Pepperstone vs Blueberry Markets: Which One Is Best?

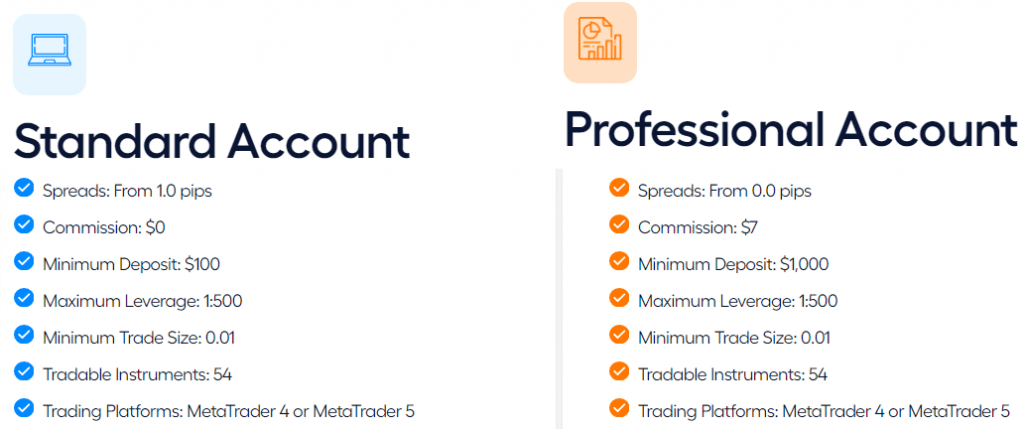

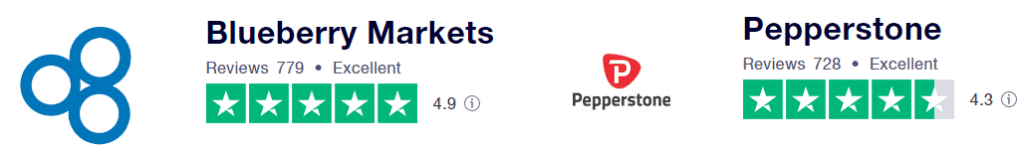

Our Pepperstone vs Blueberry Markets review found the former has 63+ currency pairs (i.e. EUR/USA) while the latter offers 44. With Pepperstone you can trade with 180 CFDs like stocks and crypto while Blueberry Markets offers 55 CFD instruments. Let’s dive right in.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

which broker is the most beginner friendly?

Beginners friendly can mean different things to different people. Do you mean a broker with risk management tools? Both brokers have the same risk management tools when using MetaTrader 4 or 5 platforms. Do you mean Beginner-friendly trading platforms? We would suggest sticking with MetaTrader 4 since this platform as it is very intuitive and much used by beginners across the globe. As a bonus, because the platform has such a large community, there is no shortage of online resources for help. OR maybe you mean when it comes to customer services and trading education library? if so then we suggest Pepperstone.