Markets.com Review Of 2026

Our Markets.com review found key strengths in its trading platform which has great sentiment, technical, and fundamental analysis for forex and CFD products. It is a market maker offering commission-free trading via its own account.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Markets.com Summary

| 🗺️ Regulation | FCA, ASIC, CySEC |

| 💰 Trading Fees | Spread only (no commissions) |

| 📊 Trading Platforms | MT4, MT5, Markets.com |

| 💰 Minimum Deposit | $/€/£ 100 |

| 💰 Deposit/Withdrawal Fee | $0 |

| 🛍️ Instruments Offered | Forex, CFDs |

| 💳 Credit Card Deposit | Yes |

Why Choose Markets.com

Markets.com’s point of difference in a crowded market lies in its platforms and wealth of trading tools. Their trading platform offers 14 distinctive trading tools including a large range of sentiment tools you won’t find with other brokers.

A good range of Forex pairs and a solid range of other CFD products is also available. These two features along with no commission forex trading and security through top-tier regulators make the broker a solid choice.

Markets.com Pros and Cons

- Excellent research and education tools

- Easy account opening

- Free deposit and withdrawal

- Limited products

- Lackluster platform features

- High forex fees

Open a demo accountVisit Markets.com

*Your capital is at risk ‘72.4% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

Markets.com is a dealing desk broker or market maker. This explains why the broker only offers a standard account. 65 currency pairs are available consisting of majors, minors and exotics.

Spreads

Markets.com offers a standard account, which means it is a spread-only account. With this account, there are no commission charges for forex and CFDs as trading fees are included in your spreads.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

1.00 0.80 1.20 2.10 1.80

1.00 1.00 1.27 1.30 1.20

0.83 0.83 1.02 1.37 0.92

1.00 1.20 1.00 1.20 1.00

0.80 1.20 1.20 1.50 1.20

1.00 1.00 1.20 N/A 1.10

0.80 1.00 1.00 1.50 1.60

1.20 1.90 1.90 2.30 2.10

1.20 1.40 1.40 2.00 1.50

1.00 1.11 N/A 1.30 1.28

0.60 0.60 0.90 1.50 1.30

1.10 1.10 1.10 1.20 1.20

0.60 0.70 0.90 1.00 0.80

1.20 1.30 1.20 1.20 4.00

1.20 1.41 1.47 1.85 1.67

Out of the 9 most traded forex pairs, 6 have lower spreads with Markets.com compared to the average broker.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Markets.com Average Spread | 1.3 | 1.2 | 1.5 | 1 | 2.2 | 1.1 | 2 | 1.7 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

Other Fees

There are no deposit and withdrawal fees when trading at Markets.com. If your account remains inactive for 90 days, a fee of $10 will be charged.

Verdict on Markets.com Fees

While spreads may seem wide compared to STP / ECN brokers with no dealing desk, it is important to remember there are no commission costs for all CFD products.

Open a demo accountVisit Markets.com

*Your capital is at risk ‘72.4% of retail CFD accounts lose money’

Trading Platforms

Markets.com offers a choice of Markets.com, MetaTrader 4 and MetaTrader 5 trading platforms.

| Trading Plaform | Available With Markets.com |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

While the Markets.com app has some good selling points, in some circumstances you may prefer to use MetaTrader 4 or MetaTrader 5 trading platforms.

Fortunately, Markets.com allows you to get the best from Markets.com and also MetaTrader. All traders that sign up for a Standard account will have access to the Markets.com platform, this allows you to get many of the trading tools Markets.com offers.

To get access to MT4 or MT5 you then sign up to access MetaTrader. This will be a different account, meaning you won’t be able to transfer your trading data between the two platforms, but you will be able to further your choice of trading features and use each platform when best suited.

Some reasons to use MT4 or MT5 over Markets.com include:

- You want to trade via a Windows or macOS desktop

- You wish to use automation or algorithmic trading. Markets.com does not offer this, but MT4 and MT5 have Expert Advisors (EAs)

- You want to integrate 3rd party tools for extra charting or possibly social trading

- You want to access MetaTrader’s large trading community

- You want greater customisation ability – this can be through customising your chart layouts or through coding with MQL4 and MQL5

- MetaTrader has features not available on Markets.com

MetaTrader 4 social trading (Expert Advisors) is the most popular but eToro has the most popular copy trading community and is recommended if you prefer this trading approach. MetaTrader 4 is best for traders looking to trade forex and other CFDs that don’t go through an exchange when trading. In 2018, MetaQuotes announced new developments for MT4 will cease, meaning this platform may not be the best option if you do not have previous experience with the platform.

MetaTrader 5

MetaTrader 5 can be considered an upgrade on MT4, it not only offers more features but also allows you to trade a greater range of CFDs. MT5 has faster speed due to its 64-bit processing and more advanced backtesting than its predecessor.

If you do choose a MetaTrader platform, it is worth noting that some add-on apps can be expensive to unlock and Markets.com do not offer a VPS service. A VPS service can help traders get the most from Expert Advisors, so you may need to arrange your own.

Mobile Trading App

This is Markets.com trading app is built to the needs of broker’s clients who wish to be mobile. Available via iOS and Android app stores, the platform is suitable for phones and tablets with these operating systems.

Markets.com offers several features that distinguish it from other platforms on the market. These include:

- Ability to log in to your platform via Facebook, Google and Apple accounts

- One-click trading and on chart trading, which allows you to save time by executing your trades with the click of a button and directly through the charts.

- 14 different tools to give you greater insights into markets and trading instruments so you can make better trading decisions and find more trading opportunities. 8 of these tools help you get a feel for general market sentiment, 2 of them help with technical analysis and 4 tools help with fundamentals.

Perhaps the main feature that differentiates Markets.com in a crowded market for trading platforms is the range of market sentiment tools. Sentiment tools help relay the market’s thoughts about an asset, these are generally best for short-term decisions. Tools include:

- Bloggers Opinions – Rank/compare and follow tips from 50,000 of the best performing financial experts and bloggers

- Hedge Fund Activity – Gain insights and decisions from leading hedge fund managers

- Insider Traders – Follow which major inside shareholders are buying and selling of their company

- Trading Analyst Recommendations – Learn what key analysts think of major US stocks

- Traders Trend – Learn the major trading trends on the Markets.com platforms. Markets.com version of social trading

- News Alerts – News sentiments for indications of asset price movements

- News Trading Sentiment -Find out the best news buzz based on keywords

- Signals – This combines other sentiment tools to give trading insisted in snapshot form without needing to leave your charts

Technical Tools available with Markets.com include:

- Daily Technical Analysis levels And Ideas – Daily Email for Markets.com traders covering major indices, forex pairs and commodities.

- Advanced Charting With TradingView – 88 Technical Indicators, 10 TimeFrames, Regular and Multi-Chart types, View 8 charts at once, 9 Chart views (candles, area, bar, line, Renko, Kagi, Baseline, Point & Figure or Heikin-Ashi charts) to help with trading technical analysis

Fundamental Tools include:

- Financial Commentary – Tool that provides real-time market insights into what may affect forex movements

- Advanced Alerts – Receive alerts direct to your mobile, email or via Markets.com platform so you can stay on top of market activities

- Thomson Reuters Stock Reports – If you are a stock trader, Thomson Reuters provides downloadable reports on key stocks

- Dow Jones News on Markets.com – Receive news fees on the most important news events around the world that can impact your trading

- Economic Calendar – lets you set up alerts for the upcoming risk events

Is Markets.com Safe?

Markets.com earns a Trust Score of 70, giving traders a good level of confidence in the platform

1. Regulation

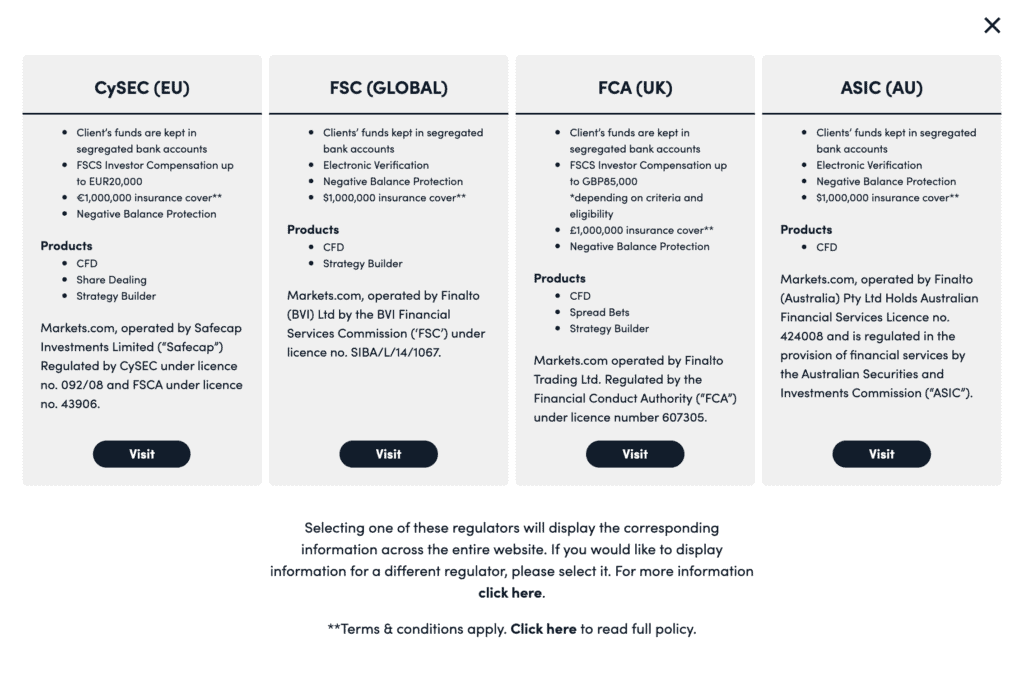

Markets.com is a global company operated by a number of regulated entities as part of the Finalto group (a constituent of Playtech, an FTSE 250 company that is listed on the London Stock Exchange.

Markets.com is a broker that can be trusted, as Markets.com is regulated by several tier-1 entities.

The Markets.com group offers regulation

- Markets.com (Europe): Cyprus Securities and Exchange Commission (CySEC),

- Markets.com (Outside Europe, Africa and Australia): the British Virgin Islands Financial Services Commission (FSC),

- Markets.com (United Kingdom): Financial Conduct Authority (FCA)

- Markets.com (Australia): the Australian Securities and Investments Commission (ASIC)

- Markets.com (South Africa): Financial Sector Conduct Authority of South Africa (FSCA)

| Markets.com Safety | Regulator |

|---|---|

| Tier-1 | FCA ASIC CySEC |

| Tier-2 | X |

| Tier-3 | FSC-BVI FSCA |

Risk Management

Guaranteed Negative Balance Protection

Markets.com offers guaranteed Negative Balance Protection to all its clients. This applies to both retail and professional traders. Professional traders will especially appreciate this feature, as most brokers don’t provide negative balance protection to professional accounts.

Guaranteed Stop-Loss Orders

Markets.com offers traders from France guaranteed stop-loss orders, as this is a requirement of the French regulator Autorité des Novés financiers (AMF).

Investor Compensation Scheme

Traders with Markets.com in the UK and Europe have access to up to EUR 20k (CySEC) and GBP 85k (FCA) compensation in the event the broker is unable to pay what you are owed.

Protecting Yourself Online

Markets.com provides guidelines regarding how to protect yourself online from scams or fraudulent websites.

2. Reputation

Markets.com was founded in 2008 in Miami, US. Their popularity shows a modest online presence in the forex industry. With approximately 12,100 monthly Google searches, it ranks as the 54th most popular forex broker among the 65 brokers analyzed. Web traffic data presents a somewhat stronger picture, with Similarweb reporting 241,000 global visits in February 2024, placing Markets.com as the 46th most visited broker.

Despite its relatively limited search visibility, Markets.com reports significant operational scale. According to the company’s website, Markets.com has processed over $3 trillion in trading volume throughout its history. The broker has been in business for 17 years and currently serves traders in more than 170 countries worldwide.

