Global Prime Review Of 2026

Global Prime (Global Prime Pty Ltd) is a leading Australian-based forex broker that specialises in offering prime of prime trade execution and spreads. We take a look at its excellent low fees and strong customer support.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Global Prime Summary

| 🗺️ Tier 1 Regulation | ASIC |

| 🗺️ Tier 3 Regulation | VFSC |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MT4, Myfxbook Auto Trade System, TraderEvolution |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments | Forex, Stocks, Crypto, Commodities |

Why Choose Global Prime

When selecting a broker for your Forex trading activities, transparency, integrity and a proven track record of great customer service are among the top qualities you should seek. Global Prime is one brokerage with all these qualities, plus an excellent business model that makes it great for traders of all types and experience levels.

New traders will find the low trading costs and relatively low funding threshold appealing. In contrast, even the most experienced traders can take advantage of features such as the FIX API and deep liquidity.

Global Prime Pros and Cons

- Low spreads

- Transparent pricing model

- No minimum deposit

- Limited asset variety

- No cryptocurrency trading

- Lacks educational resources

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Fees

Spreads

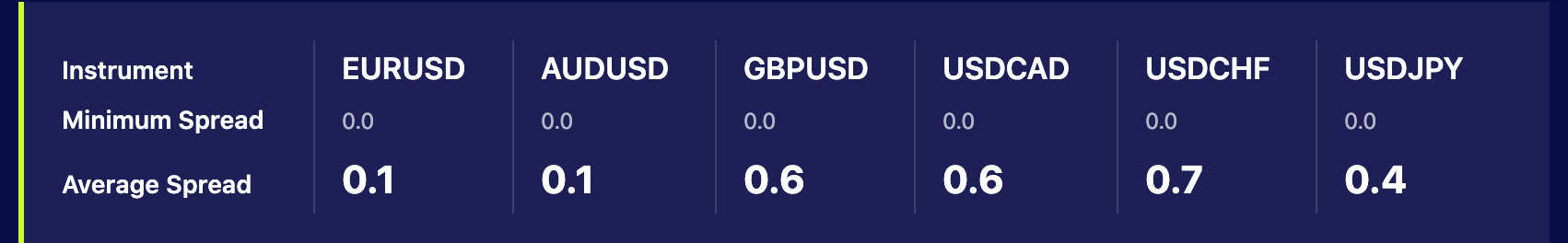

Like everything else about it, Global Prime’s fee structure is trader-friendly. Spreads average just 0.1 pip on the popular EUR/USD currency pair and are relatively low across the board.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.12 | 0.64 | 0.26 | 0.53 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.99 | 0.94 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Commissions

A commission of $7 (round turn) per 100k units is applied to fx and spot metal trades (other CFDs are commission-free, spread only products), keeping the costs of trading quite low.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| IC Markets | $3.50 | $4.50 | £2.75 | €3.25 |

| FXCM | $4 | $4 | NA | NA |

| XTB | $4 | NA | £3 | €3.50 |

| Global Prime | $3.50 | $3.50 | £2.70 | €3.10 |

| Dukascopy | $5 | NA | £3.50 | €4.00 |

A final point to note is that the brokerage sets its margin stop at 100 percent and its margin call at 120 percent.

Note* Global Prime offers low spreads for the AUD crosses, starting from 0.1 pips on AUD/USD. For the minor currency pairs, the spread comes a little higher. For example, the GBP/AUD pair has an average spread of 1.0 pips.

Trade Experience

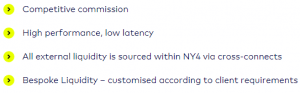

One of the most important points that should be mentioned in any Global Prime review is its somewhat unique liquidity structure. Many digital Forex brokers use a single large provider for their trading liquidity, a method that works reasonably well in most cases but can cause difficulties for high-volume traders on occasion. With Global Prime, however, this problem is solved through the use of a more diverse pool of providers.

Global Prime use 26 liquidity providers consisting of tier 1 banks, ECNs and non-bank liquidity provider who specialise in particular currency pairs. This not only helps to ensure available liquidity but also helps traders get the most competitive rates on their trades by choosing the most appropriate liquidity provider. It is, for this reason, Global Prime call itself a prime of prime POP broker.

