IG Group vs XTB 2025

Our comparison of leading Forex brokers IG and XTB, examines trading features like costs, platform, customer service and more to help you make an informed decision when choosing a broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

trading spread bets and CFDs with this provider

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Allowed but not supported

Overall

How Do XTB Vs IG Group Compare?

Our full comparison covers the 10 most important trading factors to help you decide between IG and XTB. Here are five key differences:

- IG offers lower spreads on its standard account compared to XTB, making it more cost-effective for traders focusing on low spreads.

- For RAW account spreads, XTB leads with ultra-low spreads, offering significant savings for high-volume traders.

- IG is regulated by a larger number of regulatory bodies, making it a more trustworthy choice for traders concerned about security.

- XTB offers social and copy trading through its xSocial platform, a feature not currently available with IG.

- IG requires a minimum deposit of $450, while XTB requires only $250, making XTB more accessible for traders with smaller budgets.

1. Lowest Spreads And Fees – Tie

When it comes to trading costs, both IG and XTB offer competitive pricing.

1. Standard Account Spreads

IG offers lower spreads on its standard account compared to XTB, making it a more cost-effective choice for traders who prioritise low spreads.

2. RAW Account Spreads

For RAW account spreads, XTB takes the lead with its ultra-low spreads, offering significant savings for high-volume traders.

3. Commission Rates

Both brokers charge competitive commission rates, but IG’s rates are slightly lower, providing an edge for cost-conscious traders.

4. Deposit & Withdrawal Fees

Neither broker charges fees for deposits or withdrawals, making them both excellent choices for traders who frequently move money in and out of their accounts.

5. Other Fees

In terms of other fees, such as inactivity fees, both brokers are on par with industry standards.

Our Lowest Spreads and Fees Verdict

In terms of other fees, such as inactivity fees, both brokers are on par with industry standards.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

2. Better Trading Platform – XTB

Both IG and XTB offer a range of trading platforms to suit different trading styles and experience levels.

| Trading Platform | IG Group | XTB |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

1. MetaTrader 4 and 5

Both brokers offer MetaTrader 4 and 5, popular platforms known for their advanced charting features and automated trading capabilities.

2. cTrader and TradingView

While neither broker offers cTrader or TradingView, they both provide their own proprietary platforms that offer similar functionality.

3. Social And Copy Trading

XTB offers social and copy trading through its xSocial platform, while IG does not currently offer this feature.

4. VPS and Other Trading Tools

Both brokers offer VPS services and a range of other trading tools, including advanced charting tools, economic calendars, and market news updates.

Our Better Trading Platform Verdict

While both brokers offer a range of robust trading platforms, XTB’s social and copy trading capabilities give it a slight edge for traders interested in these features.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

3. Superior Accounts And Features – IG Group

IG offers a wider range of account types, including standard, DMA, and professional accounts. XTB, on the other hand, offers standard and pro accounts.

| IG Group | XTB | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

IG Group’s wider range of account types makes it a more versatile choice for traders with varying needs and trading styles.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – XTB

When it comes to user experience, both IG and XTB have their merits, but they offer different vibes. IG’s platform is sleek and professional, making you feel like you’re in the cockpit of a fighter jet with all its advanced features. It’s perfect for those who love to have all the bells and whistles. On the other hand, XTB’s xStation 5 is more intuitive and user-friendly, ideal for those who want to get straight to the point without any fuss.

- IG’s advanced technology infrastructure provides slightly faster execution speeds, which is crucial for high-frequency or scalping strategies.

- XTB offers social and copy trading through its xSocial platform, adding a community aspect to trading.

- According to our own testing, neither broker stands out in terms of the “Best for Automation” category.

- Both brokers offer MetaTrader 4, but only IG offers MetaTrader 5, giving it a slight edge for those who prefer this platform.

Our Best Trading Experience and Ease Verdict

For traders who prioritise a streamlined, community-focused experience, XTB takes the cake. However, if you’re all about advanced features and faster execution, IG Group is the way to go.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IG Group

IG Group Trust Score

XTB Trust Score

IG is regulated by a larger number of regulatory bodies, including ASIC, FCA, BaFin, FINMA, NFA/CFTC, CySEC, DFSA, FMA, MAS, JFSA, BMA, and FSCA.

On the other hand, XTB is regulated by FCA, CMNV, BaFin, KNF, CySEC, DFSA, and IFSC.

| IG Group | XTB | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) | FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | JFSA (Japan) DFSA (Dubai) | DFSA (Dubai) CMNV (Spain) KNF (Poland) |

| Tier 3 Regulation | BMA (Bermuda) FSCA (South Africa) | FSC-BZ |

Reviews

IG Markets has a Trustpilot rating of 3.9 out of 5, based on over 8,000 reviews. XTB holds a slightly higher score of 4.0 out of 5, from around 2,000 reviews. IG Markets appeals to seasoned traders with its depth and global reach, while XTB stands out for user-friendliness and solid support.

Our Stronger Trust and Regulation Verdict

IG Group’s broader regulatory oversight makes it the more trustworthy choice for traders concerned about security and regulation.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

6. Most Popular Broker – XTB

XTB gets searched on Google more than IG Group. On average, XTB sees around 368,000 branded searches each month, while IG Group gets about 97,080 — that’s 73% fewer.

| Country | IG Group | XTB |

|---|---|---|

| Poland | 90 | 135,000 |

| Portugal | 320 | 40,500 |

| Spain | 110 | 27,100 |

| France | 14,800 | 18,100 |

| Germany | 5,400 | 12,100 |

| Brazil | 170 | 9,900 |

| Chile | 50 | 5,400 |

| Vietnam | 260 | 5,400 |

| United Kingdom | 2,900 | 4,400 |

| Italy | 8,100 | 4,400 |

| Colombia | 70 | 3,600 |

| United States | 2,900 | 2,400 |

| Peru | 50 | 2,400 |

| Thailand | 320 | 2,400 |

| United Arab Emirates | 260 | 1,900 |

| Mexico | 90 | 1,900 |

| Netherlands | 480 | 1,600 |

| Switzerland | 320 | 1,300 |

| India | 4,400 | 1,300 |

| Argentina | 50 | 1,300 |

| Austria | 480 | 1,000 |

| Morocco | 260 | 1,000 |

| Saudi Arabia | 1,000 | 1,000 |

| Ecuador | 20 | 880 |

| Algeria | 90 | 880 |

| Canada | 320 | 720 |

| Bolivia | 10 | 720 |

| Egypt | 50 | 720 |

| Ireland | 90 | 480 |

| Sweden | 3,600 | 480 |

| Nigeria | 90 | 480 |

| Turkey | 320 | 480 |

| South Africa | 2,400 | 390 |

| Japan | 140 | 390 |

| Jordan | 20 | 390 |

| Australia | 6,600 | 320 |

| Malaysia | 480 | 320 |

| Philippines | 90 | 320 |

| Indonesia | 110 | 320 |

| Dominican Republic | 30 | 320 |

| Costa Rica | 10 | 320 |

| Venezuela | 10 | 320 |

| Cyprus | 70 | 260 |

| Greece | 140 | 210 |

| Pakistan | 1,000 | 210 |

| Hong Kong | 5,400 | 170 |

| Cambodia | 30 | 170 |

| Taiwan | 480 | 140 |

| Singapore | 1,000 | 140 |

| Bangladesh | 50 | 110 |

| Uzbekistan | 10 | 110 |

| Sri Lanka | 40 | 90 |

| Kenya | 90 | 70 |

| Ghana | 20 | 70 |

| Panama | 10 | 70 |

| Tanzania | 20 | 70 |

| New Zealand | 170 | 50 |

| Uganda | 10 | 40 |

| Ethiopia | 10 | 30 |

| Mauritius | 30 | 20 |

| Botswana | 20 | 20 |

| Mongolia | 10 | 10 |

90 1st | |

135,000 2nd | |

320 3rd | |

40,500 4th | |

14,800 5th | |

18,100 6th | |

170 7th | |

9,900 8th |

Similarweb shows a different story when it comes to February 2024 website visits with XTB receiving 7,682,000 visits vs. 9,438,000 for IG Group.

Our Most Popular Broker Verdict

XTB is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IG Group

When it comes to the range of products and CFD markets, IG and XTB both offer a broad spectrum, but they cater to different types of traders. IG is a powerhouse, offering a staggering range of CFDs on forex, shares, commodities, and more. If you’re the kind of trader who likes to diversify your portfolio, IG is like a treasure trove. XTB, while not as extensive as IG, still offers a solid range of CFDs, particularly excelling in the cryptocurrency sector.

| CFDs | IG Group | XTB |

|---|---|---|

| Forex Pairs | 110 | 48 |

| Indices | 130 | 30 |

| Commodities | 11 Metals 7 Energies 23 Softs | 7 Metals 6 Energies 10 Softs |

| Cryptocurrencies | 13 (+ Crypto 10 Index) | 10+ |

| Shares CFDs | 13000+ | 1848 |

| ETFs | 2000+ | 155 |

| Bonds | 14 | 3 |

| Futures | Yes | No |

| Treasuries | 14 | 3 |

| Investment | Yes | No |

Our Top Product Range and CFD Markets Verdict

For traders looking for a wide array of CFDs and markets, IG Group is the clear winner with its extensive product range.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

8. Superior Educational Resources – IG Group

Education is a cornerstone for any trader, whether you’re a newbie or a seasoned pro looking to upskill. IG offers a comprehensive set of educational resources, including webinars, video tutorials, and articles that cover a wide range of topics. XTB isn’t far behind, though. They have a robust educational centre filled with courses, webinars, and e-books, making it a great place for traders who are keen to learn.

- IG provides an extensive library of webinars that cover various trading strategies and market analysis techniques.

- XTB offers a unique educational centre that includes courses specifically designed for beginner traders.

- IG’s video tutorials are highly detailed, offering insights into complex trading strategies.

- XTB’s e-books are downloadable and cover a wide range of topics, from basic to advanced.

- Both brokers offer demo accounts, allowing traders to practise without risking real money.

- According to our own testing, IG scored 8.5, and XTB scored 8.0 in educational resources.

Our Superior Educational Resources Verdict

Based on our team’s scoring, IG Group slightly edges out XTB in offering superior educational resources with a score of 8.5 compared to XTB’s 8.0.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

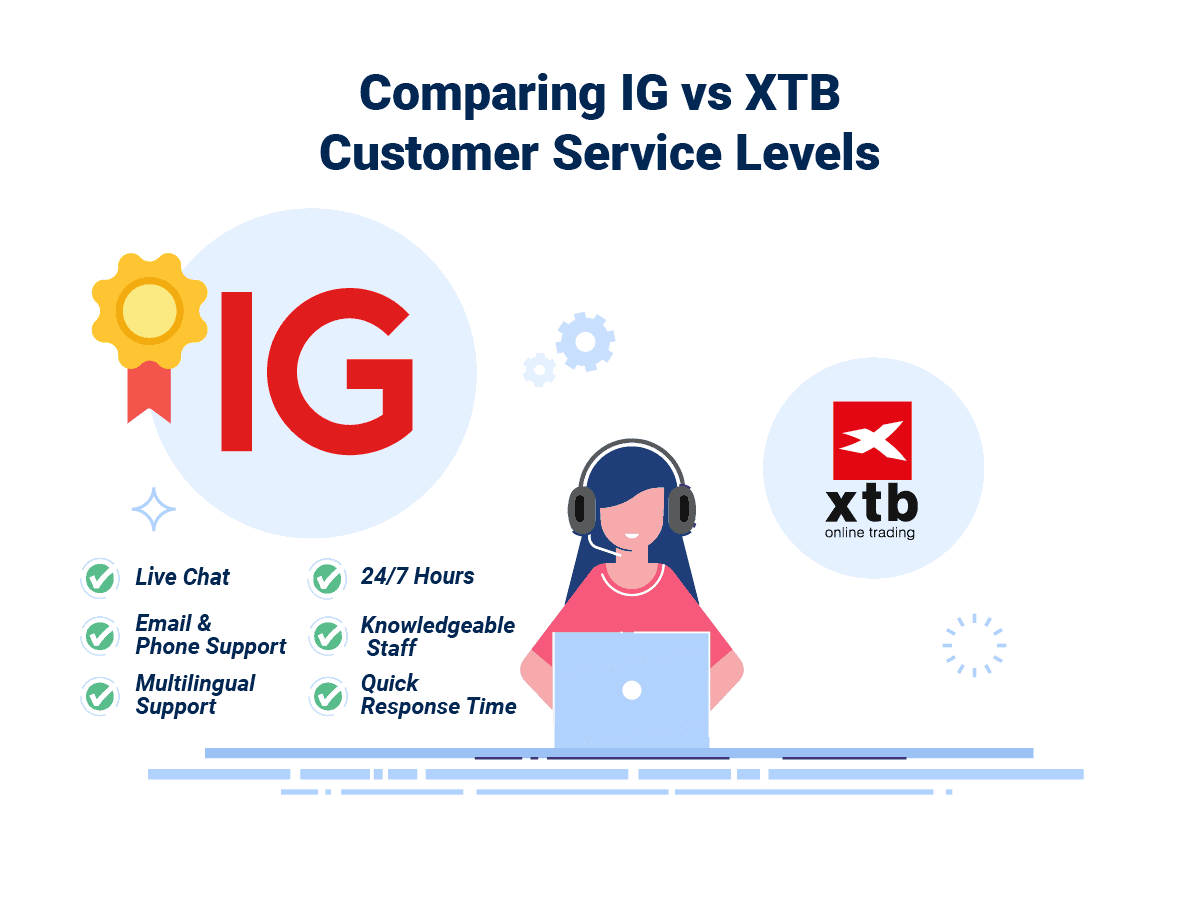

9. Superior Customer Service – IG Group

Both IG and XTB offer excellent customer service, with multiple channels of communication and 24/7 support. However, IG’s customer service is slightly more responsive based on user reviews.

| Feature | IG Group | XTB |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 12/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

While both brokers offer excellent customer service, IG Group’s slightly more responsive service gives it the edge in this category.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

10. Better Funding Options – IG Group

Funding your trading account should be as straightforward as possible, and both IG and XTB understand this. IG offers a variety of funding options, including debit/credit cards, bank transfers, and even PayPal for those who prefer digital wallets. XTB also provides multiple funding options but lacks the PayPal option, which could be a deal-breaker for some.

XTB compensates for this by not charging any deposit fees, whereas IG does charge a small fee for credit card deposits. Both brokers process withdrawals quickly, usually within 1-2 business days, making it easier for you to access your funds when you need them.

| Funding Methods | IG Group | XTB |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

For traders who value a wider range of funding options, including PayPal, IG Group takes the lead. However, if you’re looking to avoid deposit fees, XTB is your go-to broker.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

11. Lower Minimum Deposit – XTB

Getting started in trading shouldn’t break the bank, and both IG and XTB offer options that make it easier for traders to jump in. IG offers a $0 minimum deposit for its CFD account, but if you’re looking to get into Direct Market Access (DMA), you’ll need to put down $450. XTB, on the other hand, keeps things simple with a $0 minimum deposit for its standard account, making it an accessible option for traders who are just starting out or those who prefer to start small.

The minimum deposit can often be a deciding factor, especially for new traders who might not want to commit a large sum initially. Here’s a quick look at the minimum deposit requirements for both brokers:

| Broker | Minimum Deposit | Recommended Deposit |

| IG Group | $0 | $100 |

| XTB | $0 | $250 |

Our Lower Minimum Deposit Verdict

For traders looking for the lowest barrier to entry, XTB is the clear winner, with a $0 minimum deposit for its standard account.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: XTB or IG Group

XTB is the winner because it offers a well-rounded trading experience with a user-friendly platform, low minimum deposit, and excellent trading experience and ease. The table below summarises the key information leading to this verdict:

| Criteria | IG Group | XTB |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ❌ | ✅ |

Best For Beginner Traders

For beginner traders, XTB is the better choice due to its user-friendly platform and low minimum deposit.

Best For Experienced Traders

For experienced traders, IG offers a more comprehensive range of products and advanced features.

FAQs Comparing IG Group Vs XTB

Does XTB or IG Group Have Lower Costs?

XTB generally offers lower costs, particularly with its RAW account spreads. IG also has competitive spreads on its standard account. For a deeper dive into brokers with low spreads, you can explore this guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IG and XTB offer MetaTrader 4, but IG comes with a broader range of additional features and plugins for MT4. For a detailed comparison of top brokers offering MT4, you can visit this comprehensive analysis of the Best MT4 Brokers list.

Which Broker Offers Social Trading?

XTB stands out for offering social trading through its xSocial platform, a feature not currently available with IG. For more options and insights into social or copy trading platforms, check out this review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

IG offers spread betting, a feature that is not available with XTB. This makes IG a suitable choice for traders in the UK looking to take advantage of tax benefits associated with spread betting. For more information on this, you can check out this best spread betting broker guide.

What Broker is Superior For Australian Forex Traders?

In my opinion, neither IG nor XTB particularly stands out for Australian Forex traders. Both brokers are regulated by ASIC but are not founded in Australia. If you’re an Aussie trader looking for more localized options, you might want to explore other brokers listed in this Best Forex Brokers In Australia review.

What Broker is Superior For UK Forex Traders?

For UK Forex traders, I’d say IG is the superior choice. Both brokers are FCA-regulated, but IG has a more extensive presence in the UK. With its wide range of products and strong regulatory framework, IG is a reliable option for UK traders. For a more detailed comparison, you can visit this best UK Forex brokers.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert