Best Forex Brokers In Europe 2026

The best forex brokers in Europe are regulated by top European authorities, and our experts reviewed 10 of the best EU brokers licensed by regulators such as CySEC, FINMA, and BaFin. Find out what trading platforms and spreads these brokers offer in our review.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

The best European regulated forex brokers are:

- Eightcap - Best Forex Broker Overall for Europe

- Pepperstone - Top Broker with the MetaTrader 4 Platform

- OANDA - Great Broker for Beginners

- IG Group - Largest Forex Broker in Europe

- IC Markets - Good Commission Free Trading Account

- eToro - Leading Social Trading Platform

- FP Markets - Great Range of CFD Products

- Plus500 - CFD Platform with Strong Charting and Technical Analysis Tools

- AvaTrade - Top Broker for Day Trading

- XM - Broker with the Best Customer Service

What is the best forex broker in Europe?

Eightcap offers the best forex broker in Europe, providing FCA, CySEC and ASIC regulation with a 143ms execution speed and RAW spreads from 0.06 pips on EUR/USD. With $3.50 commissions and Standard spreads from 1.0 pips across 56 currency pairs plus 130+ crypto CFDs, Eightcap delivers ESMA-compliant trading with 30:1 retail leverage and $100 minimum deposit. We also shortlisted other FX brokers in the EU that we think are the best.

1. Eightcap - Best Forex Broker Overall for European Traders

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.23 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

From our experience, Eightcap is the best overall forex broker for most traders in Europe. They offer highly competitive trading costs, characterised by tight spreads, low commissions, and a complete absence of hidden fees. Furthermore, they offer a huge range of trading products, allowing you to find exciting global trading opportunities at any hour of the day.

Pros & Cons

- Low trading costs

- Good variety of market analysis research

- Solid choice of trading platforms

- Lacks the range of CFDs

- Customer support is not 24/7

- No MT4

Broker Details

Eightcap Accounts and Spreads

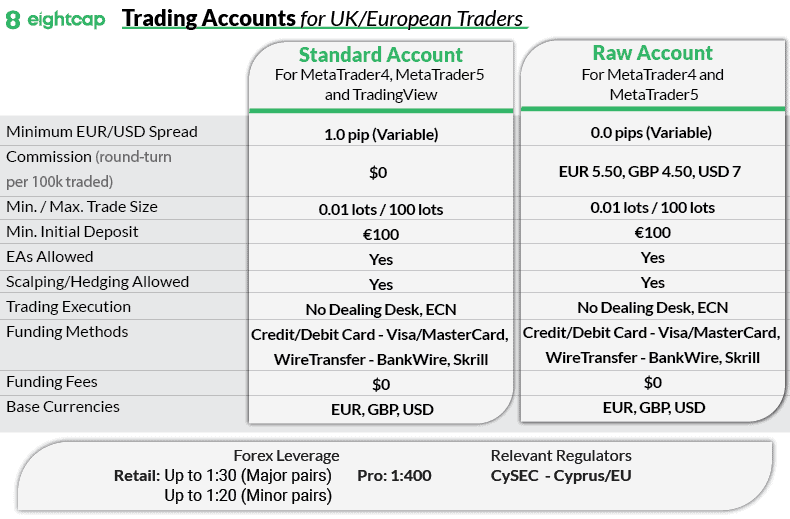

Eightcap gives you a choice between two account types: a no-commission, spread-only Standard account and a spreads plus commission Raw account.

Eightcap Standard Account Spreads

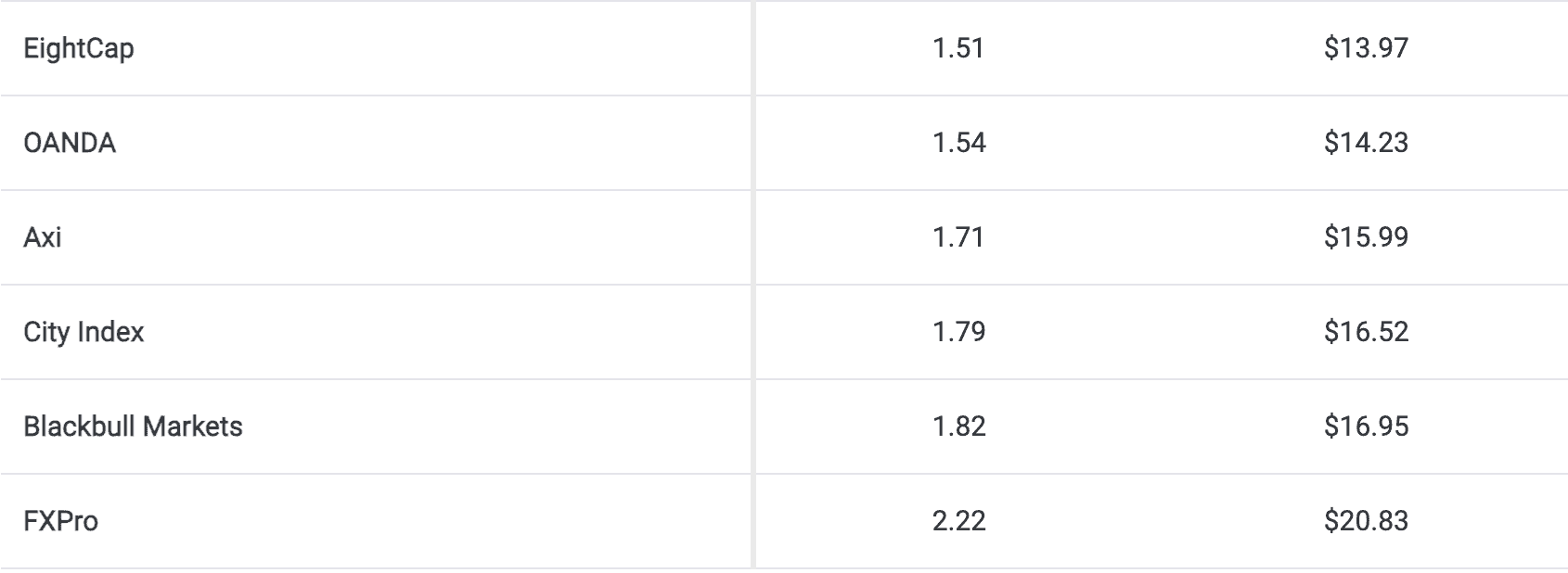

The Eightcap Standard account has an average variable spread of 1.0 pips, which is very competitive. ROss Collins tested the average Standard Account Spreads across top brokers, we discovered that most range from 1.03 to 2.22.

How did Eightcap fare? While not the lowest of the low-spread brokers, it comfortably outperformed similarly-sized competitors with an average spread of 1.51 pips (USD 13.97). Importantly, Eightcap posted even better results for some of the most popular currency pairs: 1 pips for EUR/USD and 1.2 for AUD/USD, for example. Compare those numbers to our poorest-performing broker, which averaged 2.2 pips.

Eightcap Raw Account Spreads

Eightcap’s Raw account also stacked up well against the competition in terms of trading costs. Ross Collins tested the average Raw Account Spreads for commission accounts and found that Eightcap averages a respectable 0.5 pips (vs 0.94 from our worst-performing broker).

The broker’s commission of USD 3.50 to open or close a position is aligned with similar brokers. That’s a full USD 2 less per round-turn trade.

Eightcap Trading Platforms

If you’re all about currency pairs, exotic crosses and fundamental market analysis, we don’t think you can go wrong with MetaTrader 5 (MT5). MT5 is the successor to the popular MetaTrader 4 but offers even more features and trading capabilities.

Over 80 trading indicators are available, including 21 timeframes, We put Eightcap’s assertion that the platform could accommodate up to 100 charts to the test, and indeed, MT5 lived up to the hype.

If you prefer automated trading, Eightcap and MetaTrader 5 don’t disappoint. You can either cook up your custom Expert Advisor or purchase one pre-made to match your specifications.

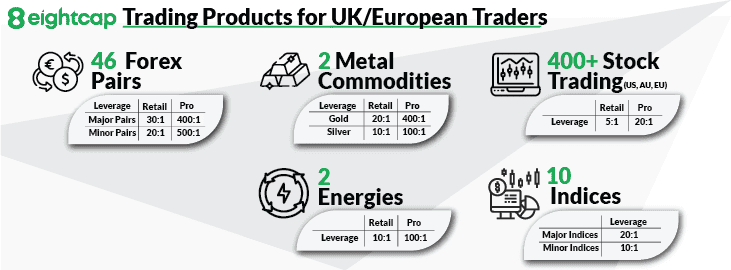

Eightcap Range of Markets

If your trading interests extend beyond forex, Eightcap offers a respectable selection of financial instruments to trade beyond just currency pairs. Think commodities and indices, as well as over 400 stocks.

Additionally, Eightcap allows you to amplify your positions through leverage. For major currency pairs, the leverage stands at 30:1, while for minors, it’s set at 20:1. It’s important to note that these ratios represent the absolute maximum established by CySEC and FCA regulations, so it’s wise to exercise caution.

Eightcap Customer Support

If you’re based in Europe, rest assured knowing that Eightcap representatives remain at your disposal, no matter the time of day. This broker goes the extra mile by maintaining two distinct customer support centres specifically catering to EU and UK clients, ensuring around-the-clock assistance for technical issues.

For those who’d rather avoid the phone, Eightcap offers support alternatives in the form of email or a custom chatbot. While the interface of the chatbot may come across as a bit cumbersome, we managed to retrieve the necessary information without significant hassle.

Eightcap Education and Research Resources

Eightcap has significantly invested in building a comprehensive knowledge hub for its clients. The proprietary trading library, Eightcap Labs, provides valuable resources, including free articles, courses, and tutorials. This diverse collection covers everything from the basics of trading to advanced charting techniques to how to choose a trading platform.

Our Verdict on Eightcap

Thanks to its narrow spreads and exceptional trading tools, Eightcap earned top marks in our review of European-friendly forex brokers. Although the absence of MetaTrader 4 might be a minor drawback, the truth is MetaTrader 5 is the superior platform in the MetaQuotes family anyway. Other features that appeal include abundant educational materials establish this broker as one of our preferred choices, especially for those new to trading.

2. Pepperstone - TOP BROKER WITH THE METATRADER 4 PLATFORM

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

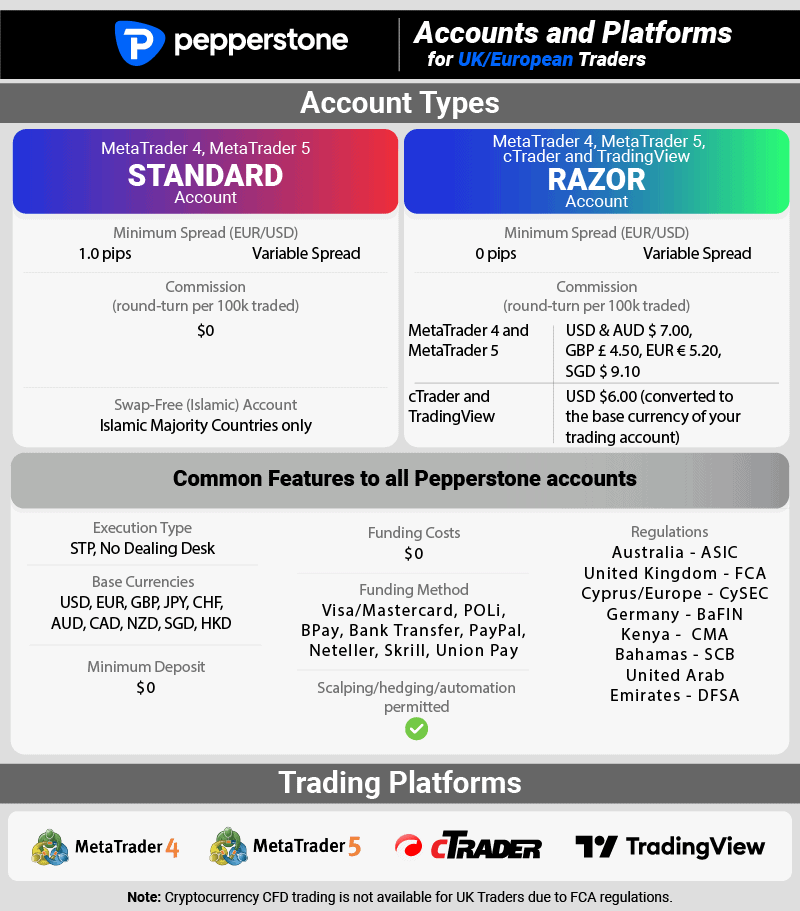

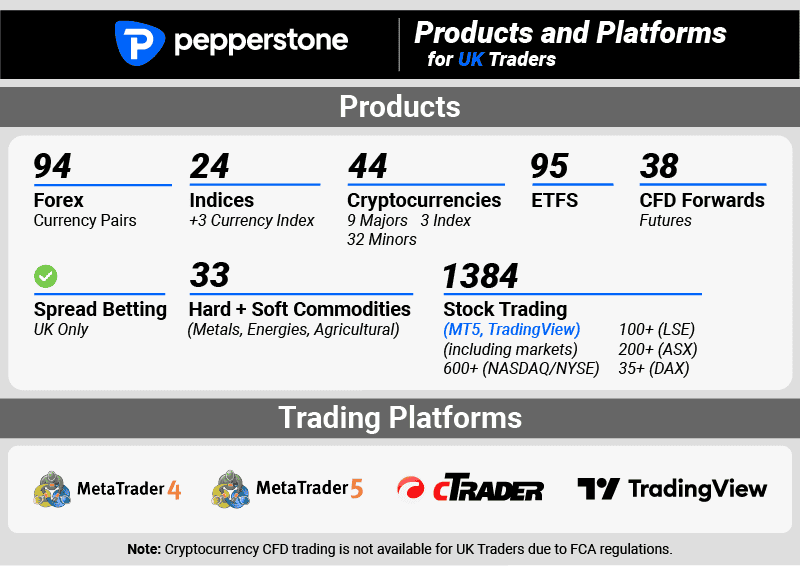

Pepperstone is a godsend for European traders using MetaTrader4, MetaTrader 5, cTrader or TradingView, due to the extremely low spreads, fast execution and no-dealing desk ECN pricing.

We’ve thoroughly tested Pepperstone and have no reservations about naming it the Top Broker with the MetaTrader 4 Platform for European traders. We were particularly impressed by the minimal trading costs, huge range of available CFDs and forex trading options, quick execution times and diverse account funding options including PayPal.

Pros & Cons

- Fast execution speeds

- Weekly webinars for market research and education

- Good collection of markets to trade

- Has no copy-trading tools

- No guaranteed stop-loss

- No cryptocurrency markets

Broker Details

Pepperstone Accounts and Spreads

Pepperstone’s Standard account boasts impressively narrow spreads, noteworthy for a broker operating with a no-dealing desk, market-making model.

Pepperstone Standard Account Spreads

Based on the module below, Pepperstone not only stands its ground but excels in comparison to similar brokers in terms of standard account spreads. (Our team collects and analyses this data monthly from every broker we review.) Pepperstone’s average monthly spreads for its Standard account stack up well against similarly-sized brokers.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Pepperstone Razor Account Spreads

If you’re a more experienced trader comfortable calculating trading costs and looking for tighter spreads, we recommend Pepperstone’s Razor account. With this account, you’re only billed the commission for opening and closing your position alongside the spread.

We’ve developed the module below to compare trading costs across brokers using ECN pricing coupled with the commission model (also updated monthly).

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

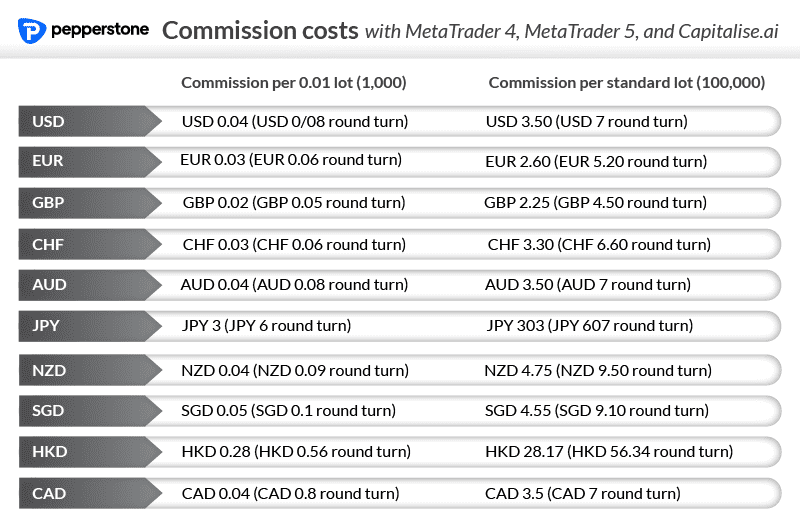

Speaking of commissions, Pepperstone’s are decidedly competitive: EUR 5.20 per round-turn trade.

Common Pepperstone Account Features

No matter which account type you opt for, you’ll benefit from several shared features when trading with Pepperstone. Features like:

- Scalping

- Hedging

- Expert advisors (MetaTrader), cAutomate (cTrader)

Pepperstone Trading Platforms

Pepperstone consistently secures a top position in our forex broker rankings in large part due to its diverse assortment of trading platforms. Beyond the ever-popular MetaTrader 4 and MetaTrader 5, Pepperstone also provides access to cTrader.

Additionally, you can explore various social and copy trading platforms, including options like MetaTrader Signals, Pelican, and DupliTrade.

MetaTrader 4 continues dominating the forex trading platform market and remains the top platform after over two decades. We strongly recommend it for beginners, given its proven track record and collection of essential tools. Key features include:

- 9 Timeframes

- 30 chart indicators

- 33 analytical objects

- 6 pending order types

- MQL4 for Expert Advisors and backtesting

Choose MT4 if:

- You want access to the MT4 trading community, which is one of the world’s largest communities

- You don’t intend to trade shares

- You don’t have a powerful server that can take advantage of the extra grunt MT5 may require

Pepperstone Execution Speeds

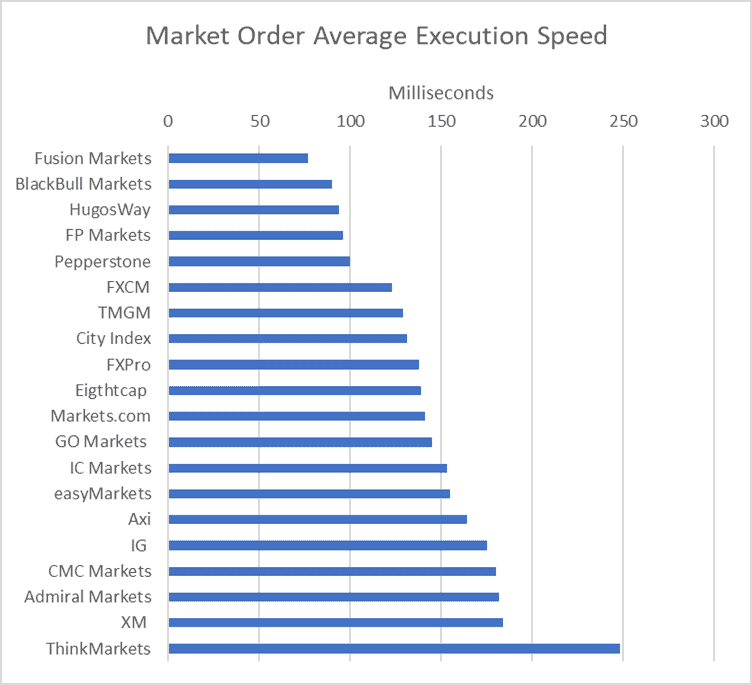

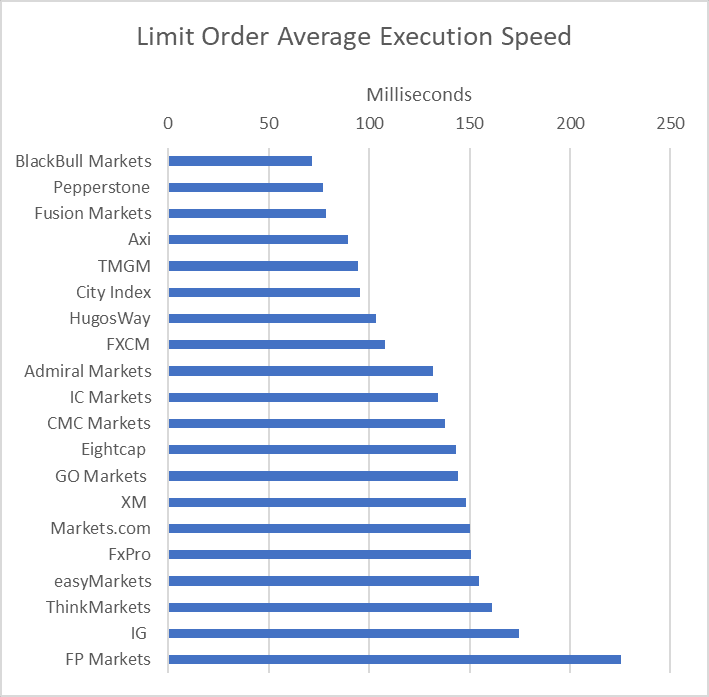

When we tested Execution Speeds, Pepperstone posted some of the best results of any broker. Market orders were processed at a respectable 100ms, while limit orders came under 75ms.

Our Verdict on Pepperstone

Pepperstone stands out as a premier European forex broker with exceptional MT4 trading experience. With access to over 1000 instruments spanning markets from forex to cryptocurrencies, Pepperstone has a wide range of markets and the tools to help you take full advantage. The broker’s two distinct account types ensure that whether you’re a seasoned day trader or a novice, you’ll find a trading experience that caters to your experience level and budget.

‘72.9% of retail investor accounts lose money when trading CFDs with this provider’

3. OANDA - Great Broker for Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA is a fantastic broker for beginner forex traders, due to the ultra-low minimum lot sizes and no minimum deposit amount, allowing traders to start with a tiny amount of capital. We also like there there are no commission costs and find their education tools impressive.

The guaranteed stop-loss order is a standout feature for us when using OANDA Trade. This is especially valuable for newcomers still learning the ropes and developing their trading strategies. These are just a few of the reasons why we recommend OANDA as the top choice for beginner forex traders in Europe.

Pros & Cons

- Trade lot sizes from 1 unit (0.00001 lots)

- Low spreads with no commissions

- No minimum deposit

- Only offers spread-based trading account

- Lacks content for education

- Do not offer share CFDs

Broker Details

OANDA Accounts, Spreads and Range of Markets

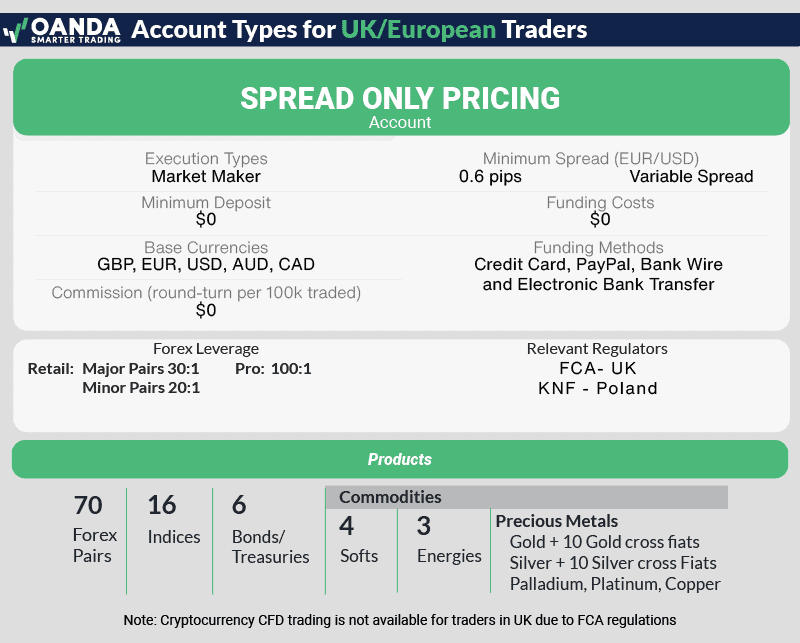

Like other streamlined brokers in this list, OANDA aims to save traders time and money with a single, optimised account type. As the name implies, the Spread Only account carries no extra commissions.

OANDA has an average spread of 0.6 pips for the EUR/USD pair, but where the broker distinguishes itself is its low indirect trading costs. With no minimum deposit requirement, no fees for deposits or withdrawals, and an inactivity fee that is only triggered after a full calendar year, it’s cost-effective for traders.

Newcomers to trading will find OANDA’s unique Trading Performance Portal, powered by Chasing Returns, particularly helpful. Leveraging behavioural science and cutting-edge data analytics, this portal helped us identify your trading strengths and weaknesses and offered constructive suggestions to enhance our strategy.

The real game-changer for us? The guaranteed stop loss order. By setting a floor for our position, we could trade with greater peace of mind, confident that the platform would automatically exit us from the trade if the market dipped below our pre-set tolerance level.

Our Verdict on OANDA

Best-in-class risk management tools, comprehensive educational resources and an accessible trading environment make OANDA our top choice for beginner traders.

4. IG Group - Largest Forex Broker in Europe

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

With over 10,000 markets to trade, IG Group stands out as Europe’s largest broker in terms of product offerings. From Forex to options, commodities, stocks and more, we found IG to be an exceptional choice for traders looking for a wide range of financial instruments to trade.

Safety is also a priority, evidenced by the multiple licenses IG holds from top-tier financial regulators. While some high-volume traders might be cautious of the trading costs, with the extensive range of products offered by IG, the benefits may outweigh the costs.

Pros & Cons

- Has 10,000+ markets to trade

- User-friendly IG trading platform

- Many deposit options, including PayPal

- Provides top market analysis with IGTV

- High minimum deposit compared to other brokers

- MetaTrader 4 has limited access to some of IG’s trading products

- No social trading tools

Broker Details

IG Accounts and Spreads

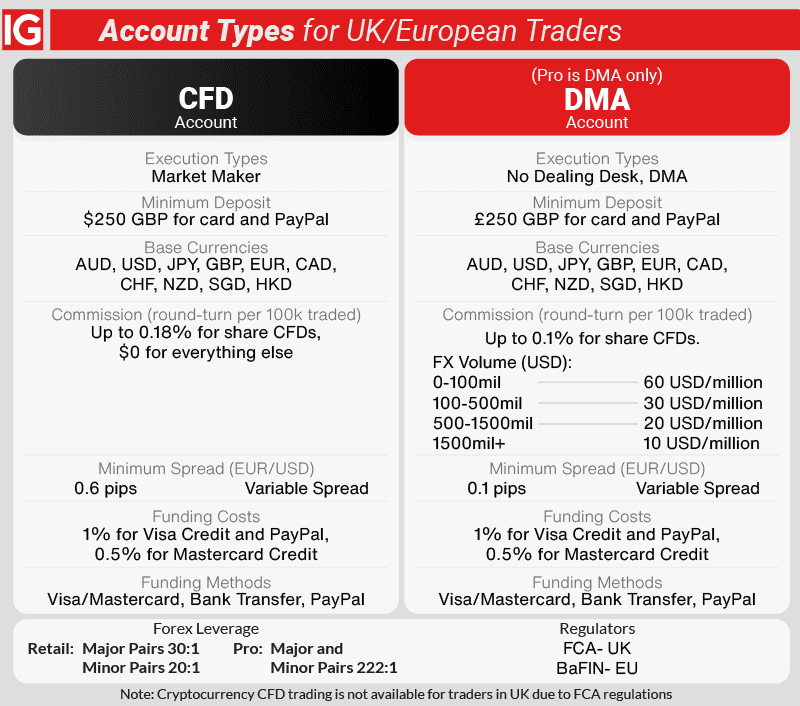

Much as we appreciate what IG offers, we’re the first to admit that the account structure isn’t exactly intuitive.

IG’s CFD Account

The CFD account has most of the characteristics of a Standard account – the broker acts as a market maker to guarantee order fills and charges only the spread.

When using the IG Group standard account, you will find the brokers spread are competitive. The broker has the following average spreads

EUR/USD – 1.13 pips

USD/JPY – 1.12 pips

GBP/USD – 1.66 pips

AUD/USD -1.01 pips

EUR/GBP – 1.71 pips

IG’s DMA Account

If you have years of experience as a trader, and trade in high volumes, you’re the client IG had in mind when it devised the DMA account.

Average spreads with the DMA account are:

EUR/USD – 0.16 pips

USD/JPY – 0.24 pips

GBP/USD – 0.59 pips

AUD/USD – 0.29 pips

EUR/GBP – 0.54 pips

A position of 45 million lots will set you back USD 60.00 per million. Change that to 4500 million lots, and you’ll pay just USD 10.00 per million. IG explains that the commission structure helps ensure that all traders using the account type pay their fair share of the depth of market access it affords them.

Either way, you’ll need money in your wallet before trading with IG. The broker requires a minimum deposit of GBP 250.00 and assesses a processing fee of 1.0% and 0.5% for deposits made by bank card, credit card or PayPal but Skill is not available.

IG Range of Markets

IG has one of the largest range of markets of any brokers we have come across. In addition to a larger range of Forex pairs, shares, indices and commodities that most CFD brokers offer, they also have bonds, interest rates, futures and even 13,000 options, it’s an endless buffet of CFDs.

Our Verdict on IG

IG is regulated by FINMA in Switzerland, the broker has high trading costs and a complicated account structure shouldn’t deter you if you’re after a varied trading experience with access to multiple markets. IG’s reputation as a reliable and responsive broker is also well-deserved.

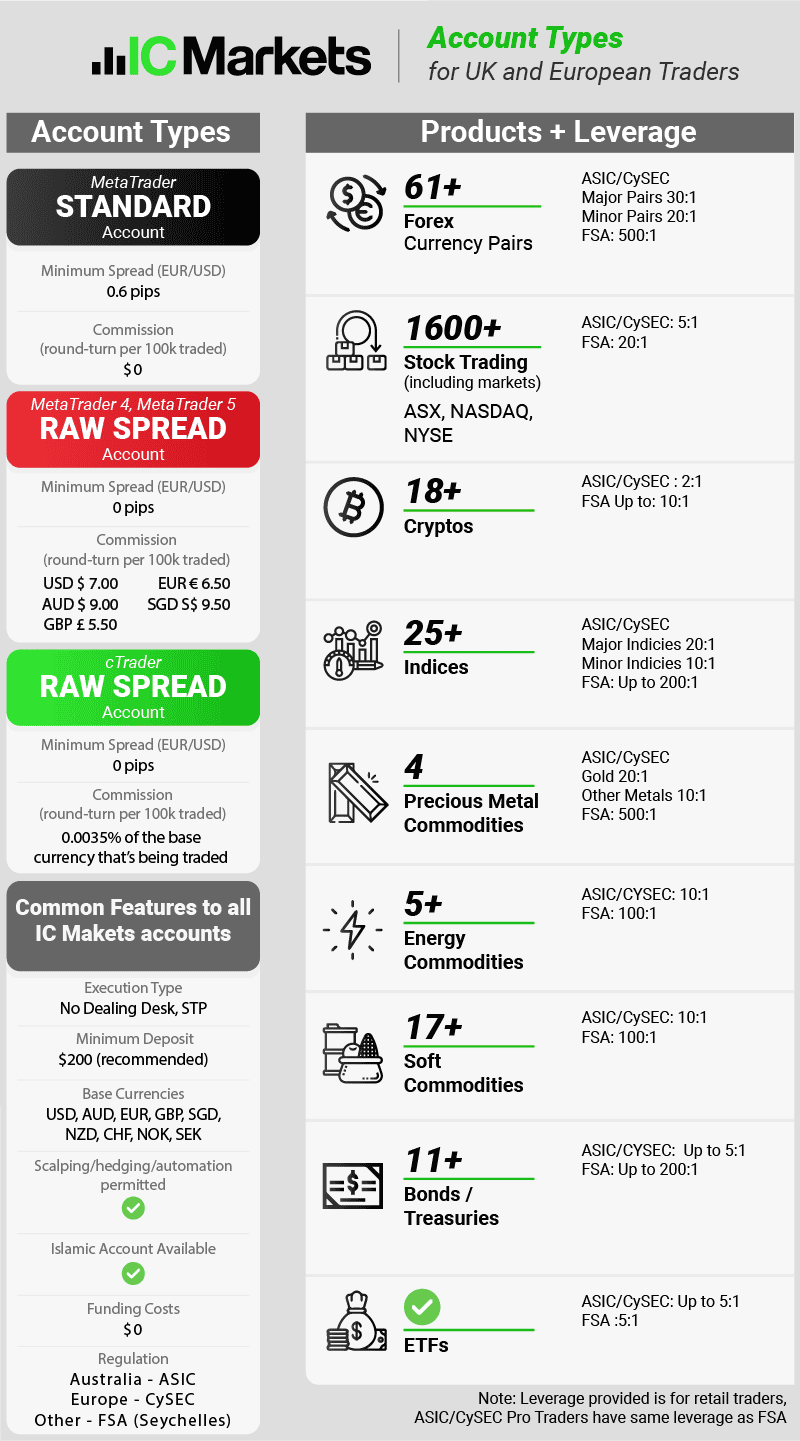

5. IC Markets - Top Commission-Free Trading Account

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We found IC Markets to have consistently low spreads, along with zero commissions on the standard accounts, making them a great low-cost brokerage option. The large list of trading products offered, and competitive spreads make IC Markets a standout choice for cost-conscious European traders.

Pros & Cons

- Has low trading spreads from 0.6 pips

- Good catalogue of trading products

- Offers MetaTrader and cTrader platforms

- Good funding options like Skrill, Neteller, Klarna

- Live chat response can be slow

- Limited education materials available

Broker Details

IC Markets Accounts and Spreads

If you trade with IC Markets, you’ll choose between a Standard and a Raw Spread account. The Standard account uses spread-only pricing, which we recommend for beginner traders. The Raw Spread charges a commission on top of the spread, which makes calculating your trading costs a bit more complicated. We recommend this account type for more experienced traders.

We believe IC Markets’ standard account option deserves your attention if you’re on the fence about this broker. Like most standard accounts, this account type uses spread-only pricing, which means the broker includes its commission in the minimum spread. Unlike other brokers, IC consistently posts an average in line with its posted minimum. In our tests on Standard Account Spreads, IC snagged the top spot for the tightest spreads with an average of 1.03 pips (less than USD 10 per trade).

The dynamics change a bit with IC Markets’ Raw account. Here, commission isn’t included in the spreads; the broker charges a minimum spread plus a fee to open and close your position. You benefit from tighter spreads but may have more difficulty calculating your costs. The Raw Spread account at IC Markets truly shines if you’re seeking ultra-low spreads. Our tests posted results as low as 0.10 pips on major pairs like Euro vs. US Dollar (EUR/USD).

Regardless of your choice, leverage is at your disposal. It’s akin to supercharging your trades, but here’s the caveat: While it can enhance potential profits, caution is essential. High leverage entails high risk. Don’t be so swayed by the prospect of substantial gains that you fail to appreciate the downside possibilities. Exercise risk management and develop a solid grasp of the intricacies of your preferred markets before diving into high-leverage trading scenarios.

IC Markets Range of Markets

For forex enthusiasts, we maintain that you can’t go wrong with the tried and true MetaTrader 4. Explicitly designed for forex trading, it remains among the best-suited trading platforms for the currency markets while supporting CFDs across various asset classes.

That said, if you want to broaden your trading horizons and delve into various asset classes, MetaTrader 5 (MT5) is the better platform for your needs. MT5 is a multi-asset platform that extends its reach across a wider spectrum of financial instruments, including shares and other assets traded on centralised exchanges.

With this platform, you can access 60 currency pairs, more than 17 indices, upwards of 19 commodities, and an impressive collection of 120+ stocks and ETFs (exclusive to MT5). Moreover, 6 bonds, 4 futures, and a tantalising array of 10 cryptocurrencies add to the platform’s appeal.

Our Verdict on IC Markets

Impressively tight spreads and one of the world’s largest selections of trading products make IC Markets a great choice. But the online broker’s size and reach also come with drawbacks. Customer service sometimes takes longer than we’d like to come back with a response, and we found some of the platform features less than intuitive.

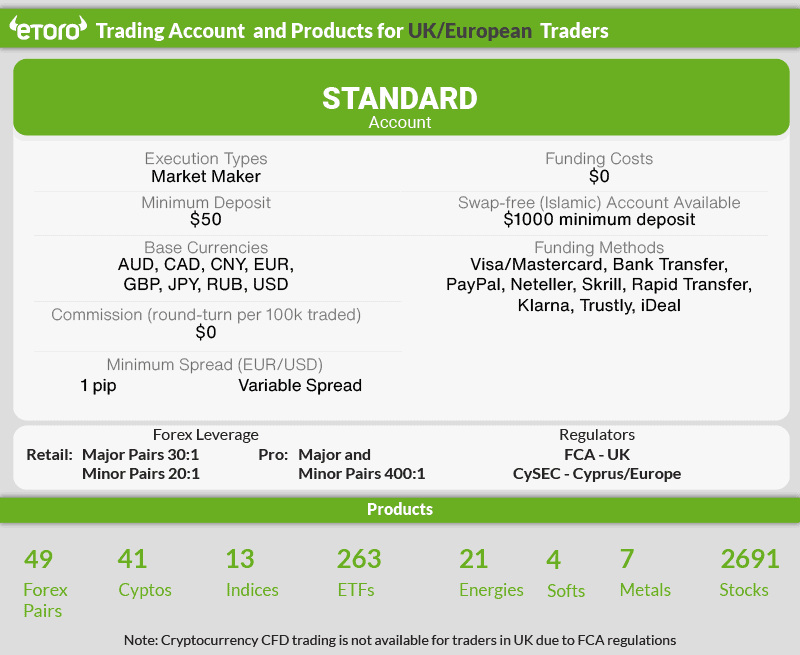

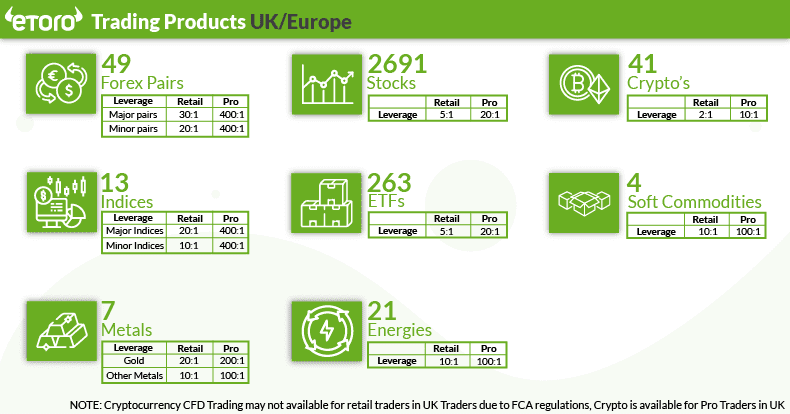

6. eToro - Good Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1 GBP/USD = 2 AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We found eToro to be a top forex broker when it comes to social and copy trading, which allows traders a community experience and trade copying. With an offering of over 2000 trading products ranging from forex and cryptocurrencies to commodities, traders are spoilt for choice. All of this is conveniently accessible directly from their social trading platform, where you can copy or be copied by other traders.

Pros & Cons

- A simple platform that makes copy trading easy

- Have a choice of 30M+ traders to copy trade from

- Has a good selection of forex pairs to trade

- Higher trading costs compared to other brokers

- Does not offer ECN/STP services

- You can only trade using eToro’s platform

Broker Details

eToro’s Trading Account

If you like options regarding trading accounts, there might be better fits than eToro. This broker sticks to the basics with a single, no-frills Standard account and a variable minimum spread starting at 1.0 pips.

eToro Social Trading and Copy Trading Platforms

Engaging in social trading on eToro has allowed us to leverage the collective wisdom of a vast community comprising 10 million users across 140 countries. With the right combination of trading bots, you can bypass conducting your own technical or fundamental analysis – or even executing trades independently – while still enjoying the mental exercise of day trading.

eToro has clearly invested in fostering a sense of community with a user interface that reminds us more of Meta’s Facebook than any product by MetaQuotes. The platform features an ever-refreshing wall-style feed that encourages conversations around trading philosophies, allowing us to garner valuable insights and trading strategies from the community. Furthermore, eToro’s automation features let us mirror the trades of other participants in real-time. The standout feature of the eToro trading platform lies in its copy trading functionality. The broker offers two proprietary tools designed to enhance your copy trading experience: CopyTrader™ and CopyPortfolios™.

eToro’s CopyTrader™

With CopyTrader™, you can follow expert traders, monitor their positions and replicate their strategies via automation. This feature includes filtering options that let you discover traders aligned with your specific trading requirements, such as risk score, assets, performance metrics or annual profit.

CopyPortfolios™

While CopyTrader™ allows you to copy a single professional, CopyPortfolios™ expands the field to a pool of similar traders focused on the same asset class. eToro uses proprietary algorithms to create these pools, regularly screening members for their performance and rebalancing. These ‘pools’ or indices of traders can also comprise a single CFD or a collection of products tied to the same market or industry. For example:

- Quarterly Gainers – this index is rebalanced each quarter with 50 of the platform’s best traders for the quarter

- Active Traders – this index is formed using frequent traders with a consistently positive track record.

- Trending Traders – for conservative traders, this draws on ten traders with an eToro risk rating of 7 or below.

- CopyPlus R4 – this index uses social trading to compile low-risk traders that get the most followers or copiers in the past month

- Market CopyPortfolios™ – an index focused on securities in sectors such as banks, big tech, gaming, gold, energy

eToro Range of Markets

eToro offers an extensive array of markets and financial instruments to trade, each with varying degrees of leverage. It’s particularly well known for its crypto offering: 41 tokens, the most of any top-tier broker.

Some of the most popular instruments to trade include:

- Over 40 forex CFD pairs

- Spreads start from 1 pip for EUR/USD and 1.5 pips for EUR/GBP

- Stocks have the option of being traded as a CFD (spreads starting from 0.09%) or actually owning the asset outright with no spread or commission charges

- Cryptocurrencies have the same option of purchasing either the outright asset or purchasing a CFD of the asset, both with spreads starting from 0.75% on BTC

- Access to over 30 commodity CFDs

- Spreads start from 2 pips for Copper, and 45 pips for Gold

- Binary options CySEC Leverage RegulationsMajor Forex pairsMinor forex pairs + Gold

Our Verdict on eToro

Putting its stellar social and copy trading features to one side, we must point out that eToro’s limited range of account types and somewhat restricted set of technical analysis tools may hinder its usefulness for traders focusing solely on fundamental or technical analysis. For those who are hobby traders or have a keen interest in cryptocurrencies, we recommend eToro.

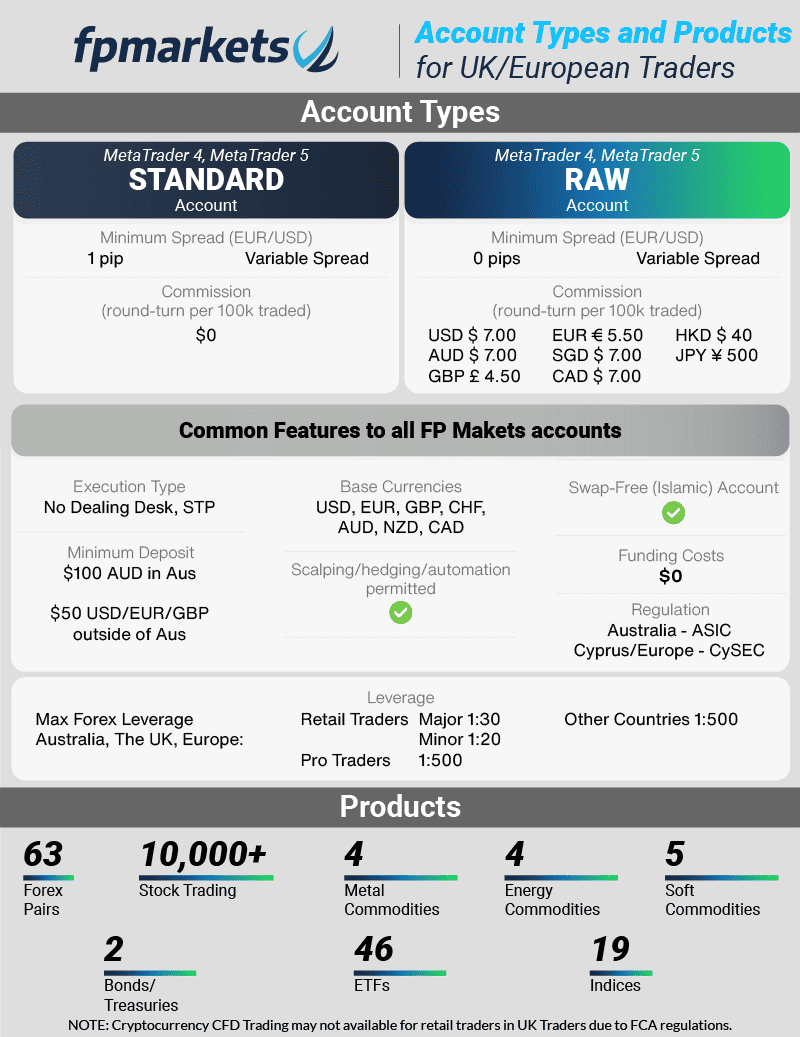

7. FP Markets - Great CFD Product Range

Forex Panel Score

Average Spread

EUR/USD = 0.08 GBP/USD = 0.39 AUD/USD = 0.35

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We highly regard FP Markets as a great CFD Broker for European traders, based on our long history of reviewing the firm. One of the key strengths is their low spreads, which can be significant in keeping the costs of active trading down and trading platform options which include MT4, MT5, cTrader and TradingView.

FP Markets also impress us with their speedy market order execution which minimises slippage and enhances the likelihood of securing the best possible prices in trades. This is important when trading Forex due to the high liquidity in the market which means prices are changing rapidly.

Pros & Cons

- Low trading costs with the RAW account

- Excellent trading platforms for CFDs

- Offers a good selection of technical analysis tools

- Limited selection of forex pairs compared to other brokers

- IRESS account and platform not available in Europe

Broker Details

FP Markets Accounts and Spreads

With FP Markets, you’ll choose between a spread-only Standard and a commission-based RAW account. The two account types share multiple features. However, you’ll need to think about the amount of time you have available to manage your trading costs and your risk tolerance. Commission plus spread can get expensive in the trial-and-error phase of developing a trading strategy.

FP Markets Standard Account

With the FP Markets Standard account, you won’t have to worry about commission costs when you trade – just the minimum spread of 1.0 pips. This no-commission account is a solid pick, especially if you’re new to trading and want to keep your trading costs reasonably consistent.

FP Markets Zero Account

If you opt for the RAW account, you’ll have access to FP Markets’ tightest spreads – 0.0 pips as a minimum – though you’ll also pay a commission of USD 6.00 to execute a trade. This account is tailor-made for day traders who are into techniques like scalping and prefer shorter time frames for trading. As noted above, FP Markets clocked in some of the fastest market order execution speeds in our tests. Limit order execution speeds weren’t quite as impressive, but we do note that we used a demo account.

FP Markets Range of Markets

Some of the markets available for trade include:

- 80+ share CFDs from around the world, including Adidas, Volkswagen, and Amazon, with leverage options up to 5:1

- 60+ Forex pairs that trade 24/5

- Gold, Silver, Oil, and Gas with leverage of up to 20:1

- 14 different indices, including the volatility index, Euro 50, and even the US dollar, with an average spread of 0.09 pips

- Trade the 3 most popular cryptocurrencies: Bitcoin, Ethereum, and Litecoin

Our Verdict on FP Markets

If you want to minimise slippage and prefer a balanced portfolio with a range of assets, we think you’ll appreciate what FP Markets offers.

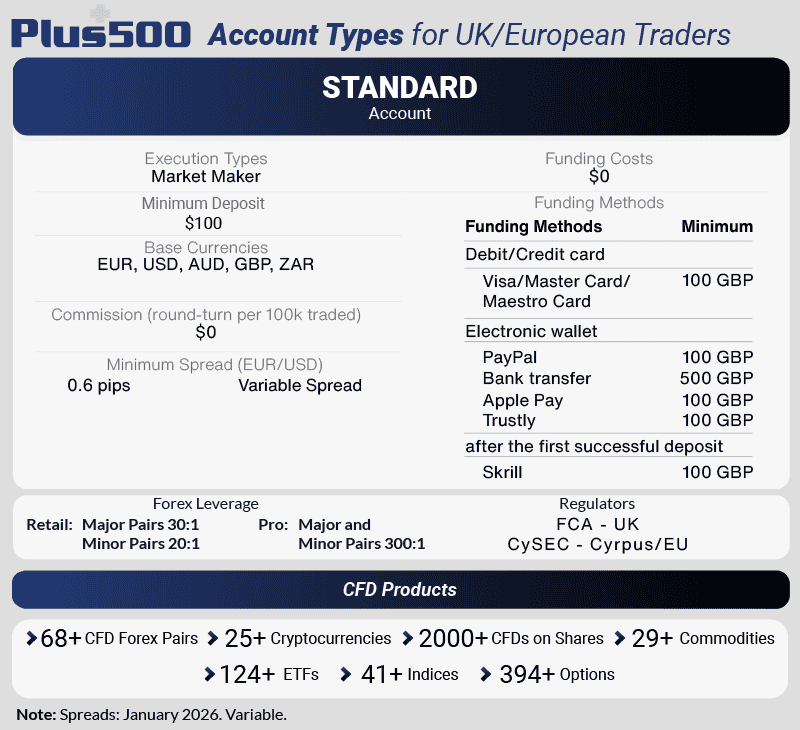

8. Plus500 - Good Range of Technical Analysis and Charting Tools

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

Plus500’s meticulously designed interface and platform are a joy for traders when it comes to technical analysis and charting. Built in response to customer feedback, it’s one of the most user-friendly and visually appealing platforms we’ve encountered. The layout and tools are intuitively arranged, making technical analysis and charting a breeze.

As a CFD provider, Plus500 offers an extensive range of markets, including forex pairs, indices, and cryptocurrencies, all traded via CFDs.

Pros & Cons

- Provides trader sentiment with +Insights tools

- Tight spreads

- Has 100+ technical indicators

- Large range of cryptos and indices

- Lacks MetaTrader and TradingView platforms

- No automated trading tools

- Lack of additional market research tools

- No social trading

Broker Details

Plus500 Accounts, Spreads and Range of Markets

Plus500 follows the KISS system when it comes to trading accounts. The broker offers a single Standard account with a variable spread of 1.7 pips. The broker doesn’t charge additional fees for withdrawals or deposits, but you will need to make a GBP 100 minimum deposit to begin trading.

On a more positive note, Plus500 boasts an extensive range of markets, featuring a whopping 2000+ CFD instruments available for trading across various markets.

Our Verdict on Plus500

With a sleek, intuitive trading platform, an impressive variety of tradable products and a low minimum spread, we recommend Plus500 if you’re searching for a good all-around broker with an easy-to-navigate trading environment.

*Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money.’

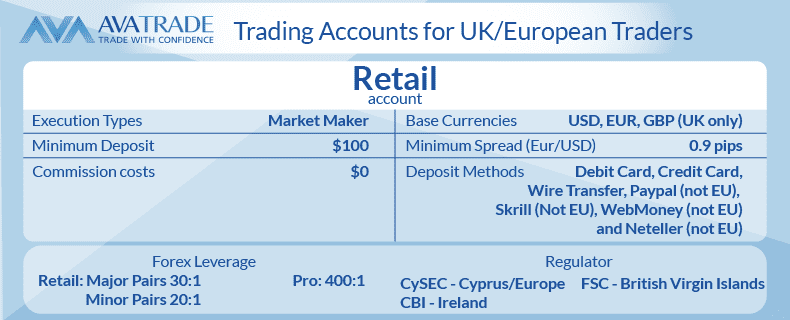

9. AvaTrade - Best Broker for Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade stands out as a top-tier market maker, offering commission-free trading with narrow spreads, making it a fantastic choice for day traders.

The broker impresses with its extensive range of 55 Forex pairs, 26 commodities, 23 indices, and bonds. With regulation in Europe, the UK, Australia, UAE, South Africa, and a range of account types, AvaTrade ensures a secure and tailored trading environment. The broker’s commitment to customer protection, robust educational resources, and risk management tools like the AvaProtect found on the AvaTradeGo mobile app.

One unique feature is that have over 40 Forex pairs plus gold and silver that you can buy using Options. The broker even has a mobile app just for options trading called AvaOptions. This trading app is available on iOS and Android.

Pros & Cons

- A diverse range of trading instruments

- Tight spreads

- AvaProtect

- Good for options trading

- Limited account types

- Customer service lacks trading knowledge

- Inactivity fees on dormant accounts

Broker Details

For traders in the UK and Europe, AvaTrade offers a simple account known as the “Retail Account.”

Traders benefit from commission-free trading, with costs embedded in the spreads. The leverage for major forex pairs is up to 1:30, maintaining alignment with regulatory standards.

The account requires a minimum deposit of 100 base units (approximately USD 100). This account is suitable for retail traders looking for a straightforward trading experience with fixed spreads, enabling them to participate in the global financial markets efficiently.

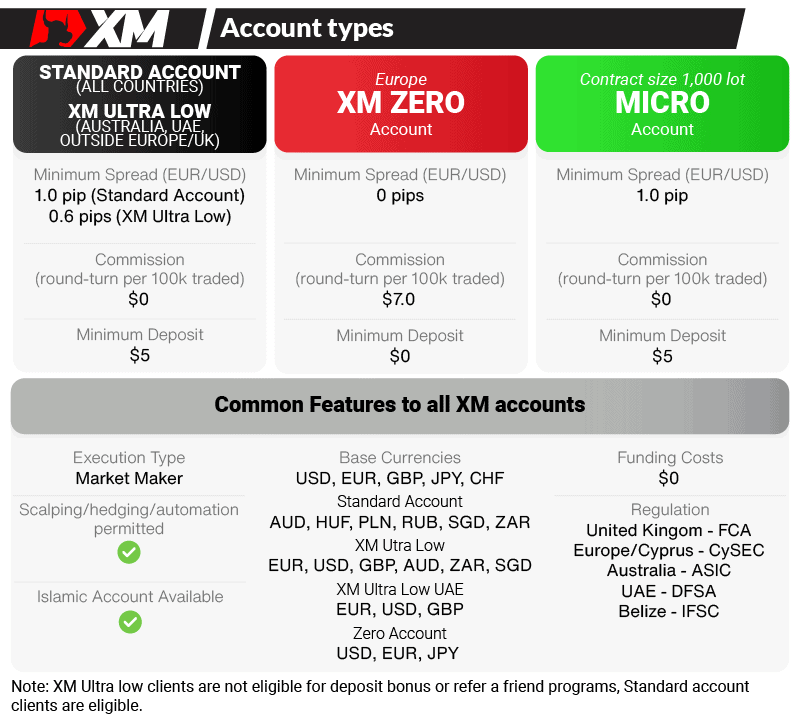

10. XM - Broker With Top Customer Service

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

We found XM to stand out as an exceptional broker due to its diverse account offerings, including commission-free options and low minimum deposits. What sets them apart is their unwavering commitment to traders, particularly evident in their stellar customer service.

With multilingual support, 24/5 availability, and a dedicated account manager for each client, XM ensures that traders, from beginners to seasoned professionals, receive unparalleled assistance, making them a top choice in the competitive forex market.

Pros & Cons

- Many account types to choose from

- Fantastic customer service

- Extensive product range

- Withdrawal fees can be high

- Inactivity fees for dormant accounts

- Customer support is not available during the weekend

Broker Details

With XM, traders benefit from a choice of four account types, including Micro, Standard, Ultra-Low, and Zero accounts, tailored to suit various trading preferences.

The broker offers the ultra-popular MetaTrader 4 and MetaTrader 5 platforms, providing access to over 1,250 CFD instruments across forex, stocks, commodities, indices, precious metals, and energies.

After carefully reviewing different aspects of top-regulated Forex brokers in Europe, our team of industry experts concluded that Pepperstone is the best bang for your buck. Pepperstone offers you extensive resources, advanced charting tools combined with low spreads starting from 0.0 pips, ECN pricing, 3 powerful trading platforms, fast order speeds and +180 CFD instruments that can help you grow your account quicker.

After carefully reviewing different aspects of top-regulated Forex brokers in Europe, our team of industry experts concluded that Pepperstone is the best bang for your buck. Pepperstone offers you extensive resources, advanced charting tools combined with low spreads starting from 0.0 pips, ECN pricing, 3 powerful trading platforms, fast order speeds and +180 CFD instruments that can help you grow your account quicker.

Ask an Expert

What is ESMA?

ESMA is short for the European Securities and Markets Authority. As one of 3 financial supervisory bodies in the European Union, ESMA is responsible for protecting investors and traders when dealing with brokers offering financial services. ESMA sets the guidelines all brokers in the EU must follow and task financial regulators in each country that is a member of the European Union with enforcing these guidelines.

Can I use these brokers if my country is in Europe but not a part of the EU?

Yes of course However what regulation you receive will depend on the broker. As an example, IF you are using Pepperstone, you will join Pepperstone Limited which is the brokers UK subsidiary which has FCA regulation. Example countries include San Marino, Switzerland, Albania, Andorra, Faroe Islands

Gibraltar, Guernsey, Isle of Man, Jersey, Kosovo, Moldova, Monaco, Montenegro, North Macedonia. There are exceptions however clients from Ukraine will sign Pepperstone Markets Kenya Limited who are regulated with CMA (Capital Markets Authority)

Which broker would you recommend me to start with , I’m attending to forex clases for about 4 months and I would love to start with a small account for 300euros, by the way I live in Berlin thank you 🤗

As someone based in Germany, make sure any broker you choose is using a financial regulator from a country in the EU. The regulator for Germany is Bundesanstalt für Finanzdienstleistungsaufsicht (Bafin) so we suggest this be your starting point. We have covered some of these brokers on this page: Best forex brokers in Germany As a new trader, we recommend starting with a demo account, this means you can practice trading with virtual currency before using your own.

What country has the most forex traders in Europe?

I would think the UK surely…Poland apparently has a lot of traders

I live in Nigeria, but i want use forexbroker in western Europe. Is anything bad in it ? . Which forexbroker is the best for a beginner in western Europe?

Why do you wish to use a Forex Broker in Western Europe?

I’ve been learning forex for a bit and thinking about opening my first account soon. What should I be looking for in a broker for someone in France starting with a small amount?

Congrats on thinking about the next step. The first priority is to ensure the broker is regulated, which is usually through CySEC in France.

Next, it’s about having the best trading conditions. You want to choose a broker that offers low spreads with no commissions like Eightcap. Check the spreads on the asset you want to trade, but as a rule of thumb anything 1 pip or less on EUR/USD is decent. The third feature to look for is the broker’s execution speeds. This will get you better pricing, tighter spreads, and less likely to suffer slippage. Lastly, making sure the broker has the trading platform you like to use. Most brokers let French traders fund their starting account with €100 or less.

Which brokers are well-regulated by trusted European authorities such as the FCA, BaFin, or CySEC?

You mean for traders in Europe? Pepperstone, AvaTrade, Admirals, FP Markets, Eightcap, CMC Markets are all good choices.

Because of regulatory rules in the EU, requirements are going to be in place as providing signal counts as investment advice or portfolio management.

As a beginner, how exactly does FINMA regulation protect my funds, and why should I care about choosing a FINMA-regulated broker over others?

FINMA is only for trader in Switzerland, this is because Switzerland is no part of the EU so there is no passporting of FINMA licence to other EU countries. That said like all most good regulators, FINMA regulated brokers can help traders based in Switzerland if there is a dispute with the broker and they ensure you funds are segregated and have leverage caps. In short, they make sure the broker acts in a responsible and profession way.