How Do Pepperstone Vs XM Compare?

XM is a spread-only forex broker, while Pepperstone offers tight ECN pricing with commissions. Our team of forex experts have compared the two brokers to see who offers the best spreads, platforms and accounts. Here is our XM vs Pepperstone Comparison.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our detailed comparison of XM and Pepperstone focuses on the 10 most crucial trading aspects. Here are five other significant differences:

- Pepperstone offers a wider range of trading platforms, including MT4, MT5, and cTrader, compared to XM’s offering of only MT4 and MT5.

- XM provides a unique Ultra-Low account for traders outside the UK and Europe, offering tighter spreads without commissions.

- Pepperstone’s execution speed is faster, with orders typically executed in less than 30 ms, compared to XM’s average execution speed.

- XM’s Zero Account, offering tighter spreads with commission, is only available to traders in the UK and Europe.

- Pepperstone has a more competitive spread for the AUD/JPY pair, averaging 1.33 pips compared to XM’s 3.30 pips.

1. Pepperstone: Lowest Spreads And Fees

Try the XM vs Pepperstone fee calculator below based on the most popular forex pairs and base currencies.

XM Spreads

| XM | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.20 | 0.10 | 0.10 | 0.40 | 0.60 | 0.40 | 1.10 | 1.10 | N/A | N/A |

| BrokerChooser | 0.10 | 0.10 | 0.20 | 0.40 | 0.50 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CompareForexBrokers | 0.26 | 0.10 | 0.10 | 0.20 | 0.10 | 0.50 | 0.30 | 0.40 | N/A | N/A |

| XM | 0.70 | 0.70 | 0.60 | 0.90 | 1.20 | 1.00 | 1.00 | 1.50 | N/A | N/A |

| Consensus | 0.32 | 0.25 | 0.25 | 0.48 | 0.60 | 0.63 | 0.80 | 1.00 | N/A | N/A |

Pepperstone Spreads

| Pepperstone | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.10 | 0.10 | 0.70 | 0.10 | 0.60 | 0.50 | 1.00 | 0.40 | N/A |

| BrokerChooser | 0.10 | 0.30 | 0.20 | 0.20 | 0.30 | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 0.77 |

| CompareForexBrokers | 0.19 | 0.36 | 0.41 | 0.19 | 0.61 | 0.40 | 1.10 | 0.70 | 1.10 |

| Pepperstone | 1.00 | 1.00 | 1.00 | 1.00 | 1.10 | 1.20 | N/A | N/A | N/A |

| Consensus | 0.30 | 0.44 | 0.57 | 0.37 | 0.65 | 0.70 | 1.05 | 0.55 | 0.94 |

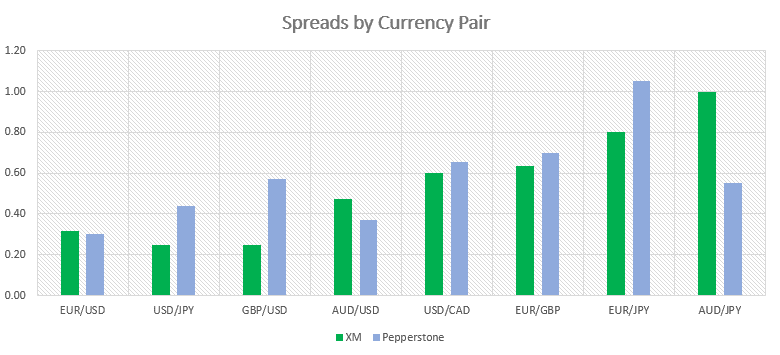

The graph below shows the consensus data, with Pepperstone having wider spreads than XM in some pairs.

There are two main pricing structures when trading forex via a retail investor account. ECN-style spreads charge flat-rate commission fees, while Standard Accounts are commission-free, but spreads tend to be wider. Pepperstone offers both pricing structures, yet XM traders are restricted to no commission accounts unless they are based in the UK or Europe.

| Account Types | Pepperstone | XM |

|---|---|---|

| Commission, ECN-Style Accounts | 1. Razor Account | 1. Zero Account (EU/UK Only) |

| Commission Free Accounts | 2. Standard Account | 2. Ultra-Low Account (Outside EU/UK) |

| 3. Standard Account | ||

| 4. Micro Account |

While certain brokers fix their forex spreads, both XM and Pepperstone offer variable spreads that change with market conditions.

XM’s Zero Spreads: UK And Europe Only

If you are based in the UK or Europe, you can sign up for XM’s Zero Account. Flat-rate commission fees are $7 round turn per 100,000 traded, yet spreads are less competitive than Pepperstone and other top brokers for most currency pairs except the EUR/USD and GBP/USD.

Pepperstone’s ECN-Like Razor Spreads

Much the same as an ECN broker, Pepperstone offers ultra-tight spreads on a range of major, minor and exotic currency pairs. Razor Accounts provide access to an institutional trading environment where spreads can be as low as 0.0 pips. Like XM, commission fees are $7 round turn per 100,000.

When compared to other top forex brokers, Pepperstone’s Razor spreads are far more competitive for the majority of major fx pairs. For instance, if you are trading with Forextime.com, USD/JPY average spreads are 0.50 pips, while Pepperstone offers 0.13 pips. Similarly, with the AUD/JPY currency pairs, XM offers 1.20 pips compared to Pepperstone’s ultra-low spreads of 0.32 pips.

|

Commission Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.10 | 0.20 | 0.10 | 0.20 | 0.90 |

|

0.10 | 0.60 | 0.50 | 2.00 | 0.70 |

|

0.50 | 0.50 | 0.70 | 0.50 | 1.70 |

|

0.21 | 0.63 | 0.90 | 0.78 | 0.85 |

|

0.20 | 0.30 | 0.40 | 0.60 | 0.60 |

|

0.20 | 0.50 | 0.50 | 0.50 | 0.70 |

|

0.10 | 0.30 | 0.20 | 0.20 | 0.60 |

|

0.30 | 0.30 | 0.40 | 0.60 | 0.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Pepperstone’s Commission Free Standard Account

Beginners and infrequent traders may prefer a simple fee structure where there is no need to calculate commission costs. Pepperstone’s Standard Account offers low average spreads on most currency pairs and is an excellent option for those wanting to focus on the AUD/JPY forex pair, which averages 1.33 pips compared to XM’s 3.30 pips.

|

Commission-Free Average Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.90 | 1.20 | 1.40 | 1.10 |

|

1.40 | 4.90 | 2.10 | 2.60 | 2.50 |

|

1.46 | 3.35 | 1.76 | 1.78 | 2.06 |

|

1.40 | 2.40 | 1.60 | 1.90 | 1.60 |

|

1.12 | 1.80 | 1.30 | 1.32 | 1.64 |

|

1.70 | 1.40 | 2.00 | 2.70 | 1.60 |

|

2.00 | 1.54 | 1.59 | 2.05 | 1.40 |

|

1.20 | 1.20 | 1.20 | 4.00 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

XM’s No Commission Spreads

XM’s Standard and Micro account types charge no commission fees on top of the quoted spread. When compared to Pepperstone and other online brokers, XM’s average spreads are much wider across all currency pairs.

XM’s Ultra Low Account: Not Available In UK/Europe

For those based outside of Europe and the United Kingdom, XM offers an Ultra-Low account type that is commission-free yet provides access to tighter spreads than the broker’s Micro and Standard accounts.

Ultra-low accounts can provide spreads similar to ECN accounts when commission costs are included. For instance, XM offers average spreads of 0.80 pips for the EUR/USD currency pair compared to 0.10 pips with XM’s Zero account. When commission fees are accounted for, Zero and Ultra-Low spreads are equal:

- XM Ultra Low, EUR/USD: 0.80 pips = $8

- XM Zero, EUR/USD: 0.10 pips + $7 commission fee = $8

Trading Conditions: Liquidity And Execution

Pepperstone, A No Dealing Desk Broker

Similar to an ECN broker, Pepperstone is a no dealing desk (NDD) broker where orders are executed with Straight-Through-Processing (STP). As an NDD and STP broker, orders are matched with different top-tier external liquidity sources, allowing traders to gain access to ECN-style pricing traditionally reserved for institutional investors.

As well as institutional-grade pricing, Pepperstone clients can enjoy extra-fast execution due to the broker’s partnership with Equinix. With servers located at New York’s Wall Street financial hub, on average, Pepperstone’s orders are executed in less than 30ms, ensuring low latency and minimal lag. With ECN-style pricing and fast execution, Pepperstone is an ideal online broker for scalpers, active traders and Expert Advisors.

XM: Market Maker

Unlike NDD brokers that source their prices from external liquidity providers, market makers such as XM match orders internally, setting their own bid-ask prices. Generally, market makers offer commission-free spreads, yet in the case of XM, they also provide the option of an ECN-style account to the UK and European traders.

Although a market maker, XM promotes a no requote guarantee, with 100% of orders being filled by the broker and no potential for orders to be rejected. Although XM’s servers are located in London, New York and London, 99.35% of orders are executed in less than 1 second and therefore XM’s average order execution speed lags behind Pepperstone.

Other Trading Fees

Inactivity Fees

As a Pepperstone customer, you can leave your trading account dormant for any length of time without incurring inactivity fees. XM, on the other hand, charges $5 per month if you do not make a trade for 90 days. Once your XM account balance falls below zero, your account will be archived.

Swap Costs

Swap fees (aka overnight financing fees) apply when positions are held open for extended periods. Both XM and Pepperstone traders incur swap costs when positions are open for longer than one day, with the fee derived from the interest rates of the currencies included in the fx pair being traded.

Verdict

When Pepperstone and XM spread and execution are compared, Pepperstone wins overall due to its no dealing desk execution and institutional-grade pricing. While XM offers tighter spreads through its Zero account type, only UK and European residents are able to access the broker’s ECN-style pricing, while Pepperstone’s Razor account has no restrictions.

As well as low spreads thanks to top-tier liquidity providers, Pepperstone charges no inactivity fees keeping trading costs low, while XM traders incur penalties when accounts are left inactive.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Pepperstone: Better Trading Platform

| Trading Platform | Pepperstone | XM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Pepperstone and XM both offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5) software, with Pepperstone Razor account holders providing the additional trading platform option of cTrader. All platforms allow you to conduct advanced analysis while automating trading with algorithmic strategies or account mirroring services.

MT4, MT5 and cTrader are available as desktop or webtrader platforms as well as trading apps for iOS and Android devices. Trading platform features are outlined below, followed by the social trading tools and add-on features offered by both brokers.

MT4 & MT5

Both Pepperstone and XM provide access to the hugely popular MT4 and MT5 trading platforms. As well as advanced charting and analysis tools, MetaTrader users can fully automate trading by using Expert Advisors (EAs). EAs allow traders to develop algorithmic trading strategies where positions are automatically opened and closed according to a set of parameters determined by the user, reducing the time spent finding profitable opportunities and placing orders. For beginner traders who may lack the experience needed to write Expert Advisors themselves, MetaTrader’s online Marketplace offers an extensive library of EAs that can be purchased and downloaded.

Key Differences Between MT4 And MT5:

- MT4 was designed as a forex trading platform (Share CFDs are not available), while MT5 is a multi-asset platform that permits share trading.

- Expert Advisors are created using the MQL4 programming language on MT4 compared to MT5, which uses MQL5.

- To backtest EAs against historical data, MT4 users can only test one currency at a time. MT5 offers the improvement of multi-currency backtesting.

- Four pending order types are available on MT4, and six order types are offered on MT5.

- MT5 provides a wider range of charting tools with 38 inbuilt indicators, 44 objects, and 21 timeframes. MT4 offers 30 technical indicators, 31 objects and 9 timeframes.

- MT4 only allows hedging, whereas hedging and netting are both permitted on MT5.

As well as the differences mentioned above, MT5 also offers improvements over MT4, such as an economic calendar, depth of market and an MQL5 trading community chat function.

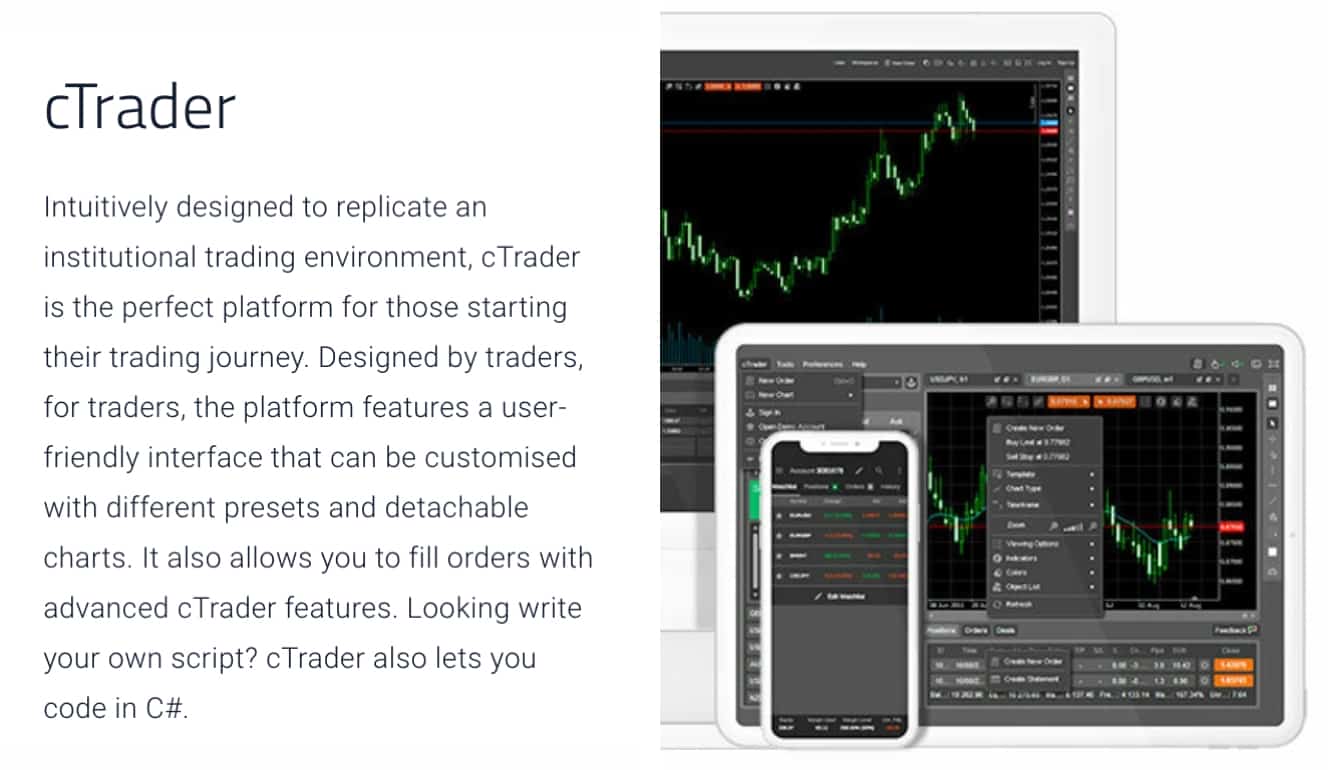

cTrader

Pepperstone’s Razor account holders can access cTrader, but the platform is not offered to XM customers. cTrader is a forex trading platform that provides an ECN-style trading environment with ultra-fast execution and institutional-grade pricing. cTrader features include:

- Extensive analysis tools with 70 inbuilt technical indicators and a range of objects and charts.

- Level 2 depth of market to provide traders with ECN-like pricing.

Like MetaTrader 4 and 5, algorithmic trading strategies can be executed on the cTrader platform. Instead of Expert Advisors, traders can develop cBots using the C# programming language that automatically monitors markets and enters/exits positions following the trader’s preset parameters.

Social Trading: Pepperstone vs XM

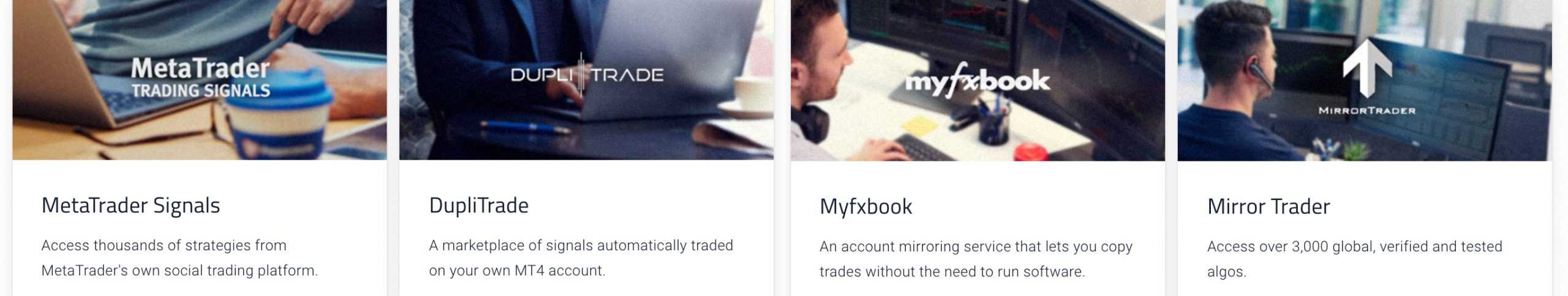

Pepperstone offers four different social-copy trading tools that customers can use to automate trading:

- Myfxbook

- DupliTrade

- Mirror Trader

- MetaTrader Signals

The account mirroring services allow you to copy and follow the trades of experienced investors, greatly reducing the time spent analysing markets and conducting research. This can be an excellent tool for beginner traders as it provides the opportunity to learn from seasoned traders and build confidence in forex trading. When searching for trading strategies to copy, most third-party providers allow you to filter traders by risk profile, location and asset classes being traded.

XM traders can access the broker’s free forex signals through the broker’s ‘Members Area’ online. Trading signals supported by XM’s expert traders and analysts can be easily copied into both MT4 and MT5, with 10 currency pairs covered daily.

XM traders can access the broker’s free forex signals through the broker’s ‘Members Area’ online. Trading signals supported by XM’s expert traders and analysts can be easily copied into both MT4 and MT5, with 10 currency pairs covered daily.

Verdict

With three trading platforms to choose from and multiple social-copy trading options, Pepperstone provides superior top forex trading software when compared to XM. As MetaTrader 5 offers certain benefits over MT4 and cTrader, such as multi-currency backtesting, a wider product range and MQL5 Expert Advisors, using MT5 with a Pepperstone Razor account is a great option for all traders regardless of trading strategy or experience.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Pepperstone: Superior Accounts And Features

Pepperstone and XM offer a choice of account types to choose from. As well as commission-free and ECN-style accounts, both brokers offer swap-free accounts suited to Islamic traders.

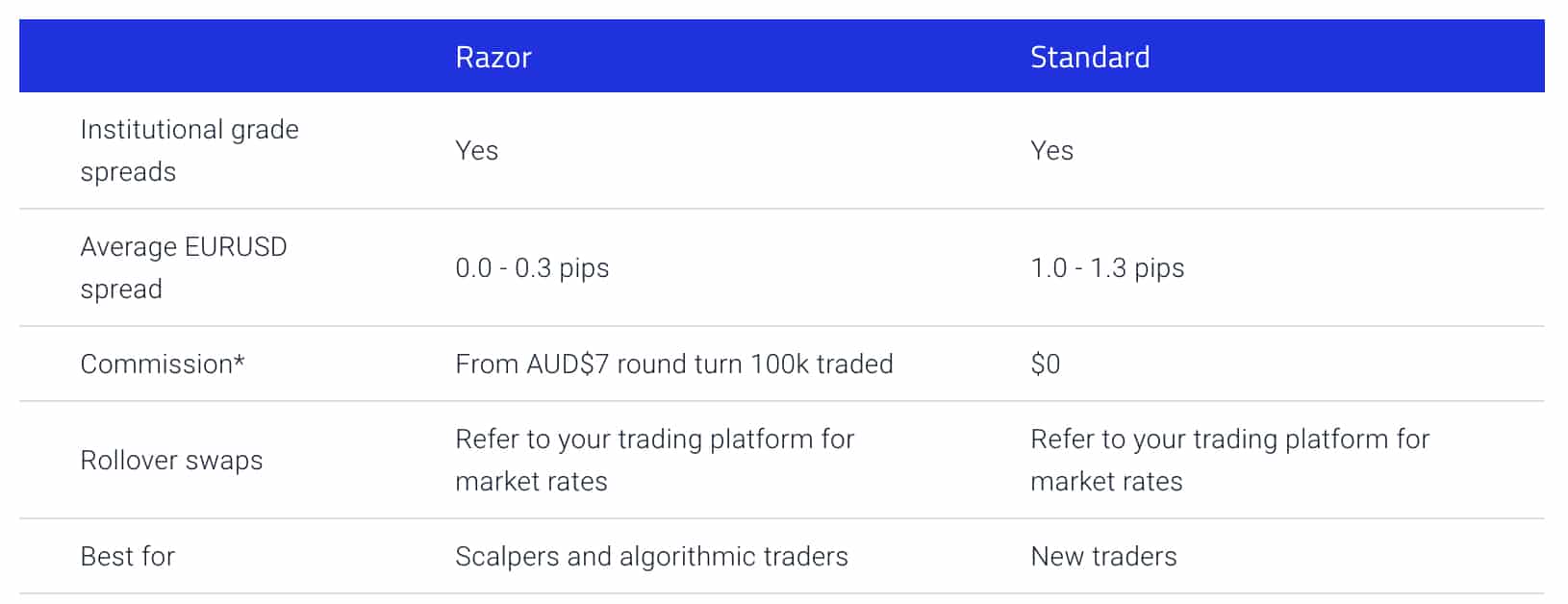

Pepperstone Account Types: Commission & No Commission Options

Pepperstone offers two account types. Standard account types are commission-free, while Razor accounts charge flat-rate commission fees yet provide ECN-like spreads. Account features that both Razor and Standard accounts offer include:

- Minimum trade size: 0.01 lots

- Maximum trade size: 100 lots

- Scalping and hedging permitted

- Leverage of up to 500:1 (SCB) or 30:1 (FCA, ASIC, CySEC)

- $200 minimum deposit to open an account, although Pepperstone tend to be flexible with initial deposit requirements

The main differences between the two account types are:

- Razor Account: Minimum spreads of 0.0 pips and round turn commission fees of $7

- Ideal for scalping, Expert Advisors and active traders

- Standard Account: Minimum spreads of 1.0 pips but no commission fees

- Suited to infrequent or beginner traders

XM Trading Account Types

XM offers four retail investor accounts for forex trading that features different contract sizes, minimum deposits, and minimum spreads. As shown below, all of XM’s account types are commission-free, apart from the broker’s ECN-style Zero Account.

