XM Review Of 2026

XM has decent regulation and offers UK and EU based traders good spreads. While they don’t have commissions, their spreads are not competitive and they have limited trading platforms and market range.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

XM Summary

| 🗺️ Regulation Country | Australia, Europe, UK, UAE |

| 💰 Trading Fees | Variable Spread No Commission + ECN Commission Spread |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💰 Minimum Deposit | $5 |

| 💰 Withdrawal Fees | $15 |

| 🛍️ Instruments | Forex, Shares, Indices, Soft Commodities, Metals, Energies |

| 💳 Credit Card Deposit | Yes |

Why Choose XM

XM has a low minimum deposit of just $5 and good execution speeds. However they have a limited CFD range and lack trading platform variety. XM is decent for newer traders as opening an account is relatively easy, however advanced traders will find a lack of advanced tools.

The broker has good regulation worldwide, including CySEC for European traders, ASIC in Australia, and FSCA for offshore traders. If you are a UK trader, it’s best to consider other brokers as XM is not regulated there.

XM Pros and Cons

- Low fees

- Extensive educational materials

- Easy account opening

- Limited products

- Mediocre CFD fees

- No FCA Licence

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

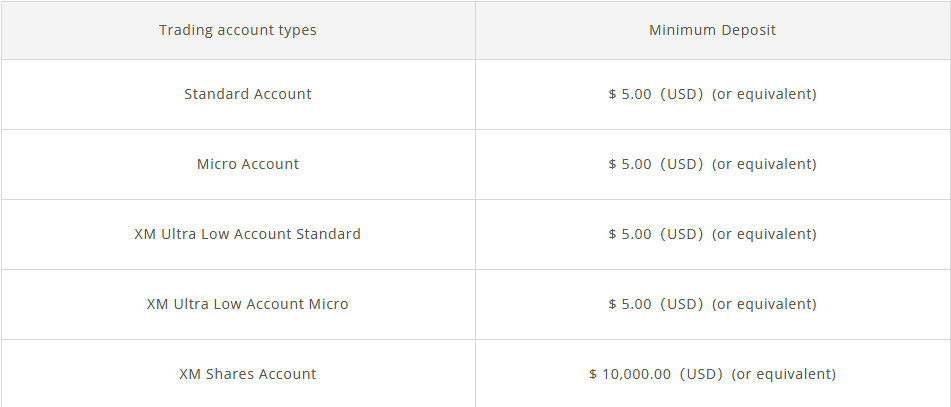

Depending on which Country you register for XM, you can pick from five different account types with varying lot size and pricing. The Ultra Low account is ideal if you are a high volume trader due to lower swap fees.

Depending on which Country you register for XM, you can pick from five different account types with varying lot size and pricing. The Ultra Low account is ideal if you are a high volume trader due to lower swap fees.

While the Zero account is good if you value fixed commissions and lower spreads. For offshore traders, XM also offers a Standard account that is suitable for beginners.

You might also have access to open a Shares account for long term trading, but with a high $10,000 minimum deposit. Lastly, XM offers a Professional Account with high leverage if you meet special client criteria.

1. Raw Account Spreads

XM’s Zero Account, available to clients in Europe and the UK, offers ECN-style pricing with spreads starting as low as 0.1 pips for major pairs like EUR/USD, alongside a $3.50 commission per lot per trade.

In my review, XM’s Zero Account offered tight spreads on key currency pairs. The EUR/GBP average spread was 0.30 pips, and the USD/JPY average spread was 0.10 pips.

These ECN spreads are some of the industry’s lowest, matching or beating leading brokers like FP Markets and Pepperstone.

