FP Markets vs XM: Which One Is Best?

Dive into our comprehensive comparison of FP Markets and XM Group. We dissect key areas like trading costs, platforms, regulation, and more to help you choose the right broker for your trading needs.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors between FP Markets and XM. Here are the five most noticeable differences:

- FP Markets offers lower average spreads on its standard account, starting at 1.47 pips, while XM Group starts from 1.6 pips.

- For raw account spreads, FP Markets starts from 0.41 pips, whereas XM Group offers even lower spreads starting from 0.1 pips.

- FP Markets charges a commission of $3.50 per lot per side on its RAW account, while XM Group charges no commission on its Ultra Low account.

- Both brokers do not charge any fees for deposits and withdrawals.

- FP Markets imposes a $10 monthly inactivity fee, while XM Group charges a $5 monthly inactivity fee after 90 days of no trading activity.

1. FP Markets: Lowest Spreads And Fees

When it comes to trading costs, both FP Markets and XM Group offer competitive pricing. Our dedicated and highly skilled team has put in extensive effort and expertise to design the exclusive fee calculator that you see below:

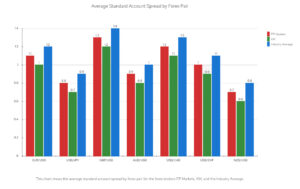

1. Standard Account Spreads

FP Markets offers lower Standard Account Spreads, with an average spread of 1.56 pips, while XM Group’s spreads start from 1.6 pips. Tight spreads are important as they reduce the cost of trading, which can significantly impact your profitability, especially if you trade frequently.

| Standard Account | FP Markets Spreads | XM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.56 | 2.11 | 1.7 |

| EUR/USD | 1.18 | 1.6 | 1.2 |

| USD/JPY | 1.6 | 2 | 1.4 |

| GBP/USD | 1.49 | 1.8 | 1.5 |

| AUD/USD | 1.45 | 2.3 | 1.5 |

| USD/CAD | 1.75 | 2.3 | 1.9 |

| EUR/GBP | 1.4 | 1.8 | 1.5 |

| EUR/JPY | 1.8 | 2.1 | 1.9 |

| AUD/JPY | 1.8 | 3 | 2.2 |

Standard Account Analysis Updated January 2026[1]January 2026 Published And Tested Data

Looking at the average standard account spreads for the forex pairs, we can see some interesting patterns. FP Markets and XM have fairly competitive spreads across all pairs, but there are some key differences.

For instance, FP Markets consistently offers slightly tighter spreads than XM. This is particularly noticeable in pairs like EUR/USD and GBP/USD, where the difference can be as much as 0.3 pips. This might not seem like much, but for active traders who execute numerous trades each day, these small differences can add up.

The industry average, however, is consistently higher than both FP Markets and XM. This suggests that both brokers are offering competitive pricing, with FP Markets having a slight edge.

In my opinion, if cost is a significant factor in your decision-making process, FP Markets seems to be the cheaper option. However, it’s important to remember that cost is just one aspect of choosing a broker. Other factors, such as trading environment, trustworthiness, and customer service, are equally important.

Here is the bar chart visualising the average standard account spread by forex pair for FP Markets, XM, and the Industry Average:

2. RAW Account Spreads

For traders who prefer raw spreads, FP Markets offers spreads from 0.41 pips on its RAW account, while XM Group offers spreads from 0.1 pips on its Ultra Low account.

3. Commission Rates

FP Markets charges a commission of $3.50 per lot per side on its RAW account, while XM Group does not charge any commission on its Ultra Low account. More details here on our list of Lowest Commission Brokers.

4. Deposit & Withdrawal Fees

Both FP Markets and XM Group do not charge any fees for deposits and withdrawals, which is a significant advantage for traders.

5. Other Fees

FP Markets charges an inactivity fee of $10 per month after a period of inactivity, while XM Group charges a $5 monthly inactivity fee after 90 days of inactivity.

Our Lowest Spreads and Fees Verdict

While both brokers offer competitive pricing, FP Markets comes out slightly ahead due to its lower spreads and commission rates.

FP Markets ReviewVisit FP Markets

2. XM: Better Trading Platform

Both FP Markets and XM Group offer a range of trading platforms to suit different trading styles and preferences.

| Trading Platform | FP Markets | XM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

1. MetaTrader 4 and 5

Both forex brokers offer the popular MetaTrader 4 and MetaTrader 5 platforms, known for their advanced charting features, customizability, and automated trading capabilities.

2. cTrader and TradingView

FP Markets offers the cTrader platform, which is known for its direct market access trading, while XM Group does not. However, XM Group offers TradingView, a platform known for its social trading features and advanced charting tools.

3. Social And Copy Trading

XM Group offers social and copy trading through its TradingView platform, allowing traders to follow and copy the trades of experienced traders. FP Markets does not currently offer social or copy trading.

4. VPS and Other Trading Tools

Both brokers offer VPS services for uninterrupted trading, along with a range of other trading tools, such as economic calendars, market news, and technical analysis tools.

Our Better Trading Platform Verdict

While both brokers offer a range of trading platforms and tools, XM Group has the advantage of its social and copy trading features.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

3. XM: Superior Accounts And Features

FP Markets offers two main types of accounts: Standard and RAW. The Standard account offers spreads from 1.0 pips with no commission, while the RAW account offers spreads from 0.0 pips with a commission of $3 per lot per side.

XM Group offers four types of accounts: Micro, Standard, Ultra Low, and Shares. The Micro and Standard accounts offer spreads from 1.6 pips with no commission, while the Ultra Low account offers spreads from 0.1 pips with no commission. The Shares account is designed for trading on share CFDs.

| FP Markets | XM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

XM Group offers more account types, giving traders more options to choose from based on their trading needs and preferences.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

4. FP Markets: Best Trading Experience And Ease

According to our research on Execution Speeds, FP Markets has a slight edge over XM Group. FP Markets has an average execution speed of 85 milliseconds compared to XM Group’s 150 milliseconds. This faster execution speed can be a significant advantage for traders, especially those who use high-frequency trading strategies.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| FP Markets | 225ms | 31/36 | 96ms | 8/36 |

| XM | 148ms | 21/36 | 184ms | 28/36 |

Our Best Trading Experience and Ease Verdict

FP Markets wins this category due to its faster execution speeds.

5. XM: Stronger Trust And Regulation

XM has a higher trust score of 88 vs 64 for FP Markets. The score factors in regulation, reputation, and reviews for each broker.

XM Trust Score

FP Markets Trust Score

1. Regulation

FP Markets is regulated by the ASIC Regulated Brokers and the Cyprus Securities Exchange Commission (CySEC). On the other hand, XM Group is regulated by the ASIC, CySEC, and the International Financial Services Commission (IFSC) of Belize. More details on ASIC Regulated Brokers.

| FP Markets | XM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) | FSC-BZ |

2. Reputation

With XM being established in 2009, and FP Markets 2005, both brokers have been in the industry for a similar length of time. XM gets searched on Google more than FP Markets. On average, XM sees around 723,000 branded searches each month, while FP Markets gets about 49,500 — that’s 93% fewer. Similarweb shows a similar story when it comes to February 2024 website visits with XM receiving 15,630,000 visits vs. 482,000 for FP Markets.

| Country | FP Markets | XM |

|---|---|---|

| United States | 1,600 | 74,000 |

| Japan | 140 | 74,000 |

| Thailand | 720 | 74,000 |

| India | 2,900 | 60,500 |

| South Africa | 2,400 | 33,100 |

| Malaysia | 720 | 27,100 |

| Indonesia | 590 | 27,100 |

| Egypt | 210 | 22,200 |

| Colombia | 260 | 18,100 |

| Vietnam | 320 | 18,100 |

| Brazil | 590 | 18,100 |

| Morocco | 590 | 18,100 |

| France | 880 | 14,800 |

| Germany | 1,300 | 14,800 |

| Mexico | 170 | 14,800 |

| Pakistan | 1,300 | 12,100 |

| Philippines | 390 | 12,100 |

| Uzbekistan | 70 | 12,100 |

| Italy | 12,100 | 9,900 |

| Turkey | 720 | 9,900 |

| United Kingdom | 2,400 | 8,100 |

| Algeria | 210 | 8,100 |

| Cambodia | 210 | 6,600 |

| Canada | 1,600 | 5,400 |

| Spain | 1,600 | 5,400 |

| Taiwan | 210 | 5,400 |

| Bangladesh | 720 | 5,400 |

| Kenya | 590 | 5,400 |

| Peru | 70 | 5,400 |

| Nigeria | 590 | 4,400 |

| Singapore | 590 | 4,400 |

| Netherlands | 480 | 4,400 |

| Saudi Arabia | 210 | 4,400 |

| Ecuador | 70 | 4,400 |

| Sri Lanka | 140 | 4,400 |

| United Arab Emirates | 480 | 3,600 |

| Poland | 720 | 3,600 |

| Australia | 1,900 | 2,900 |

| Venezuela | 110 | 2,900 |

| Greece | 1,900 | 2,900 |

| Chile | 70 | 2,900 |

| Jordan | 70 | 2,900 |

| Argentina | 140 | 2,400 |

| Switzerland | 480 | 2,400 |

| Dominican Republic | 70 | 2,400 |

| Cyprus | 480 | 1,900 |

| Portugal | 210 | 1,900 |

| Austria | 170 | 1,900 |

| Ghana | 70 | 1,900 |

| Botswana | 50 | 1,900 |

| Bolivia | 30 | 1,600 |

| Mongolia | 10 | 1,600 |

| Hong Kong | 170 | 1,300 |

| Sweden | 210 | 1,300 |

| Ethiopia | 110 | 1,300 |

| Uganda | 70 | 1,000 |

| Tanzania | 110 | 880 |

| Costa Rica | 20 | 880 |

| Ireland | 90 | 590 |

| Panama | 20 | 590 |

| New Zealand | 40 | 480 |

| Mauritius | 20 | 260 |

1,600 1st | |

74,000 2nd | |

140 3rd | |

74,000 4th | |

2,900 5th | |

60,500 6th | |

590 7th | |

27,100 8th |

3. Reviews

FP Markets has a near perfect TrustPilot score of 4.9 out of 5, while XM’s score of 3.9 is lagging behind.

Our Stronger Trust and Regulation Verdict

Thanks to its additional regulation by the IFSC, XM Group has the slightest edge over FP Markets in terms of regulation.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

6. FP Markets: Top Product Range And CFD Markets

When it comes to the range of products and CFD markets, both FP Markets and XM have their unique offerings. FP Markets provides a wide array of over 10,000 trading instruments, including forex, indices, commodities, shares, and cryptocurrencies. On the other hand, XM Group offers a more limited range but is still substantial, with over 1,000 trading instruments, including forex, indices, commodities, stocks, and cryptocurrencies.

| CFDs | FP Markets | XM |

|---|---|---|

| Forex Pairs | 63 | 55 |

| Indices | 19 | 14 |

| Commodities | 4 Metals (vs USD, AUD, EUR) 4 Energies 5 Softs | 2 Metals 5 Energies 8 Softs |

| Cryptocurrencies | 12 | No |

| Shares CFDs | 10000+ (with IRESS) 814 (with MT5) | 1261 |

| ETFs | 46 | No |

| Bonds | 2 | No |

| Futures | No | No |

| Treasuries | 2 | No |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

FP Markets offers a more comprehensive range of CFDs and Markets, making it the better choice for traders looking for variety.

7. XM: Superior Educational Resources

Education is a crucial aspect for both beginner and experienced traders. FP Markets and XM Group both offer educational resources, but the extent and quality differ. XM Group is particularly known for its extensive educational resources, including webinars, video tutorials, and articles. FP Markets, while not as extensive, offers quality educational content, including eBooks and some video tutorials.

Educational Resources Comparison:

- Webinars: XM Group offers frequent webinars, while FP Markets has fewer.

- Video Tutorials: Both brokers offer video tutorials, but XM Group has a more extensive collection.

- Articles: XM Group provides a wide range of articles on various trading topics, whereas FP Markets offers fewer articles.

- eBooks: FP Markets offers eBooks for in-depth learning, while XM Group does not focus much on eBooks.

- Beginner Guides: Both brokers offer beginner guides, but XM Group’s are more comprehensive.

- Advanced Learning: XM Group offers more advanced learning materials compared to FP Markets.

Our Superior Educational Resources Verdict

Based on our testing, XM Group offers the best educational resources, scoring higher in most categories.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

8. Tie: Superior Customer Service

Both FP Markets and XM Group offer excellent customer service, with multiple channels of communication, including live chat, email, and phone support. They also offer educational resources to help traders improve their trading skills.

| Feature | FP Markets | XM |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | 24/7 | 24/7 |

| FAQ Section | Yes | Yes |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

It’s a tie in this category, as both brokers offer excellent customer service and educational resources.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

9. XM: Better Funding Options

Funding options are a vital consideration for traders as they determine how easily you can deposit and withdraw funds from your trading account. FP Markets offers a variety of funding options, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. XM Group also provides multiple funding options but stands out for its support for local bank transfers, which can be a significant advantage for traders in specific regions.

Both brokers offer quick and secure transactions, but the range of options varies. For instance, FP Markets does not support PayPal, while XM Group does. On the other hand, FP Markets supports more types of e-wallets compared to XM Group.

| Funding Methods | FP Markets | XM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | ||

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

XM Group offers the best funding options, providing a broader range of methods, including local bank transfers and PayPal.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

10. XM: Lower Minimum Deposit

XM has a lower minimum deposit of $5 than FP Markets which requires traders at least $100. These minimum amounts are applicable worldwide to different base currencies.

FP Markets

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Paypal | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

XM

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £5 | $5 | €5 | $5 |

| Bank Wire | £5 | $5 | €5 | $5 |

| Electronic Wallets | £5 | $5 | €5 | $5 |

Our Lower Minimum Deposit Verdict

XM’s minimum deposit condition at $5 wins this category. You will need a bigger amount to start a trading position, but it does offer a flexible approach for beginners.

*Your capital is at risk ‘75.99% of retail CFD accounts lose money’

So Is XM or FP Markets The Best Broker?

XM is the winner because it excels in more categories, including trading platforms, account features, educational resources, funding options, and minimum deposit requirements. The table below summarises the key information leading to this verdict.

| Criteria | FP Markets | XM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

XM: Best For Beginner Traders

For beginner traders, XM is the better choice due to its lower minimum deposit and superior educational resources.

FP Markets: Best For Experienced Traders

For experienced traders, FP Markets is the better option, offering a wider range of products and CFD markets.

FAQs Comparing FP Markets Vs XM

Does XM or FP Markets Have Lower Costs?

FP Markets has lower costs when it comes to spreads and fees. The broker offers lower average spreads on its standard account, starting at 1.47 pips, while XM Group starts from 1.6 pips. For raw account spreads, FP Markets starts from 0.41 pips. For more information, you can visit this list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

When it comes to MetaTrader 4, XM is the better choice. XM offers more features and tools specifically designed for MT4 users. FP Markets also supports MT4 but doesn’t offer as many custom features. For a comprehensive list, check out this best MT4 brokers guide.

Which Broker Offers Social Trading?

For social trading, neither FP Markets nor XM offers this feature. While both brokers offer various tools and educational resources, they do not currently support social or copy trading. If you’re interested, you might want to explore this best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither FP Markets nor XM offers spread betting as part of their services. If you’re specifically interested in spread betting, you’ll need to look elsewhere. For more options, you can check out this list of best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, FP Markets is the superior choice for Australian forex traders. FP Markets is ASIC-regulated and was founded in Australia, offering a sense of trust and local expertise. XM is also ASIC-regulated but is based overseas. For more details, you can visit this Best Forex Brokers In Australia comparison.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe XM is the better option. While both brokers are FCA-regulated, XM offers a more comprehensive set of features and lower minimum deposits. FP Markets, although FCA-regulated, is based overseas. For more information, you can check out this list of best UK forex brokers.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

I was wondering about that execution speed comparison. What factors played into it, and what specific aspects led to the conclusion that FP Markets had a slight edge in this category?

Our execution speed tests done by our colleague Ross Collins found FP Markets has limit order speed of 225 ms and markets order speed of 96 ms while XM has a limit order speed of 148 ms for limit orders and 184 for market orders. When you sum the two FP Markets finished 10th and XM finished 19th of the 20 brokers tested.

What is the execution speed of FP Markets?

In the month of December 2022, FP Markets found their median order execution time from the time the trade is received, processed and closed is 29 milliseconds. Our tests found FP Markets has a limit order speed of 225 ms and market order speed of 96 ms.

What is the stop out level for FP Markets?

FP Markets have a stop out level of 50% by default however this can be adjusted should you wish.