Best AI For Forex Trading

I tested 2026’s top AI forex trading tools, indicators, and bots to help you find the best fit for your strategy. In this guide, you’ll also discover which brokers offer AI-powered trading, what AI is, and the pros and cons of using it in Forex trading.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Best AI For Forex Trading

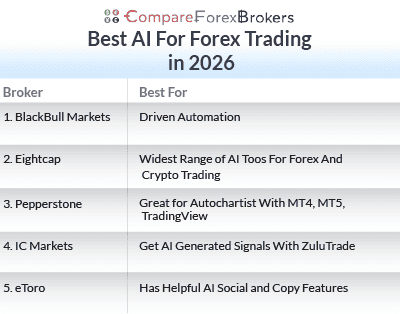

- BlackBull Markets - Driven Automation

- Eightcap - Widest Range of AI Toos For Forex And Crypto Trading

- Pepperstone - Great for Autochartist With MT4, MT5, TradingView

- IC Markets - Get AI Generated Signals With ZuluTrade

- eToro - Has Helpful AI Social and Copy Features

What Are The Top 5 Brokers For AI Trading in 2026?

Out of 25 brokers and their AI tools I tested, five stood out. My criteria evaluates their overall trading platforms, low-latency execution, and how seamless the integration with AI trading tools is. Bonus points were given for features like algorithmic trading systems, sentiment analysis, and machine learning-driven signals.

1. Blackbull Markets - Best for AI-Driven Automation

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, cTrader, BlackBull CopyTrader

Minimum Deposit

$0

Why I Recommend BlackBull Markets

I rated BlackBull Markets highly in my tests, scoring 95/100. They achieved this after delivering the fastest execution speeds and low fees ($3.00/lot and 0.1 pip spreads) on the ECN Prime account.

The broker offers many AI features, including Myfxbook AutoTrade integration and Capitalise.ai for automating strategies using plain English (instead of programming code).

BlackBull Markets offers 1:500 leverage and over 2,000 CFDs which is great if you want to scale your trading account.

Pros & Cons

- Free TradingView Premium for active traders

- Advanced AI tools with manual parameter control

- Fastest global execution speeds.

- Not ASIC-regulated.

- Limited educational content.

Broker Details

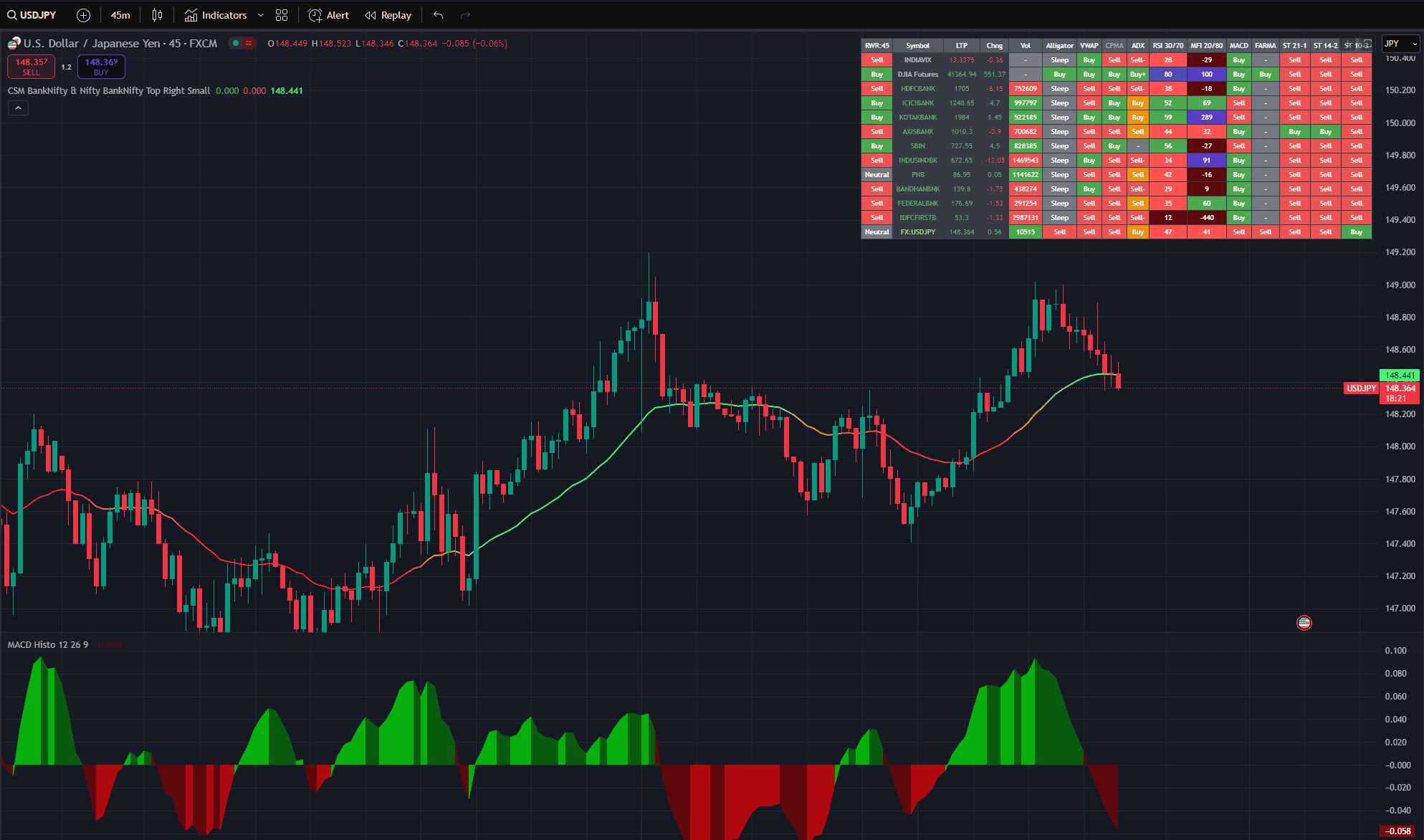

Access Multiple AI Tools Through MT5

BlackBull Markets has access to multiple AI tools through the MT5 platform. These tools can help you develop better strategies, receive trading signals, or provide dynamic risk management.

You can use AI wrappers like OpenAI or Grok to manage your Expert Advisors through Python (a coding language). This allows you to apply machine learning to fine-tune your strategies.

If you’re not a computer whiz, Capitalise.ai is available to create automated trading strategies using instructions instead of a programming language (like MQL5).

Or if you want hands-off trading, using Myfxbook’s AutoTrade lets you use AI to find copy traders to follow based on your risk profile.

Low Commissions On ECN Prime Account

All account types from BlackBull Markets are backed by the broker’s ECN execution services. This means you get their low spreads, fast execution speeds, and a wide choice of trading platforms. I found the only difference between the accounts is the minimum deposit and commissions.

ECN Standard account is the simplest route to trading with variable spreads and no commissions from 0.80 pips on EUR/USD.

The ECN Prime account is the better choice if you want tighter spreads. You’ll get spreads from 0.1 pips and pay a $3.00/lot commission.

Fastest Execution Speeds Tested

My analyst, Ross Collins, tests every broker I review. One of the most important tests is figuring out the broker’s actual trading conditions, especially execution speeds.

In his tests, BlackBull Markets recorded the fastest execution speeds overall (out of 36 brokers).

The broker recorded an average limit order speed of 72 ms and a market order speed of 90 ms. Both are near-instant when trading liquid markets like EUR/USD.

[Execution speed tests]

2. Eightcap - Widest Range of Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.23 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why I Recommend Eightcap

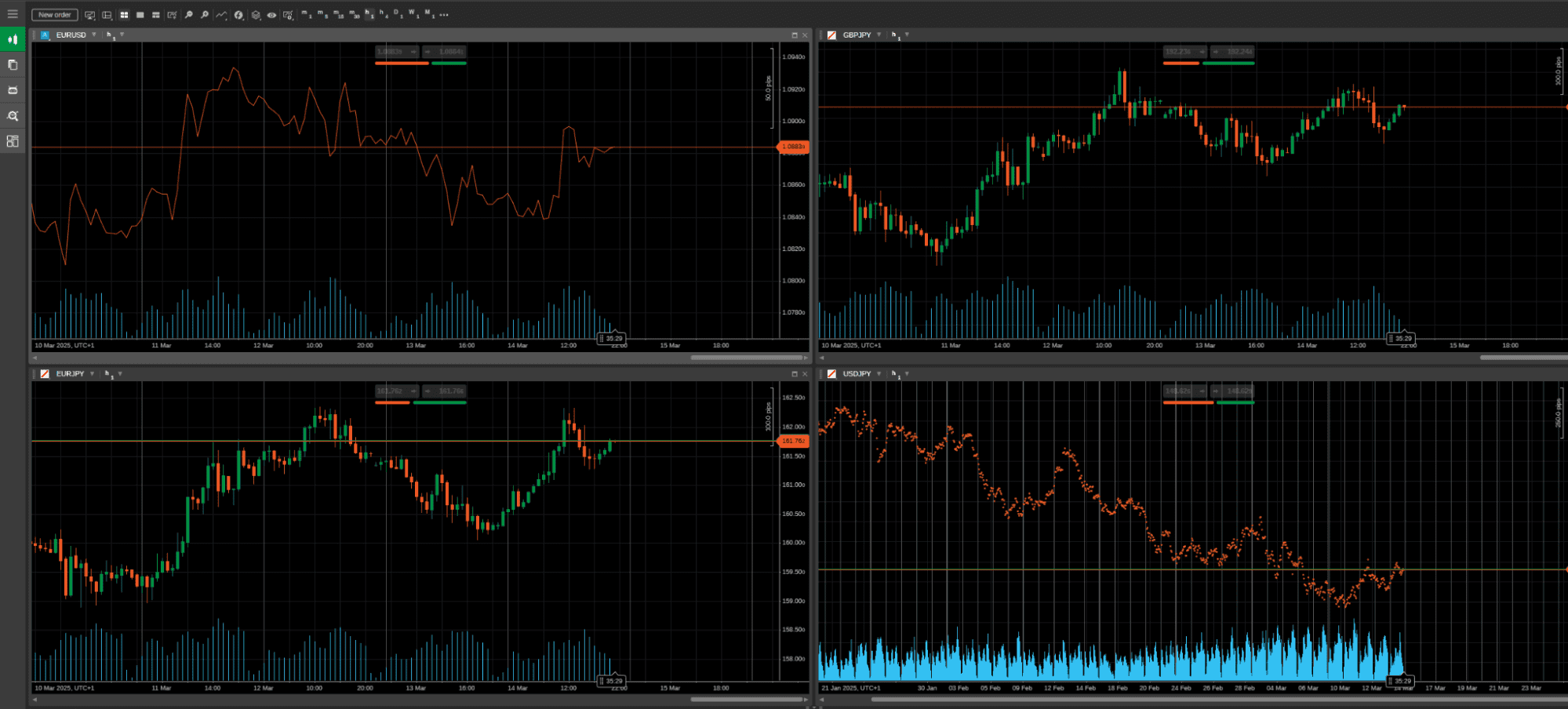

I chose Eightcap for its wide range of AI tools. These work with the broker’s 95+ cryptocurrencies, including Bitcoin and altcoins (the largest range for a forex broker in my tests).

Outside of crypto, the broker has 500+ markets covering share CFDs, indices, commodities, and 55 forex pairs. Making it a solid trading account for multi-asset trading.

With AI tools like Capitalise.ai, you can automate your trades within minutes (without knowing how to code). The AI-powered economic calendar also delivers automated fundamental analysis.

You can use these tools to trade Eightcap’s markets with MetaTrader 4, MT5, and TradingView.

Pros & Cons

- Largest crypto CFD offering (100+ tokens).

- Beginner-friendly AI tools like Capitalise.ai.

- Competitive raw spreads from 0.0 pips.

- Research tools lack depth.

- Execution speeds lag behind Pepperstone/IC Markets.

Broker Details

Trade 95+ Cryptocurrencies

Eightcap lets you trade 95+ cryptocurrencies like Bitcoin and XRP, while also including altcoins such as DOGE or Shiba Inu (which typically get neglected).

This is almost 3 times larger than what other regulated forex brokers offer. It lets you use your trading strategies with popular coins like Bitcoin or to try higher-risk cryptos like DOGE.

In addition to cryptocurrencies, Eightcap also hosts 500+ markets. These markets include 55 forex pairs and an extensive range of share CFDs meaning you can trade multiple markets under one account.

Automate Strategies With Capitalise.ai

One of the top AI features from Eightcap is through Capitalise.ai, a no-code tool that automates your manual trading strategies using simple written instructions.

This AI software opens up automated trading to a larger audience as you do not need to learn how to code a trading robot.

When using Capitalise.ai, I was able to write instructions in plain English. For example “Buy USD/JPY when RSI is below 20 and 10 moving average crosses the 31 moving average”. The AI then asks you for your risk management settings, helping to fine-tune your strategy.

Creating and deploying the strategy to my MetaTrader 5 account took less than 10 minutes. That included running a backtest to see how the bot will run before launching the automation.

AI-Driven Economic Calendar

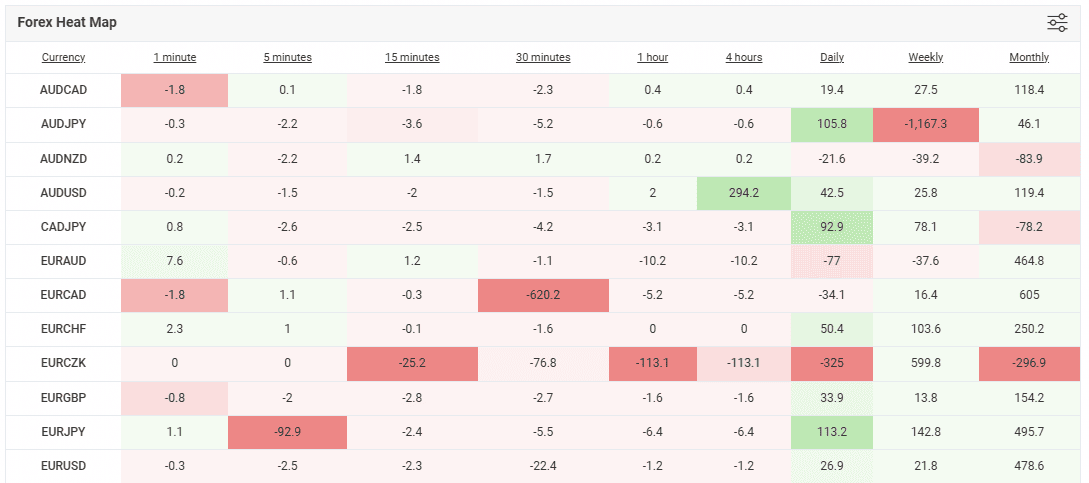

As someone who uses macroeconomic data to build a world view, I found the AI-driven economic calendar to help speed up your research.

I like that the calendar’s AI analyses the impact of major economic announcements (like Non-farm Payrolls). It gives you an insight into how much the market may move after the announcement.

For example, the AI will plot the potential movements (in pips) the asset may move in the next hour, day, week, and month based on the new data release.

I find the AI-powered economic calendar useful. You can use this data to trade for higher-probability trade setups by using the new fundamental analysis to trade with the overall trend.

3. Pepperstone - The Best Broker Overall (Globally)

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

Pepperstone is my highest-scoring forex broker, scoring 98/100 for offering excellent trading conditions. With the Razor account, you can get spreads from 0 pips. The broker’s execution speeds are among the fastest tested by my analyst, helping reduce slippage.

The broker offers Autochartist for automated trading signals. This signal tool uses AI-generated technical analysis that scans multiple markets, including gold, oil, forex pairs, and indices. I also like that you can use Autochartist with TradingView, cTrader, MT5, and MT4.

Pros & Cons

- Fastest execution speeds from 50+ brokers tested

- Top-tier ECN spreads and low commissions ($3.50/lot).

- Ideal for scalping and algorithmic strategies.

- Limited stockbroking services.

- Higher standard account spreads.

Broker Details

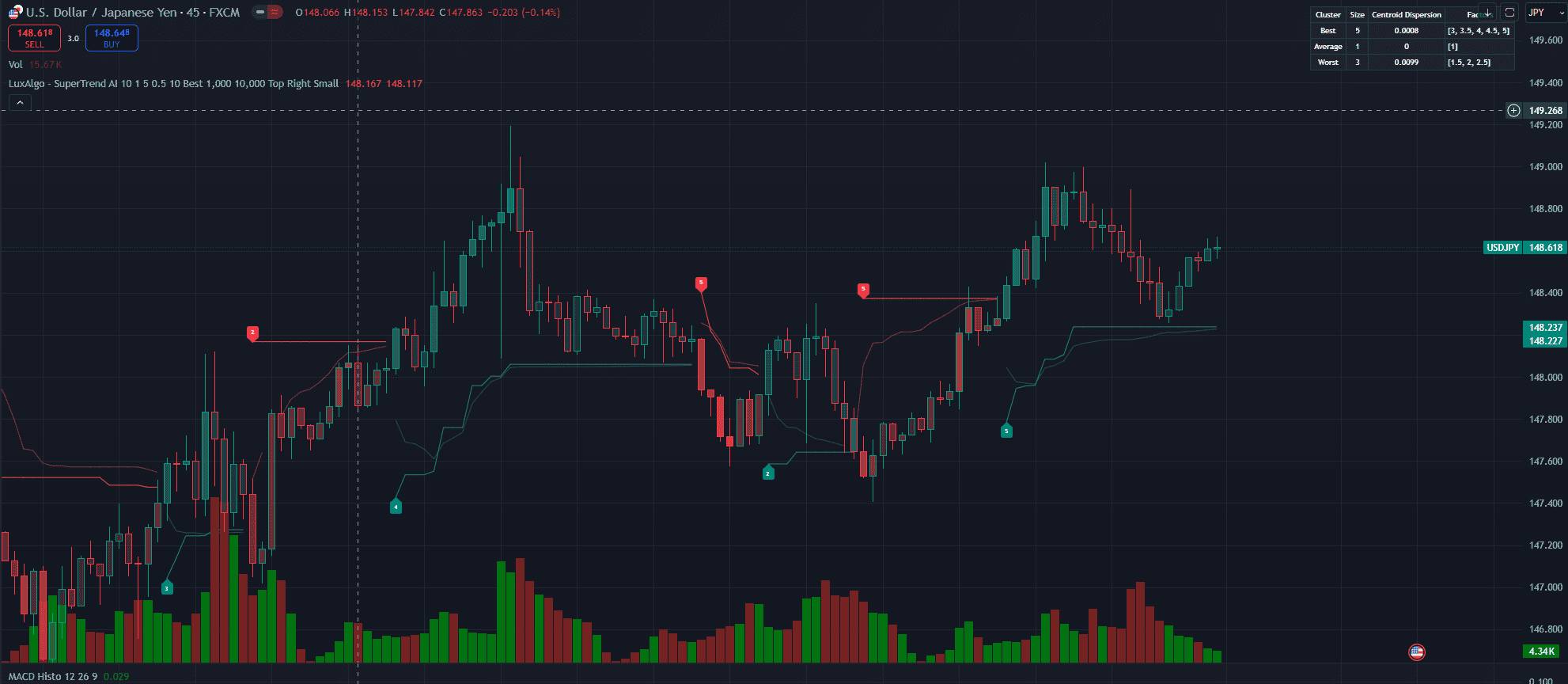

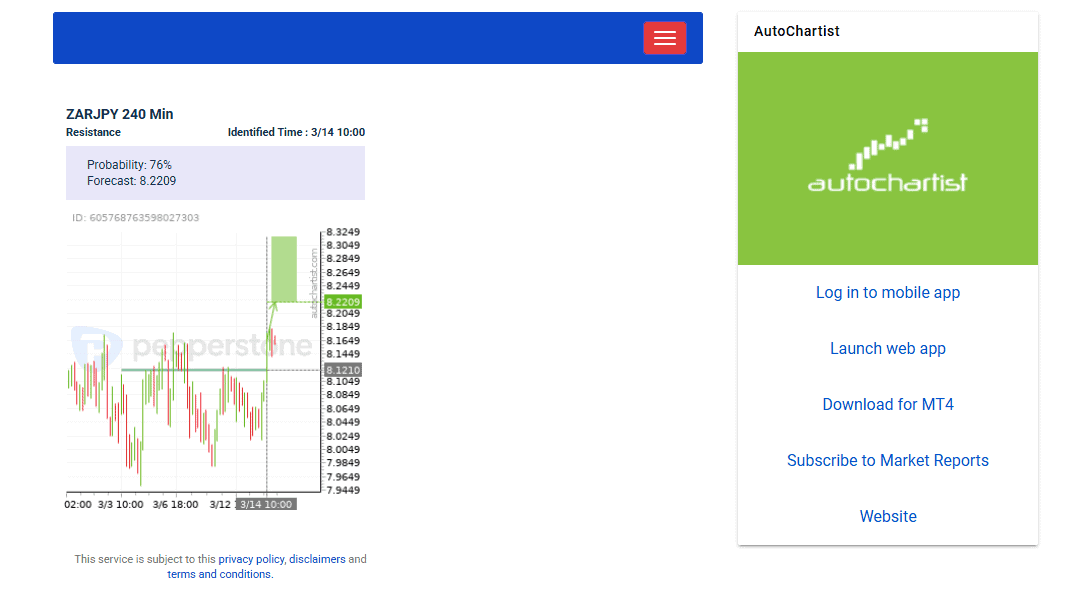

Automated AI Signals With Autochartist On MT4

One of the tools I most like using for technical analysis is Autochartist. Available with Standard and Razor accounts, this tool provides automated technical analysis. Some of the signals I received from the AI included chart patterns (like wedges) or price action, such as Fibonacci retracements.

One helpful feature is that it generates multiple signals (7+) throughout the day, making it a solid companion when day trading. Its AI integration means it can “estimate” the time for the signal to trigger, helping prepare you for the trigger.

Other valuable features with Autochartist include that it generates a “confidence” level that filters out trades you don’t need. This means it delivers only the highest-rated ideas, improving signal quality and saving you from viewing trades that are unlikely to be successful.

Tight Spreads On Its Razor Account

In my analyst’s tests, the Razor account from Pepperstone achieved joint 3rd best spreads on EUR/USD. The average spread was 0.19 pips, beating the industry average by 30%.

[Raw account EUR/USD spreads – tested]

With $3.50/lot commissions, I think the Razor account provides great value for scalping. You’ll benefit from the fixed costs (via commission) with cheaper spreads.

Fast Limit Order Execution Speeds To Limit Slippage

Pepperstone also outperformed in our execution speeds test, especially for the limit orders, coming second to BlackBull Markets.

In my analyst’s tests, Pepperstone achieved an average limit order speed of 77ms. This is excellent for breakout trading and stop losses, protecting you from slippage and failed orders.

[Limit order execution speeds]

4. IC Markets - Lowest Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

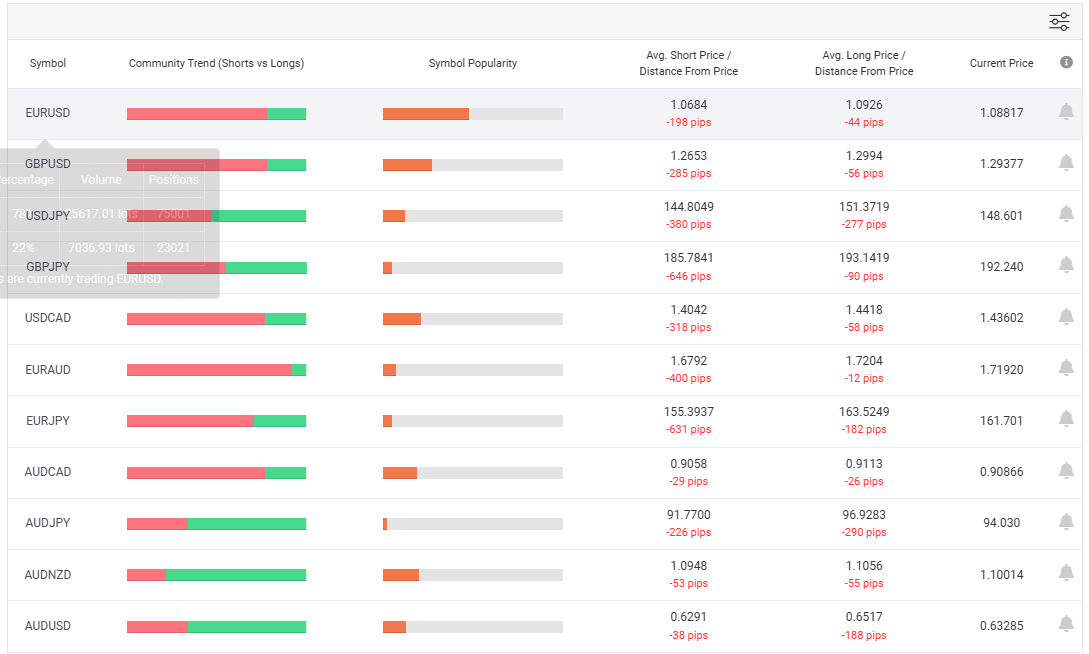

IC Markets paces the industry for raw spreads (EUR/USD of 0.0 pips) and features sub-1ms execution speeds for high-frequency traders. Advanced Analytics Hub’s machine learning provides backtesting capabilities for strategies, while partnerships with ZuluTrade allow you to replicate AI-facilitated social trading strategies.

Pros & Cons

- Best-in-class spreads and liquidity

- Robust support for MT4/MT5 Expert Advisors (EAs)

- Trusted by scalpers and HFT traders

- Slow live chat support

- No cTrader Copy functionality

Broker Details

Lowest Spreads From Our Tests

IC Markets offers a Standard account (no commission, spread-only) and a Raw account (tighter spreads, with $3.50/lot commissions). This lets you choose how to pay your trading costs.

My analyst tested IC Markets’ Standard account and compared it to 14 other brokers by capturing the average spreads to find the lowest spread broker overall.

His findings show that IC Markets is a clear winner, averaging 0.73 pips on EUR/USD, 34% cheaper than the industry average.

[Ross Standard EUR/USD comparison]

Interestingly, I found this spread is cheaper than its Raw account when you consider the $7.00 round-trip commission and 0.19 pips average spreads. When you combine the spread and commission, it gives you an effective spread of 0.89 pips, which is very cheap.

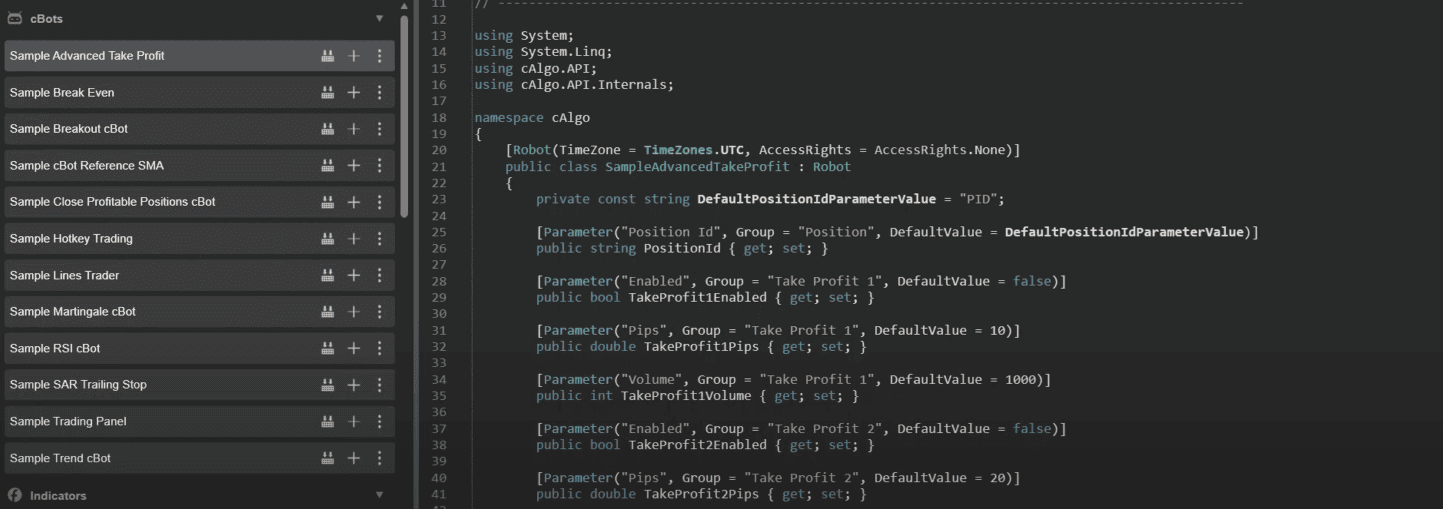

Use AI Expert Advisors on MetaTrader 4

IC Markets allows you to use Expert Advisors on MetaTrader 4, which is now programmable using AI like OpenAI.

EAs can automatically trade your account by following the AI’s instructions, such as buy and sell signals, while performing risk management across multiple open positions.

With the correct AI, the EAs can continually optimise their performance by using your trading performance data in real-time. I find this provides an excellent feedback loop on the MT4 platform, helping you min-max your performance.

Raw Trader+ Reduces Trading Costs

If you’re an active trader, I recommend you see if you qualify for the Raw Trader+ account. This add-on account has all the benefits of the tighter spreads plus the ability to earn rebates on your trading activity.

The requirements are low (in my opinion), where you can be eligible for the Raw Trader+ account after trading 100 lots over 3 months.

After qualifying, you’ll get a rebate of $1.50/lot on FX and metals, reducing your commissions to $2.00/lot. To put this into perspective, the rebates can save you 42%, which is a considerable saving.

5. eToro - Best Social and Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why I Recommend eToro

eToro also has Smart Portfolios that allow you to invest in baskets based on specific themes like crypto or electric vehicles. These baskets are managed by eToro’s team of analysts – providing a professional approach to copy trading.

The trading costs with eToro are competitive with its Standard account offering spreads from 1 pip on EUR/USD with no commissions on any of the 5,000+ assets.

Pros & Cons

- Zero-commission stock/crypto trading.

- Intuitive social trading ecosystem.

- 50+ cryptocurrencies and thematic portfolios.

- No MT4/MT5 support.

- Higher spreads for forex pairs.

Broker Details

AI Managed Smart Portfolios

eToro’s Smart Portfolios provide a hands-off approach to investing in sector-specific markets such as cryptocurrencies, bond markets, or industries like AI. The only thing you have to do is choose how much you wish to invest.

eToro’s analysts professionally review all the baskets with Smart Portfolios, while AI rebalances your portfolio to maximise your profits (and limit your losses).

I think this approach to investing is excellent if you don’t want to learn how to trade but still want exposure to high-risk products like cryptocurrencies.

Copy Trade From 2,000,000 Traders

eToro’s CopyTrader platform lets you search the broker’s database of copy traders (2 million) to find ones that match your risk profile.

Once you find a copy trader that meets your requirements, you can set up the platform to automatically mirror the trades. This gives you another way of hands-free trading.

As you invest with individuals vs. professionals (like the Smart Portfolios), eToro provides an automated risk management tool to protect your funds. This tool will close your positions and protect your account if the copy trader is underperforming.

Low Trading Costs For Copy Trading

I find that copy trading can be expensive as you normally pay a premium spread to cover the costs of the copy trading service and broker. With eToro being its own broker and platform, you won’t pay these premiums – making the broker a cost-effective way for copy trading.

Based on my experience with eToro, you can get spreads from 1 pip on EUR/USD, which is competitive. I also like that eToro does not charge commissions on any of their markets (even share CFDs), keeping your trading costs simple.

Ask an Expert

What’s the difference between AI trading software and just using indicators?

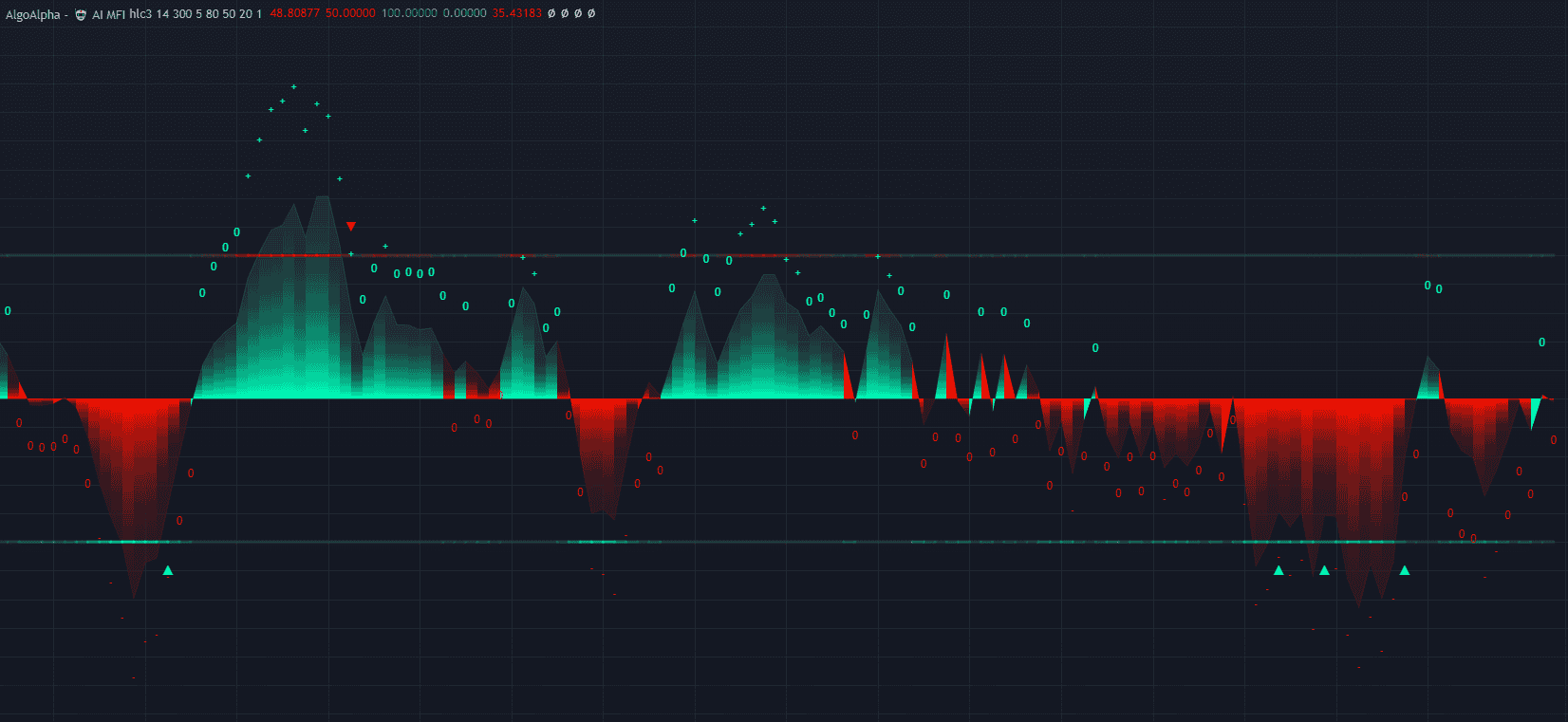

Indicators calculate its signals using formulas based on past price and/or trading volume. You still have to interpret the indicator, and they only output based on the pre-programmed rules.

AI trading software has an instruction set, but the AI can process the data automatically and show you true trading opportunities. The AI can also learn from its signals, improving its accuracy over time.