Saxo Markets vs IC Markets 2026

Deciding between Saxo Markets and IC Markets in 2026 really depends on your priorities as a trader. In this comparison guide, I’ll break down the key differences and help you narrow down your search to the broker that fits your trading style.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

But first, let’s take a quick look at how the two brokers compare across the fundamentals:

- Saxo is one of the oldest brokers and is strongly regulated in multiple jurisdictions

- Saxo only offers its proprietary platforms, SaxoPRO and GO

- Both IC and Saxo offer a wide range of CFD products

- IC Markets offers excellent multilingual customer support that runs 24/7

- IC Markets offers the lowest raw spreads starting from 0.0 pips and fast order execution

1. Lowest Spreads And Fees – IC Markets

A Standard account is the simplest way to trade forex and CFDs since broker fees are built into the spread. However, this isn’t the most cost-effective account type and you’ll see why as you continue reading.

IC Markets keeps Standard account spreads low with EUR/USD averaging 0.82 pips, unlike Saxo Markets which offers spreads starting from 1.1 pips. Other majors such as GBP/USD (1.03 vs 1.8 pips) and AUD/USD (0.83 vs 1.1 pips) see equally tight pricing compared to Saxo Markets.

So if you’re just starting out and want a Standard account that won’t eat into your margin, IC Markets is the better choice by a mile.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 1.00 | 1.00 | 1.20 | 1.30 | 1.00 |

| 0.60 | 0.70 | 0.90 | 1.10 | 0.70 |

| 0.80 | 1.00 | 1.00 | 1.00 | 1.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Raw Account

Most traders usually transition to the Raw account after gaining some experience, since it offers much tighter spreads and faster execution. Instead of paying a pip or more in spread every time you enter and exit, you’re getting near-zero spreads plus a fixed commission per lot. If you trade actively, you’ll find that the cost savings often outweigh the simplicity of a Standard account.

Once again, IC Markets offers extremely tight pricing on this account type, and is in fact one of the best in the world at this. On the EUR/USD, their average raw spread is just 0.02 pips which is basically as close to zero as you’ll see in retail forex.

Even the more volatile majors like GBP/USD (0.23 pips) or AUD/JPY (0.5 pips) stay impressively tight.

The commission is also competitive, sitting within industry standards at $3.50 per side ($7 round turn).

| Broker | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| IC Markets | 3.5 | 3.5 | 2.5 | 2.75 |

So if you place one standard lot EUR/USD trade at IC Markets, your spread cost comes to $0.20, which is practically nothing. Add the $7 commission and your total cost is about $7.20. Now compare that to trading on the Standard accounts and you’re looking at around $8–$11 per trade.

Verdict

Across both Standard and Raw accounts, IC Markets consistently offers the lowest trading costs, with lower spreads and transparent commissions.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

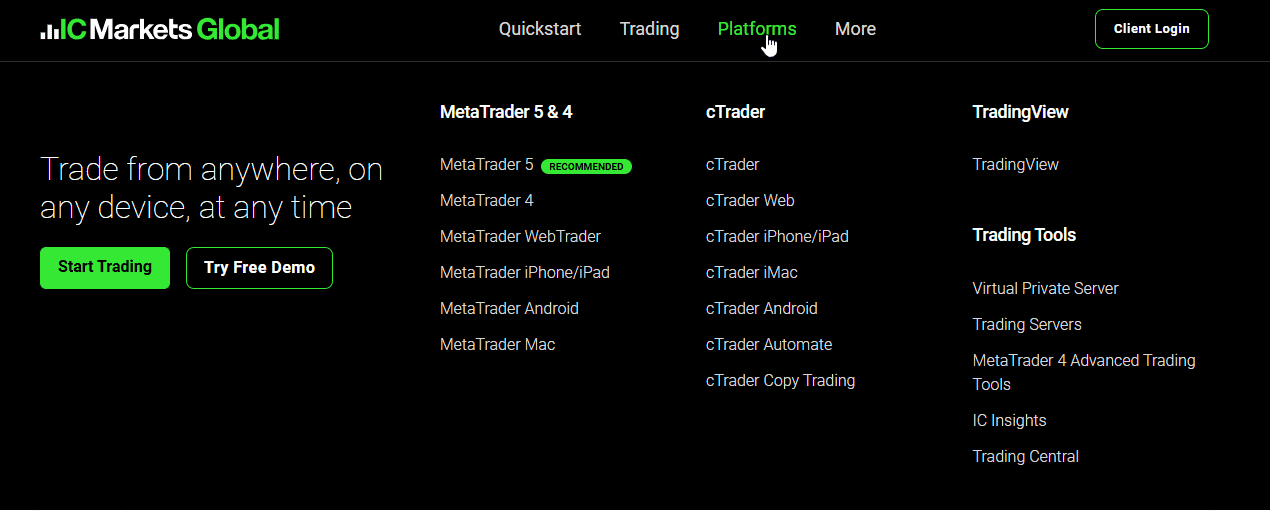

Both brokers offer a wide range of platforms but they go about it differently. While IC Markets mainly offer well-established platforms such as MT4, MT5, cTrader, and TradingView, Saxo only offer their proprietary platforms.

| Trading Platform | Saxo Markets | IC Markets |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | No | Yes |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

I tested all of them and what stood out was how well IC Markets has built around MT5. The Australian broker does a fantastic job turning them from a regular old charting platform to a true multi-asset platform.

You can trade a variety of CFDs from the same account with ultra-tight pricing and quick execution routed through Equinix NY4 servers for low latency.

Charting features are more powerful than MT4 with more indicators, more drawing tools, and a wider choice of timeframes. Even Depth of Market (DoM) is integrated, so you can see liquidity across price levels, and fine-tune your entries and exits.

If you like to automate strategies through Expert Advisors (EAs), the new and improved MQL5 language lets you do so with a lot of ease.

Automation is supported through Expert Advisors (EAs) built in MQL5, which is faster and more versatile than the old MQL4 language.

You can download all the IC Markets platforms on any device and a WebTrader is available for MetaTrader. And the experience is pretty much the same across devices with things like analytical tools available and order types.

Saxo Markets

Saxo Markets mainly offers its own proprietary platforms known as SaxoTraderGO and SaxoTraderPRO. They used to offer MT4 and TradingView, but support was discontinued. You’ll still be able to access TradingView as a third-party tool that can be integrated with their platforms.

SaxoTraderPRO is their flagship platform, which I found better suited for active traders who want advanced execution and institutional-level tools.

The charting features were actually better than I expected, with over 50 indicators and the ability to trade directly from charts. For risk management they’ve got unique risk management tools such as the account shield which acts as stop-loss on your entire portfolio.

The trade ticket gives you all the critical data and the ability to place orders with fewer clicks. Features like Depth Trader and Time and Sales offer a direct window into exchange activity, though you’ll need a paid subscription for market data.

SaxoTraderGO is their more accessible platform, carrying a few similar features to PRO such as the improved trade ticket, option chains, and risk management tools. There are more than 40 indicators for technical analysis along with customisable charts, and automated trade signals.

But in my view, the platform places heavier emphasis on fundamental analysis with equity research tools, sentiment indicators, and market insights from experts via SaxoStrats.

I’ve created a software questionnaire with six questions to help you find the best trading platform for your style.

Verdict

IC Markets offers you way more flexibility with its platform range.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

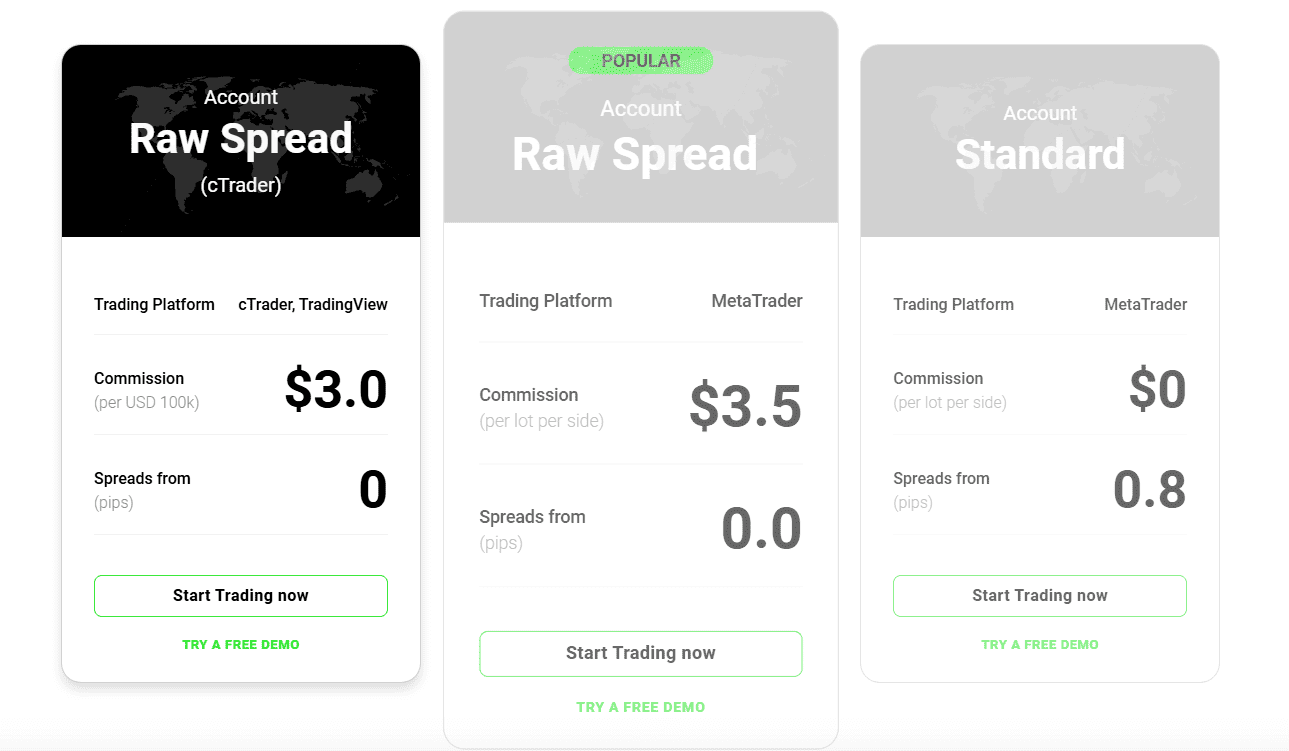

3. Superior Accounts and Features – IC Markets

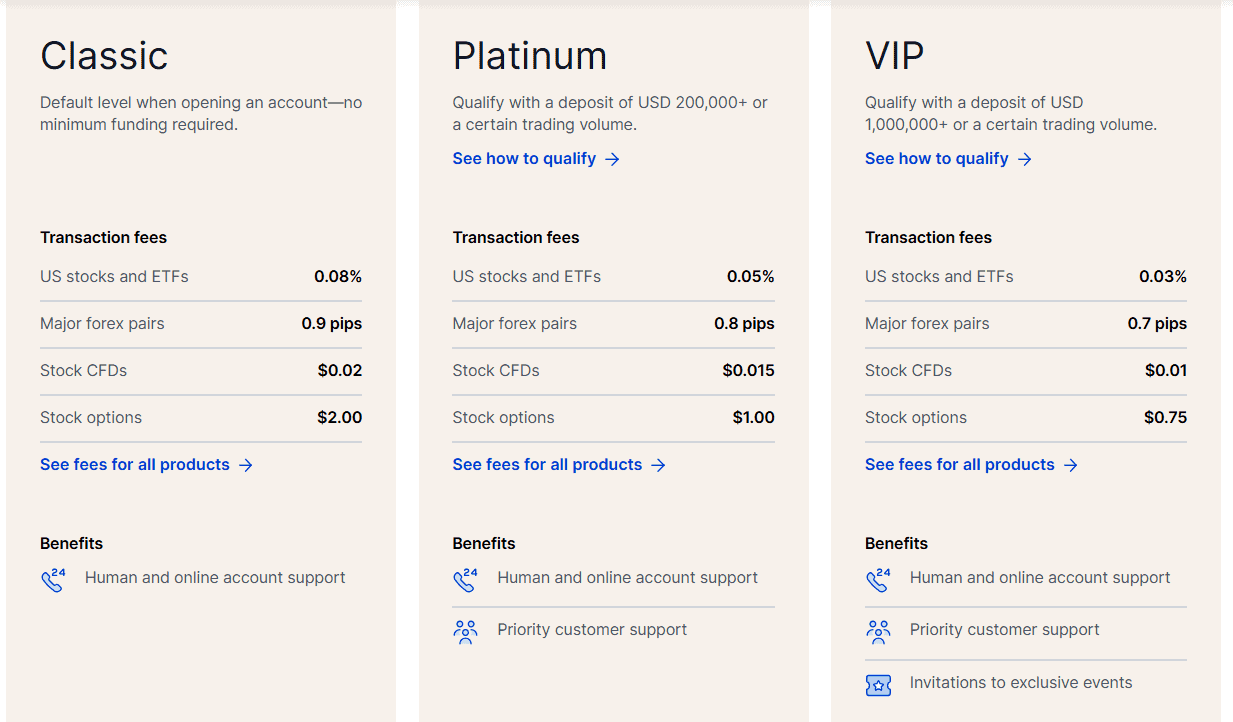

Saxo Markets offers three account tiers, where higher deposits or greater trading volume unlock better service and pricing.

The Classic account is the default option, where spreads on major forex pairs begin at 0.9 pips and no commission is charged.

If you want tighter pricing, you need to qualify for a Platinum account, either by depositing $200,000+ or hitting certain trading volumes. The VIP account promises equally tighter pricing and even better services but you’re looking at deposits north of $1,000,000 to qualify.

With IC Markets, you don’t need six figures in your account to get competitive pricing or great services. You have total freedom to choose from any of their three account types which also have demo versions. Leverage is set to 1:1000 for all accounts and the option for swap-free Islamic accounts is available.

The Raw Spread accounts start from 0.0 pips with low commissions of $3.50 per 100k on MetaTrader and $3.00 on cTrader. If you’re scalping or running high-frequency strategies on this account type, you’ll find it very cost-efficient over time.

If you prefer simplicity or you’re still new to forex trading, sticking with the Standard account is your best bet. Spreads are obviously wider here but broker fees are already included so you don’t need to worry about calculating commissions.

| Saxo Capital Markets | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Verdict

IC Markets offers flexible account types with better pricing and features while Saxo reserves its best features for high-spending clients.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

My trading experience with IC Markets was generally great right from the get-go with account opening. You are required to upload the usual documents like proof of ID and address, and in my case, verification was completed within a few hours. The process felt smooth and straightforward, with clear instructions at every step, so I was up and running the same day.

When it came to placing my first and subsequent trades, execution was impressively fast. Orders went through in fractions of a second, with limit orders averaging around 134 ms and market orders just 155 ms in my testing.

With Saxo Markets, the account opening process took longer, and the KYC checks were more detailed, which is fair considering their focus on higher-net-worth traders. The execution speed wasn’t at par with IC Markets but at least they make up for it with strong platform stability and a premium feel.

Verdict

IC Markets delivers the best trading experience with faster execution and easier account opening and handling.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Saxo Markets

As shown here, both Saxo Markets and IC Markets are highly regulated brokers. Saxo and IC Markets each have a score of 80 out of 100, indicating a high level of trust and security for their clients.

Saxo Markets Trust Score

IC Markets Trust Score

1. Regulations

In forex trading, trust starts with regulation and Saxo Markets is one of the strongest regulated brokers I’ve come across. They hold multiple licences from tier-one regulators including ASIC in Australia and the FCA in the UK.

IC Markets is licensed by ASIC and CySEC in Cyprus, both well-respected tier-one authorities. Beyond that, they operate under Seychelles’ FSA and the Bahamas’ SCB, which are considered tier-three or offshore regulators and usually offer lighter investor protections.

| Saxo Markets | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) MAS (Singapore) FINMA (Switzerland) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | SFC | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

This means, Saxo is the safer broker if you want the reassurance of strict, multi-jurisdiction oversight, especially if you’ll be trading serious capital.

2. Reputation

IC Markets took in a staggering US$1.64 trillion in trading volume in August 2025 from 200,000+ active clients globally. More traders means more feedback, which fuels word-of-mouth growth and that’s why IC is a household name among retail traders.

It’s more popular than Saxo in Australia where it’s headquartered, UK and broader Europe, South Asia particularly in Thailand and Vietnam, South Africa and India.

The only place Saxo holds its ground is in parts of Western Europe, where its banking heritage and institutional partnerships carry more weight. But globally, IC Markets is the broker retail traders are looking for, talking about, and signing up with.

