8 Best Zero Pip Forex Brokers [Updated For 2025]

Zero-pip spreads are the lowest spreads a forex broker can offer to you. They are exclusive to ECN brokers, as this type of broker will not add a markup to the spreads supplied by liquidity providers. I’ve tested the best zero-pip spread forex brokers, and posted my findings below.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

These are the best brokers with zero pip spreads in 2025:

- Pepperstone - The Best Broker With Zero Spreads

- IC Markets - Zero Spreads with MT4

- Eightcap - The Zero Pip Account With The Most Cryptocurrencies

- FP Markets - The Best Zero Spread Account For Scalping

- Fusion Markets - Zero Pip Spreads And Low Commissions

- CMC Markets - The Best Zero Spread Account For Forex Trading

- Exness - Zero Spread Account With High Leverage

- GO Markets - Top Zero Spread Broker With Low Commissions

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

88 |

FCA, CySEC, CMA FSC, FSCA, FSA |

0.63 | 0.74 | 0.62 | $3.50 | 0.9 | 1.1 | 0.9 |

|

|

|

92ms | $200 | 96 | 34 | Unlimited | Unlimited |

|

Read review ›

Read review ›

|

76 |

ASIC, CYSEC FSC, FSA, SCA |

0.2 | 0.5 | 0.2 | $2.50 | 1.0 | 1.3 | 1 |

|

|

|

144ms | $200 | 47 | 14 | 30:1 | 500:1 |

|

What Are The Top Forex Brokers With Zero Pip Spreads?

I’ve tested 30+ ECN forex brokers, and shortlisted the top 8 brokers that delivered zero pip spreads 100% of the time on major forex pairs. To select the very best, I only chose brokers with fast execution speeds, good customer service, and a wide range of platforms and trading tools.

1. Pepperstone - Best Broker With Zero Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

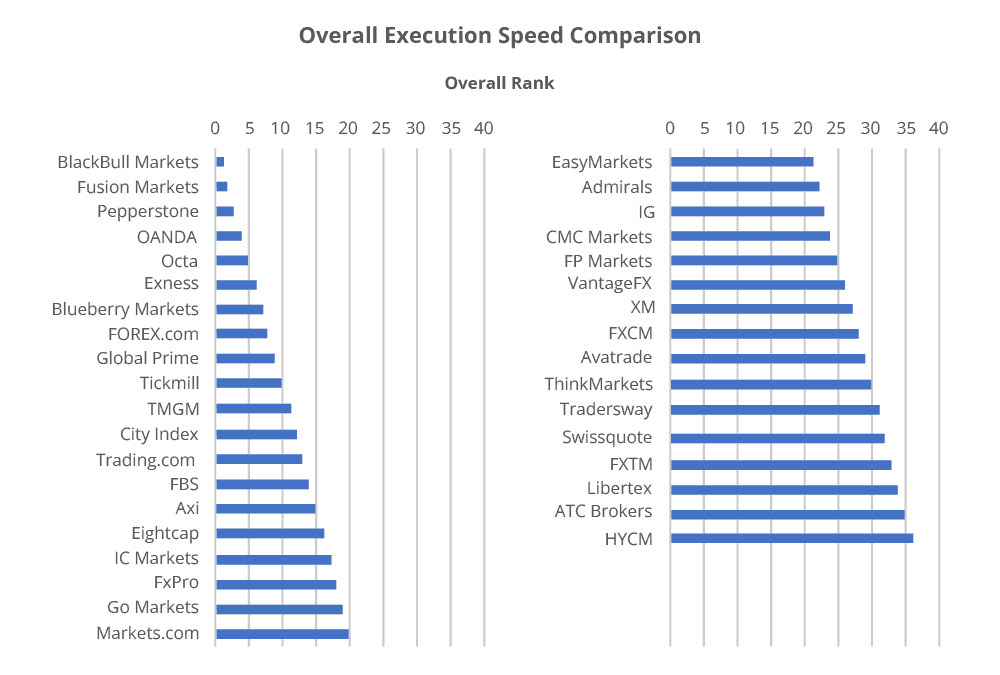

I rated Pepperstone 98/100 in my forex broker tests. Its Razor account’s 100% zero pip spreads across all major pairs contributed to its overall score. Pepperstone also produced top execution speeds in my analysts’ tests, coming 3rd overall. This translates to excellent trading conditions and limiting slippage.

Pepperstone has the best variety of trading platforms, including TradingView, MT4, MetaTrader 5, and cTrader. You can trade 1,200+ markets, including 93 forex pairs, with the broker.

Pros & Cons

- Zero spreads on EUR/USD

- Offers MT4, MT5, cTrader, and TradingView

- Good selection of markets

- Demo account expires

- Lacks guaranteed stop-loss orders

- Crypto markets are limited

Broker Details

Zero-pip Spreads On Razor Account

Pepperstone’s Razor account is the best for zero pip spreads based on my tests. CompareForexBrokers analyst, Ross Collins, tested 15 brokers to see if you can actually get these spreads during typical market conditions.

In Ross’ tests, Pepperstone did provide EUR/USD at 0 pips during the trading day. While the spreads do fluctuate, they remained tight across the entire day, with EUR/USD testing at 0.19 pips on average.

As well as this, the other major pairs remained tight too. This means you’ll get the best spreads on the Razor account whenever you trade, helping reduce your trading costs.

| Tested Raw Average Spreads By Ross Collins | AUD/USD Average Spread | EUR/USD Average Spread | GBP/USD Average Spread | USD/CAD Average spread | USD/CHF Average Spread | USD/JPY Average Spread |

|---|---|---|---|---|---|---|

| Pepperstone | 0.19 | 0.19 | 0.41 | 0.61 | 0.39 | 0.36 |

With the Razor account, you’ll have to pay a commission of $3.50 per lot traded on forex pairs. This is the average commission I’ve found for Raw pricing accounts.

Fast Limit Order Speeds

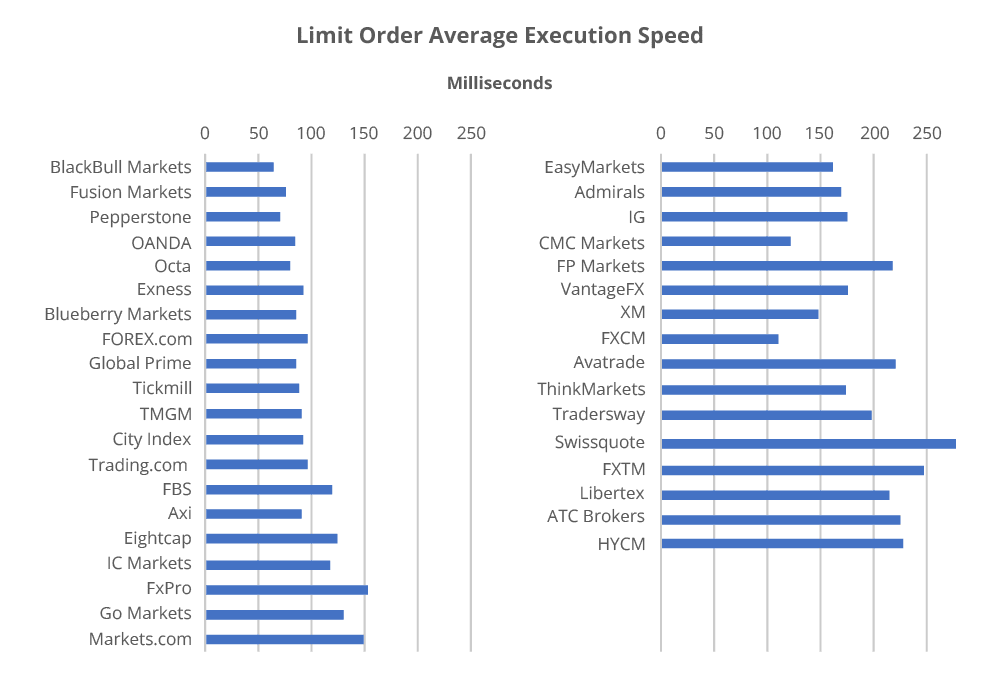

Ross also found that Pepperstone had some of the fastest execution speeds, recording an average limit order speed of 77ms. The limit order speed impacts your stop-loss and take-profits – the faster the speed, the better.

I find anything less than 100ms lowers the chances of slippage.

Wide Range of Advanced Trading Platforms

One feature I like about Pepperstone is that they offer a large selection of trading platforms, including top platforms like TradingView, MT4, MetaTrader 5, and cTrader.

I prefer it when brokers give you a choice, and with Pepperstone, you can use your favourite trading platform while enjoying zero pip spreads. My recommendation is TradingView, as you’ll have access to 110+ technical indicators and 50+ drawing tools. I find its one-click trading features pair really well with Pepperstone’s fast execution speeds.

2. IC Markets - Zero Spreads with MT4

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

I chose IC Markets as my top broker for MetaTrader 4, as they give you Advanced Trading Tools to improve the platform’s features. The package also provides upgraded indicators like pivot points and high-low indicators, which are great for intraday trading.

From my tests, IC Markets Raw account provided zero pip spreads 100% of the time on the major pairs. The broker also has 2250+ markets to trade, and solid customer support with live chat that operates 24/7.

Pros & Cons

- Excellent trading tools for MT4

- Offers multiple trading platforms

- Large choice of markets

- Requires a minimum deposit

- Different commissions for cTrader and MT4

- Slow live chat support

Broker Details

Excellent MetaTrader 4 Tools

While using the IC Markets’ Raw account, I found the trading conditions and tools made the broker a solid choice for pairing with the MetaTrader 4 platform.

MetaTrader 4 comes with 30+ technical indicators out of the box, but I found that IC Markets augments this. They provide 15 more indicators through their MT4 Advanced Trading Tools suite.

These indicators include automated pivot points, which are good for intraday breakout trading. There are also high-low indicators, that I think are particularly good for scalpers.

On top of all of this, I found eight additional Expert Advisors (EAs), which help with trade management. For example, I like the Mini Terminal EA – it offers one-click trading but also appends your stop-loss and take-profit orders at execution. This means you don’t have to add them manually afterward, and there’s no risk of forgetting them.

Zero Pip Spreads On Raw Account

With these advanced tools on MT4, you can get the most from the low spreads on the Raw account. In our tests, IC Markets achieved 100% zero pip spreads throughout the day, on 5 out of 6 majors tested – similar to Fusion Markets. Only the USD/CHF let the broker down among the pairs I looked at.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

In my opinion, I’m not too worried about outliers like USD/CHF. I still recommend considering an account with IC Markets, as I was able to build a strong strategy with just EUR/USD, AUD/USD, and USD/JPY.

3. Eightcap - Zero Pip Account With Most Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.23

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Eightcap is one of my highest-rated brokers, scoring 96/100 in my broker review. This was thanks to the zero-pip spreads on the Raw account, and the wide choice of forex and crypto markets. For me, Eightcap provides a solid trading environment if you want to trade crypto, as it has low spreads and 95+ crypto CFDs. This is the largest selection I’ve tested.

I like that you can trade using either TradingView, MT5, or MetaTrader 4 for technical analysis. Or you can try Capitalise.ai to automate your trades without learning how to code.

Pros & Cons

- The widest selection of cryptocurrencies on this list

- Offers automated trading tools

- Supports the TradingView platform

- Can’t access all the broker’s markets on the MT4 platform

- Lacks copy trading tools

- Has a minimum deposit

Broker Details

100% 0-Pips On Eightcap

In our tests, Eightcap’s Raw account produced 100% zero pip spreads on the majority of the pairs tested. Only USD/CHF let the broker down, so it missed out on a perfect result. I wouldn’t read too much into the USD/CHF spread. It’s much more important that popular pairs like EUR/USD achieved 100%.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

When Eightcap supplies 0 pip spreads, it earns its money through the $3.50 per lot traded commission. This is about the average for Raw accounts.

The broker does offer a no-commission Standard account – but there are no zero-pip spreads here. Instead, the Standard spreads are much wider, which is how the broker makes money on this sort of account.

Decent Variety Of Markets and 95+ Cryptocurrencies

In our tests, only the forex majors offered zero pip spreads out of the 55 currency pairs available. However, the minors and exotics available still had competitive spreads. If you trade anything outside of forex, like indices, you’ll pay variable spreads with no commissions.

The broker also offers some of the cheapest spreads on its 95+ cryptocurrencies. I found Bitcoin starts at 17 pips, almost ~22% lower than FP Markets, who have an average of 22 pips.

You can trade crypto and forex through TradingView, MetaTrader 4, and MT5 – although if you choose MT4, I found you can only trade 79 cryptocurrencies. This is still a big number in my view, and much better than basically all the others on this list.

4. FP Markets - Zero Spread Account For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

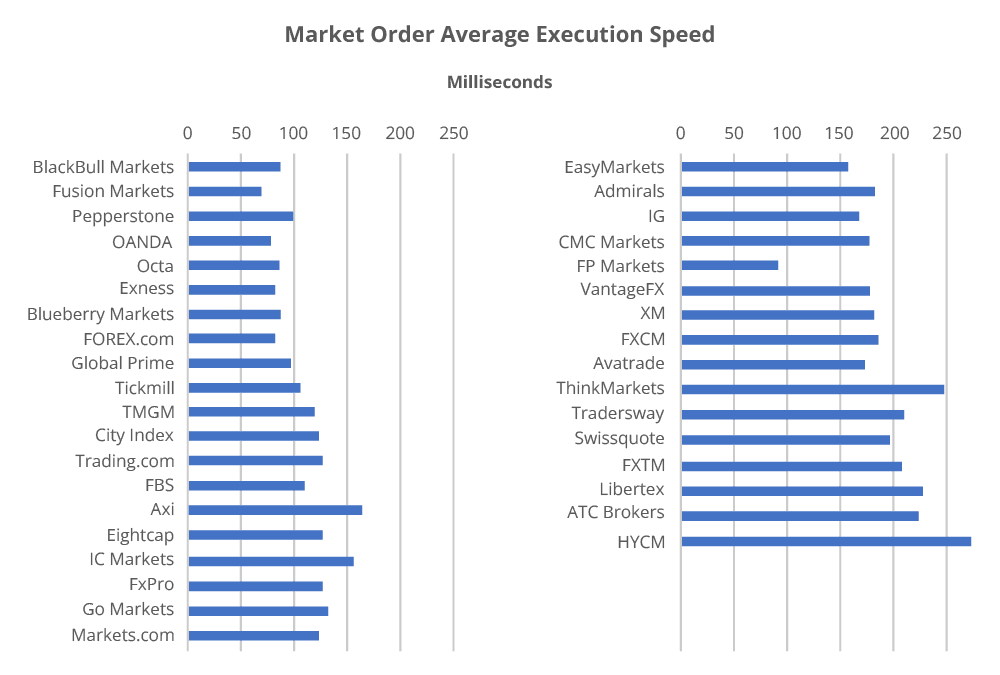

FP Markets is my top pick for scalping liquid markets like forex. The broker offers fast market order execution speed (96ms), which is ideal for one-click trading. You have the option of MT5 or cTrader for scalping. Both offer excellent features like Depth of Markets and volume-based trading indicators.

cTrader might be the better option if you want the lowest costs. With FP Markets’ zero pip spreads and $3.00 per lot commissions, it’s the cheapest of the four platforms.

Pros & Cons

- Offers zero spreads

- Choice of MetaTrader 4, MetaTrader 5, cTrader and TradingView platforms

- Wide choice of trading products

- Requires a minimum deposit

- Most of its share instruments are only offered through the IRESS platform

- Basic mobile trading app

Broker Details

Zero pip Spreads With Fast Market Order Speeds

FP Markets Raw account also delivered 100% zero pips on EUR/USD during typical trading hours in our tests, which is perfect if you scalp this pair.

One of the reasons I picked FP Markets for scalping is that it achieved an average market order speed of 96ms. This is one of the fastest execution speeds to emerge from our tests. With this speed, the broker placed 8th – and it comes in below my near-instant 100ms threshold.

| Broker | Market Order Average Execution Speed (ms) |

|---|---|

| Fusion Markets | 77 |

| OANDA | 84 |

| Exness | 88 |

| FOREX.com | 88 |

| Blackbull Markets | 90 |

| Octa | 91 |

| Blueberry Markets | 94 |

| FP Markets | 96 |

| Global Prime | 98 |

| Pepperstone | 100 |

| Tickmill | 112 |

As you get zero pip spreads on the Raw account, and fast execution speeds, you have a better chance of entering at the price you requested.

This is very important for scalping, where every millisecond counts. And because there’s no spread to cover, you’ll be in a profitable position quicker, if the market moves in your favour.

FP Markets Supports cTrader

I find that FP Markets gives scalpers solid options when it comes to trading platforms, especially with MT5 and cTrader, which I think are the best for scalping.

Both platforms provide one-click trading, saving you time as you don’t have to worry about opening order tickets. With Level 2 pricing, you get real-time insights into the liquidity provider’s order books.

For me, I think cTrader slightly edges MT5 for scalping as its infrastructure supports true tick pricing. This allows for accurate volume-based indicators like VWAP and volume profiles.

Plus, the cTrader Raw account has lower trading commissions – $3.00 vs. MT5’s $3.50 per lot traded. This saves you around 15% in trading costs.

If you’re not sure what forex trading platform to choose, you can use my trading platform tool to discover which is best for your trading needs.

5. Fusion Markets - Zero Pip Spread And Low Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

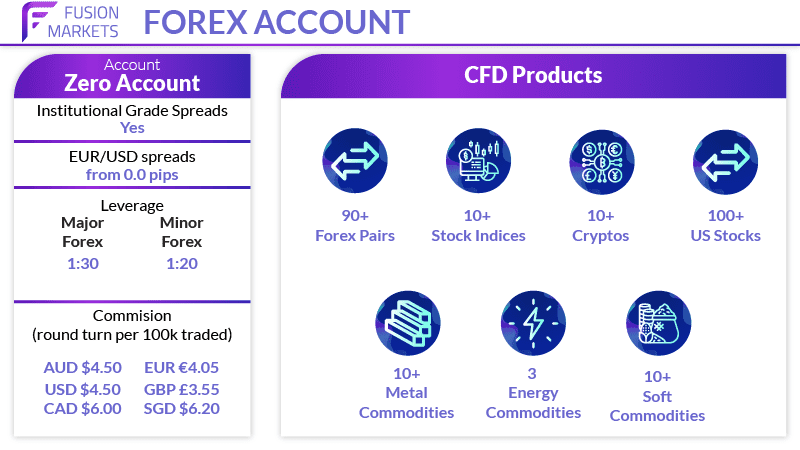

Why We Recommend Fusion Markets

As all brokers on this list offer zero pip spreads, Fusion Markets stands out with a commission that’s $1.25 cheaper than most brokers. This is one of the reasons I awarded the broker 92/100 in my tests. Other reasons include zero pip spreads, excellent trading experience, and fast execution speeds – Fusion placed 2nd overall for execution.

The broker gives you the cheapest trading costs on the TradingView, cTrader, MT4, and MT5 platforms, while also offering copy trading tools like DupliTrade. If you are a high-volume trader, I think choosing Fusion Markets will be a solid broker. You’ll really notice the lower trading costs as they improve your bottom line.

Pros & Cons

- Low commissions

- Fast execution speed with MT4

- Good choice of trading tools

- Only offers US share CFDs

- Inactivity fee

- Educational resources could be better

Broker Details

Zero Account Has Lowest Trading Commissions

From my tests, I found Fusion Markets has the lowest trading commissions in Australia, at just $2.25 per lot traded. This is 30% cheaper than the tested industry average of $3.25. This is a huge saving and will cut your trading costs, especially when paired with the broker’s zero pip spreads.

The lower commissions will benefit every type of trader, but I think you’ll notice the benefits more if you have a high-volume trading style, like scalping or algorithmic trading.

100% Zero Account 0-Pip Spreads

In my analyst’s tests, Fusion Markets almost achieved a perfect 100% score. However, the spreads on USD/CHF let them down. That said, the broker recorded 100% zero-pip spreads across the other 5 majors, including EUR/USD, AUD/USD, and USD/JPY, as you can see in Ross’ findings below.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% | 98.55% |

Although it didn’t quite gain a perfect score, I think most would agree that the popular majors pulled through in the tests. USD/CHF is a niche major, and isn’t included in most people’s strategies.

Second Fastest Execution Speeds Overall

Fusion Markets also performed well in my analyst’s execution speed tests, ending up second fastest out of 36 brokers tested. The test found Fusion Markets’ limit order speed averaged 79ms, which is great for breakout trading. Also, the market order speed averaged 77ms – the fastest we recorded.

Decent Trading Platforms With Copy Trading Tools

I like that Fusion Markets offers a variety of trading platforms that include TradingView, MetaTrader 5, MetaTrader 4, and cTrader – all of these platforms benefit from the faster execution speeds.

If you like copy trading, I found that the broker offers DupliTrade on MT4. This allows you to benefit from Fusion Markets’ low trading costs and leverage market-proven professional traders.

6. CMC Markets - Best Zero Spread Account For Forex Trading

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 0.7

AUD/USD = 1.4

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets’ FX Active account is the ideal trading account for forex trading, based on my testing. You get zero pip spreads across the major pairs and 25% reduced spreads on the broker’s 338 forex pairs – the widest choice available. The account comes with a small commission fee of $2.50, making it one of the cheapest options for forex trading.

I found the broker’s NGEN platform is excellent for forex trading, thanks to its chart pattern recognition tool. The tool automates finding new trades across the broker’s 12,000+ financial instruments.

Pros & Cons

- FX Active account is best for forex trading

- Wide range of 12,000 markets

- NGEN platform has excellent trading tools

- Limited social trading tools

- Lacks customer support via Live Chat

- Most FX pairs are reverse pairs

Broker Details

FX Active Account Has 0-Pip Spreads On Forex Majors

To get zero pip spreads, I had to open an FX Active account, which is focused on providing lower spreads on forex pairs only. While using the account, I found CMC Markets provided stable zero pip spreads on the EUR/USD, AUD/USD, and USD/JPY.

If you want to trade minor pairs or exotics, you’ll benefit from spreads around 25% tighter than the broker’s Standard account. Regardless of the currency pair you trade, you still pay commissions at $2.50 per lot traded, amongst the lowest from my tests.

I personally prefer this set-up of low commission and zero pip spreads that focus on forex pairs only, which is why I like the FX Active account.

The broker gives you 25% discounted spreads across its 338 currency pairs – the largest collection of forex markets I’ve reviewed.

Wide Range of 12,000 CFD Markets

If you want to trade other financial markets, I think CMC Markets is one of the best for multi-asset trading with its wide range of 12,000+ markets. These include 10,000+ share CFDs, 19 cryptocurrencies, 124 commodity markets, and 82 indices.

NGEN Trading Platform Has Advanced Charting Tools

What I found helpful with the FX Active account is the CMC Market Next Generation (NGEN) trading platform for forex trading. The platform has a decent selection of 80+ technical analysis and drawing tools, including Ichimoku and RSI, making it easy to apply your forex trading strategy with the broker.

The best feature of the NGEN platform was the pattern recognition tool, in my opinion. This tool scans the forex markets to find candlestick and chart patterns emerging and alerts you to the opportunity.

7. Exness - Zero Spread Account With High Leverage

Forex Panel Score

Average Spread

EUR/USD = 0.63

GBP/USD = 0.74

AUD/USD = 0.62

Trading Platforms

MT4, MT5, Exness Trade App

Minimum Deposit

$200

Why We Recommend Exness

I rated Exness 88/100 in my testing, as its high leverage of 1:2000 and tight spreads on the Raw and Zero accounts are a unique combination from my tests. The Raw account is your traditional account, while the Zero account has zero pip spreads on 30 of the most traded products, which vary daily.

While the broker has a solid selection of 90+ currency markets, it lacks in other areas. There aren’t as many indices and share CFDs, compared to other brokers I’ve used.

Pros & Cons

- Offers a choice of zero spread accounts

- Highest leverage available (1:2000)

- Decent range of forex pairs

- Zero account has fluctuating commissions

- $200 minimum deposit

- Negative balance protection is case by case

Broker Details

Choice Of Zero-Pip Trading Accounts

Exness offers two zero-spread accounts to choose from. The first is the Raw account, which has $3.50 per lot commissions across its currency markets and zero pip spreads.

The second is the Exness Zero account, which has zero pip spreads on its top 30 financial instruments for 95% of the trading day. This can be any asset, including indices, gold, or forex, but the specific instruments vary based on demand.

With both accounts, I found that they had commissions from $3.50 per lot on forex pairs, but the Zero account can rise up to $4.50 depending on your currency pair.

I find this makes the Raw Spread account the better option if you want to trade a wide range of forex pairs. While the Zero account is best if you want to trade major markets, which are more likely to be in the top 30 trading volume.

Highest Leverage Available

Along with its zero-spread accounts, I like that Exness offers high leverage up to 1:2000 on forex majors, which was the highest available in my tests. Exness offers this as it is regulated by the Seychelles Financial Services Authority (FSA), which is more relaxed on the leverage limits compared to other authorities like ASIC.

| Broker | Leverage |

|---|---|

| Exness | 1:2000 |

| Pepperstone | 1:30 |

| IC Markets | 1:30 |

| Eightcap | 1:30 |

| FP Markets | 1:30 |

| Fusion Markets | 1:30 |

| CMC Markets | 1:30 |

| GO Markets | 1:30 |

The one thing that I felt let down Exness was its market range. It only offers around 200 markets – mainly its 90+ forex and 30+ crypto markets. If you want to trade share CFDs, you are limited to just popular markets like Tesla or Apple, which might not meet your needs.

8. Go Markets - Top Zero Spread Broker With $3 Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.5

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Go Markets Trading App

Minimum Deposit

$200

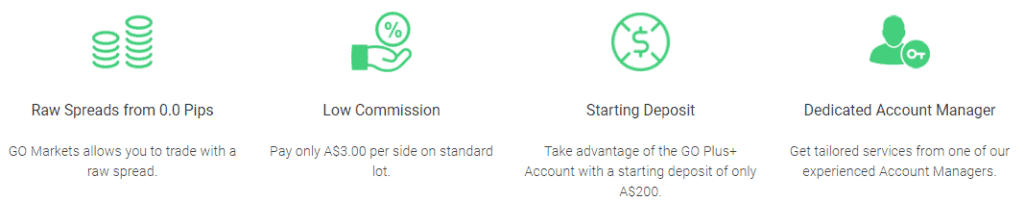

Why We Recommend Go Markets

Go Markets has some of the lowest commissions I’ve seen for a Raw account, at $3.00 per lot. At times when Go Markets didn’t produce zero pip spreads, I still found their Raw spreads to be competitive. These averaged 0.28 pips across the majors, which beats the industry average.

I found the broker supports you with 3 platforms, including MT4, MT5, and cTrader. There are decent trading tools available, like a VPS and a copy trading tool on cTrader. You can trade over 1,250+ markets, covering everything from forex to share CFDs, making Go Markets a solid all-around broker in my opinion.

Pros & Cons

- Wide choice of trading platforms

- Excellent educational tools

- Low commissions with tight forex spreads

- Lacks 24/7 customer support for non-clients

- Minimum deposit required

- Doesn’t offer zero spreads 100% of the time

Broker Details

Low Cost Commissions

You need to factor in commission when selecting your zero pip spread account. And from my testing, Go Markets’ are very good. With a $3.00 per lot commission, the Go+ account is around 8% cheaper than the industry average of $3.25. While this isn’t the largest discount, it will still provide value over time.

The broker offers zero pips on its markets, but in our tests, these were offered only 87.68% of the time.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Go Markets | 82.61% | 91.30% | 86.96% | 91.30% | 82.61% | 91.30% | 87.68% |

Tight Spreads On Go+ Trading Account

Fortunately, the Go+ account has an average spread of 0.28 pips across the most traded currency pairs – much better than the industry average of 0.44 pips. So even if EUR/USD has spreads above 0.0 pips 9% of the time, at least they won’t be too wide.

| Top 5 (EUR/USD. USD/JPY, GBP/USD, AUD/USD, USD/CAD) Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| Tickmill | 0.16 |

| IC Markets | 0.13 |

| Fusion Markets | 0.23 |

| ThinkMarkets | 0.22 |

| FP Markets | 0.35 |

| XM | 0.21 |

| GO Markets | 0.28 |

| Eightcap | 0.20 |

| LQDFX | 0.30 |

| Tested Average | 0.45 |

Decent Trading Platforms With Trading Tools.

Alongside its low commissions and competitive Raw spreads, GO Markets offers one of my favourite platform ranges, including MT4, MT5, cTrader, and its own GO Webtrader.

I found the Genesis upgrade to the MetaTrader platform was a nice bonus when opening the account. This tool provides seven Expert Advisors (EAs) that improve your MetaTrader platform. You can make trade management easier with the Trade Terminal EA, or find divergences with its Correlation Trader EA.

Ask an Expert