Best Forex Demo Account

Opening a demo account with a Forex broker is recommended for new traders or those looking to test trading strategies with automation. I compared the top Forex demo accounts and paired them to different trader requirements.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

My top demo accounts based on the trading platform experience are:

- Pepperstone - Best Forex Demo Account With MetaTrader 4

- IC Markets - Great CFD Demo Account With MetaTrader 5

- BlackBull Markets - Good Demo Choice for Lightning Fast Execution

- Plus500 - Top Demo Account For With Risk Management

- OANDA - Top Demo Account For Unlimited Forex Trading

- Eightcap - Great Account to Test FX and Cryptocurrency Trading

- eToro - Top Demo Account For Social And Copy Trading

- IG Group - Best Range of Trading Products for a Test Account

What is the best forex demo account?

Pepperstone offers the best forex demo account, providing MT4 with 28 Smart Trader Tools and a 77ms execution speed. With RAW spreads from 0.10 pips across 94 currency pairs and no minimum deposit, Pepperstone delivers risk-free practice trading conditions. We also shortlisted other demo accounts based on their expiration periods and platform features.

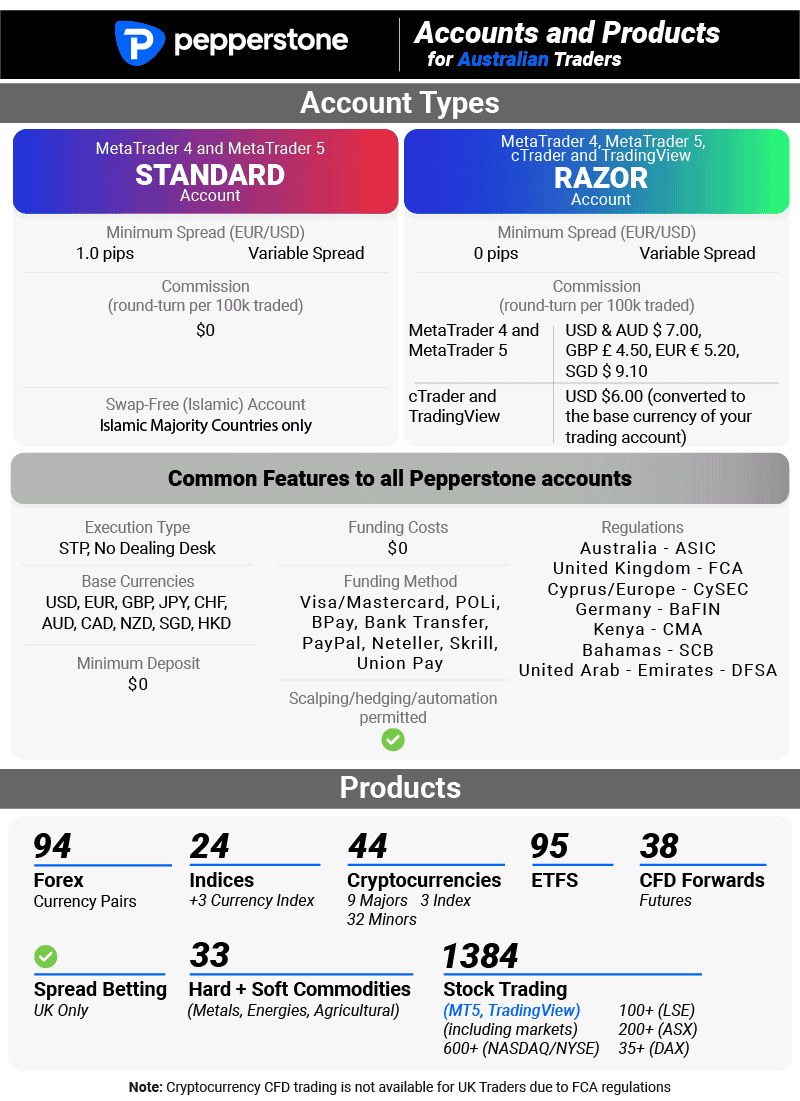

1. Pepperstone - Best Forex Demo Account With MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

I liked how Pepperstone offered a genuine trading experience that stands head and shoulders above the rest. I’ve personally traded forex on their platform and can attest that their demo account makes the broker a breeze to simulate real trading conditions. The demo allows for easy replication of your go-to strategies and chart setups, offering a seamless transition to a live account when ready. If you’re after a demo account that truly prepares you for the live markets, Pepperstone should be your first port of call.

Pros & Cons

- Fastest Execution Times

- Unlimited virtual funds

- Four trading platforms

- Limited automation tools

- Demo account is limited to 30 days

- Educational resources are dated

Broker Details

Founded in Australia in 2010, Pepperstone is one of the leading MT4 brokers of all time. With this popularity, I decided to open a RAW spread demo account to explore Pepperstone’s features and services without spending on the experience.

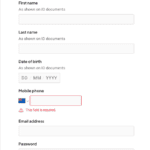

As a retail investor for many years, I can say that opening the demo account with this broker was easy; you need a few personal details like your name and email address. I liked that I didn’t need to key in elaborate financial details to set up the demo account or go through multiple questionnaires. This is my ultimate pet peeve with other brokers, making me do a lot of stuff before opening a demo account.

Pepperstone’s demo account allows you to access MetaTrader 4, an excellent trading platform with 30+ indicators built in and is fully customizable. With this extensive line-up, I think Pepperstone really is a solid choice for MetaTrader 4 users, providing third-party tools to enhance the platform with 28 smart tools to extend the functionality of MT4.

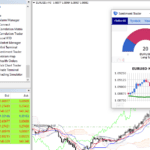

One feature that caught my attention is the sentiment indicator, which provides valuable insights into how Pepperstone’s clients are positioned in the markets. You can use the crowd’s wisdom to determine if you should take a long or short position.

While exploring the accounts, I ran a test to find if Pepperstone offers tight spreads. For the RAW account, I found that the actual spreads on major currency pairs were 0.0 pips. Intrigued by this finding, I did further investigations to see how frequently Pepperstone offers these zero-pip spreads.

My findings revealed that Pepperstone offered 0.0 pips on major pairs an impressive 100% of the time, meaning you would only pay the $3.50 commission per lot traded. With 0.0 pips on the broker’s majors 100% of the time, you can significantly reduce your trading costs, especially if you trade frequently on major currency pairs.

I also found that Pepperstone’s Standard account had wider spreads of 1.12 pips but no commission. Notably, both account types offer spreads lower than the industry averages for their respective categories.

Disclaimer: The results provided are based on my personal tests and findings and may not reflect the actual experience of all users. Trading conditions, including spreads and commissions, can vary and are subject to change.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

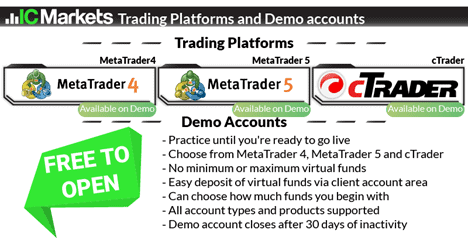

2. IC Markets - Top CFD Demo Account With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

I liked how IC Markets brings to the table features akin to Pepperstone, particularly when it comes to quick spreads and ECN-style execution and having extensive trading platforms. The broker has the four staple Forex trading platforms namely MetaTrader4, MetaTrader5, cTrader, and TradingView. The MT5 comes with standout features, more technical indicators and timeframe options, and a built-in economic calendar which you can take advantage of if you are a trend-following type of trader.

Another advantage that caught my eye is IC Markets’ excellent trading spreads, and if you are a trader looking to test strategies under real market conditions, this is the broker to go. However, I want to point that while IC Markets offers automation, social trading, and copy trading, these options are less extensive than those with Pepperstone. For this reason, I’ve ranked IC Markets second overall, but it’s still a strong option for those keen to test trades with great spreads on MT5.

Pros & Cons

- Fast execution speeds

- Unlimited virtual cash

- 64 forex pairs

- High minimum deposit

- Limited trading options

Broker Details

We found that IC Markets offers its demo account with MetaTrader 5, which doesn’t expire unless you fail to place a trade once every twenty days. We appreciate this feature as it allows you to practice and refine your strategies without the pressure of the account expiring.

During our tests, we explored the MetaTrader 5 platform provided by IC Markets. It offers a solid array of tools for technical analysis, including 38+ indicators, 15+ drawing tools, and three chart types.

What stood out for us was the inclusion of the depth of market tool, letting you view the liquidity providers’ order books and see where other traders place their orders. We find this feature interesting because it provides a snapshot of where the money is currently concentrated and which side, buy or sell, is stronger.

While using the demo account, our analyst Ross to test IC Markets’ Standard account spreads for the major forex pairs and compare them to 14 other brokers we’ve tested. This allowed us to gauge the competitiveness of IC Markets’ pricing structure.

Ross found that IC Markets had the lowest average spread of 1.03 pips across its major pairs. We also found they offered the lowest EUR/USD and USD/JPY spreads, averaging 0.73 and 1.09 pips, respectively.

Remember, this is a commission-free account, so these spreads are exceptionally low compared to industry standards.

| EURUSD | SPREAD | USDJPY | SPREAD |

|---|---|---|---|

| IC Markets | 0.73 | IC Markets | 1.09 |

| Admiral Markets | 0.74 | CMC Markets | 1.17 |

| CMC Markets | 0.8 | TMGM | 1.26 |

| FXCM | 0.93 | FusionMarkets | 1.27 |

| TMGM | 1 | Admiral Markets | 1.32 |

| FusionMarkets | 1.01 | FXCM | 1.38 |

| OandA | 1.06 | FP Markets | 1.51 |

| City Index | 1.16 | Go Markets | 1.52 |

| EightCap | 1.16 | EightCap | 1.55 |

| FP Markets | 1.19 | OANDA | 1.55 |

| Pepperstone | 1.21 | Pepperstone | 1.55 |

| Blackbull Markets | 1.34 | Axi | 1.62 |

| Go Markets | 1.34 | City Index | 1.74 |

| Axi | 1.45 | FXPro | 1.87 |

| FXPro | 1.59 | Blackbull Markets | 2 |

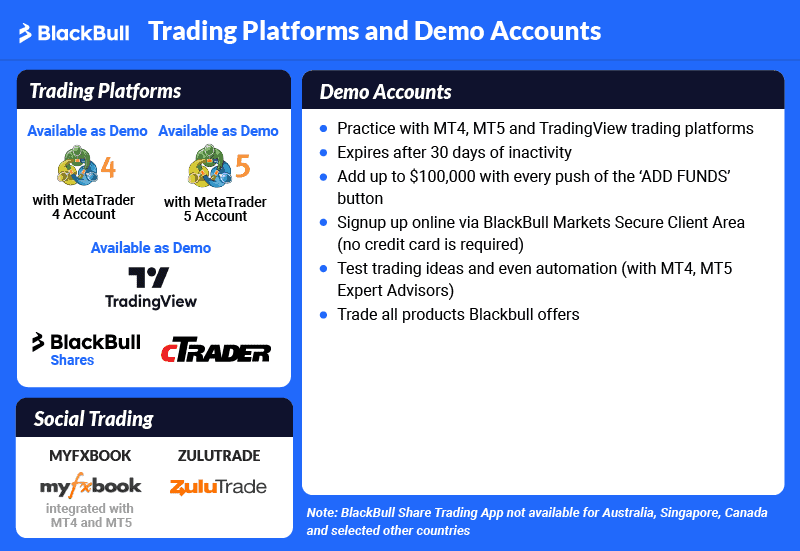

3. BlackBull Markets - Top Demo Choice for Lightning Fast Execution

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.1 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlakckBull Trade

Minimum Deposit

$0

Why I Recommend BlackBull Markets

I liked BlackBull Markets for its remarkable execution speeds, easily making it my top demo choice for traders after lightning-fast transactions. The platform provides considerable leverage, all backed by negative balance protection, giving you a solid safety net.

On top of that, there’s no minimum deposit for the broker’s ECN Standard account, which makes it easy to get started. While their ECN Prime has a $2,000 minimum deposit, which could be a hurdle for some, the speed and leverage may make it worthwhile.

Despite giving BlackBull Markets a final grade of 58 out of 100, I still consider this broker a compelling option, especially if you prioritize having fast execution speed in a demo account.

Pros & Cons

- Fast execution speeds

- Easy signup process

- Available demo platforms

- Demo expires quickly

- Leverage caps

- High minimum deposit

Broker Details

I appreciate having various trading platforms, including TradingView, MT4, MT5, and cTrader, with my broker. This variety enables me to experiment with different interfaces and tools, ensuring that I find the platform that best fits my trading style, all without risking real money.

BlackBull Markets, a broker founded in New Zealand in 2014 has an offering which I’ve never seen from any other broker I reviewed in the past. Depending on your chosen trading platform, the broker grants free subscription to TradingView Pro.

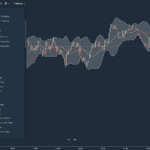

It’s not a secret that TradingView, in website or mobile app version, is everyone’s favorite charting partner for technical analysis and trading signals. With its 110+ indicators and drawing tools, you can do so much. From spotting trading opportunities to setting stop loss and take profit levels, everything is possible in this platform.

I looked into BlackBulls’ offer further and found that the cost of these upgrades is relatively low. I broke down the trading volume required for each tier of the TradingView plan below.

| TradingView Plan | Trading Volume |

|---|---|

| Essential Account | One lot traded per month |

| Plus Account | Five lots traded per month |

| Premium Account | Ten lots traded per month |

Our analyst, Ross Collins, conducted tests on the broker’s execution speeds and compared them across the industry. His findings were impressive, showing BlackBull Markets led the pack with a 72ms limit order speed and a 90ms market order speed, securing its position as the fastest broker.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| HugosWay | 4 | 104 | 7 | 94 | 3 |

| TMGM | 5 | 94 | 5 | 129 | 7 |

| FXCM | 6 | 108 | 8 | 123 | 6 |

| City Index | 6 | 95 | 6 | 131 | 8 |

| Axi | 8 | 90 | 4 | 164 | 16 |

| Eightcap | 9 | 143 | 12 | 139 | 10 |

I believe execution speed is crucial, particularly if you’re using fast-paced trading strategies or scalping, where milliseconds can mean the difference between profit and loss.

The excellent speed offered by BlackBull Markets can help you enter your trades faster while reducing the likelihood of slippage, saving you on trading costs over time.

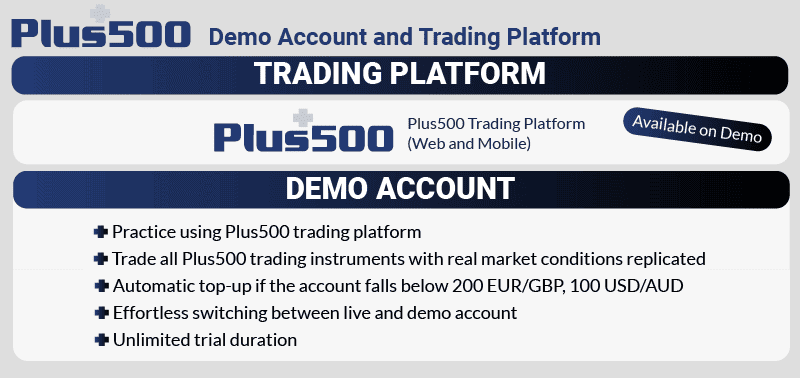

4. Plus500 - Top Demo Account For With Risk Management

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why I Recommend Plus500

I appreciate Plus500’s emphasis on risk management, especially when using the demo account. The demo account will allow you to access the broker’s CFD education features and its Guaranteed Stop Loss Order (GSLO) which can be beneficial if you are new to trading.

Pros & Cons

- FREE unlimited account

- Risk management features

- Diverse range of CFDs

- Limited account types

- Restricted platform options

- Lacks advanced tools

Broker Details

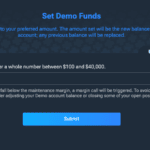

Plus500 is a broker founded in 2008 offering an unlimited time demo account with $40,000 in virtual funds. This is a notch higher compared to the average amount offered by the majority of brokers which is $10,000. I had greater flexibility to test different strategies and take larger positions which made the experience more realistic.

Using just the demo account, I also managed to explore the vast range of trading products; 68+ CFD forex pairs, 2000+ CFDs on shares, 57 indices, 25+ CFD crypto markets, and 30 CFD commodities. Having this extensive range provides you with good learning opportunities to refine your trading strategies in a risk-free environment.

I also want to mention that there is a feature where you can “deposit” new funds using the broker’s internal transfer system. This enhances the realism of the trading experience and serves as a practical tutorial on managing real funds.

One feature that sealed the deal for Plus500 as a top choice for novice forex traders is the guaranteed stop-loss orders, readily available on every order ticket that I opened. I found that this can protect your losses during volatile markets and avoid slippage which is crucial for risk management when you are still learning the ropes.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

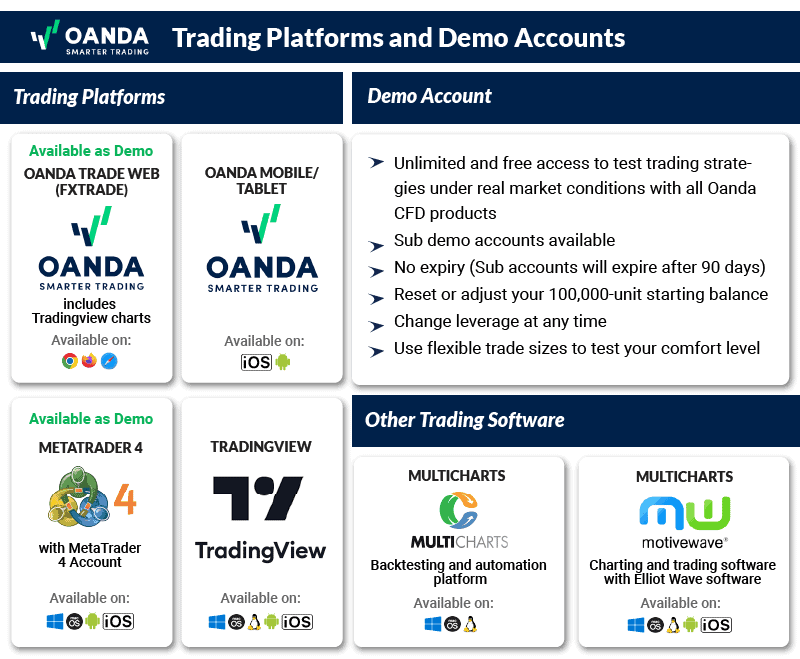

5. OANDA - Top Demo Account For Unlimited Forex Trading

Forex Panel Score

Average Spread

EUR/USD = 0.94 GBP/USD = 1.68 AUD/USD = 1.48

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why I Recommend OANDA

I liked OANDA’s demo account for its comprehensive feature set, making it my top recommendation for those keen to experiment with automated trading. In my experience, OANDA’s platform has shown itself to be a strong contender for traders eager to dive into automated strategies. This makes the broker a highly viable option for those who want to simulate realistic trading conditions while testing out bots.

Pros & Cons

- Flexible leverage

- 70+ currency pairs

- No requotes or rejections

- Customer support is not 24/7

- No share CFDs

- Doesn’t offer ECN/STP

Broker Details

I was particularly impressed by having unlimited access to a demo account loaded with $100,000 in virtual funds on the OANDA Trade Platform. This offer will allow you to practice without the pressure of expiration or immediately running out of funds, and you will come to value this especially if you are still refining your strategies.

The integration of TradingView’s advanced charting within the OANDA Trade platform comes with 80+ indicators and 10+ chart types, and doing technical analysis in this setting turned out to be a wholesome experience for me.

Another standout feature is the platform’s default trade ticket feature. This ensures that all future trade tickets automatically reflect the same settings by allowing you to pre-set your trade size, stop loss, and take profit levels. This will save time and minimize the risk of costly errors due to manual input mistakes. In my opinion, this is a small but a thoughtful detail that can significantly enhance your entire experience.

OANDA extends demo account offerings to other platforms, such as TradingView and MetaTrader 4, although take note that these have expiration dates. Nevertheless, getting to explore OANDA’s services across different trading environments could enrich your understanding of the tools and features each platform provides.

During my live spread test, the broker’s performance turned out to be excellent. The average spreads on EUR/USD is 0.6 pips, significantly lower than the industry average of 1.24 pips. That will be a good save there, especially when like to open many positions at once. I found this spread to be consistent across major currency pairs, with an average spread of 0.7 pips. This makes OANDA a highly competitive low-cost broker in the forex market.

| Broker | EUR/USD |

|---|---|

| OANDA | 0.6 |

| IC Markets | 0.62 |

| Eightcap | 1 |

| eToro | 1 |

| CMC Markets | 1.12 |

| IG | 1.13 |

| Pepperstone | 1.12 |

| Blackbull Markets | 1.2 |

| Plus500 | 1.7 |

| Industry Average | 1.24 |

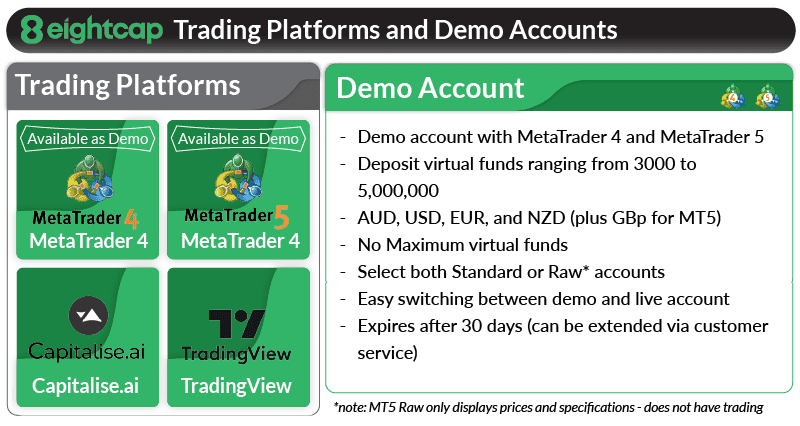

6. Eightcap - Great Account to Test FX and Cryptocurrency Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why I Recommend Eightcap

I like Eightcap’s demo account and found it to be a great platform to test both FX and cryptocurrency trading. This Melbourne-based broker offers a range of cryptocurrency options on the practice account, making them a solid choice for Aussies keen to get a handle on crypto trading alongside forex.

Eightcap particularly shines as an alternative to eToro, especially for those looking to delve deeply into technical analysis and wants to do it with ease. The platform provides a user-friendly experience that aids in understanding both the forex and crypto markets.

Pros & Cons

- Comprehensive crypto selection

- No limit on virtual funds

- Seamless transition from demo to live account

- Limited demo platform options

- Incomplete MetaTrader 5 experience

- Has a minimum deposit

Broker Details

After opening my demo account with Eightcap, I was pleased to find that the platform supports MetaTrader 5 and TradingView, granting access to an impressive array of 95 cryptocurrency markets. This range includes heavyweights like Bitcoin, Ethereum, and Litecoin, alongside other names such as Ripple and Cardano, offering one of the most extensive cryptocurrency selections I’ve encountered among forex brokers.

Eightcap’s is also known to be an excellent broker for automating crypto strategies. The tool, developed in partnership with Capitalise AI, has allowed me to automate my strategy by typing my entry and exit strategies in simple language. No coding skills needed, and best part is that the strategy was developed right after.

Eightcap’s technology has allowed me to backtest my strategy to test its performance in a 90-day timeframe. This means that the feature will allow you to see trade outcomes and find optimization opportunities even before you put them live. That’s a great risk management feature you are getting there, and this will save you a lot of cost moving forward.

| Broker | Cryptocurrency Markets |

|---|---|

| Eightcap | 95 |

| eToro | 41 |

| Pepperstone | 19 |

| IC Markets | 18 |

| IG Group | 15 |

| Plus500 | 15 |

| BlackBull Markets | 11 |

| OANDA | 4 |

However, despite Eightcap’s strong choice in cryptocurrency, I noticed a limitation in its overall market variety. The broker provides access to 56 forex pairs, 16 indices, 586 shares, and eight commodities, and when compared to brokers like IG Group (17,000 markets), Eightcap’s offerings seem modest.

My tests revealed that Eightcap features competitive spreads, with an average of 0.2 pips on EUR/USD, slightly lower than the industry standard (0.22 pips).

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

If you’re interested in automating cryptocurrency trading strategies without learning how to program them through complex programming, Eightcap’s partnership with Capitalse.ai is a standout feature. Available for free, even with a demo account, Capitalse.ai is a user-friendly, no-code platform that translates your trading strategy rules and parameters into automated systems.

After following their beginner-friendly tutorials, I found this tool remarkably easy to use, which allowed us to generate an automated strategy within minutes of starting the tutorial. This is especially appealing if you want to leverage the volatile crypto market with automated strategies, as Capitalise.ai allows you to apply these strategies to cryptocurrencies.

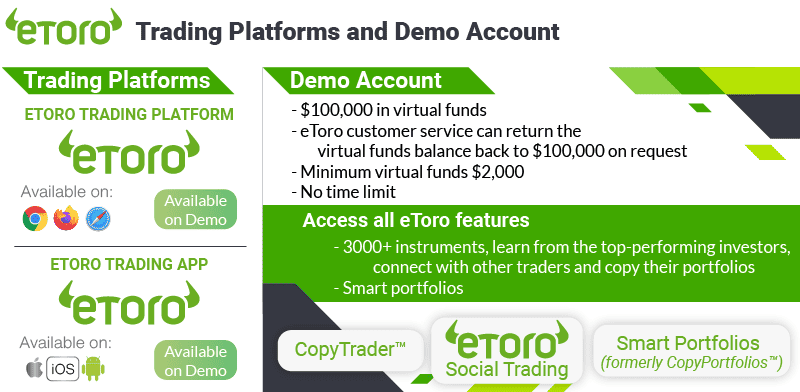

7. eToro - Top Demo Account For Social And Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1 GBP/USD = 2 AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

I like eToro’s social media-style interface. In my opinion, this makes the broker an excellent choice if you are interested in learning from others in a dynamic community setting. The social trading platform simplifies the trading process, allowing you to follow and replicate the strategies from an extensive choice of seasoned traders.

This can be a real boon if you’re looking to bypass the intricacies of individual analysis and trade placements. Basically, eToro is a one-stop shop for those wanting a social twist to their trading experience.

Pros & Cons

- 100,000 eToro virtual cash

- No time limitation

- No commission trading

- Slow customer support response

- Demo account limitations

- No support for third-party trading platforms

Broker Details

eToro’s demo account stands out for its integration with the CopyTrader platform. This provides a unique opportunity to forward-test traders before actually copying them. I like that the broker comes an unlimited demo account that doesn’t expire, funded with a generous $100,000 virtual fund. This can set you up for a risk-free test of manual trading and social trading at no cost.

eToro’s demo account stands out for its integration with the CopyTrader platform. This provides a unique opportunity to forward-test traders before actually copying them. I like that the broker comes an unlimited demo account that doesn’t expire, funded with a generous $100,000 virtual fund. This can set you up for a risk-free test of manual trading and social trading at no cost.

I appreciate having the CopyTrader feature in the demo account. This allowed me to learn the mechanics of selecting traders to copy without any financial risk. The platform’s advanced filtering capabilities with 14 different settings made it easy to sift through the 2 million+ trader profiles. Although narrowing my options to just five seemed limited at first, these turned out to be precisely aligned with my preferences. The filter’s effectiveness in tailoring copy trading experience to your specific goals is a top-notch little feature.

If you want to trade manually, you will have no problem. I found that the eToro’s platform allows you to do this and offers 49 forex pairs, 13 indices, 2900+ stocks, and 41 commodities, in the selection.

Moreover, if you want to leverage TradingView charts, the broker provides access to over 100 indicators, nine chart types, and eight timeframes, giving you a solid choice of analytical tools to develop your trading strategies.

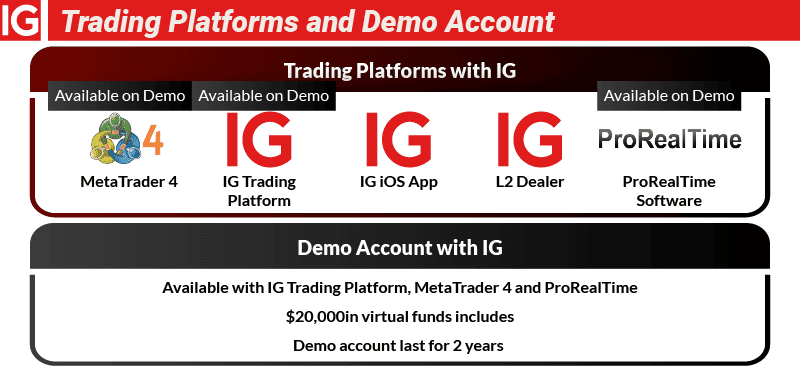

8. IG Group - Best Range of Trading Products for a Test Account

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why I Recommend IG Group

I like IG Group for having an expansive range of trading instruments. This has easily made the broker my top pick if you are seeking diversity in a demo account.

It also helps that IG Group offers competitive spreads and top-notch customer service, which I find invaluable in any trading journey. If you’re looking to practice with forex, commodities, or other financial instruments, IG Group offers a demo account that lets you do that with great flexibility.

Pros & Cons

- Easy and fast account opening with no credit card required

- Two-year lifespan

- Access to ProRealTime

- Platform-based market limitations

- Customer service is limited over the weekend

- Lacks social trading tools

Broker Details

While exploring my IG Group demo account, I was very impressed by the extensive range of financial instruments available. The practice account covers 17,000 markets – the most I’ve found available from any broker. This includes a selection of 80+ forex pairs, over 12,000 shares, 130 indices, 41 commodities, 15 cryptocurrencies, and more than 6,000 ETFs.

IG Group’s demo account doesn’t expire and starts with a $10,000 balance. Although this might look like a tight budget at first, I found that you could top up this amount whenever necessary, providing you with practically unlimited virtual funds for practice trading.

During my testing, I also discovered that IG Group offers multiple trading platforms, each with a dedicated demo account. If you’re someone who likes having variety, this will allow you to test each platform individually and find the one that best suits your trading style.

The IG Trading Platform, the broker’s flagship offering, is a decent web-based platform granting access to IG’s full market range. It has an impressive charting package, with over 28 indicators and trading signals from PIA First and AutoChartist. This is helpful for finding new trading ideas throughout the day.

Having MetaTrader 4 for automating trades is a cherry on top. I coded my own Expert Advisors to automate trading strategies on the platform, and the process is straightforward as usual. If you want a tool that automatically draws support and resistance levels and trend lines when following price action strategies, a feature called ProRealTime is available for that.

Lastly, there’s IG Group’s L2 Dealer platform. This provides direct market access and level II pricing, showing open and pending orders directly from liquidity providers. This will be an essential tool if you want to measure market sentiment before trading.

Ask an Expert

How long should I use a forex demo account?

You should use one to practice with until you are certain your skills are up to scratch for live trading and even then you should keep using one to keep practicing and get better. Keep in mind some brokers only allow demo accounts for a limited time.

Are forex demo accounts accurate?

Yes, demo accounts use live data sourced from liquidity providers. SO they are accurate in this sense however you will not get slippage with a demo account since your orders are not filled by real counter-parties but by software.

Does MT4 demo account expire?

This will depend on the broker, some brokers limit the demo account period with MT4 to 30 or 90 days while other have no expiry date as long as you remain active on it within 30 days or sign up for a live account with the broker.

How do i join my demo account

The broker will have a link to sign up to a demo account on their website.

Are there hidden changes when moving from demo to live? Like higher spreads or deposits?

no, spreads are the same on both demo and live account.