| Country | IC Markets | Saxo Markets |

|---|---|---|

| India | 33,100 | 4,400 |

| Argentina | 8,100 | 1,600 |

| Germany | 8,100 | 170 |

| Colombia | 6,600 | 1,900 |

| Brazil | 6,600 | 1,600 |

| Turkey | 6,600 | 320 |

| United Arab Emirates | 5,400 | 8,100 |

| Thailand | 5,400 | 1,600 |

| Pakistan | 5,400 | 590 |

| Philippines | 5,400 | 590 |

| Morocco | 5,400 | 140 |

| Peru | 4,400 | 18,100 |

| Bangladesh | 4,400 | 2,900 |

| United States | 4,400 | 720 |

| Singapore | 4,400 | 260 |

| Australia | 4,400 | 210 |

| Poland | 3,600 | 3,600 |

| Indonesia | 3,600 | 720 |

| Vietnam | 2,900 | 1,000 |

| Nigeria | 2,900 | 110 |

| Ethiopia | 2,900 | 50 |

| Hong Kong | 2,400 | 14,800 |

| Ecuador | 2,400 | 2,400 |

| Uzbekistan | 2,400 | 390 |

| United Kingdom | 2,400 | 390 |

| Taiwan | 2,400 | 260 |

| Saudi Arabia | 2,400 | 140 |

| South Africa | 2,400 | 50 |

| Malaysia | 1,900 | 1,000 |

| Switzerland | 1,900 | 1,000 |

| Uruguay | 1,900 | 70 |

| Sweden | 1,600 | 4,400 |

| Mexico | 1,600 | 2,900 |

| Algeria | 1,600 | 2,400 |

| Jordan | 1,600 | 1,000 |

| Italy | 1,600 | 320 |

| Bolivia | 1,600 | 90 |

| Spain | 1,300 | 2,400 |

| Netherlands | 1,300 | 590 |

| Tanzania | 1,000 | 390 |

| Venezuela | 1,000 | 90 |

| Ireland | 1,000 | 70 |

| Canada | 880 | 1,300 |

| Cyprus | 880 | 880 |

| Sri Lanka | 880 | 210 |

| Portugal | 880 | 70 |

| Botswana | 880 | 20 |

| Austria | 720 | 2,400 |

| Greece | 720 | 210 |

| Chile | 720 | 20 |

| Ghana | 590 | 210 |

| New Zealand | 590 | 20 |

| France | 590 | 10 |

| Mauritius | 480 | 110 |

| Kenya | 480 | 50 |

| Dominican Republic | 390 | 50 |

| Japan | 320 | 10 |

| Egypt | 260 | 260 |

| Panama | 260 | 210 |

| Cambodia | 260 | 70 |

| Uganda | 260 | 30 |

| Mongolia | 210 | 50 |

| Costa Rica | 170 | 10 |

33,100 1st | |

4,400 2nd | |

8,100 3rd | |

170 4th | |

6,600 5th | |

1,600 6th | |

5,400 7th | |

1,600 8th |

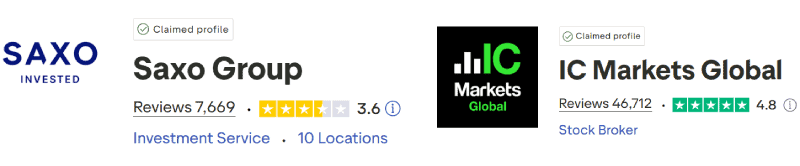

3. Reviews

Although, IC Markets has an impressive rating of 4.8 out of 5, based on over 46,000 reviews, Saxo Markets also holds a more modest rating of 3.6 out of 5, from around 7,700 reviews.

Verdict

Saxo brings deeper tier-one regulation and history, while IC wins retail trust with global reach, strong reviews, and some of the highest client satisfaction scores.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

6. Top Product Range And CFD Markets – A Tie

I liked what both brokers had to offer in the CFD products department.

Saxo Markets’ forex offering is among the largest I’ve seen with a broker, with over 300 pairs while IC offers a mere handful in comparison. They also offer 9000+ share CFDs including blue-chip stocks from the US, Europe, and Asia.

IC Markets put up a great fight against Saxo, matching them in other key areas like indices and bonds, and actually surpassing them in some. Their crypto range is broader, and you can trade futures which Saxo currently doesn’t offer.

| CFDs | Saxo Markets | IC Markets |

|---|---|---|

| Forex Pairs | 327 | 61 |

| Indices | 29 | 23 Spot Indices 3 Index Futures |

| Commodities | 5 Metals 7 Energies 8 Softs | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures |

| Cryptocurrencies | 9 | 18 |

| Share CFDs | 9000+ | 2100+ |

| ETFs | 1200 | 3 NASDAQ 33 NYSE |

| Bonds | 8 | 12 |

| Futures | No | Yes |

| Treasuries | 8 | Yes |

| Investments | No | Yes |

Verdict

I have to call this one a tie since both brokers deliver at the top level in product range and CFD markets.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

7. Superior Educational Resources – IC Markets

The education section on IC Market’s page contains guides on the basics of forex and CFD trading, and tutorial videos which I think can benefit beginners. However, it’s just surface level stuff so you’ll have to supplement it with outside material.

The live webinars and podcasts are for more experienced traders looking for deeper market insight and perspectives from analysts who trade these moves every day.

Saxo lean more on the research side of things thanks to their SaxoStrats team, who put out regular analysis and commentary. But when it comes to structured learning, they don’t offer much for beginners or intermediates.

Verdict

IC Markets has better educational resources catering to both new and experienced traders.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Customer Service – IC Markets

IC offers 24/7 support, which means there’s always someone available any time you need urgent assistance.

Live chat connects you first to a bot, but you can escalate to a human instantly, and the responses are quick and knowledgeable. Their help centre is strong too, with clear FAQs and platform guides that actually solve problems rather than just restating features.

Multilingual support is available, and while IC doesn’t assign dedicated account managers, the overall service experience is excellent for the average retail trader.

Saxo’s support is limited mainly to 9-to-5 coverage, and in some cases only available once you’re already a client. Live chat exists, but the quality is inconsistent, often rated as average compared to IC’s higher standards.

| Feature | Saxo Markets | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 9/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Verdict

IC Markets takes another win for their 24/7 availability, faster responses, and overall better services.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Better Funding Options – IC Markets

With IC Markets, you can fund in multiple base currencies, which helps cut down on conversion fees right from the start. The major global payment methods like bank cards, bank transfers, e-wallets and crypto are all available. Alongside them are POLi and BPAY for Australian and New Zealand clients.

Saxo has fewer base currencies, and while card payments and bank transfers are supported, PayPal, Skrill, and Neteller are missing. They do allow crypto deposits and POLi/BPAY, but overall the funding options are limited.

| Funding Option | Saxo Markets | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Verdict

IC Markets offers a wider variety of funding options with more base currencies.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Lower Minimum Deposit – IC Markets

Saxo lets you technically open an account with no minimum deposit, but the reality is that their platforms and product structure are designed for high-value clients. Even though there’s no stated barrier, Saxo’s tiered accounts, higher spreads at entry level, and institutional focus make it impractical to start small.

IC Markets sets a clear and realistic starting point at $200 that’s actually well within industry standards though some brokers have no minimum deposit requirement.

| Minimum Deposit | Recommended Deposit | |

|---|---|---|

| Saxo Markets | $0 | - |

| IC Markets | $200 | $200 |

Verdict

IC wraps things up with a win because they provide a realistic entry point that matches the needs of everyday traders looking to grow.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: IC Markets Or Saxo Markets?

Across every major category I’ve looked at, IC Markets is the broker that consistently delivers the stronger experience.

| Categories | Saxo Markets | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Most Popular Broker | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

Saxo Markets: Best For Beginner Traders

Saxo Markets is better suited for beginner traders thanks to its low minimum deposit and more user-friendly platforms.

IC Markets: Best For Experienced Traders

IC Markets is the best choice for experienced traders because it offers a broad product range, advanced trading platforms and ultra-tight spreads.

FAQs Comparing Saxo Markets vs IC Markets

Does Saxo Markets or IC Markets Have Lower Costs?

IC Markets generally has lower trading costs. On its Raw Spread account, you’ll often see spreads from 0.0 pips with a $3.50 commission per side on MetaTrader ($3.00 on cTrader/TradingView). Even the Standard account holds competitive spreads around 0.8–1.0 pips without commissions. For more details on low-cost trading, check out our Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

If you’re trading on MetaTrader 4, IC Markets is the stronger choice. With its custom suite of 20+ trading tools, support for EAs through MQL4, enhanced order management features, and deeper liquidity connections, IC’s MT4 setup is built for serious trading. For a closer look at the top MT4 setups in the market, check out this list of the Best MT4 Brokers.

What Broker is Superior For Australian Forex Traders?

If you’re trading from Australia, IC Markets is the clear pick. They’re ASIC-regulated, have deep local roots, and offer more firepower across platforms, tools, and liquidity. Add in their long-standing reputation and institutional-grade infrastructure and you’ve got a broker built for serious Aussie traders. Check out our Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

Saxo Markets is the better broker for UK traders because they’re fully authorised by the FCA, which means you get strict oversight, and key protections like segregated client funds, and negative balance protection. For more details, check out our Forex Brokers In UK page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert