Pepperstone vs XTB 2025

Our Pepperstone vs XTB comparison found that Pepperstone offers lower spreads with EUR/USD at 0.13 vs 0.30 for XTB. Pepperstone and XTB commission rate is $3.50, but Pepperstone offers rebates up to 15% for active traders.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Allowed but not supported

Overall

How Do Pepperstone Vs XTB Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and XTB:

- Pepperstone offers lower spreads with EUR/USD at 0.13 vs 0.30 for XTB.

- Both have a commission rate of $3.50, but Pepperstone provides rebates of up to 15% for active traders.

- Pepperstone offers over 150 financial instruments, while XTB provides over 1,500.

- Pepperstone’s execution speeds are quicker, processing most trades in less than 30 ms.

- XTB offers an Islamic Account with wider spreads, while Pepperstone provides a no commission swap-free option.

1. Lowest Spreads And Fees: Pepperstone

Pepperstone and XTB are no dealing desk (NDD) brokers that both offer two main account types with either a commission or commission-free pricing structure. While account types are discussed in more detail in the next section, average forex spreads offered by XTB and Pepperstone are compared below.

XTB and Pepperstone both offer two main account types:

- Commission-free accounts that pay no additional commission fees on top of the spread

- Commission-based accounts that pay flat rate commission fees meaning tighter spreads

1. No Commission Spreads (Standard Accounts)

Commission-free spreads and accounts are convenient for those wanting to avoid complex fee calculations due to lack of experience or time. While spreads are generally wider than commission-based accounts, XTB and Pepperstone both offer competitive spreads to standard account holders.

As shown in the table below, Pepperstone offers the tightest standard spreads for the majority of major currency pairs (AUD/USD, AUD/JPY, EUR/JPY and USD/CAD) when compared to XTB and other Best Forex Brokers In Australia. While XTB provides lower average spreads for the GBP/USD fx pair, it is only 0.04 pips less than Pepperstone’s spread of 1.44 pips.

|

Commission-Free Average Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.90 | 2.10 | 1.40 | 1.20 |

|

1.30 | 1.70 | 1.40 | 1.80 | 1.40 |

|

2.06 | 3.35 | 2.04 | 1.78 | 1.76 |

|

2.50 | 4.90 | 2.60 | 2.60 | 2.10 |

|

1.60 | 2.40 | 2.10 | 1.90 | 1.60 |

|

1.60 | 1.40 | 2.50 | 2.70 | 2.00 |

|

1.30 | 1.20 | 1.20 | 4.00 | 1.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

2. Commission Spreads (ECN-Style Account Types)

Many traders prefer commission-free pricing as it allows them to trade institutional grade spreads that are much narrower than what is offered to standard account holders.

Both brokers offer ECN-like spreads to those signed up to a Razor Account (Pepperstone) or Pro Account (XTB). As spreads are low, traders pay flat-rate commission fees to compensate the broker for their services. Overall, Pepperstone charges lower commission fees, meaning Pepperstone clients are able to achieve greater net profits with lower trading costs than XTB traders.

- Pepperstone Razor Account Commission Fees = AUD 3.5 / EUR 2.61 / GBP 2.29 / CHF 3.30 per side

- XTB Pro Account Commission Fees = GBP 3 / EUR 3.5 / USD 3.5 per side

When comparing XTB and Pepperstone’s average spreads for Pro and Raw account types, Pepperstone clearly offers significantly tighter spreads for the EUR/USD, AUD/USD, USD/JPY and EUR/JPY. For those wanting to focus on the GBP/USD, there is little difference between the average spreads offered by Pepperstone and XTB.

|

Commission Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.10 | 0.10 | 0.20 | 0.20 | 1.10 |

|

0.09 | 0.13 | 0.14 | 0.14 | 1.40 |

|

0.10 | 0.50 | 0.60 | 2.00 | 0.40 |

|

0.21 | 0.90 | 0.63 | 0.78 | 1.17 |

|

0.20 | 0.40 | 0.30 | 0.60 | 0.70 |

|

0.20 | 0.50 | 0.50 | 0.50 | 0.60 |

|

0.30 | 0.40 | 0.30 | 0.60 | 0.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Verdict

Although both brokers offer competitive spreads for commission and no-commission accounts, Pepperstone wins overall by providing access to the tightest average spreads for the majority of currency pairs. With both standard and ECN-style pricing, Pepperstone offers the lowest spreads for all but one of the major forex pairs listed above. As well as lower spreads, Pepperstone wins this round as its commission fees are also lower than XTB’s.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform: Pepperstone

| Trading Platform | Pepperstone | XTB |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

Both brokers provide clients with a choice of trading platforms that suit different traders’ needs and preferences. Pepperstone offers the three gold standards trading platforms for retail traders: MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. XTB, on the other hand, provides access to either MT4 or its proprietary platform, xStation 5.

MT4, MT5, cTrader and xStation 5 are available on the following devices:

- Desktop trading platforms for Windows and Mac computers.

- Webtrader platforms that are accessed through an internet browser.

- Mobile trading apps compatible with Android and iOS devices.

Pepperstone: The World’s Top Retail Trading Platforms

Pepperstone offers the three top retail trading platforms currently on the market, being MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. Advanced technical analysis, automated trading and risk management tools are available on all platforms, although there are key differences to consider when choosing your Pepperstone platform.

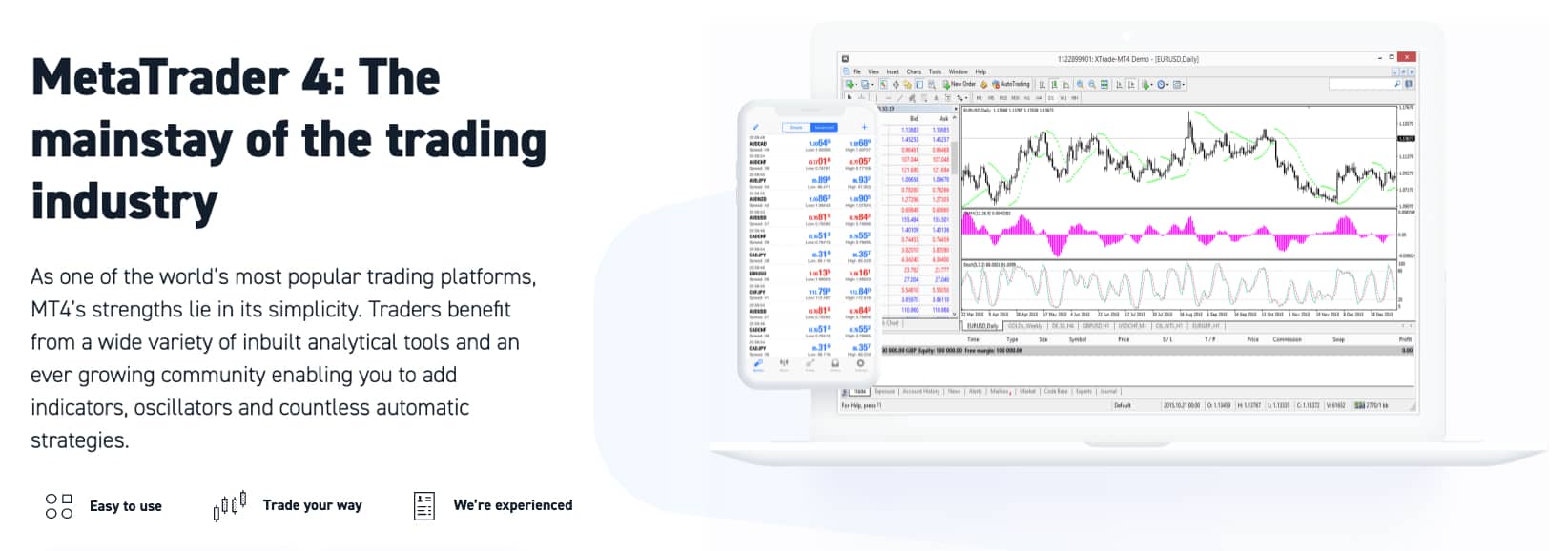

MetaTrader 4 (MT4)

Predominately a forex trading platform, MT4 is still popular with those wanting to develop trading strategies that focus on forex. Although MT4 provides a wide range of trading tools sufficient for many investors, unlike MetaTrader 5 (MT5), MT4 users are not able to access and trade share CFD markets.

MetaTrader 4 key features include:

- Advanced inbuilt technical analysis tools with 30 technical indicators, 24 objects and 9 timeframes

- Algorithmic trading with Expert Advisors (EAs). Traders can write their own EAs using the MQL4 programming language or, alternatively, download existing EAs from the MetaTrader marketplace.

- Single-currency backtesting of EAs against historical market data.

- Basic order types to help traders manage the high risk of trading.

- Social-copy trading with MT4 and third-party account mirroring services such as MetaTrader Signals, DupliTrade and Myfxbook.

- Autochartist is an automatic market scanner to detect trading opportunities and market movements.

- Basic order types to help traders manage the high risk of trading.

