Eightcap vs ThinkMarkets: Which Broker is Better?

Our analysis and testing revealed certain features that placed one broker ahead of the other. Although both have no dealing desk models, one of them has proven to be superior. View the full ThinkMarkets vs Eightcap evaluation below.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

1. Lowest Spreads And Commission Rates – Eightcap

Eightcap offers two account options: a standard account with no commission fees and a raw account with commission fees. In ThinkMarkets, similarly, there are two account types: a standard account with no commission fees and a ThinkZero account with a flat-rate commission fee.

Eightcap has lower spreads for 5 of the 7 most traded forex pairs compared to ThinkMarkets. We based our findings on multiple sources’ census data, factoring in both brokers’ commission rates. Our trading fee calculator below factors in the two brokers’ spreads and commissions to work out the costs each broker would charge for an individual trade.

Standard Account Spreads

Eightcap offers competitive standard spreads, with rates as low as 1 pip for major currency pairs like EUR/USD, EUR/GBP, and GBP/USD. ThinkMarkets’ standard account spreads are wider compared to its other account, as there are no commission costs.

No Commission Spreads: Standard Accounts | |||||

|---|---|---|---|---|---|

| 1.00 | 1.20 | 1.00 | 1.20 | 1.00 |

| 1.10 | 1.10 | 1.10 | 1.20 | 1.20 |

| 1.00 | 1.00 | 1.27 | 1.30 | 1.20 |

| 0.83 | 0.83 | 1.02 | 1.37 | 0.92 |

| 0.80 | 1.20 | 1.20 | 1.50 | 1.20 |

| 1.00 | 1.00 | 1.20 | N/A | 1.10 |

| 0.80 | 1.00 | 1.00 | 1.50 | 1.60 |

| 1.20 | 1.90 | 1.90 | 2.30 | 2.10 |

| 1.20 | 1.40 | 1.40 | 2.00 | 1.50 |

| 1.00 | 1.11 | N/A | 1.30 | 1.28 |

| 0.60 | 0.60 | 0.90 | 1.50 | 1.30 |

| 0.60 | 0.70 | 0.90 | 1.00 | 0.80 |

| 1.20 | 1.30 | 1.20 | 1.20 | 4.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Raw Account Spreads

Eightcap offers tight raw spreads with their lowest spread being 0.06 pips for USD/JPY and 0.20 pips for USD/CAD. ThinkZero offers ECN pricing with spreads that can go as low as 0.0 pips.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.11 | 0.30 | 0.47 | 0.40 | 0.44 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.10 | 0.12 | 0.64 | 0.26 | 0.53 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.99 | 0.94 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Commission Cost Comparison

We compared the commission rate for the Eightcap Raw vs ThinkMarkets ZERO account. These are the broker’s Flagstaff ECN accounts. We found that Eightcap and ThinkMarkets charge identical commission rates unless the base currency is set to the British Pound (GBP), in which case Eightcap is over 10% cheaper with a commission rate of £2.25 per side vs £2.50 for ThinkMarkets.

| Base Currency | Eightcap Commission Per Side | ThinkMarkets Commission Per Side | Eightcap Round Lot Commission | ThinkMarkets Round Lot Commission |

|---|---|---|---|---|

| USD | $3.50 | $3.50 | $7.00 | $7.00 |

| AUD | $3.50 | $3.50 | $7.00 | $7.00 |

| NZD | $3.50 | N/A | $7.00 | N/A |

| SGD | $3.50 | N/A | $7.00 | N/A |

| CAD | $3.50 | N/A | $7.00 | N/A |

| GBP | £2.25 | £2.50 | £4.50 | £5.00 |

| EUR | €2.75 | N/A | €3.50 | N/A |

Other Broker Fees To Note

Both ThinkMarkets and Eightcap charge a forex swap rate, which is also known as a rollover rate. This fee is applicable when a trade is kept open at the end of each trading session. The fee is calculated based on the interest rate for keeping the position open overnight and can either be charged or earned by a trader, depending on their position.

Our Lowest Spreads and Fees Verdict

Eightcap has lower spreads on most forex pairs and has no inactivity fee and a slightly lower commission rate. This makes them the clear winner for this category looking at trading costs.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

2. Better Trading Platforms – Eightcap

Eightcap and ThinkMarkets offer the most popular forex trading platform (MetaTrader 4) and CFD trading platform (MetaTrader 5). TradingView is only available with Eightcap, while cTrader is not offered by either broker. Additionally, ThinkMarkets has its own proprietary platform called ThinkTrader.

| Trading Platform | Eightcap | ThinkMarkets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

Reasons Why Eightcap Is Superior For MT4

MT4’s widespread usage can be attributed to its ease of use and access and the many essential tools it provides to traders.

MT4 provides you with 30 technical indicators and also has over 2,000 additional free custom indicators available for you to add on. They also have 8 order types, including 4 pending orders.

You also have access to the largest range of Expert Advisors (EAs) compared to all other forex trading platforms. An EA can provide you with functions to help you automate your trade or provide a more in-depth market analysis.

Both brokers are generous with how you use the MT4 trading platform. Both brokers allow full use of EAs so you can automate your trading. Scalping is also permitted, and when it comes to lot size, you can trade with mini lots, micro lots and standard lots.

Eightcap has partnered with FX Blue Labs, one of the leading providers of apps and widgets for forex and derivatives analysis. Tools available for you to use include a correlation matrix, a sentiment trader, and even a ‘mini terminal’ for your convenience.

They also offer Capitalise.ai, which is a code-free program that allows you to automate your trades. This makes automated trading far more accessible to traders without a programming background.

ThinkMarkets, however, might be a better option for social trading since they offer ZuluTrade, which can integrate with the web version of MT4. Eightcap only has a MetaTrader signal, which is included with MetaTrader platforms.

Why We Prefer MT5 For Eightcap

Unlike MT4, MT5 provides access to both centralised and decentralised markets. This allows you to access trading instruments that are unavailable on MT4, and this includes most cryptocurrencies.

As the top broker for trading cryptocurrencies, this greatly benefits Eightcap, allowing the broker to offer their full range of products to traders using MT5.

You still have access to Eightcap’s trading tools, FX Blue Labs and Capitalise.ai, on MT5. ZuluTrade is not available on MT5 with ThinkMarkets.

Although ThinkMarkets does offer more forex pairs and shares than Eightcap, Eightcap’s overall MT5 offering, with various trading tools and a wide range of crypto options, makes them a better MT5 broker.

Our Better Trading Platform Verdict

What makes Eightcap superior to ThinkMarkets is their superior execution speeds.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

3. Superior Accounts And Features – ThinkMarkets

Both Eightcap and ThinkMarkets offer standard and raw accounts, with the feature of an Islamic account as the tiebreaker.

Eightcap’s Standard account has a minimum deposit of $100, with spreads as low as 1.0 pips. Their Raw account suits experienced traders who primarily trade forex CFDs.

ThinkMarkets’ no commission Standard account has average FX spreads of 1.2 pips, while their ThinkZero account can go as low as 0.1 pips.

| Eightcap | ThinkMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Islamic Account

Under Sharia Law, Muslims are forbidden from taking or paying a riba or interest. However, most brokers charge interest (also known as ‘swap fees’) every time you hold your trading position overnight.

The use of a riba means traders processing Islam cannot trade; to resolve this, some brokers offer Islamic or swap-free accounts.

ThinkMarkets offers an Islamic version of both of their account types. They also charge a weekly ‘administration fee’ instead of swap fees to facilitate this account. It is also worth noting that ThinkMarkets is restricted on which instruments are available, with many exotic forex pairs not being an option.

Eightcap, by contrast, does not offer a swap-free account.

Our Superior Accounts and Features Verdict

If you wish to comply with Sharia Law and be able to trade, you need to use ThinkMarkets.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Eightcap

Both Eightcap and ThinkMarkets operate with a no dealing desk model, yet our head of research (Ross Collins) found that Eightcap was faster than ThinkMarkets for both limit order and market order speeds.

He opened live accounts and used bots (EAs) to test over a 30-hour period each broker’s MT4 execution speeds. More information is shown in the table below and discussed on our Execution Speeds methodology page.

| Limit Order Execution Speed | Market Order Execution Speed | |

|---|---|---|

| Eightcap | 143 | 139 |

| ThinkMarkets | 161 | 248 |

After conducting a thorough analysis and collecting relevant data, it is clear that both brokers have made substantial investments in developing user-friendly platforms equipped with efficient trading tools.

- Eightcap stands out for its TradingView platform, which is renowned for its intuitive interface and powerful charting tools.

- ThinkMarkets, on the other hand, has been recognised for its ThinkTrader app, offering a seamless mobile trading experience.

- Both brokers offer MetaTrader 4 and 5, but Eightcap edges out with additional tools and partnerships, enhancing the MT4 experience.

- Automation is a strong suit for both, with Eightcap and Pepperstone offering Capitalise.ai, a tool that allows traders to automate their strategies without coding.

Our Best Trading Experience and Ease Verdict

While both brokers offer commendable trading experiences, Eightcap slightly edges out ThinkMarkets due to its comprehensive toolset and platform versatility.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

5. Higher Trust Score – ThinkMarkets

Eightcap has a superior Trust Score of 85 vs 80 for Thinkmarkets. The trust score factored in the reputation, regulation and reviews of both brokers.

ThinkMarkets Trust Score

The Trust Score of ThinkMarkets was 80 scoring strongly for both regulation and reviews.

Eightcap Trust Score

The Trust Score of Eightcap was 85 scoring highly for their strong reputation and popularity.

Regulations

ThinkMarkets is regulated in more markets than Eightcap. Eightcap holds 3 ‘tier 1’ licences vs ThinkMarkets 4 which includes the FMA in New Zealand. ThinkMarkets also holds more tier 3 licences including South Africa (FSCA), Cayman Islands (CIMA) and Mauritius (FSC-M).

| Eightcap | ThinkMarkets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CySEC (Europe) ASIC (Australia) | FCA (UK) CySEC (Europe) ASIC (Australia) FMA (New Zealand) |

| Tier 2 Regulation | JFSA (Japan) DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) | FSCA (South Africa) FSA-S (Seychelles) CIMA (Cayman Islands) FSC-M (Mauritius) |

Reputation

Eightcap was founded in 2009 making it one year older than ThinkMarkets. Both brokers are based in highly trusted regions including Melbourne, Australia for Eightcap and London, UK for ThinkMarkets. It’s worth noting that Eightcap is more popular with 27,100 monthly searches vs 8,100 for ThinkMarkets on Google.

Reviews

Eightcap has a Trustpilot score of 4.2 out of 5, based on over 3,100 reviews. ThinkMarkets scores 4.3 out of 5, from approximately around 630 reviews. ThinkMarkets edges ahead slightly in rating, while Eightcap has a broader review base. Both brokers are well-regarded, but ThinkMarkets may offer a more consistently polished experience according to user sentiment.

Our Stronger Trust and Regulation Verdict

Eightcap and ThinkMarkets can both be trusted. It really come down to the region each broker was founded with Eightcap better known in Australia and Asia while ThinkMarkets for Europe and the UK.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

6. Most Popular Broker – Eightcap

Eightcap gets searched on Google more than ThinkMarkets. On average, Eightcap sees around 40,500 branded searches each month, while ThinkMarkets gets about 18,100 — that’s 55% fewer.

| Country | Eightcap | ThinkMarkets |

|---|---|---|

| Thailand | 9,900 | 390 |

| Australia | 2,400 | 320 |

| Canada | 2,400 | 170 |

| United States | 1,900 | 1,000 |

| United Kingdom | 1,600 | 590 |

| India | 1,300 | 720 |

| Germany | 1,000 | 260 |

| Brazil | 1,000 | 320 |

| Malaysia | 880 | 170 |

| Spain | 720 | 260 |

| France | 720 | 590 |

| Colombia | 720 | 170 |

| Italy | 590 | 140 |

| Indonesia | 590 | 260 |

| Argentina | 590 | 90 |

| South Africa | 480 | 880 |

| Netherlands | 480 | 210 |

| Singapore | 390 | 110 |

| Nigeria | 390 | 260 |

| Pakistan | 320 | 260 |

| Sweden | 320 | 70 |

| Mexico | 320 | 110 |

| Dominican Republic | 320 | 90 |

| Poland | 260 | 90 |

| Morocco | 210 | 390 |

| United Arab Emirates | 210 | 210 |

| Philippines | 210 | 90 |

| Portugal | 210 | 50 |

| New Zealand | 210 | 30 |

| Kenya | 170 | 140 |

| Switzerland | 170 | 50 |

| Vietnam | 170 | 880 |

| Hong Kong | 170 | 140 |

| Bangladesh | 140 | 90 |

| Taiwan | 140 | 480 |

| Austria | 140 | 70 |

| Japan | 140 | 720 |

| Peru | 140 | 50 |

| Chile | 140 | 40 |

| Turkey | 110 | 170 |

| Algeria | 110 | 480 |

| Venezuela | 110 | 110 |

| Ireland | 110 | 30 |

| Ecuador | 110 | 40 |

| Greece | 90 | 110 |

| Cyprus | 90 | 90 |

| Egypt | 90 | 1,600 |

| Cambodia | 90 | 20 |

| Uzbekistan | 90 | 70 |

| Saudi Arabia | 70 | 140 |

| Ghana | 70 | 50 |

| Uganda | 70 | 30 |

| Mongolia | 70 | 10 |

| Sri Lanka | 50 | 20 |

| Ethiopia | 30 | 40 |

| Tanzania | 30 | 40 |

| Jordan | 30 | 40 |

| Botswana | 30 | 20 |

| Bolivia | 30 | 10 |

| Costa Rica | 30 | 10 |

| Mauritius | 20 | 10 |

| Panama | 20 | 10 |

9,900 1st | |

390 2nd | |

2,400 3rd | |

320 4th | |

1,900 5th | |

1,000 6th | |

1,000 7th | |

260 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Eightcap receiving 259,000 visits vs. 283,000 for ThinkMarkets.

Our Most Popular Broker Verdict

Eightcap is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – ThinkMarkets

EightCap provides an extensive range of more than 360 CFD products, including forex, commodities, indices, shares, and cryptocurrencies. With ThinkMarkets, you can trade over 4,000 CFDs globally.

Based on our own testing, here’s a comparative table showcasing the range of CFDs, products, and markets available:

| Feature | Eightcap | ThinkMarkets |

|---|---|---|

| Forex Pairs | 55 | 43 |

| Indices | 16 | 16 |

| Commodities | 4 Metals (vs USD, AUD, EUR) 2 Energies | 4 Metals (3 x Golds) (3 x Silver) 3 Energies |

| ETFs | No | 352 |

| Cryptocurrencies | 86 pairs | 19 |

| Bonds | No | No |

| Options, Futures | No | No |

| Stocks | No | Yes |

Our Top Product Range and CFD Markets Verdict

While both brokers offer a comprehensive range of products and CFD markets, ThinkMarkets slightly edges out Eightcap in terms of the sheer number of offerings, especially in the Shares and ETFs categories.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

8. Superior Educational Resources – ThinkMarkets

When it comes to enhancing one’s trading knowledge, both Eightcap and ThinkMarkets have put in considerable effort to provide their traders with valuable educational resources. From webinars to articles, these brokers ensure that both beginners and experienced traders have the tools they need to succeed.

- Both Eightcap and ThinkMarkets offer webinars, tutorials, educational videos, demo accounts, trading glossaries, FAQs, and articles to their users.

- eBooks are a valuable resource for in-depth learning, and while Eightcap doesn’t provide them, ThinkMarkets does.

- For those who prefer structured learning, online courses can be a boon. Here, ThinkMarkets takes the lead again by offering online courses, whereas Eightcap does not.

- Seminars are a great way to interact and learn directly from experts. However, neither Eightcap nor ThinkMarkets currently offer them.

- While both brokers provide a plethora of resources, ThinkMarkets slightly edges out with its offering of eBooks and online courses, which are absent in Eightcap’s educational suite.

Our Superior Educational Resources Verdict

Based on the range and depth of educational resources, ThinkMarkets offers a more comprehensive educational suite compared to Eightcap.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

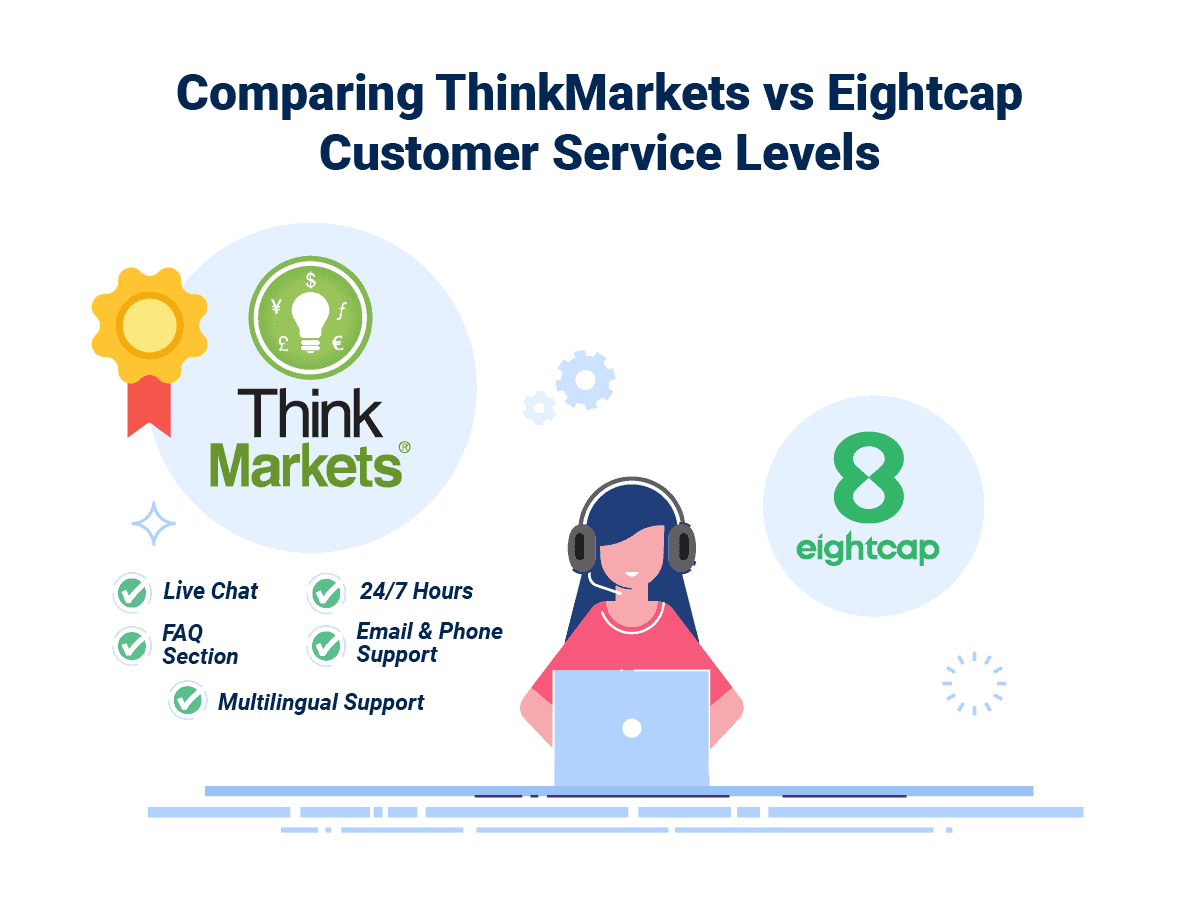

9. Better Customer Service – ThinkMarkets

ThinkMarkets’ customer service is available 24 hours a day, 7 days a week through live chat, phone or email. Eightcap’s customer support is available 24/5 from Monday 8 am to Saturday 5 am Melbourne, Australia time. However, this may not be convenient for traders in different time zones as immediate access outside these hours is limited.

We felt that the response rate of Eightcap was faster, and they understood the trading platforms better than ThinkMarkets. It’s worth noting that the staff of ThinkMarkets were more interested in educating us and explaining the basics, so the broker would be better if you are a beginner trader.

Our Superior Customer Service Verdict

Whilst both brokers offer excellent customer support, ThinkMarkets is more responsive with a more knowledgable team and is available round the clock.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

10. More Funding Options – ThinkMarkets

ThinkMarkets offers more payment options than Eightcap. Customers of ThinkMarkets can deposit funds in base currencies, including USD, CHF, EUR, AUD and GBP. EightCap offers trading accounts in seven base currencies: AUD, USD, EUR, GBP, NZD, CAD, and SGD.

| Funding Option | Eightcap | ThinkMarkets |

|---|---|---|

| Credit Card | ✅ | ✅ |

| Debit Card | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| PayPal | ❌ | ✅ |

| Skrill | ✅ | ✅ |

| Neteller | ✅ | ✅ |

| Bitcoin | ❌ | ❌ |

| UnionPay | ✅ | ❌ |

| FasaPay | ✅ | ❌ |

| BPay | ❌ | ✅ |

| Klarna | ❌ | ✅ |

Both Eightcap and ThinkMarkets have made efforts to provide traders with a variety of choices. This is crucial for traders as it allows them to choose the most convenient method for them, whether through credit cards, e-wallets, or bank transfers. We further break down each broker’s funding methods.

Eightcap

The payment methods offered by Eightcap usually take approximately one business day to process payments.

| PAYMENT METHOD | FEES | AVAILABLE CURRENCIES | PROCESSING TIME |

|---|---|---|---|

| Visa/Mastercard | $0 | AUD, USD, GBP, EUR, NZD, CAD, SGD | 1-5 business days |

| PayPal | $0 | AUD, USD, GBP, EUR, NZD, SGD | 1 business day |

| Wire Transfer | Variable | AUD, USD, GBP, EUR, NZD, CAD, SGD | 1-5 business days |

| Bpay | $0 | AUD | 1 business day |

| Skrill | Variable | USD, EUR (EEA clients), CAD | 1 business day |

| Neteller | Variable | USD, EUR (EEA clients), CAD | 1 business day |

ThinkMarkets

With ThinkMarkets, you have access to multiple payment channels, and most payments are processed instantly.

| Provider | Available currencies | Estimated transaction time |

|---|---|---|

| Debit Card | AUD, EUR, CHF, GBP, USD | Instant |

| Debit Card (EU) | EUR | 1 business day |

| Skrill | AUD, EUR, CHF, GBP, USD | Instant |

| Neteller | USD, EUR, GBP, JPY, AUD | Instant |

| Skrill | AUD, EUR, CHF, GBP, USD | Instant |

| Cryptocurrency | BTC, ETH, USDT, ERC-20, TRC-20, BCH, XLM, LTC, EOS, DASH, USDC, XRP, TRX, BUSD | Instant |

| Perfect Money | USD, EUR, BTC | Instant |

| Apple Pay | AUD, EUR, CHF, GBP, USD | Instant |

| Google Pay | AUD, EUR, CHF, GBP, USD | Instant |

| UPI | INR | Instant |

| Netbanking | INR | Instant |

| MPesa | KES | Instant |

| Mobile Money Ghana | GHS | Instan |

Our Better Funding Options Verdict

Based on the available funding options, ThinkMarkets offers a slightly broader range of choices compared to Eightcap, making it the preferable choice for traders looking for diverse funding methods.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

11. Lower Minimum Deposit – ThinkMarkets

ThinkMarkets has a lower minimum deposit of $0 compared to $100 Eightcap. The broker, though, lifts this minimum deposit to $500 for traders looking for an ECN account, while Eightcap’s $100 remains the same.

Here is Eightcap’s minimum per region and payment method:

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

The below table shows ThinkMarkets’ deposit requirements:

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 | $0 | €0 | $0 |

| Paypal | £0 | $0 | €0 | $0 |

| Bank Wire | £0 | $0 | €0 | $0 |

| Skrill | £0 | $0 | €0 | $0 |

We formulated the table below to simplify the minimum deposit of both brokers by account type and the most popular base currencies.

| Base Currency | ThinkMarkets Standard Account | Eightcap Standard Account | ThinkMarkets ThinkZero Account | Eightcap RAW Account |

|---|---|---|---|---|

| AUD | $0 | $100 | $500 | $100 |

| USD | $0 | $100 | $500 | $100 |

| GBP | £0 | £100 | £500 | £100 |

| EUR | €0 | €100 | €500 | €100 |

Our Lower Minimum Deposit Verdict

ThinkMarket has the lower minimum deposit for a standard account while Eightcap has a lower minimum deposit for an ECN account. Generally, all these minimum levels are more than reasonable compared to other global brokers.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

So Is Eightcap or ThinkMarkets The Best Broker?

ThinkMarkets wins with more features on offer. Key areas in which ThinkMarkets was superior include their trust and regulation, CFD products and customer service.

| Criteria | Eightcap | ThinkMarkets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | No |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | No | Yes |

| CFD Product Range And Financial Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Better Customer Service | No | Yes |

| More Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

ThinkMarkets: Best For Beginner Traders

With a lower minimum deposit, an easier-to-use trading platform and a higher trust score, we felt ThinkMarkets was better suited for beginners. We also think the superior funding options and trading app were also nice bonuses.

Eightcap: Best For Experienced Traders

Intermediate to expert traders should go for Eightcap based on the broker’s lower spreads and superior trading platforms. Their customer service in our testing was also better for more advanced traders. We recommend opening their RAW account with lower fees than the standard account.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

FAQs Comparing Eightcap Vs ThinkMarkets

Does ThinkMarkets or Eightcap Have Lower Costs?

ThinkMarkets generally offers lower costs compared to Eightcap. For instance, ThinkMarkets boasts tighter spreads on major currency pairs, which can significantly reduce trading costs. On average, traders can expect spreads as low as 0.4 pips on the EUR/USD pair. For a more comprehensive breakdown of low-cost brokers, you can explore this guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and ThinkMarkets offer MetaTrader 4, but Eightcap is often preferred for its enhanced tools and partnerships that augment the MT4 experience. MetaTrader 4 is a popular choice among traders globally, known for its user-friendly interface and advanced charting tools. If you’re keen to delve deeper into the best MT4 brokers, this comprehensive list of top MT4 brokers might be of interest.

Which Broker Offers Social Trading?

ThinkMarkets offers social trading features, allowing traders to follow and copy the trades of professionals. Social trading, also known as copy trading, has gained popularity as it provides an opportunity for less experienced traders to benefit from the strategies of market veterans. For those interested in exploring more about this trading approach, here’s a detailed overview of the best social trading platforms.

Does Either Broker Offer Spread Betting?

ThinkMarkets offers spread betting, whereas Eightcap does not. Spread betting is a popular form of trading in the UK, allowing traders to speculate on the price movements of various financial instruments without owning the underlying asset. For those in the UK looking to delve deeper into spread betting, this comprehensive guide on the best spread betting brokers provides valuable insights.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap is the superior choice for Australian forex traders. Both Eightcap and ThinkMarkets are ASIC regulated, ensuring a high level of trust and security for traders. However, Eightcap stands out as it was founded in Australia, giving it a home advantage and a deeper understanding of the local market. For those keen on exploring more about the best brokers in Australia, here’s a detailed overview of the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe ThinkMarkets holds the edge. Both brokers are FCA regulated, which is crucial for ensuring the safety and security of traders’ funds. However, ThinkMarkets, being founded overseas, brings a global perspective combined with local expertise, making it a preferred choice for many in the UK. If you’re based in the UK and looking for more insights, this guide on the Forex brokers In UK might be of interest.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does Eightcap allow scalping?

Yes – Eightcap is a no dealing desk broker so make their money by taking a small commission for each trader you do. They also do not act as the counter-party to your trades. For this reason High volumne and scalp trading is very profitable for the broker.