Standard Spread Account Testing

The CompareForexBrokers team tested 15 brokers using MetaTrader 4 to find which forex broker has the tightest average spreads for their standard account. Read on to find the broker with the best spreads with no commissions.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Tight spreads are vital to reducing the cost of forex trading. To determine which brokers with the tightest spreads, CompareForexBrokers did testing on 15 forex brokers’ live accounts using MetaTrader 4. For this test, we compared the “standard” account

Finalists for Tightest Spreads

Based on our 2026 testing we concluded that IC Markets, CMC Markets, and Fusion Markets have the tightest spreads

The brokers we chose

- have “standard” accounts that charge zero commission but have a variable bid/ask spread for all forex trades

- are well covered on our website

- represent a mix of No-dealing Desk (NDD) brokers and market makers

- support MT4 as we wanted to use freely available indicators and scripts for testing

Tightest Spreads

This table summarises our test results with the average spread shown in pips. Since this is the average spread across all six major currency pairs, we have also converted the spreads to a standard USD cost. Our overall winner for the Lowest Spread Forex Brokers category was IC Markets.

These follow our testing to find the brokers with the fastest Execution Speeds and VPS Speeds.

| Broker | Average Spread | Average Spread Cost (USD) |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| Fusion Markets | 1.19 | $11.07 |

| Admiral Markets | 1.31 | $11.96 |

| Pepperstone | 1.46 | $13.52 |

| FP Markets | 1.47 | $13.60 |

| Go Markets | 1.49 | $13.87 |

| EightCap | 1.51 | $13.97 |

| OANDA | 1.54 | $14.23 |

| Axi | 1.71 | $15.99 |

| Blackbull Markets | 1.82 | $16.95 |

| FXPro | 2.22 | $20.83 |

Why do tight spreads matter?

The spread represents the amount a trade must move before generating profit. For instance, if you buy 1 lot (100,000) using IC Markets, the trade must increase by $9.63 before you earn any profit. This cost is comparable to commissions in “raw” accounts. Lower trade costs result in higher profits.

For trading strategies that rely on small pip profits (e.g., scalping) or automated trading, narrow spreads are crucial for success.

Average spreads for currency pairs

In our analysis, EUR/USD had the smallest spread, averaging 1.11 pips across all brokers, equal to a USD spread cost of $11.13.

As the world’s most traded pair (often representing a quarter of global FX volume), it’s no surprise that EUR/USD has the tightest spread.

The table displays the average spread and corresponding USD spread cost for the six major currency pairs we examined, across all brokers.

| Currency Pair | Average Spread | Average Spread Cost (USD) |

|---|---|---|

| EURUSD | 1.11 | $11.13 |

| USDJPY | 1.49 | $11.19 |

| USDCAD | 1.66 | $12.12 |

| AUDUSD | 1.28 | $12.76 |

| GBPUSD | 1.50 | $15.00 |

| USDCHF | 1.88 | $20.54 |

Cheapest brokers for each currency pair

Our tests also show the cheapest brokers for each of the six currency pairs.

CMC Markets and IC Markets are among the cheapest 4 brokers for all currency pairs. Admiral Markets is second cheapest for EURUSD and GPBUSD.

FX Pro is among the most expensive 2 brokers for all currency pairs. Blackbull Markets is among the most expensive 3 brokers for AUDUSD, USDCHF and USDJPY.

| AUDUSD | Cost | EURUSD | Cost | GBPUSD | Cost |

|---|---|---|---|---|---|

| CMC Markets | $7.71 | IC Markets | $7.31 | CMC Markets | $10.84 |

| IC Markets | $8.21 | Admiral Markets | $7.39 | Admiral Markets | $11.05 |

| OandA | $10.01 | CMC Markets | $7.97 | IC Markets | $11.52 |

| FusionMarkets | $10.18 | FXCM | $9.29 | TMGM | $12.11 |

| TMGM | $10.27 | TMGM | $9.99 | FusionMarkets | $12.29 |

| City Index | $10.66 | FusionMarkets | $10.14 | FXCM | $13.89 |

| Admiral Markets | $11.03 | OandA | $10.58 | FP Markets | $14.15 |

| Pepperstone | $12.45 | City Index | $11.58 | EightCap | $14.90 |

| FP Markets | $12.84 | EightCap | $11.58 | Pepperstone | $15.02 |

| FXCM | $13.07 | FP Markets | $11.92 | Go Markets | $15.85 |

| EightCap | $13.41 | Pepperstone | $12.13 | City Index | $17.69 |

| Go Markets | $13.79 | Blackbull Markets | $13.39 | Blackbull Markets | $17.84 |

| Axi | $15.93 | Go Markets | $13.40 | Axi | $18.32 |

| Blackbull Markets | $16.93 | Axi | $14.45 | OandA | $18.56 |

| FXPro | $24.89 | FXPro | $15.91 | FXPro | $21.01 |

| AUDUSD | Cost | EURUSD | Cost | GBPUSD | Cost |

|---|---|---|---|---|---|

| CMC Markets | $7.71 | IC Markets | $7.31 | CMC Markets | $10.84 |

| IC Markets | $8.21 | Admiral Markets | $7.39 | Admiral Markets | $11.05 |

| OandA | $10.01 | CMC Markets | $7.97 | IC Markets | $11.52 |

| FusionMarkets | $10.18 | FXCM | $9.29 | TMGM | $12.11 |

| TMGM | $10.27 | TMGM | $9.99 | FusionMarkets | $12.29 |

| City Index | $10.66 | FusionMarkets | $10.14 | FXCM | $13.89 |

| Admiral Markets | $11.03 | OandA | $10.58 | FP Markets | $14.15 |

| Pepperstone | $12.45 | City Index | $11.58 | EightCap | $14.90 |

| FP Markets | $12.84 | EightCap | $11.58 | Pepperstone | $15.02 |

| FXCM | $13.07 | FP Markets | $11.92 | Go Markets | $15.85 |

| EightCap | $13.41 | Pepperstone | $12.13 | City Index | $17.69 |

| Go Markets | $13.79 | Blackbull Markets | $13.39 | Blackbull Markets | $17.84 |

| Axi | $15.93 | Go Markets | $13.40 | Axi | $18.32 |

| Blackbull Markets | $16.93 | Axi | $14.45 | OandA | $18.56 |

| FXPro | $24.89 | FXPro | $15.91 | FXPro | $21.01 |

Average Spread For Each Currency Pair In Pips

| AUDUSD | Spread | EURUSD | Spread | GBPUSD | Spread |

|---|---|---|---|---|---|

| CMC Markets | 0.77 | IC Markets | 0.73 | CMC Markets | 1.08 |

| IC Markets | 0.82 | Admiral Markets | 0.74 | Admiral Markets | 1.11 |

| OANDA | 1 | CMC Markets | 0.8 | IC Markets | 1.15 |

| FusionMarkets | 1.02 | FXCM | 0.93 | TMGM | 1.21 |

| TMGM | 1.03 | TMGM | 1 | FusionMarkets | 1.23 |

| City Index | 1.07 | FusionMarkets | 1.01 | FXCM | 1.39 |

| Admiral Markets | 1.1 | OandA | 1.06 | FP Markets | 1.42 |

| Pepperstone | 1.24 | City Index | 1.16 | EightCap | 1.49 |

| FP Markets | 1.28 | EightCap | 1.16 | Pepperstone | 1.5 |

| FXCM | 1.31 | FP Markets | 1.19 | Go Markets | 1.59 |

| EightCap | 1.34 | Pepperstone | 1.21 | City Index | 1.77 |

| Go Markets | 1.38 | Blackbull Markets | 1.34 | Blackbull Markets | 1.78 |

| Axi | 1.59 | Go Markets | 1.34 | Axi | 1.83 |

| Blackbull Markets | 1.69 | Axi | 1.45 | OandA | 1.86 |

| FXPro | 2.49 | FXPro | 1.59 | FXPro | 2.1 |

| USDCAD | Spread | USDCHF | Spread | USDJPY | Spread |

|---|---|---|---|---|---|

| IC Markets | 1 | CMC Markets | 1.31 | IC Markets | 1.09 |

| FusionMarkets | 1.17 | IC Markets | 1.4 | CMC Markets | 1.17 |

| TMGM | 1.31 | TMGM | 1.43 | TMGM | 1.26 |

| CMC Markets | 1.5 | FusionMarkets | 1.44 | FusionMarkets | 1.27 |

| Go Markets | 1.5 | Go Markets | 1.62 | Admiral Markets | 1.32 |

| FP Markets | 1.56 | Pepperstone | 1.67 | FXCM | 1.38 |

| Pepperstone | 1.6 | Admiral Markets | 1.75 | FP Markets | 1.51 |

| EightCap | 1.7 | EightCap | 1.83 | Go Markets | 1.52 |

| Axi | 1.73 | FP Markets | 1.83 | EightCap | 1.55 |

| OANDA | 1.75 | FXCM | 1.84 | OANDA | 1.55 |

| Blackbull Markets | 1.82 | OANDA | 2 | Pepperstone | 1.55 |

| Admiral Markets | 1.83 | Axi | 2.06 | Axi | 1.62 |

| FXCM | 1.96 | Blackbull Markets | 2.31 | City Index | 1.74 |

| FXPro | 2.28 | City Index | 2.68 | FXPro | 1.87 |

| City Index | 2.3 | FXPro | 3 | Blackbull Markets | 2 |

What factors influence spreads?

Factors that can influence the spreads offered by different brokers include

1. The currency pair being traded

2. The volume of trades in the currency pair being traded

3. The volatility of the currency pair being traded

4. The time of day the trade is made

Volumes and the time of day

To see how volumes, volatility and the time of day affect spreads, we must look at some examples.

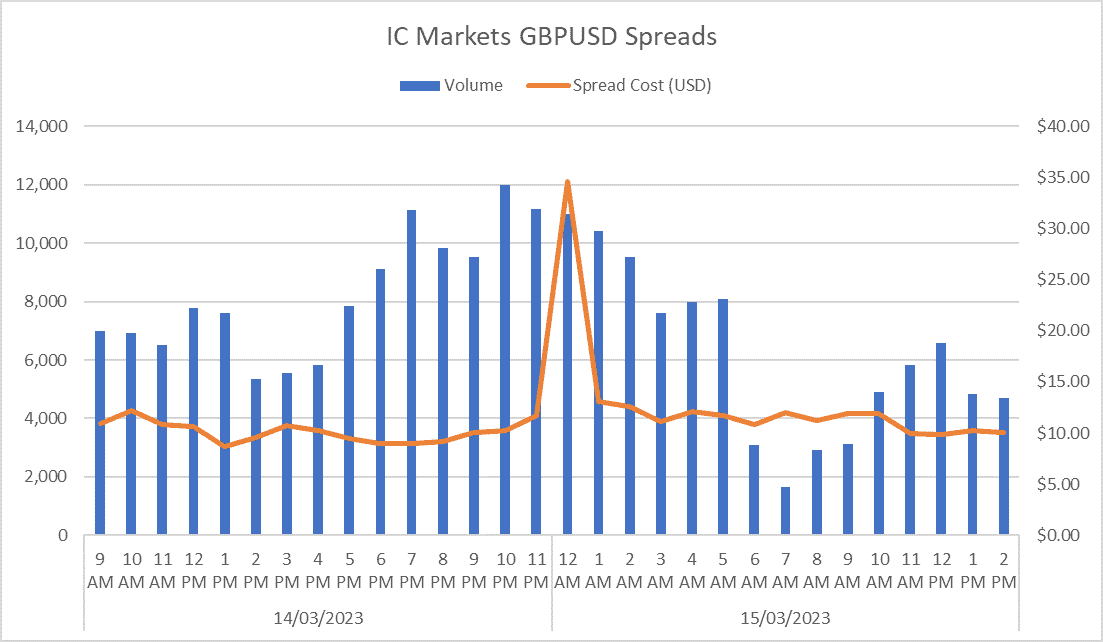

If we take the cheapest broker in our tests, IC Markets, we can see a typical picture. During the 30 hours of our tests, GBPUSD spreads peak around $35 at midnight Brisbane time. Midnight Brisbane time happens to be 2 PM London time and two hours into the New York Session. This is just when you’d expect GBPUSD volumes to be at their highest.

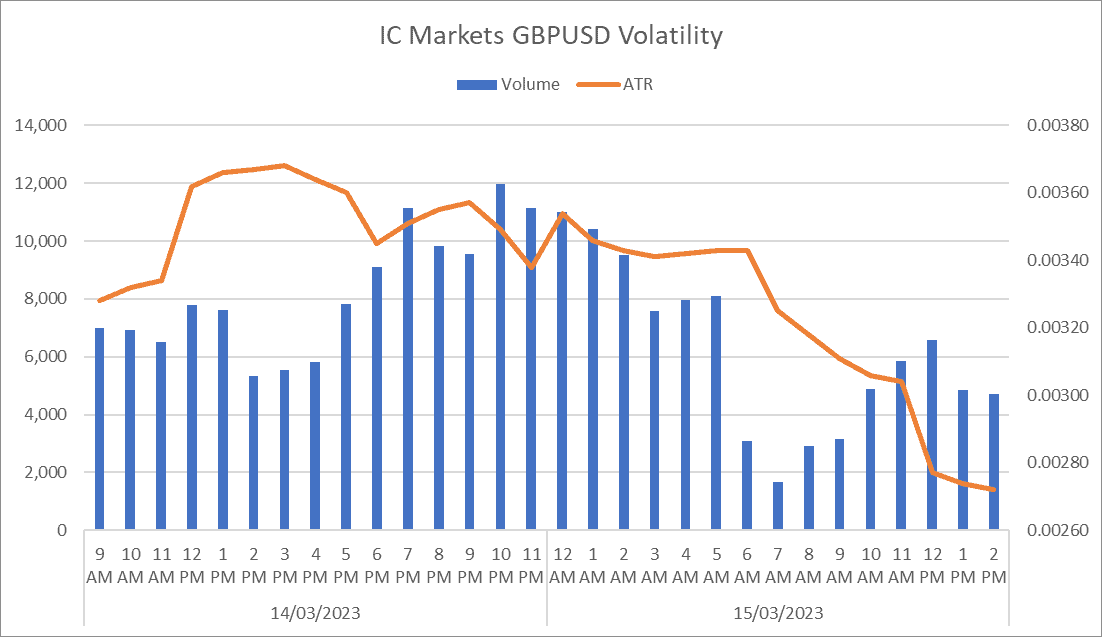

Volatility

To see how volatility affects spreads, we recorded the hourly volatility for each currency pair at every broker. We did this by recording the hourly Average True Range (ATR) with a period of 24 hours. Again, using IC Markets data for GBPUSD, we see volatility at its highest around 3 PM Brisbane time and around 10 PM to midnight, in the middle of the London session. In all our data, spikes in spreads happen when high volumes coincide with high volatility. These conditions cause spreads to double, or even triple at some brokers.

Brokers with the most stable spreads

As traders, we don’t enjoy seeing spikes in spreads like the ones in the charts above. We’d much prefer the spreads to be stable regardless of the volumes traded, the time of day or the volatility. So, which are the brokers with the most stable spreads?

To measure spread stability for each broker, we calculated the highest spread cost (spike) for each broker, averaged across the currency pairs.