This broad liquidity pool is also beneficial in terms of the depth of liquidity that Global Prime is able to offer to its customers. While most brokers are able to offer liquidity in the range of 50k at the top of the book, Global Prime is able to substantially outperform the field with 500k-1m unit liquidity available. Though this will make very little difference for smaller retail traders, it is of enormous benefit to high-volume and institutional users. For these users, Global Prime is even able to customise liquidity models in order to ensure the best possible user experience.

This broad liquidity pool is also beneficial in terms of the depth of liquidity that Global Prime is able to offer to its customers. While most brokers are able to offer liquidity in the range of 50k at the top of the book, Global Prime is able to substantially outperform the field with 500k-1m unit liquidity available. Though this will make very little difference for smaller retail traders, it is of enormous benefit to high-volume and institutional users. For these users, Global Prime is even able to customise liquidity models in order to ensure the best possible user experience.

Prime Broker Service

Global Prime differentiates itself from other market makers because its financial services cater to institutional investors as well. Professional traders can gain Direct Market Access DMA that connects them to a deep liquidity network procured from 3 main sources:

- Tier-1 bank No Dealing Desk Brokers

- Non-banks

- ECN liquidity providers (Fastmatch, LMAX, Currenex, Gain GTX, and Hotspot)

- Alternative connectivity options available via PrimeXM, OneZero, Gold-i, Celer Tech, Trader

Tools, Integral, Flextrade, First Derivatives, and Xenfin Technology.

The ECN and STP execution styles combined with the customized liquidity solution and proximity to New York’s NY4 servers allows Global Prime to offer low latency orders and tight spreads. Even among the best forex brokers, there are few online trading providers that offer institutional-grade services.

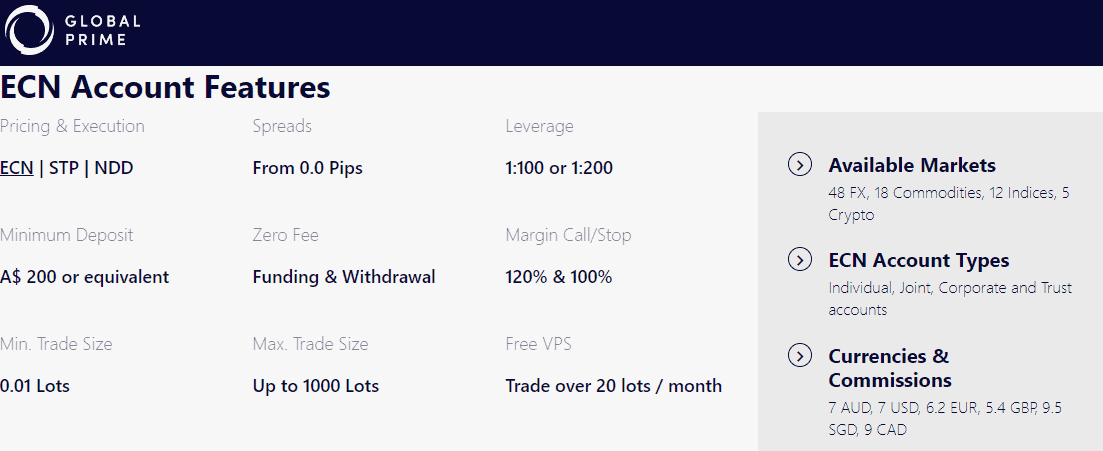

Traders can easily open a live account with leverage ratios of up to 100:1 via the broker’s offshore entity regulated in Vanuatu. In Australia, it is restricted to a maximum of 30:1. Traders are able to take advantage of relatively low minimum trade volumes starting at just 0.01 lots. Together, the low initial investment, reasonable leverage ratios and low required trade volume make Global Prime a good brokerage for beginning Forex traders who don’t want to risk too much money at the outset.

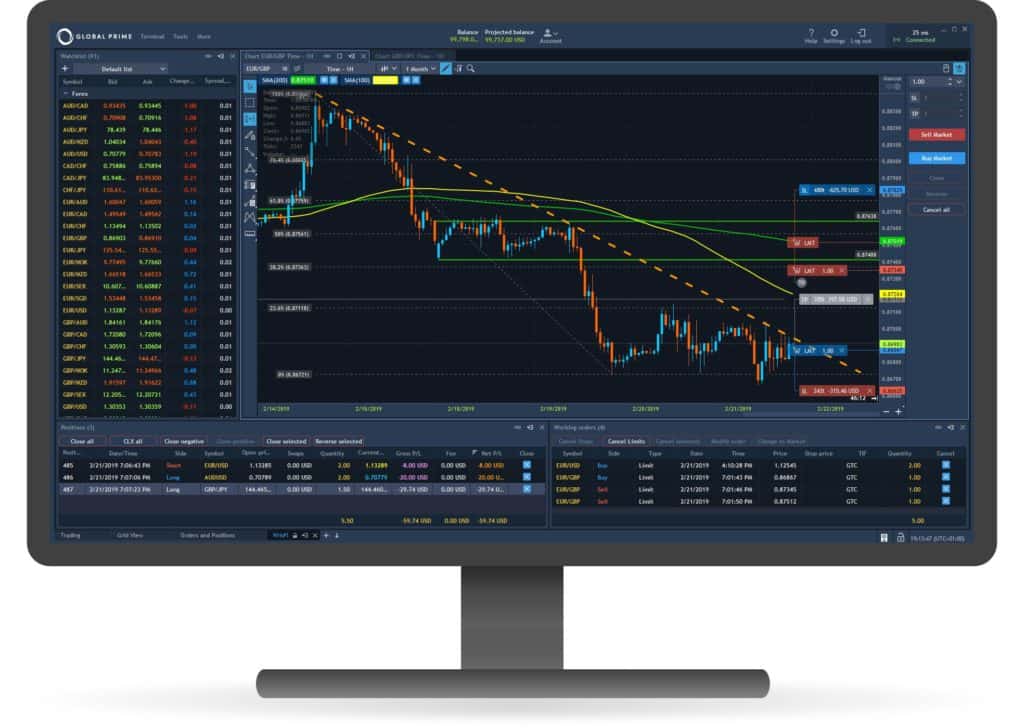

Trading Platforms

Like many leading brokerages, Global Prime offers more than one type of trading platform. The most common platform is MetaTrader 4, which is available for Windows, Mac, iPhone (IOS) and Android devices. This platform is universally popular among Forex traders and is used by many of Global Prime’s competitors, making it easy for experienced traders who are new to the brokerage to start trading quickly.

| Trading Plaform | Available With Global Prime |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | Yes |

MetaTrader 4

The other trading platform option is TraderEvolution which comes standard with a range of features including depth of market, one-click trading, 10+ customisable chart types, and algo trading capabilities. This platform requires a different global prime account to their ECN account.

Note* The mobile trading experience is comparable to the same trading conditions found on the desktop version.

Additional Trading Platforms

In addition to MT4, Global Prime also offers more specialised platforms and tools for professional and institutional users. The Myfxbook AutoTrade system, for example, enables social trading and trade mirroring for users who want to follow the activity of other traders.

Next Generation is a multi-asset platform introduced to cater to professionals seeking more advanced platform functionality with:

- Live depth-of-market (currently 15 quotes each side) with multiple depth trading panels.

- Spread charts, symbol overlay, synchronized panels, customized time frames, trailing

Added: stops/TP/SL in one click.

- Spread charts, symbol overlay, synchronized panels, customized time frames, trailing

- Volume and tick data analyses, multi-asset and multiple screen support, C# Algo trading,

Added: choice of time zone display and more.

- Volume and tick data analyses, multi-asset and multiple screen support, C# Algo trading,

API Solution

Finally, there’s the FIX API. Designed specifically with professional traders in mind, FIX lets traders customise their trading strategies in an automated environment. This trading protocol has gained popularity with institutional clients worldwide and is currently considered one of the best trading tools available to professional and high-volume Forex traders. It should also be noted that high-volume traders can access a free VPS offer to enhance their execution speeds and improve their trading. The Virtual Private Server used by Global Prime is Beeks VPS, ForexVPS and New York City Servers.

Is Global Prime Safe?

Global Prime has a trust score of 44, based on its regulation, reputation, and reviews.

1. Regulation

Unfortunately, traders based in the United States are unable to sign up as Global Prime customers. The online broker is based in Australia and not licensed and regulated by US financial authorities. Trading forex in the United States is very different to countries such as Australia, Singapore or the United Kingdom. If you are a US trader, check out our full Forex.com Review, IG Review or OANDA Review, all of which are regulated by:

- Financial Industry Regulatory Authority (FINRA)

- Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

| Global Prime Safety | Regulator |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission |

| Tier-2 | X |

| Tier-3 | VFSC (Vanuatu) - Vanuatu Financial Services Commission |

Being based in Australia, Global Prime is fully regulated by the Australian Securities and Investments Commission (ASIC). Global Prime holds the Australian Financial Services License (AFSL) number 385620 and operates with the trading name Global Prime Pty Ltd. ASIC regulations allow Global Prime Pty Ltd to accept Traders from Australia, Hong Kong, the British Virgin Islands and the Cayman Islands.

If you are not from one of the aforementioned countries, then you will be registered with Global Prime FX (Company Number 40256) which is based in Vanuatu. Global Prime FX is regulated by the Vanuatu Financial Services Commission (VFSC). Global Prime also holds a securities dealers license issued by the FSA as a registered Seychelles company.

2. Reputation

Global Prime’s headquarters are located in the Central Business District, right in the heart of Sydney at the following contact address:

- Suite 604,

- 35 Grafton St

- Bondi Junction

- Sydney, Australia

Traders from across 120 countries access the foreign exchange market through Global Prime, which handles an average monthly volume traded of $40 billion.

It is also one of the few brokerages that go above and beyond what is legally required of it when it comes to financial transparency. Global Prime is the only Forex brokerage that will readily show clients which institution provided the price for a specific trade, allowing traders to see exactly what is going on behind the scenes of the prices they’re paying. This commitment to transparency is an excellent feature of Global Prime that helps to set it apart from the pack.

Global Prime shows limited visibility in the online forex trading space. With approximately 4,400 monthly Google searches, it ranks as the 59th most popular forex broker among the 65 brokers analyzed. Web traffic data tells a similar story, with Similarweb reporting 34,000 global visits in February 2024, positioning Global Prime as the 59th most visited broker.

Founded in 2010 and based in Australia, Global Prime has positioned itself as a transparent, agency-model broker. While the company doesn’t publicly disclose its client numbers or overall trading volumes, its limited search and traffic metrics suggest a niche operator rather than a mass-market presence. Despite this modest online visibility, Global Prime has built a reputation among certain trader segments for its transparent fee structure and institutional-grade liquidity.

| Country | 2025 Monthly Searches |

|---|---|

| India | 260 |

| Australia | 260 |

| Canada | 260 |

| United Kingdom | 210 |

| United States | 210 |

| Brazil | 210 |

| South Africa | 170 |

| Spain | 170 |

| Germany | 140 |

| Italy | 140 |

| Thailand | 140 |

| Malaysia | 90 |

| Indonesia | 90 |

| Nigeria | 90 |

| Turkey | 90 |

| Singapore | 90 |

| Philippines | 90 |

| Chile | 90 |

| France | 70 |

| Japan | 70 |

| Pakistan | 50 |

| United Arab Emirates | 50 |

| Netherlands | 50 |

| Vietnam | 40 |

| Kenya | 40 |

| Bangladesh | 40 |

| Colombia | 30 |

| Mexico | 30 |

| Taiwan | 30 |

| Venezuela | 30 |

| Poland | 30 |

| Morocco | 30 |

| Algeria | 30 |

| Portugal | 30 |

| Tanzania | 30 |

| Hong Kong | 20 |

| Egypt | 20 |

| Saudi Arabia | 20 |

| Argentina | 20 |

| Cambodia | 20 |

| Cyprus | 20 |

| Switzerland | 20 |

| Sweden | 20 |

| Austria | 20 |

| Sri Lanka | 20 |

| Uganda | 20 |

| Ghana | 20 |

| Greece | 10 |

| Peru | 10 |

| Ecuador | 10 |

| Dominican Republic | 10 |

| Uzbekistan | 10 |

| Ireland | 10 |

| New Zealand | 10 |

| Bolivia | 10 |

| Panama | 10 |

| Ethiopia | 10 |

| Jordan | 10 |

| Uruguay | 10 |

| Costa Rica | 10 |

| Botswana | 10 |

| Mongolia | 10 |

| Mauritius | 10 |

260 1st | |

260 2nd | |

260 3rd | |

210 4th | |

210 5th | |

210 6th | |

170 7th | |

170 8th | |

140 9th | |

140 10th |

3. Reviews

Global Prime as a score of 4.6 out of 5.0 in TrustPilot from 270 reviews.

Deposit and Withdrawal

What is the minimum deposit at Global Prime?

The minimum deposit requirement at Global Prime is $0.

Account Base Currencies

Funding a Global Prime trading account can be done in several ways. Bank transfer is one of the simplest and can be done in most major currencies. Local currency and local bank wire transfer solutions are also available (currently, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Nigeria, South Africa with more being added: notably, Brazil, China next).

Deposit/Withdrawal Options and Fees

Alternatively, investors can fund their accounts through a credit card or debit card (VISA) and deposits are limited to $10,000 units of account currency, per transaction. For those who prefer E-teller or E-wallet services, Global Prime accepts Neteller/Skrill, Fasapay, Paypal, DragonPay, Webmoney/Qiwi, Bpay and POLi payments free of charge.

Zero Fee Partners

Note* The basic account welcomes all types of forex traders, including scalping.

Product Range

One of Global Prime’s key strengths is its diverse list of products. Traders can include four different asset classes in their trading strategies being forex, indices, commodities and cryptocurrencies. As well as 48 currency pairs, you can trade 36 CFDs including 12 major global stock indices, 4 spot metals, 2 futures (DXY and Copper), 10 soft commodities, 3 energies (oil, gas) and 5 cryptocurrencies.

CFDs

Forex

Major, minor and exotic forex pairs are offered by Global Prime. Traders can enjoy low spreads and fast execution, allowing for minimal slippage. When trading forex, you will pay overnight financing fees (swap rates) for positions held open for longer than one day.

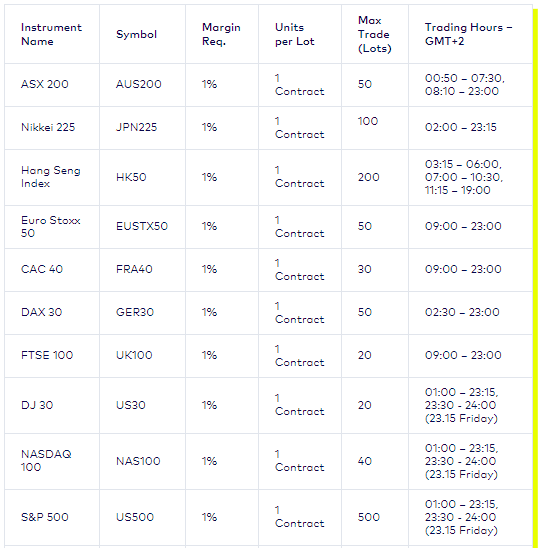

Stock Indices

Global Prime retail traders can access real-time prices for the world’s largest and most important stock market indices like the S&P 500, DAX 30, ASX 200 and Nikkei 225. At 1% margin requirements are low when trading index CFDs. Below you can review the full list of indices found at Global Prime.

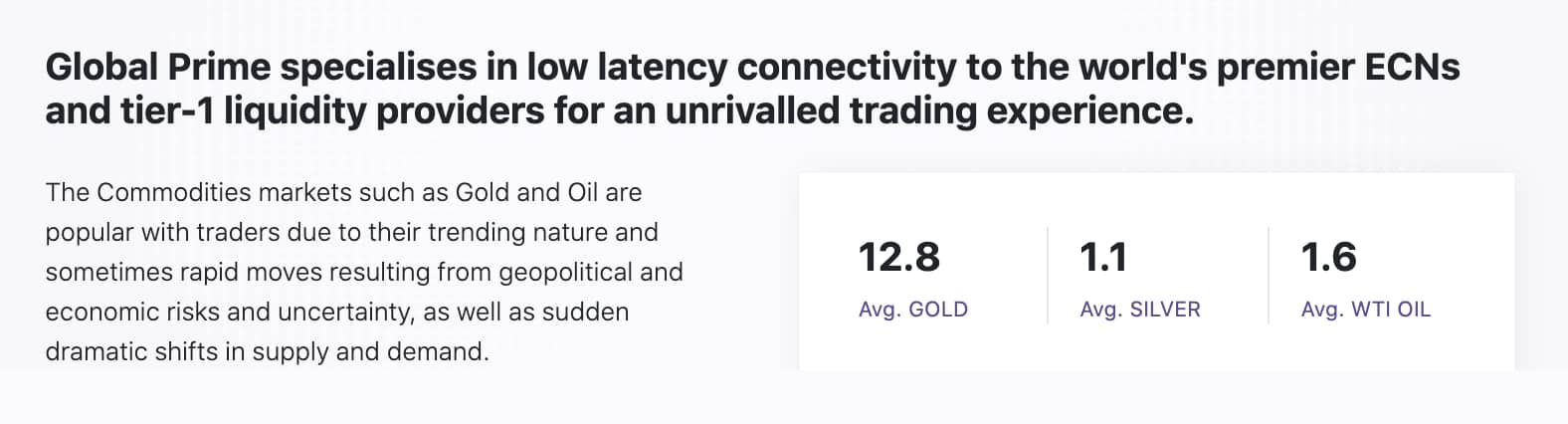

Commodities

The online broker’s commodity product range consists of metal and energy products. You can trade 18 different markets, with the following commodities available against the United States Dollar (USD) and/or the Euro (EUR):

- Metals: Gold, silver, platinum, palladium and copper.

- Energy products: Crude oils and natural gas.

Cryptocurrencies

The rapid expansion in blockchain technology prompted Global Prime to also offer its clients access to trading cryptocurrencies through CFD contracts. You can trade Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash on the broker’s trading platforms. Trading CFDs on digital coins comes with two advantages:

The rapid expansion in blockchain technology prompted Global Prime to also offer its clients access to trading cryptocurrencies through CFD contracts. You can trade Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash on the broker’s trading platforms. Trading CFDs on digital coins comes with two advantages:

- No digital wallet is required

- Zero Commission trading

Customer Service

An outstanding feature of Global Prime is the service it offers its customers. Therefore, no Global Prime review could be complete without a comprehensive overview of the company’s service model and record.

This brokerage offers a dedicated team of support professionals ready to answer questions and resolve trader concerns 24/7. Clients can call +61 (2) 8379 3622 from Monday to Saturday (AEDT) and +61 (2) 8379 3622 from Sunday to Friday (GMT).

Alternatively, they can also email Global Prime’s support staff at support at globalprime.com at any time or start a live chat on the company’s website during support hours.

Though this customer service model may seem basic, Global Prime has made it extremely effective. This brokerage has an excellent history of customer satisfaction, garnering some of the most positive reviews of any Australian Forex broker. With an average rating of 4.75 out of five stars by users on Forex Peace Army (FPA), our Global Prime review found that this company beats out even such prominent brokers as Pepperstone (3.3 stars) and IC Markets (3.7 stars).

Research and Education

Global Prime also boasts a community Discord chatroom where traders can converse with staff, including owners, GM, operations, support team, and Market Commentator Ivan Delgado directly. It’s a unique transparent environment, where all topics, trading and general feedback and criticism are aired publicly for all to see. Competitions and discounts also feature here.

Final Verdict on Global Prime

Overall, our Global Prime review found that this platform has something to offer almost every Forex trader, from the beginner to the professional. New traders will enjoy the low costs of trading and relatively low funding threshold, while even the most experienced traders can derive benefit from features like the FIX API and deep liquidity.

All traders can be assured that they are getting the best in service in transparency at globalprime.com.au. If you are looking for a trustworthy, reliable and service-oriented Australian Forex brokerage, Global Prime is an excellent option. Online trading is a high-risk endeavour, so before you risk your hard-earned money make sure you understand the whole inherent risks associated with this type of activity.

Global Prime FAQs

Is Global Prime a Safe Broker?

Yes, Global Prime is considered a safe regulated forex broker with tier-one oversight – namely Australia’s ASIC. Global Prime is considered to be a safe brokerage trading firm by all industry standards. Retail traders can take advantage of low spreads starting from 0.0 pips, 1ms execution speed, access +100 CFD instruments and trade with a true ECN/STP forex broker.

Check out the Forex Brokers In Australia based on customer service, trading platforms, spreads, trading tools and range of markets.

What is the minimum deposit at Global Prime?

While there is no minimum deposit requirement, USD 200 is the suggested minimum deposit at Global Prime or 200 units of the account base currency. Global Prime supports 6 different account base currencies, no deposit fees, instant funding options, +20 deposit methods and +10 withdrawal methods. Client money is protected under the ASIC Client Money Reporting Rules 2017.

What spreads Global Prime offers?

Spreads start from 0.0 pips at Global Prime while the average spreads on the most popular currency pair EUR/USD is just 0.2 pips. Global Prime offers variable spreads on 48 FX pairs, 20 commodities, 15 indices, 5 cryptocurrencies and 20 Shares. The ECN spreads are aggregated from 26 tier-one liquidity providers.

To identify the lowest spread FX broker check our Lowest Spread Forex Brokers page for the best names in the forex industry.

Alternatives to Global Prime

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Is Global Prime regulated in the USA?

No they are not. Global Prime is regulated ASIC in Australia and VFSC in Vanuatu for outside Australia.