| Micro Account | Standard Account | Ultra-Low Account | Zero Account | |

|---|---|---|---|---|

| Contract Size | 1 Lot = 1,000 | 1 Lot = 100,000 | Micro Ultra: 1 Lot = 1,000 Standard Ultra: 1 Lot = 1 Lot = 100,000 | 1 Lot = 100,000 |

| Minimum Spreads | 1.0 Pip | 1.0 Pip | 0.6 Pips | 0.0 Pips |

| Commission | ❌ | ❌ | ❌ | $7 roundturn |

| Minimum Lot Size | 0.01 Lots (MT4) 0.1 Lots (MT5) | 0.01 Lots | Micro Ultra: 0.01 Lots Standard Ultra: 0.1 Lots | 0.01 Lots |

| Maximum Lot Size per Trade | 100 Lots | 50 Lots | Micro Ultra: 50 Lots Standard Ultra: 100 Lots | 50 Lots |

| Minimum Deposit | $5 | $5 | $50 | $200 |

| Restrictions | None | None | Not available to EU or UK traders | UK and Europe only |

Traders wanting to practise trading with low volumes, have smaller account balances or require precise position sizes are well-suited to Micro Accounts, while Ultra-Low Accounts offer flexible features of both Micro and Standard Accounts, although a higher minimum deposit is required.

The availability of each account type depends on your location and the XM subsidiary you are trading with. Only traders based in Europe or the UK can sign up for Zero Accounts and are not able to register for Ultra Low Accounts.

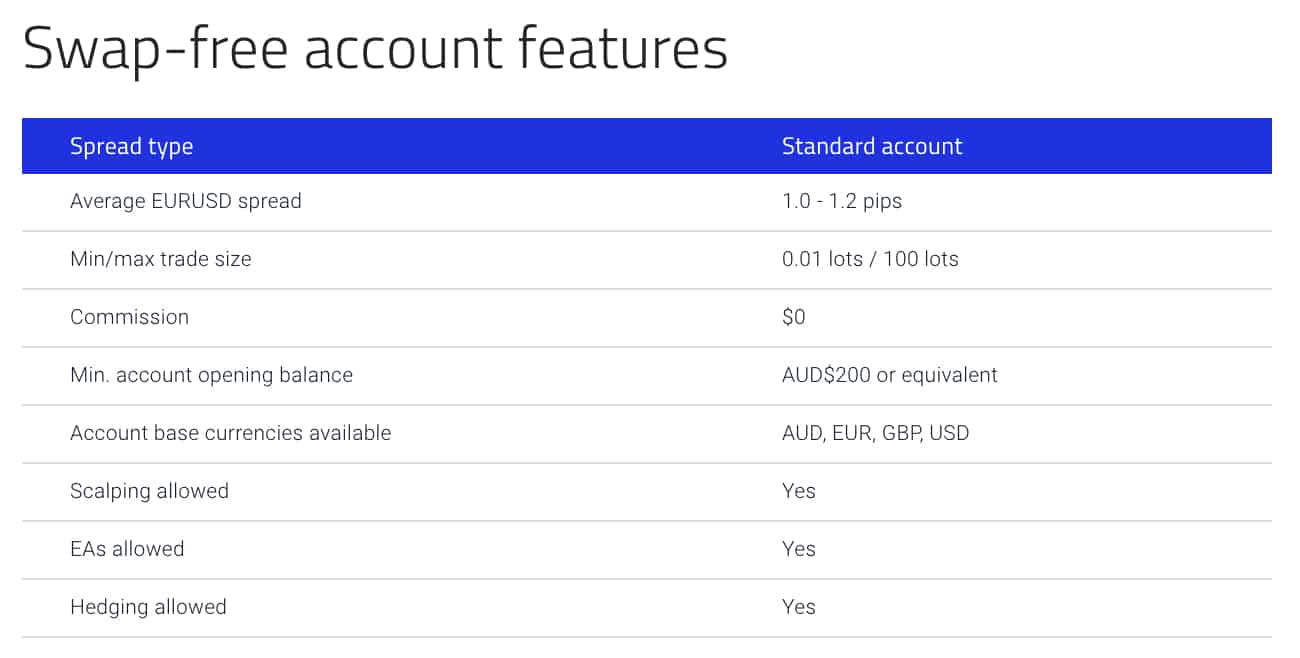

Swap Free Accounts

Pepperstone’s Swap-Free Account is similar to the broker’s Standard Account, except traders do not pay or receive swaps. Designed for those following Islamic finance practices, Swap Free account holders do not pay or receive interest-based overnight financing fees. As with the broker’s standard account, minimum spreads are as low as 1.0 pip and commission-free.

A limitation of Pepperstone’s Swap-Free Account is that you are restricted to four base currencies, being the USD, GBP, EUR or AUD. If those using Swap-Free Accounts keep a position open for longer than 10 days, traders will incur an admin charge that ranges between USD 1-50.

XM’s Islamic Accounts are offered to forex traders of the Islamic faith. With no swaps or overnight interest fees, the account type complies with Islamic finance practises where interest-based payments cannot be incurred or received. As well as imposing no hidden costs, XM does not widen spreads or charge fees for positions held open for longer periods.

XM’s Islamic Accounts are offered to forex traders of the Islamic faith. With no swaps or overnight interest fees, the account type complies with Islamic finance practises where interest-based payments cannot be incurred or received. As well as imposing no hidden costs, XM does not widen spreads or charge fees for positions held open for longer periods.

Leverage

When trading forex, the maximum leverage you can use depends on your broker’s financial jurisdiction and regulators.

If You Are An XM Trader, The Leverage Limits Are As Follows:

- XM’s Europe (CySEC) and Australia (ASIC): maximum leverage major currencies 30:1, minor and exotic currencies 20:1

- XM Dubai (DFSA): maximum leverage of 50:1

- XM Belize (IFSC): higher leverage of 888:1

As A Pepperstone Trader, You Will Be Offered The Following Maximum Leverage Limits:

- Pepperstone Australia (ASIC), UK (FCA), Europe (BaFin and CySEC) and Dubai (DFSA): maximum forex leverage of 30:1

- Pepperstone Kenya (CMA): maximum leverage 400:1

- Pepperstone the Bahamas (SCB): maximum leverage 500:1

| Pepperstone | XM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Verdict

Account features vary greatly between XM and Pepperstone accounts. XM’s minimum spreads are generally wider than Pepperstone’s. Plus, Pepperstone‘s Razor Account provides an ECN-trading environment suitable for active traders or algorithmic strategies and, therefore, the best account type for forex traders.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Pepperstone: Best Trading Experience And Ease

When it comes to trading experience and ease, both XM and Pepperstone have their strengths. We’ve spent countless hours testing and comparing these platforms, and here’s what we found:

- Pepperstone is recognised as the best MT4 broker, offering a seamless experience for traders who prefer this platform.

- For those who are into automation, Pepperstone stands out with its integration of Capitalise.ai.

- XM, on the other hand, offers a spread-only forex broker experience, which some traders might find more straightforward.

- Both brokers provide MT4 and MT5 platforms, but Pepperstone takes it a notch higher by also offering cTrader.

Now, if you’re like me and value a smooth, hassle-free trading experience, these details matter. Both brokers have their unique offerings, and the choice often boils down to personal preference and trading style.

Verdict

Based on our extensive testing, Pepperstone offers a slightly better overall trading experience.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Tie: Stronger Trust And Regulation

Pepperstone Trust Score

XM Trust Score

Both XM and Pepperstone are overseen by well-respected financial authorities that enforce differing regulations for online brokers. Trading CFDs and forex with a regulated broker ensures policies are in place to provide investors’ protection and can reduce the high risk of trading.

Both XM and Pepperstone are overseen by well-respected financial authorities that enforce differing regulations for online brokers. Trading CFDs and forex with a regulated broker ensures policies are in place to provide investors’ protection and can reduce the high risk of trading.

Pepperstone: Top-Tier Regulators

With oversight from the three major regulatory bodies around the world, Pepperstone is seen as one of the most trusted forex brokers.

- Australia: The Australian Securities and Investments Commission (ASIC)

- The United Kingdom: The Financial Conduct Authority (FCA)

- Germany: The Federal Financial Supervisory Authority of Germany (BaFin)

- Dubai: The Dubai Financial Services Authority (DFSA)

- Europe: The Cyprus Securities and Exchange Commission (CySEC)

- Kenya: The Capital Markets Authority (CMA)

- Global: The Securities Commission of the Bahamas (SCB)

While all regulators require brokers to segregate client funds from company funds, only those trading with the United Kingdom subsidiary will receive protection through the FCA’s Financial Services Compensation Scheme (FSCS). The FSCS protects clients in the case a broker becomes insolvent by providing compensation of up to £85,000. Additionally, the FCA, ASIC and CySEC enforce leverage caps of 30:1 for major currency pairs and 20:1 for minor and exotic fx pairs.

Pepperstone’s Dubai branch accepts residents of Dubai as well as certain Gulf states, while the FCA-regulated entity caters to European and UK traders. Most traders based elsewhere are able to register with the ASIC-regulated Pepperstone branch.

Multi-Regulated Forex Broker: XM

XM is regulated by multiple financial regulators, with clients protected through segregated funds in each of XM’s five different locations. Depending on where you reside, you can register with one of the following XM subsidiaries:

- The United Kingdom: FCA

- Australia: ASIC

- Dubai: DFSA

- Cyprus: The Cyprus Securities and Exchange Commission (CySEC)

- Belize: International Financial Services Commission (IFSC)

Like Pepperstone’s UK branch, XM traders’ account balances are protected through compensation schemes if they are based in the UK (FCA) or Europe (CySEC).

| Pepperstone | XM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSC-BZ |

Verdict

Both brokers are regulated by top-tier financial authorities in multiple locations and follow the regulations enforced in each jurisdiction. Although policies providing investors protection vary between subsidiaries, XM and Pepperstone are highly regulated and well-respected online brokers.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – XM

XM gets searched on Google more than Pepperstone. On average, XM sees around 723,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 84% fewer.

| Country | XM | Pepperstone |

|---|---|---|

| Thailand | 74,000 | 4,400 |

| United States | 74,000 | 4,400 |

| Japan | 74,000 | 480 |

| India | 60,500 | 2,900 |

| South Africa | 33,100 | 2,900 |

| Malaysia | 27,100 | 4,400 |

| Indonesia | 27,100 | 1,600 |

| Egypt | 22,200 | 390 |

| Vietnam | 18,100 | 720 |

| Brazil | 18,100 | 6,600 |

| Morocco | 18,100 | 720 |

| Colombia | 18,100 | 3,600 |

| Germany | 14,800 | 3,600 |

| France | 14,800 | 1,000 |

| Mexico | 14,800 | 3,600 |

| Pakistan | 12,100 | 1,300 |

| Philippines | 12,100 | 880 |

| Uzbekistan | 12,100 | 140 |

| Italy | 9,900 | 1,900 |

| Turkey | 9,900 | 1,600 |

| United Kingdom | 8,100 | 5,400 |

| Algeria | 8,100 | 390 |

| Cambodia | 6,600 | 320 |

| Spain | 5,400 | 1,900 |

| Canada | 5,400 | 720 |

| Kenya | 5,400 | 4,400 |

| Bangladesh | 5,400 | 390 |

| Peru | 5,400 | 1,600 |

| Taiwan | 5,400 | 1,000 |

| Singapore | 4,400 | 1,600 |

| Nigeria | 4,400 | 1,300 |

| Sri Lanka | 4,400 | 320 |

| Netherlands | 4,400 | 880 |

| Saudi Arabia | 4,400 | 260 |

| Ecuador | 4,400 | 1,000 |

| United Arab Emirates | 3,600 | 1,000 |

| Poland | 3,600 | 720 |

| Australia | 2,900 | 8,100 |

| Greece | 2,900 | 210 |

| Chile | 2,900 | 1,000 |

| Venezuela | 2,900 | 390 |

| Jordan | 2,900 | 260 |

| Switzerland | 2,400 | 320 |

| Argentina | 2,400 | 1,300 |

| Dominican Republic | 2,400 | 880 |

| Portugal | 1,900 | 480 |

| Cyprus | 1,900 | 480 |

| Ghana | 1,900 | 260 |

| Austria | 1,900 | 320 |

| Botswana | 1,900 | 390 |

| Mongolia | 1,600 | 1,900 |

| Bolivia | 1,600 | 1,300 |

| Hong Kong | 1,300 | 3,600 |

| Sweden | 1,300 | 390 |

| Ethiopia | 1,300 | 390 |

| Uganda | 1,000 | 390 |

| Costa Rica | 880 | 480 |

| Tanzania | 880 | 720 |

| Ireland | 590 | 260 |

| Panama | 590 | 320 |

| New Zealand | 480 | 170 |

| Mauritius | 260 | 110 |

2024 Monthly Searches For Each Brand

XM - Thailand

XM - Thailand

|

74,000

1st

|

Pepperstone - Thailand

Pepperstone - Thailand

|

4,400

2nd

|

XM - Japan

XM - Japan

|

74,000

3rd

|

Pepperstone - Japan

Pepperstone - Japan

|

480

4th

|

XM - India

XM - India

|

60,500

5th

|

Pepperstone - India

Pepperstone - India

|

2,900

6th

|

XM - Malaysia

XM - Malaysia

|

27,100

7th

|

Pepperstone - Malaysia

Pepperstone - Malaysia

|

4,400

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with XM receiving 15,630,000 visits vs. 1,273,000 for Pepperstone.

Verdict

XM is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

7. Tie: Top Product Range And CFD Markets

In addition to forex trading, both XM and Pepperstone offer a range of asset classes and CFDs that customers can trade. As MT4 and cTrader are forex platforms, both Pepperstone and XM’s Share CFDs are only available when using MetaTrader 5.

Market Access: Pepperstone

Pepperstone clients gain access to over 150 financial instruments derived from five different asset classes:

- Forex: Over 92 forex pairs as well as a currency index CFD (US dollar index)

- Indices: 14+ stock market indices with no commission fees

- Commodities: Gold, silver, gas, oil and soft commodity CFDs.

- Cryptocurrencies(not in the UK): Bitcoin, Ethereum, Dash Litecoin and Bitcoin Cash CFDs

- Share CFDs: 64 CFDs derived from major, top-quality stocks.

Those trading forexes and CFDs with Pepperstone’s UK subsidiary should note that cryptocurrency trading is no longer available to retail traders due to recent changes in FCA regulation.

XM’s CFDs

XM offers a greater range of CFDs with thousands of different products available, yet they do not offer any Cryptocurrency CFDs, which is a major weakness.

- Forex: Over 55 major, minor and exotic currency pairs

- Indices: Cash and future stock indices from major global exchanges.

- Commodities: Soft, energy and precious metal commodity CFD products.

- Share CFDs: Over 1,100 different share CFDs from 18 different countries.

Verdict

Unlike XM, Pepperstone offers Cryptocurrency trading, yet on the other hand, XM offers a much wider range of Share CFDs. As the two brokers offer similar asset classes and the number of currency pairs, XM and Pepperstone tie in regards to the CFD product range.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

8. XM: Superior Educational Resources

XM:

- Offers a comprehensive range of educational materials.

- Provides webinars and seminars for traders of all levels.

- Features a dedicated learning centre with video tutorials.

- Includes articles and daily news updates for market insights.

- Has a user-friendly platform with interactive charts and tools.

- Provides a demo account for practice and learning.

Pepperstone:

- Boasts an extensive library of educational content.

- Conducts regular webinars and workshops for traders.

- Features in-depth video tutorials and courses.

- Offers market analysis and daily news updates.

- Provides a user-friendly platform with advanced charting tools.

- Offers a demo account for hands-on learning.

Verdict

Based on our team’s testing, XM offers the best educational resources with a score of 8.5, closely followed by Pepperstone with a score of 8.0.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

9. Pepperstone: Superior Customer Service

XM and Pepperstone offer multiple contact methods, along with research and educational materials, to assist traders. Whether you are new to forex trading or want to develop your advanced analysis skills, both brokers provide a range of resources ranging from webinars to economic calendars.

Award-Winning Customer Support: Pepperstone

Pepperstone offers award-winning customer support via live chat, phone and email. Pepperstone responds to email queries within 24 hours, while phone and live chat contact methods are available 24 hours a day, 5 days a week.

The online broker is well known for its excellent trading support, receiving the following awards for their customer service:

- Best Client Relationship Manager Service, 2019 Professional Trader Awards

- Best Forex Trading Support, Global Forex Awards 2019

- Best Forex Trading Support, UK Forex Awards 2018

- #1 for Customer Service, Australia FX Report

Customer Support: XM

XM offers multilingual customer service with live chat, phone and email contact methods available. Unfortunately, while assistance is available 24/5, XM is known for poor customer service, with long response times and irrelevant answers.

Education And Research: Pepperstone

When trading with Pepperstone, customers gain access to a library of educational resources suited to both beginner and experienced traders. Articles, webinars and tutorials cover topics such as the basics of forex trading, technical analysis, Expert Advisors and trading strategy development. Upcoming webinars can be found on the broker’s website, with past webinars available to watch anytime. For those wanting to build confidence trading on MetaTrader 4, an extensive trading platform tutorial is also available.

As well as educational materials, Pepperstone clients can utilise a range of research tools to enhance their forex knowledge and develop strategies. The broker’s research and analysis tools include:

- Trading ideas via Autochartist

- Newsfeed and market analysis with reporting from Pepperstone’s in-house expert research team

- Advanced charting tools are built into all trading platforms offered by Pepperstone

Research And Education: XM

XM offers a free educational course that explains the basics of forex trading with a focus on fundamental and technical analysis. Like Pepperstone, tutorials are available in addition to live webinars that are hosted by industry experts.

A detailed economic calendar and newsfeed can be used to research financial markets, yet overall, XM’s fundamental research tools are limited.

Verdict

With award-winning customer support, comprehensive educational resources and strong research tools, Pepperstone provides the best customer support when compared to XM. All contact methods gain efficient responses, while XM suffers a reputation for poor and slow support.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

10. Pepperstone: Better Funding Options

Pepperstone and XM both offer traditional and e-wallet payment methods. Please note that the availability of the below funding options varies depending on your location and the subsidiary you are trading with.

Account Funding: Pepperstone

When opening a Pepperstone account, you can choose AUD, NZD, SGD, HKD, JPY, USD, EUR, CAD, CHF or GBP as your trading account base currency.

To fund your account, Pepperstone provides a wide range of fee-free deposit options such as:

- Debit and credit card: Visa, Mastercard, UnionPay

- Neteller, Skrill, POLi, BPay and PayPal

- Bank transfer (approx $20 fee for international transfers)

When withdrawing funds from your account, Pepperstone will return the funds to your nominated bank account within 3-5 days.

Account Funding: XM

Base currencies available depend on the XM account type you are signed up to, with Zero accounts restricted to fewer options:

- Micro and Standard Accounts: AUD, USD, EUR, GBP, CHF, JPY, RUB, PLN or HUF

- Ultra-Low Account: AUD, GBP, EUR, USD, CHF, HUF or PLN

- Zero Account: EUR, USD or JPY

Depending on the subsidiary you are signed up to and the location you are trading from, XM offers the following deposit options:

- Debit and credit card: UnionPay, Visa, Mastercard

- Skrill, Neteller, Sofort, CashU, Przelewy 24, Bitcoin

- Bank transfer

All deposit methods are fee-free unless you transfer less than $200 via bank transfer, where a $20 fee will apply. When making a withdrawal, XM will return the funds via the same method as the funds were deposited. I.e. if you make deposits via Skrill, funds can only be returned to your Skrill account.

All deposit methods are fee-free unless you transfer less than $200 via bank transfer, where a $20 fee will apply. When making a withdrawal, XM will return the funds via the same method as the funds were deposited. I.e. if you make deposits via Skrill, funds can only be returned to your Skrill account.

Verdict

With no deposit and withdrawal fees and e-wallet funding methods such as PayPal, Skrill and BPay, Pepperstone provides the best payment options when compared to XM. XM charges fees when small amounts are transferred via bank wire, whereas Pepperstone clients incur no such withdrawal fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Pepperstone: Lower Minimum Deposit

Pepperstone has a lower minimum deposit of $0 compared to XM which has $5. The truth is, both minimum deposits are generous with some forex brokers requiring over $1,000 to open an account. It’s worth noting that Pepperstone recommends depositing $200 which is reasonable as all accounts have a margin call. This means that when a balance is low, the broker will automatically close the account.

Here are the requirements of XM and Pepperstone minimum deposit and recommended deposit requirements.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| XM | $5 | $5 |

Verdict

Pepperstone the lower minimum deposit requirement but teh truth is XM is also low. With both brokers so close, this shouldn’t be a factor when deciding which broker is best.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

So is Pepperstone or XM The Best Broker?

Pepperstone is the winner because of its comprehensive features, superior trading platforms and more flexible deposit options.

The table below summarises the key information leading to this verdict:

| Criteria | Pepperstone | XM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

XM: Best For Beginner Traders

XM is better suited for beginner traders due to its lower minimum deposit and comprehensive educational resources.

Pepperstone: Best For Experienced Traders

Pepperstone stands out as the top choice for experienced traders because of its advanced trading platforms and broader product range.

FAQs Comparing XM Vs Pepperstone

Does Pepperstone or XM Have Lower Costs?

Pepperstone generally offers lower costs compared to XM. They have been recognised for their competitive spreads and low commissions. For instance, their Razor account boasts ultra-tight spreads. For a detailed comparison on spreads, you can check out this guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and XM offer MetaTrader 4, but Pepperstone is often recognised as the best MT4 broker. They provide a seamless experience with advanced tools and features. For traders who are keen on using MT4, this list of the best MT4 brokers can offer more insights.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to copy strategies from experienced traders. This feature is beneficial for those who prefer a more hands-off approach or are new to trading. If you’re interested in exploring more about social trading platforms, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for its UK clients. This form of trading allows traders to bet on the direction of a financial market without owning the underlying asset. If you’re keen on exploring spread betting further, especially on the MT4 platform, this guide on the best MT4 spread betting brokers can be quite insightful.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it was also founded in Australia, ensuring a deep understanding of the local market. Their platform offers a seamless trading experience, and their commitment to transparency is commendable. For a broader perspective on Australian forex brokers, you might want to check out this comprehensive list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe Pepperstone has the edge. They are FCA regulated, ensuring a high level of trust and security for UK traders. While XM is also a strong contender in the market, Pepperstone’s deep commitment to providing top-notch services and platforms makes them stand out. If you’re a UK trader looking for more insights, this guide on the Best Forex Brokers In UK can offer a broader perspective.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Can i spread bet with Pepperstone and FXCM?

Yes but only if you are in the UK and are using their UK subsidiaries. You cannot spread bet outside the UK.