From the table below, we see that the cheapest broker in our tests, IC Markets, also has the second lowest spike, so it’s the best example of tight, stable spreads.

| Broker | Highest Spread Cost |

|---|---|

| FXCM | $38.10 |

| IC Markets | $39.54 |

| Admiral Markets | $44.06 |

| TMGM | $46.77 |

| FusionMarkets | $48.12 |

| City Index | $48.20 |

| Blackbull Markets | $48.30 |

| Pepperstone | $50.76 |

| EightCap | $50.93 |

| CMC Markets | $52.14 |

| Axi | $54.22 |

| FP Markets | $57.61 |

| OandA | $58.90 |

| FXPro | $59.80 |

| Go Markets | $61.53 |

How we tested

We used live “standard” accounts (as opposed to “raw” or fixed-commission accounts) for our testing. The six major currency pairs – AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF and USDJPY were used to conduct our testing. We used hourly (H1) data over a 30-hour period.

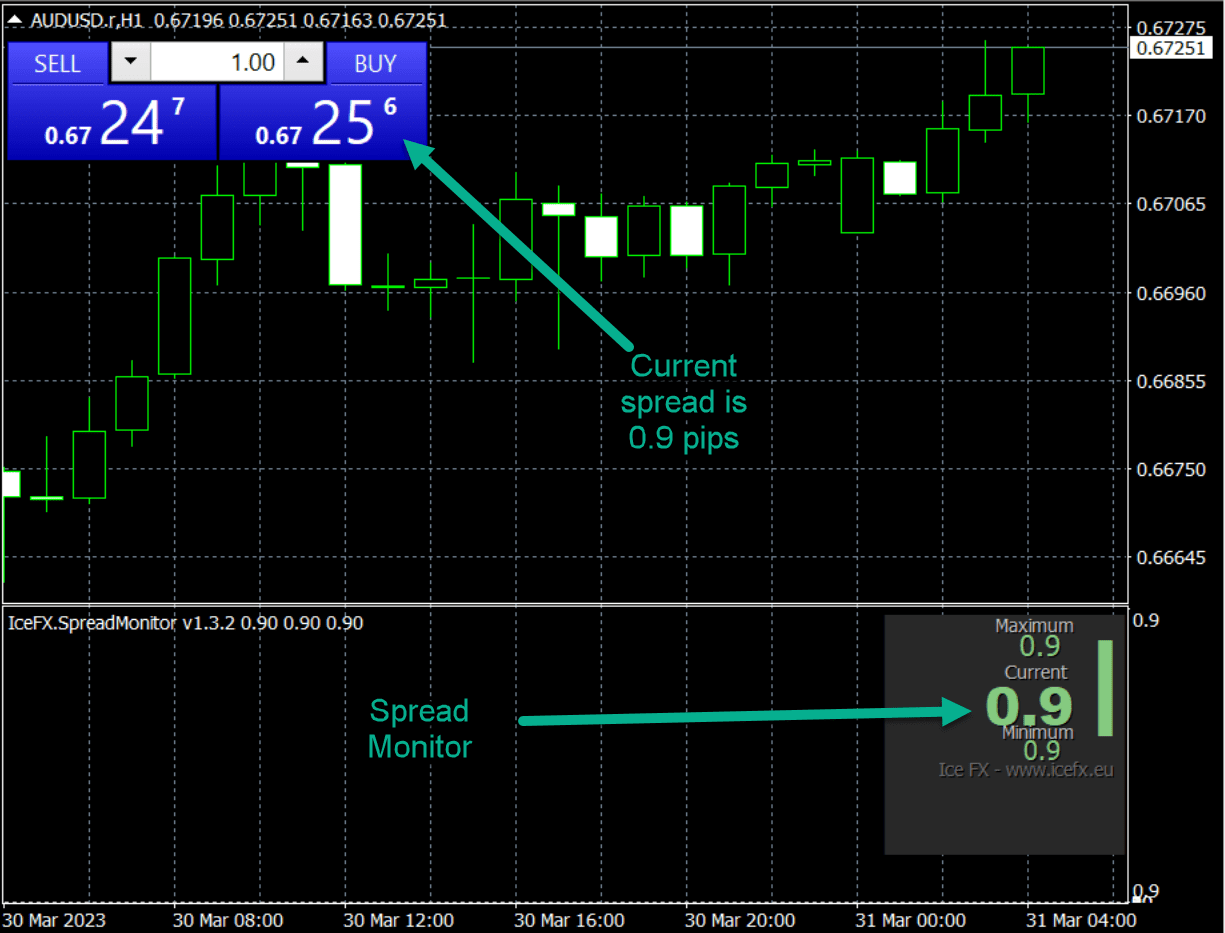

To record the spreads, we used a freely available MT4 indicator, IceFX SpreadMonitor, that displays the current minimum, maximum and average spread values for a chart (currency pair). The indicator’s screen output looks like this on an AUDUSD chart for H1 (hourly) data:

The indicator also writes the results to CSV files, providing us with data to perform our analysis. A typical CSV (for GBPUSD data at IC Markets) looks like this:

| Time | MaxSpread | AvgSpread | MinSpread |

|---|---|---|---|

| 2023.03.14 08:00 | 1.40 | 0.92 | 0.60 |

| 2023.03.14 09:00 | 1.40 | 1.09 | 0.60 |

| 2023.03.14 10:00 | 1.40 | 1.22 | 0.60 |

| 2023.03.14 11:00 | 1.40 | 1.08 | 0.60 |

| 2023.03.14 12:00 | 1.40 | 1.06 | 0.60 |

| 2023.03.14 13:00 | 1.40 | 0.87 | 0.60 |

| 2023.03.14 14:00 | 1.40 | 0.96 | 0.60 |

| 2023.03.14 15:00 | 10.30 | 1.07 | 0.60 |

| 2023.03.14 16:00 | 1.40 | 1.02 | 0.60 |

| 2023.03.14 17:00 | 1.40 | 0.95 | 0.60 |

| 2023.03.14 18:00 | 1.40 | 0.90 | 0.60 |

| 2023.03.14 19:00 | 1.40 | 0.90 | 0.60 |

| 2023.03.14 20:00 | 1.40 | 0.92 | 0.60 |

| 2023.03.14 21:00 | 1.40 | 1.01 | 0.60 |

| 2023.03.14 22:00 | 1.40 | 1.02 | 0.60 |

To record the volume and volatility history, we modified an open-source MT4 script, ExportHistoryCSV.mq4. The critical data we wanted to record was the hourly close, the hourly volume and the hourly Average True Range (ATR), which we used to measure volatility. The code snippet below enabled us to do that.

iDigits=MarketInfo(Symbol(),MODE_DIGITS);

dSymClose = (iClose(dSymbol,Period(),i));

dSymVolume = (iVolume(dSymbol,Period(),i));

dSymATR = (iATR(dSymbol,PERIOD_H1,24,i));

WriteData(DoubleToStr(dSymClose, iDigits)+”,”);

WriteData(DoubleToStr(dSymVolume, iDigits)+”,”);

WriteData(DoubleToStr(dSymATR, iDigits)+”,”);

A sample from the IC Markets data for GBPUSD looks like this:

| Symbol | Date | Close | Volume | ATR |

|---|---|---|---|---|

| GBPUSD | 2023.03.14 23:00 | 1.21586 | 2,121 | 0.00229 |

| GBPUSD | 2023.03.14 22:00 | 1.21782 | 6,816 | 0.00221 |

| GBPUSD | 2023.03.14 21:00 | 1.21756 | 6,880 | 0.00225 |

| GBPUSD | 2023.03.14 20:00 | 1.21685 | 8,265 | 0.00227 |

| GBPUSD | 2023.03.14 19:00 | 1.21548 | 6,980 | 0.00234 |

| GBPUSD | 2023.03.14 18:00 | 1.21448 | 7,287 | 0.00238 |

| GBPUSD | 2023.03.14 17:00 | 1.21569 | 9,410 | 0.00241 |

| GBPUSD | 2023.03.14 16:00 | 1.21647 | 11,503 | 0.00262 |

How we calculated the spread cost (in USD)

This table shows the calculations we used to compare spread costs across the currency pairs. A standard USD spread cost allows us to compare spreads from different brokers and different currency pairs.

| Currency Pair | Close | Unit Size (1 lot) | Pip Size | Spread | Value of a Pip (USD) | Spread Cost (USD) |

|---|---|---|---|---|---|---|

| AUDUSD | 0.665 | $ 100,000 | 0.0001 | 0.82 | $ 10.00 | |

| EURUSD | 1.071 | $ 100,000 | 0.0001 | 0.73 | $ 10.00 | $ 7.31 |

| GBPUSD | 1.213 | $ 100,000 | 0.0001 | 1.15 | $ 10.00 | $ 11.52 |

| USDCAD | 1.374 | $ 100,000 | 0.0001 | 1.00 | $ 7.28 | $ 7.27 |

| USDCHF | 0.914 | $ 100,000 | 0.0001 | 1.40 | $ 10.94 | $ 15.32 |

| USDJPY | 133.617 | $ 100,000 | 0.0100 | 1.09 | $ 7.48 | $ 8.17 |

In forex trading, spreads are always expressed in pips, with a pip being 1/10,000th (0.0001) of a standard “lot.” A “lot” consists of 100,000 units, so for an AUDUSD trade, a pip equates to USD $10 (0.0001 x 100,000).

Suppose the average spread for AUDUSD is 0.821 pips (as per IC Markets); the spread cost amounts to USD $8.21 (0.821 x $10). This calculation method can be similarly applied to determine USD spread costs for EURUSD and GBPUSD spreads.

Calculating USD spread costs for USDCAD and USDCHF spreads is slightly more complex. Pips are expressed in the quote currency or the second currency in the pair. Hence, USDCAD pips are in CAD, and USDCHF pips are in CHF.

To convert CAD and CHF to hourly USD spread costs, we utilized the hourly closing prices of USDCAD and USDCHF, respectively. For instance, if USDCAD closed at 1.374, a pip’s value is USD $7.27 (10 / 1.374).

Lastly, to calculate USD spread costs for USDJPY, we employed the same method as for USDCAD and USDCHF. However, a pip for USDJPY is 1/100th (0.001) rather than 1/10,000th.

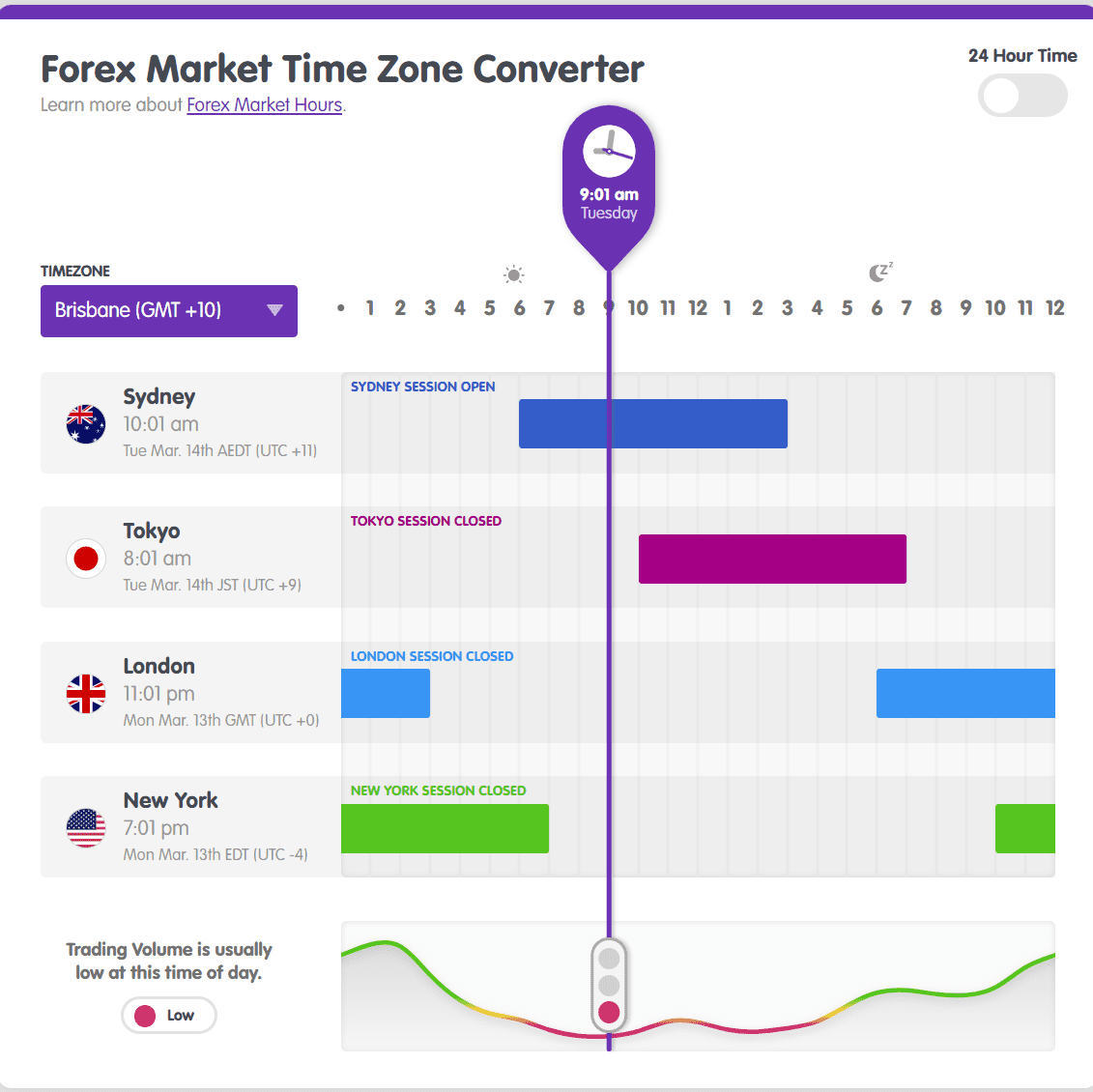

The time zones of our tests

We ran our tests across a 30-hour period from 9:00 AM on 14th March, 2023 to 2:00 PM on 15th March, 2023. These times are in time zone UTC + 10, which aligns with Brisbane, Australia.

As we can see from the Time Zone Converter, 9:00 AM Brisbane has the lowest volume of all times during the forex day, meaning spreads should be at their lowest and most stable.

We kept our tests running overnight, during the highest volumes of trading and through all the major forex sessions – Sydney, Tokyo, London, and New York. These 4 markets all have different Trading Hours for forex trading. Our tests stopped at 2:00 PM Brisbane time, about half-way through the Tokyo session.

A second test to confirm our results

To confirm our test results, we ran another test exactly a week later. We expected increased volatility, and perhaps wider spreads since the market was still reacting to the banking crisis and the fall of Credit Suisse and Silicon Valley Bank.

Overall, however, the spread costs were very similar, as we can see below.

Some highlights are:

- IC Markets and CMC Markets were still the cheapest brokers, while FXPro was still the most expensive

- FXCM was $1.94 cheaper on average in the second week of testing

- Pepperstone Spreads were $1.94 more expensive on average in the second week of testing

| Week 2 | Week 1 | ||||

|---|---|---|---|---|---|

| Broker | Cost | Rank | Cost | Rank | Difference |

| IC Markets | $9.49 | 1 | $ 9.53 | 1 | -$0.05 |

| CMC Markets | $10.58 | 2 | $ 9.97 | 2 | $0.61 |

| TMGM | $11.10 | 3 | $ 11.07 | 4 | $0.03 |

| Fusion Markets | $11.44 | 4 | $ 10.97 | 3 | $0.47 |

| FXCM | $11.44 | 4 | $ 13.38 | 6 | -$1.94 |

| Admiral Markets | $11.98 | 6 | $ 11.80 | 5 | $0.19 |

| OandA | $12.85 | 7 | $ 14.07 | 11 | -$1.22 |

| FP Markets | $14.18 | 8 | $ 13.42 | 8 | $0.76 |

| Eightcap | $14.18 | 8 | $ 13.74 | 10 | $0.45 |

| Go Markets | $14.23 | 10 | $ 13.67 | 9 | $0.56 |

| Pepperstone | $15.32 | 11 | $ 13.39 | 7 | $1.94 |

| City Index | $15.89 | 12 | $ 16.35 | 13 | -$0.46 |

| Blackbull Markets | $16.00 | 13 | $ 17.16 | 14 | -$1.16 |

| Axi | $16.26 | 14 | $ 15.82 | 12 | $0.44 |

| FXPro | $20.76 | 15 | $ 20.61 | 15 | $0.15 |

Tightest Spread Standard Accounts for Australian Traders

ASIC is the Australian Securities and Investments Commission. In Australia, ASIC-regulated brokers are legitimate and trustworthy. These are the five tightest spread, ASIC-regulated brokers.

The table shows the Average Spread and equivalent Spread Cost (in USD)

| Broker | Spread | Spread Cost |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| Fusion Markets | 1.19 | $11.07 |

| TMGM | 1.21 | $11.18 |

| Admiral Markets | 1.31 | $11.96 |

Tightest Spread Standard Accounts for UK Traders

FCA is the Financial Conduct Authority. In the United Kingdom, FCA-regulated brokers are legitimate and trustworthy. These are the five tightest spread, FCA-regulated brokers.

The table shows the Average Spread and equivalent Spread Cost (in USD)

| Broker | Spread | Spread Cost |

|---|---|---|

| CMC Markets | 1.11 | $10.10 |

| Admiral Markets | 1.31 | $11.96 |

| FXCM | 1.47 | $13.49 |

| Pepperstone | 1.46 | $13.52 |

| OANDA | 1.54 | $14.23 |

Cheapest Accounts for US Traders

In the USA, the National Futures Association (NFA) and the (CFTC ) Commodity Futures Trading Commission have regulatory oversight of forex brokers. These are the five cheapest brokers. Note MT4 is not offered by all brokers.

The table shows the Total Trade Cost (Commissions plus Spread)

| Broker | Commissions | Spread Cost | Total Cost | Comment |

|---|---|---|---|---|

| IB | $4.00 | $6.00 | $10.00 | No MT4 available. Cost information taken from website |

| IG | $0.00 | $12.79 | $12.79 | This is their Standard MT4 Account |

| TD Ameritrade | $0.00 | $13.00 | $13.00 | No MT4 available. Cost information taken from website |

| Oanda | $0.00 | $14.23 | $14.23 | This is their Standard MT4 Account |

| Forex.com | $5.00 | $10.00 | $15.00 | No MT4 available. Cost information taken from website |

Key Takeaways

- IC Markets, CMC Markets and Fusion Markets had the tightest spreads across the major currencies in our testing, against “standard” accounts.

- High volume (coinciding with high volatility) in the middle of trading sessions caused spreads to spike upwards for all brokers.

- IC Markets is the best broker for tight and stable spreads.

- A second test showed similar results to our first test run, adding to our confidence in the outcomes.

It’s worth noting that you should pick a low spread broker regulated in your region. For this reason we made lists based on regulator like the FCA-regulated Lowest Spreads Forex Brokers in the UK, and the CTFC regulated Lowest Spread Forex Brokers in the US.

Published Standard Account Forex Spreads

We consider our testing results with those published by the forex brokers. This is sourced either from their website, product disclosure statements or direct communication. The last update was in February 2026.

| Standard Account Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| IC Markets | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 |

| Fusion Markets | 0.89 | 1.2 | 1.11 | 0.95 | 1.05 | 1.06 | 1.43 | 1.49 |

| Eightcap | 1 | 1.2 | 1.2 | 1.2 | 1.2 | 1.1 | 1.2 | 1.2 |

| Go Markets | 1 | 1 | 1.3 | 1 | 1.1 | 1.2 | 1.4 | 1.5 |

| OANDA | 0.92 | 1.2 | 0.9 | 1.1 | 1.5 | 1.16 | 1.5 | 1.3 |

| Thinkmarkets | 1.1 | 1.4 | 1.3 | 1.1 | 1.2 | 1.1 | 1.2 | 1.2 |

| Admiral Markets | 0.8 | 1 | 1 | 1 | 1.6 | 1 | 1.5 | 2.2 |

| Axi | 1.2 | 1.3 | 1.3 | 1.3 | 1.3 | 1.2 | 1.5 | 1.4 |

| FIBO Group | 0.8 | 1 | 1.2 | 1.2 | 1.2 | 1.2 | 1.5 | 2.5 |

| SpreadEx | 0.9 | 1,1 | 1.4 | 1.1 | 1.1 | 1.2 | 1.8 | 1.8 |

| Exness | 0.9 | 1 | 1.1 | 0.9 | 1.5 | 1.4 | 2 | 1.9 |

| Pepperstone | 1.1 | 1.3 | 1.3 | 1.2 | 1.4 | 1.2 | 1.8 | 1.5 |

| TMGM | 1 | 1.09 | 1.32 | 1.11 | 1.28 | 1.9 | 1.5 | 1.7 |

| Markets.com | 0.8 | 0.9 | 1.3 | 0.9 | 1.6 | 1.1 | 2.2 | 2.1 |

| FP Markets | 1.2 | 1.5 | 1.4 | 1.3 | 1.4 | 1.2 | 1.4 | 1.6 |

| XTB | 0.9 | 1.4 | 1.4 | 1.3 | 1.8 | 1.4 | 1.4 | 1.7 |

| FBS | 0.9 | 1 | 1 | 1.5 | 1.5 | 1.6 | 1.8 | 2.1 |

| Avatrade | 0.9 | 1.3 | 1.3 | 1.1 | 1.8 | 1.2 | 1.8 | 2.1 |

| FBS | 0.9 | 1.1 | 1 | 1.5 | 1.5 | 1.6 | 1.8 | 2.1 |

| Forex.com | 1.2 | 1.1 | 1.1 | 1.7 | 2 | 1.3 | 1.5 | 1.7 |

| FXCM | 1.3 | 1.1 | 1.8 | 0.7 | 1.3 | 1.1 | 1.9 | 2.6 |

| Mitrade | 1 | 0.9 | 3 | 1.5 | 1 | 1.5 | 1.4 | 1.5 |

| BlackBull Markets | 1.1 | 1.4 | 1.4 | 1.2 | 1.4 | 1.7 | 1.8 | 2 |

| eToro | 1 | 1 | 2 | 1 | 1.5 | 1.5 | 2 | 2 |

| CMC Markets | 1.3 | 1.3 | 1.5 | 1.5 | 1.5 | 1.5 | 1.7 | 1.9 |

| Blueberry Markets | 1.2 | 1.5 | 1.4 | 1.5 | 1.5 | 1.3 | 2 | 1.8 |

| HYCM | 1.2 | 1.2 | 1.2 | 1.3 | 4 | 1.2 | 1.2 | 1.2 |

| ActivTrades | 0.89 | 1.31 | 1.35 | 1.24 | 2 | 1.5 | 2.6 | 1.88 |

| MultiBank Group | 1.5 | 1.5 | 1.6 | 1.5 | 1.6 | 1.7 | 1.6 | 1.9 |

| Vantage FX | 1.4 | 1.5 | 1.6 | 1.4 | 1.6 | 1.6 | 1.8 | 2 |

| RoboForex | 1.3 | 1.9 | 1.5 | 1.7 | 1.9 | 1.2 | 1.5 | 1.9 |

| IG | 1.13 | 1.12 | 1.66 | 1.01 | 1.98 | 1.71 | 2.27 | 2.06 |

| Tickmill | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.6 | 1.9 |

| OctaFx | 0.9 | 1.8 | 1.2 | 1.5 | 1.9 | 1.7 | 1.9 | 2.3 |

| FXPro | 1.4 | 1.4 | 1.7 | 1.9 | 1.7 | 1.4 | 1.8 | 2.2 |

| Saxo Markets | 1.1 | 2.2 | 1.8 | 1.1 | 1.9 | 1.6 | 2 | 1.9 |

| Axiory | 1.3 | 1.8 | 1.5 | 2.1 | 1.9 | 1.2 | 1.8 | 2.1 |

| Plus500 | 1.2 | 2 | 1.7 | 1.1 | 2 | 1.5 | 2.5 | 2 |

| HF Markets | 1.4 | 1.8 | 1.6 | 1.6 | 1.9 | 1.4 | 2.1 | 2.4 |

| BDSwiss | 1.6 | 1.7 | 1.9 | 1.8 | 1.8 | 1.6 | 2 | 2 |

| EasyMarkets | 0.8 | 1.5 | 1.3 | 1.5 | 2.3 | 2 | 2.2 | 3 |

| LQDFX | 1.2 | 1.2 | 1.8 | 2 | 1.2 | 1.7 | 2.7 | 3.2 |

| ADROFX | 1.4 | 1.4 | 1.3 | 2 | 2 | 2.3 | 2.8 | 2 |

| GCI Trading | 1 | 1 | 2 | 3 | 3 | 2 | 2 | 2 |

| Swissquote | 1.7 | 1.6 | 2 | 1.6 | 2.7 | 1.7 | 2.5 | 2.5 |

| XM | 1.6 | 2 | 1.8 | 2.3 | 2.3 | 1.8 | 2.1 | 3 |

| IFC Markets | 1.8 | 1.8 | 3 | 2 | 3 | 1.8 | 2.5 | 3.5 |

| AMarkets | 1.9 | 1.8 | 2.9 | 2.6 | 3.1 | 1.8 | 1.9 | 3.6 |

| Tradersway | 1.4 | 1.6 | 2.1 | 2.5 | 2.6 | 2.5 | 2.6 | 4.9 |

| FXTM | 2.1 | 2.5 | 2.5 | 2.1 | 2.8 | 2.7 | 2.5 | 3.6 |

| Trading 212 | 1.6 | 3 | 2.5 | 1.7 | 2.1 | 2.5 | 4.2 | 3.3 |

Frequently asked questions about spreads

Who is the best low spread forex broker?

We tested 15 forex brokers with the MetaTrader 4 trading platform using their no-commission account (i.e. standard account) to find who has the tightest spread. Our tests using 6 major currency pairs over a 24 hour period showed IC Markets has the tightest spreads with an average 1.03 pips.

Do low spreads matter when trading forex?

Low spreads mean your cost to trade will be lower however keep in mind any other costs such as commissions. If commission costs are high, then it might be worth considering the Lowest Commission Brokers or even a broker with no commission costs despite the wider spread.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Ask an Expert