Execution Speed Testing Results

We tested 20 forex brokers to find out who has the fastest execution speed. Speeds under of 0.1 seconds improve your chances of avoiding slippage and getting the price at your order. Find out which brokers are fastest.

Written by Ross Collins

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Fast execution speed is vital to avoid slippage which can result in your orders closing at a price different to the requested price. To help find the brokers with the fastest order execution speed, CompareForexBrokers conducted testing using 20 MetaTrader 4 forex brokers.

Which Forex Broker Has The Fastest Execution?

Our 2026 testing found that Blackbull Markets has the fastest execution speed.

The test determined the following category finalist.

Top 2 Limit Order Execution Speeds

- Blackbull Markets

- Pepperstone

Top 2 Market Order Execution Speeds

- Fusion Markets

- Blackbull Markets

Based on the above, the overall winner was Blackbull Markets when it came to the fastest execution speed. It should be noted that the brokers we selected:

- are well covered on our website

- represent a mix of No-dealing Desk (NDD) brokers and market makers

- support MT4 as we wanted to use freely available Expert Advisors (EAs) for testing

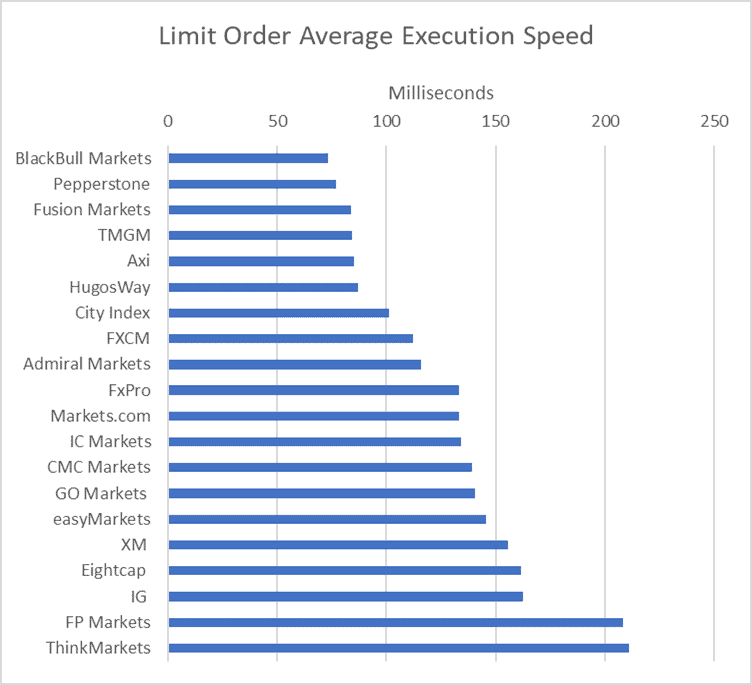

Execution speeds for limit orders

Our tests showed the following results for limit order execution speeds.

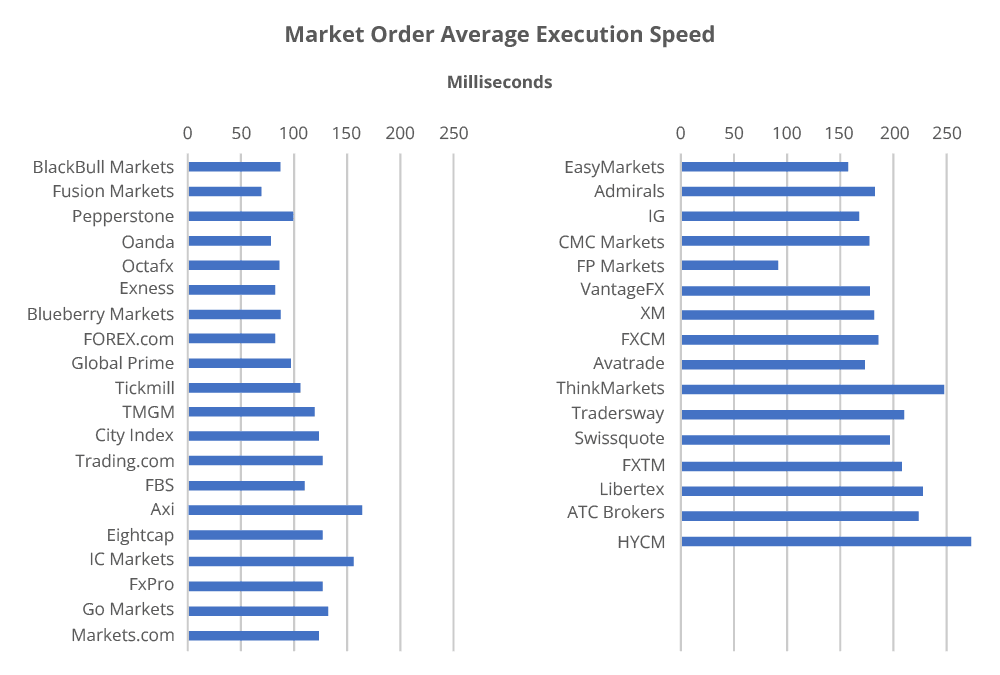

Execution speeds for market orders

Our tests showed the following results for market order execution speeds.

Fastest execution speeds

This table summarises the results of our tests. We show an overall rank (1 to 20) and the corresponding rank for limit and market orders. We also show whether the broker is a market maker or an NDD with STP.

| Broker | Execution Type | Overall Speed Ranking | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|---|---|

| Blackbull Markets | ECN | 1 | 72 | 90 |

| Fusion Markets | ECN | 2 | 79 | 77 |

| Pepperstone | ECN | 3 | 77 | 100 |

| OANDA | Market Maker | 4 | 86 | 84 |

| Octafx | ECN | 5 | 81 | 91 |

| Exness | Market Maker | 6 | 92 | 88 |

| Blueberry Markets | ECN | 7 | 88 | 94 |

| FOREX.com | Market Maker | 8 | 98 | 88 |

| Global Prime | ECN | 9 | 88 | 98 |

| Tickmill | ECN | 10 | 91 | 112 |

| TMGM | ECN | 11 | 94 | 129 |

| City Index | Market Maker | 12 | 95 | 131 |

| Trading.com | Market Maker | 13 | 98 | 138 |

| FBS | ECN | 14 | 135 | 118 |

| Axi | ECN | 15 | 90 | 164 |

| Eightcap | ECN | 16 | 143 | 139 |

| IC Markets | ECN | 17 | 134 | 153 |

| FxPro | ECN | 18 | 151 | 138 |

| Go Markets | ECN | 19 | 144 | 145 |

| Markets.com | Market Maker | 20 | 150 | 141 |

| EasyMarkets | Market Maker | 21 | 155 | 155 |

| Admirals | ECN | 22 | 132 | 182 |

| IG | Market Maker | 23 | 174 | 141 |

| CMC Markets | Market Maker | 24 | 138 | 180 |

| FP Markets | ECN | 25 | 225 | 96 |

| VantageFX | ECN | 26 | 175 | 154 |

| XM | Market Maker | 27 | 148 | 184 |

| FXCM | Market Maker | 28 | 108 | 189 |

| Avatrade | Market Maker | 29 | 235 | 145 |

| ThinkMarkets | ECN | 30 | 161 | 248 |

| Tradersway | ECN | 31 | 198 | 214 |

| Swissquote | Market Maker | 32 | 258 | 198 |

| FXTM | ECN | 33 | 248 | 210 |

| Libertex | Market Maker | 34 | 215 | 244 |

| ATC Brokers | ECN | 35 | 238 | 241 |

| HYCM | Market Maker | 36 | 241 | 268 |

Straight-Through Processing is faster

From the results, it’s notable that the fastest market maker, FXCM, came in at number 6. Detailed inspection of our results shows that order execution speeds for market makers are around 50 milliseconds slower than for NDD brokers. As we would expect, the Straight-Through Processing capabilities of the NDD brokers provide faster execution speeds than achievable with a market maker.

Why does order execution speed matter?

A faster execution speed matters because it can help prevent slippage. All trades have a lag time (even if miniscule) between an order being placed and being filled which is enough time for forex prices to change and this process is called slippage. While slippage can be both positive or negative depending on which way the price moves, most traders prefer to get the price they placed their order at.

If your trading strategy relies on profits of just a few pips (e.g. scalping), or if you use automated trading, execution speeds are key to your success

What factors influence execution speed?

Factors that can influence the speed trades are executed include:

- The type of execution the broker is using

- Where broker’s servers are located

- The quality of the infrastructure the broker is using

- The trading platform you are using.

Type of execution

How brokers execute your trades will affect the time taken to process your orders. Brokers consist of two types: those with their own Dealing Desk (DD) such as a market maker who use their own liquidity and those without. No Dealing Desk (NDD) brokers use Straight-through Processing (STP) or Electronic Communication Networks (ECN) to source quotes from external liquidity providers and open and close your orders.

Where the servers are located?

The location of the broker’s servers will also affect the time taken to execute orders. Storing servers in the same data centres as the liquidity providers is one way to reduce the travel time to transmit data. Another way brokers reduce the distance your orders need to transmit is to use data centres closer to your trading desk.

We talk about the network latency due to server locations in this section: Location Independent Testing.

Quality of the infrastructure

The quality of the infrastructure is another factor that can affect execution speed. Is the broker using fibre optic cables and if so how many? fewer cables mean more congestion and therefore slower speed.

Trading platform speed

One last factor worth mentioning is the trading platform you are using. Some trading platforms are just faster than other platforms. MetaTrader 5 for example, has 64-bit processing, so is more powerful than MetaTrader 4 which has 32-bit processing and by extension faster speed.

How we tested

To compare the execution speeds of forex brokers, Account Opening were processed for 20 trading accounts across top brokers, for testing purposes we used a demo rather than live account. We wanted to compare data for all types of orders (limit and market), so we chose MT4 Expert Advisors (EAs) specifically designed for these two types of orders. We chose EAs which are freely available and have been proven through previous testing.

For limit orders, we used the MT4 EA known as ExTest_ForExpat. This EA places several limit orders (buy and sell) and calculates the time between sending orders to brokers and receiving an answer from them or executing the orders. Minimum, maximum, and average response times are recorded.

For market orders, we used the MT4 EA known as Broker Latency Tester. This EA sends a market order and calculates the time between sending the order and receiving the confirmation. After confirmation, the position is closed. The average response time is calculated across 20 trades at a lot size of MODE_MINLOT (the minimum amount allowed by the broker).

Demo Testing Limitation (and possible advantage)

There are some testing limitations with using a demo account as opposed to a live account.

Demo accounts don’t require orders to be filled since there is no cash involved. While a demo account simulates a real trading environment, your trades never leave the trading platform since there is no requirement for a liquidity provider to accept or fill your trade. Trades with a demo account are therefore server-side only so there will be a difference in how fast trades are executed. For the reasons explained above, you will find there are no partials fills or slippage with a demo account.

One could argue that using a demo account provides a more even comparison for each broker since variables such as available liquidity and time to fill an order is removed. This, however, doesn’t recognise that brokers use different infrastructures to execute trades and often different liquidity providers which can influence execution time along with the fill rate.

We intend to run similar tests on live accounts, and on Virtual Private Server (VPS) setups soon which will better capture real world influences that affect the speed an order is filled.

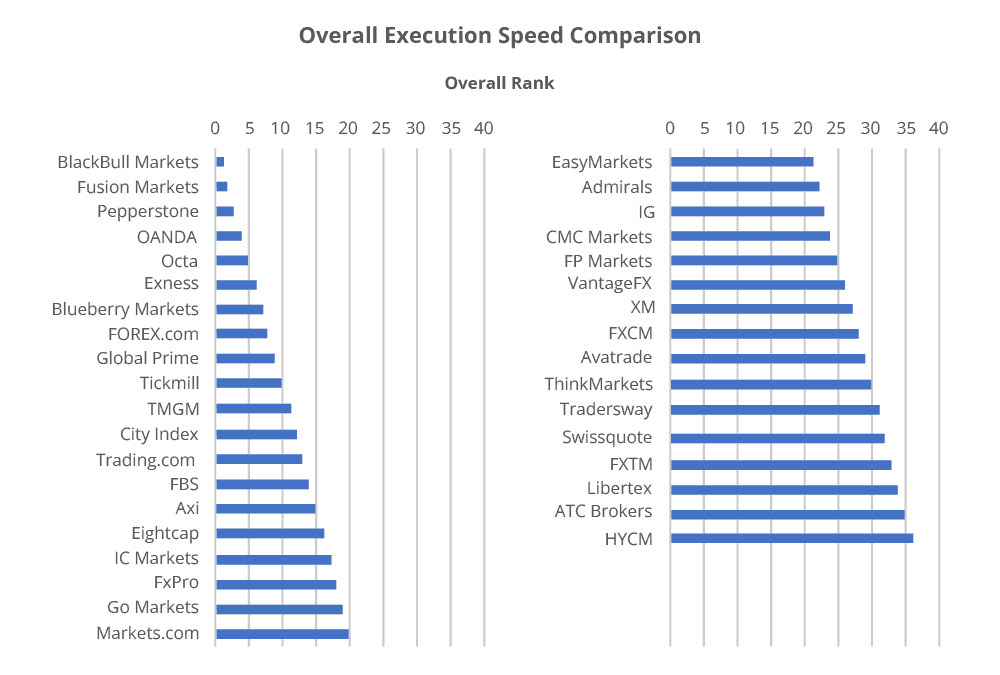

How we ranked forex brokers

In our testing, we first tested limit order execution speeds. We assigned a rank (1 to 20) to each broker based on the results, with 1 being the fastest and 20 being the slowest.

We then did the same thing for market order execution speeds. We ranked brokers 1 to 20 for market orders, and added this ranking to the limit order ranking to come up with an overall rank. So, our overall rank can be as low as 2 (meaning a broker tested fastest on both limit and market orders) and can be as high as 40 (meaning a broker tested slowest on both limit and market orders). The overall execution speed comparison is shown below – the lowest overall rank is fastest.

Note: We could have also used the average of limit and market order rankings to produce an overall ranking. However, we note that this produces exactly the same order of brokers. Our additive approach provides a better view of the scale of the difference between the faster brokers and the slower ones.

Location Independent Testing

In this case, our testing machine was in Australia. While some brokers have demo servers in Australia, many don’t. Overall execution speeds are slower when using overseas servers, due to the time it takes data packets to travel over the network to and from the broker’s server.

To make a fair comparison of broker’s order execution speeds, we subtracted the network latency between the machine used for testing and the broker’s server from the overall execution speeds. Subtracting network latency means that our results would theoretically be the same no matter where our testing machine was located. In other words, our tests are location independent.

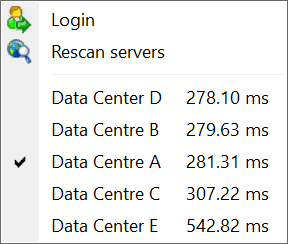

Network latency (known as “ping”) can be found in two places on an MT4 terminal.

One way to see “ping” is in the connection status (bottom right of the terminal).

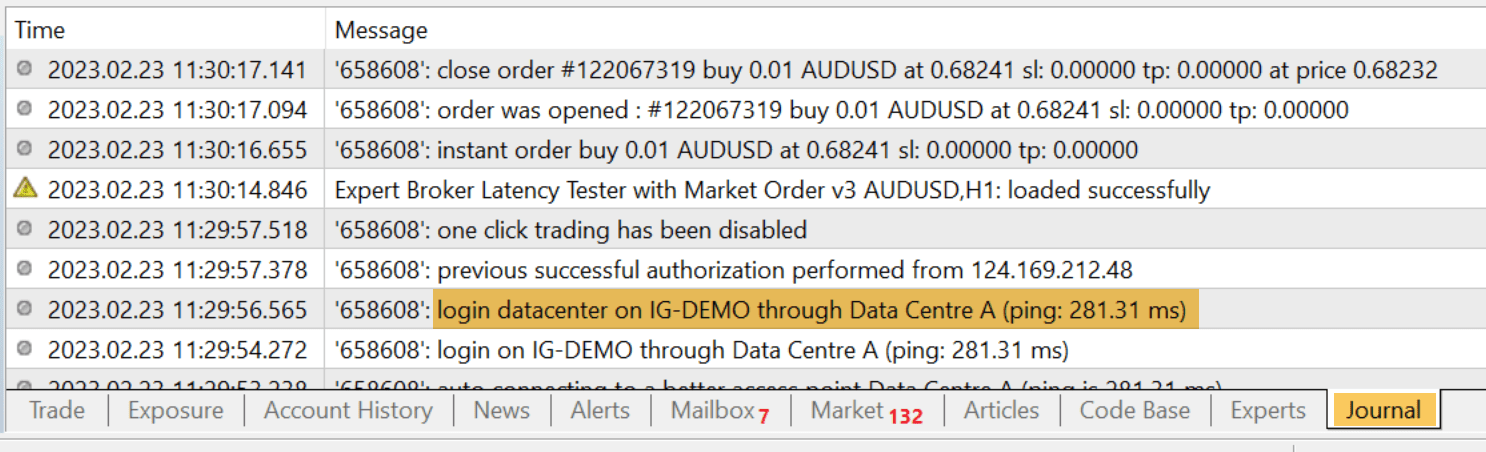

The other way to see “ping” is in the Journal tab of the Terminal Window.

Combined test results

Here are our combined limit and market order test results. BlackBull Markets came out on top, being 1st fastest in limit orders and 3rd fastest in market orders for an overall Rank of 4. Limit order and market order speeds are shown in milliseconds.

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

| Trading.com | 13 | 14 | 98 | 15 | 138 |

| FBS | 14 | 17 | 135 | 12 | 118 |

| Axi | 15 | 8 | 90 | 25 | 164 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

| FxPro | 18 | 23 | 151 | 16 | 138 |

| Go Markets | 19 | 20 | 144 | 20 | 145 |

| Markets.com | 20 | 22 | 150 | 18 | 141 |

| EasyMarkets | 21 | 24 | 155 | 24 | 155 |

| Admirals | 22 | 15 | 132 | 28 | 182 |

| IG | 23 | 26 | 174 | 19 | 141 |

| CMC Markets | 24 | 18 | 138 | 26 | 180 |

| FP Markets | 25 | 32 | 225 | 8 | 96 |

| VantageFX | 26 | 27 | 175 | 23 | 154 |

| XM | 27 | 21 | 148 | 29 | 184 |

| FXCM | 28 | 28 | 108 | 30 | 189 |

| Avatrade | 29 | 33 | 235 | 21 | 145 |

| ThinkMarkets | 30 | 25 | 161 | 36 | 248 |

| Tradersway | 31 | 29 | 198 | 33 | 214 |

| Swissquote | 32 | 37 | 258 | 31 | 198 |

| FXTM | 33 | 36 | 248 | 32 | 210 |

| Libertex | 34 | 31 | 215 | 35 | 244 |

| ATC Brokers | 35 | 34 | 238 | 34 | 241 |

| HYCM | 36 | 35 | 241 | 37 | 268 |

Using VPS to reduce Latency

Our tests showed that the fastest brokers provide order execution speeds of less than 80 milliseconds. Network latency from our testing machine in Australia was generally between 230 and 300 milliseconds. So, overall it can take anywhere from 300 to 500 milliseconds to execute your trade. We had a few trades take over 1 second, round-trip.

The best way to reduce this delay is to remove the network latency between the trader’s machine and the broker’s servers. And the best way to do that is to do your trading on a Virtual Private Server (VPS).

A VPS will sit in the same data centre as the broker’s servers, preferably with a network Cross Connection between the VPS and the broker’s servers.

Tests (VPS Latency) show that Cross Connection VPS setups result in average latencies of 0.33 milliseconds for the LD4 (London) data centre and 0.37 milliseconds for the NY4 (New York) data centre.

At those latencies, the only delay between placing your order and it being executed is the execution speed of your broker. That’s why VPS is the chosen configuration of scalpers and automated trading.

Key Takeaways

- BlackBull Markets, Fusion Markets and Pepperstone were the most consistent performers across the limit order and market order tests.

- For the top 5 brokers, Order Execution Speeds average less than 100 milliseconds.

- Removing network latency (ping) means these tests are location independent.

- The best way to remove network latency is to use a cross-connected VPS configuration.

Next Up

Here’s a quick view of our pipeline of testing:

- Comparing order execution speeds for regulated versus unregulated brokers

- Testing for a broader set of brokers

- Order execution speeds on live accounts

- Average spreads on different brokers by currency pair

- Slippage monitoring across different brokers and currency pairs

Ross Collins

As Chief Technology Researcher at CompareForexBrokers, Ross is in charge of driving technical innovation for the website. Ross uses his deep knowledge of Forex and Information Technology to capture and deliver real-world Forex insights that can help you make better trading decisions. Prior to joining CompareForexBroker, Ross developed trading systems for forex, bonds and options trading.

Ask an Expert