Saxo Bank Review Of 2026

With over 35,000 instruments, Saxo Bank offers forex trading and share-market CFDs through its award-winning platform. Among the features we liked were its 66:1 leverage and spreads starting from 0.4 pips.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Saxo Bank Summary

| 🗺️ Tier 1 Regulation | ASIC, FCA, MAS, FINMA |

| 🗺️ Tier 2 Regulation | SFC |

| 📊 Trading Platforms | SaxotraderGO, SaxotraderPRO |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, CFD, Stocks, Commodities, Futures, Crypto |

| 💳 Credit Card Deposit | Yes |

Why Choose Saxo Bank

For us, Saxo Bank stands out for their SaxoTraderGo and SaxoTraderPro trading platforms. The first will appeal for beginner traders and comes with good research tools, while the latter will appeal to experienced traders wanting advanced features like automation.

Fees are decent, and trading products are broad, but be aware that SaxoBank does have custody fees which can be costly.

Saxo Bank Pros and Cons

- Range Of Markets

- Tight Spreads

- Forex Trading Platforms

- Lack Of Risk Management

- 30:1 Leverage

- Funding Requirements

Open A Demo AccountVisit Saxo Markets

*Your capital is at risk ‘62% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

Standard Account Spreads

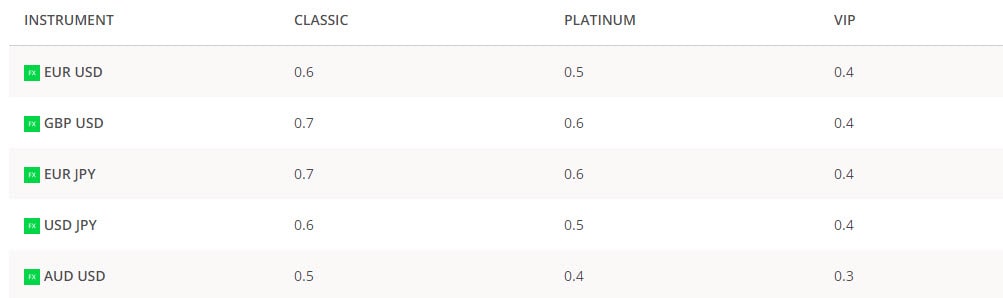

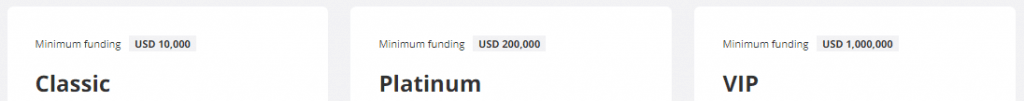

Saxo offers three trading accounts including classic, platinum and VIP. The most popular trading account is the Classic account which has a minimum deposit requirement of $10,000. This account has entry prices that beat other leading forex brokers when it comes to spreads.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

1.10 1.10 1.60 2.00 1.90

1.00 1.00 1.27 1.30 1.20

0.83 0.83 1.08 1.39 0.92

1.00 1.20 1.00 1.20 1.00

0.80 1.20 1.20 1.50 1.20

1.00 1.00 1.20 N/A 1.10

0.80 1.00 1.00 1.50 1.60

1.20 1.90 1.90 2.30 2.10

1.20 1.40 1.40 1.90 1.50

1.00 1.11 N/A 1.30 1.28

0.60 0.60 0.90 1.50 1.30

1.10 1.10 1.10 1.20 1.20

0.70 0.70 0.90 1.00 0.80

Breaking down the three accounts further:

Breaking down the three accounts further:

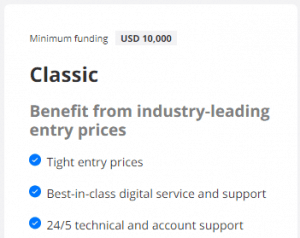

1) Classic Account

As mentioned above, the minimum funding required of the classic account is $10,000. While a core feature of the account is the low spreads, the other elements are:

- In-house analyst

- 24-hour customer support

- Integrated support online

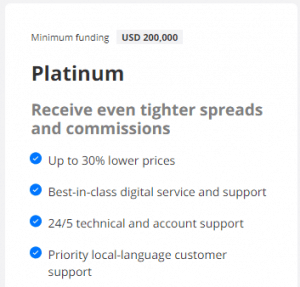

2) Platinum Account

2) Platinum Account

This account is designed for advanced traders, which is why the IC Markets Minimum Deposit for this account is $200,000 . This account type advertises tighter spreads and commissions. Other core features include:

- Up to 30% lower prices – recommended for active traders

- A personal relationship manager

- Access to customer service 24/5

- Analyst data and information

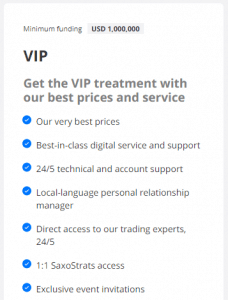

3) VIP Account

3) VIP Account

The VIP account is one of the most exclusive trading accounts offered by a forex broker and stockbroker industry. With a funding requirement of at least $1,000,000, this account type is geared towards the high-net-worth individual (HNWI). These premium clients receive VIP spreads and fees as well as features including:

- fixed lower spreads

- Dedicated sales trader

- Personal relationship manager

- Exclusive events and hospitality

- Direct access to Saxo experts

- 1:1 SaxoStrats access

Other Fees

There is on deposit fee, but there is a fee of $30 for paper based withdrawals.

Forex traders need to be aware of the inactivity fee charged by Saxo Bank. Our Saxo Bank review found that an inactivity fee is levied on all Saxo Bank accounts that have been inactive for a prolonged period. Saxo Bank charges an inactivity fee of $100 or the equivalent amount in the account currency if there are no trades executed for a period of 180 days.

Verdict of Saxo Bank Spreads

Across the three accounts offered Saxo has low spreads compared against leading retail brokers such as IG Markets. The more you’re willing to deposit, the lower the spreads will be, but even the classic is competitive. Saxo also focuses on simplicity with trading costs with no volume-based commissions and minimum commission fee.

Open A Demo AccountVisit Saxo Markets

*Your capital is at risk ‘62% of retail CFD accounts lose money’

Trading Platforms

Saxo Bank offers MetaTrader 4, TradingView, and their proprietary platforms, SaxoTraderGo and SaxoTraderPro.

| Trading Plaform | Available With Saxo Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

While there is a MetaTrader 4 platform at Saxo, it doesn’t have MT5. The most popular trading platform among retail traders, the MetaTrader 5 platform is not supported by Saxo Bank. Forex traders who are accustomed to do their technical analysis with one of the most user-friendly platforms in the FX space can be disappointed to not find the MT5 among the trading platforms offered by Saxo Bank.

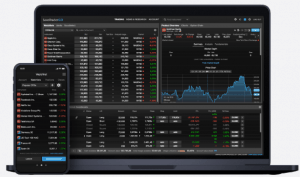

Saxo Forex Trading Platform

Saxo Bank Australia offers two of their own propriety forex trading platforms. Each has distinct advantages over each other, with one designed more for mobility across mobile and tablet while the other is designed for trading power. These have won many awards, including the ADVFN platform award.

SaxotraderGO – The Choice For Traders + Investors

This platform has won Saxo Bank awards based on reliability, execution speeds, and functionality across devices. It’s web-based with full functionality across desktop, mobile app and tablet devices with:

- Access to over 35,000 instruments with no subscription fees

- Trades and orders can be managed directly from charts

- A wide range of markets from forex, stocks to CFDs

- Equity research tools that analyse sentiment and fundamentals

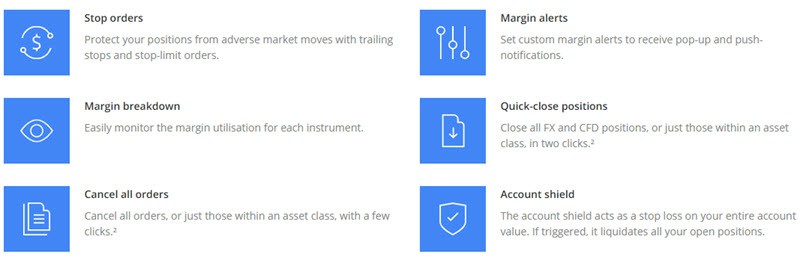

Below shows six additional features Saxotrader Go offers FX traders. Features like quick close, margin breakdown and cancel all orders are unique to Saxo. Historical reports can also be downloaded for tax and bookkeeping purposes.

SaxotraderPRO – Build For Professionals

This professional-grade fox trading platform is designed for expert traders who use multiple screens when trading. It works both on Mac and Windows and while it also has apps for tablet and mobile devices (iOS and Android) it’s made for PC. There is no web-based version with features including:

- Enhanced trade tickets maximising speed and productivity

- Algorithmic orders that are integrated into trade tickets

- Charting packages with over 50 technical indicators

- Option chain allowing switching between instruments

- Level 2 market depth with real-time prices

Summary Of Saxo Bank Trading Platforms

Our Saxo Bank Australia review found it was strong in this category but lost points for the lack of mainstream options such as MT4 and cTrader. Both Saxo trading platforms don’t require subscription costs with the PRO platform recommended on desktops with multiple screens, while the GO account is for everyday traders.

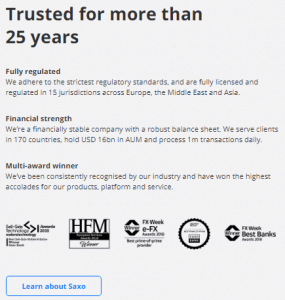

Is Saxo Bank Safe?

Saxo Bank has a trust score of 80/100. It was based on the broker’s regulation, reputation, and reviews.

1. Regulation

| Saxo Capital Markets Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA MAS FINMA |

| Tier-2 | SFC |

| Tier-3 | X |

Saxo clients can trade under the umbrella of the world’s top financial regulators. Retail investors can start trading and invest in the financial markets knowing that Saxo complies with the high standards imposed by the local Danish regulatory agency the Financial Supervisory Authority (FSA) as well as 12 other global regulatory bodies, including:

- Financial Conduct Authority FCA (License number 551422)

- Swiss Financial Market Supervisory Authority FINMA (License number CHE-106.787.764)

- Japanese Financial Services Agency (Registration Number 239)

- Australian Securities and Investments Commission ASIC (Registration Number 126 373 859)

2. Reputation

With its headquarters in Copenhagen, Denmark and 15 main offices that include Switzerland, UK, Paris, Hong Kong or Dubai, the Danish company can serve professional traders and retail investors from more than 180 countries.

Saxo Markets ranks among the more popular brokers for CFD trading based on both search and web traffic data. It receives approximately 165,000 Google searches each month, making it the 15th most popular forex broker according to 2024 data. Web analytics from Similarweb in February 2024 show Saxo Markets as the 21st most visited broker, with 1,047,000 global visits.

In terms of trading activity, Saxo Bank (which operates Saxo Markets) reported $482.7 billion in total trading volume in April 2024 — the highest monthly figure in over four years. This included $303.7 billion in equities and $70.7 billion in commodities, both key CFD asset classes.

Saxo Markets offers access to over 19,000 instruments, and its parent company had nearly 1.3 million clients and DKK 853 billion in client assets by the end of 2024. These figures indicate that Saxo Markets holds a strong position in the global CFD trading space.

| Country | 2025 Monthly Searches |

|---|---|

| France | 18,100 |

| Netherlands | 14,800 |

| Spain | 8,100 |

| United Kingdom | 4,400 |

| Switzerland | 4,400 |

| Italy | 3,600 |

| Singapore | 2,900 |

| Peru | 2,900 |

| Greece | 2,400 |

| Argentina | 2,400 |

| Turkey | 2,400 |

| Poland | 2,400 |

| United States | 1,900 |

| Germany | 1,600 |

| Australia | 1,600 |

| India | 1,600 |

| Portugal | 1,300 |

| Mexico | 1,000 |

| Japan | 1,000 |

| Brazil | 1,000 |

| Algeria | 1,000 |

| Chile | 880 |

| Colombia | 720 |

| Malaysia | 720 |

| United Arab Emirates | 590 |

| Sweden | 590 |

| Indonesia | 590 |

| Hong Kong | 390 |

| Canada | 390 |

| Ecuador | 390 |

| Taiwan | 320 |

| Thailand | 320 |

| Saudi Arabia | 260 |

| Pakistan | 260 |

| Bolivia | 260 |

| Austria | 210 |

| Uruguay | 210 |

| Ireland | 210 |

| Morocco | 210 |

| Venezuela | 210 |

| South Africa | 170 |

| Philippines | 140 |

| Vietnam | 140 |

| Nigeria | 110 |

| Mauritius | 110 |

| Egypt | 90 |

| Dominican Republic | 90 |

| Cyprus | 70 |

| Bangladesh | 70 |

| Cambodia | 70 |

| Uzbekistan | 70 |

| New Zealand | 50 |

| Kenya | 50 |

| Costa Rica | 50 |

| Sri Lanka | 50 |

| Ethiopia | 50 |

| Panama | 30 |

| Jordan | 20 |

| Ghana | 20 |

| Uganda | 20 |

| Botswana | 10 |

| Tanzania | 10 |

| Mongolia | 10 |

18,100 1st | |

14,800 2nd | |

8,100 3rd | |

4,400 4th | |

4,400 5th | |

3,600 6th | |

2,900 7th | |

2,900 8th | |

2,400 9th | |

2,400 10th |

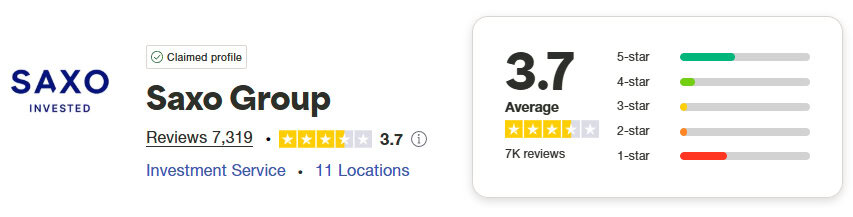

3. Reviews

Saxo Bank has a TrustPilot score of 3.7 out of 5 from 7,319 reviews.

Deposit and Withdrawal

What is the minimum deposit at Saxo Bank?

There’s no minimum deposit required, giving you the freedom to start trading with as little money as you want.

Account Base Currencies

Saxo Bank supports a limited range of funding currencies. Forex traders can deposit funds using USD, GBP and EUR. By comparison to other online brokers, Pepperstone can offer multi-currency deposit solution that includes 10 different base currencies.

Deposit Options and Fees

Many traders look to trade small amounts and require a low minimum deposit by their forex broker. Saxo Bank accounts don’t offer this with the classic account starting at $10,000. The $1,000,000 VIP account is one of the highest minimum funding accounts of any retail forex brokers.

If you’re happy to have funds locked in an account, then funding requirements won’t be an issue. But if you don’t like funds tied up in any account, then you should consider other forex brokers who have a minimum deposit as low as $50.

Withdrawal Options and Fees

In terms of the deposit and withdrawal methods, Saxo Bank offers only a limited number of payment options. In our Saxo Bank review, we only found that forex traders can make a deposit or withdraw funds from the Saxo Bank account via the following methods for transferring money:

- Credit card

- Debit card

- Wire transfer from your bank account

Product Range

CFDs

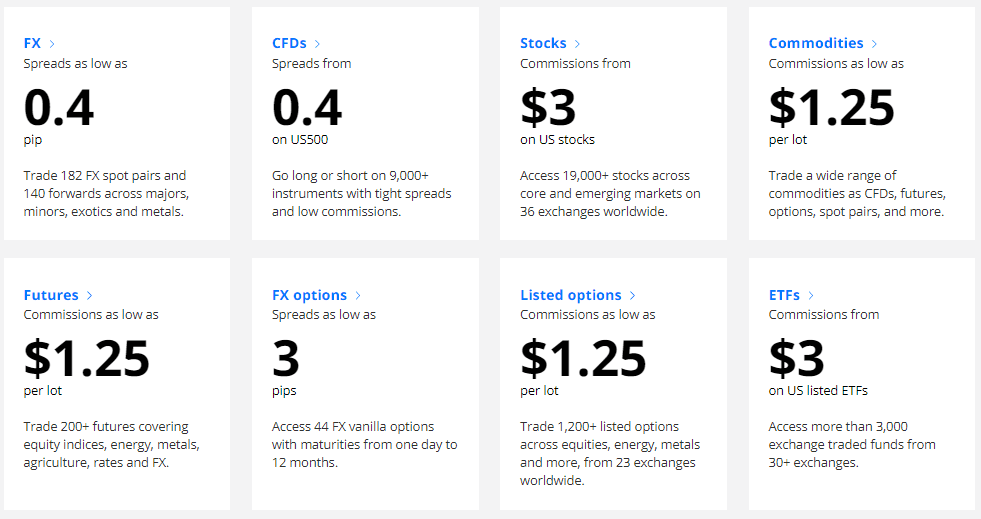

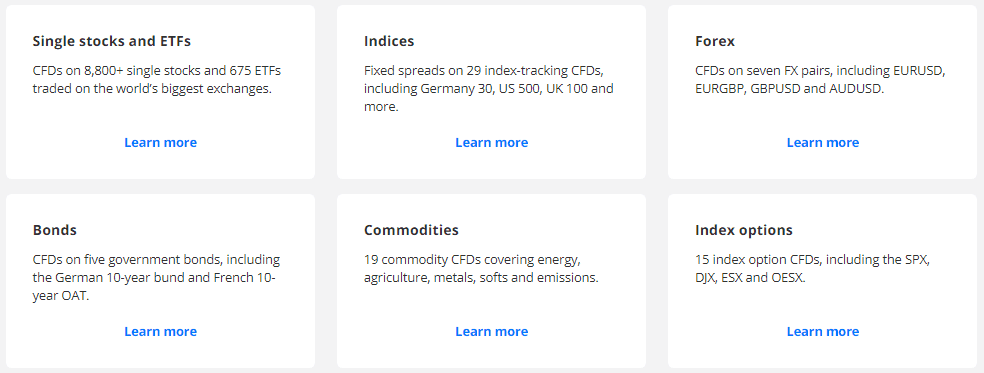

Saxo Bank Australia offering is more than just currency trading. The broker has a wide range of services from share trading to contract for difference (CFDs). Below shows the wide range of markets offered all matches by low brokerage fees and commissions.

Saxo Bank offers forex traders access to a selected range of trading instruments across different asset classes. With a Saxo Bank account, you can gain exposure to the most popular and liquid markets worldwide, including:

- Forex currency pairs (+182 major pairs, minor and exotic)

- CFDs (+9,000 instruments)

- Stocks (+19,000 across 36 global exchanges)

- Commodities (19 commodity CFDs)

- Futures (+200 future contracts)

- FX Options (+40 FX vanilla options)

- Listed Options (+1,200 options from 23 exchanges worldwide)

- ETFs (3,101 from 30 exchanges worldwide)

- Bonds (5,000 government and corporate bonds)

- Mutual Funds (250 top-rated mutual funds)

- Cryptocurrency (Bitcoin and Ethereum traded through ETNs)

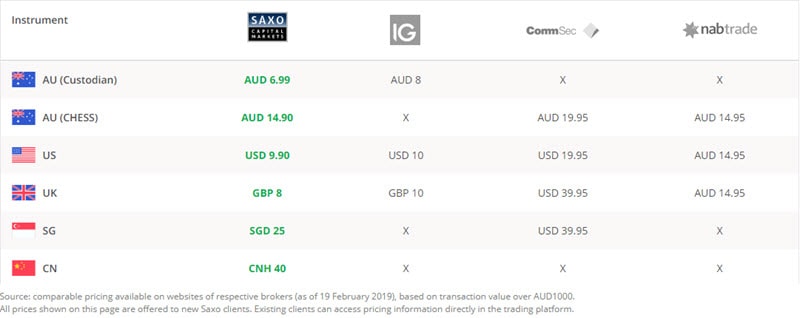

Stock Brokerage Services

Shares trading is one of the most popular services offered by Saxo Bank. They offer share trading in Australia, USA, UK, Singapore and even Chinese stocks. Overall, traders have access to over 19,000 shares overseas across 36 exchanges. Their share trading offering won “Outstanding Value International Share Trading” in both 2017 and 2018. Other share related services are over 3,101 ETFs, ETCs and ETNs and they also offer over 1,200 listed options. Below shows the Saxo Bank brokerage fees compared to other leading stockbrokers.

Forex Trading Services

The key areas of this Saxo Bank review were on their currency trading offering. This includes the ability to trade across 182 forex spot pairs, over 140 forwards and +40 FX vanilla options. Four key components lead FX traders to choose Saxo for currency trading.

i) ‘Tier 1’ Liquidity

i) ‘Tier 1’ Liquidity

Saxo uses a wide range of ‘tier 1’ banks and other sources from market-making firms to ECNs to ensure traders receive the best possible price. This helps minimise spreads that exist when a forex broker sources just one or two sources for a buy/sell rate.

ii) Price Improvement Technology

ii) Price Improvement Technology

A key Saxo Bank feature is its customised orders offering. This provides forex traders with great control and near-zero asymmetric slippage occurring. This leads to real benefits on a large number of currency trades through the Saxo forex trading platform.

iii) Reduced Premature Stop-Outs

iii) Reduced Premature Stop-Outs

Saxo triggers stop orders at the opposite end of the spreads, to minimise forex traders from being stopped out early. This is set at a neutral price via a large inter-bank venue. Premature stop-outs are one of the most complained features of other forex brokers and a key positive found in this Saxo Bank Australia review.

iv) Client-centric approach

iv) Client-centric approach

We fully disclose our dealing practices and never trade against you in the market. Our commitment to transparency shows that our interests are fully aligned with yours.

CFD Trading Services

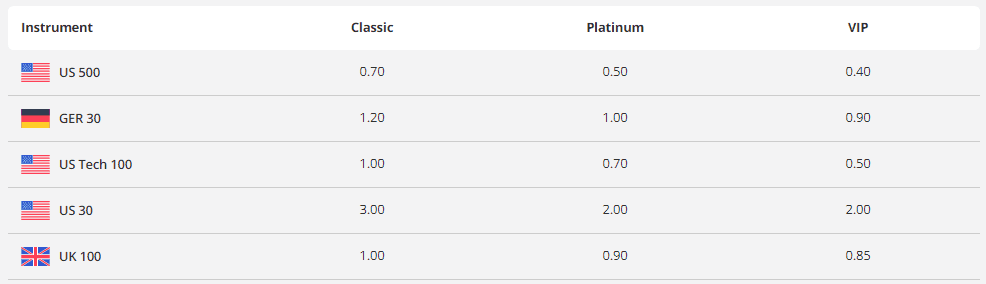

The final area Saxo offers is the contract for difference (CFDs Trading). You can trade leveraged products with Saxo Bank on more than 9,000 CFD instruments including shares, indices, bonds, ETFs, commodities and index options as shown below.

Commissions on US stocks are USD 3.00 while Australian CFDs stock commissions start at AUD$6. Leverage varies and for the US 500 is 40:1 with spreads of 0.4 points. Below you can review the different types of CFD trading commissions charged across the 3 main Saxo trading accounts.

Verdict On Saxo’s Range Of Markets

It’s not unique for a forex broker to offer more than just currency trading, with most also offering CFDs trading. What separates Saxo is their domestic and international stockbroking services. This makes Saxo Bank a one-stop-shop broker ideal for those looking for more than just a forex broker.

Does Saxo Markets Offer Spread Betting?

Saxo no longer offers spread betting. Prior to 2o15 Saxo had a partnership with London Capital Group (LCG) but a leadership change led by Charles-Henri Sabet led to the closure of the spread betting partnership.

Customer Service

The customer service at Saxo Bank was a bit of a letdown. Their support hours are only on weekdays, with no 24/7 support. Only current clients have access to their live chat and their knowledge base is average at best.

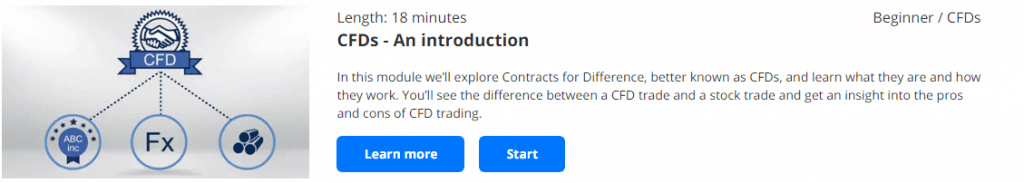

Research and Education

Saxo Bank gives its clients access to world-class education material that caters to beginner traders as well as professional traders. Saxo Bank’s courses are designed to help beginner currency traders start trading. What’s unique about Saxo offering is its quizzes, which can assist traders to track their progress.

The educational and market research resources found on Saxo Bank website also includes:

- Webinars

- Video Guides

- Market Analysis

- Macro – Fundamental Analysis

- Quarterly Outlook

- Outrageous Predictions

- IPOs

Additionally, SaxoStrats offers forex traders the chance to follow a team of Saxo Bank experts that will supply you with actionable insights via a podcast service.

Final Verdict on Saxo Bank

Overall, our Saxo Bank review concludes that the Denmark-based forex broker offers all the trading tools and a wide range of financial products to accommodate the needs of all types of traders. The only major disadvantage is that Saxo Bank requires a high minimum deposit of $10,000 to start trading CFDs.

Overall, our Saxo Bank review concludes that the Denmark-based forex broker offers all the trading tools and a wide range of financial products to accommodate the needs of all types of traders. The only major disadvantage is that Saxo Bank requires a high minimum deposit of $10,000 to start trading CFDs.

Saxo is recommended for anyone looking for an all-in-one trading solution. You can buy and sell both domestic and international shares as well as trading currency pairs and CFDs with their award-winning trading platform. They also offer low spreads and fees, making them a low fee share and trading solution. You should only consider a different forex broker if you require high leverage, risk management tools, or require a low minimum deposit.

Open A Demo AccountVisit Saxo Markets

*Your capital is at risk ‘62% of retail CFD accounts lose money’

Saxo Markets Review FAQ

Is Saxo market safe?

Yes, Saxo Markets is considered a safe brokerage trading firm by all industry standards. Saxo Bank is headquartered in Copenhagen and regulated by the local financial authority FSA, but as a global leading provider of online trading services, it also abides by the rules imposed by top tier-one regulators like FCA, ASIC or FINMA.

Compare the best UK Forex brokers regulated by the Financial Conduct Authority (FCA) here: Best Forex Brokers In UK.

What is the minimum deposit for Saxo Bank?

GBP 500 is the minimum deposit at Saxo Bank. The minimum funding varies based on account tiers and jurisdiction. For example, Australian-based traders have a minimum deposit policy of AUD 3,000. At Saxo, funding is supported in 18 different currencies while your money is kept safe in segregated trust accounts and protected by different compensation schemes.

You can also check ASIC Regulated Brokers if you fall under this jurisdiction.

How do I withdraw money from Saxo?

At Saxo Markets, clients can withdraw money via debit/credit cards or bank transfers. Saxo Bank processes all withdrawals the next business day without any additional withdrawal fee.

See How Saxo Bank Stacks Up To These Brokers

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Is Saxo good for beginners?

This is subjective but we think no. We find their account types quite confusing and their trading platforms can be quite complicated to learn. We think stick to more popular trading platforms like MetaTrader 4.