The Most Trusted Forex Brokers List [Guide for 2025]

The best forex brokers follow rules set by tier-1 regulators such as ASIC in Australia and the FCA in the United Kingdom. As CFD and forex trading always carries high risk, I recommend choosing one of the most trusted forex brokers and trading platforms for your own strategy.

This is why I created my list – to help you find these trusted brokers. I exclusively looked at brokers with strong reputations, and with licenses from reputable bodies across the world.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

For me, the top eight most trusted forex brokers for 2025 are:

- Pepperstone - The Most Trusted Forex Broker Overall

- IC Markets - The Trusted Broker With The Best RAW Spreads

- Fusion Markets - A Great Broker With The Lowest Commissions

- IG Group - The Largest Range Of Trading Products

- FP Markets - A Good Trusted Broker For Scalping

- eToro - The Most Trusted Social Trading Platform

- XTB - The Top Trusted Broker For Research and Education

- OANDA - The Most Trusted Forex Broker With Competitive Spreads

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.09 | 0.28 | 0.14 | $2.25 | 0.89 | 1.11 | 0.95 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

51 |

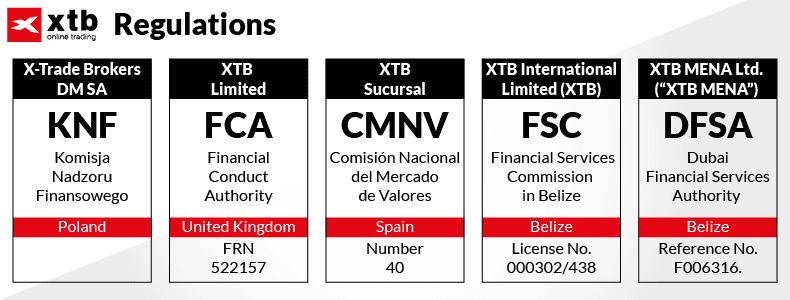

FCA, DFSA, CySEC FSCBZ, CMNV, KNF |

0.9 | 0.14 | 0.13 | - | 0.9 | 1.4 | 1.3 |

|

|

|

160ms | $250 | 49+ | 16+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

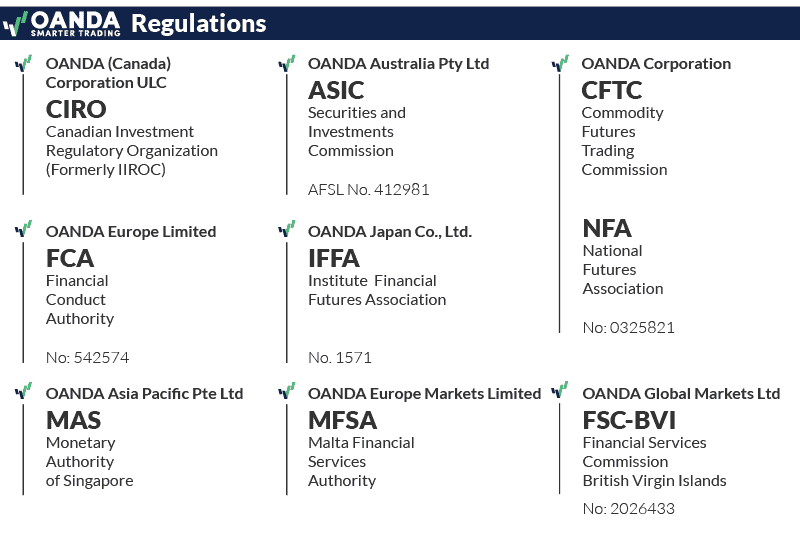

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

What Are The Most Trusted Forex Brokers?

A trusted forex broker must be regulated by one or more tier-1 financial bodies. For example, the Australian Securities and Investments Commission (ASIC) in Australia and the Financial Conduct Authority (FCA) in the UK. The list below contains my most trusted forex brokers globally. In each case, I’m picking out a specific trading advantage over other brokers.

1. Pepperstone - Most Trusted Forex Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

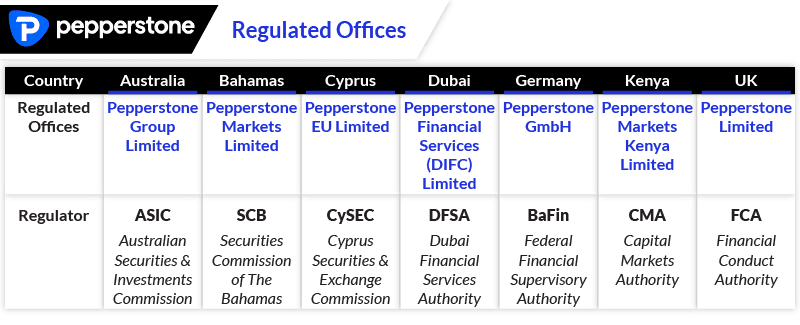

Pepperstone is regulated in seven jurisdictions – including tier-1 regulators, ASIC and the FCA. It also has a strong reputation, built up over 15 years since it was founded in 2010. All this makes it my most trusted broker overall.

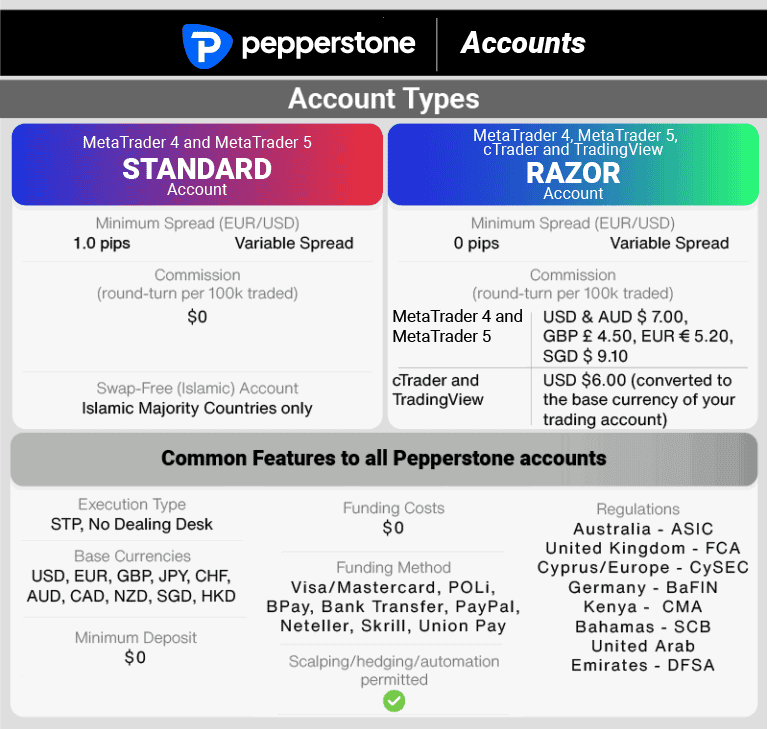

Notably, the broker delivers fast execution speeds, averaging 77 ms in our tests. It also has low average spreads, starting from 0.1 pips on the Razor account, and supports the leading MetaTrader 4, MetaTrader 5, cTrader and TradingView platforms. This contributes to Pepperstone’s compelling blend of trust, speed, and cost-effectiveness – leading to our high 98/100 review score.

Pros & Cons

- Fast execution speeds

- Low standard and RAW average spreads

- Well-regulated and established

- No guaranteed stop-loss orders

- Only 30-day access to demo accounts

- Educational resources are basic

Broker Details

Top Multi-Regulated Forex Broker Overall

Pepperstone holds financial services licences from multiple major financial authorities around the world. This includes four tier-1 jurisdictions – in the UK (FCA), Australia (ASIC), Germany (BaFin) and Cyprus (CySEC).

This allows the broker to accept customers from around the world. It also helped them achieve a score of 91/100 for trust in my review.

It’s important to note that only tier-1 regulators offer the Financial Compensation Scheme and Negative Balance Protection. This is the best way to safeguard your funds.

Low Commission-Free Spreads

Another aspect of trust is transparent pricing, which Pepperstone provides.

I found this was particularly true on the broker’s cost-effective, commission-free Standard account. In my analysis, Pepperstone offered some of the tightest spreads across the board. They averaged 1.26 pips for Standard account holders, which is a good saving on the industry average of 1.53 pips.

| Location and Regulator | Pepperstone UK (FCA), Australia (ASIC), Europe (BaFIN, CySEC) | Pepperstone (SCB) | Pepperstone UAE (DFSA) | Pepperstone Kenya (CMA) |

|---|---|---|---|---|

| Segregated Client Funds | ✔ | ✔ | ✔ | ✔ |

| Financial Compensation Scheme | ✔ (FSCS up to £85) | ✘ | ✘ | ✘ |

| Negative Balance Protection | ✔ | ✘ | ✘ | ✘ |

| Maximum Leverage - Major Forex Pairs | 30:1 | 500:1 | 50:1 | 400:1 |

| Maximum Leverage - Minor Forex Pairs, Major Indices, Gold and Silver | 20:1 | 500:1 | 50:1 | 400:1 |

| Maximum Leverage - Commodities and Minor Indices | 10:1 | 500:1 | 20:1 | 400:1 |

| Maximum Leverage - Shares | 5:1 | 20:1 | 10:1 | 20:1 |

| Maximum Leverage - Cryptocurrencies | 2:1 | 5:1 | 5:1 | ✘ |

For major currency pairs, the performance is even better. On the EUR/USD, for example, Pepperstone clients can access no-commission spreads of 1.1 pips. In comparison, FxPro offers 1.40 pips – quite a lot wider than Pepperstone.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Award-winning Customer Service

Pepperstone offers award-winning customer support, and the broker has scooped numerous accolades for Customer Service and Overall Client Satisfaction. From my own experience of trading with the broker, I’d say this recognition is justified.

I was pleased to find excellent 24/7 customer support coverage across live chat, email and phone. On top of this, the broker offers a top-notch knowledge base and a very useful account manager. If you need help while opening an account, or trading with the broker, assistance is very easy to find.

2. IC Markets - Trusted Broker With Best RAW Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

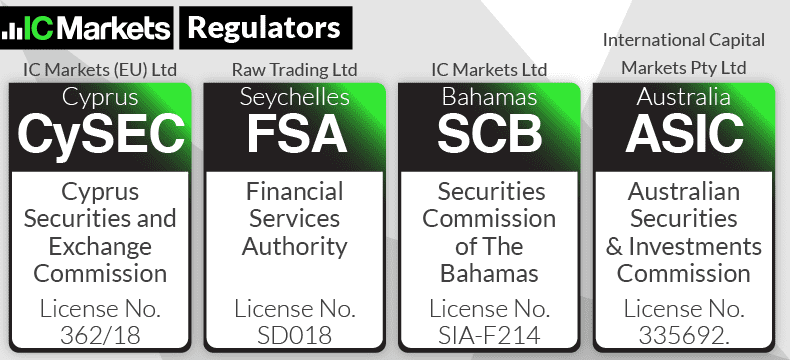

With its long-standing reputation stretching back to 2007, its sterling regulatory record with ASIC and CySEC, and reliably low spreads, IC Markets is one of my favourite brokers. It certainly earned a spot on our most trusted broker list with a rating of 93/100.

Where IC Markets really stands out is in its RAW spreads. The EUR/USD pair averages 0.02 pips – 90% lower than the industry average of 0.22 pips. I also liked that you can trade with the MT4, MT5, cTrader and TradingView platforms.

Pros & Cons

- Low average RAW spreads

- Offers MetaTrader and cTrader platforms

- Provides social trading products

- Minimum deposit required

- Limited market analysis resources

Broker Details

In addition to licenses from four jurisdictions – including tier-1 regulators like ASIC and CySEC – I really rate IC Markets for its low RAW spreads. Additionally, I liked IC Markets’ support for top trading platforms like MT4, MT5, cTrader and TradingView. The large range of more than 1600 products is another big plus point in my eyes.

Lowest RAW Spreads

IC Markets offers two main retail investor account types, but it’s the low spreads on the Raw account that really impressed me.

We tested the 20 top brokers’ Raw account spreads using six USD-backed currency pairs. In these tests, IC Markets averaged spreads of 0.32 pips, which put it third on our list overall. By comparison, the tested industry average was 0.50 pips – which shows how low IC Markets’ spreads were.

IC Markets’ ECN-Pricing means your orders will be executed with no dealing desk (NDD) interference. This gives great transparency, as the broker’s spreads are sourced from multiple external liquidity providers.

This adds another layer of trust for IC Markets in my view. It’s a better way to trade than through market makers, who set their own bid-ask prices (spreads), and fill orders using internal liquidity sources.

| Tested Raw Spread | |

|---|---|

| Broker | Average on Tested Major Pairs |

| Fusion Markets | 0.22 |

| City Index | 0.25 |

| IC Markets | 0.32 |

| TMGM | 0.32 |

| Pepperstone | 0.36 |

| FP Markets | 0.41 |

| Blueberry Markets | 0.43 |

| GO Markets | 0.46 |

| ThinkMarkets | 0.46 |

| Tickmill | 0.47 |

| Eightcap | 0.5 |

| Axi | 0.73 |

| CMC Markets | 0.73 |

| Admirals | 0.79 |

| BlackBull Markets | 0.94 |

As you can see, IC Markets finished a respectable third in our tests, and offered far cheaper spreads than many of its biggest competitors.

Trusted Range of Trading Platforms

IC Markets offers you four trusted trading platforms – MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView.

While all platforms have their merits, I appreciate MT5 for its 38+ trading indicators and 44+ drawing tools. You’re can also trade a broader range of CFDs on MT5 – as MT4 is more suited to trading strategies focused exclusively on forex.

I particularly liked the Depth of Market tool, which allowed me to access the current order flow of the liquidity providers’ books, giving me insights into where other traders thought the market was going.

3. Fusion Markets - Great Broker With Lowest Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

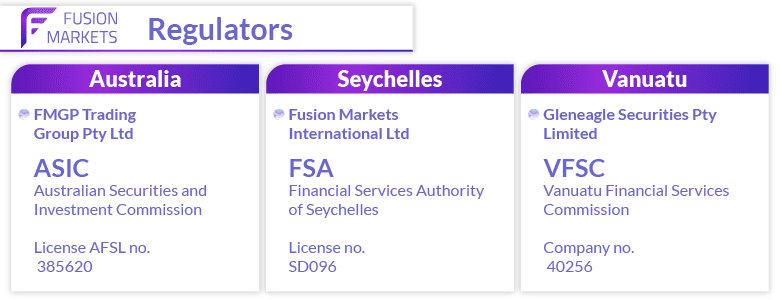

From my research, Fusion Markets emerged as one of the most cost-effective brokers. This was due to a combination of tight spreads and low commissions, which keeps your trading costs low.

Our research reveals the broker’s commission is only $2.25 per lot, significantly below the industry average of $3.48. The RAW account boasts exceptionally low spreads, averaging 0.22 pips on the major currency pairs, and beating the industry average of 0.49 pips.

Pros & Cons

- Cheapest trading commissions

- Fast execution speeds

- Low RAW spreads

- Charges an inactivity fee

- Range of trading products is limited

- No TradingView platform

Broker Details

Fusion Markets is a top ASIC-regulated forex broker, and is also overseen by the VFSC in Vanuatu and FSA in Seychelles. From our analysis, the broker also charges commission fees of A$2.25 per side, per lot of 100,000 traded. This is significantly lower than other top brokers.

Lowest Commission Fees

After extensive analysis, I found that the Fusion Markets ZERO account charges ultra-competitive commission fees when compared to other top brokers.

Most brokers charge A$3.50 per side per lot. Fusion Markets, on the other hand, charges only $2.25 per side in commissions. As shown below, regardless of your base currency, you will pay around half of what competing brokers charge.

| Tested Raw Spread | |

|---|---|

| Broker | AUD |

| DNA Markets | $2.25 |

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Fair Markets | $2.50 |

| Go Markets | $3.00 |

| City Index (Web Trader) | $3.00 |

| VT Markets | $3.00 |

| FIBO Group | $3.00 |

| FlowBank | $3.25 |

| City Index (MT4) | $3.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| Axi | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

| Global Prime | $3.50 |

| TMGM | $3.50 |

| Blueberry Markets | $3.50 |

| FP Markets | $3.50 |

| Admirals | $4.00 |

| Blackbull Markets | $4.50 |

As well as low fees, I found that the ZERO account averaged spreads of 0.22 pips. This is very good, especially when compared to our tested average of 0.50 pips.

Further reducing your fees, there are no inactivity, deposit or withdrawal fees. Fusion Markets doesn’t have a minimum deposit requirement either, meaning you can open a trading account with as little as $0.

Fastest Execution Speeds

To further reduce your trading costs, Fusion Markets offers the fastest execution speeds of any trusted broker on this list, and the second fastest overall. When we tested limit and market orders using the broker’s MT4 platform, Fusion Markets averaged speeds of 79ms for limit orders and 77ms for market orders.

Only BlackBull Markets displayed faster limit order speeds – hitting 72ms. Fusion Markets’ market order speed was the fastest of all the brokers we tested.

Fast execution speeds greatly reduce the risk of slippage. For me, this adds to Fusion Markets’ reputation as a low-cost, trusted broker.

4. IG Group - Largest Range Of Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

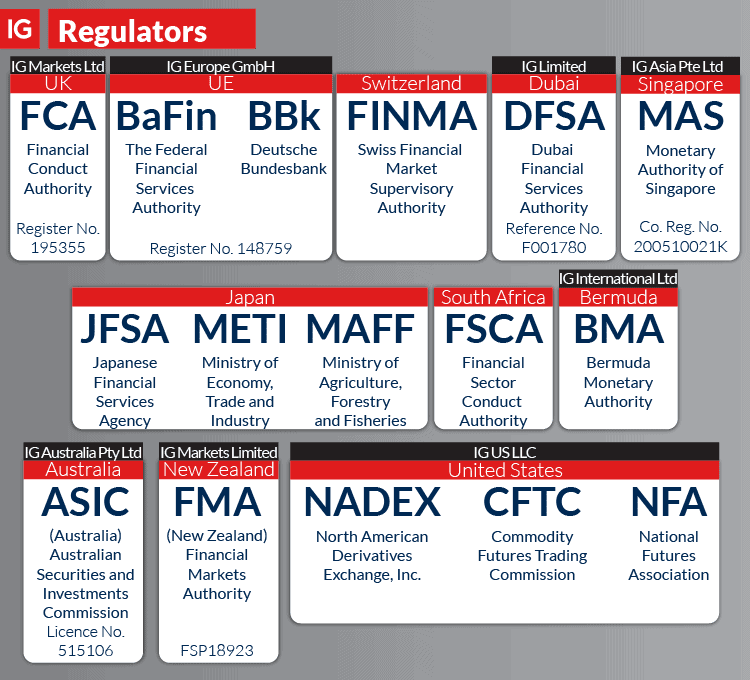

IG Group has the most extensive range of trading products I’ve seen, with over 17,000 markets – ranging from forex to indices. The broker is regulated by 13 authorities, including five tier-1 regulators like CySEC, FCA, and ASIC. This makes it the most regulated broker on my list.

The broker has decent spreads, averaging 1.13 pips on the EUR/USD pair, with no commission. I was impressed by the range of trading features IG Group offers, as well as its low fees. This is why I scored them 78/100 in my reviews.

Pros & Cons

- Decent average spreads

- Most markets available to trade

- Excellent trading tools

- Requires a minimum deposit

- Lacks copy trading tools

- MetaTrader 4 has limited market access

Broker Details

Established in 1974, IG Group is one of the oldest and best-trusted forex brokers around. IG Group has the largest selection of CFDs – more than 17,000. These come from a range of asset classes, including forex, commodities, indices, cryptocurrencies, shares, bonds, interest rates, options and ETFs.

Large and Established Broker

Signing up with a reputable broker will help you avoid scams and reduce some of the risk of trading CFDs. This is because you enjoy various investor protections – although these vary depending on where you live. Worldwide, IG Group is seen as a well-respected and global broker with 12 regulated subsidiaries – including regulation in five tier-1 jurisdictions.

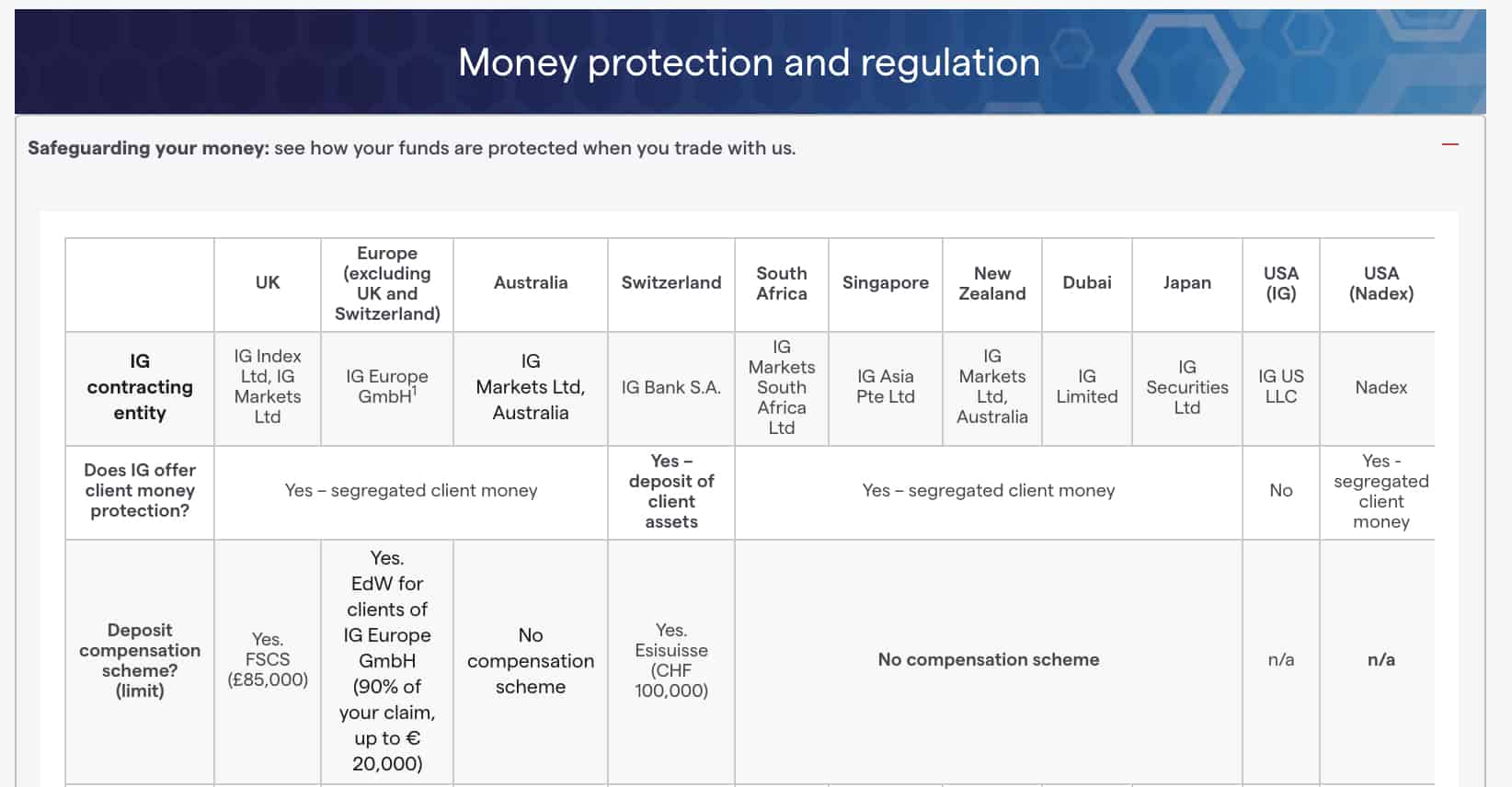

For instance, IG Group segregates your funds from the broker’s own operating capital, offering some protection if the broker were to become insolvent. There are also deposit compensation schemes in some jurisdictions, such as in Switzerland and the UK.

If you are based in the UK, the US or the EU, you will also benefit from negative balance protection. This means you cannot lose more than you have deposited into your trading account, so you never end up in debt to IG Group.

Largest Range of Trading Products

From my trading experience with IG Group, the broker offers the largest range of trading products I’ve seen, providing over 17,000 financial instruments for you try your hand with. These products are spread across a diverse range of asset classes, including 80 forex pairs, 12,000 share CFDs and 130 indices.

I was also impressed by the complex derivatives you could trade, from over 7000 options to 6000 ETFs (Exchange Traded Funds).

You can even trade physical shares via the broker’s own dedicated L2 Dealer share trading platform. The DMA (direct market access) execution model is available on this platform.

5. FP Markets - Good Trusted Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

I found FP Markets to be a trusted broker for scalping. It offers average Raw spreads starting at 0.1 pips on major pairs like EUR/USD and USD/JPY – considerably tighter than its competitors.

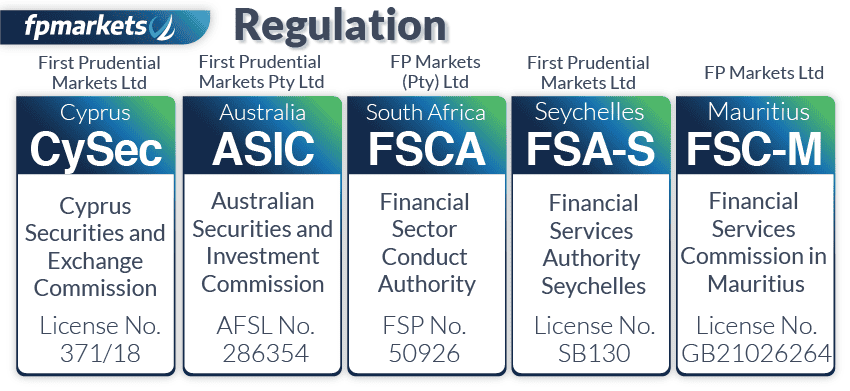

Like all the best Australian forex brokers, FP Markets is regulated by the ASIC. As well as this, the broker is regulated by CySEC in Europe, and has more than 20 years of experience in the forex market. This makes FP Markets an extremely trustworthy broker in my book.

CompareForexBrokers analyst Ross Collins tested FP Markets’ execution speeds, averaging 99 ms for market orders.

Pros & Cons

- Tight average RAW spreads

- Fast execution speeds on MT4

- Good range of trading platforms

- Requires a minimum deposit

- The IRESS platform is expensive

- Fewer shares available on MT5

Broker Details

FP Markets is an ECN-Pricing forex broker overseen by multiple financial authorities. I think this is a great option for scalpers, as the broker offers ultra-tight spreads while adhering to top-tier financial regulation.

You can obtain these tight spreads using four of the most popular and reliable trading platforms: MT4, MT5, cTrader or TradingView.

Transparent Spreads and Low Fees

During my analysis, FP Markets impressed me with low average spreads of 0.22 pips on the five most traded currency pairs. This includes popular pairs like EUR/USD and GBP/USD.

This puts the broker in the top five of 40 I analysed. For reference, the industry average was 0.44 pips for those same forex pairs.

FP Markets can achieve this because it is a no dealing desk (NDD) broker, with ECN-pricing and execution. So it offers a transparent pricing structure, which adds a layer of trust.

Fast Market Execution Speeds

Along with ultra-tight spreads, my team found that FP Markets had fast market execution speeds of 96ms. This low latency execution is important for avoiding slippage – in my experience, anything below 100ms is enough to avoid this.

I really like this combination of transparent spreads and low fees. It’s perfect for scalpers who need speed and low spreads to profit off small price changes over a short time period.

6. eToro - Most Trusted Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

I think eToro stands out with the biggest and best social trading platform in the market. The CopyTrader platform allows easy replication of trades from experienced investors – an invaluable resource for beginners.

With low average spreads, starting from 1 pip on EUR/USD, eToro proves more cost-effective than other copy trade platforms I’ve traded with. Others tend to apply added markups on copy trading, which eToro doesn’t do.

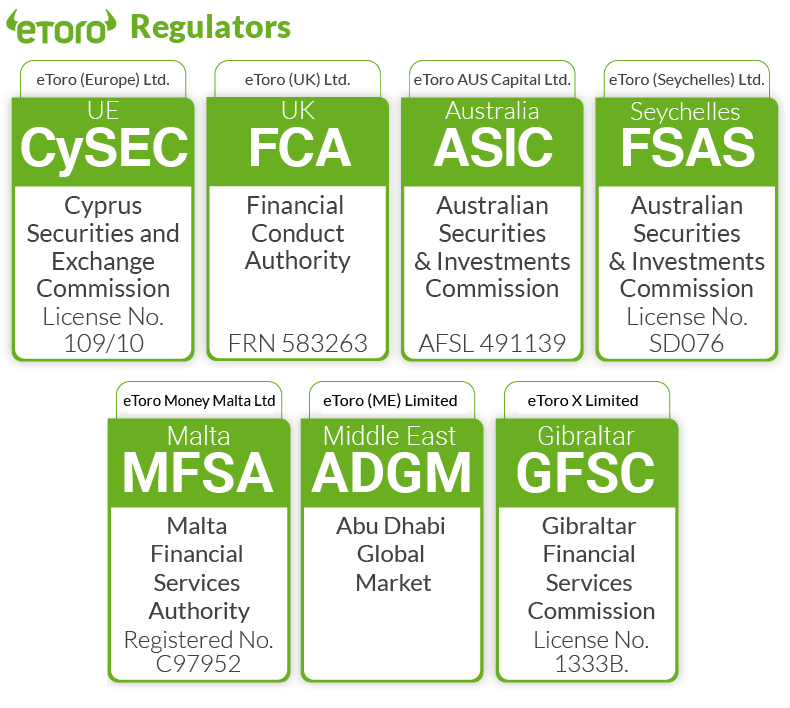

eToro is also regulated by six authorities, including the FCA, ASIC, and CySEC. This is why I gave the broker a high 81/100 Trust score.

Pros & Cons

- Good selection of trading products

- No commission on trading

- Solid Copy trading platform

- Lacks educational resources

- Charges a withdrawal fee

- Doesn’t offer a RAW spread account

Broker Details

I like eToro for many reasons, but there are two that really jump out at me. One, is their excellent regulation – they’ve got licenses from seven jurisdictions, including three tier-1 bodies.

And two, I believe that eToro manages to strike a rare balance. It combines the largest, most trusted social trading platform in the world, with a simplistic, intuitive trading experience.

There are also over 3000 products to trade, and so the broker comfortably makes my list.

Largest, Most Trusted Social Trading Community

Don’t just take it from me – eToro’s huge social trading community speaks volumes for its trust levels. The broker offers social trading to over 30 million traders from over 140 countries. With their account-mirroring features, eToro gives you the chance to copy the trading strategies of more experienced clients.

To find trading strategies to copy, you simply view trader stats and compare their trading history and risk profiles. As well as copy trading, you can communicate with other members of the forex community. This social approach helps you share ideas and learn from one another.

eToro’s proprietary trading platform also has a newsfeed feature where you can keep up to date with others’ strategies and the latest market news.

I really like the simplicity of CFD trading on eToro’s platform, adding to its appeal for beginner forex traders.

Low, commission-free spreads

Another sign of a trusted broker is competitive fees. eToro delivers this too.

The broker offers low average spreads of 1 pip for three of the most traded currency pairs: EUR/USD, AUD/USD and USD/JPY. All of these are far better than the industry average, which ranges from 1.2 to 1.5 pips.

Low spreads will lower your trading costs, which tells me the broker cares about offering transparent pricing to its customers.

7. XTB - Top Trusted Broker For Research and Education

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.14

AUD/USD = 0.13

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

XTB is a top broker that provides decent research and education resources for free, while still being regulated by CySEC and the FCA – two of the top regulators in the world. What impressed me was the extensive catalogue of educational resources available, covering everything from basic market terminology to trading strategies.

Interestingly, the broker also has low average spreads, starting at 0.9 pips on EUR/USD. The industry average is 1.2 pips, and XTB easily beats this.

Pros & Cons

- No minimum deposit

- Low average spreads

- Wide choice of financial instruments

- Customer support isn’t available 24/7

- Inactivity fees are applied

- Lacks third-party trading platforms

Broker Details

XTB is an award-winning CFD brokerage offering impressive access to over 2000 financial markets and an excellent proprietary platform, xStation. I consider the broker trustworthy, and believe it’s one of the best in the business.

This is thanks to regulation from six financial authorities, including two offshore regulators. The research and education resources are also excellent.

Top Research and Education Resources

In my experience with the broker, XTB offers an excellent variety of research and educational resources.

These resources include videos, written content, FAQs, tutorials, financial market education, and over 200 lessons via its Trading Academy.

I was particularly impressed with the videos available through the broker’s xStation mobile app. Content included webinar-style educational resources, and many of the videos are over an hour long.

To me, this is strong evidence that the broker is dedicated to its clients. The XTB team works hard to keep you well-informed and educated, whatever your trading background.

Large Range of CFDS for Online Trading

I rate XTB as one of the top CFD brokers, as they offer thousands of instruments in this category. These are derived from six major asset classes: forex (71 pairs), shares (+1700), indices (33), commodities (27), cryptocurrencies (+10) and ETFs (390).

You can even trade over 2800 real stocks from 16 major exchanges around the world, via the broker’s xStation platform. XTB’s share trading platform stood out to me, with its free access to real-time quotes. It also offers zero commissions when you have a monthly turnover under 100,000 EUR.

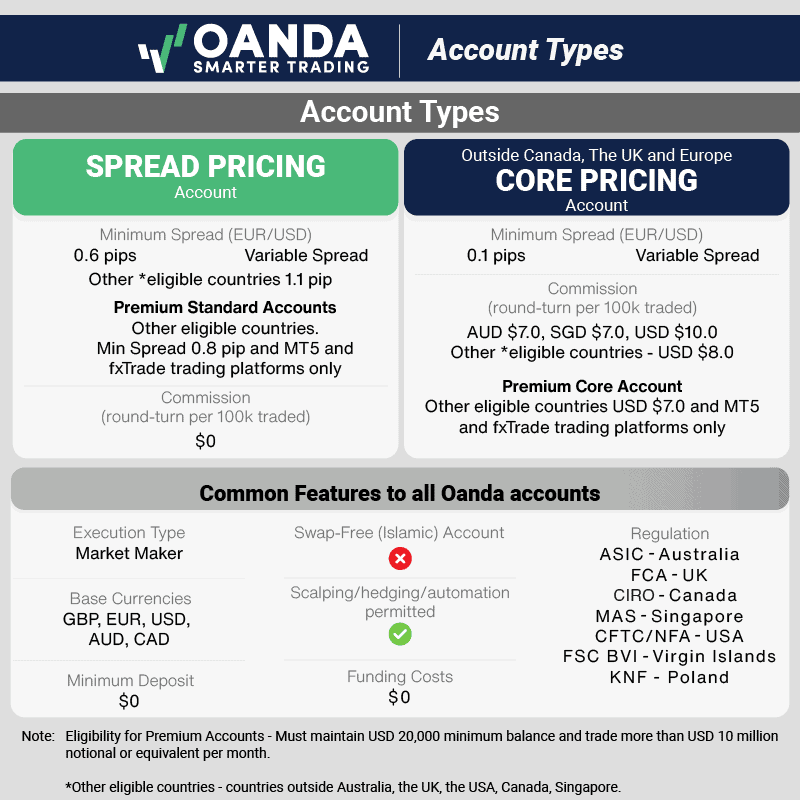

8. OANDA - The Most Trusted Forex Broker with Competitive Spreads

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

In my extensive review, I gave OANDA a near-perfect score of 96/100 in the Trust category. This is a testament to the reputation it has built over almost 20 years. The broker is regulated by nine major authorities across many jurisdictions, including five tier-1 regulators: NFA/CFTC (U.S.), MAS (Singapore), CIRO (Canada), FCA (UK), and ASIC (Australia).

With OANDA, you are trading with a broker that has stood the test of time, not to mention regulatory scrutiny.

Pros & Cons

- No minimum deposit

- Excellent trading platforms

- Low average spreads

- Lacks share CFDs

- Doesn’t offer RAW spreads

- Customer service isn’t 24/7

Broker Details

OANDA is one of the oldest and best-regulated brokers, contributing to our high trust score. Beyond this, it offers some of the lowest commission-free spreads in the market. I also like the broker’s three solid trading platforms: MT4, TradingView, and its own OANDA Trade platform.

Excellent Reputation and Regulatory History

Established in 1996, OANDA has a long-standing reputation and regulatory history. The broker is regulated in 9 jurisdictions – including five tier-1 regulators like the CFTC (Commodities Futures Trading Commission) and the NFA (National Futures Association).

It’s genuinely quite hard to achieve licensing from a body like this, so gaining so many licenses is impressive. This should give you valuable peace of mind when you sign up with OANDA.

Low Commission-Free Spreads

While OANDA only offers a Spread Only (no commission) account, it still manages to give you low spreads. In fact, they are some of the lowest I’ve tested in this category.

In my analysis, OANDA had the lowest average spreads from any Standard account broker. They achieved an average of 1.12 pips across the five most traded currency pairs – the EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD pairs.

The average spread across the 48 brokers was 1.53 pips. So you’ve got a significant saving of 0.41 pips per trade here.

Low commission-free spreads really boost OANDA’s trustworthiness in my book. They indicates that the broker works hard to ensure competitive pricing for its customers.

Ask an Expert

Is OptiCapital Liofanno Limited a reputal company

We can’t recommend this broker since they are not regulated by any notable regulated