FP Markets vs IG Group: Which One Is Best?

In this FP markets vs IG Group (IG) review, we cover each forex broker’s features, including trading accounts, fees, and products. FP markets have over 10,000 CFD products with ECN pricing, while IG has 17,000 markets and no commissions for forex.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are some key differences between FP Markets and IG:

- FP Markets offers over 10,000 CFD products with ECN pricing, whereas IG provides access to 17,000 markets without forex commissions.

- FP Markets has a minimum deposit requirement of $100, while IG requires $0.

- FP Markets offers a maximum leverage of 500:1 for professional traders, whereas IG offers up to 200:1 for its professional clientele.

- FP Markets primarily offers the MetaTrader 4 platform, while IG provides its in-house web trading platform, ProRealTime, and L2 Dealer.

- FP Markets provides access to 61 currency pairs, while IG offers a slightly larger variety with 68 currency pairs.

1. IG Group: Lowest Spreads And Fees

Many brokers publish their average spreads on their websites, which allows us to compare the spreads of different brokers. Below, we compare the spreads of IG and FP Markets along with other brokers, and this is updated each month.

ECN-Pricing Account By Broker

FP Market’s best account for Forex trading is their RAW account. This account has ECN pricing, which means prices are sourced from liquidity providers with no dealing desk. IG Group have a similar account that uses Direct Market Access (DMA) trading in place of Straight Through Processing (STP). DMA is similar to STP but is recommended to professional traders, so retail traders should not really consider it.

The table below compares FP Markets with IG along with other brokers. While IG average spreads are slightly lower on average than FP Markets for EUR/USD, it is worth noting that FP Markets has better average spreads for other currency pairs. Other brokers, such as Pepperstone and IC Markets are also excellent choices for low spreads.

To keep costs true to quotes provided by the liquidity pool, commission costs are applied instead of widening the spread. The following costs apply:

- FP Markets raw account minimum spread of 0.0 pips and USD 3/ AUD 3.50 commission per side (USD $6, AUD$7 round-turn)

- IG vary by volume you trade – the more you trade, the lower the commission. Keep in mind that the DMA account is recommended for professional traders, so you need to be trading with exceptionally high volume to get the most value.

Standard Account

The standard account has all-inclusive spreads, which means costs are wider in place of commissions. Beginner traders tend to prefer this type of account because of the simpler commission structure.

If this is the type of account you prefer, IG clearly presents better value than FP MarketsSpreads, with FP Markets starting from 1.2 pips while IG spreads start from 1.01 pips. If you wish to consider other brokers with no commissions accounts, take a look at Markets.com Review, and Pepperstone, whose spreads are similar to IG.

| Standard Account | FP Markets Spreads | IG Group Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.38 | 1.62 | 1.7 |

| EUR/USD | 1.2 | 1.13 | 1.2 |

| USD/JPY | 1.4 | 1.12 | 1.5 |

| GBP/USD | 1.5 | 1.66 | 1.6 |

| AUD/USD | 1.4 | 1.01 | 1.6 |

| USD/CAD | 1.5 | 1.98 | 1.9 |

| EUR/GBP | 1.4 | 1.71 | 1.5 |

| EUR/JPY | 1.9 | 2.27 | 2.1 |

| AUD/JPY | 1.9 | 2.06 | 2.3 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

Standard Account Spreads

When it comes to the average standard account spreads, both FP Markets and IG offer competitive rates across various forex pairs. However, there are some noticeable differences that could impact your trading decisions.

For instance, FP Markets consistently offers lower spreads on EUR/USD, USD/JPY, and GBP/USD compared to IG. This is particularly important if you’re trading these major currency pairs frequently. Lower spreads mean lower trading costs, which can significantly add up over time.

On the other hand, IG shines when it comes to AUD/USD, offering a spread of 1.01 compared to FP Markets’ 1.3. If you’re an Aussie trader or if you’re trading this pair often, IG might be a more cost-effective choice.

| | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FP Markets | $3.00 | N/A | £2.25 | €2.75 |

| IG Group | $6.00 | N/A | N/A | N/A |

Try the IG Group vs FP Markets fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 0.80 | 0.90 | 1.40 | 1.00 | 1.00 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.70 | 0.80 | 1.30 | 1.00 | 1.00 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

However, it’s crucial to consider the industry averages as well. Both FP Markets and IG have spreads that are generally below or around the industry average, indicating their competitiveness in the market. But remember, the spread isn’t the only cost to consider. Other factors such as commission fees, platform usability, and customer service should also play a role in your decision.

In my opinion, while both FP Markets and IG offer competitive spreads, FP Markets seems to have a slight edge due to its consistently lower spreads across most forex pairs. But as always, it’s essential to consider your individual trading needs and strategies when choosing a forex broker.

Our Lowest Spreads and Fees Verdict

ECN pricing account offers the lowest spreads, so we recommended this type of account to most brokers. IG DMA or Level 2 dealing account has some benefits; however, requires particular skills, so is not the best choice for most traders. If you are new to trading, then IG can be a good choice, especially if you plan to use the proprietary trading platform, which has risk management tools not found on other platforms.

FP Markets ReviewVisit FP Markets

2. Tie: Better Trading Platform

Both FP Markets and IG offer their clients the most popular trading platform, MetaTrader 4 (MT4). FP Markets clients have the option to trade CFDs and Forex on the MetaTrader 5 multi-asset platform, as well as stock trading on their proprietary software IRESS. IG offers a variety of trading platforms, including their own web platform, ProRealTime, and L2 Dealer.

| Trading Platform | FP Markets | IG Group |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

MetaTrader vs IG Trading Platform

FP Markets’ primary trading platform offered to their clients is the popular MetaTrader 4 by MetaQuotes Software, which is available across all account types. MetaTrader 4 offers one-click trading, over 60 pre-installed indicators, customisable charts, and automated trading through Expert Advisors (EAs).

Traders can choose from 5 versions of the MetaTrader 4 available for Windows, Mac, WebTrader, iOS and Android.

FP Markets clients can access ECN pricing on MT4 across 60+ currency pairs, 63 stocks, 14 indices, cryptocurrencies and commodities.

On the other hand, IG’s state-of-the-art web-based trading platform doesn’t require any installation and can be accessed directly from your web browser. IG web platform supports the following browsers: Mozilla Firefox, Google Chrome, Internet Explorer 11, Microsoft Edge and Safari (Mac only).

With the IG web-based trading platform, traders can access elite-level trading tools, including:

- Integrated news feed via Reuters, Twitter and IG expert team

- Trading alerts

- 28 indicators and 19 drawings

- Integrated access to ProRealTime

- Buy and sell signals based on chart pattern recognition

- Ability to customise a wide array of features

Mobile Trading

Mobile trading, right from the palm of your hand, is possible with both FP Markets and IG. On the one hand, FP Markets offers 3 different mobile apps (proprietary FP Markets Trading App, MT4 App, MT5 App) compatible with iOS and Android devices. FP markets mobile apps are powered with real-time pricing, user-friendly charting tools, funding options, one-click trading, easy scrolls and zooms, and so much more.

On the other hand, IG clients only have access to 2 mobile trading Apps (MT4 + IG trading platform) compatible only with Android devices. The only drawback is that iOS users need to use a progressive web app (PWA).

IG trading App offers the full dealing functionality of the web platform, including interactive price charts, 28 technical indicators, sentiment data, alerts with push notifications and advanced order types.

Unfortunately, the ProRealTime platform and the L2 Dealer platform don’t have mobile accessibility.

Trading Tools

For trading tools, IG’s MetaTrader 4 comes with 18 add-ons plus Autochartist. By comparison, FP Markets provides a suite of 12 additional trading tools and the Autochartist plugin for MT4. FP Markets MT4 Traders Toolbox includes:

- Market manager and Trade terminal – an advanced client portal

- Alarm Manager – set automated alarms when a pre-defined level is reached or an order is triggered

- Sentiment trader – gauges the market sentiment

- Trader Toolbox Connect – access the economic calendar and the latest news

Our Better Trading Platform Verdict

All in all, both forex brokers offer traders industry-leading trading platforms and excellent trading tools. IG has an exceptional choice of trading platforms, but they have a steep learning curve and are not compatible with beginner traders. On the other hand, FP Markets clients can enjoy more sophisticated trading tools and social trading features.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

3. FP Markets: Superior Accounts And Features

![]() FP Markets is a no-dealing desk (NDD) broker which reflects the type of trading accounts they offer. IG is a Market Maker, which means most of their products are spread-only products, meaning no commissions.

FP Markets is a no-dealing desk (NDD) broker which reflects the type of trading accounts they offer. IG is a Market Maker, which means most of their products are spread-only products, meaning no commissions.

Forex traders can register for a free demo account with both brokerage trading firms. FP Markets’ demo account comes with USD 100,000 in paper money with no strings attached. By comparison, IG offers a free demo account with USD 20,000 in virtual funds.

| FP Markets | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

While both forex brokers provide a positive user experience, FP Markets tops IG. FP Markets is an ECN – STP forex broker, while IG runs a market maker model. On top of that, FP Markets is more accessible to beginner traders who only require USD 100 to open a live trading account.

4. Tie: Best Trading Experience And Ease

When it comes to trading, having a seamless user experience is crucial. After conducting an in-depth analysis and our own testing, we have noticed some distinct features that set FP Markets and IG apart from each other.

- FP Markets features a user-friendly interface with easy navigation, suitable for new traders as well as experienced ones.

- On the other hand, IG’s platform offers a vast range of advanced tools and resources for experienced traders.

- IG’s mobile app stands out with its sleek design and seamless functionality. Both brokers offer mobile trading options.

- FP Markets provides comprehensive educational resources to ensure traders are well-informed to make smart decisions.

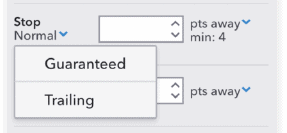

Guaranteed Stop Losses (GSLO)

As part of the risk management tools, the guaranteed stop losses can help traders minimise losses from market gapping, especially slippage. Because FP Markets offers ECN pricing and your orders are matched against liquidity providers, they are not able to offer guaranteed stop losses.

On the other hand, since IG is a market maker, they support GSLO. However, there is a GSLO premium charge for placing such orders.

Negative Balance Protection

Another risk management tool that helps traders minimise their losses is negative balance protection*. Both IG and FP Markets offer a negative balance protection policy, but only for the retail trading accounts. Professional trading accounts are not protected by the NBPP.

Note* The negative balance protection policy is a regulatory requirement in the ESMA-regulated region and the UK.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| FP Markets | 225ms | 31/36 | 96ms | 8/36 |

| IG Group | 174ms | 26/36 | 141ms | 19/36 |

When selecting a broker, it is important to consider which one aligns best with your trading style and needs, as each has its own strengths. FP Markets and IG offer unique platforms tailored to different needs.

Our Best Trading Experience and Ease Verdict

After our assessment, we found that IG provides a more robust trading platform with advanced tools, while FP Markets is more suitable for beginners due to its educational resources.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Tie: Stronger Trust And Regulation

IG Group has a high trust score of 95, with FP Markets trailing behind with 64. Our scoring was based on each broker’s regulation, reputation, and reviews from traders.

IG Group Trust Score

FP Markets Trust Score

Regulations

It’s safe to trade with both FP Markets and IG Group. Both online brokers are globally regulated across multiple tier-1 jurisdictions worldwide. FP Markets holds two tier-1 licenses compared to six tier-1 licenses held by IG.

| FP Markets | IG Group | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | JFSA (Japan) DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) | BMA (Bermuda) FSCA (South Africa) |

Reviews

As show below, FP Markets boasts an excellent rating of 4.9 out of 5 on Trustpilot, based on over 8,800 reviews. IG Group holds a Trustpilot score of 3.9 out of 5, with around 8,000 reviews. FP Markets has a significantly higher rating and far more reviews, suggesting broader and more consistent customer satisfaction compared to IG Group.

Our Stronger Trust and Regulation Verdict

Overall, both brokers are in good standing and comply with the most stringent regulatory frameworks. Regulators like FCA, ASIC and CySEC ensure a fair trading environment for all retail traders.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

6. Most Popular Broker – IG Group

IG Group gets searched on Google more than FP Markets. On average, IG Group sees around 97,080 branded searches each month, while FP Markets gets about 49,500 — that’s 49% fewer.

| Country | FP Markets | IG Group |

|---|---|---|

| France | 880 | 14,800 |

| Italy | 12,100 | 8,100 |

| Australia | 1,900 | 6,600 |

| Germany | 1,300 | 5,400 |

| Hong Kong | 170 | 5,400 |

| India | 2,900 | 4,400 |

| Sweden | 210 | 3,600 |

| United Kingdom | 2,400 | 2,900 |

| United States | 1,600 | 2,900 |

| South Africa | 2,400 | 2,400 |

| Pakistan | 1,300 | 1,000 |

| Singapore | 590 | 1,000 |

| Saudi Arabia | 210 | 1,000 |

| Malaysia | 720 | 480 |

| Netherlands | 480 | 480 |

| Taiwan | 210 | 480 |

| Austria | 170 | 480 |

| Thailand | 720 | 320 |

| Canada | 1,600 | 320 |

| Switzerland | 480 | 320 |

| Turkey | 720 | 320 |

| Portugal | 210 | 320 |

| Vietnam | 320 | 260 |

| United Arab Emirates | 480 | 260 |

| Morocco | 590 | 260 |

| Brazil | 590 | 170 |

| New Zealand | 40 | 170 |

| Japan | 140 | 140 |

| Greece | 1,900 | 140 |

| Spain | 1,600 | 110 |

| Indonesia | 590 | 110 |

| Nigeria | 590 | 90 |

| Poland | 720 | 90 |

| Mexico | 170 | 90 |

| Philippines | 390 | 90 |

| Algeria | 210 | 90 |

| Kenya | 590 | 90 |

| Ireland | 90 | 90 |

| Colombia | 260 | 70 |

| Cyprus | 480 | 70 |

| Bangladesh | 720 | 50 |

| Peru | 70 | 50 |

| Egypt | 210 | 50 |

| Argentina | 140 | 50 |

| Chile | 70 | 50 |

| Sri Lanka | 140 | 40 |

| Dominican Republic | 70 | 30 |

| Mauritius | 20 | 30 |

| Cambodia | 210 | 30 |

| Ecuador | 70 | 20 |

| Ghana | 70 | 20 |

| Jordan | 70 | 20 |

| Tanzania | 110 | 20 |

| Botswana | 50 | 20 |

| Uzbekistan | 70 | 10 |

| Venezuela | 110 | 10 |

| Uganda | 70 | 10 |

| Ethiopia | 110 | 10 |

| Mongolia | 10 | 10 |

| Costa Rica | 20 | 10 |

| Bolivia | 30 | 10 |

| Panama | 20 | 10 |

14,800 1st | |

880 2nd | |

6,600 3rd | |

1,900 4th | |

3,600 5th | |

210 6th | |

2,900 7th | |

2,400 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with IG Group receiving 9,438,000 visits vs. 482,000 for FP Markets.

Our Most Popular Broker Verdict

IG Group is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

7. Tie: Top Product Range And CFD Markets

![]() Forex traders can get 61 currency pairs at FP Markets compared to a slightly large variety of FX pairs (68 currency pairs) at IG Group. In terms of asset classes, both online brokers allow trading in index CFDs, commodity CFDs, metals, share CFDs and some cryptocurrencies.

Forex traders can get 61 currency pairs at FP Markets compared to a slightly large variety of FX pairs (68 currency pairs) at IG Group. In terms of asset classes, both online brokers allow trading in index CFDs, commodity CFDs, metals, share CFDs and some cryptocurrencies.

In addition to standard financial instruments, FP Markets offers a currency index not found with IG. But IG also provides more sophisticated trading instruments like bonds, ETFs, fixed-risk digital 100s, knock-outs, options and interest rates.

| CFDs | FP Markets | IG Group |

|---|---|---|

| Forex Pairs | 63 | 110 |

| Indices | 19 | 130 |

| Commodities | 4 Metals (vs USD, AUD, EUR) 4 Energies 5 Softs | 11 Metals 7 Energies 23 Softs |

| Cryptocurrencies | 12 | 13 (+ Crypto 10 Index) |

| Shares CFDs | 10000+ (with IRESS) 814 (with MT5) | 13000+ |

| ETFs | 46 | 2000+ |

| Bonds | 2 | 14 |

| Futures | No | Yes |

| Treasuries | 2 | 14 |

| Investment | No | Yes |

Our Top Product Range and CFD Markets Verdict

Overall, both brokers have an excellent selection of CFD products. FP Markets and IG offer a similar range of FX pairs, but IG tops FP Markets in CFD markets. We suggest using FP Markets if you’re looking to trade in the forex market, and IG if you’re interested in CFD trading.

8. FP Markets: Superior Educational Resources

FP Markets and IG have comprehensive educational content for beginners and experienced traders alike.

Trading Course

IG Academy offers an engaging course, available at beginner, intermediate, and advanced levels. FP Markets provides educational resources for beginners including the Forex 101 section, video tutorials, and a trading glossary section to help traders understand the basic concept of trading and familiarise themselves with complex forex terms.

Webinars

In addition to the trading courses, IG and FP Markets also provide live webinars that you can register for. IG Global’s team has partnered with DailyFX’s team of experts to enhance user experience.

eBooks

At FP Markets, clients can download multiple free Forex eBooks with reliable trading insights from professional traders. By comparison, we couldn’t find any eBooks on the IG website.

Blogs And News

If you want to find forex news and blogs that are disseminating the latest developments in the market, both online brokers are equally good. FP Markets offers a daily report, technical report, market insights, fundamental analysis, forex news, and essential weekly briefings in video format (Currency Point).

On the other side, IG offers forex news and trade idea sections and expert analysis of the latest news.

Our Superior Educational Resources Verdict

While the IG Academy is on par with FP Markets’ resources, we feel that the Australian-based FX broker content is better structured and easier to follow. You’re free to check them both.

9. FP Markets: Superior Customer Service

![]()

Both forex brokers have been around for a long time to be able to provide excellent customer support service.

Customer Support Comparison

FP Markets’ customer support service outpaced IG’s client support service. FP Markets offers extended client support service 24/7, including over-the-weekend support, which is not available with IG’s trading services team. IG’s customer support only runs Monday through Friday, 24 hours a day.

FP Markets staff is also available through more modern messaging services like WhatsApp, Messenger, Telegram, etc. By comparison, IG doesn’t offer such options. Additionally, at FP Markets, traders can seek help in 12 different languages. We couldn’t find whether IG offers multi-lingual support.

| Feature | FP Markets | IG Group |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

FP Markets’ help centre completes what is an award-winning customer support service. FP Markets received multiple prominent awards from Investment Trend Reports that testify to the quality of their products and services. At the same time, IG can boast industry recognition with their award-winning technology, but they don’t have any awards for their customer support service.

Our Superior Customer Service Verdict

FP Markets has been around for 16 years and delivers professional multi-lingual customer support service via traditional communication channels like live chat, email or telephone.

10. FP Markets: Better Funding Options

At FP Markets, the multi-currency account supports the following currencies: AUD, USD, EUR, GBP, SGD, HKD, NZD, CHF, CAD and CNY. At the same time, IG allows deposits and withdrawals to be made in USD, GBP, EUR, CHF, Rand and JPY.

Account Funding Options

In terms of deposit methods, both forex brokers share between them the standard methods of transferring money like credit cards, debit cards (Visa and MasterCard), plus bank transfers. It is worth mentioning that at IG, deposits made via credit cards will incur a 1% charge for Visa and a 0.5% fee for MasterCard.

At IG, the available deposit methods and minimum deposits depend on the country of residence. The table below outlines the full list of deposit and withdrawal methods and the withdrawal fees charged by IG.

| Funding Option | FP Markets | IG Group |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Additionally, FP Markets clients can fund their accounts using different electronic wallets like PayPal, POLi, BPay, Skrill, Neteller, PayTrust (local bank transfer), Fasapay, OnlinePay, and Nganluong.vn (Vietnamese clients) Dragonpay, Perfect Money.

FP Markets also offers cryptocurrency deposit solutions via LetKnowPay. Accepted cryptocurrencies for deposit include Bitcoin, Ethereum, Ripple and USDT. With FP Markets, it’s also possible to transfer your funds from one broker to another broker.

Inactivity Fee

Only IG will charge its clients an inactivity fee of $18 if their trading account becomes inactive for 24 months. Unlike most brokers, FP Markets doesn’t charge an inactivity fee. However, if your account becomes dormant and there is no activity for over 3 months, your trading account will be disabled.

Our Better Funding Options Verdict

Overall, FP Markets has more funding methods and accepts more currencies than IG. Finally, we found FP Markets does not charge any withdrawal fees, which makes this broker a better choice.

11. IG Group: Lower Minimum Deposit

![]() IG has a lower minimum deposit than FP Markets, with $0 and $100, respectively. This $0 minimum amount is possible via bank wire; otherwise, you have to pay more when opening an account with IG.

IG has a lower minimum deposit than FP Markets, with $0 and $100, respectively. This $0 minimum amount is possible via bank wire; otherwise, you have to pay more when opening an account with IG.

The table below shows the different minimum amounts for IG:

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £250 Minimum Deposit | $50 Minimum Deposit | €300 Minimum Deposit | $100 |

| Paypal | £250 Minimum Deposit | $50 Minimum Deposit | €300 Minimum Deposit | $100 |

| Bank Wire | £0 Minimum Deposit | $250 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | N/A | N/A | N/A | N/A |

With FP Markets, regardless of region or payment method, you only need to pay $100.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Paypal | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

While IG doesn’t require an initial amount, they do recommend traders start with at least $100.

| Minimum Deposit | Recommended Deposit | |

| FP Markets | $100 | $100 |

| IG | $0 | $100 |

Our Lower Minimum Deposit Verdict

Technically, IG does have a smaller minimum deposit requirement. However, with the $100 minimum they recommend, we feel that FP Markets comes close.

Is IG Group or FP Markets The Best Broker?

FP Markets is the winner because of its comprehensive offerings, competitive spreads and fees, superior accounts and features, and overall better trading experience.

The table below summarises the key information leading to this verdict:

| Criteria | FP Markets | IG Group |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platforms | ✅ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience | ✅ | ✅ |

| Stronger Trust And Regulation | ✅ | ✅ |

| CFD Product Range And Financial Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Better Customer Service | ✅ | ❌ |

| More Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

FP Markets: Best For Beginner Traders

FP Markets is recommended for beginner traders due to its user-friendly interface, comprehensive educational resources, and a lower minimum deposit requirement.

IG Group: Best For Experienced Traders

IG Group is suitable for experienced traders because of its robust platform, advanced tools, and a wide range of products and CFD markets.

FAQs Comparing FP Markets Vs IG Group

Does IG Group or FP Markets Have Lower Costs?

FP Markets generally offers more competitive spreads and fees than IG. On average, traders can find spreads as low as 0.0 pips on major currency pairs with FP Markets. IG, while competitive, tends to have slightly wider spreads. For an in-depth analysis of brokers with the most competitive commissions, delve into our Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both FP Markets and IG offer MetaTrader 4, but FP Markets is often preferred for its seamless integration and enhanced features on this platform. Traders passionate about MT4 will appreciate the offerings from FP Markets. For those keen on exploring the top brokers offering MT4, here’s our curated list of the best MT4 brokers.

Which Broker Offers Social Trading?

IG provides a form of social trading through its platform, enabling traders to emulate the strategies of market leaders. FP Markets, in contrast, doesn’t focus heavily on social or copy trading. For enthusiasts looking to dive into the world of social trading, here’s our guide on the best copy trading platforms.

Does Either Broker Offer Spread Betting?

IG offers spread betting, allowing traders to speculate on price movements without owning the underlying asset. FP Markets, on the other hand, does not provide spread betting services. For those interested in exploring spread betting further, our comprehensive guide on the best spread betting brokers can be a valuable resource.

What Broker is Superior For Australian Forex Traders?

In my opinion, FP Markets stands out for Australian Forex traders. Not only is it ASIC regulated, ensuring a high level of trust and security, but it’s also an Australian-founded company. IG, while also ASIC regulated, is originally from overseas. Both brokers offer a robust trading experience, but there’s a certain home advantage with FP Markets. For a deeper dive into the best options for Australian traders, check out this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, IG holds the edge for UK Forex traders. It’s FCA-regulated, which instills a great deal of confidence, and its roots are firmly planted in the UK. FP Markets, while offering competitive services, is not originally from the UK. When it comes to trading platforms, tools, and overall experience, IG consistently ranks high among UK traders. For those keen on understanding the UK Forex landscape better, here’s our detailed analysis of the Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does FP Markets accept crypto deposits?

Yes but only in certain regions. You can make deposits with following crypto currencies – ADA, BCH, BTC, DASH. ETH, LTC, PAX, XRP, TUSD, USDC (ERC20), USDT (ERC20), USDT (TRC20), ZEC vis LetKnowPay.