Pepperstone Razor vs Standard Account

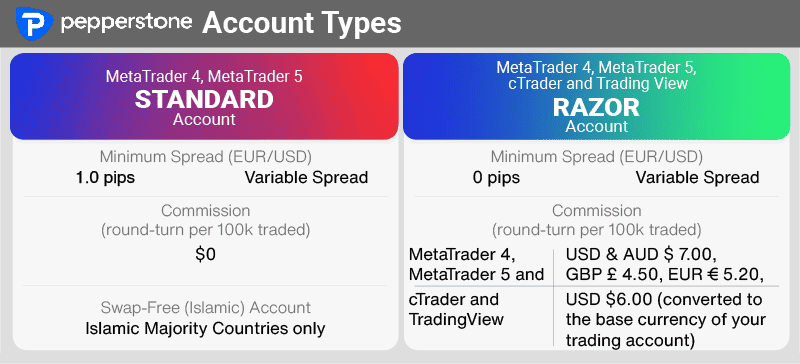

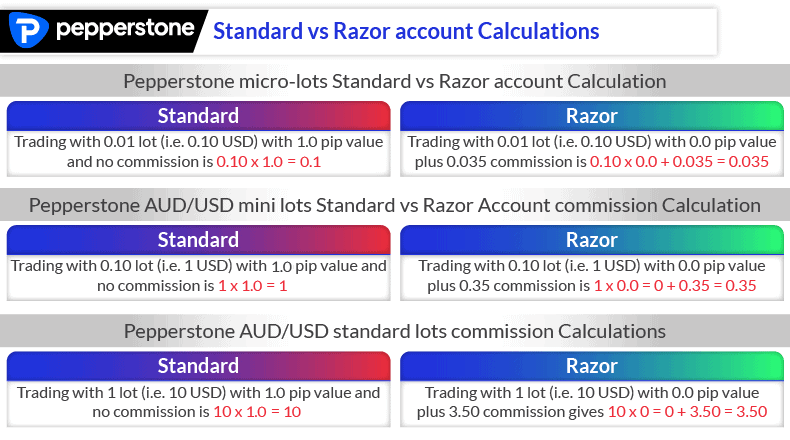

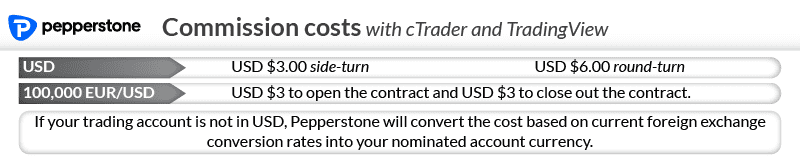

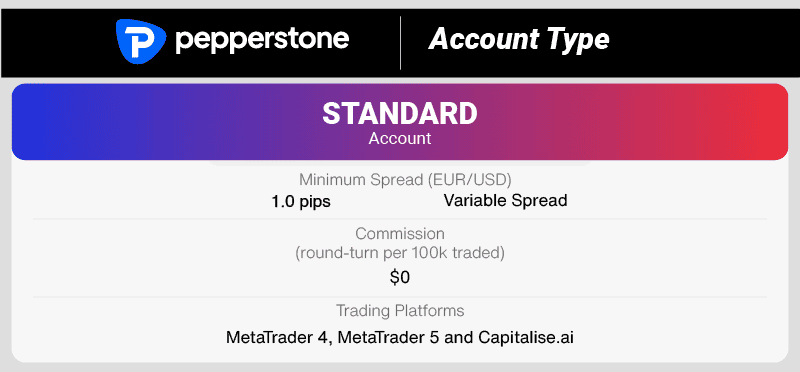

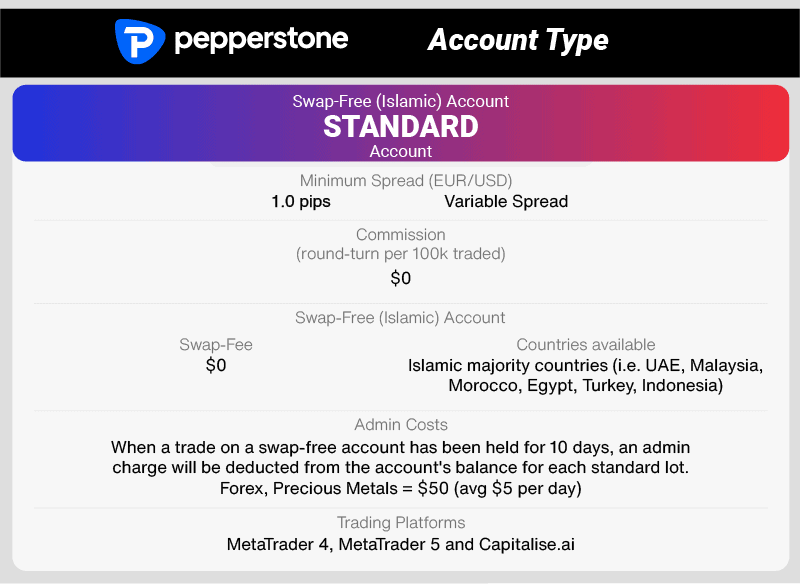

The key difference between Pepperstone’s Standard vs Razor accounts is fees. The Razor account has the lowest fees with raw spreads from 0.0 pips and a modest commission while the standard account has 1 pip markup and no commission.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

The Pepperstone Razor account has the tightest spreads (even with commission costs) so is the best choice, especially if you have trading experience

As Kenyan resident of Qatar. Can trade with pepper stone live aaccount What are the requirements?

Pepperstone is regulated by the CMA in Kenya so they can offer services to Kenyan Residents. You are best to spread with Pepperstone via their live chat to confirm how to do this

Between razor account and standard which account is best for bigginers using scalping strategies

What is the maximum withdrawal from Pepperstone?

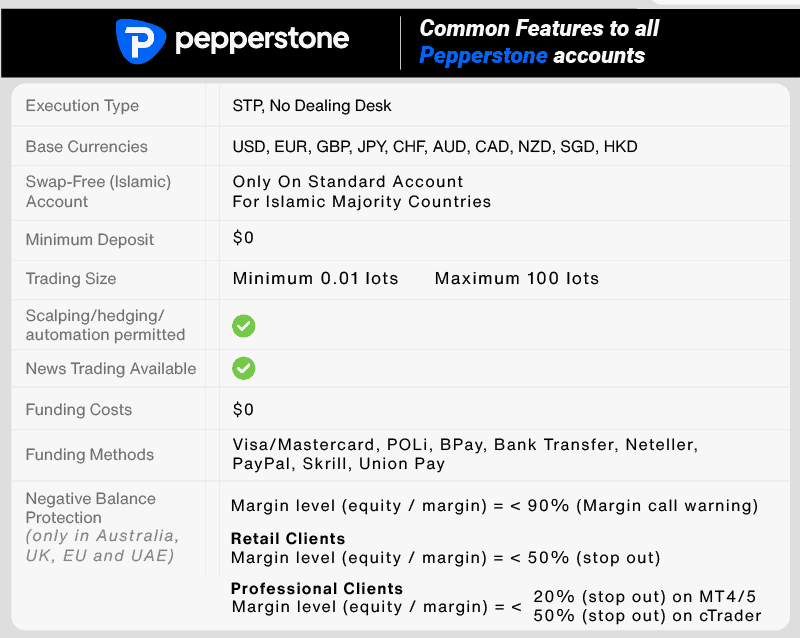

There is no minimum or maximum withdrawals with Pepperstone. You must withdrawal back to the same account you made your deposit from. Withdrawal methods include Visa, Mastercard, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill and Union Pay

What is the lot size for a Pepperstone razor account?

You can choose between Standard lots (100,000), Mini lots (10,000) and Micro lots (1000) when trading with Pepperstone

You can choose between Standard lots (100,000), Mini lots (10,000) and Micro lots (1000) when trading with Pepperstone.