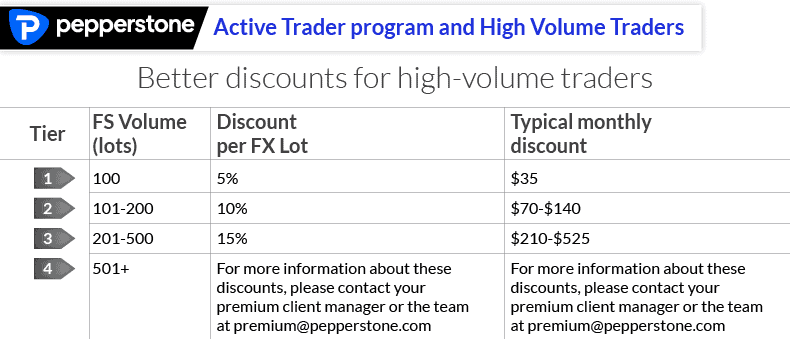

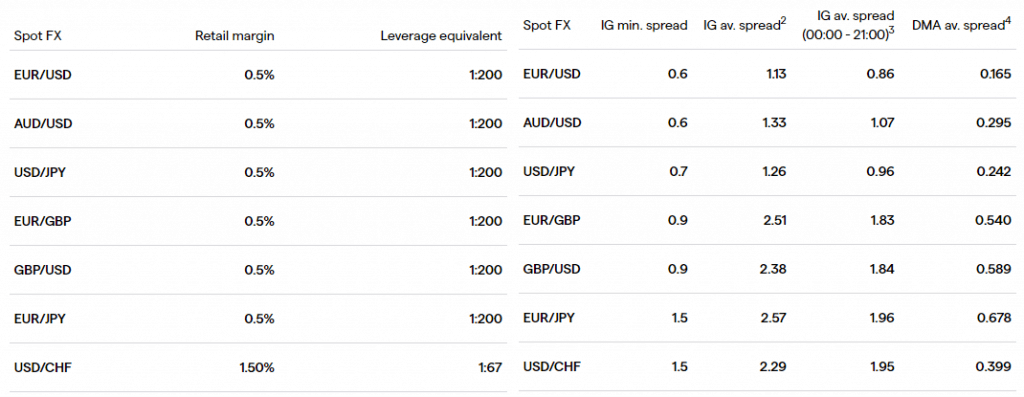

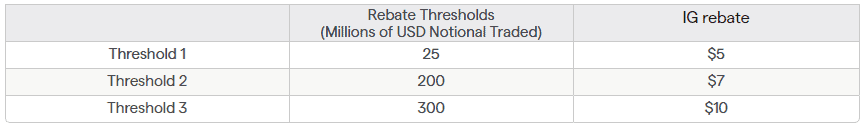

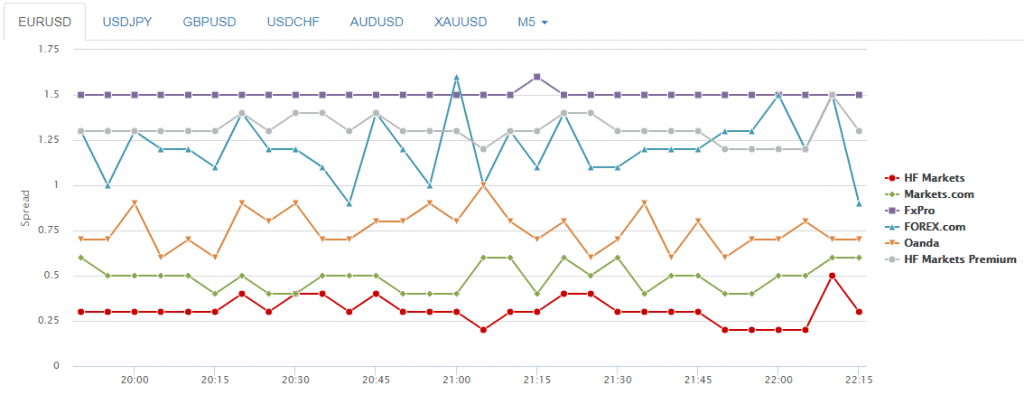

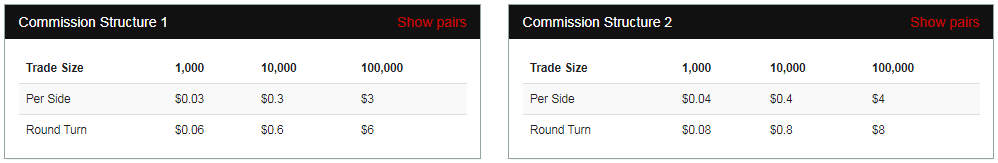

To help choose an ECN forex broker, a spread and ECN forex platform comparison was completed. This led to a list of the top ECN brokers that offer straight-through processing (STP) allowing direct access to liquidity markets.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

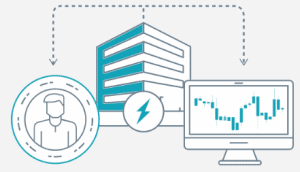

1) A direct optical fibre connection to trading servers

1) A direct optical fibre connection to trading servers

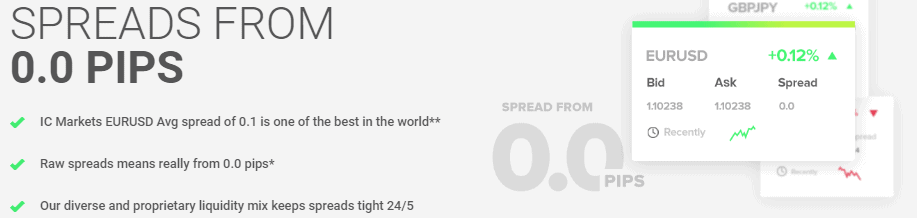

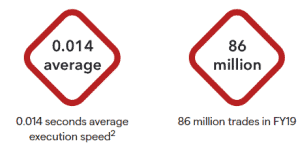

FP Markets operates a pricing model based on Electronic Communication Network (ECN) technology, which ensures deep liquidity, the highest level of price transparency, ultra-tight spreads as well as exceptional order execution with minimal slippage.

FP Markets operates a pricing model based on Electronic Communication Network (ECN) technology, which ensures deep liquidity, the highest level of price transparency, ultra-tight spreads as well as exceptional order execution with minimal slippage.

Ask an Expert