Eightcap vs Blueberry Markets: Which One Is Best?

This in-depth review of Eightcap and Blueberry Markets will carefully evaluate the traits and faults of each broker, following the traditions of the forex trading industry. The decision of whom to trust with your trading activities ultimately lies with you, the trader. We will transparently present the features that set these two brokers apart, guiding you to determine which one stands out as the better choice. Our conclusions are based on extensive research and analysis, but we invite you to make your own informed judgment.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors to help you make an informed decision.

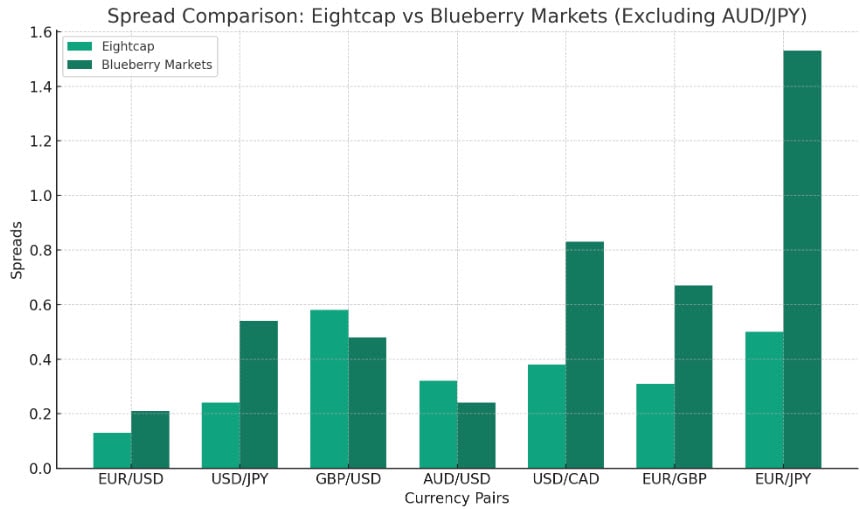

- Eightcap generally offers lower spreads notably on the EUR/USD pair.

- Blueberry Markets has a competitive edge with a lower spread on the USD/CAD pair.

- Blueberry Markets maintains spreads closer to the industry norm.

- Eightcap’s spreads are often below the industry average

- Both Eightcap and Blueberry Markets impose commissions on their Raw and Professional accounts.

- Both Eightcap and Blueberry Markets neither charge fees for deposits or withdrawals, benefiting traders.

1. Lowest Spread Forex Broker – Eightcap

For traders, working with brokers that offer the lowest spreads is highly advantageous, particularly for those who conduct multiple trades. Brokers with minimal spreads are more likely to attract clients by providing cost-effective trading options.

In this section, we see that Eightcap has the lowest spreads for 5 of the 6 most traded currency pairs compared to Blueberry Markets. We created the calculator below factoring the average spreads and the commissions charged based on the base currency a trader selects.

Actual Spreads Of Eightcap

Owing to the conflicting nature of spreads, the team combined MyFxBook data the spreads of competitors’ forex broker comparison sites and the published spreads shown in the Eightcap trading cost section. Our head of research (Ross Collins) also conducted his own research by opening live MT4 accounts and using EAs (bots) over 48 hours to determine the average spreads. Combining these data sources led to the following consensus spreads.

| Eightcap | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.2 | 0.3 | 0.8 | 0.4 | 0.6 | 0.2 | 0.4 | 16.3 | N/A | N/A |

| BrokerChooser | 0.1 | 0.2 | 0.2 | 0.3 | 0.3 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 0.76 | 1 |

| CompareForexBrokers | 0.06 | 0.23 | 0.73 | 0.27 | 0.23 | 0.42 | 0.59 | 0.49 | N/A | N/A |

| Eightcap | 0.17 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1 |

| Consensus | 0.13 | 0.24 | 0.58 | 0.32 | 0.38 | 0.31 | 0.5 | 8.4 | 0.76 | 1 |

Actual Spreads Of Blueberry Markets

Now compare this to Blueberry, where we used similar data sources including MyFxBook data, Ross’s ECN Raw Account Spreads testing findings and published data on Blueberry Market’s website.

| Blueberry Markets | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.17 | 0.6 | 0.8 | 0.3 | 0.8 | 0.6 | 0.8 | 14 | N/A | N/A |

| BrokerChooser | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CompareForexBrokers | 0.27 | 0.43 | 0.44 | 0.32 | 0.5 | 0.7 | 1.9 | 0.6 | N/A | N/A |

| Blueberry Markets | 0.2 | 0.6 | 0.2 | 0.1 | 1.2 | 0.7 | 1.9 | 0.6 | N/A | N/A |

| Consensus | 0.21 | 0.54 | 0.48 | 0.24 | 0.83 | 0.67 | 1.53 | 5.07 | N/A | N/A |

Below are the consensus head-to-head spreads (AUD/JPY was removed as it blew out the chart) and really highlight just how much better Eightcap spreads are compared to Blueberry Markets.

Account Commission Comparison

The commission rate of each broker’s RAW account (ECN account) is based on the base currency the trader selects when opening an account. As below highlights, Eightcap offers more base currency options and has a more global reach of traders.

For the base currencies, both Eightcap and Blueberry Markets charge $3.50 per lot when opening and closing a position also known as a $7.00 round term per 1.0 standard lot. This is in-line with most global forex brokers from IC Markets, Pepperstone to FP Markets. With commission levels so similar, the real fee differential is the spread discussed earlier.

| Base Currency | Eightcap Commission Per Side | Blueberry Markets Commission Per Side | Eightcap Round Lot Commission | Blueberry Markets Round Lot Commission |

|---|---|---|---|---|

| USD | $3.50 | $3.50 | $7.00 | $7.00 |

| AUD | $3.50 | $3.50 | $7.00 | $7.00 |

| NZD | $3.50 | N/A | $7.00 | N/A |

| SGD | $3.50 | N/A | $7.00 | N/A |

| CAD | $3.50 | N/A | $7.00 | N/A |

| GBP | £2.25 | N/A | £4.50 | N/A |

| EUR | €2.75 | N/A | €3.50 | N/A |

Deposit & Withdrawal Fees

Both Eightcap and Blueberry Markets do not charge any deposit or withdrawal fees, which is a great advantage for traders.

Other Fees

There are no hidden fees with either broker. However, it’s important to note that a swap fee or overnight financing fee may apply if you hold positions overnight.

Based on our studies, we therefore conclude that Eightcap edges our Blueberry when it comes to brokerage with tighter spreads and competitive commissions. With the broker avoiding hidden fees (eg withdrawal fees) they are the clear choice for traders looking to minimise their trading costs.

Our Lowest Spreads and Fees Verdict

Eightcap outperfoms the challenger in this division thanks to their lowest spreads from a forex broker.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Better Trading Platform – A Tie

We can truly see here that both Eightcap and Blueberry Markets offer MetaTrader 4 and 5, the most popular trading platforms in the forex industry. Let’s take a closer look at the Best cTrader Brokers. Keep in mind that having a trading platform that features enhanced user experience is beneficial for traders as it provides advanced tools for ease of use.

| Trading Platform | Eightcap | Blueberry Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader 4 and 5

Both brokers offer MetaTrader 4 and 5, which are known for their user-friendly interface, advanced charting capabilities, and automated trading features.

cTrader and TradingView

Neither Eightcap nor Blueberry Markets offer cTrader. TradingView, on the other hand, is offered by Eightcap.

Social And Copy Trading

Both Eightcap and Blueberry Markets offer social or copy trading.

VPS and Other Trading Tools

Both brokers offer VPS services for better trading execution. They also provide a range of trading tools to assist their clients.

We can easily surmise that it’s a tie between Eightcap and Blueberry Markets, in terms of trading platforms, as they both offer MetaTrader 4 and 5, VPS services, and a range of trading tools.

Our Better Trading Platform Verdict

In this section, both Eightcap and Blueberry Markets, are definitely tied due to having better trading platform.

3. Superior Accounts And Features – A Tie

Eightcap offers two types of accounts:

- Standard.

- Raw.

The Standard account is commission-free with slightly wider spreads, while the Raw account has tighter spreads but includes a commission. Let’s compare these with the Best spread betting brokers, but before we do, you need to keep in mind that having these features will provide traders with flexibility, advanced tools, and better trading conditions which will enhance the overall trading experience for traders, new or seasoned.

Blueberry Markets also offers two account types:

- Standard.

- Professional.

The Standard account is commission-free with wider spreads, while the Professional account has tighter spreads but includes a commission.

| Eightcap | Blueberry Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | No |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

We have reached a tie between Eightcap and Blueberry Markets, owing to their exceptional accounts and features.

4. Best Trading Experience And Ease – Eightcap

When it comes to trading experience – this trading feature gives access to reliable market data and various forex trading tools, which will enhance trader’s ability to make informed decisions, while, at the same time, managing risks most effectively – Eightcap really stands out with their TradingView featured platform. It’s a game-changer, offering a seamless, intuitive trading experience that’s hard to beat. Blueberry Markets, on the other hand, doesn’t offer TradingView, which could be a significant drawback for traders who swear by it.

- Eightcap offers the TradingView platform, which is a big plus.

- Blueberry Markets doesn’t have the TradingView platform in its arsenal.

- Both brokers offer the popular MT4 and MT5 platforms.

- Eightcap has been recognised for its ECN account, which enhances the trading experience.

Now, let’s talk about our own testing. Eightcap has the upper hand when it comes to execution speed. If quick trades are your thing, Eightcap should be at the top of your list.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| Eightcap | 143ms | 19/36 | 139ms | 17/36 |

| Blueberry Markets | 88ms | 6/36 | 94ms | 7/36 |

Our Best Trading Experience and Ease Verdict

Eightcap takes home the crown in this category in light of their best trading experience.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Stronger Trust And Regulation A Tie

If traders want a secured and transparent trading environment, go for a broker with strong trust and regulations. Conversely, offering competitive spreads and fees, sophisticated trading tools and platforms, fast execution speeds, exceptional customer support, and a variety of funding options can significantly elevate a trader’s overall experience.

Eightcap Trust Score

Blueberry Markets Trust Score

Regulation

We see here that both Eightcap and Blueberry Markets are regulated by the Australian Securities and Investments Commission (ASIC), which is one of the most respected regulatory bodies in the world. This ensures that they adhere to strict regulatory standards, including client fund segregation and regular audits. Here’s more about ASIC Regulated Brokers.

| Eightcap | Blueberry Markets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | ASIC (Australia) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | SCB (Bahamas) | SVG-FSA |

Reviews

As shown below, Eightcap holds a Trustpilot rating of 4.2 out of 5 based on over 3,100 reviews, while Blueberry Markets scores slightly higher at 4.7 out of 5 based on around 3,000 reviews.

Our Stronger Trust and Regulation Verdict

Again, it’s a draw for both Eightcap and Blueberry Markets, this is in light of their stronger trust and regulation.

6. Most Popular Broker – Eightcap

Eightcap gets searched on Google more than Blueberry Markets. On average, Eightcap sees around 40,500 branded searches each month, while Blueberry Markets gets about 22,200 — that’s 45% fewer.

| Country | Eightcap | Blueberry Markets |

|---|---|---|

| Thailand | 9,900 | 110 |

| Australia | 2,400 | 1,000 |

| Canada | 2,400 | 1,900 |

| United States | 1,900 | 1,300 |

| United Kingdom | 1,600 | 1,900 |

| India | 1,300 | 880 |

| Brazil | 1,000 | 210 |

| Germany | 1,000 | 1,000 |

| Malaysia | 880 | 480 |

| France | 720 | 1,600 |

| Colombia | 720 | 170 |

| Spain | 720 | 320 |

| Indonesia | 590 | 320 |

| Argentina | 590 | 50 |

| Italy | 590 | 320 |

| South Africa | 480 | 480 |

| Netherlands | 480 | 320 |

| Nigeria | 390 | 480 |

| Singapore | 390 | 480 |

| Pakistan | 320 | 320 |

| Mexico | 320 | 90 |

| Sweden | 320 | 140 |

| Dominican Republic | 320 | 50 |

| Poland | 260 | 110 |

| United Arab Emirates | 210 | 170 |

| Morocco | 210 | 210 |

| Philippines | 210 | 590 |

| Portugal | 210 | 110 |

| New Zealand | 210 | 260 |

| Vietnam | 170 | 260 |

| Kenya | 170 | 110 |

| Hong Kong | 170 | 70 |

| Switzerland | 170 | 170 |

| Japan | 140 | 70 |

| Peru | 140 | 30 |

| Taiwan | 140 | 30 |

| Chile | 140 | 20 |

| Bangladesh | 140 | 170 |

| Austria | 140 | 170 |

| Turkey | 110 | 210 |

| Ecuador | 110 | 30 |

| Venezuela | 110 | 30 |

| Algeria | 110 | 70 |

| Ireland | 110 | 90 |

| Egypt | 90 | 70 |

| Cyprus | 90 | 50 |

| Uzbekistan | 90 | 70 |

| Greece | 90 | 50 |

| Cambodia | 90 | 20 |

| Uganda | 70 | 50 |

| Saudi Arabia | 70 | 50 |

| Ghana | 70 | 70 |

| Mongolia | 70 | 10 |

| Sri Lanka | 50 | 50 |

| Tanzania | 30 | 40 |

| Botswana | 30 | 50 |

| Jordan | 30 | 20 |

| Costa Rica | 30 | 10 |

| Bolivia | 30 | 10 |

| Ethiopia | 30 | 30 |

| Mauritius | 20 | 20 |

| Panama | 20 | 10 |

9,900 1st | |

110 2nd | |

2,400 3rd | |

1,900 4th | |

1,600 5th | |

1,900 6th | |

880 7th | |

480 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Eightcap receiving 259,000 visits vs. 265,000 for Blueberry Markets.

Our Most Popular Broker Verdict

Eightcap is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Eightcap

Eightcap and Blueberry Markets both offer a wide range of products – which is beneficial for traders most especially those who want to capitalise on different market conditions – but Eightcap has a slight edge owing to having particularly strong in the crypto trading arena, offering a broader range of crypto CFDs than Blueberry Markets.

| CFDs | Eightcap | Blueberry Markets |

|---|---|---|

| Forex Pairs | 61 | 38 |

| Indices | 16 | 19 |

| Commodities | 8 Commodities Softs and Metals | 9 Metals (Gold x 7 Currencies) (Silver x 6 Currencies) 3 Energies |

| Cryptocurrencies | 95 Crypto | 10 |

| Shares CFDs | 586 | 300+ |

| ETFs | No | 140 |

| Bonds | No | No |

| Futures | No | No |

| Treasuries | No | No |

| Investment | No | No |

Our Top Product Range and CFD Markets Verdict

Eightcap dominates this category as a result of their top product range and CFD markets.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Superior Educational Resources – Blueberry Markets

Evidently, Eightcap and Blueberry Markets both provide valuable educational resources, yet they target distinct audiences. Eightcap specializes in advanced strategies and webinars, appealing to more experienced traders, whereas Blueberry Markets emphasizes beginner-friendly tutorials and courses. Keep in mind that these educational offerings are essential in the forex trading industry, as they equip traders with a deeper understanding of market dynamics, empowering them to make informed decisions.

- Eightcap offers webinars and advanced trading strategies.

- Blueberry Markets provides beginner-friendly tutorials.

- Both brokers offer eBooks for traders.

- Eightcap provides articles on market analysis.

- Blueberry Markets offers trading courses.

- Both brokers provide a demo account for practice.

Our Superior Educational Resources Verdict

Blueberry Markets stands out in this portion on account of having superior educational resources.

9. Superior Customer Service – Blueberry Markets

Customer service is crucial due to the fact that they help traders resolve technical issues and at the same time hand out guidance and other important information to give traders an overall trading experience; both brokers get that principle. Based on our research, Eightcap offers 24/5 support, while Blueberry Markets goes the extra mile with 24/7 support, which is fantastic for weekend traders.

| Feature | Eightcap | Blueberry Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Blueberry Markets takes the cake thanks to their superior customer service.

10. Better Funding Options – Eightcap

Funding options are diverse for both brokers for it provides traders with flexibility and convenience. However, we see here that Eightcap has a slight edge over the challenger. It offers more crypto-based funding options, which could be a significant advantage for crypto enthusiasts.

| Funding Methods | Eightcap | Blueberry Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Eightcap ranks highest in this category thanks to their better funding opition.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

Our team’s research indicates that both Eightcap and Blueberry Markets mandate a minimum deposit of $100 from traders. This requirement signifies that forex trading is more accessible, catering to those looking to invest smaller amounts, whether you’re a novice or an experienced trader. Below, you will see the minor differences between the two brokers.

Eightcap

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

Blueberry Markets

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Neteller | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

Our Lower Minimum Deposit Verdict

Both Blueberry Markets and Eightcap are tied to this round. Thanks to having lower minimum deposit.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

So Is Blueberry Markets or Eightcap The Best Broker?

Eightcap steals the show just because it offers a more comprehensive trading experience, from lower spreads to a broader range of CFDs and funding options. The table below summarises the key information leading to this verdict.

| Categories | Eightcap | Blueberry Markets |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ✅ | ✅ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ✅ |

Blueberry Markets: Best For Beginner Traders

Blueberry Markets is better suited for beginner traders due to its comprehensive educational resources.

Eightcap: Best For Experienced Traders

For experienced traders, Eightcap is the go-to option, especially with its advanced trading platforms and lower spreads.

FAQs Comparing Eightcap vs Blueberry Markets

Does Blueberry Markets or Eightcap Have Lower Costs?

Eightcap has lower costs, particularly when it comes to spreads. For example, the EUR/USD spread starts at 1.0 pips. For more information on low-cost brokers, you can visit our Lowest Spread Forex Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and Blueberry Markets offer MetaTrader 4, but Eightcap has a slight edge with its lower spreads. For more details, check out our Best MT4 Forex Brokers.

Which Broker Offers Social Trading?

Neither Eightcap nor Blueberry Markets offer social or copy trading. If social trading is a priority for you, you might want to look elsewhere. Here’s our list of best copy trading platforms.

Does Either Broker Offer Spread Betting?

No, neither Eightcap nor Blueberry Markets offer spread betting. If you’re interested in spread betting, you can check out our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap is superior for Australian Forex traders. It’s ASIC-regulated and offers a broad range of CFDs. For more information, you can visit our Best Forex Brokers In Australia list.

What Broker is Superior For UK Forex Traders?

For UK Forex traders, I’d recommend Blueberry Markets. It’s FCA-regulated and offers excellent customer service. For more details, you can check out our Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert