Blueberry Markets vs AvaTrade 2025

Our Blueberry Markets vs. AvaTrade review compares trading costs, platforms, account types, and support. Blueberry Markets offers tight spreads and metaTrader, while AvaTrade excels with diverse platforms and risk management tools. In this comparison, AvaTrade takes the lead.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 17:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors you need to know.

- AvaTrade stands out with its proprietary social and copy trading platform, AvaSocial.

- AvaTrade hands out superior educational resources for traders.

- Both brokers offer MetaTrader 4 and 5, but provide access to either cTrader or TradingView.

1. Lowest Spreads And Fees – AvaTrade

Blueberry Markets and AvaTrade offer competitive features and platforms, catering to diverse trader needs. Blueberry Markets stands out with its RAW account providing spreads from 0.0 pips, charging a $3.50 commission. meanwhile, AvaTrade operates on a commission-free model but delivers tighter spreads on its standard account, such as 0.9 pips for EUR/USD. Both require a minimum deposit of $100 and waive inactivity fees, ensuring accessibility for traders. Their extensive funding methods and no-fee policies enhance the funding experience, while AvaTrade provides broader market instruments and CFDs than Blueberry Markets, appealing to advanced traders.

Spreads

Blueberry Markets and AvaTrade present competitive spreads, tailored to different trader preferences. Blueberry markets offer RAW accounts with spreads starting as low as 0.0 pips, ideal for traders seeking cost-effectiveness in high-volume trading. Its standard account spreads for EUR/USD are at 1.2 pips. Avatrade, on the other hand, features tighter standard spreads, such as 0.9 pips for EUR/USD, which can be advantageous for traders prioritising a commission-free structure. while Blueberry markets provide flexibility through RAW spreads, AvaTrader’s tighter standard spreads shine for simplicity. These options ensure traders can choose a broker aligning with their unique strategies and cost preferences.

| Standard Account | Blueberry Markets Spreads | AvaTrade Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.53 | 1.36 | 1.7 |

| EUR/USD | 1.2 | 0.8 | 1.2 |

| USD/JPY | 1.5 | 1.3 | 1.4 |

| GBP/USD | 1.4 | 1.2 | 1.5 |

| AUD/USD | 1.5 | 0.9 | 1.5 |

| USD/CAD | 1.5 | 1.8 | 1.9 |

| EUR/GBP | 1.3 | 1.2 | 1.5 |

| EUR/JPY | 2 | 1.8 | 1.9 |

| AUD/JPY | 1.8 | 1.9 | 2.2 |

We have created a fee calculator below to help you understand how lower spreads affect trading costs. You can select your base currency, trading size, and currency pair to see the resulting fee.

Commission Levels

Blueberry Markets distinguishes itself with its RAW account, charging $3.50 per lot as a commission. This structure benefits high-volume traders who value low spreads combined with predictable costs. Alternatively, its standard account is commission-free, offering flexibility for cost-conscious users. AvaTrade simplifies pricing with a fully commission-free model across all accounts. while this may appeal to traders seeking straightforward cost structures, slightly higher spreads could impact overall trading costs. Blueberry Markets, with its dual m model, accommodates traders preferring precision and choice, whereas AvaTrade’s simplicity suits those who prioritise hassle-free fee setups.

Standard Account Fees

Blueberry Markets and AvaTrade keep minimum deposits reasonable at $100, offering affordability for beginner traders. neither broker imposes inactivity fees, making it easier for users to maintain accounts even during low-activity periods. Blueberry Markets provides added versatility through its dual account types, catering to flexible trading strategies. AvaTrade counters with competitive spreads on its standard accounts, appealing to cost-conscious traders who value simplicity in pricing. While both offer accessible energy points, Blueberry Markets’ approach to supporting diverse trading styles provides a compelling advantage for traders seeking versatility.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.20 | 1.10 | 1.70 | 1.20 | 1.60 |

| 0.80 | 0.90 | 1.20 | 1.20 | 1.30 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Blueberry Markets leads with flexibility and RAW spread options for cost-efficient trading, while AvaTrade excels with fixed spreads and a broader CFD product range. Both provide excellent platforms, eand nsure a seamless trading experience for users. Ultimately, the choice depends on a trader’s priorities, cost-focused and flexible trading with Blueberry Markets or commission-free, broader product access with AvaTrade

Our Lowest Spreads and Fees Verdict

AvaTrade wins in this segment due to the lowest spreads and fees.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

2. Better Trading Platforms – AvaTrade

Blueberry Markets and AvaTrade offer robust trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are celebrated for their advanced charting tools, automated trading capabilities, and customisable interfaces. AvaTrade takes the lead with its proprietary platform and Avasocial, a dedicated social and copy trading tool that allows traders to follow and replicate strategies from experienced professionals. Blueberry Markets, while lacking a proprietary platform, supports copy trading through MT4 and MT5. Both provide VPS services and essential trading tools like economic calendar and market analysis, ensuring a seamless trading experience for users.

| Trading Platform | Blueberry Markets | AvaTrade |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

Both provide access to MT4 and MT5, offering traders advanced charting, algorithmic trading, and a user-friendly interface. These platforms cater to both beginners and experienced traders, ensuring versatility and efficiency.

Advanced Platforms

Neither broker offers cTrader, but AvaTrade includes TradingVies, a powerful tool for social networking and data analysis. Blueberry Markets lacks TradingView but compensates with its focus on MT4 and MT5, which are industry benchmarks for trading.

Copy Trading

AvaTrade excels with AvaSocial, a proprietary platform for social and copy trading, enabling users to follow and replicate trades from seasoned traders. Blueberry Markets supports copy trading through MT4 and MT5 but lacks a dedicated social trading platform.

AvaTrade shines in this segment with its proprietary platform and AvaSocial, o offering a more comprehensive trading experience for users seeking advanced tools and social trading capabilities. Blueberry Markets remains competitive with its strong reliance on MT4 and MT5, catering to traders who prioritise these industry-standard platforms. Both contribute significantly to the trading industry, but AvaTrade’s innovative features and proprietary tools give it a clear edge.

Our Better Trading Platform Verdict

AvaTrade is highly regarded in this niche due to its superior trading platforms.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

3. Superior Accounts And Features – AvaTrade

Blueberry Markets and AvaTrade shine with diverse account offerings tailored to suit different trader needs. Blueberry Markets provides two account types:

- Standard – with no commission and spreads from 1.0 pips.

- RAW – delivering ultra-tight spreads from 0.0 pips with a $7 per lot commission.

AvaTrade offers a standard account with competitive fixed spreads starting at 0.9 pips, as well as a professional account for experienced traders, enabling lower spreads and higher leverage. Both provide SWAP-free accounts to accommodate diverse trading preferences, making them valuable contenders for traders of varying skill levels and requirements.

Blueberry Markets focuses on flexibility with its dual-account structure. The Standard account is commission-free, making it ideal for beginners and casual traders seeking simplicity. The RAW account, with tighter spreads from 0.0 pips, appeals to active and high-volume traders willing to pay a $7 commission per lot for cost-efficient trading. AvaTrade differentiated itself with its fixed spreads starting from 0.9 pips, offering predictable trading costs. Its professional account caters specifically to experienced traders, featuring lower spreads and enhanced leverage options. Together, these brokers contribute significantly to meeting the needs of both novice and expert traders with tailored solutions.

| Blackbull Markets | AvaTrade | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

AvaTrade leads in this segment by providing competitive fixed spreads and a professional account designed for seasoned trders, making it highly suitable for advanced trading strategies. Blueberry Markets offers remarkable flexibility with its two account types, ensuring accessibility for traders across experience levels. Both bring value to the forex trading industry, but AvaTrade stands out for its focus on experienced traders, complemented by competitive and predictable pricing structures.

Our Superior Accounts and Features Verdict

AvaTrade excels highly with their superior accounts and features.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

4. Best Trading Experience – Blueberry Markets

Blueberry Markets and AvaTrade deliver strong trading experiences, catering to distinct trader preferences. Blueberry Markets offers access to cTrader, a highly intuitive platform with advanced order capabilities, ensuring precision for active traders. It also boasts limit and market order speeds of 82ms and 90ms, respectively, underscoring its focus on fast execution. AvaTrade, while lacking cTrader, compensates with TradingView’s powerful tool for social networking and data analysis. This platform appeals to traders seeking community engagement and enriched insights, making the competition between these brokers tight but favourably geared towards different needs.

Blueberry Markets excels in execution speed and innovation, providing tools like cTrader that enhance user control, transparency, and intuitive trading experiences. Its rapid order execution speeds (limit: 82ms; market: 90ms) offer reliability for high-frequency traders needing swift transactions. AvaTrade differentiates itself by focusing on community-driven analysis with TradingView, a favoured tool among traders seeking real-time collaboration and technical data exploration. Both integrate VPS services for uninterrupted algorithmic trading and practical features like economic calendars, making them valuable for strategy-focused users. While Blueberry markets supports intuitive execution, AvaTrade emphasises social integration for robust analytical depth.

- Blueberry Markets: Limit Order Speed 82 ms

- Blueberry Markets: Market Order Speed 90 ms

- AvaTrade: Limit Order Speed N/A

- AvaTrade: Market Order Speed N/A

Blueberry Markets leads in delivering precise and intuitive trading experiences, thanks to cTrader and impressive execution speeds. AvaTrade stands out with TradingView integration, appealing to traders focused on data analysis and social connections. Both offer essential tools to elevate trading strategies, but cater to different styles- speed and precision for Blueberry Markets versus community-driven insights for AvaTrade. Their contributions collectively shape the trading industry, ensuring users can achieve their goals effectively. However, Blueberry Markets’ Technological edge positions it slightly ahead for performance-driven trading.

Our Best Trading Experience and Ease Verdict

Due to having cTrader and lightning-fast execution speeds, Blueberry Markets wins in this section due to its best trading experience and ease.

5. Stronger Trust And Regulation – AvaTrade

Blueberry Markets and AvaTrade ensure trader trust through regulation by reputable authorities. Blueberry Markets is regulated by ASIC (Australia) and VFSC (Vanuatu), offering adequate oversight. AvaTrade stands out with broader regulatory coverage across multiple entities, including the Central Bank of Ireland, KNF (Poland), FSCA (South Africa), and ADGM FSRA (UAE). Its presence in top-tier jurisdictions provides added security, making AvaTrade the preferred choice for traders who prioritise stringent compliance and reliability.

Without any doubt, AvaTrade takes the lead here due to its high trust score of 72 compared to Blueberry Markets’ 28.

AvaTrade Trust Score

Blueberry Markets Trust Score

1. Regulation

AvaTrade builds its strong reputation with regulation from globally recognised entities, including ASIC, JFSA (Japan), and CBI (Ireland), ensuring robust oversight. Its reach across major regions like Europe, Africa, and the Middle East appeals to international traders. In comparison, Blueberry Markets relies on ASIC and VFSC regulations, providing limited global coverage. While both brokers ensure compliance and secure environments for trading, AvaTrade’s extensive regulatory network instills higher confidence in its ability to maintain industry-leading standards. Traders seeking peace of mind and added protection benefit greatly from AvaTrade’s stringent regulatory framework.

AvaTrade, on the other hand, is regulated by several entities including:

- AVA Trade EU Ltd – Europe, Central Bank of Ireland

- AVA Trade EU Ltd – Poland, Polish Financial Supervision Authority (KNF)

- Ava Capital Markets Australia Pty Ltd – Australia, Australian Securities and Investments Commission (ASIC)

- Ava Trade Japan K.K – Japan, FSA and the FFA

- Ava Capital Markets Pty Ltd – Financial Sector Conduct Authority (FSCA) South Africa, FSB

- Ava Trade Ltd – International, British Virgin Islands Financial Services Commission

- AvaTrade Middle East Ltd Abu Dhabi Global Market Financial Services Regulatory Authorities (ADGM FSRA)

| Blueberry Markets | AvaTrade | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) | ASIC (Australia) CIRO (CANADA) CYSEC (Cyprus) |

| Tier 2 Regulation | ADGM (UAE) ISA (Israel) JFSA (Japan) CBI KNF (Poland) | |

| Tier 3 Regulation | SVG-FSA | FSC- BVI FSCA (South Africa) |

AvaTrade excels in this segment due to its broad regulatory reach, appealing to traders who value security and global oversight. Blueberry Markets remains reliable but falls short in terms of international presence and tier 1 regulatory coverage. Both contribute meaningfully to fostering trust in the forex industry, yet AvaTrade’s widespread regulation and higher trust score (77 vs. 31) solidify its leadership in this category.

2. Reputation

AvaTrade gets searched on Google more than Blueberry Markets. On average, AvaTrade sees around 90,500 branded searches each month, while Blueberry Markets gets about 22,200 — that’s 55% fewer. Similarweb shows a similar story when it comes to February 2024 website visits with AvaTrade receiving 713,000 visits vs. 265,000 for Blueberry Markets.

| Country | Blueberry Markets | AvaTrade |

|---|---|---|

| South Africa | 480 | 8,100 |

| Italy | 320 | 5,400 |

| United Kingdom | 1,900 | 4,400 |

| France | 1,600 | 4,400 |

| India | 880 | 3,600 |

| Germany | 1,000 | 2,900 |

| Spain | 320 | 2,900 |

| United States | 1,300 | 2,900 |

| Canada | 1,900 | 2,900 |

| United Arab Emirates | 170 | 2,900 |

| Nigeria | 480 | 1,900 |

| Malaysia | 480 | 1,600 |

| Netherlands | 320 | 1,300 |

| Poland | 110 | 1,300 |

| Australia | 1,000 | 1,300 |

| Singapore | 480 | 1,300 |

| Mexico | 90 | 1,300 |

| Mongolia | 10 | 1,300 |

| Pakistan | 320 | 1,000 |

| Colombia | 170 | 1,000 |

| Turkey | 210 | 880 |

| Brazil | 210 | 880 |

| Indonesia | 320 | 880 |

| Ireland | 90 | 720 |

| Japan | 70 | 720 |

| Vietnam | 260 | 720 |

| Portugal | 110 | 590 |

| Switzerland | 170 | 590 |

| Philippines | 590 | 590 |

| Sweden | 140 | 590 |

| Kenya | 110 | 590 |

| Morocco | 210 | 590 |

| Thailand | 110 | 480 |

| Egypt | 70 | 480 |

| Argentina | 50 | 480 |

| Peru | 30 | 480 |

| Greece | 50 | 390 |

| Saudi Arabia | 50 | 390 |

| Algeria | 70 | 390 |

| Chile | 20 | 390 |

| Venezuela | 30 | 390 |

| Austria | 170 | 320 |

| Cyprus | 50 | 320 |

| Hong Kong | 70 | 320 |

| Ghana | 70 | 320 |

| Bangladesh | 170 | 320 |

| Sri Lanka | 50 | 320 |

| Ecuador | 30 | 320 |

| Tanzania | 40 | 260 |

| Jordan | 20 | 260 |

| Uganda | 50 | 260 |

| Botswana | 50 | 260 |

| Taiwan | 30 | 210 |

| Uzbekistan | 70 | 210 |

| Dominican Republic | 50 | 210 |

| Cambodia | 20 | 140 |

| Bolivia | 10 | 140 |

| Ethiopia | 30 | 110 |

| Costa Rica | 10 | 90 |

| Mauritius | 20 | 90 |

| Panama | 10 | 90 |

| New Zealand | 260 | 70 |

480 1st | |

8,100 2nd | |

1,900 3rd | |

4,400 4th | |

1,600 5th | |

4,400 6th | |

170 7th | |

2,900 8th |

3. Reviews

As shown below, Blueberry Markets has a TrustPilot score of 4.7/5.0 based on about 3,000 reviews. On the other hand, AvaTrade has the same score of 4.7/5.0 but significantly higher reviews for about 10,700.

Our Stronger Trust and Regulation Verdict

Due to its diverse oversight, AvaTrade comes out on top for having stronger trust and regulation.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

6. CFD Product Range And Financial Markets – AvaTrade

Blueberry Markets and AvaTrade offer a diverse range of CFDs and trading instruments, catering to various trader preferences. AvaTrade leads with a wider selection of forex pairs (55 vs. 38), indices (33 vs. 19), and an extensive range of commodities, cryptocurrencies, and innovative offerings such as bonds and futures. Blueberry Markets, however, stands out with its rich ETF variety (140 vs. 59) and share CFEDs (300+), providing unique options for equity-focused traders. This competition showcases the strength of each broker in catering to different trading strategies, with AvaTrade favouring advanced instruments and Blueberry Markets emphasising ETF and equity flexibility.

| CFDs | Blueberry Markets | AvaTrade |

|---|---|---|

| Forex Pairs | 38 | 55 |

| Indices | 19 | 33 |

| Commodities | 9 Metals (Gold x 7 Currencies) (Silver x 6 Currencies) 3 Energies | 5 Metals 5 Energies 7 Softs |

| Cryptocurrencies | 10 | 17 (+ Crypto10 Index) |

| Share CFDs | 300+ | No |

| ETFs | 140 | 59 |

| Bonds | No | 2 |

| Futures | No | Yes |

| Treasuries | No | 2 |

| Investments | No | Yes |

AvaTrade impresses with its well-rounded market coverage, offering bonds, futures, and treasuries that cater to traders seeking broader diversification opportunities. Its Crypto10 Index and 17 cryptocurrencies provide excellent options for those exploring digital assets. on the other hand, Blueberry Markets emphasises EFTs and shares CFDs, catering to long-term investors and equity traders. AvaTrade’s edge in commodities (122 products, including soft) and indices ensures comprehensive market access for tactical trading strategies. Both cater to traders with varying needs- AvaTrade for advanced instruments and diversity, and Blueberry Markets for equity-centric portfolios and ETF flexibility.

AvaTrade dominates in this segment by delivering a vast range of trading options, including innovative instruments like bonds and futures, paired with substantial forex and index offerings. Blueberry Markets complements with strong ETF and Share CFD portfolios, appealing to traders focused on equities and long-term strategies. Both significantly enhance the trading industry with their diverse offerings, but AvaTrade stands out for its breadth and ability to accommodate traders aiming for well-rounded market exposure and advanced opportunities.

Our Top Product Range and CFD Markets Verdict

Thanks to their comprehensive range of trading instruments, AvaTrade ranks the best due to its top product range and CFD markets.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

7. Superior Educational Resources – AvaTrade

Blueberry Markets and AvaTrade provide educational resources, but their depth and focus vary. Blueberry Markets offers webinars and tutorials, targeting beginners and traders looking for foundational knowledge. AvaTrade steps up with a richer suite, featuring eBooks, webinars, tutorials and detailed market analysis, creating a more advanced and diverse learning environment. Both aim to empower traders, but AvaTrade’s expansive materials give it an edge for those keen on holistic learning.

- Blueberry: Webinars

- Blueberry: Tutorials

- AvaTrade: Webinars

- AvaTrade: Tutorials

- AvaTrade: eBooks

- AvaTrade: Market Analysis

Blueberry Markets focuses on delivering practical knowledge through straightforward webinars and tutorials. While effective for building basic skills, these resources are less diverse in comparison. AvaTrade enhances the learning journey with eBooks that delve into forex concepts, webinars covering evolving strategies and actionable market analysis, appealing to traders aiming for continuous skill improvement. Both include structured content, but AvaTrader’s detailed, comprehensive approach ensures better support for traders seeking to elevate their expertise across multiple trading strategies.

AvaTrade leads with superior educational resources, making it a top choice for traders who prioritise learning and growth. Blueberry Markets provides essential learning tools, perfect for beginners seeking a straightforward start. However, AvaTrade goes beyond the basics, offering diverse, insightful materials catering to novice and experienced traders. These brokers foster education in forex trading, but AvaTrade’s holistic offerings position it as the clear winner in this category.

Our Superior Educational Resources Verdict

AvaTrade dominates this part for having superior educational resources.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

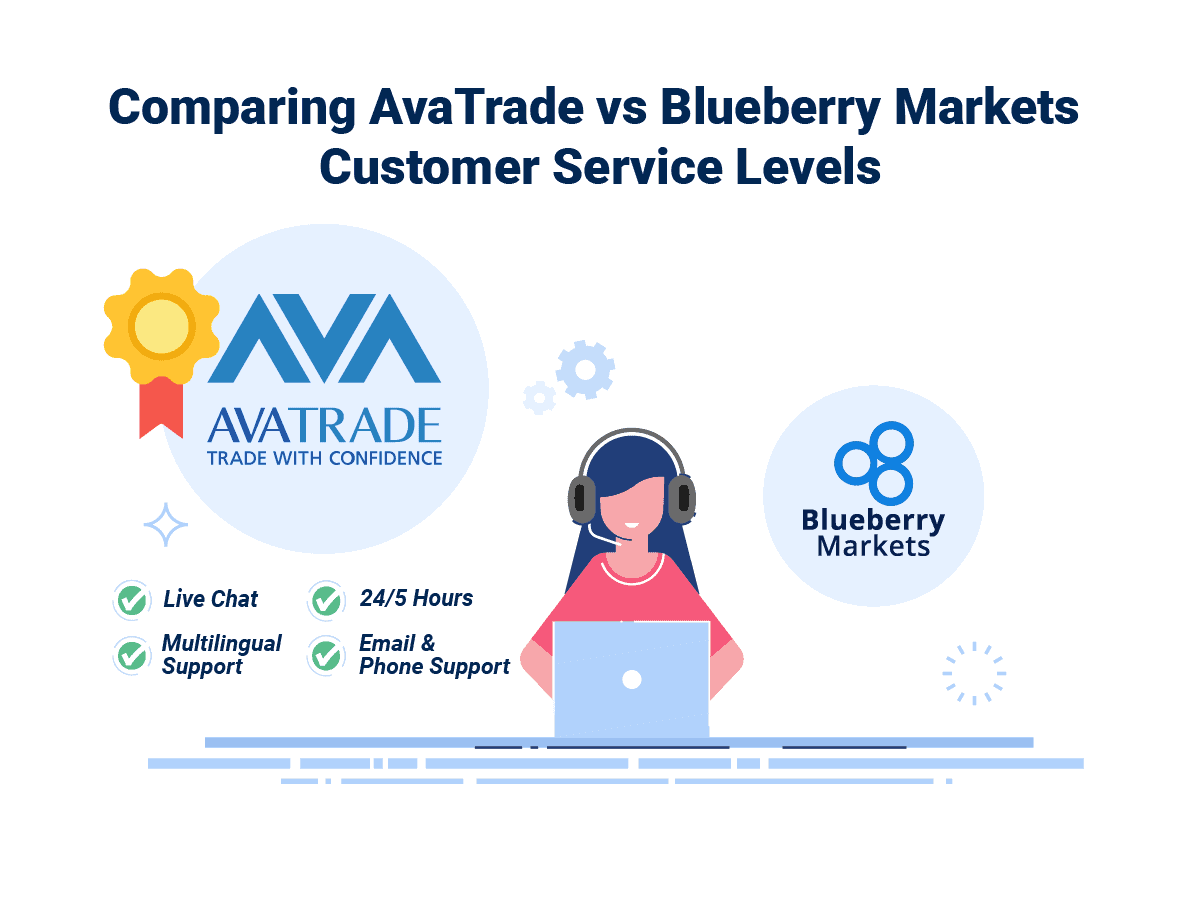

8. Better Customer Service – AvaTrade

Blueberry Markets and AvaTrade are committed to delivering top-notch customer service to support traders effectively. AvaTrade takes the lead with 24/7 multilingual support, offering constant accessibility worldwide. This ensures traders can seek guidance and resolve issues without time constraints. Blueberry Markets, while offering 24/7 live chat and support through automated systems and chatbots, falls short in personal responsiveness compared to AvaTrade’s human-centric approach. Both provide email and phone support, enhancing convenience, but AvaTrade’s global and continuous support system makes it a more reliable choice.

AvaTrade excels in accessibility with its round-the-clock customer support services. Traders benefit from multilingual assistance, addressing a diverse clientele’s needs seamlessly. The availability of live agents ensures a more personal, human touch in problem-solving and guidance. Blueberry Markets shines with its live chat, supported by automated systems and chatbots that streamline basic queries effectively. However, its reliance on these automated services limits the human interaction that experienced traders often prefer. While both prioritise accessibility, AvaTrade’s robust 24/7 and multilingual team gives traders confidence and trust in resolving challenges effectively at any time.

| Feature | Blueberry Markets | AvaTrade |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 16/5 |

| Multilingual Support | Yes | Yes |

AvaTrade stands out as the winner in customer service due to its comprehensive 24/7 support structure and multilingual capabilities. This accessibility fosters stronger relationships with global traders, making it highly competitive in the forex industry. Blueberry Markets, with its efficient live chat and automated systems, ensures prompt responses but lacks the depth of human-centric support available through AvaTrade. Both contribute to elevating the trading experience, yet AvaTrade’s advanced support options position it as the more versatile and reliable choice for traders seeking continuous, responsive assistance.

Our Superior Customer Service Verdict

AvaTrade outperforms in this category due to having better customer service.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

9. Better Funding Options – AvaTrade

Blueberry Markets and AvaTrade provide diverse funding methods, catering to traders with varying preferences and needs. AvaTrade leads in this segment by offering more options, including PayPal, cryptocurrency, and other alternative methods, enhancing flexibility and accessibility. Blueberry Markets offers a solid range, such as credit cards, bank transfers, Skrill, and Neteller, ensuring reliability but falling short in variety compared to AvaTrade. Both support efficient deposits and withdrawals, with no funding fees, prioritising convenience for traders.

| Funding Option | Blueberry Markets | AvaTrade |

|---|---|---|

| Credit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | No | Yes |

| Other | No | Yes |

AvaTrade stands out with its broader selection of funding options, including PayPal highly preferred method among international users-and cryptocurrency payments, embracing modern financial trends. Additionally, it offers alternative methods that cater to niche trader preferences. Blueberry Markets maintains a strong foundation, providing widely used methods like Skrill and Neteller alongside traditional bank transfers. This ensures secure and dependable transactions, but lacks the innovative edge AvaTrade presents. Both priorities are seamless funding processes, enabling traders to capitalise on market opportunities efficiently. AvaTrade’s ability to accommodate a more diverse global audience positions it as the stronger contender in this category.

Our Better Funding Options Verdict

AvaTrade has made a big achievement by having better funding options.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

10. Lower Minimum Deposit – A Tie

Blueberry Markets and AvaTrade share a minimum deposit requirement of $100, making forex trading accessible to beginner traders and small investors alike. This aligns them in terms of affordability, offering equal opportunities for those starting their trading journey with manageable financial commitments. The reasonable deposit ensures both appeal to a wider audience, encouraging market participation and fostering trader loyalty. While neither broker gains a definitive edge in this segment, their shared approach reinforces a commitment to supporting entry-level traders.

Blueberry Markets attracts budget-conscious traders by combining its $100 minimum deposit with accessible trading options, ensuring that beginners can enter the market without financial strain. Similarly, AvaTrade complements its fixed deposit threshold with diverse trading instruments and features designed for novice and intermediate users. Both support efficient deposits and withdrawals, ensuring traders can quickly capitalise on market opportunities. Although they differ in platform offerings, their focus on inclusivity makes them appealing to traders seeking affordability and straightforward entry into the forex trading world. The shared deposit structure demonstrates their alignment in fostering growth and attracting diverse clientele.

| Broker | Minimum Deposit |

|---|---|

| Blueberry Markets | $100 |

| AvaTrade | $100 |

Blueberry Markets and AvaTrade remain evenly matched in the lower minimum deposit category, solidifying their appeal to entry-level traders. Their shared $100 deposit provides a balanced level of accessibility, enabling small investors and beginners to explore forex trading confidently. Both enhance their trader experience by waiving finding fees, ensuring cost-effectiveness. While other factors like platform features may set them apart in broader evaluations, this segment reveals their mutual commitment to affordability and inclusivity. Both strengthen the forex market by expanding opportunities for traders without heavy financial barriers.

Our Lower Minimum Deposit Verdict

It’s a draw! Both equally excel in offering a $100 minimum deposit, making forex trading accessible for beginners and small investors globally. Undoubtedly, Blueberry Markets and AvaTrade are tied due to their lower minimum deposit.

So is AvaTrade or Blueberry Markets the Best Broker?

AvaTrade is more accomplished and successful in this field of brokerage due to its comprehensive range of services, from trading platforms to educational resources.

The table below summarises the key information leading to this verdict.

| Criteria | Blueberry Markets | AvaTrade |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ✅ |

Best For Beginner Traders

AvaTrade is better for beginner traders due to its comprehensive educational resources.

Best For Experienced Traders

Blueberry Markets is the go-to for experienced traders who prefer a more intuitive trading experience.

FAQs Comparing Blueberry Markets vs AvaTrade

Does AvaTrade or Blueberry Have Lower Costs?

AvaTrade has lower costs. They offer spreads starting at 0.9 pips, compared to Blueberry Markets’ 1.0 pips. For more on low-cost trading, check out our lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both Blueberry Markets and AvaTrade offer MetaTrader 4. However, Blueberry Markets also provides cTrader for those looking for an alternative. Learn more about the best MT4 brokers here.

Which Broker Offers Social Trading?

AvaTrade takes the lead in social and copy trading with its AvaSocial platform. For more on social trading, visit our best copy trading platforms.

Does Either Broker Offer Spread Betting?

Neither Blueberry Markets nor AvaTrade offer spread betting. For spread betting options, you can check out our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Blueberry Markets is superior for Australian Forex traders. They are ASIC regulated and founded in Australia. For more details, visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, AvaTrade is the superior choice. They are FCA regulated and offer a wide range of services. For more, check out our Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How long does it take for AvaTrade to deposit money?

Depends on the method you use. For e-payments like Neteller, Skrill (Moneybookers), WebMoney, and others, funds should be credited in your account within 24 hours.

What is the maximum amount of lots in blueberry markets?

100 lots (10,000,000 units) on major currency pairs is the maximum number of lots with BlueBerry Markets.