Commission Account Spreads | |||||

|---|---|---|---|---|---|

| 0.10 | 0.90 | 0.70 | 0.10 | 1.30 |

| 0.10 | 0.10 | 0.20 | 0.30 | 0.40 |

| 0.08 | 0.35 | 3.50 | 0.60 | 0.65 |

| 0.10 | 0.20 | 0.30 | 0.30 | 0.50 |

| 0.10 | 0.20 | 0.30 | 0.30 | 0.20 |

| 0.16 | 0.29 | 0.54 | 0.24 | 0.70 |

| 0.10 | 0.40 | 0.50 | 0.40 | 1.40 |

| 0.10 | 0.50 | 0.60 | 0.60 | 0.60 |

| 0.50 | 0.70 | 0.60 | 0.50 | 0.80 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

I and my team at CompareForexBrokers examined 38 brokers and 9 major currency pairs. We discovered that XM had tighter average spreads for 5 of these pairs.

The total average was likewise the highest of all the brokers we reviewed, predominantly due to the USD/SGD rate, which I verified twice over since it was so elevated.

| Raw Account Spreads | XM | Average Spread |

|---|---|---|

| Overall | 2 | 0.74 |

| EUR/USD | 0.2 | 0.21 |

| USD/JPY | 0.5 | 0.39 |

| GBP/USD | 0.5 | 0.48 |

| AUD/USD | 0.8 | 0.39 |

| USD/CAD | 0.5 | 0.53 |

| EUR/GBP | 0.5 | 0.55 |

| EUR/JPY | 0.9 | 0.74 |

| AUD/JPY | 1.21 | 1.07 |

| USD/SGD | 10 | 2.34 |

Overall, while XM has low RAW account spreads for some currency pairs they tend to be more expensive than brokers like Pepperstone, Eightcap and IC Markets. That said, the commission rate of this account type also significantly contributes to trading costs so we examine this next.

2. Raw Account Commission Rate

XM Zero Account holders are charged a commission fee of $3.50 per standard lot, which amounts to $7 for a round-turn per $100,000 traded.

While this fee is competitive in USD accounts, options are limited for AUD, EUR, or GBP. As such, this can result in conversion fees, and in general, local currency accounts, such as AUD, offer more competitive commission rates.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| XM Commission Rate | $3.50 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

XM Micro and Standard Accounts are commission-free account types that have 1 pip starting spreads.

Our analysis of over 40 of the leading brokers’ average monthly spreads showed that while XM’s no commission spreads are competitive, there are brokers with tighter spreads.

Specifically, for EUR/USD and AUD/USD pairs, the average spread at XM is 1.60 pips.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| XM Average Spread | 1.6 | 2 | 1.8 | 2.3 | 2.3 | 1.8 | 2.1 | 3 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

4. Swap-Free Account Fees

XM Islamic accounts stand out remarkably from most other forex brokers’ standard offerings. The key difference is that, unlike most forex companies that charge additional fees by widening the spread on Islamic accounts, XM does not impose any extra charges.

5. Other Fees

There are no additional charges when you make a deposit or withdrawal. However, there is an inactivity fee of $5 after 90 days.

My Verdict on XM Trading Costs

This is an area that is perhaps the most important for traders looking for a new broker, and XM regretfully falls short. They have rather high trading costs and spreads compared to the industry average, which nets them an overall score in this category of 6.0 out of 10.

Trading Platforms

XM offers traders MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own web and mobile XM App to suit different trading needs.

| Trading Platform | Available With XM |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

My team at CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

I have used MT4 most of my trading career because it has a simple interface and a good balance of features. MT4 is also one of the first mainstream platforms on the market, and is used by more retail traders than any other platform.

Why I use MT4:

- MT4 has a very user-friendly interface, simple to manage even for novice traders.

- A large community means easily accessible resources such as custom indicators, Expert Advisors (EAs) and support forums.

- Good selection of charting tools (31 analytical objects, 30 technical indicators and 9 timeframes)

- 4 order types which are waiting status (buy-stop, buy-limit, sell-limit, sell-stop) and three order types for execution

- Ability to create your own Expert Advisors using MQL4 to automate and implement custom indicators

Also, if you consider flexibility in devices as important, I can highly recommend MT4 as you can run it on Android, iOS, desktop (both Windows and Mac), and browser (using MT4 WebTrader).

That is a nice advantage if you are a trader and am busy because you can see positions, and manage them anywhere.

Why you might not use it

- Limited access to stock CFDs, with a main emphasis on forex and indices.

- Though still in use, MT4 is outdated compared to newer platforms (like MT5) with advanced features.

- MetaQuotes does no longer support nor develop MT4, something that indicates MT5 will eventually replace it.

MetaTrader 5

MT5 is an upgrade from MT4, with far greater possibilities in the number of analysis tools or charts you can have open, the product types you can trade, and processing speeds.

As opposed to MT4, which is appropriate for trading via decentralised exchanges (e.g. forex), MT5 is a multi-asset platform that allows for more diversified market access. In XM’s case, it’s the addition of stock market CFDs since they’re traded via a centralised exchange.

While the look and feel of MT4 vs MT5 do have their similarities, the change did take a bit of getting used to. Learning the full potential and features of MT5 (in comparison to MT4) does take a little time.

But I’d say if you’re a intermediate or experienced trader, it’s worth a try, as it’s essentially an updated MT4 (with extra features and functionality).

Additional features that are included with MT5 (in addition to what is offered on MT4):

- Improved charting with 44 analytical objects, 38 technical indicators and 21 timeframes (scalping delight)

- Has two additional pending order types not available with MT5 – buy-stop-limit and sell-stop-limit

- Access to real volume data unlike MT4 which limits tick volumes.

- Improved programming language with MQL5 reported to be more user-friendly than MQL4 on MT4.

Also, 64-bit processing backtesting provides MT5 with the capacity to pass historical data for a particular trading strategy, and MT4, which is 32-bit, can backtest with a certain pair only.

XM App

XM have a single mobile app that offers full functionality of the desktop and WebTrader platforms.

You can download and use their app on both Android and Apple devices and use it to trade on the go, access your accounts and deposit or withdrawal funds.

After using their App for a few weeks, I found that it stood out amongst other broker’s proprietary mobile apps with its modern feel and rich trading features.

My Verdict on XM’s Trading Platforms

XM only support MT4 and MT5, which while great tools on their own, are not quite the versatile platform offering compared to competitors. They also have a great proprietary app, which stood out compared to competing brokers mobile solutions.

However, the lack of platforms such as cTrader or TradingView is a big downside for me, as I frequently use their unique features and TA tools. For this reason I give XM a score of 6.0 / 10 for their trading platforms.

Is XM Safe?

After reviewing multiple areas, I award XM a trust score of 88 out of 100, as it has decent regulation, but some not so favorable 3rd party reviews.

1. Regulation

XM is a global broker and as such accepts clients from all over the world, as it has regulatory oversight with multiple top-tier regulators Including ASIC for Australia-based traders and CySEC for European traders.

| XM Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA CySEC |

| Tier-2 | DFSA |

| Tier-3 | FSCA, FSC-BZ, FSC-M, FSA-S |

As I mentioned at the start, they don’t have FCA regulation, so as a UK trader, it’s best to check for other brokers instead.

2. Reputation

XM was established in 2009 in Belize City, Central America. During my research, I found that the online broker had no major regulatory issues on record during its 15 years of business.

They rank among the most popular forex brokers globally. With approximately 723,000 monthly Google searches, it stands as the 4th most searched forex broker among the 65 brokers we analyzed. Similarweb data from February 2024 confirms this strong position, showing XM as the 4th most visited broker with an impressive 15,630,000 global visits.

XM has built a substantial global presence, serving over 15 million clients across 190+ countries. While the company doesn’t publicly disclose its exact trading volumes, it is in excess of 8.5 billion. XM’s popularity is particularly strong in Southeast Asia, the Middle East, and parts of Latin America, reflected in its multilingual support for 30+ languages.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 74,000 |

| Japan | 74,000 |

| India | 60,500 |

| Thailand | 60,500 |

| Indonesia | 33,100 |

| South Africa | 27,100 |

| Malaysia | 27,100 |

| Colombia | 18,100 |

| Vietnam | 18,100 |

| Morocco | 18,100 |

| Egypt | 18,100 |

| France | 14,800 |

| Brazil | 14,800 |

| Mexico | 14,800 |

| Germany | 12,100 |

| Pakistan | 12,100 |

| Philippines | 12,100 |

| Uzbekistan | 12,100 |

| Turkey | 9,900 |

| United Kingdom | 8,100 |

| Italy | 8,100 |

| Spain | 6,600 |

| Cambodia | 6,600 |

| Bangladesh | 6,600 |

| Taiwan | 6,600 |

| Peru | 5,400 |

| Ecuador | 5,400 |

| Canada | 5,400 |

| Algeria | 5,400 |

| Nigeria | 5,400 |

| Netherlands | 4,400 |

| Saudi Arabia | 4,400 |

| Singapore | 4,400 |

| Kenya | 4,400 |

| Poland | 3,600 |

| United Arab Emirates | 3,600 |

| Australia | 3,600 |

| Jordan | 3,600 |

| Sri Lanka | 3,600 |

| Chile | 2,900 |

| Venezuela | 2,900 |

| Greece | 2,900 |

| Argentina | 2,400 |

| Switzerland | 2,400 |

| Dominican Republic | 2,400 |

| Cyprus | 2,400 |

| Mongolia | 2,400 |

| Portugal | 1,900 |

| Austria | 1,900 |

| Hong Kong | 1,900 |

| Ghana | 1,900 |

| Bolivia | 1,600 |

| Botswana | 1,600 |

| Sweden | 1,300 |

| Tanzania | 1,000 |

| Uganda | 1,000 |

| Costa Rica | 880 |

| Panama | 720 |

| Ireland | 590 |

| Uruguay | 590 |

| Ethiopia | 590 |

| New Zealand | 480 |

| Mauritius | 260 |

74,000 1st | |

74,000 2nd | |

60,500 3rd | |

60,500 4th | |

33,100 5th | |

27,100 6th | |

27,100 7th | |

18,100 8th | |

18,100 9th | |

18,100 10th |

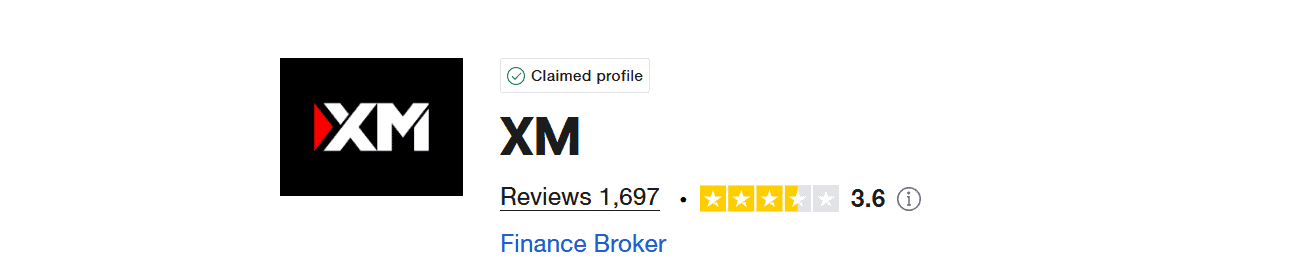

3. TrustPilot Reviews

After checking the 2026 reviews of XM from TrustPilot, I found that the broker had a sub-par 3.6 out of 5 average rating. After going investigating further I found that many traders complained about deposit/withdrawal issues.

However, many users gave it a 5 star rating citing their appreciation of the fast execution speeds.

My Verdict on XM Trust

XM have great regulatory coverage including tier-1 entities such as the ASIC or CySEC and some tier 2 and tier 3 offshore regulators. This is weighed heavily towards a good score of 9/10 for their overall safety.

Deposit and Withdrawal

To start trading with XM, an initial minimum deposit of $5 is required for Micro and Standard accounts, $5 for Ultra-Low accounts, and $5 for Zero Accounts and Professional Accounts. If you wish to use their Shares account, you are required to have a $10,000 minimum deposit.

Account Base Currencies

XM offers USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, and RUB as base currencies for Micro and Standard Accounts.

For Ultra Low and Zero Accounts, a more limited selection of base currencies are available as shown below.

| XM Accounts and Fees | Micro account | Standard Account | Ultra Low Account | Zero Account |

|---|---|---|---|---|

| Restrictions | None | None | Australia and select countries only | UK and Europe only |

| Base currency options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB | USD, EUR, GBP, CHF, AUD, HUF, PLN, RUB | EUR, USD, GBP, AUD, PLN, HUF | USD, EUR, JPY |

| Minimum trade volume | 0.01 Lots (MT4) 0.1 Lots (MT5) | 0.01 Lots (MT4) 0.1 Lots (MT5) | Standard Ultra: 0.01 Lots Micro Ultra; 0.1 Lots | 0.01 Lots |

| Minimum deposit | $5 | $5 | $50 | $100 |

Deposit Options and Fees

XM has a rather limited way of depositing, including Bank transfer, VISA/Mastercard credit or debit cards, Neteller, Skrill, SticPay, and local payment gateways (depending on your region). They charge no deposit fees however.

Withdrawal Options and Fees

XM have no withdrawal fees, but like the deposit options you are limited to just Bank transfer, credit/debit card, Neteller, Skrill, SticPay, and local payment gateways (based on client location).

Other Fees

XM traders who have not traded for 90 days will be charged a monthly inactivity fee of $5.

My Verdict on XM Funding Options

XM has very few deposit and withdrawal options, namely just credit/debit, bank and Skrill transfers. However, they have no deposit or withdrawal fees, for which I have to give them a score of 6.4/10 for the category of funding.

Product Range

XM offer 1400+ global assets including forex, commodities, precious metals, thematic indices, stock CFDs and energies.

XM provides access to forex trading with competitive spreads and commission-free accounts. While the exact number of currency pairs is not explicitly stated, the broker supports major, minor, and exotic pairs, including EUR/USD, GBP/USD, USD/JPY, and USD/SGD.

- Forex: Over 55 currency pairs including majors, minors, and exotics

- For Precious Metals, the broker also offers CFDs for Gold, Silver, Platinum, and Palladium.

- Stocks – the broker has access to over 1,200 stock CFDs from the US, UK, Germany, France, and more.

- Energies: There are also three energies CFDs including Oil, Brent and natural gas.

- Up to 10 different cash indices CFDs including popular options like the NASDAQ and Dow Jones.

- Up to 8 different soft commodities

- Cryptocurrencies* (Available under selected entities): 60+

Note: Trading Cryptocurrency CFDs varies by regulatory jurisdiction and is not offered under all entities (e.g., not available under DFSA or CySEC).

My Verdict on XM Range of Markets

XM have a decent offering of over 1400+ assets and CFDs for you to pick from, including quite a lot of forex and stock CFDs with some energies and indices as well. I give XM a score of 8.5 out of 10 for their good range of markets offering.

Customer Service

Based on your location, XM offers customer support over live chat, phone, email and telegram. Depending on your region, you can get support in multiple languages. XM’s multilingual support team covers over 30 languages, which is a big plus for traders in non-English-speaking countries. The phone support is available only on weekdays from 08:00 – 22:00, while the live chat is available 24/7. XM also has a Help Center and FAQ library for self-service if you prefer to find answers on your own.

Their chat window opens up with the typical AI assistant, but you can navigate to a person instead using the workflow.

As of my personal experience, I had to contact their support after I made a decent profit in GBP/JPY and tried to withdraw $500. A few hours passed, but nothing happened. XM’s support team replied in robotic efficiency: “Your withdrawal is under review.”

I had better success reaching out to their phone support, as they could look into my account and figure out where the hold was occurring (it had something to do with bank hoping to reach my account).

Eventually after a few days I got an email confirming that my deposit was processed.

My Verdict on XM Customer Service

XM Markets have a decent mix of support channels – live chat, email, phone, and even a structured ticket system with tracking – but its not so easy to get a hold of a human support agent during certain times. Their support was able to resolve my query relatively quickly for which I give them a score of 10 out of 10 for the category of customer service.

Research and Education

XM have put quite an effort into their Education segment, which you can find after clicking on “Discover” on their menu. You then get the option to pick from multiple educational content types, including videos, articles and even webinars hosted 7 days a week and presented by 77, in multiple languages and for traders of all levels.

XM also provides free, self-paced courses covering foundational trading topics such as fundamental analysis, technical analysis, risk management, and trading strategies. These courses are segmented into digestible modules, allowing users to build skills progressively.

For instance, technical analysis modules teach chart patterns and indicators like RSI and MACD.

With materials available in 20 languages, including Arabic, Spanish, and Japanese, XM ensures inclusivity for a global audience.

What I liked the most was that XM put a great effort into making learning more user-centered, with very well organised guided educational segments.

Overall I was pleasantly surprised, as most brokers neglect this segment and only offer written guides and generic explanations of terms like lots and leverage.

My Verdict on Research and Education

Its very evident that XM spent quite a lot of time adding educational content and making it easy to follow for new traders. I found that there was excellent variety of educational materials, including webinars, videos and guides. I give them a score of 7.5 out of 10 for their education content.

Final Verdict on XM

XM is a viable broker choice if you are a beginner and more cost-conscious trader, as opening an account requires a small deposit, and the process is very quick. You also have access to MT4 and MT5, which are amazing in terms of functionality and ease of use.

However the broker falls a bit short on crucial areas such as high trading costs, especially compared to brokers like Pepperstone or IC Markets. The lack of deposit and withdrawal methods and sub-par 3-rd party user reviews are also notable downsides.

I have to give them some extra points for the excellent educational content page and hope they will add more CFDs in the future such as cryptocurrencies and other forex pairs. After a thorough review and evaluation, my overall rating of XM comes to 83 out of 100.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

XM FAQs

Does XM Offer Negative Balance Protection?

XM offers guaranteed negative balance protection across all accounts, ensuring traders don’t owe more than their account balance. This protection includes a 50% margin call and a 20% stop-out level to manage potential losses. In cases of slippage leading to a negative balance, XM resets the account to $0, preventing debt accumulation. However, XM does not provide guaranteed stop-loss orders.

Can UK Traders Use XM?

Yes, while you can use the broker if you are based in the UK, you wont have the oversight of the FCA, which might be a big downside.

Are There Hidden Fees?

No, the broker has no hidden fees, except for a $5 inactivity fee if you don’t use your account for longer than 90 days.

About the Review

This review of XM is grounded in CompareForexBrokers’ comprehensive and methodical approach. Our methodology, updated for 2026, involves a detailed analysis of 40 brokers across eight key categories, including trading costs, trading experience, trust, trading platforms, customer service, market range, education, and funding.

This process is backed by rigorous testing and research, conducted by a team of traders and industry experts. We employ both manual assessments and automated testing through Expert Advisors, Indicators, and Scripts to ensure accurate and unbiased evaluations.

Our goal is to provide traders with clear, factual, and up-to-date information, helping them find the best forex broker that aligns with their trading needs.

Compare XM Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Which XM account is best for scalping?

While XM does allow scalping, since most accounts are commission free, their spreads will be wider compared to a RAW account. For this reason, there are better brokers to consider but if you wish to scalp trade with XM, your best account would be XM Ultra Low Account.

Which account is best for XM?

This really depends on your preference and experience. For beginners, the Micro Account at XM is ideal for managing smaller trades with lower risk. Experienced traders may prefer the XM Zero Account for its lower spreads and cost efficiency.

Which documents do I need to provide to become an XM client?

Exact documents required with XM will vary by regions but generally you will need identification, proof of address, payment method verification and in some cases tax documentation

How long does XM verification take?

XM verification should take 3 to 7 days in most cases.

How does XM affiliate program work?

XMs affiliate program has a commission of $25 for each lot referred. Commissions are available on 2nd tier refferals as well.