Markets.com is operated by Finalto, a division of Playtech, a company listed on the London Stock Exchange with a market capitalization of approximately £1.6 billion in 2024.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 1,600 |

| Turkey | 590 |

| India | 480 |

| South Africa | 480 |

| United Kingdom | 390 |

| France | 260 |

| Germany | 260 |

| Jordan | 170 |

| Cyprus | 170 |

| Italy | 140 |

| Canada | 140 |

| Nigeria | 140 |

| Spain | 110 |

| United Arab Emirates | 110 |

| Indonesia | 90 |

| Pakistan | 70 |

| Colombia | 70 |

| Brazil | 70 |

| Mexico | 70 |

| Netherlands | 70 |

| Australia | 50 |

| Egypt | 50 |

| Saudi Arabia | 50 |

| Venezuela | 50 |

| Sweden | 50 |

| Malaysia | 40 |

| Vietnam | 40 |

| Bangladesh | 40 |

| Poland | 40 |

| Dominican Republic | 40 |

| New Zealand | 40 |

| Thailand | 30 |

| Morocco | 30 |

| Philippines | 30 |

| Taiwan | 30 |

| Kenya | 30 |

| Argentina | 30 |

| Austria | 30 |

| Hong Kong | 30 |

| Uruguay | 30 |

| Japan | 20 |

| Peru | 20 |

| Algeria | 20 |

| Singapore | 20 |

| Greece | 20 |

| Switzerland | 20 |

| Portugal | 20 |

| Cambodia | 10 |

| Ecuador | 10 |

| Sri Lanka | 10 |

| Chile | 10 |

| Mongolia | 10 |

| Ghana | 10 |

| Botswana | 10 |

| Tanzania | 10 |

| Uganda | 10 |

| Costa Rica | 10 |

| Panama | 10 |

| Ireland | 10 |

| Ethiopia | 10 |

| Uzbekistan | 10 |

| Bolivia | 10 |

| Mauritius | 10 |

1,600 1st | |

590 2nd | |

480 3rd | |

480 4th | |

390 5th | |

260 6th | |

260 7th | |

170 8th | |

170 9th | |

140 10th |

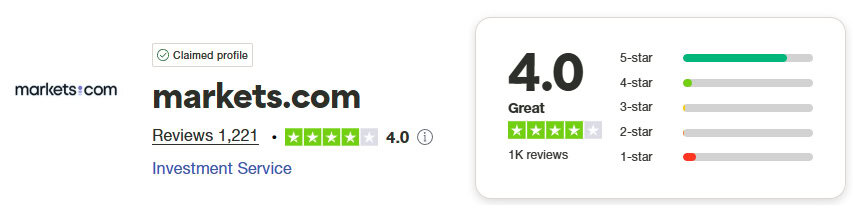

3. Reviews

On TrustPilot, they have a good score of 4.0 out of 5 from 1,221 reviews.

Deposit And Withdrawal

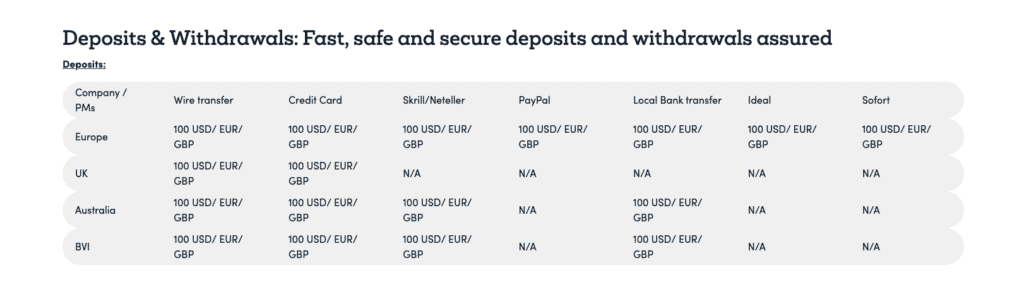

What is the minimum deposit at Markets.com?

The minimum deposit required is 100 USD/EUR/GBP regardless of the chosen deposit method.

Account Base Currencies

Markets.com supports nine base currencies for trading accounts, including USD, DKK, EUR, NOK, AUD, PLN, ZAR, GBP, and SEK.

Deposit Options and Fees

Markets.com offers a range of deposit methods including wire transfer, Visa and MasterCard credit cards. Skrill, Neteller, PayPal, Local Bank Transfer, Ideal, SoFort. ,

Withdrawal Options and Fees

When making a withdrawal, Markets.com has the following minimum amounts

- Credit/Debit card: Min. 10 USD/EUR/GBP

- Wire Transfer: Min. 100 USD/EUR/GBP. There is a 20 EUR minimum requirement within the EU

- Skrill/Neteller: Min 5 USD/EUR/GBP

- PayPal: Min 10 USD/EUR/GBP

Markets.com charges no fees for deposit or withdrawals. Do note that some deposit methods are not available in some countries.

Product Range

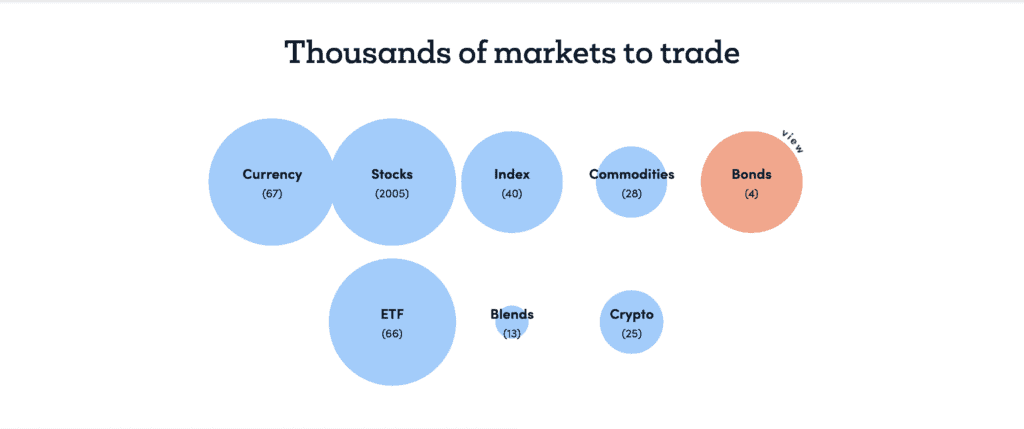

Markets.com offers over 2,200 instruments when trading CFDs. This makes the broker a great option if you are looking to diversify your investments. The Markets.com tools provide lots of sentiment, technical and fundamental tools that will give you lots of insights when trading these products.

CFDs

CFDs available for trade include when using Markets.com include:

- 65 Forex Pairs

- 38 Indices

- 1837 Shares CFD (17 in The UK)

- 28 Commodities

- 60 ETFs

- 9 Blends (8 in the UK)

- 4 Bonds/Treasuries

- 24 Cryptocurrencies (Crypto CFDs are not offered to UK residents or from the brokers UK entity)

Spread Betting

(available to UK residents only)

UK residents have the extra option of spread betting. Spread betting is similar to CFD trading in that one is speculating on movements of the underlying asset and both are leveraged products however there are a few key differences to note:

- There is no exchange of a contract (you are purely betting on price movements of assets)

- You bet in points, not in lots

- There are no commission fees

- You can bet how much the underlying asset moves

Spread betting is popular in the UK as there are no capital gains taxes, as you don’t own the asset. This presents an opportunity to save when it comes to profits. Unlike with CFDs, losses cannot be claimed with your tax return.

Markets.com allows spread betting with currencies, indices, commodities, shares and ETFs.

Customer Service

Markets.com has a solid variety of outreach for customer support including live chat and dedicated phone support which is available 24/5 from Mon 00:00 to Friday 23:55 PM (GMT +2) which is Sun 22:00 PM – Friday 21:55 UK time and an online query form. Phone support is also available with local contacts available in several European countries, Australia and South Africa (for Africa) and a range of languages such as Italian, French, Arabic and Spanish.

Research and Education

Markets.com has a ‘Knowledge Centre’ section where a range of education and learning materials is available in 4 different ways.

XRAY

XRay is a live streaming service available directly through the Markets.com trading app. As it is directly integrated into the platform, you never need to navigate away from your charts and trades. XRay has the following key features:

XRay is a live streaming service available directly through the Markets.com trading app. As it is directly integrated into the platform, you never need to navigate away from your charts and trades. XRay has the following key features:

- Leading Financial Experts: Here you will be able to listen to leading financial experts around the world discuss the markets.

- Live And Interactive Webinars: This feature allows you to ask experts questions and receive answers live

- Insights On The Markets: XRay covers a wide range of topics including strategy, markets events and market analysis for greater trading knowledge

Insights Trading News

Markets.com in-house team of financial analysts discuss market news on a range of categories including CFD Trading, Commodities, Equities, Forex, Elections, Morning Notes to give you extra insight into your trades.

Financial Analysts

The Markets in-house team take a deeper look at financial, political and news issues that are likely to have an impact on your trades. Here analysts try to provide insight where basic background information is not enough.

FAQ

This section tries to answer all your questions regarding Markets.com features, platforms and trading concepts such as Forex and how CFDs work.

Demo Account

To help you get the most of your Markets.com trading experience, a demo account is available which give you access to all the features available in the platform. This account is valid for 3 months and has unlimited virtual cash. This makes Markets.com offering one of the best available as most brokers only offer 1 month and limit the amount of virtual cash.

Final Verdict on Markets.com

Markets.com’s unique selling point in a saturated market is its platforms and wide range of trading tools. The Markets.com trading platform offers 14 distinctive trading tools, including a wide range of sentiment tools that are unavailable with other brokers. A good variety of Forex pairs and a rich selection of other CFD products is also accessible. These two features, combined with no-commission forex trading and security provided by top-tier regulators, make the broker an excellent choice.

Markets.com FAQs

What is the minimum deposit for Markets.com?

100 USD/EUR/GBP is the minimum deposit requirement to open a live trading account at Markets.com. Markets.com supports 11 different account base currencies (USD/EUR/GBP/DKK/NOK/SEK/PLN/CZK/AUD/CHF/ZAR) with no additional charges. For deposits greater than USD 2,500, Markets.com will refund any external transaction fees charged by third-party providers.

We also recommend reading our Pepperstone Review as this broker doesn’t have a minimum deposit policy.

Is Markets.com legit?

Yes, Markets.com is considered a safe brokerage trading firm compliant with tier-one regulators (FCA, ASIC, CySEC). Markets.com is a member of the Financial Services Compensation Scheme Limited (FSCS) in the UK (FCA) for UK clients. Clients are accounts are protected for up to GBP 85,000 should Markets.com be unable to pay in event of default

Clients in mainland Europe funds is protected by the Investor Compensation Fund (ICF) as required by CySEC. Compensation up to EUR 20,000 is available.

You can read more about the Best Forex Brokers In Europe to find a trusted FX broker.

How do I withdraw money from Markets.com?

Markets.com supports several deposit and withdrawal methods including the traditional debit/credit cards and bank wire transfer and other electronic methods like Neteller, Skrill, PayPal, Fast Bank Transfers, Sofort, and iDeal. The minimum withdrawal amount is USD/EUR/GBP 5 and there are no withdrawal fees. Withdrawals are processed within 24 hours for E-wallets and up to 2-7 business days for credit cards.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Is Markets.com available in Australia?

In Australia, Markets.com is registered as Finalto (Australia) Pty Ltd (ACN 158 641 064) and is regulated by the Australian Securities and Investments Commission (“ASIC”) under license no.424008.

As Markets.com is regulated by ASIC, Australian traders can use this broker

Does Markets.com have no deposit bonus?

Yes but this no deposit bonus will only be during promotion period. This may only be available in certain regions.

How to get Markets.com no deposit bonus?

Markets.com does not currently offer a no deposit bonus. Instead, they provide a $25 bonus when you make your first deposit of at least $100 (USD).