FxPro Vs Pepperstone: Which One Is Best?

Reviewing these two brokers is quite interesting, let alone challenging. Since both have great qualities that they can contribute to traders in the industry. Through this review, we will lay down the cards for both Pepperstone and FxPro’s winning streaks. So, read further and learn more.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between FxPro and Pepperstone:

- Pepperstone offers lower average spreads.

- Pepperstone provides more currency pairs and CFDs.

- Pepperstone’s product range includes over 80 currency pairs.

- Pepperstone provides access to cryptocurrency trading.

- FXPro is regulated in multiple jurisdictions, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and SCB (Bahamas).

- FXPro operates with an NDD execution model, ensuring ultra-fast order execution with minimal slippage.

- FXPro offers a range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and their proprietary FXPro Edge.

- Both brokers support MetaTrader 4, MetaTrader 5, and cTrader.

1. Lowest Spreads And Fees – A Tie

Spreads

Both Pepperstone and FxPro offer competitive spreads, which are crucial for traders looking to minimize transaction costs. Pepperstone provides the lowest forex spreads in comparison to FxPro in both major and exotic currencies. For instance, Pepperstone offers EUR/USD spreads as low as 0.1 pips, while FxPro’s spreads are around 0.2 pips, with the industry average being 0.28 pips. For AUD/USD, Pepperstone offers 0.2 pips compared to FxPro’s 0.31 pips, which is still below the average spread of 0.45 pips. This demonstrates Pepperstone’s advantage in offering tighter spreads, making it an attractive option for traders seeking cost-effective trading conditions.

| RAW Account | FxPro Spreads | Pepperstone Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.08 | 0.47 | 0.72 |

| EUR/USD | 0.2 | 0.1 | 0.28 |

| USD/JPY | 0.31 | 0.3 | 0.44 |

| GBP/USD | 0.21 | 0.3 | 0.54 |

| AUD/USD | 0.31 | 0.2 | 0.45 |

| USD/CAD | 0.5 | 0.4 | 0.61 |

| EUR/GBP | 0.28 | 0.2 | 0.55 |

| EUR/JPY | 0.25 | 0.711 | 0.74 |

| AUD/JPY | 0.50 | 0.50 | 0.93 |

| USD/SGD | 7.19 | 1.5 | 1.97 |

Commission Levels

Both Pepperstone and FxPro offer two commission fee structures. Traders can choose from lower spreads with flat-rate commissions or no commission with fees built into the spread. Pepperstone’s Razor account is particularly appealing for those who prefer to pay round-trip commissions to access tighter spreads, offering spreads as low as 0.0 pips with a $7 round-trip commission fee. FxPro, on the other hand, charges a USD $0.9 commission with spreads of 0.1 pips, varying between cTrader and MetaTrader platforms. For commission-free trading, Pepperstone’s EUR/USD spreads can be as low as 1.0 pips, whereas FxPro’s spreads are, on average, 1.4 pips. This flexibility allows traders to choose the fee structure that best suits their trading style and volume.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| FxPro | $3.50 | N/A | N/A | N/A |

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

Our committed and exceptionally talented team has invested considerable effort into developing the exclusive fee calculator presented below.

Standard Account Fees

When it comes to standard account fees, Pepperstone and FxPro both offer competitive options. Pepperstone’s standard account spreads for EUR/USD are 1.10 pips, and AUD/USD is 1.20 pips, compared to FxPro’s 1.32 pips and 1.95 pips, respectively. Both brokers offer a $0 minimum deposit, with Pepperstone recommending an initial deposit of $200 and FxPro recommending $1000. This makes Pepperstone a more accessible option for new traders, while FxPro’s higher recommended deposit may appeal to more experienced traders seeking additional features and services.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.00 | 1.11 | N/A | 1.32 | 1.09 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Pepperstone stands out with its tighter spreads, flexible commission structures, and lower standard account fees, making it an attractive choice for both new and experienced traders. FxPro, while offering competitive spreads and commission options, falls slightly behind Pepperstone in terms of overall cost-effectiveness. Both brokers provide a range of account options and fee structures to cater to different trading styles and preferences, ensuring that traders can find the best fit for their needs. With the latest trends in forex trading emphasizing cost-efficiency and flexibility, Pepperstone and FxPro continue to adapt and offer competitive trading conditions to their clients.

Our Lowest Spreads and Fees Verdict

It’s a standoff for both Pepperstone and FxPro, this is due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

For traders in forex trading, having a top-tier trading platform is the backbone of a successful forex trading experience. It combines advanced charting tools, real-time market data, and lightning-fast execution speeds to ensure precision in every trade. A well-designed platform offers a user-friendly interface, customizable features, and strong security protocols, catering to both novice and professional traders. Additionally, support for automated trading, social trading, and access to diverse financial instruments enhances flexibility and strategy execution. These elements work together to create a seamless and efficient trading environment, empowering traders to make informed decisions with confidence.

| Trading Platform | FxPro | Pepperstone |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

Both Pepperstone and FxPro offer MetaTrader 4 and 5, as well as cTrader, Copy Trading, and their proprietary platforms. However, Pepperstone has an edge with the inclusion of TradingView, which FxPro does not offer. MetaTrader platforms are renowned for their user-friendly interfaces and advanced charting tools, providing traders with a range of technical analysis tools, automated trading capabilities, and customizable layouts. These platforms are the gold standard for traders worldwide, known for their automated trading functions with a library of Expert Advisors and add-on tools available for download. While cTrader is Windows-based software, desktop versions of MT4 and MT5 are available on both Windows and Mac.

Advanced Platforms

Pepperstone’s advanced platforms include Expert Advisors (EAs), cTrader Automate, the Pepperstone Trading app, and a free demo account. FxPro also offers Expert Advisors (EAs), the FxPro Trading Platform, their own Mobile Trading app, and a free demo account. Both brokers are compatible with MetaTrader 4, MetaTrader 5, and cTrader through desktop and online platforms. Developed for spread betting in the UK, FxPro Edge is a web platform that requires no software installation. cTrader is designed to be accessible to both novice and experienced traders and is known for its availability of market depth and superior execution features. Pepperstone provides significantly more algorithmic trading features than FxPro on MetaTrader platforms, with a larger library of Expert Advisors and add-ons available for download.

Copy Trading

Both Pepperstone and FxPro support Copy Trading through their cTrader platforms. This feature allows traders to replicate the strategies of experienced traders, enhancing their trading experience. The functionality of cTrader and MetaTrader mobile apps mirrors the desktop trading platforms, offering customized charting features for mobile and tablet viewing. Both trading platform software providers offer features for on-the-go trading, ensuring that traders can manage their accounts and execute trades seamlessly from their mobile devices.

Both Pepperstone and FxPro offer robust trading platforms with a range of advanced features. Pepperstone stands out with its inclusion of TradingView and a more extensive library of algorithmic trading tools and Expert Advisors. Both brokers provide comprehensive mobile trading solutions, ensuring that traders can stay connected and manage their accounts from anywhere. With the latest trends in forex trading emphasizing accessibility, advanced tools, and seamless execution, Pepperstone and FxPro continue to adapt and offer competitive trading conditions to their clients.

Our Better Trading Platform Verdict

Pepperstone is having its moment in the spotlight due to their better trading platforms.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

A well-structured trading account, for traders in the forex industry, is essential for maximizing potential in the forex market. Top-tier brokers offer a variety of account types designed to meet different trading styles, whether through tight spreads, low commissions, or advanced trading tools. Features such as demo accounts, swap-free options, and access to diverse financial instruments ensure flexibility and inclusivity. Additionally, innovative features like automated and social trading, along with responsive customer support, enhance the overall trading experience, making it seamless, efficient, and tailored to traders’ needs.

For traders in the forex trading industry, a well-organized trading account is essential for traders aiming to unlock their full potential in the forex market. Top-tier brokers like FxPro and Pepperstone present a diverse range of account options designed to cater to various trading styles, featuring benefits such as narrow spreads, low commissions, and a wide array of financial instruments. Both brokers offer demo accounts, enabling traders to hone their skills on the MT4 and MT5 platforms before advancing to live trading. Additionally, those in need of swap-free trading can request Islamic accounts by reaching out to customer support.

For high-volume traders, VIP accounts provide exclusive advantages. FxPro’s VIP traders enjoy market spread discounts and commission reductions of up to 30%. Meanwhile, Pepperstone’s VIP offerings, which include Razor and Pro accounts, are particularly noteworthy. These accounts come with minimized commission fees, forex rebates through the Active Trader Program, and additional benefits like premium rebates and access to exclusive trading seminars. Eligible traders can also elevate their experience by upgrading to Pepperstone Pro, gaining even more advantages such as personalized account management and priority access to new trading products.

| FxPro | Pepperstone | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | Yes | Yes |

Our Superior Accounts and Features Verdict

Pepperstone takes the cake here owing it to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

Forex trading is always busy and complicated, and having a superior trading experience is built on the foundation of advanced platforms, lightning-fast execution speeds, and competitive spreads. Reliable customer support and a seamless interface enable confident and efficient market navigation. Educational resources, varied trading tools, and intuitive account management enhance the experience for both beginners and experienced traders.

When it comes to the trading experience, both FxPro and Pepperstone have their unique strengths. Recent trends and insights highlight that Pepperstone stands out in several crucial areas. Their MetaTrader 4 (MT4) platform is celebrated for delivering a seamless trading experience, complete with advanced charting tools and a user-friendly interface. It has gained popularity among traders for its reliability and strong community support. Moreover, Pepperstone’s integration of TradingView and cTrader further enriches their platform offerings, equipping traders with a robust suite of tools for technical analysis and automated trading. When you combine these features with competitive spreads and rapid execution speeds, Pepperstone undeniably emerges as a premier option in the forex trading arena.

- Pepperstone is recognised as the best MT4 broker.

- They also shine in the automation department with integrations like Capitalise.ai.

- Both brokers support MetaTrader 4, MetaTrader 5, and cTrader, but Pepperstone’s offerings on these platforms seem more robust.

- The availability of tools, especially for algorithmic trading, gives Pepperstone an edge.

However, FxPro isn’t far behind. Their platform diversity, including their proprietary FxPro Edge, ensures traders have ample choices. The user interface, combined with their range of instruments, makes for a compelling trading environment.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| FxPro | 151ms | 23/36 | 138ms | 16/36 |

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

Our Best Trading Experience and Ease Verdict

Based on our analysis and testing, Pepperstone outperforms the contender here, this is due to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

Strong regulation and trust create a secure trading environment. Brokers under strict oversight protect traders from fraud and unethical practices, fostering confidence. Reputable regulated brokers attract more clients, enhancing credibility. When traders feel secure, they engage more actively and grow their portfolios confidently.

Pepperstone Trust Score

FxPro Trust Score

We see in this section that Pepperstone boasts a high trust score of 95, significantly surpassing FxPro’s trust score of 60. This demonstrates Pepperstone’s strong reputation and reliability within the forex trading industry. The higher trust score reflects Pepperstone’s commitment to providing a secure and transparent trading environment, which is crucial for traders seeking a dependable broker. With top-tier regulatory oversight and a track record of excellent customer service, Pepperstone continues to be a trusted choice for traders worldwide, aligning with the latest trends in forex trading that emphasize security and trustworthiness.

FxPro and Pepperstone are both regulated by highly reputable international authorities, which guarantee the fair and efficient functioning of financial markets. FxPro is governed by the CySEC (Cyprus Securities and Exchange Commission), FSCA (Financial Sector Conduct Authority, South Africa), and FCA (Financial Conduct Authority, UK). CySEC not only regulates forex brokers in Cyprus but also oversees the Cyprus Stock Exchange and enforces legal regulations. As Cyprus is part of the EU, traders benefit from various protections; in the event that a CySEC-licensed broker becomes insolvent, retail investors are entitled to compensation of up to €20,000 or 90% of their funds—whichever is lower.

Pepperstone is licensed by several regulatory bodies, including ASIC in Australia, FCA in the United Kingdom, DFSA in Dubai, CMA in Kenya, BaFin in Germany, CySEC in Europe, and SCB in The Bahamas. In Australia, ASIC mandates that brokers obtain an Australian Financial Services (AFS) license, which includes strict rules against using client funds for operational purposes; traders’ funds are held in trust for added security. The FCA in the UK is renowned for its rigorous regulations that offer robust consumer protection. Customers of both FxPro and Pepperstone in the UK benefit from the Financial Services Compensation Scheme (FSCS), which provides coverage up to £85,000 in the event of broker insolvency. Furthermore, the UK enforces the segregation of client funds, ensuring they remain distinct from the broker’s operational finances. Currently, FxPro is under the watch of South Africa’s sole financial regulator, the FSCA, while Pepperstone is in the process of obtaining its license. The FSCA plays a crucial role in safeguarding local traders and actively issues warnings about fraudulent operations within South Africa.

The latest trends in forex trading are underscored by these regulatory frameworks and protections, highlighting the critical need for strong oversight and the security of client funds. FxPro and Pepperstone are both committed to adapting to the ever-changing regulatory landscape, ensuring they offer their clients secure and trustworthy trading environments.

| FxPro | Pepperstone | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) FSC-M (Mauritius) FSCA (South Africa) | SCB (Bahamas) CMA (Kenya) |

Our Stronger Trust and Regulation Verdict

It’s a deadlock for both Pepperstone and FxPro, this is due to both of their stronger trust and regulation.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than FxPro. On average, Pepperstone sees around 110,000 branded searches each month, while FxPro gets about 60,500 — that’s 45% fewer.

| Country | FxPro | Pepperstone |

|---|---|---|

| Australia | 390 | 8,100 |

| Brazil | 1,300 | 6,600 |

| United Kingdom | 1,900 | 5,400 |

| United States | 1,900 | 4,400 |

| Malaysia | 2,400 | 4,400 |

| Kenya | 1,600 | 4,400 |

| Thailand | 1,600 | 4,400 |

| Germany | 1,000 | 3,600 |

| Colombia | 880 | 3,600 |

| Mexico | 880 | 3,600 |

| Hong Kong | 260 | 3,600 |

| India | 1,900 | 2,900 |

| South Africa | 9,900 | 2,900 |

| Spain | 720 | 1,900 |

| Italy | 1,000 | 1,900 |

| Mongolia | 70 | 1,900 |

| Singapore | 320 | 1,600 |

| Turkey | 1,900 | 1,600 |

| Indonesia | 1,600 | 1,600 |

| Peru | 480 | 1,600 |

| Nigeria | 1,900 | 1,300 |

| Argentina | 1,600 | 1,300 |

| Pakistan | 1,300 | 1,300 |

| Bolivia | 70 | 1,300 |

| France | 880 | 1,000 |

| United Arab Emirates | 1,000 | 1,000 |

| Taiwan | 210 | 1,000 |

| Chile | 210 | 1,000 |

| Ecuador | 480 | 1,000 |

| Philippines | 210 | 880 |

| Netherlands | 480 | 880 |

| Dominican Republic | 140 | 880 |

| Canada | 320 | 720 |

| Poland | 480 | 720 |

| Vietnam | 3,600 | 720 |

| Morocco | 590 | 720 |

| Tanzania | 590 | 720 |

| Japan | 880 | 480 |

| Portugal | 170 | 480 |

| Cyprus | 1,000 | 480 |

| Costa Rica | 110 | 480 |

| Sweden | 170 | 390 |

| Egypt | 1,600 | 390 |

| Bangladesh | 170 | 390 |

| Algeria | 210 | 390 |

| Uganda | 390 | 390 |

| Venezuela | 320 | 390 |

| Ethiopia | 50 | 390 |

| Botswana | 260 | 390 |

| Switzerland | 140 | 320 |

| Austria | 110 | 320 |

| Sri Lanka | 90 | 320 |

| Panama | 90 | 320 |

| Cambodia | 170 | 320 |

| Ireland | 110 | 260 |

| Ghana | 260 | 260 |

| Saudi Arabia | 260 | 260 |

| Jordan | 140 | 260 |

| Greece | 210 | 210 |

| New Zealand | 70 | 170 |

| Uzbekistan | 390 | 140 |

| Mauritius | 140 | 110 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

FxPro - Australia

FxPro - Australia

|

390

2nd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

3rd

|

FxPro - UK

FxPro - UK

|

1,900

4th

|

Pepperstone - US

Pepperstone - US

|

4,400

5th

|

FxPro - US

FxPro - US

|

1,900

6th

|

Pepperstone - Kenya

Pepperstone - Kenya

|

4,400

7th

|

FxPro - Kenya

FxPro - Kenya

|

1,600

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 412,000 for FxPro.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A wide range of financial instruments is very important for traders, new and seasoned, aiming to navigate evolving market conditions and seize profit opportunities. Brokers that provide a wide variety of CFDs spanning forex, commodities, indices, and cryptocurrencies equip traders with enhanced flexibility and strategic options. This broad product offering not only promotes portfolio diversification but also guarantees a dynamic trading experience tailored to multiple market trends and strategies.

Market access differs when comparing FxPro vs Pepperstone. FxPro allows clients to trade forex, shares, futures, commodities and indices, while Pepperstone is one of the leading CFD and forex brokers around the world. As with most forex brokers, Pepperstone and FxPro do not offer ETF, bond, or option trading.

Market access differs when comparing FxPro vs Pepperstone. FxPro allows clients to trade forex, shares, futures, commodities and indices, while Pepperstone is one of the leading CFD and forex brokers around the world. As with most forex brokers, Pepperstone and FxPro do not offer ETF, bond, or option trading.

Currency Pairs

If your preference is trading forex, Pepperstone provides an excellent selection of over 92 currency pairs, compared to FxPro’s over 69 currency pairs.

Contracts For Difference (CFDs)

Pepperstone’s product range is standard with over 90 CFDs. FxPro offers a larger product selection with 0ver 200 commodities, index and stock CFDs, although they do not allow trading CFDs on Japanese shares.

Trading Cryptocurrency With Pepperstone

If you are looking to trade crypto, Pepperstone is the best forex broker as FxPro does not offer cryptocurrency trading. Pepperstone gives investors access to the following cryptocurrencies that can be traded against USD:

- Dash (DASH)

- Litecoin (LTC)

- Ethereum (ETH)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

| CFDs | FxPro | Pepperstone |

|---|---|---|

| Forex Pairs | 69 | 93 |

| Indices | 18 | 26 |

| Commodities | 8 Metals (3 x Gold) 3 Energies | 29 Commodities 4 Metals, 4 Energies, 16 Softs, 5 Hard |

| Cryptocurrencies | 28 | 27 |

| Share CFDs | 2031 | 1,200+ |

| ETFs | 18 (11 futures) | 108+ |

| Bonds | No | No |

| Futures | No | 42 |

| Treasuries | No | No |

| Investments | No | No |

Pepperstone provides a competitive crypto trading environment with tight spreads, maximum leverage of 5:1, and no commission fees. This arrangement presents an appealing opportunity for traders eager to leverage the volatility of digital assets without facing steep expenses. However, recent alterations to FCA regulations have affected the accessibility of crypto trading for retail investors. Previously, Pepperstone’s FCA-regulated UK subsidiary facilitated crypto trading, but the latest regulations now restrict retail traders from participating in crypto trading through FCA-regulated brokers. This regulatory change highlights the dynamic nature of the cryptocurrency trading environment, where authorities are placing greater emphasis on risk management and consumer protection.

Our Top Product Range and CFD Markets Verdict

Undeniably, Pepperstone steals the show in this category owing it to their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

When commencing on a journey in forex trading, this can be a daunting task, but the right educational resources can transform this challenge into an opportunity. Access to comprehensive learning materials—such as webinars, articles, video tutorials, and structured courses—provides traders with the knowledge and skills they need to make informed decisions, refine their strategies, and confidently navigate the forex market. These high-quality educational tools foster continuous growth and development, laying the foundation for long-term success in the dynamic world of forex trading.

Both FxPro and Pepperstone understand this and have invested in providing top-tier educational content for their users. From our own testing, here’s a comparison of the educational resources each broker offers:

- FxPro:

- Offers a comprehensive educational section with webinars, videos, and articles.

- Their ‘FxPro Academy’ is a dedicated space for learning, catering to both beginners and experienced traders.

- Provides in-depth market analysis and insights regularly.

- Pepperstone:

- Known for their extensive range of educational materials, including tutorials and guides.

- They host regular webinars and seminars for traders to enhance their skills.

- Their ‘Learn to Trade Forex’ section is especially beneficial for newcomers.

While both brokers offer commendable educational resources, it’s essential to consider the depth, quality, and accessibility of these materials.

Our Superior Educational Resources Verdict

Based on our testing, Pepperstone excels in this niche, this is in light of their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

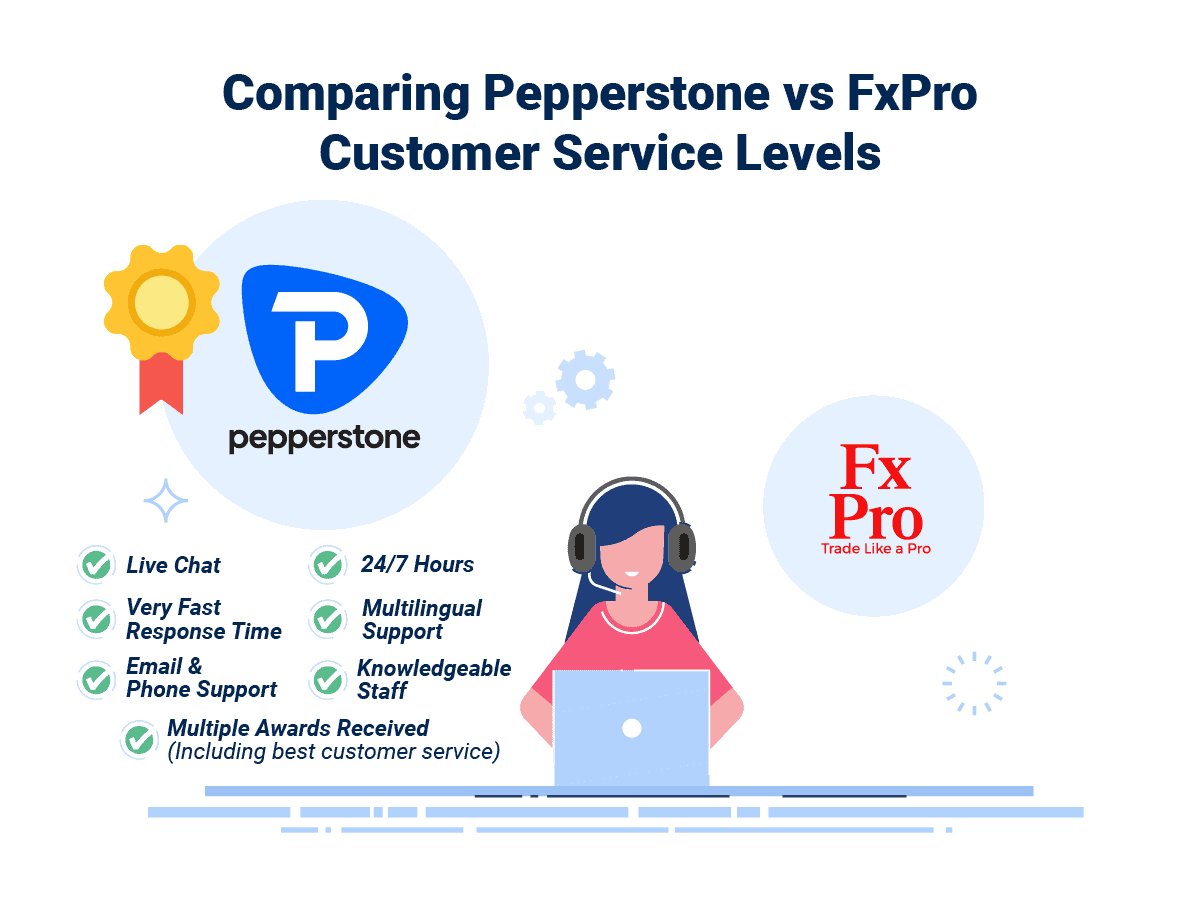

9. Superior Customer Service – Pepperstone

In forex trading, responsive and reliable customer support is crucial for a smooth and confident trading experience. A quality brokerage customer service guarantees traders round-the-clock support via live chat, phone, and email, frequently offering multilingual assistance to serve a worldwide audience. Swift and effective service not only resolves issues quickly but also boosts trader satisfaction, cultivates lasting trust, and ultimately creates a more efficient and stress-free trading experience.

Both FxPro and Pepperstone have made considerable efforts to ensure their clients receive top-notch support. From our own testing, it’s evident that both brokers prioritise customer satisfaction.

FxPro boasts a dedicated support team that’s available 24/5, ensuring that traders can get assistance whenever they need it. Their multi-lingual support, combined with a range of contact methods, makes them a reliable choice for traders worldwide.

Pepperstone, on the other hand, is renowned for its award-winning customer service. They offer a variety of contact methods, ensuring that traders can reach out in a way that’s most convenient for them. Their commitment to providing timely and effective support is evident in the numerous accolades they’ve received over the years.

| Feature | FxPro | Pepperstone |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 9/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Based on our testing scores, Pepperstone ranks highest in this portion by the reason of their superior customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

10. Pepperstone: Better Funding Options – Pepperstone

In forex trading, seamless, flexible and better funding options are essential for a hassle-free trading experience. Top brokers provide a variety of deposit and withdrawal options, ranging from bank transfers and credit/debit cards to digital wallets such as PayPal, Skrill, and Neteller, with some even allowing cryptocurrency transactions. By offering low-cost or fee-free transactions, these brokers enable traders to manage their funds efficiently, access capital swiftly, and concentrate on executing their trading strategies without any unwarranted interruptions.

When comparing account management features between FxPro and Pepperstone, Pepperstone emerges as the front-runner. Pepperstone stands out as an ideal option for traders who prioritize efficient and cost-effective account management, as it imposes no deposit or withdrawal fees for most clients, offers rapid processing times, and supports a variety of payment methods.

FxPro, on the other hand, allows clients to transfer funds through several means, including bank transfers, credit cards, Skrill, Neteller, PayPal, and Union Pay. While there are no deposit or withdrawal fees, clients may experience longer processing times of up to 7 working days. FxPro requires an initial deposit of $100, although a minimum of $500 is recommended. In contrast, Pepperstone’s efficient processes and lack of transaction fees reflect the latest trends in forex trading, where brokers emphasize seamless and affordable services to attract and retain clients.

| Funding Option | FxPro | Pepperstone |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | No | Yes |

| Klarna | No | No |

Pepperstone offers a highly accessible trading environment by not requiring a minimum deposit and accepting a wide range of payment methods, including credit cards, bank transfers, POLi, BPay, PayPal, Neteller, Skrill, and Union Pay. The broker offers a competitive edge by waiving deposit and withdrawal fees for clients located in Australia and the EU. However, clients outside these regions will incur a $20 fee for international transfers. Notably, Pepperstone outshines FxPro with significantly faster processing times for both deposits and withdrawals—most funding methods are processed instantly. This remarkable efficiency is in line with the latest trends in forex trading, where brokers prioritize delivering seamless and cost-effective services to elevate the trading experience for their clients.

Our Better Funding Options Verdict

For this category, Pepperstone takes the cake due to their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

A low minimum deposit is a key factor for traders looking to enter the forex market with minimal financial commitment. Brokers that provide this feature enhance accessibility for beginners and those with limited funds, effectively lowering the barriers to entry. By allowing traders to begin with a modest investment, they can gain practical experience, improve their strategies, and steadily build confidence while minimizing risk. This inclusivity not only encourages wider market participation but also nurtures long-term growth in a trader’s journey.

Pepperstone distinguishes itself with an impressive $0 minimum deposit, allowing traders of all experience levels to easily participate. Although there is no strict minimum, the broker suggests an initial deposit of $200 to facilitate a more seamless trading experience and sufficient margin coverage. This accommodating approach reflects the current trends in forex trading, as brokers work to lower entry barriers and reach a wider audience.

On the other hand, FxPro requires a minimum deposit of $100 and recommends starting with $500 for optimal trading conditions, which caters primarily to more seasoned traders willing to invest a larger sum upfront. While both brokers provide competitive trading environments, Pepperstone’s lower entry threshold makes it particularly appealing for newcomers eager to venture into the forex market without a hefty financial obligation.

| Minimum Deposit | Recommended Deposit | |

| FxPro | $100 | $1,000 |

| Pepperstone | $0 | $200 |

Our Lower Minimum Deposit Verdict

Unmistakably, Pepperstone outperforms very well in this category owing it to their lower minimum deposit.

Is FxPro or Pepperstone The Best Broker?

Pepperstone excels very well in this field this is due to their comprehensive and competitive offerings, superior customer service, and robust educational resources. The table below summarises the key information leading to this verdict:

| Categories | FxPro | Pepperstone |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

Pepperstone: Best For Beginner Traders

Pepperstone is the ideal choice for beginner traders due to its user-friendly platform and extensive educational resources.

FxPro: Best For Experienced Traders

For seasoned professionals, FxPro offers a diverse range of tools and advanced features that cater to their specific needs.

FAQs Comparing FxPro Vs Pepperstone

Does Pepperstone or FxPro Have Lower Costs?

Pepperstone generally offers lower costs compared to FxPro. They are known for their competitive spreads, especially during peak trading hours. For instance, traders can find spreads as low as 0.13 on major pairs. For a more detailed breakdown of low commission brokers, you can check out this Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and FxPro offer MetaTrader 4, but Pepperstone is often recognised for its enhanced MT4 features and tools. They provide a seamless trading experience with faster execution speeds. For traders specifically interested in MT4 platforms, this list of the best MT4 brokers offers a deep dive into the top choices.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to offering social trading features. They have integrated platforms like ZuluTrade and Myfxbook for traders interested in copy trading. This allows traders to emulate the strategies of successful peers. If you’re keen on exploring more about social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

FxPro offers spread betting for its UK clients. This form of trading is tax-free in the UK and is a popular choice among traders looking to capitalise on market movements without owning the underlying asset. Spread betting can be done on various platforms, including MT4. For those interested in diving deeper into spread betting, especially on the MT4 platform, here’s a detailed guide on the best MT4 spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it was also founded in Australia, showcasing its deep roots and commitment to the local trading community. They offer a robust platform with a wide range of trading instruments. Their reputation in the Australian market is unparalleled, and they’ve consistently been a top choice for Aussie traders. For a comprehensive list of top brokers in Australia, you can check out this Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

From my perspective, FxPro stands out for UK forex traders. They are FCA regulated, ensuring a high level of trust and security for UK-based traders. While they were founded overseas, their strong presence and offerings in the UK market make them a top choice. They provide a diverse range of trading platforms and tools tailored to the needs of UK traders. For those looking for more options in the UK, this comprehensive review of the Best Forex Brokers In UK offers valuable insights.

Related Forex Broker Comparison Tables

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

This article is inaccurate and the “fact checker” should be fired. Pepperstone does not, and never has, offered a “guaranteed stop loss” to any trader on any account type. Pepperstone does not offer guaranteed stop loss orders, and negative balance protection is available only for U.K./E.U. clients.

Hi Johhny, I don’t believe we say Pepperstone have a guaranteed stop loss, they do however have a standard stop loos order. Regarding negative balance protection, you are incorrect, all Pepperstone entities offer this – not just in UK and EU but also Australia, Dubai, Kenya and their Bahamas entities.

Does FxPro accept mobile money?

FxPro accepts mobile money through Bank Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill and other methods available as per your country of residence.