eToro vs XTB 2025

We compared eToro to XTB in 2025 based on the areas that matter the most when trading including spreads, trading platform, and features. By opening accounts, testing trading platforms, and measuring fees we have created the XTB vs eToro table below.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Allowed but not supported

Overall

Our full comparison covers the 10 most important trading factors to help you decide between eToro and XTB.

- eToro excels in social and copy trading, while XTB is more suited for conventional or automated trading. XTB offers MetaTrader 4 as a platform option, whereas eToro does not.

- XTB has lower overall trading costs, with average spreads notably less than those of eToro.

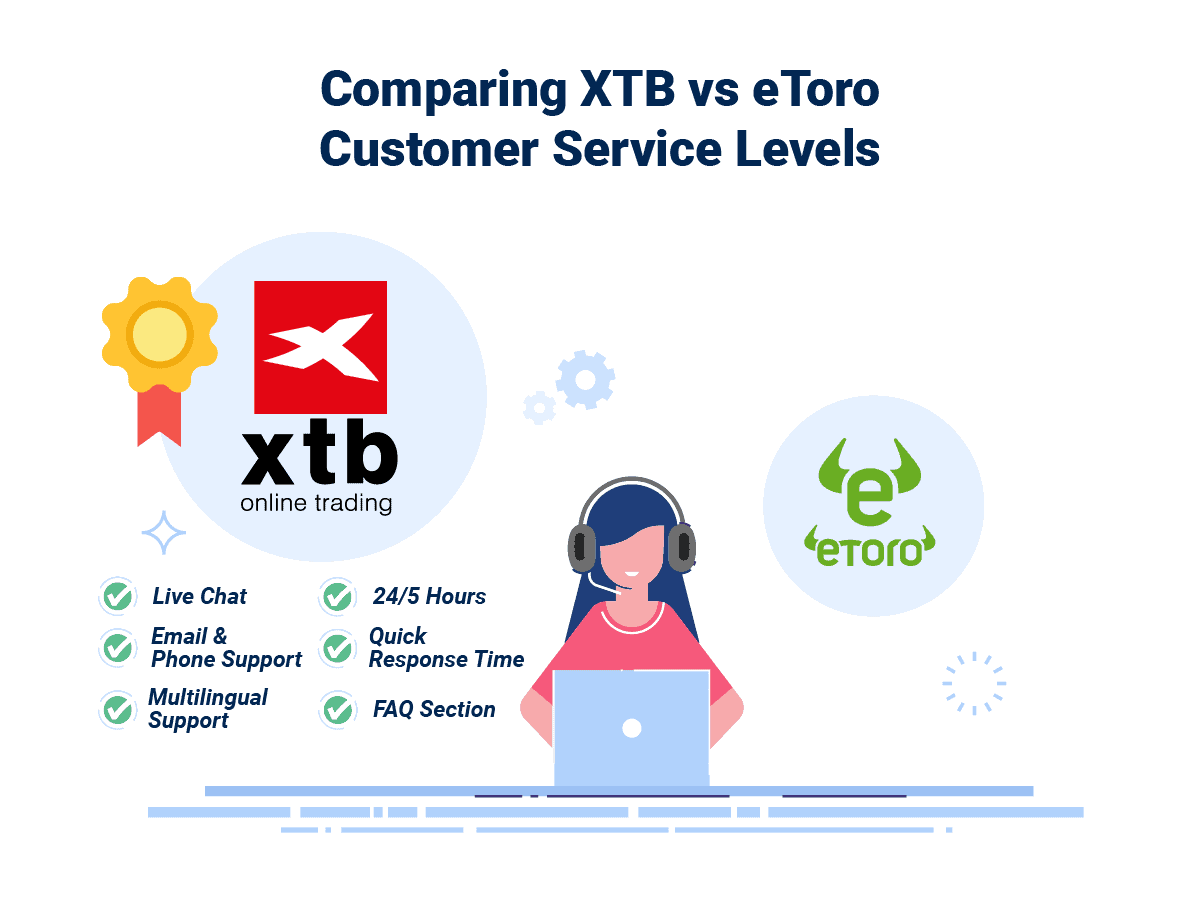

- Customer support at XTB is more responsive and available in multiple languages, unlike eToro, which lacks live chat support.

1. Lowest Spreads And Fees – XTB

Looking at the average standard account spreads for the forex pairs, we can see some interesting patterns. For eToro, the spreads range from 1.0 to 2.0 across all forex pairs. XTB, on the other hand, has a slightly wider range, with spreads from 0.9 to 1.8.

Comparing these two brokers, it’s clear that eToro has a more consistent spread across all forex pairs, which can be beneficial for traders who value predictability. However, XTB’s spreads, while slightly more varied, are competitive and, in some cases, lower than eToro’s.

| Standard Account | eToro Spreads | XTB Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.5 | 1.41 | 1.6 |

| EUR/USD | 1 | 0.9 | 1.2 |

| USD/JPY | 1 | 1.4 | 1.4 |

| GBP/USD | 2 | 1.4 | 1.6 |

| AUD/USD | 1 | 1.3 | 1.5 |

| USD/CAD | 1.5 | 1.8 | 1.8 |

| EUR/GBP | 1.5 | 1.4 | 1.5 |

| EUR/JPY | 2 | 1.4 | 1.9 |

| AUD/JPY | 2 | 1.7 | 2.1 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

When we bring the industry average into the picture, things get even more interesting. The industry average spreads range from 1.2 to 2.1. This means that both eToro and XTB offer spreads that are below the industry average for some forex pairs, making them attractive options for cost-conscious traders.

In my opinion, while both brokers offer competitive spreads, XTB seems to have a slight edge in terms of offering lower spreads for certain forex pairs. However, the consistency of eToro’s spreads should not be overlooked, as it can provide a more stable trading environment. As always, it’s important to consider your individual trading needs and strategies when choosing a broker.

We made a fee calculator to show how lower spreads affect trading costs. Choose your base currency, trade size, and currency pair to find out the fee.

Our Lowest Spreads and Fees Verdict

The low average spread makes XTB our top choice, especially compared to the eToro average. If you want a lower spread standard account, then consider IC Markets. Ross Collins, Our Chief Technology researcher at CompareForexBrokers, tested the average spreads for a standard account using 20 brokers (with MT4) and found most were superior to eToro and XTB.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

2. Better Trading Platforms – Tie

XTB pushes customers towards its proprietary trading platforms, but we appreciated that the broker also offered access to MT4. If you’re a casual trader looking for the best copy trading platforms, on the other hand, eToro tops the class. Ultimately, it comes down to which is the right platform for you.

| Trading Platform | eToro | XTB |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

Our Better Trading Platform Verdict

Call us picky, but we like options when it comes to our trading platforms. Granted, neither XTB nor eToro explicitly caters to forex traders, but our team found ourselves wishing for even a basic, white-label version of MetaTrader 4 (MT4) when trading on eToro. We gave XTB a score of 35/100 while eToro got a score of 30/100; the main factor holding the brokers back is the lack of platform choices.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

3. Superior Accounts And Features –XTB

Our comparison found both eToro and XTB had standard and swap-free accounts that were ideal for beginner traders. The good news? Neither broker charges commissions. The less-than-good news? We found that both brokers set their minimum spreads higher than other comparable brokers.

Our Chief Technology Researcher at CompareForexBrokers, Ross Collins, tested 20 brokers to find out which brokers have the best Standard Account Spreads. In terms of no commission spreads, our IC Markets Review found the broker offered the lowest spreads of 1.03 pips; this was aggregated using 6 major currency pairs over a 24-hour period.

| eToro | XTB | |

|---|---|---|

| Market Maker | Yes. eToro acts as a market maker. | No |

| Dealing Desk | No. | No. |

| Execution Type | ECN | STP |

| Demo Account | Yes. The e-Toro demo accounts includes $100K of virtual funds and does not expire. | Yes. The XTB demo account includes four weeks of risk-free trading with $100K virtual funds. |

| Standard Account | Yes. Standard Account minimum variable spread: 1.0 pip. | Yes. Standard Account minimum variable spread: 0.5 pips. |

| No Commission Account | Yes. | Yes. |

| Fixed Spread Account | No. | No. |

| Swap-Free Account | Yes. | Yes. |

| # of Base Currencies | 1 USD | 5 USD, EUR, GBP, PLN, HUF |

| Maximum Leverage | 1:500 | 1:500 |

| eToro | XTB | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

While we appreciate that both of these top forex brokers try to strike a balance between simplicity and savings, we prefer XTB for its lower overall trading costs.

Our tests revealed a standard average spread of 1.6 pips and a RAW spread of 1.02 pips for XTB. Compare that to our findings for eToro: a whopping 4.2 pips for the standard average spread and 1.0 pips RAW. We also don’t love that eToro’s minimum spreads start at 1.0 pips – well over the typical industry average.

Our Superior Accounts and Features Verdict

When it comes to trading costs, XTB wins easily with a score of 35. While this is a poor score (you can find other brokers with lower costs. For more information, read our full Fusion Markets Review or CMC Markets Review), it is still superior to the score we gave eToro, being 26 out of 100.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

4. Best Trading Experience – XTB

When it comes to trading experience, both eToro and XTB have their unique strengths. eToro’s user interface is intuitive and ideal for beginners, especially those interested in social trading. You can easily find your way around, and the copy trading feature is a gem for those who want to mimic the strategies of successful traders.

- eToro’s platform is visually appealing and easy to navigate.

- XTB’s xStation 5 offers advanced charting tools and is highly customizable.

- eToro provides a seamless mobile trading experience with its well-designed app.

- XTB’s customer support is quick to respond, making the trading experience smoother.

On the other hand, XTB’s xStation 5 is a powerhouse for more experienced traders. It offers advanced charting tools, and the speed of execution is impressive. The platform is also highly customizable, allowing you to set it up just the way you like.

Our Best Trading Experience and Ease Verdict

For a balanced blend of ease and advanced features, XTB offers the best trading experience.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – XTB

XTB Trust Score

eToro Trust Score

Trading via an online broker carries two types of risk. Putting your money in the market can lead to big wins if you predict movements correctly – but equally significant losses when you don’t. That’s normal and an inevitable possibility when trading CFDs, stocks or forex.

Fortunately, you can virtually eliminate the other major risk by trading with a broker licensed by a Tier 1 regulator, such as the UK’s Financial Conduct Authority or the Commodities Futures Trading Commission and National Futures Association in the US. These government-run oversight agencies place strict requirements on brokers and other financial service providers designed to protect customer funds and prevent fraud.

| eToro | XTB | |

|---|---|---|

| Tier 1 regulators* | ASIC (Australia) CYSEC (Cyprus) FCA (UK) | FCA (UK) CYSEC (Cyprus) |

| Tier 2 regulators | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) | DFSA (Dubai) CMNV (Spain) KNF (Poland) |

| Tier 3 regulators | FSA-S (Seychelles) | FSC-BZ |

| Negative Balance Protection | Yes | Yes |

| Trust Score | 63 | 74 |

* We explain who these regulators are in Our Methodology section.

Our Stronger Trust and Regulation Verdict

Our comparison tried to focus on the best of the best when it came to regulation. To us, that means brokers with at least one (preferably multiple) Tier-1 regulation or, even better, one regulated in your jurisdiction. Other factors we looked at for ‘trust’ included the age of the broker (eToro was founded in 2009 and XTB in 2002) and if they have ever been in trouble with their regulator (XTB was once hit with a 2.7M fine for regulatory breaches). XTB achieved a score of 73, while eToro scored 64.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. Most Popular Broker – eToro

eToro gets searched on Google more than XTB. On average, eToro sees around 823,000 branded searches each month, while XTB gets about 368,000 — that’s 55% fewer.

| Country | XTB | eToro |

|---|---|---|

| United Kingdom | 4,400 | 135,000 |

| France | 18,100 | 110,000 |

| Italy | 4,400 | 110,000 |

| Germany | 12,100 | 74,000 |

| Spain | 27,100 | 60,500 |

| United States | 2,400 | 33,100 |

| Australia | 320 | 27,100 |

| Netherlands | 1,600 | 18,100 |

| Colombia | 3,600 | 14,800 |

| United Arab Emirates | 1,900 | 14,800 |

| Mexico | 1,900 | 12,100 |

| Switzerland | 1,300 | 12,100 |

| India | 1,300 | 9,900 |

| Malaysia | 320 | 9,900 |

| Poland | 135,000 | 9,900 |

| Peru | 2,400 | 9,900 |

| Taiwan | 140 | 8,100 |

| Philippines | 320 | 8,100 |

| Argentina | 1,300 | 8,100 |

| Portugal | 40,500 | 8,100 |

| Austria | 1,000 | 8,100 |

| Ireland | 480 | 8,100 |

| Greece | 210 | 6,600 |

| Brazil | 9,900 | 5,400 |

| Chile | 5,400 | 5,400 |

| Sweden | 480 | 4,400 |

| Canada | 720 | 3,600 |

| Morocco | 1,000 | 3,600 |

| Singapore | 140 | 3,600 |

| South Africa | 390 | 2,900 |

| Thailand | 2,400 | 2,900 |

| Indonesia | 320 | 2,900 |

| Pakistan | 210 | 2,900 |

| Vietnam | 5,400 | 2,900 |

| Nigeria | 480 | 2,900 |

| Ecuador | 880 | 2,900 |

| Turkey | 480 | 2,400 |

| Bolivia | 720 | 2,400 |

| Cyprus | 260 | 1,900 |

| Dominican Republic | 320 | 1,900 |

| New Zealand | 50 | 1,900 |

| Costa Rica | 320 | 1,900 |

| Japan | 390 | 1,600 |

| Hong Kong | 170 | 1,600 |

| Egypt | 720 | 1,600 |

| Venezuela | 320 | 1,300 |

| Saudi Arabia | 1,000 | 1,300 |

| Algeria | 880 | 1,300 |

| Kenya | 70 | 1,000 |

| Bangladesh | 110 | 1,000 |

| Jordan | 390 | 1,000 |

| Cambodia | 170 | 880 |

| Ghana | 70 | 480 |

| Sri Lanka | 90 | 390 |

| Panama | 70 | 390 |

| Uganda | 40 | 260 |

| Uzbekistan | 110 | 260 |

| Ethiopia | 30 | 260 |

| Mauritius | 20 | 260 |

| Tanzania | 70 | 210 |

| Botswana | 20 | 70 |

| Mongolia | 10 | 70 |

2024 Monthly Searches For Each Brand

eToro - UK

eToro - UK

|

135,000

1st

|

XTB - UK

XTB - UK

|

4,400

2nd

|

eToro - Italy

eToro - Italy

|

110,000

3rd

|

XTB - Italy

XTB - Italy

|

4,400

4th

|

eToro - US

eToro - US

|

33,100

5th

|

XTB - US

XTB - US

|

2,400

6th

|

eToro - Australia

eToro - Australia

|

27,100

7th

|

XTB - Australia

XTB - Australia

|

320

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 51,160,000 visits vs. 7,682,000 for XTB.

Our Most Popular Broker Verdict

eToro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – eToro

When it comes to trading instruments, both XTB and eToro offer customers a comprehensive selection of products and markets from which to choose.

| eToro | XTB | |

|---|---|---|

| Forex trading | 49 currency pairs | 48 currency pairs |

| Cryptocurrency trading | 79 cryptos 14 crosses | 10 cryptos |

| Share CFD trading | Yes | Yes |

| Commodities CFD trading | 26 | 23 |

| ETF CFD Trading | 300 | 155 |

| Indices CFD trading | 20 | 30 |

| Bonds/Treasuries CFD trading | No | 3 |

| Real Stocks | 17 | 17 |

It should be noted that eToro also has investment options such as buying shares. Investors rather than traders may want to review eToro’s share offering as this comparison focuses on trading rather than on investors.

Our Top Product Range and CFD Markets Verdict

Both eToro and XTB have something for everyone, but eToro consistently outperformed XTB in terms of the breadth of markets available. Our crypto enthusiasts especially preferred the Israeli broker for its 79 pairs and 14 crosses, but our trading team also appreciated the extensive range of ETF CFDs available. Just note neither broker can offer cryptocurrency trading for retail traders in the UK due to FCA rules. We gave eToro a score of 60, which is slightly better than XTB’s, with 57.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

8. Superior Educational Resources – XTB

When it comes to educational resources, eToro and XTB both offer a wealth of information, but they cater to different types of traders. eToro has a robust educational section that includes webinars, video tutorials, and even podcasts. These resources are particularly useful for beginners who are just starting their trading journey.

- eToro offers a wide range of webinars covering various trading topics.

- XTB provides an extensive library of articles and research reports.

- eToro’s video tutorials are beginner-friendly and cover the basics of trading.

- XTB offers advanced courses for more experienced traders.

- eToro has podcasts that provide market insights and trading strategies.

- XTB provides a demo account for hands-on learning and practice.

XTB, on the other hand, leans more towards the experienced trader. Their educational resources include in-depth articles, research reports, and advanced courses. They also offer a demo account where you can practice trading without risking real money, which is a great way to get a feel for their platform and tools.

Our Superior Educational Resources Verdict

Based on our team’s scoring, XTB offers the best educational resources, catering to both beginners and experienced traders.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

9. Better Customer Service – XTB

Customer service is a crucial aspect of any trading platform, and both eToro and XTB have their merits. eToro offers a comprehensive FAQ section and email support, but it lacks live chat, which can be a downside for traders who need immediate assistance. On the other hand, XTB excels in this area with a responsive customer support team available via live chat, email, and phone.

| Feature | eToro | XTB |

|---|---|---|

| Live Chat | No | Yes |

| Email Support | Yes | Yes |

| Phone Support | No | Yes |

| FAQ Section | Comprehensive | Detailed |

| Response Time | Average | Quick |

| Multilingual Support | Yes | Yes |

XTB doesn’t just stop at providing multiple channels of communication; their support team is also quick to respond and available in multiple languages. This is particularly useful for traders who may not be fluent in English. The detailed FAQ section and educational resources also add to the overall excellent customer service experience at XTB.

Our Superior Customer Service Verdict

Based on our team’s testing, XTB outshines eToro in customer service, offering quick and multilingual support across various channels.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

10. More Funding Options – XTB

When it comes to funding options, both eToro and XTB offer a variety of methods to suit different needs. eToro provides a range of options, including credit/debit cards, PayPal, and wire transfers. These options are user-friendly and make it easy for traders to fund their accounts quickly.

| Funding Option | eToro | XTB |

|---|---|---|

| Credit/Debit Card | ✓ | ✓ |

| PayPal | ✓ | ✗ |

| Wire Transfer | ✓ | ✓ |

| Skrill | ✓ | ✓ |

| Neteller | ✓ | ✓ |

| UnionPay | ✗ | ✓ |

| WebMoney | ✗ | ✓ |

| Bitcoin | ✗ | ✗ |

| Ethereum | ✗ | ✗ |

| Other Cryptos | ✗ | ✗ |

XTB, on the other hand, also offers a good range of funding options but adds a few more to the list, like UnionPay and WebMoney. These additional options can be particularly useful for traders who prefer these specific methods. It’s worth noting that while eToro offers PayPal, XTB does not, which could be a deciding factor for some traders.

Our Better Funding Options Verdict

Based on the variety and flexibility of funding options, XTB takes the lead by offering a few more methods than eToro.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

11. Lower Minimum Deposit – XTB

When it comes to getting started with trading, the initial deposit can be a significant factor for many traders. eToro requires a minimum deposit of $50 for its standard account, which might not be a big deal for seasoned traders but could be a hurdle for beginners. On the other hand, XTB offers a more welcoming approach with a $0 minimum deposit for its standard account, making it easier for anyone to start trading without financial constraints.

Here’s a quick comparison table to put things into perspective:

| Broker | Minimum Deposit |

|---|---|

| eToro | $50 |

| XTB | $0 |

| Trader is a redident in: | Minimum First Deposit (USD) |

| Australia, United Kingdom, Germany, Malaysia, Singapore, Thailand, Ireland, Spain, Sweden | $50 |

| France, Poland, Slovakia, Belgium, Czech Republic | $100 |

| Eligible countries outside of the list | $200 |

| New Zealand | $1,000 |

| Israel | $10,000 |

| Uniited States | $10 |

Now, you might argue that a lower minimum deposit isn’t always better, as it could mean fewer features or less robust customer service. However, it’s crucial to consider that a lower entry barrier allows more people to explore the world of trading without feeling financially overwhelmed.

Our Lower Minimum Deposit Verdict

Based on our testing, XTB takes the lead in this category by offering a $0 minimum deposit, making it more accessible for traders of all levels.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

So is XTB or eToro the Best Broker?

XTB is the winner because it offers a more comprehensive range of features, lower fees, and better customer service. The table below summarises the key information leading to this verdict:

| Criteria | eToro | XTB |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ✅ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

eToro: Best For Beginner Traders

eToro is better suited for beginner traders due to its user-friendly interface and educational resources.

XTB: Best For Experienced Traders

XTB is the better choice for experienced traders, offering advanced features and a customizable trading platform.

FAQs Comparing eToro Vs XTB

Does XTB or eToro Markets Have Lower Costs?

XTB has lower costs compared to eToro. XTB offers lower spreads, starting from 0.2 pips for major currency pairs. eToro, on the other hand, has spreads starting from 3 pips for the same pairs. For more information on low-cost brokers, you can visit this comprehensive guide on low commissions.

Which Broker Is Better For MetaTrader 4?

XTB is the better choice for MetaTrader 4 users, as eToro does not offer this platform. XTB not only supports MetaTrader 4 but also provides advanced features and tools for a better trading experience. For more details, check out this list of the best MT4 brokers.

Which Broker Offers Social Trading?

eToro is the go-to broker for social and copy trading. They offer a feature-rich platform that allows you to follow and copy the trades of successful traders. If you’re interested in social trading, you can explore this list of the best copy trading platforms.

Does Either Broker Offer Spread Betting?

Neither eToro nor XTB offer spread betting. If you’re specifically looking for spread betting options, you might need to consider other brokers. For a list of brokers that do offer spread betting, you can check out this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, XTB is the superior choice for Australian Forex traders. Both eToro and XTB are ASIC regulated, but XTB offers a more comprehensive range of features and lower fees. eToro, although popular, is founded overseas, while XTB is also not Australian-based. For more details, you can visit this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK Forex traders, I’d recommend XTB. Both eToro and XTB are FCA regulated, but XTB offers a more robust trading platform and lower fees. Neither broker is founded in the UK; eToro is based in Cyprus, and XTB is headquartered in Poland. For more information, you can check out this list of the Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What is the minimum lot in XTB?

XTB offers investment opportunities for both small and large volumes, with a minimum transaction size of 0.01 lot.