Fondex Review Of 2026

While Fondex is not a regulated Forex broker, we did find some appealing features like decent spreads, 500:1 leverage, and trading via the cTrader trading platform. See what we say about Fondex in our Fondex review.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Fondex Summary

| 🗺️ Country Regulation | Unregulated |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | cTrader |

| 💰 Minimum Deposit | $€100 |

| 💰 Funding Fees | $0 |

| 🛍️ CFDs Offered | Forex, Commodities, Shares, ETFs, Indices |

| 💳 Credit Card Deposit | No |

Note: Fondex Global (formerly Kawase) ceased operating in 2024. This page is just for reference. Other brokers offering the cTrader platform that we recommend are Pepperstone and BlackBull Markets.

Why Choose Fondex

Fondex is the only broker we’ve encountered that exclusively trades via the cTrader trading platform. While the lack of MetaTrader (and even TradingView) as an option may disappoint some, we think cTrader is a quality platform in its own right, especially if you plan on scalp trading. The other point is that Fondex offers the full suite of cTrader products, which means you can trade manually, copy trade, or auto trade.

While Fondex only has one trading account with no-commission spread, we found conflicting information on how wide the spreads are. According to the Fondex website, Forex spreads start from 0.5 pips, yet the broker claims an average daily spread for EUR/USD of 0.45 pips. Obviously, this doesn’t make sense, and we found an average spread of 0.7 to 0.8 pips for major pairs to be more realistic and decent.

Fondex Pros and Cons

- Competitive spreads

- cTrader Platform with no commissions

- 80+ Forex pairs to trade

- Copy and automated trading is available

- Negative balance protection provided

- Not a regulated broker

- No MetaTrader 4, MetaTrader 5 or TradingView

- Limited range of asset classes to trade

- Confusing website to navigate

- Funding methods are not clear

The overall rating is based on review by our experts

Fees

Fondex uses a hybrid agency model, meaning it uses a mix of execution types. This may mean Fondex may use a Market Maker model and be your counterparty. At other times, Fondex may connect you with their liquidity provider (or providers – they wouldn’t reveal) based in New York.

Spreads

Fortunately, Fondex displays the average spread of all its currency pairs on its website daily. As you can see in our module below where we compiled the average spread Forex Fees broker publish on their website, spreads with Fondex are market-beating (and by some margin).

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 0.28 | 0.51 | 0.70 | 0.71 | 0.50 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 0.80 | 0.90 | 1.20 | 1.20 | 1.30 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.94 | 1.48 | 1.45 | 1.68 | 1.90 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

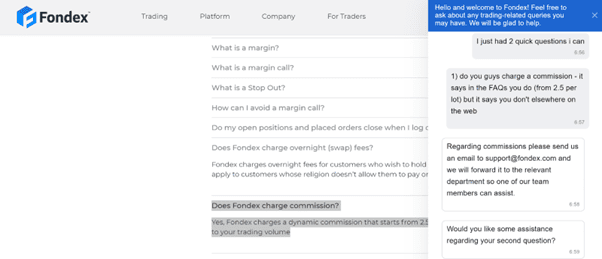

We’ve never seen average spreads quite as low as what Fondex lists on their website for no-commission trading. We checked with the Fondex customer support on live chat and they insist the spreads are the average for a Standard account. They even claimed to have the best spreads on the market.

We will have to trust the feedback live chat gave but given the broker advertises spread “from” 0.5 pips on their website which is higher than their average, we have good reason to be skeptical.

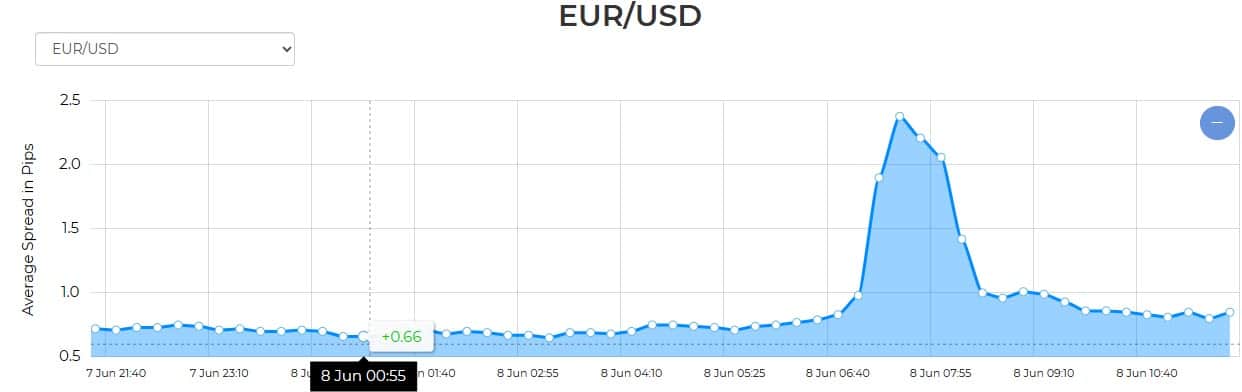

We did some more sleuthing, and the broker has a page devoted to trading execution transparency. On this page, the broker does list their average spreads for 15-minute intervals, and try as we might, we couldn’t capture any internal with a spread close to 0.45 pips.

When we look at the graph for EUR/USD, we can see that their average daily spread doesn’t come close to the 0.45 pips daily average they claim to have. The tightest spread we could find was 0.64 pips with most intervals hovering between 0.68 and 0. 75 pips with spikes at a particular time each day (most likely when the New York Forex market opens).

Account Types

Fondex Standard Account

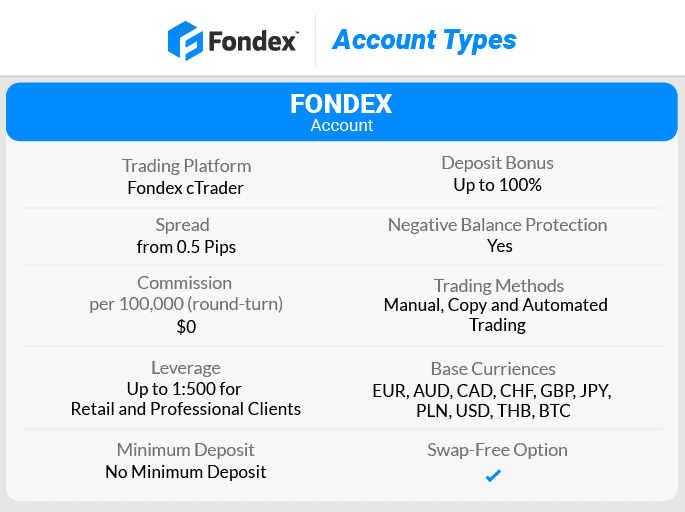

Fondex offers just one trading account type which is a Standard account. This account has no commissions when trading Forex and spreads from 0.5 pips (but is more likely to be around 0.70 pips or higher, which is still competitive).

This is interesting given you will be trading via the cTrader platform which in our experience, is nearly always using a commission-based (aka RAW, ECN, or STP) trading model.

Fondex has no minimum deposit requirement, and you can choose from 10 base currencies including Bitcoin.

Indeed, Fondex also used to have a commission-based model, which is why we found the broker’s website has contradictory (more specifically outdated) information in parts of its website. For example, their homepage advertises zero commissions, but the FAQs state that Fondex charges a dynamic commission starting from $2.5 per lot (per side), decreasing according to trading volume.

This isn’t helpful regarding the user experience with the broker’s website. We reasonably expect any broker’s website to be up-to-date and consistent.

Leverage and negative balance protection

Fondex offers fairly High Leverage Forex Brokers, up to 1:500 for retail and professional traders when trading Forex pairs. While having access toLeverage can be a useful tool for increasing profits, the opposite is true, and losses can quickly chew through your trading account. So it’s fair to say, that trading with such high leverage is only recommended if you have sound trading experience and can afford to take on any risks should markets move against you.

Considering these risks of unfavorable movements and the potential losses that may result, we think it is good that Fondex includes negative balance protection. Generally, these protections are provided due to requirements of the regulator, so we found it surprising (but in a good way) given that Fondex is an unregulated broker.

Order execution and execution speed

Fondex uses market execution rather than instant execution. This means if slippage occurs, you will get the next best available price and there will not be requotes.

According to Fondex customer service, execution speeds tend to take 100 to 200 ms once the order has been processed by the cTrader platform and sent to the liquidity provider. We have tested the Execution Speeds with 20 different brokers, and agree this speed falls in the normal range however you can find brokers with average speeds under 100ms for market orders and limits orders such as with BlackBull Markets and Pepperstone.

Swap-Free Account

Fondex offers an Swap Free Islamic Accounts however we should point out that there will be an administration fee applied for each day you hold an open position. So Fondex is just replacing the rollover or swap fees with an admin fee so we do question if their swap-free account is truly Sharia-compliant. We however are not experts on this subject so do your research.

| Currency Pair | Admin Fee (USD) Per lot | CFD | Admin Fee (USD) Per lot |

|---|---|---|---|

| EUR/USD | 3 | US 30 | 2.7 |

| EUR/AUD | 4 | Natural Gas | 50 |

| AUD/USD | 2 | DSH/BT | 1 |

| EUR/GBP | 4 | BTC/USD | 7.5 |

| GBP/USD | 2 | XAG/USD | 2.5 |

| AUD/USD | 9 | XAU/USD | 5 |

To set up an Islamic account, you must email the broker with ‘proof of faith’ and request this account.

Verdict

We didn’t mind that Fondex has only one account type available but you will pay for this with higher spreads (even if there are no commissions). We just wish Fondex were more consistent with their trading cost information such as commission and spreads on their website. We also wish finding detailed information about the Islamic account was easier.

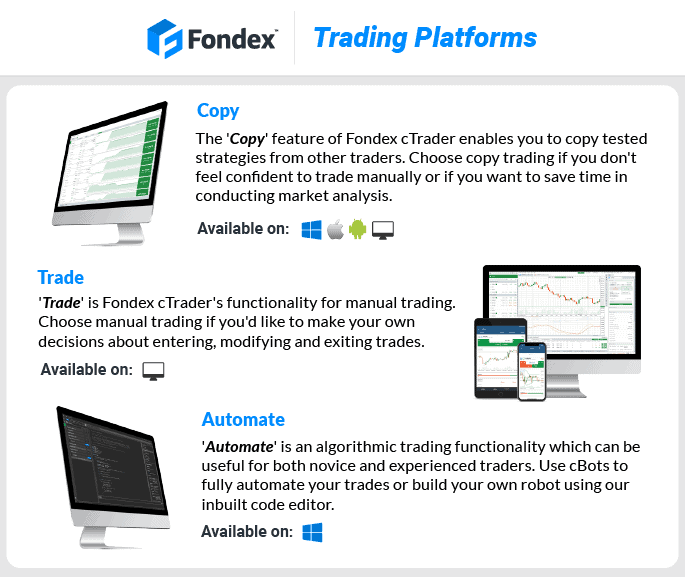

Trading Platforms

| Trading Plaform | Available With Fondex |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | Yes |

| TradingView | No |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Fondex only offers trading via the cTrader platform developed by a third party called Spotware Systems. It is a popular free/mainstream alternative to MetaTrader 4, MetaTrader 5, and TradingView. The trading platform is particularly designed to meet the needs of No Dealing Desk Brokers, meaning is The trading platform is popular with scalpers due to its fast execution speed and depth of market (DoM).

Like all platforms, it has strengths and weaknesses. We have compared cTrader vs MT4 in the past.

| cTrader | MetaTrader 4 | |

|---|---|---|

| Programming Languages | C# | MQL4 & MQL5 |

| One-click trading | ✔ | ✔ |

| Online community | Small | Huge |

| Built-in technical indicators | +70 | 30 |

| Experts Advisors (EAs) or trading robots | +270 | +15,000 |

| Custom indicators | +860 | +7,000 |

| Execution Model | ECN+STP | ECN |

cTrader

Compared to MetaTrader 4, the cTrader platform has more advanced trading and analysis capabilities, offering the ability to assess market depth in greater detail, access a larger number of indicators and timeframes, and use various sophisticated order types. It also has an inbuilt trading performance dashboard and is generally suited to more experienced and professional traders who adopt scalping and day trading strategies.

You can access the cTrader platform via the webtrader, the desktop app, and the mobile/tablet app.

Fondex cTrader Trade – Web, Desktop

The Fondex Trade platform offers over 70 pre-installed indicators and provides you with trading ideas from Autochartist which we think is a helpful feature.

They also provide you with a market sentiment gauge, a depth of market order book, and advanced order types including advanced take profit orders, advanced stop loss orders, one cancels the other (OCO) orders, and trailing stops.

The Trade platform is also accessible via webtrader, mobile, and desktop apps.

Fondex cTrader Mobile

Fondex cTrader Copy

Fondex’s copy trading platform has won a couple of awards for best trade execution and platform and provides you with access to a wide range of other traders’ trading strategies.

We checked out the platform, and the user interface is fairly decent, allowing you to easily browse and assess each strategy using its profitability/equity curve.

You can also allocate multiple copy strategies and combine them with algorithmic and manual trading, which is a cool function.

Each copy trading strategy is automatically placed in a separate account from the other strategies, allowing for better risk management. Additionally, if you want to increase or reduce exposure to a specific strategy, you can do so without needing to close the position entirely.

The Copy trading platform is accessible via the web trader, mobile app, and desktop app.

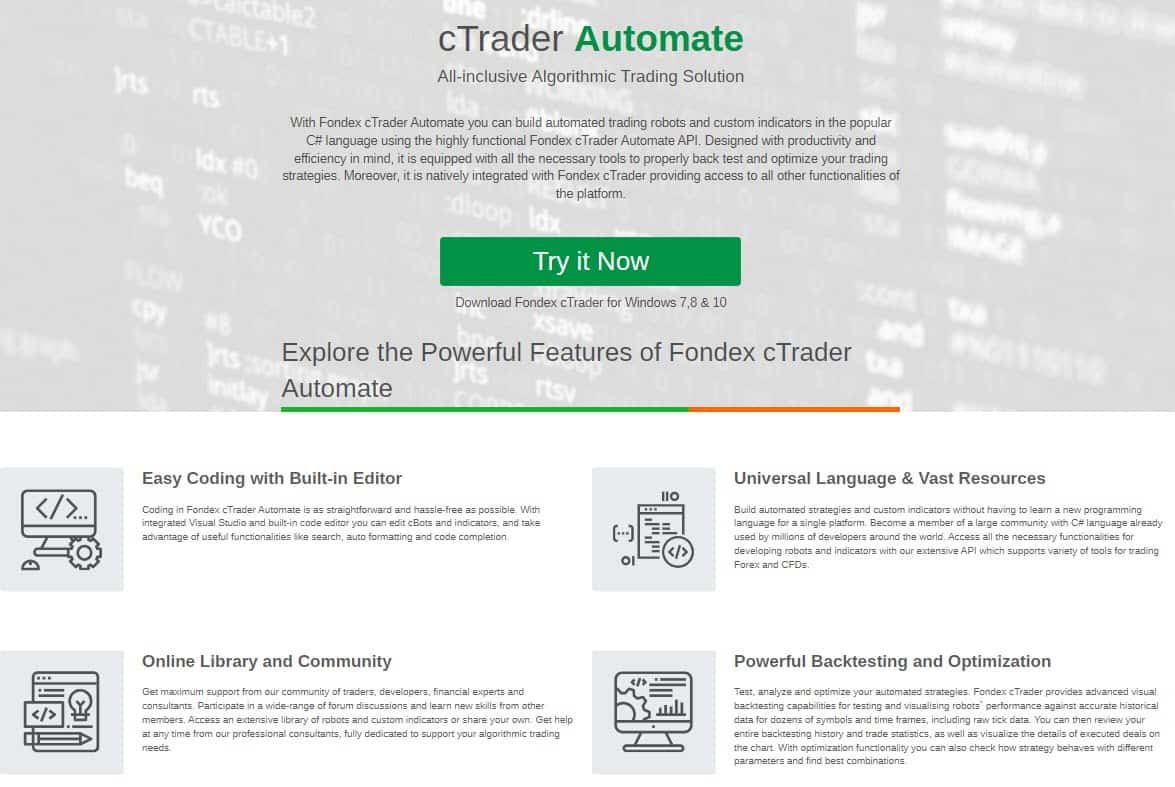

Fondex cTrader Automate

The Automate platform (formerly called cAlgo) allows you to use a range of trading robots that are accessible via the cBots library. There are a range of pre-packaged cBots to choose from including trend-based and range-based automated trading strategies. Alternatively, you can create your own if you have the programming skills.

Importantly, you can use automated MetaTrader robots and expert advisers (EAs) with Fondex cTrader, which is a big plus but requires some technical knowledge. You can only access the Automate platform via the desktop app.

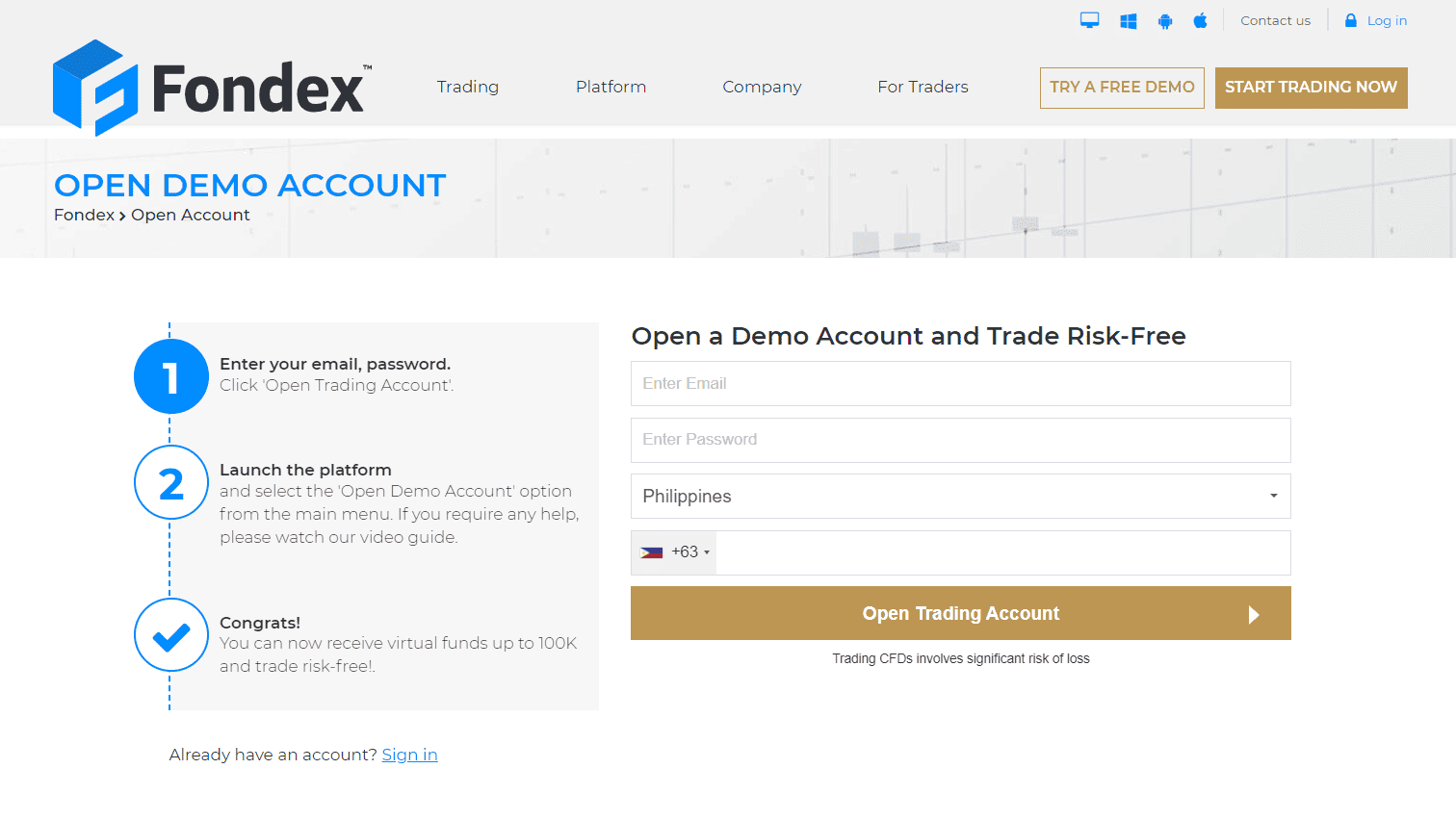

Demo account

Fondex does offer a demo account that lets you test the cTrader platform using real-time market data. Click ‘Start trading’ from the top-right of the broker’s website or ‘Open a demo account’ from the homepage and it will load the cTrader workspace. You can start to get a feel for the platform and if you like it, you can easily set up a client account by adding your KYC details.

The demo account is good for 30 days and is easily transferable into a real account. We think this is a good call from Fondex, especially as many traders are used to using MetaTrader rather than the cTrader platform.

Verdict

Overall, we think the functionality offered by Fondex via cTrader is good. Still, the lack of a proprietary platform combined with the lack of integration with MetaTrader 4 and TradingView caused the broker to lose marks based on the out-scoring methodology.

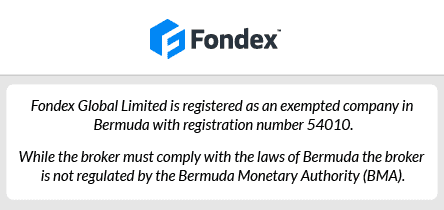

Is Fondex Safe?

Fondex is slightly shifty or vague about its regulatory status, which was why it scored 28 out of 100.

1. Regulation

Their website states the following: “Fondex Global Limited is an exempted Company incorporated and registered under the law of Bermuda with registration number 54010.”

| Fondex Safety | Regulator |

|---|---|

| Tier-1 | X |

| Tier-2 | X |

| Tier-3 | BMA |

We asked Fondex customer service via live chat if they are regulated, and they repeated that they are registered and incorporated under the law of Bermuda. So there is no confusion, we checked the Bermuda Business Registry and can see they are registered as a company in Bermuda.

After checking the business registry, we then checked the Bermuda Authority Website (BMA) and there is no mention of Fondex so we can confirm the broker is not regulated. To hold a regulatory licence to offer Forex trading services with the BMA the broker needs to hold a “Class F” licence meaning the broker can operate as a digital asset derivative exchange provider.

We think it is a shame Fondex chose not to hold a regulatory licence with the BMA and operate purely as an offshore broker since it would add a lot of credibilities. IG Markets one of the world’s largest and most regulated CFD brokers holds this “Class F” licence for example.

Two final points to note – we found some suggestions on other broker review websites that Fondex is regulated by the Cyprus Securities and Exchange Commission (CySEC). While this may have been correct once, they no longer are.

We also received a popup when we checked the Fondex website that would be taken over by TopFX Ltd., a broker regulated by the Financial Services Authority (FSA) in Seychelles. We asked Fondex customer support about this and this does not appear to be happening now.

While this idea appears abandoned, we wonder about the longevity of Fondex as a company.

2. Reputation

Fondex was established in 2017 in Cyprus. With approximately 2,900 monthly Google searches, it ranks as the 60th most popular forex broker among the 65 brokers analyzed. Web traffic data confirms this limited presence, with Similarweb reporting just 8,000 global visits in February 2024, positioning Fondex as the 64th most visited broker.

Fondex is also a relatively newer entrant to the market. The broker doesn’t publicly disclose its client numbers or trading volumes, but its extremely limited search and traffic metrics suggest a niche operator rather than a broker with broad market penetration. Despite its low visibility rankings, Fondex has worked to differentiate itself through its cTrader-exclusive platform offering, targeting a specific segment of algorithmic and copy traders.

| Country | 2025 Monthly Searches |

|---|---|

| Colombia | 1,600 |

| France | 170 |

| India | 90 |

| Indonesia | 90 |

| United States | 70 |

| Australia | 70 |

| Sweden | 50 |

| Canada | 40 |

| Mexico | 30 |

| Germany | 30 |

| Turkey | 30 |

| Ecuador | 30 |

| United Kingdom | 20 |

| Spain | 20 |

| Peru | 20 |

| Argentina | 20 |

| Italy | 20 |

| Egypt | 20 |

| Venezuela | 20 |

| Algeria | 20 |

| Uzbekistan | 20 |

| Malaysia | 10 |

| Nigeria | 10 |

| South Africa | 10 |

| Pakistan | 10 |

| Singapore | 10 |

| United Arab Emirates | 10 |

| Kenya | 10 |

| Philippines | 10 |

| Bangladesh | 10 |

| Brazil | 10 |

| Japan | 10 |

| Ghana | 10 |

| Thailand | 10 |

| Saudi Arabia | 10 |

| Cambodia | 10 |

| Sri Lanka | 10 |

| Bolivia | 10 |

| Ethiopia | 10 |

| Netherlands | 10 |

| Vietnam | 10 |

| Tanzania | 10 |

| Morocco | 10 |

| Dominican Republic | 10 |

| Uganda | 10 |

| Botswana | 10 |

| Poland | 10 |

| Hong Kong | 10 |

| Taiwan | 10 |

| Chile | 10 |

| Cyprus | 10 |

| New Zealand | 10 |

| Costa Rica | 10 |

| Jordan | 10 |

| Portugal | 10 |

| Switzerland | 10 |

| Ireland | 10 |

| Mongolia | 10 |

| Mauritius | 10 |

| Austria | 10 |

| Greece | 10 |

| Panama | 10 |

| Uruguay | 10 |

1,600 1st | |

170 2nd | |

90 3rd | |

90 4th | |

70 5th | |

70 6th | |

50 7th | |

40 8th | |

30 9th | |

30 10th |

3. Reviews

Despite their lack of regulation, they have a great TrustPilot score of 4.5/5.

Verdict

Given the above, we ranked Fondex very poorly regarding broker trust and safety.

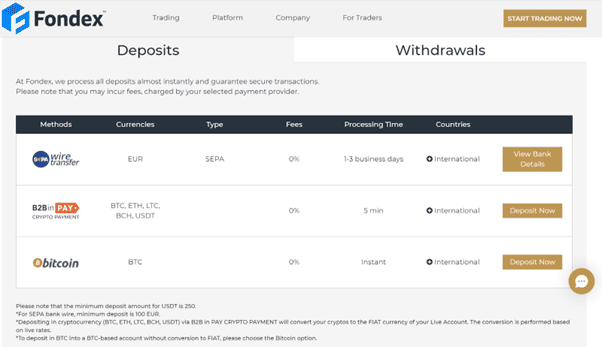

Deposit And Withdrawal

Fondex also has a fairly limited range of funding options, but it offers the ability to fund your account using cryptocurrency or fiat currency.

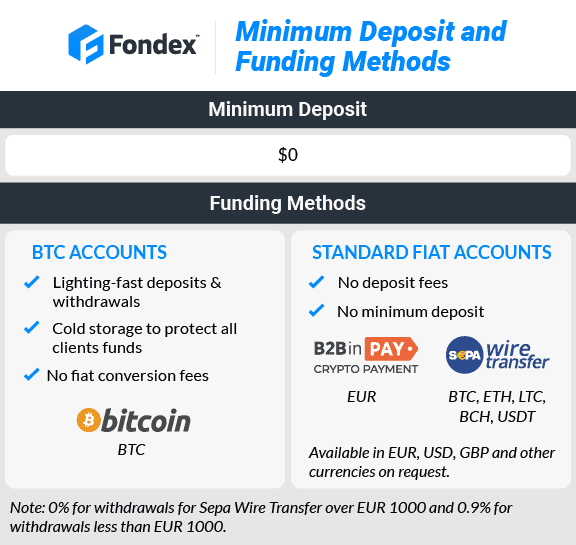

What is the minimum deposit at Fondex?

Fondex states in various places on its website that they don’t have a minimum, but this appears to be contradicted elsewhere.

For example, their funding page in small fine print clearly states certain limitations, including a €100 minimum deposit via bank transfer and a 250 USD minimum deposit.

After speaking with customer service, we discovered that Fondex has minimum deposits. Hence, the branding used extensively across their website appears disingenuous and misleading.

Account Base Currencies

While you can fund your account with Bitcoin and a range of fiat currencies including USD, EUR, GBP, and more (including with cryptocurrency conversion), we think the funding options are pretty limited overall, especially considering they are missing some key providers like PayPal, NETELLER and Skrill.

Deposit Options and Fees

Fiat accounts

For fiat accounts, you can fund your account via a SEPA wire transfer (a bank transfer), which takes 1-3 business days. This obviously isn’t ideal if you’re rushing to get your account funded quickly, but on the plus side, Fondex does not charge fees.

The alternative option is B2B in Pay, which can only be used to fund your trading account with cryptocurrency. This option will automatically convert your crypto to the fiat currency your account is denominated in.

Cryptocurrencies that can be used to fund your account include Ethereum (ETH), Litecoin (LTC) and Tether (USDT).

Fondex states they don’t charge fees for this funding option either, but from our research, it looks like B2B in Pay possibly does, so do check before funding your account.

Bitcoin accounts

One of the things we do like about Fondex is you can choose to denominate your trading account in Bitcoin. Again, there are two options to fund your account: directly using a Bitcoin address or via B2B in Pay.

Deposits are processed almost instantly if funded directly from a Bitcoin wallet but take a little longer when using B2B in Pay. With this option, there are no conversion fees, and the Bitcoin is stored securely in ‘cold storage.’

Deposit bonus

While Fondex does offer a deposit bonus when you first deposit funds into your account, it’s important to recognise that many regulators have banned these sorts of strategies.

It should go without saying that it’s always important to focus on the quality and features of a forex broker, rather than any incentive they might be offering to entice you to deposit funds.

If you are planning on taking up the offer, be aware that the deposit bonus is credited to your account only after you deposit funds and request it from the broker directly. The bonus is provided in the form of credit and is capped at $2,000, which isn’t withdrawable, effectively increasing your total trading account size.

Withdrawal Options and Fees

Traders are only charged a withdrawal fee of 0.9% when they use bank wire transfers and withdraw less than EUR 1000. You should note that a minimum of EUR 20 can be withdrawn when using Bank Wire Transfer for withdrawals.

Ease To Open An Account

Setting up an account with Fondex is easy, quick, and straightforward. To open an account, we selected “Start trading now” via their home page, at this stage, you can choose between a demo or a live account.

Should you choose a Demo account, you enter a username and password, you can even use your Gmail sign-in. There is no need to enter further details like your credit card. At this stage, you will be directed to the web version of cTrader.

To activate a live account, you can choose ‘Create a live account’, instead of Demo account or Activate Account if you are on the Demo account.

Here are the steps you need to take:

- Click on the “Start Trading Now” button at the top of the page and fill in your email address, and register a password

- Proceed to add your personal details, including name, surname, date of birth, and physical address.

- You must then complete a questionnaire that helps Fondex assess your investment knowledge, experience, and expertise. Note, if you fail the questionnaire then you won’t be able to open a live account.

- Once you pass the questionnaire, you will then be prompted to add your KYC information, which can include the following:

- Proof of Identification – Fondex accepts all government-issued identification documents such as Passports, national ID cards, driving licence, or other government-issued IDs.

- Proof of Address – Proof of residence/address document must be issued in the account holder’s name within the last 6 months and contain your full name, current residential address, issue date, and issuing authority. Once this step is complete, you can fund your account and commence trading.

We wanted to add that while the questionnaire might be considered an annoying extra step by some, we think it demonstrates Fondex’s responsibility only to serve customers who have the required knowledge to begin trading. As such, we scored Fondex highly for the account opening process. Despite this minor annoyance, the signup process is pretty straightforward.

Verdict

It’s unclear what the minimum deposit amounts are and whether processing fees are charged using their third-party crypto payment provider. The broker doesn’t specify these and the onus is put on the trader.

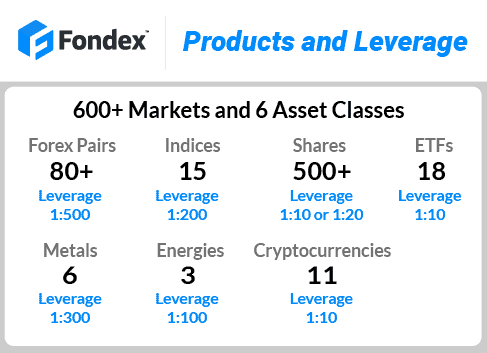

Product Range

Fondex offers a wide range of financial instruments to trade including over 80 currency pairs which is a substantial range, but they are fairly limited across other markets.

While their shares offering is decent with more than 500 to choose from, there’s no way to purchase the underlying shares.

Likewise, their indices offering is good with all the majors you would expect including the US Tech 100, US 500 and Aus 200, but they don’t offer any bonds, interest rates or options. Additionally, their commodities and energy CFDs are fairly limited.

Fondex allows leverage up to 1:500 when trading currency pairs which is pretty high. It should be said however that while excessively high leverage is never a good idea, we like the flexibility and choice it provides, leaving it up to you to select whatever leverage suits your risk appetite.

Verdict

As mentioned, we like the 1:500 leverage provided for forex pairs, and with 80+ pairs to choose from, there is plenty of selection.

We scored Fondex highly for this but we felt the overall offering was lacking across other asset classes which detracted from the overall rank.

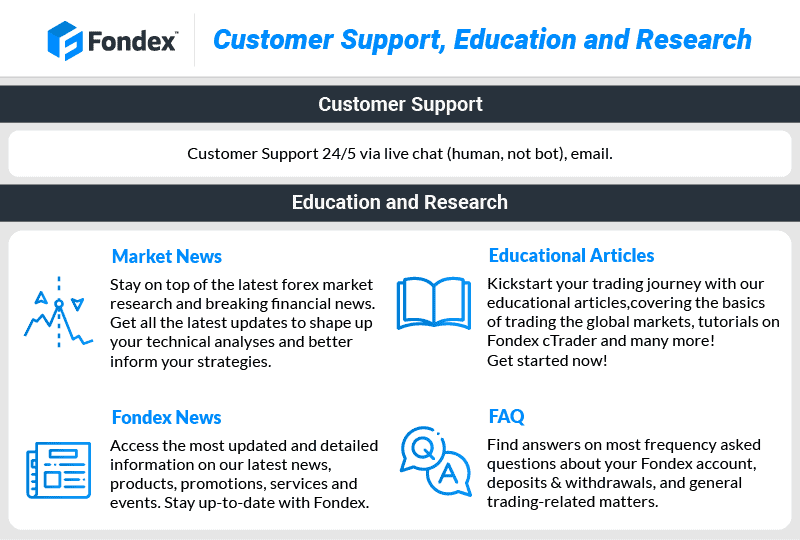

Customer Service

Fondex has live chat support (24/5), and response times are fast. Still, they don’t seem overly forthcoming with any helpful information and constantly refer you back to pages on the Fondex website.

They also offer support via phone and email in numerous supported languages, including Arabic, English, French, Greek, Russian, and Spanish.

Verdict

Despite the somewhat lacklustre responses from the customer support, we actually scored Fondex well given response times are quick and you get to speak to a real person almost immediately. Additionally, the multi-lingual support and 24/5 accessibility earned Fondex even more points.

Research and Education

Fondex has a decent range of educational-related articles and the content is fairly good, although there isn’t any way to filter or search for something you’re specifically looking for. While they have some FAQs, they aren’t very detailed and don’t provide much useful information.

Additionally, there aren’t any trading courses, webinars, or other events, and their Market News section is no longer being updated with the last post dated 6th April 2022. Likewise, the last update on the Fondex News section is from 2021.

Verdict

While we think the nature of the Educational Articles section is decent, we would have liked to see different content types including courses, training sessions, and webinars.

Also, given there is no way to filter the existing articles by topic, this makes it a little cumbersome to scroll through until you find what you’re looking for.

Considering the above, in combination with the relatively ‘lite’ FAQs and the outdated Market News and Fondex News section, we ranked Fondex as average.

Final Verdict on Fondex

For us, the big issues with Fondex are that they are unregulated, and are not always clear when presenting some of the information on their website. All that said, the broker does have a few features going for them that make them stand out among many no-dealing desk brokers who can be slightly generic at times.

The most obvious difference is that you will be using the cTrader trading platform along with cTrader Copy and cTrader Automate rather than MetaTrader 4, MetaTrader 5, or even TradingView. While cTrader is overshadowed by these other platforms, it’s a strong trading platform in its own right and comes with a Depth of Market (DoM), fast execution, and useful analysis tools which make it popular with scalpers and swing traders. Other features include decent spreads with no commission, leverage of 500:1, and account funding with cryptocurrencies.

Overall, we can’t deny that Fondex has a decent offering, we just wish they were regulated, preferably with a tier 1 broker.

Fondex FAQs

What is the minimum deposit at Fondex?

Fondex has a $0 minimum deposit, as stated on its website. Upon closer inspection, their funding page clearly states certain limitations in small fine print. These limitations include a €100 minimum deposit via bank transfer and a 250 USD minimum deposit.

What Demo Account Does Fondex Offer?

Fondex provides a demo account for real-time testing of the cTrader platform. The demo account is transferable into a real account and valid for 30 days.

Is Fondex a Safe Broker?

Despite not being regulated by top-tier bodies, Fondex can still be considered a safe broker.

What Leverage Does Fondex Offer?

Fondex offers leverage of up to 1:500 for retail and professional traders trading Forex pairs. It is recommended to trade with high leverage only if you have sufficient trading experience and are capable of handling any market movements against you.

What are the payment methods for Fondex?

You can deposit and withdraw funds through various payment methods, including bank wire transfer, e-wallets, and credit cards.

Compare Fondex Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert