FP Markets vs Blueberry Markets: Which One Is Best?

Blueberry Markets and FP Markets offer spreads from 0.0 pips, two account types and MetaTrader 4 and 5. However, key differences set them apart. After assessing their features, FP Markets takes the lead in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five key differences between FP Markets and Blueberry Markets:

- FP Markets uses at least 14 major banks and financial institutions as liquidity providers.

- FP Markets has operated since 2005, making it one of the oldest online forex trading brokers.

- Blueberry Markets has slightly lower fees on their standard and commission accounts.

1. Lowest Spreads And Fees – FP Markets

Blueberry Markets and FP Markets are competitive brokers offering diverse features. FP Markets excels with tighter spreads for major forex pairs like EUR/USD and AUD/USD, beating industry averages. Blueberry Markets provides slightly higher spreads but compensates with reliable execution and a straightforward fee structure. Both offer commission accounts with spreads as low as 0.0 pips, ensuring cost-effective trading for high-volume traders. FP Markets stands out with greater transparency in commission costs and a broader pool of liquidity providers, enhancing its appeal for traders seeking precision and lower trading costs.

Spreads

FP Markets offers tighter spreads for major pairs like EUR/USD (0.10 pips) and AUD/USD (0.30 pips), which are the same spreads as Blueberry Markets in this area. Blueberry Markets provides competitive spreads but lacks transparency in average spread data.

| RAW Account | FP Markets Spreads | Blueberry Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.50 | 0.60 | 0.75 |

| EUR/USD | 0.10 | 0.10 | 0.22 |

| USD/JPY | 0.30 | 0.30 | 0.38 |

| GBP/USD | 0.40 | 0.40 | 0.53 |

| AUD/USD | 0.30 | 0.30 | 0.47 |

| USD/CAD | 0.4 | 0.8 | 0.56 |

| EUR/GBP | 0.30 | 0.30 | 0.55 |

| EUR/JPY | 0.8 | 1 | 0.80 |

| AUD/JPY | 0.80 | 0.80 | 0.96 |

| USD/SGD | 1.1 | 1.4 | 2.29 |

Commission Levels

Both charge $7.00 round-turn for standard lots, but FP Markets provides detailed commission rates across multiple currencies, ensuring clarity for traders using diverse base currencies.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| FP Markets | $3.00 | N/A | £2.25 | €2.75 |

| Blueberry Markets | $3.50 | $3.50 | N/A | N/A |

Standard Account Fees

FP Markets leads with lower spreads on standard accounts for major pairs, while Blueberry Markets maintains consistent fees but trails in spread competitiveness for certain pairs.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.20 | 1.10 | 1.70 | 1.20 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

FP Markets emerges as the leader in this segment due to its tighter spreads, transparent commission costs, and extensive liquidity provider network. Blueberry Markets remains a reliable alternative with its straightforward fee structure and consistent execution. Both contribute significantly to the forex trading landscape, offering tailored solutions for diverse trader needs. However, FP Markets’ focus on cost-effectiveness and precision positions it as the preferred choice for traders seeking lower spreads and greater transparency

Our Lowest Spreads and Fees Verdict

Thanks to its tighter spreads and transparent commission cost, FP Markets dominates in this field of having the lowest spreads and fees.

BlueBerry Markets ReviewVisit BlueBerry Markets

2. Better Trading Platform – FP Markets

Blueberry Markets and FP Markets deliver robust trading platform options, yet FP Markets leads with its inclusion of cTrader, TradingView, and a proprietary platform. Both offer MetaTrader 4 and 5, ensuring access to cutting-edge tools for charting and algorithmic trading. FP Markets enhances its offering with advanced features like AutoChartist and social trading via Myfxbook, while Blueberry Markets remains more focused on MetaTrader tools without additional customisation. These distinctions make FP Markets a preferred choice for traders seeking a diverse variety of platforms and enhanced analytics capabilities, fostering a more versatile trading experience.

Metatrader

Both provide MeatTrader 4 and 5 platforms, allowing traders access to automated trading and technical analysis tools. FP Markets excels with a superior product range integration across its MetaTrader platforms, including over 900 instruments.

| Trading Platform | FP Markets | Blueberry Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

Advanced Platforms

FP Markets offers cTrader, TradingView, and IRESS for a seamless and transparent trading experience. Blueberry Markets focuses solely on MetaTrader but lacks additional advanced platform options.

Alongside their MetaTrader platform offerings, FP Markets provides Australian traders with IRESS and non-Australian traders with their proprietary social-trading app.

IRESS is a web-based trading platform that provides you with access to over 10,000 stocks on a range of global markets. FP Markets’ IRESS uses Direct Market Access (DMA) to increase transparency for you, allowing you to clearly see where in the queue your order is.

Copy Trading

Both enable copy trading; FP Markets takes it a step further with Myfxbook integration and a mobile social-trading app, enhancing accessibility and collaboration for new traders.

While both FP Markets and Blueberry Markets provide you with the MT4 platform, we find FP Markets’ offering is superior for the following reasons:

- MT4 is designed for forex trading, so it helps if you have lots of forex pairs to trade. FP Markets lets you trade 63 different pairs, while Blueberry Markets has 38 forex pairs.

- MT4 Traders Toolbox: FP Markets provides 12 online trading tools to use with MT4. These are EAs, such as risk management tools and indicators.

- MyFxBook for social trading, Blueberry Markets, does not provide such an option with MetaTrader 4.

- AutoChartist for more drawing and technical analysis capabilities. Blueberry Markets does not provide this or similar.

FP Markets emerges as the leader in trading platforms by providing an extensive range of advanced options like cTrader, TradingView, and a proprietary social-trading app. These features, combined with superior integration of advanced tools like AutoChartist, make FP Markets ideal for traders seeking diversity and customisation. Blueberry Markets offers reliability and user-friendly access to MetaTrader but lacks the breadth and innovation seen in FP Markets’ platform portfolio. These brokers elevate the forex trading experience, but FP Markets’ wider platform offerings distinguish it as the top choice.

Our Better Trading Platform Verdict

In light of having advanced platforms like cTrader, TradingView, and IRESS, FP Markets ranks highest in this category.

3. Superior Accounts And Features – FP Markets

FP Markets and Blueberry Markets provide robust account options catering to varied trading preferences. Both offer Standard and RAW Spread accounts that emphasise cost-effectiveness and transparency. FP Markets, however, excels by providing a SWAP-Free Islamic account, uniquely accommodating traders adhering to Sharia law principles. Blueberry Markets lacks this specialized option, limiting flexibility for Muslim traders. FP Markets charges administration fees for these accounts instead of overnight swap charges, ensuring compliance. Overall, FP Markets delivers a more inclusive account structure, targeting a global trader audience with broader customisation than Blueberry Markets’ simplified offerings.

FP Markets stands out in offering swap-free Islamic accounts on both Standard and RAW Spread options, a vital feature for traders following Sharia law. By replacing swaps with administration fees, FP Markets allows overnight positions without compromising Islamic principles, a significant advantage for Muslim traders. Blueberry Markets, while providing solid Standard and RAW accounts, does not extend this flexibility to swap-free options, limiting its appeal. Beyond this, both cater to active traders with transparent fee structures, yet FP Markets enhances its platform with unique features like diversified account types and administration fee transparency, ensuring a comprehensive trading experience.

| FP Markets | Blueberry Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

FP Markets leads the segment with its thoughtful inclusion of Swap-Free Islamic accounts, accommodating a more diverse trader demographic. Its commitment to transparency and customisation reflects its global focus. While Blueberry Markets offers reliable account types suited to straightforward trading, it falls short in flexibility. Both contribute meaningfully to the forex industry by prioritising trader needs, yet FP Markets’ tailored solutions elevate its position as the preferred broker for those seeking inclusivity and adaptability. Blueberry Markets appeals to a focused audience, but FP Markets’ proactive features make it a standout choice.

Our Superior Accounts and Features Verdict

By offering Swap-Free Islamic accounts and diverse customisation, FP Markets shines in this category of having superior accounts and features.

4. Best Trading Experience And Ease – FP Markets

FP Markets and Blueberry Markets prioritise a seamless trading experience. FP Markets excels with a robust suite of tools like AutoChartist and Myfxbook integration, enhancing decision-making and customisation. Blueberry Markets shines with an intuitive platform tailored to beginners, fostering a straightforward experience. Reliable customer support is a common strength, addressing trading concerns efficiently. Execution speeds are commendable for both, but FP Markets edges out with after-market order performance (96ms compared to Blueberry Markets’ 94ms). These brokers cater to diverse trader needs, ensuring accessibility and efficiency across different expertise levels.

In our comprehensive analysis of FP Markets and Blueberry Markets, we delved deep into the user experience and ease of trading. From the onset, it’s evident that both brokers have made significant efforts to ensure traders have a seamless experience. Here’s what we found:

- FP Markets offers a robust range of trading tools, enhancing the overall trading experience.

- Blueberry Markets, while not as extensive in tools, provides a straightforward and intuitive platform, especially for beginners.

- Both brokers have reliable customer support, which is crucial for addressing any trading concerns.

- Our tests showed that the execution speed of trades was commendable for both, with minimal slippage.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| FP Markets | 225ms | 31/36 | 96ms | 8/36 |

| BlackBull Markets | 88ms | 6/36 | 94ms | 7/36 |

FP Markets enhances trading ease with advanced tools and platforms, making it an excellent choice for experienced traders seeking flexibility. Its integration of AutoChartist ensures detailed technical analysis, while Myfxbook support enriches social trading experiences. For beginners, Blueberry Markets offers a clean and intuitive interface, simplifying navigation and trading processes. Both ensure minimal slippage and reliable execution, but FP Markets ‘ superior market order speed provides traders a competitive advantage in fast-moving markets. With Supportive customer service and practical tools, these brokers elevate the forex trading landscape, contributing significantly to user satisfaction and efficiency.

FP Markets leads this segment with its sophisticated trading tools and faster market order execution, offering unparalleled flexibility and precision for advanced traders. Blueberry Markets remains a dependable alternative for beginners, emphasising straightforward platform design and accessibility. Both shine by ensuring reliability and efficient user experiences. However, FP Markets’ feature-rich approach sets it apart as the go-to choice for traders seeking high-performance tools and a refined trading environment. Together, they demonstrate a commitment to fostering better trading experiences across the industry.

Our Best Trading Experience and Ease Verdict

In terms of having advanced tools and faster market order execution, FP Markets takes the cake in this category, thanks to their best trading experience and ease.

5. Stronger Trust And Regulation – FP Markets

FP Markets and Blueberry Markets differ significantly in trust and regulation. FP Markets boasts a higher trust score of 64, which is supported by tier-1 regulation from ASIC (Australia) and CySEC (Cyprus), enabling services across the European Union. Blueberry Markets, with a trust score of 46, is regulated by ASIC and SCB (Bahamas), offering offshore protection for non-European traders. FP Markets’ longevity since 2005 and broader regulatory reach enhance its credibility, while Blueberry Markets, founded in 2015, focuses on localised reliability. Both cater to distinct trader demographics, but FP Markets’ global regulatory presence gives it a competitive edge.

FP Markets Trust Score

Blueberry Markets Trust Score

Regulations

Both have impressive review scores; FP Markets and Blueberry Markets boast 76 compared to 80, and trust scores of 64 over 46. Let us see how they go further with their other features and platforms.

FP Markets excels in regulatory coverage, ensuring compliance across major jurisdictions like Europe and Australia. Its CySEC regulation allows seamless access for European traders, while ASIC oversight guarantees stringent standards for Australian clients. Blueberry Markets, though reliable under ASIC, lacks European authorisation, limiting its reach. However, its SCB regulation provides offshore protection, appealing to traders outside Europe and Australia. FP Markets’ higher online search volume and TrustPilot ratings reflect its popularity and established reputation. Both contribute to the forex industry, but FP Markets’ multi-region compliance and longer market presence position it as the more versatile choice.

| FP Markets | Blueberry Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) | SVG-FSA |

FP Markets leads in trust and regulation with its extensive tier-1 oversight and global accessibility. Its CySEC regulation ensures compliance for European traders, while ASIC guarantees reliability for Australians. Blueberry Markets remains competitive with its SCB protection for non-European clients, offering localised security. Both enhance trader confidence through their regulatory frameworks, yet FP Markets’ broader reach and higher trust score make it the preferred option for traders seeking global reliability. Together, they highlight the importance of regulation in fostering trust within the forex industry.

Reviews

FP Markets holds an impressive Trustpilot score of 4.9 out of 5, based on around 9,000 reviews. Blueberry Markets has a solid Trustpilot score of 4.7 out of 5, with around 2,900 reviews. FP Markets shows broader user satisfaction and consistency, while Blueberry Markets remains a well-regarded broker with a loyal client base.

Our Stronger Trust and Regulation Verdict

By highlighting its tier-1 regulation and its global reach, FP Markets just outperforms in this segment of having stronger trust and regulation.

6. Most Popular Broker – FP Markets

FP Markets gets searched on Google more than Blueberry Markets. On average, FP Markets sees around 49,500 branded searches each month, while Blueberry Markets gets about 22,200 — that’s 55% fewer.

| Country | FP Markets | Blueberry Markets |

|---|---|---|

| Italy | 12,100 | 320 |

| India | 2,900 | 880 |

| United Kingdom | 2,400 | 1,900 |

| South Africa | 2,400 | 480 |

| Australia | 1,900 | 1,000 |

| Greece | 1,900 | 50 |

| United States | 1,600 | 1,300 |

| Spain | 1,600 | 320 |

| Canada | 1,600 | 1,900 |

| Germany | 1,300 | 1,000 |

| Pakistan | 1,300 | 320 |

| France | 880 | 1,600 |

| Thailand | 720 | 110 |

| Malaysia | 720 | 480 |

| Poland | 720 | 110 |

| Bangladesh | 720 | 170 |

| Turkey | 720 | 210 |

| Brazil | 590 | 210 |

| Morocco | 590 | 210 |

| Indonesia | 590 | 320 |

| Singapore | 590 | 480 |

| Nigeria | 590 | 480 |

| Kenya | 590 | 110 |

| United Arab Emirates | 480 | 170 |

| Netherlands | 480 | 320 |

| Switzerland | 480 | 170 |

| Cyprus | 480 | 50 |

| Philippines | 390 | 590 |

| Vietnam | 320 | 260 |

| Colombia | 260 | 170 |

| Algeria | 210 | 70 |

| Saudi Arabia | 210 | 50 |

| Egypt | 210 | 70 |

| Sweden | 210 | 140 |

| Taiwan | 210 | 30 |

| Portugal | 210 | 110 |

| Cambodia | 210 | 20 |

| Mexico | 170 | 90 |

| Hong Kong | 170 | 70 |

| Austria | 170 | 170 |

| Sri Lanka | 140 | 50 |

| Argentina | 140 | 50 |

| Japan | 140 | 70 |

| Venezuela | 110 | 30 |

| Ethiopia | 110 | 30 |

| Tanzania | 110 | 40 |

| Ireland | 90 | 90 |

| Peru | 70 | 30 |

| Ecuador | 70 | 30 |

| Dominican Republic | 70 | 50 |

| Uzbekistan | 70 | 70 |

| Ghana | 70 | 70 |

| Chile | 70 | 20 |

| Uganda | 70 | 50 |

| Jordan | 70 | 20 |

| Botswana | 50 | 50 |

| New Zealand | 40 | 260 |

| Bolivia | 30 | 10 |

| Mauritius | 20 | 20 |

| Costa Rica | 20 | 10 |

| Panama | 20 | 10 |

| Mongolia | 10 | 10 |

12,100 1st | |

320 2nd | |

2,900 3rd | |

880 4th | |

2,400 5th | |

1,900 6th | |

1,900 7th | |

1,000 8th |

Similarweb shows a similar story when it comes to February 2025 website visits with FP Markets receiving 482,000 visits vs. 265,000 for Blueberry Markets.

Our Most Popular Broker Verdict

FP Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Top Product Range And CFD Markets – FP Markets

FP Markets and Blueberry Markets offer commendable CFD product ranges with unique strengths. FP Markets leads with a vast 10,000+ share CFDs (with IRESS), 63 forex pairs, and access to 12 cryptocurrencies. Blueberry Markets, while more focused on specific products, excels in commodities with nine metals (including unique currency pairings), 140 ETFs, and 300+ share CFDs, ensuring diversity for specialised traders. Both provide 19 indices, reflecting competitive options for index trading. Their offerings are robust, but FP Markets’ sheer product volume across a wider spectrum makes it a strong contender for traders seeking extensive market access.

When it comes to the range of products and CFD markets, both FP Markets and Blueberry Markets have their strengths. Here’s a detailed comparison:

| CFDs | FP Markets | Blueberry Markets |

|---|---|---|

| Forex Pairs | 63 | 38 |

| Indices | 19 | 19 |

| Commodities | 4 Metals (vs USD, AUD, EUR) 4 Energies 5 Softs | 9 Metals (Gold x 7 Currencies) (Silver x 6 Currencies) 3 Energies |

| Cryptocurrencies | 12 | 10 |

| Shares CFDs | 10000+ (with IRESS) 814 (with MT5) | 300+ |

| ETFs | 46 | 140 |

| Bonds | 2 | No |

| Futures | No | No |

| Treasuries | 2 | No |

| Investment | No | No |

Blueberry Markets builds its reputation through targeted diversity, particularly in commodity trading, with detailed offerings in metals and energy markets. Its range of 140 ETFs appeals to investors aiming for diversified portfolios. Conversely, FP Markets provides unparalleled depth with an extensive 10,000+ share CFDs, thanks to its IRESS platform. The broker also integrates bonds and treasuries, broadening investment opportunities for those seeking traditional financial instruments. Both cater to cryptocurrency traders, but FP Markets offers a slight edge with 12 options versus Blueberry Markets’ 10. Together, these brokers contribute immensely to the industry by offering traders flexible paths to success

FP Markets takes the lead with its unmatched product range and breadth, particularly excelling in shares, bonds, and treasuries. Blueberry Markets remains a dependable alternative for commodity and ETF traders. Both enhance the forex trading industry by addressing diverse trader needs. FP Markets’ extensive offerings, including IRESS, provide superior market access for those exploring broader instruments. However, Blueberry Markets’ commodity-specific focus ensures targeted opportunities for niche investors. Collectively, they showcase the importance of customisation and variety in ensuring trader success, yet FP Markets’ expansive reach places it ahead in this segment.

Our Top Product Range and CFD Markets Verdict

With their extensive range and variety of CFDs and markets available, FP Markets tops this category due to their top product range and CFD markets.

8. Superior Educational Resources – FP Markets

FP Markets and Blueberry Markets prioritise trader education, but their approaches and depth differ. FP Markets delivers a comprehensive suite of resources, including webinars, seminars, workshops, e-books, and detailed market analysis. This structured learning path caters to traders at every skill level. Blueberry Markets focuses on accessible resources like live webinars, tutorials, and market news updates, offering practical insights from experts. While both support beginner to advanced learning, FP Markets stands out with its in-depth content and structured courses. Blueberry Markets provides a streamlined approach suited for traders seeking concise, actionable knowledge.

FP Markets:

- Provides a comprehensive range of educational materials.

- Offers webinars, seminars, and workshops for traders.

- Features an extensive library of eBooks and articles.

- Has a dedicated section for market analysis and insights.

- Supports beginner traders with a structured learning path.

- Offers advanced courses for experienced traders.

Blueberry Markets:

- Offers a variety of educational resources tailored for traders.

- Features regular webinars and live trading sessions.

- Provides access to a wide range of eBooks and tutorials.

- Has a section dedicated to market news and updates.

- Supports traders with beginner to advanced courses.

- Provides insights and strategies from expert traders.

FP Markets builds a robust educational foundation with diverse offerings like workshops, webinars, and advanced e-books. These resources, paired with a dedicated section for market insights, appeal to traders committed to developing a strong strategic edge. Blueberry Markets supports its traders with practical learning tools such as live trading sessions and tutorials, ensuring immediate application of knowledge. Both empower traders with market updates and courses tailored to various skill levels. However, FP Markets takes an extra step by integrating structured paths for beginners and specialised content for advanced users, positioning itself as an all-encompassing educational partner in forex trading.

Our Superior Educational Resources Verdict

By delivering an exhaustive and structured learning experience, FP Markets scores higher in this segment of superior educational resources.

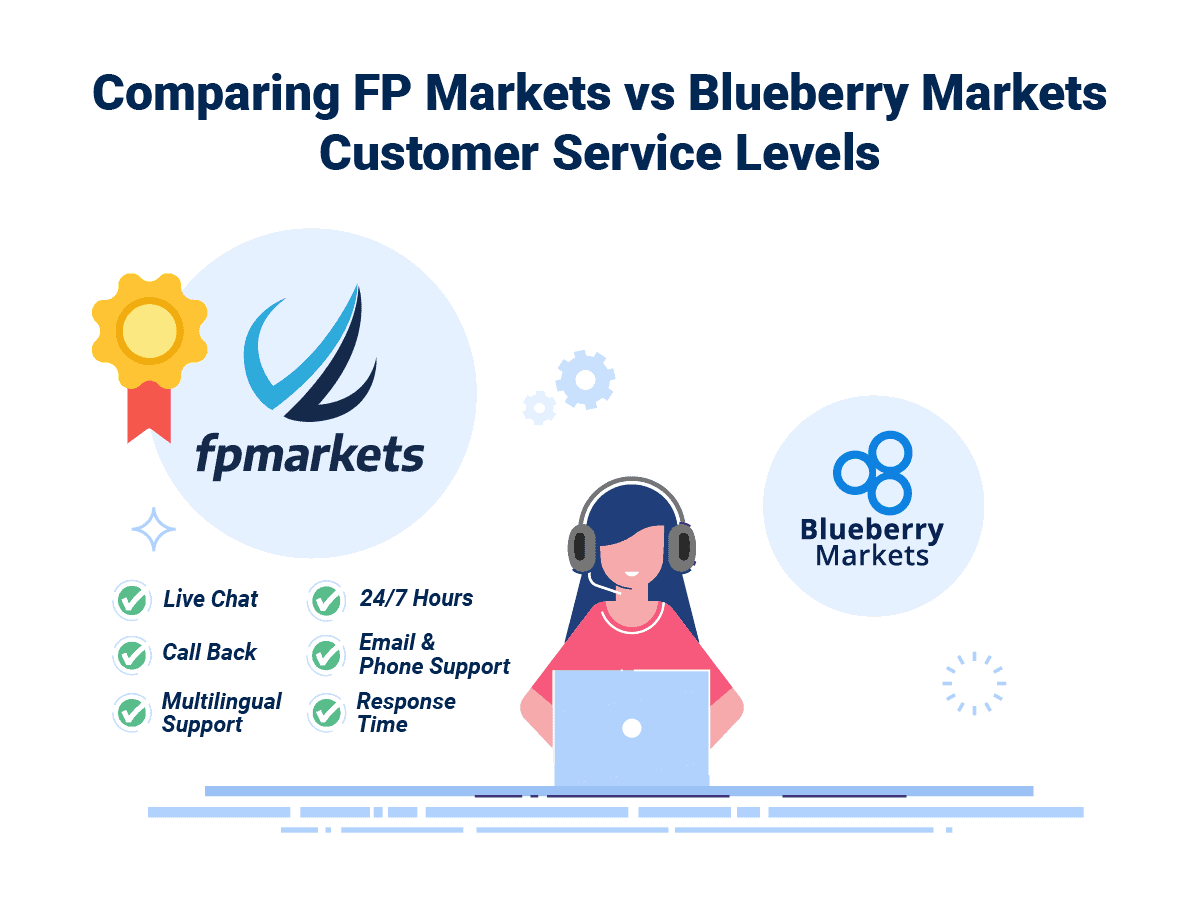

9. Superior Customer Service – FP Markets

FP Markets and Blueberry Markets excel in providing exceptional customer service, with both brokers offering 24/7 support via live chat, email, and phone. They prioritise accessibility with multilingual support, ensuring inclusivity for global traders. FP Markets enhances its customer experience by incorporating a structured and proactive support framework, addressing trader concerns with thorough assistance. Meanwhile, Blueberry Markets is known for its personable and responsive approach, consistently earning high ratings on review platforms. Their dedication to resolving trader queries promptly and effectively highlights the importance of customer care in the trading journey.

FP Markets reinforces trader confidence by delivering well-organised customer service across multiple channels. Its multilingual support ensures seamless communication for traders from diverse regions, creating a globally inclusive environment. Blueberry Marketes takes a personalised approach, earning accolades for its team’s responsiveness and problem-solving capabilities. Both foster reliability and trust, integral to building long-term trader relationships. By addressing queries with expertise and efficiency, they contribute to smoother trading experiences. FP Markets’ proactive structure appeals to traders seeking thorough assistance, while Blueberry Markets’ reputation for personable service fosters an inviting atmosphere for beginners and professionals alike.

FP Markets stands out with its structured and globalised customer service framework, ensuring comprehensive assistance for traders across various demographics. Blueberry Markets shines with its personable approach, resonating with traders who value tailored, friendly support. Both prioritise customer satisfaction and accessibility, making them reliable options for addressing trader needs. However, FP Markets’ proactive, well-rounded system offers a slight edge for those seeking extensive and efficient support. These brokers highlight the critical role of customer service in enhancing the overall trading experience

Here’s a detailed comparison of the key customer service features offered by both brokers:

| Feature | FP Markets | Blueberry Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Because of its structured, multilingual customer service framework, FP Markets secures the top spot here due to its superior customer service.

10. Better Funding Options – A Tie

FP Markets and Blueberry Markets offer diverse funding methods, ensuring accessibility and convenience. Credit/debit cards, bank transfers, PayPal, Skrill, Neteller, and crypto funding are supported by both brokers. They also cater to regional preferences with POLi/bPay for Australian and New Zealand traders. While neither broker includes Klarna or Rapid Pay, they focus on secure and flexible options that resonate with a global audience. Their shared commitment to providing various payment methods simplifies trading for clients across different regions and needs, highlighting their dedication to efficient and user-friendly financial processes.

FP Markets emphasises inclusivity by supporting a broad spectrum of funding methods, catering to traditional and modern preferences alike. Its support for crypto payments further appeals to traders seeking decentralised solutions. Blueberry Markets mirrors this versatility by offering the same range of options, ensuring smooth deposits and withdrawals. Both excel in accommodating regional needs with POLi/bPay, fostering a strong connection with Australian and New Zealand traders. Their reliability and focus on secure transactions empower users to manage their accounts effectively, contributing significantly to the forex industry by removing barriers to entry for diverse trading demographics.

However, not all funding methods are available with both brokers. To provide a clearer picture of the funding options offered by each broker, we’ve compiled a table based on our testing and the information provided on their respective websites:

| Funding Option | FP Markets | Blueberry Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

FP Markets and Blueberry Markets are neck-and-neck in providing flexible funding options for traders worldwide. Their shared support for various payment methods underscores their commitment to inclusivity and ease of transactions. Both enhance the trading experience by aligning their financial services with client expectations. Although neither offers Klarna or Rapid Pay, their robust selection of funding solutions ensures secure and efficient account management. Combined, both redefine accessibility within forex trading, yet their identical offerings make them equally strong contenders in this segment.

Our Better Funding Options Verdict

It’s a draw for both FP Markets and Blueberry Markets thanks to their better funding options.

11. Lower Minimum Deposit – A Tie

FP Markets and Blueberry Markets offer the same minimum deposit requirement of $100, ensuring consistency across all account types and funding methods. This level of accessibility accommodates a wide range of traders, making both brokers viable options for those starting their trading journey or operating within a fixed budget. Whether funding via credit/debit cards, bank transfers, or e-wallets like Skrill and Neteller, the straightforward deposit structure simplifies the onboarding process. Both maintain parity in this category, reflecting their focus on inclusivity and ease, but offering no differentiation gives either broker a competitive edge over the other.

FP Markets and Blueberry Markets streamline entry into the trading world with an identical $100 minimum deposit, ensuring affordability and consistency for traders worldwide. This deposit structure applies across all payment options, simplifying account funding and management processes. FP Markets enhances the experience by supporting multiple payment methods with strong security measures, while Blueberry Markets ensures a hassle-free setup for beginners. The low deposit requirement reflects both brokers’ commitment to lowering barriers for new traders, fostering a sense of accessibility. While their approaches are aligned in this segment, neither broker differentiates itself with innovative options for unique advantages.

Here’s a table that summarises FP markets and BlueBerry Markets deposit requirements and recommendations:

| Minimum Deposit | Recommended Deposit | |

| FP Markets | $100 | $100 |

| Blueberry Markets | $100 | $100 |

In this department, FP Markets and Blueberry Markets are evenly matched, providing the same $100 minimum deposit requirement and accommodating diverse funding methods. Both emphasise simplicity and accessibility, offering secure and efficient funding processes that support trader convenience. Their shared focus on affordability highlights a commitment to inclusivity, ensuring a smooth entry for traders with varying financial capacities. However, without unique features or options to distinguish themselves in this segment, neither broker emerges as a clear leader. Both brokers demonstrate the importance of a straightforward deposit structure in fostering confidence and engagement among traders.

Our Lower Minimum Deposit Verdict

Thanks to their equal minimum deposit requirements and funding flexibility, it’s neck-to-neck for both Blueberry Markets and FP Markets, owing to their lower minimum deposit.

Is Blueberry Markets or FP Markets The Best Broker?

FP Markets excels for both beginner and experienced traders with tailored resources, superior tools, and unmatched trading opportunities. To shine in these categories, Blueberry Markets could focus on improving specific offerings.

| Criteria | FP Markets | Blueberry Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

FP Markets: Best For Beginner Traders

FP Markets offers comprehensive educational resources, intuitive platforms, and low deposit requirements, making it ideal for beginners entering forex trading.

FP Markets: Best For Experienced Traders

FP Markets provides advanced trading tools, broader market access, and tighter spreads, creating a competitive edge for seasoned and professional traders.

FAQs Comparing FP Markets Vs Blueberry Markets

Does Blueberry Markets or FP Markets Have Lower Costs?

FP Markets generally offers lower costs compared to Blueberry Markets. They have consistently been recognised for their competitive spreads, especially during peak trading hours. For instance, their average EUR/USD spread is just 0.1 pips. For a detailed comparison of broker fees, you can check out this guide on the lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both FP Markets and Blueberry Markets offer MetaTrader 4, but FP Markets stands out due to its advanced tools and customisation options. Their MT4 platform is equipped with superior charting tools and a wider range of indicators. If you’re looking for more insights on MT4 brokers, this comprehensive list of the Best MT4 Brokers in Canada might be of interest.

Which Broker Offers Social Trading?

FP Markets offers social trading features, allowing traders to copy strategies from experienced traders. This feature is especially beneficial for beginners looking to learn from seasoned professionals. For those interested in exploring more about social trading platforms, here’s a detailed review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither FP Markets nor Blueberry Markets offer spread betting. Spread betting is a unique form of trading that’s especially popular in the UK due to its tax benefits. If you’re interested in exploring brokers that do offer this service, you can check out this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, FP Markets is superior for Australian forex traders. They are ASIC regulated, ensuring a high level of trust and security for traders. Additionally, FP Markets was founded in Australia, showcasing their deep understanding of the local market. Blueberry Markets, while also ASIC regulated, doesn’t have the same local roots. For a broader perspective on Australian forex brokers, you might find this detailed review of the Forex Brokers In Australia helpful.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe FP Markets holds an edge. While both brokers offer robust platforms and tools, FP Markets stands out with its comprehensive offerings. However, it’s worth noting that neither broker is FCA regulated or founded in the UK. If you’re keen on exploring more about UK-specific brokers, this guide on the Forex Brokers In UK might be of interest.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How long does FP Markets withdrawal take?

Withdrawal times with FP Market will vary depending on the withdrawal gateway you use. Visa and Mastercard credit cards and debit cards can take 2 to 10 business days. All other methods including bank wire, Skrill, NETELLER, PayPal and PayTrust will take 1 business day.

Is FP Markets legal in India?

FP Markets will accept clients from India.