Best Islamic Forex Account 2025 Comparison

Islamic forex broker accounts are swap-free, which means they do not receive or pay interest. This allows Muslims to trade forex and other CFD markets. Based on my personal testing, I’ve found 5 of the best Islamic forex broker accounts, all offering tight spreads and excellent trading conditions.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

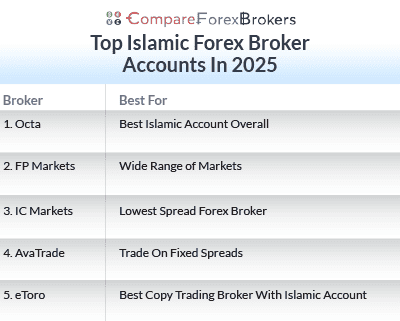

My top Islamic forex broker accounts for 2025 are:

- Octa - Best Islamic Account Overall

- FP Markets - Wide Range of Markets

- IC Markets - Lowest Spread Forex Broker

- AvaTrade - Trade On Fixed Spreads

- eToro - Best Copy Trading Broker With Islamic Account

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

88 |

CySEC MISA, FSCA, FSC-M |

- | - | - | - | 0.90 | 1.40 | 1.70 |

|

|

|

81ms | $25 | 35 | 32 | 1000:1 | 1000:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

What Are The Best Islamic Forex Broker Accounts?

Islamic accounts allow you to avoid interest when trading forex or other CFD markets. Interest is usually applied when positions are held open overnight, and is referred to as a swap – so, these Islamic accounts are often called swap-free accounts.

Not all brokers offer Islamic accounts, which is why I created this list – to help you quickly find the brokers that do. I tested more than 30 brokers to see which ones offer swap-free accounts. My top five picks all feature low admin fees and trading costs, as well as solid trading conditions.

1. Octa - Best Islamic Account Overall

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.8

Trading Platforms

Minimum Deposit

$25

Why We Recommend Octa

Octa is my top pick for Islamic accounts because it delivers swap-free trading with no admin fees. So the only trading costs are your spreads. And these spreads are pleasingly low – in my tests, the ECN broker averaged 0.90 pips on EUR/USD.

This is a saving of 25% on the industry average. The broker also achieves fast execution speeds of 91ms, which in turn leads to excellent trading conditions.

With these low costs and solid trading conditions, I awarded Octa 88/100, placing the broker in my top 10 brokers overall. You have access to MetaTrader 5 for advanced technical analysis, custom indicators, and automated trading.

While MetaTrader 5 is one of the best platforms around, I actually think the OctaTrader platform is best suited for beginners. This is thanks to its pattern recognition tools, which are ideal for relative newcomers to trading.

Pros & Cons

- Swap-free trading account

- Tight spreads with no commissions

- Excellent trading platforms

- No telephone support

- Limited range of trading platforms

- Could offer more financial markets

Broker Details

Swap-Free Trading Accounts As Standard

Out of the brokers tested, Octa’s Islamic accounts are the easiest to set up. This is because the broker already offers swap-free trading accounts as standard. You won’t need to prove your faith or background in any way, as anyone can register a swap-free account.

What also stood out is that the Octa accounts have no other fees – so no deposit fees, no withdrawal fees and no commissions. Instead, you only pay the spread when executing your trades. This is good news for traders, as Octa’s spreads tend to be very competitive, as you will see below.

ECN Low Pricing With No Commissions

During my time using Octa, I found their spreads averaged 0.90 pips on EUR/USD during the Asian trading session. Compared to other spread-only accounts, Octa delivers spreads 25% cheaper than the industry average, making it a top choice if you want to lower your trading costs

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| Octa | 0.9 | 1.8 | 1.2 | 1.5 | 1.9 | 1.7 | 1.9 | 2.3 | 1.65 |

| Industry Average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 | 1.6 |

Fast Execution Speeds

What surprised me was that the broker offers ECN execution with spread-only pricing, which is quite rare. I like this approach as you get tight spreads (as shown above) while receiving fast execution speeds thanks to Market Execution. This is when your orders are matched with other market participants on the ECN, providing near-instant execution.

CompareForexBrokers analyst Ross Collins found that Octa delivered the fastest execution speeds out of all of the Islamic accounts tested. Octa recorded average limit order speeds of 81ms and market order speeds of 91ms.

Just for reference, I find anything below 100ms is enough to keep your positions from slipping – so your trades will be executed at the price you expect.

| BROKER | LIMIT ORDER SPEED | MARKET ORDER SPEED |

|---|---|---|

| Octa | 81 | 91 |

| FP Markets | 225 | 96 |

| IC Markets | 134 | 153 |

| AvaTrade | 235 | 145 |

2. FP Markets - Wide Range Of Markets

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

Out of the Islamic account brokers, I found FP Markets gives you the best choice for markets. There are 900+ CFD markets to trade, including top share CFDs like Tesla.

FP Markets also has zero-pip spreads in our testing, providing excellent value if you choose the Islamic Raw account. At the same time, it produces some of the fastest execution speeds, clocking in at 96ms.

These results helped FP Markets score 86/100 in my tests. I think scalpers in particular will benefit from the broker’s excellent trading conditions

Pros & Cons

- Low Spreads

- Fast Market Execution Speeds

- 71 Forex Pairs

- Limited Proprietary App

- CFD Range Could Be Wider

- Admin fees could be cheaper

Broker Details

You should know that FP Markets charges an admin fee instead of swap fees. This varies depending on the asset held, and may be between $1 to $5 on major markets. I did find that FP Market’s popular markets honour a 5-day grace period – the administration fee doesn’t kick in until the end of trading on the sixth day.

| Symbol | Admin fee in USD per lot, per night | Grace period |

|---|---|---|

| NZDUSD | $1 | 5 nights |

| GBPUSD | $2 | 5 nights |

| USDCAD | $3 | 5 nights |

| AUDUSD | $3 | 5 nights |

| EURUSD | $5 | 5 nights |

| USDCHF | $10 | 5 nights |

| USDJPY | $15 | 5 nights |

| XAUUSD | $30 | 5 nights |

This five-day grace period should give you enough time to execute your short-term trade ideas without encountering excessive trading costs.

Top Choice of Financial Markets

While testing FP Markets, I found that the broker provides a solid catalogue of 900+ financial instruments, including 63 forex pairs, 800+ share CFDs, 12 cryptocurrencies, 13 commodities, and 19 indices.

0-Pip Spreads On Its Islamic Raw Account

Another area where FP Markets performed well was its Islamic Raw account spreads. My analyst, Ross Collins, tested 15 ECN brokers to check the consistency of their zero-pip spreads during a typical trading session.

He found that FP Markets offered EUR/USD at zero pips 100% of the time – outside rollover. I think this makes their Raw accounts perfect for scalping, as you won’t have to cover a spread to generate a profit.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

As you can see from the results above, Ross found that FP Markets achieved its minimum advertised spreads basically 100% of the time. Only the USD/CHF pair let them down.

Fast Market Order Execution Speed For Scalping

Fast execution speeds are also important for optimal trading conditions, and FP Markets achieved an average of 96ms for its market order speeds. This is one of the fastest speeds recorded in our tests.

3. IC Markets - Lowest Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets is one of my top picks. I scored it 93/100 for its low-spread trading accounts. The Standard account delivered an average of 0.73 pips on EUR/USD – the lowest spread I’ve tested.

You can trade with a wide range of trading platforms, letting you choose between MetaTrader 4, MetaTrader 5, cTrader, and TradingView. This makes IC Markets suitable for all trading styles.

There are advanced trading tools available, such as trading signals and VPS services. I found these very useful while trading across the broker’s 2,250+ markets.

Pros & Cons

- Ultra Competitive Spreads

- Good Range of Trading Platforms

- Over 1600 Share CFDs Available

- $200 Minimum Deposit

- No Proprietary Trading Platform

- Limited Regulations

Broker Details

Tightest Standard Account Spreads

IC Markets has the lowest spreads out of all the Islamic accounts tested. Our analyst, Ross Collins, ran his tests on the Standard accounts (spread-only) using the IceFX SpreadMonitor to capture the averages.

Ross said that IC Markets averaged 0.73 pips on EUR/USD, beating the industry average by 34%.

| EURUSD | SPREAD |

|---|---|

| IC Markets | 0.73 |

| CMC Markets | 0.8 |

| OANDA | 1.06 |

| City Index | 1.16 |

| EightCap | 1.16 |

| FP Markets | 1.19 |

| Pepperstone | 1.21 |

| Blackbull Markets | 1.34 |

| FXPro | 1.59 |

| Industry Average | 1.11 |

The broker performed well across the other five currency pairs tested. The lowest USD/JPY spreads, for example, were 1.09 pips – saving you around 27% on spreads against the industry average.

From these tests, IC Markets achieved an average Standard account spread of 1.03 pips, which placed it first overall.

| Tested Standard Spreads | |

|---|---|

| Broker | Combined for major pairs AUDUSD, EUR/USD, GBPUSD, USD/CAD, USDCHF) |

| IC Markets | 1.03 |

| Fusion Markets | 1.19 |

| Pepperstone | 1.46 |

| FP Markets | 1.47 |

| Eightcap | 1.51 |

| OANDA | 1.54 |

| Blackbull Markets | 1.82 |

| City Index | 1.79 |

| FxPro | 2.22 |

Low Raw Spread Account

I also found IC Markets’ produced decent Raw spreads, averaging 0.19 pips in our tests. There was a commission of $3.50 per lot traded, which is average for Raw spread accounts.

So IC Markets gives you a solid choice of trading accounts with low spreads. However, after seeing the test results, I think the broker’s Standard account is a clear winner.

With the Islamic account, IC Markets does not charge swap fees, but an administration fee instead. This is a fixed cost, like with FP Markets.

You can pay between $2 to $10 on major and minor currencies. I found these admin costs to be quite expensive in my opinion. Here’s the breakdown of the costs below:

| Instrument | Charges |

|---|---|

| AUDUSD | $2 per lot |

| GBPUSD | $2 per lot |

| EURUSD | $3 per lot |

| USDCHF | $3 per lot |

| EURGBP | $4 per lot |

| USDCAD | $7 per lot |

| USDJPY | $9 per lot |

| EURJPY | $9 per lot |

Wide Range of Trading Platforms

I am a fan of IC Markets for offering a wide variety of forex trading platforms, which is why I scored the broker 9.50/10. I found you have access to TradingView, MetaTrader 5, MT4, and cTrader, which are excellent platforms for technical analysis.

If you are unsure which platform is right for you, I’ve developed the Trading Platform tool, which will recommend a platform tailored to your trading needs. Check it out below:

4. AvaTrade - Trade On Fixed Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

I found AvaTrade’s fixed spreads are surprisingly competitive. The EUR/USD comes in at 0.90 pips – beating most variable-spread brokers.

AvaTrade delivers a good set of trading tools on its AvaTrade platforms. Its market sentiment tools and trading signals are great for analysing the broker’s 700+ CFD markets. You also have a choice of MT4 or MT5 if you want advanced technical analysis tools and automated trading tools through Expert Advisors.

Pros & Cons

- Stable Fixed-Spread Trading

- Decent trading tools

- Solid variety of CFD markets

- No Raw account

- TradingView Unavailable

- Market Research Limited

Broker Details

Fixed Spread Forex Trading on AvaTrade

Of the brokers tested, AvaTrade offers a unique pricing structure with its fixed spreads. This type of spread provides stable pricing when market volatility ramps up. At these times, variable spreads can become more expensive.

If you’re worried about price spikes while you trade, AvaTrade is a great choice for this reason. Your costs will always remain the same.

What’s more, AvaTrade’s fixed spreads are competitive if you trade popular markets. I found EUR/USD had 0.90 pip spreads, lower than the variable-spread industry average of 1.11 pips.

| Broker | Avg. EUR/USD Spreads* | Spread Type |

|---|---|---|

| AvaTrade | 0.90 | Fixed |

| IC Markets | 0.62 | Variable |

| eToro | 1.00 | Variable |

| FP Markets | 1.10 | Variable |

The same can be said for USD/JPY. The 1 pip spread is around 33% cheaper than our industry average for variable-spread brokers, which tested at 1.49 pips.

AvaTrade Islamic Account

The broker’s Islamic account has administration fees, which is the alternative option to paying swap fees. There is a 5-day grace period before incurring the fee. So ideally, you want to close your positions before this point.

Although the broker offers a decent range of markets, if you hold an Islamic account they restrict some markets like ZAR crosses and cryptocurrencies.

Even with the restrictions in place, you still have access to 55 forex pairs, 600+ share CFDs, 17 commodities, and 33 indices on your Islamic account.

Multiple Platforms With Fixed Spreads

You can access multiple platforms with AvaTrade, including MT4, MT5, and AvaTradeGO, letting you choose the best platform for your trading style. If you want to automate your trades, I found that only MetaTrader 4 and MT5 offer this feature through their Expert Advisor trading bots.

5. eToro - Best Copy Trading Broker With Islamic Account

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

I chose eToro as my best copy trading broker, as the CopyTrader platform makes it easy to find and manage traders you want to follow. eToro’s Islamic account has no swap fees, but does carry admin fees.

These admin fees have a 7-day grace period, which is one of the most generous periods I found while testing.

Trading costs with eToro are also simplified. You get spread-only pricing from 1 pip on EUR/USD. This means no commissions on any of its 7,000+ assets, including share CFDs.

Pros & Cons

- Top Social/Copy Trading Platform

- User-Friendly Trading Platform

- Commission-Free Spreads

- No MT4 or MT5

- Wider Spreads Than Average

- Lacks Advanced Trading Tool

Broker Details

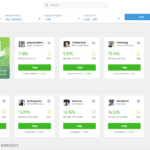

CopyTrader Simplifies Copy Trading

Out of the copy trading platforms used, I like eToro’s CopyTrader platform the best as it’s much easier to use than alternatives like DupliTrade or ZuluTrade. You can choose from 2 million+ eligible copy traders and start mirroring their trades in just three clicks, making it simple for beginners to get started.

I like the platform’s filter tool, making it easy to find traders that match your requirements for investing. You can choose standard metrics like profitability and markets traded, but also use social proof to find current performing traders by filtering to just include traders with lots of followers.

If you’re a new trader, you can filter by Risk Score. This is eToro’s proprietary score, and is based on the trader’s risk profile, markets traded, and drawdown. I find this gives you a simplified top-down view of how the trader performs, so you don’t have to manually break down their trading results.

Low Copy Trading Costs With No Commissions

When it comes to trading costs, eToro has competitive spreads with no commissions on any of the broker’s 5,000+ markets, which include share CFDs. I found the spreads start from 1 pip on EUR/USD. This is competitive, slightly beating the industry average of 1.20 pips.

The Islamic account does carry admin fees, but there is a generous grace period of seven days. However, I do think they are expensive compared with the other brokers I’ve looked at. For example, EUR/USD is $10 per lot per night after the grace period, almost triple the fee of the other brokers tested.

Ask an Expert

What is the administration cost charged by Pepperstone if I want to use their Islamic account?

The administration cost charged by Pepperstone’s Islamic account varies from instrument to instrument and is levied every time you hold a trade for 10 days. Costs vary depending on the currency you trade but major forex pairs are USD50 per lot which means an average USD5 per overnight.

Are there any Islamic accounts with zero extra costs like administration fees?

Yes – some brokers do offer ‘true’ swap-free accounts where the overnight fee is not replaced with an administration fee or wider spread. We believe Plus500, eToro, easyMarkets meet these criteria but do check as this can change. Other brokers have a time limit on the free swap. Pepperstone and IC Markets for example allow you to have your position open for 9 overnight sessions before an administration fee is applied

How to open Islamic account on Pepperstone?

You will need to contact Pepperstone customer service to open a swap free Islamic account. This account is only available ins Islamic countries so if you are in Australia, The UK or Europe, you wont be able to use one.