FxPro vs HYCM: Which One Is Best?

In the competitive world of forex trading, FxPro emerges as a subtle frontrunner in our comprehensive comparison with HYCM. This article explores the key factors that contribute to its victory, from trading platforms to regulatory compliance. Read on to discover how these elements define the best choice for your forex trading needs.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors between FxPro and HYCM. Here are five key differences:

- FxPro offers lower standard account spreads compared to HYCM.

- FxPro provides the cTrader platform, while HYCM does not.

- FxPro has four account types, including a dedicated spread betting platform; HYCM offers three.

- FxPro’s platforms have faster execution speeds and more advanced tools.

- FxPro is regulated by more authorities, including the FCA, CySEC, FSCA, and SCB.

1. Lowest Spreads And Fees – FxPro

When it comes to trading costs, both brokers have their advantages.

RAW Account Spreads

For traders who prefer the lowest possible spreads, both brokers offer RAW or ECN accounts. FxPro’s cTrader account and HYCM’s Raw account provide spreads as low as 0 pips. However, these accounts come with a commission per trade. You can check out our RAW Account Testing for more details.

FxPro Spreads

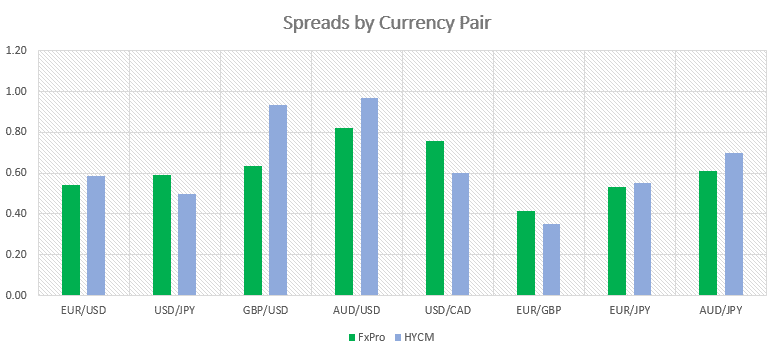

| FxPro | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.20 | 0.50 | 0.50 | 0.80 | 0.50 | 0.50 | 0.90 | 1.20 | N/A | N/A |

| BrokerChooser | 1.40 | 1.50 | 1.60 | 2.00 | 2.00 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1.27 | 1.51 |

| CompareForexBrokers | 0.32 | 0.42 | 0.37 | 0.51 | 0.74 | 0.57 | 0.58 | 0.81 | N/A | N/A |

| FxPro | 0.09 | 0.05 | 0.02 | 0.11 | 0.02 | 0.01 | 0.12 | 0.05 | N/A | N/A |

| Consensus | 0.50 | 0.62 | 0.62 | 0.86 | 0.82 | 0.36 | 0.53 | 0.69 | 1.27 | 1.51 |

HYCM Spreads

| HYCM | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| BrokerChooser | 1.40 | 1.20 | 2.20 | 2.20 | 1.20 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CompareForexBrokers | 0.26 | 0.10 | 0.20 | 0.40 | 0.30 | 0.30 | 0.40 | 0.70 | N/A | N/A |

| HYCM | 0.10 | 0.20 | 0.40 | 0.30 | 0.30 | 0.40 | 0.70 | 0.70 | N/A | N/A |

| Consensus | 0.59 | 0.50 | 0.93 | 0.97 | 0.60 | 0.35 | 0.55 | 0.70 | N/A | N/A |

The graph below shows just the consensus data with HYCM having the lower spreads for the USD/CAD and EUR/GBP but FxPro has lower spreads for all other major currency pairs.

Standard Account Spreads

In terms of Standard Account Spreads testing, FxPro offers competitive spreads that are ideal for traders who prefer a balance between cost and risk. On the other hand, HYCM provides fixed spreads that are slightly higher but offer the advantage of cost predictability.

When it comes to the average standard account spread by forex pair, both FxPro and HYCM have their strengths. FxPro provides highly competitive spreads, with values as low as 1.78 for USD/CAD. However, for the GBP/USD and AUD/USD pairs, Fxpro spread is higher than HYCM’s and the industry average, which could impact your trading costs if these are pairs you frequently trade.

In the case of the NZD/USD and USD/CAD pairs, HYCM offers a more competitive spread than FXCM, again aligning closely with the industry average. This suggests that HYCM may be a more cost-effective choice for traders who frequently trade these pairs.

| Standard Account | FxPro Spreads | HYCM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.95 | 1.56 | 1.7 |

| EUR/USD | 1.46 | 1.2 | 1.2 |

| USD/JPY | 1.59 | 1.2 | 1.5 |

| GBP/USD | 1.76 | 1.2 | 1.6 |

| AUD/USD | 2.06 | 1.3 | 1.6 |

| USD/CAD | 1.78 | 4 | 1.9 |

| EUR/GBP | 1.52 | 1.2 | 1.5 |

| EUR/JPY | 2.04 | 1.2 | 2.1 |

| AUD/JPY | 3.35 | 1.2 | 2.3 |

Standard Account Analysis Updated December 2025[1]December 2025 Published And Tested Data

Overall, while both FXCM and HYCM offer competitive spreads, HYCM seems to have a slight edge in terms of offering lower spreads for more forex pairs. However, it’s important to remember that spreads are just one aspect of trading costs. Other factors, such as commission fees, account types, and trading platforms, can also significantly impact your overall trading experience and costs. Therefore, I would recommend traders to consider these aspects as well when choosing a forex broker.

Commission Rates

FxPro charges a commission on its cTrader account, while HYCM charges a commission on its Raw account. The commission rates depend on the volume of trades.

Deposit & Withdrawal Fees

Neither broker charges fees for deposits or withdrawals, which is a significant advantage for traders who frequently move money in and out of their accounts.

Other Fees

Other fees, such as inactivity fees or swap fees, are comparable between the two brokers.

Our Lowest Spreads and Fees Verdict

While both brokers offer competitive trading costs, FxPro’s lower standard account spreads and HYCM’s tight RAW account spreads make them equally attractive to different types of traders.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

2. Better Trading Platform – FxPro

Both FxPro and HYCM offer a range of trading platforms to suit different trading styles and preferences.

| Trading Platform | FxPro | HYCM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | No | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

1. MetaTrader 4 and 5

FxPro and HYCM both offer MetaTrader 4 and 5, the most popular forex trading platforms in the industry. These platforms are known for their advanced charting features, customisability, and automated trading capabilities. Check out our comparison of the Best MT4 Brokers and the Best MT5 Brokers for more details.

2. cTrader and TradingView

FxPro also offers cTrader, a platform known for its intuitive interface and advanced order capabilities. It’s considered one of the Best cTrader Brokers. HYCM does not offer cTrader but provides Trading Central, a leading provider of technical analysis.

3. Social And Copy Trading

Both brokers offer social and copy trading features. FxPro offers FxPro SuperTrader, a platform dedicated to copy trading. HYCM offers HYCM Invest, a platform that allows you to copy the trades of successful traders. Check out our review of the Best Social Trading Platforms for more information.

4. VPS and Other Trading Tools

FxPro and HYCM both offer VPS services for traders who use automated trading systems. They also provide a range of other trading tools, including economic calendars, calculators, and market analysis.

Our Better Trading Platform Verdict

Both brokers offer a wide range of trading platforms and tools, but FxPro’s cTrader gives it a slight edge for traders looking for advanced order capabilities.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

3. Superior Accounts And Features – FxPro

FxPro and HYCM offer a range of account types to cater to different trading needs.

FxPro offers four account types: MT4, MT5, cTrader, and FxPro Edge (for spread betting). Each platform has its own account type with different features and benefits. Check out our review of the best forex demo accounts for more information.

HYCM offers three account types: Fixed, Classic, and Raw. The Fixed account offers fixed spreads, the Classic account offers variable spreads, and the Raw account offers raw spreads with a commission. HYCM also offers Islamic accounts for traders who follow Sharia law. You can read more about Swap Free Islamic Accounts here.

| FxPro | HYCM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | No | Yes |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Both brokers offer a variety of account types to suit different trading needs. However, FxPro’s dedicated spread betting platform (FxPro Edge) gives it a slight edge for traders interested in spread betting.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – FxPro

When it comes to trading experience, both FxPro and HYCM have their merits, but let’s get into the nitty-gritty. FxPro offers a no-dealing-desk execution model, which means faster execution speeds. This is a game-changer for traders like me who can’t afford to miss a beat. On the other hand, HYCM provides instant execution on its Fixed and Classic accounts, which is also quite impressive.

- FxPro offers MetaTrader 4, MetaTrader 5, and cTrader platforms, giving traders a variety of options.

- HYCM, while not offering cTrader, does provide MetaTrader 4 and 5.

- Our own testing showed that FxPro has faster execution speeds, clocking in at 10 ms for limit orders and 9 ms for market orders.

- HYCM’s execution speed data was not available, but their instant execution on certain accounts is noteworthy.

Now, let’s talk about ease of use. FxPro’s platforms are user-friendly and come with a range of tools that make trading a breeze. HYCM also offers a user-friendly experience but lacks some of the advanced tools that FxPro provides.

Our Best Trading Experience and Ease Verdict

Based on our analysis and testing, FxPro offers the best overall trading experience and ease of use.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – FxPro

FxPro Trust Score

HYCM Trust Score

Regulation

Trust and regulation are crucial factors to consider when choosing a forex broker. Both FxPro and HYCM are regulated by multiple reputable regulatory bodies.

FxPro is regulated by the CySEC in Cyprus, the FCA in the UK, the FSCA in South Africa, and the SCB in the Bahamas. It also operates under the Markets in Financial Instruments Directive (MiFID) in the European Union.

HYCM, on the other hand, is regulated by the FCA in the UK, the CySEC in Cyprus, and the DFSA in Dubai. It is also a member of the Henyep Group, a global conglomerate with a presence in 20 countries.

| FxPro | HYCM | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) | FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) FSC-M (Mauritius) FSCA (South Africa) | CIMA (Cayman) |

Reviews

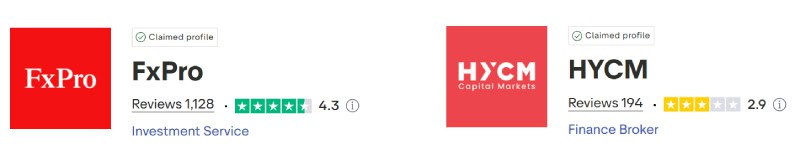

As shown below, FxPro has a Trustpilot score of 4.3 out of 5, based on over 1,100 reviews. HYCM, on the other hand, holds a Trustpilot score of 2.9 out of 5.

Our Stronger Trust and Regulation Verdict

Both brokers are highly regulated, which provides traders with a high level of trust and security. However, FxPro’s wider range of regulatory oversight gives it a slight edge in this category.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

6. Most Popular Broker – FxPro

FxPro gets searched on Google more than HYCM. On average, FxPro sees around 60,500 branded searches each month, while HYCM gets about 2,900 — that’s 95% fewer.

| Country | FxPro | HYCM |

|---|---|---|

| South Africa | 9,900 | 30 |

| Vietnam | 3,600 | 70 |

| Malaysia | 2,400 | 90 |

| United States | 1,900 | 210 |

| India | 1,900 | 170 |

| United Kingdom | 1,900 | 140 |

| Nigeria | 1,900 | 30 |

| Turkey | 1,900 | 110 |

| Egypt | 1,600 | 110 |

| Indonesia | 1,600 | 50 |

| Kenya | 1,600 | 10 |

| Argentina | 1,600 | 10 |

| Thailand | 1,600 | 20 |

| Brazil | 1,300 | 30 |

| Pakistan | 1,300 | 70 |

| Italy | 1,000 | 20 |

| Germany | 1,000 | 210 |

| Cyprus | 1,000 | 40 |

| United Arab Emirates | 1,000 | 260 |

| France | 880 | 70 |

| Japan | 880 | 70 |

| Colombia | 880 | 10 |

| Mexico | 880 | 10 |

| Spain | 720 | 30 |

| Morocco | 590 | 20 |

| Tanzania | 590 | 10 |

| Poland | 480 | 10 |

| Netherlands | 480 | 50 |

| Peru | 480 | 10 |

| Ecuador | 480 | 10 |

| Australia | 390 | 20 |

| Uzbekistan | 390 | 10 |

| Uganda | 390 | 10 |

| Canada | 320 | 50 |

| Singapore | 320 | 30 |

| Venezuela | 320 | 10 |

| Saudi Arabia | 260 | 30 |

| Hong Kong | 260 | 50 |

| Ghana | 260 | 10 |

| Botswana | 260 | 10 |

| Philippines | 210 | 20 |

| Greece | 210 | 10 |

| Algeria | 210 | 20 |

| Taiwan | 210 | 10 |

| Chile | 210 | 10 |

| Bangladesh | 170 | 10 |

| Cambodia | 170 | 20 |

| Sweden | 170 | 20 |

| Portugal | 170 | 10 |

| Switzerland | 140 | 10 |

| Dominican Republic | 140 | 10 |

| Jordan | 140 | 10 |

| Mauritius | 140 | 10 |

| Austria | 110 | 10 |

| Costa Rica | 110 | 10 |

| Ireland | 110 | 10 |

| Sri Lanka | 90 | 10 |

| Panama | 90 | 10 |

| New Zealand | 70 | 10 |

| Bolivia | 70 | 10 |

| Mongolia | 70 | 10 |

| Ethiopia | 50 | 10 |

9,900 1st | |

30 2nd | |

3,600 3rd | |

70 4th | |

1,900 5th | |

210 6th | |

1,900 7th | |

140 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with FxPro receiving 412,000 visits vs. 18,000 for HYCM.

Our Most Popular Broker Verdict

FxPro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – FxPro

When it comes to the range of products and CFD markets, both FxPro and HYCM have a lot to offer. FxPro provides a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. HYCM is no slouch either, offering a similar range but with a few unique additions.

| CFDs | FxPro | HYCM |

|---|---|---|

| Forex Pairs | 69 | 70 |

| Indices | 18 | 28 |

| Commodities | 8 Metals (3 x Gold) 3 Energies | 5 Metals (2 x Gold) (2 x Silver) 3 Energies 4 Softs |

| Cryptocurrencies | 28 | 28 |

| Shares CFDs | 2031 | No |

| ETFs | 18 (11 futures) | 19 |

| Bonds | No | No |

| Futures | No | No |

| Treasuries | No | No |

| Investment | No | No |

Our own testing didn’t reveal any significant differences in the range of products offered, but it’s worth noting that FxPro has a staggering number of Shares CFDs, which could be a deciding factor for some traders. HYCM, on the other hand, offers a wider range of Indices CFDs, which might appeal to those focused on index trading.

Our Top Product Range and CFD Markets Verdict

Based on the available range of CFDs and markets, FxPro offers a more comprehensive product range, particularly in the area of Shares CFDs.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

8. Superior Educational Resources – HYCM

When it comes to educational resources, both FxPro and HYCM have invested in helping traders up their game. FxPro offers a comprehensive educational section on its website, complete with webinars, eBooks, and video tutorials. HYCM isn’t far behind, offering a similar range of resources but with a focus on beginner-friendly content.

- FxPro provides webinars that cover a range of topics, from basic to advanced trading strategies.

- HYCM offers a set of beginner-friendly webinars that are easy to follow.

- FxPro’s educational section includes a wide range of eBooks and articles.

- HYCM also offers eBooks but focuses more on beginner-level content.

- FxPro provides video tutorials that are comprehensive and cover various trading aspects.

- HYCM’s video tutorials are more beginner-oriented and cover basic trading concepts.

Based on our own testing, FxPro scored a 6, while HYCM scored a 6.5 in the area of educational resources. Both brokers offer a solid set of educational materials that cater to traders at different levels.

Our Superior Educational Resources Verdict

Based on our testing scores, HYCM slightly edges out FxPro in offering superior educational resources with a score of 6.5 against FxPro’s 6.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

9. Superior Customer Service – HYCM

Customer service is a crucial aspect of a forex broker. Both FxPro and HYCM offer excellent customer service with multiple channels of communication, including live chat, phone, and email. They also provide extensive educational resources to help traders improve their trading skills.

| Broker | Customer Service |

|---|---|

| FxPro | Excellent |

| HYCM | Superior |

Our Superior Customer Service Verdict

Both FxPro and HYCM offer excellent customer service. However, FxPro’s customer service is available 24/5, while HYCM’s customer service is available 24/5 for trading issues and 5 days a week for other issues.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

10. Better Funding Options – FxPro

When it comes to funding options, both FxPro and HYCM offer a variety of methods to make it convenient for traders. FxPro provides multiple options, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. HYCM also offers a similar range but includes additional options like WebMoney and Bitcoin.

FxPro and HYCM both have a minimum deposit requirement of $100, which is quite reasonable. However, it’s worth noting that FxPro does not charge any deposit fees, while HYCM may charge fees depending on the method used. This could be a crucial factor for traders who are sensitive to additional costs.

| Funding Methods | FxPro | HYCM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | No |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on the available funding options and potential fees, FxPro offers a more cost-effective range of funding options.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Tie

Both FxPro and HYCM have a minimum deposit requirement of $100. FxPro requires a $100 minimum deposit for its MT4/MT5, MT4 Instant, and FxPro cTrader platforms.

HYCM has a more structured deposit requirement. For its Classic and Fixed Spread accounts, a minimum deposit of $100 is required. For the RAW account, the minimum deposit is considerably lower at $20.

Here’s a quick comparison table for your convenience:

| Minimum Deposit | Recommended Deposit | |

| FxPro | $100 | $1,000 |

| HYCM | $100 | $100 |

Our Lower Minimum Deposit Verdict

It’s a tie between the two brokers when it comes to minimum deposit. Having varying amounts between accounts, choose the broker that offers the type of account you foresee using.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

So Is HYCM or FxPro The Best Broker?

FxPro is the winner because it outperforms HYCM in most of the key areas that matter to traders, such as spreads, trading platforms, and account features. The table below summarises the key information leading to this verdict.

| Criteria | FxPro | HYCM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ✅ |

FxPro: Best For Beginner Traders

FxPro is the better choice for beginner traders due to its low spreads.

FxPro: Best For Experienced Traders

FxPro also stands out for experienced traders, offering a wide range of products and advanced trading features.

FAQs Comparing FxPro Vs HYCM

Does HYCM or FxPro Have Lower Costs?

FxPro has lower costs when it comes to spreads and fees. FxPro offers spreads as low as 0.6 pips on major currency pairs. HYCM, on the other hand, has slightly higher spreads starting at 1.2 pips. For more insights on brokers with competitive fees, you can check out this list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

FxPro is the superior choice for MetaTrader 4 users. It offers more features and tools tailored for MT4. HYCM also supports MT4 but lacks some of the advanced functionalities. For a detailed comparison, you can visit this comprehensive guide to the best MT4 brokers.

Which Broker Offers Social Trading?

Neither FxPro nor HYCM offers social or copy trading as a core feature. If you’re interested in social trading, you might want to look at other brokers. For alternative options, you can refer to this list of the best social trading platforms.

Does Either Broker Offer Spread Betting?

FxPro offers spread betting, but HYCM does not. This is particularly useful for UK traders looking to benefit from tax advantages. For more details on spread betting, you can visit this guide to the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, neither FxPro nor HYCM stands out as the superior choice for Australian Forex traders. Both brokers are not ASIC-regulated and are founded overseas. However, they do offer a range of features that could be appealing to Australian traders. For a list of brokers that are more tailored to Australian needs, you can check out this comprehensive list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

From my perspective, FxPro is the better choice for UK Forex traders. It is FCA-regulated and offers a range of features including spread betting. HYCM is also FCA-regulated but lacks some of the advanced features that FxPro offers. For more information on UK-specific brokers, you can refer to this guide to the Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert