eToro vs FXTM 2024

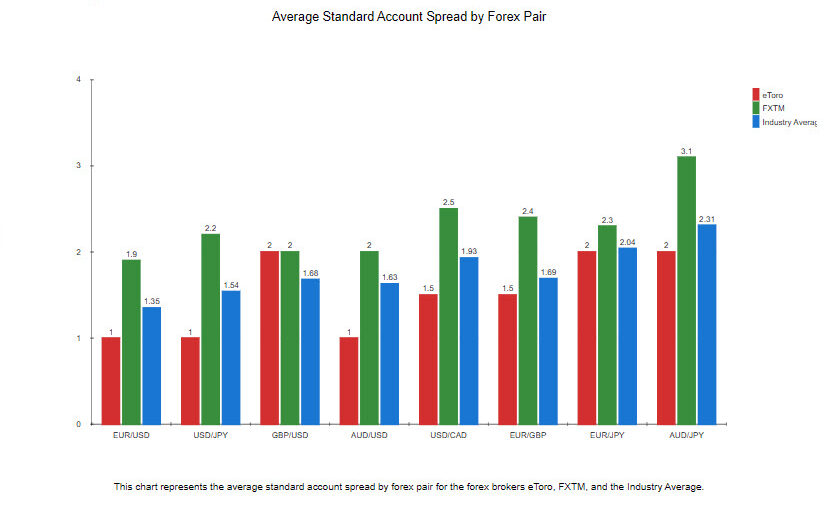

Our comprehensive comparison of eToro vs FXTM dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Risk Disclaimer: On the other hand, trading complex instruments such as CFDs on retail investor accounts is associated with a high risk of rapid capital losses as high leverage ratios are used. Therefore, clients need to make sure they fully understand how CFDs work before they start operating with such instruments on a live trading account.

Risk Disclaimer: On the other hand, trading complex instruments such as CFDs on retail investor accounts is associated with a high risk of rapid capital losses as high leverage ratios are used. Therefore, clients need to make sure they fully understand how CFDs work before they start operating with such instruments on a live trading account.

Ask an Expert

Do i need to take an online course to start trading? Does it require a lot of research?

Whether it be via an online course, a book, or video series or in person classes – Given the risks of losing money are high, it is wise to educate yourself before you commence trading,