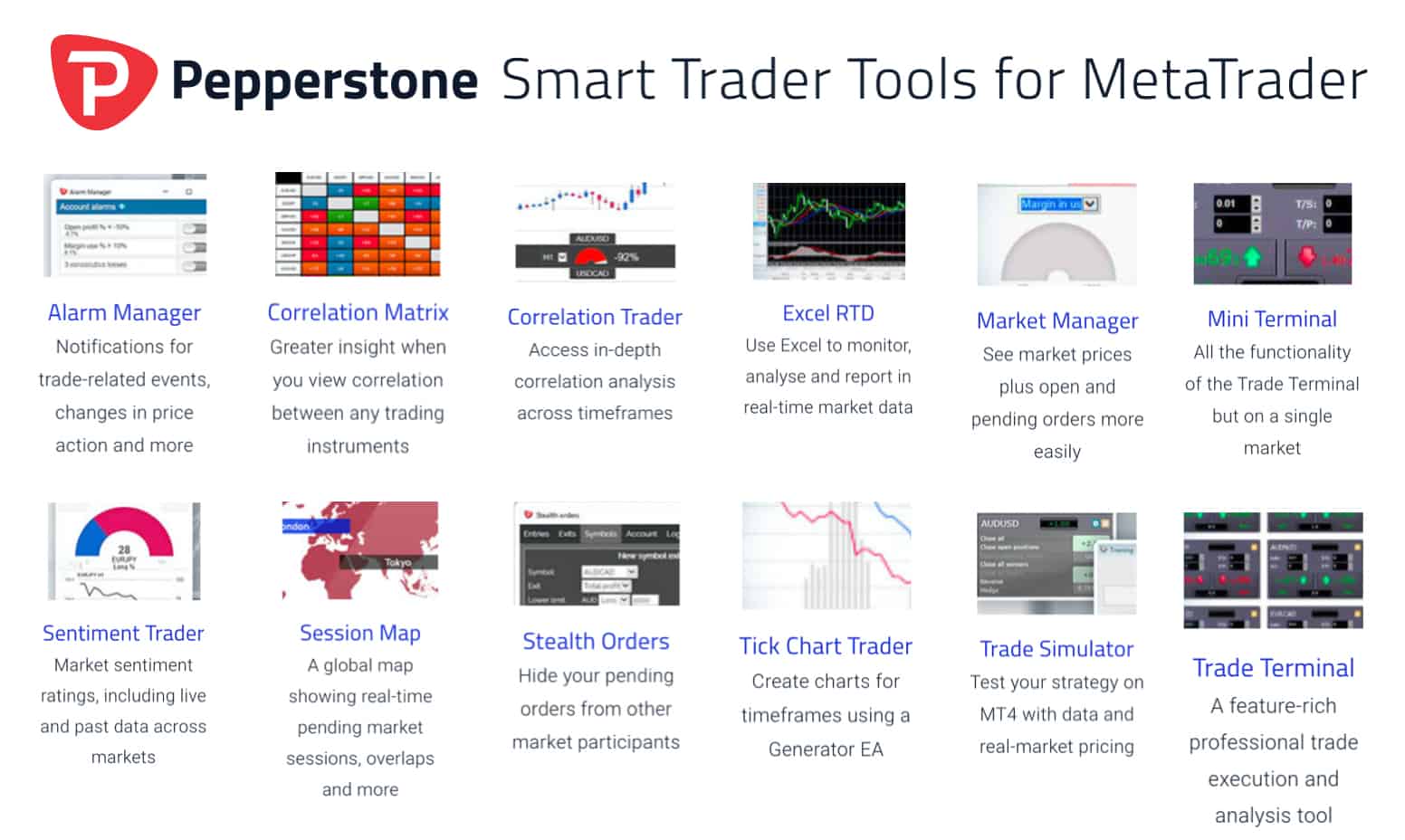

As well as a wide range of preinstalled trading tools, MT4 and MT5 users can download Pepperstone’s Smart Trader Tools. The add-on package includes 28 different EAs and indicators, such as an alarm manager, sentiment trader and mini terminal.

MetaTrader 5 (MT5)

MT5 offers a significant number of improvements over its predecessor. As mentioned above, traders can trade a wider range of asset classes, including share CFDs, a feature favoured by many Pepperstone customers. MT5 provides the same trading tools as MT4 as well as the following enhancements:

- A more extensive range of charting tools with 38 indicators, 44 objects and 21 timeframes. The greater number of timeframes is especially useful for those executing day trading and scalping strategies.

- Additional order types.

- Expert Advisors are written with the easier-to-use, object-oriented programming language, MQL5.

- Better backtesting with the ability to test multiple currency pairs simultaneously.

- Six pending order types are compared to the four available on MT4.

- Additional features such as depth of market pricing, a community chat function and an economic calendar.

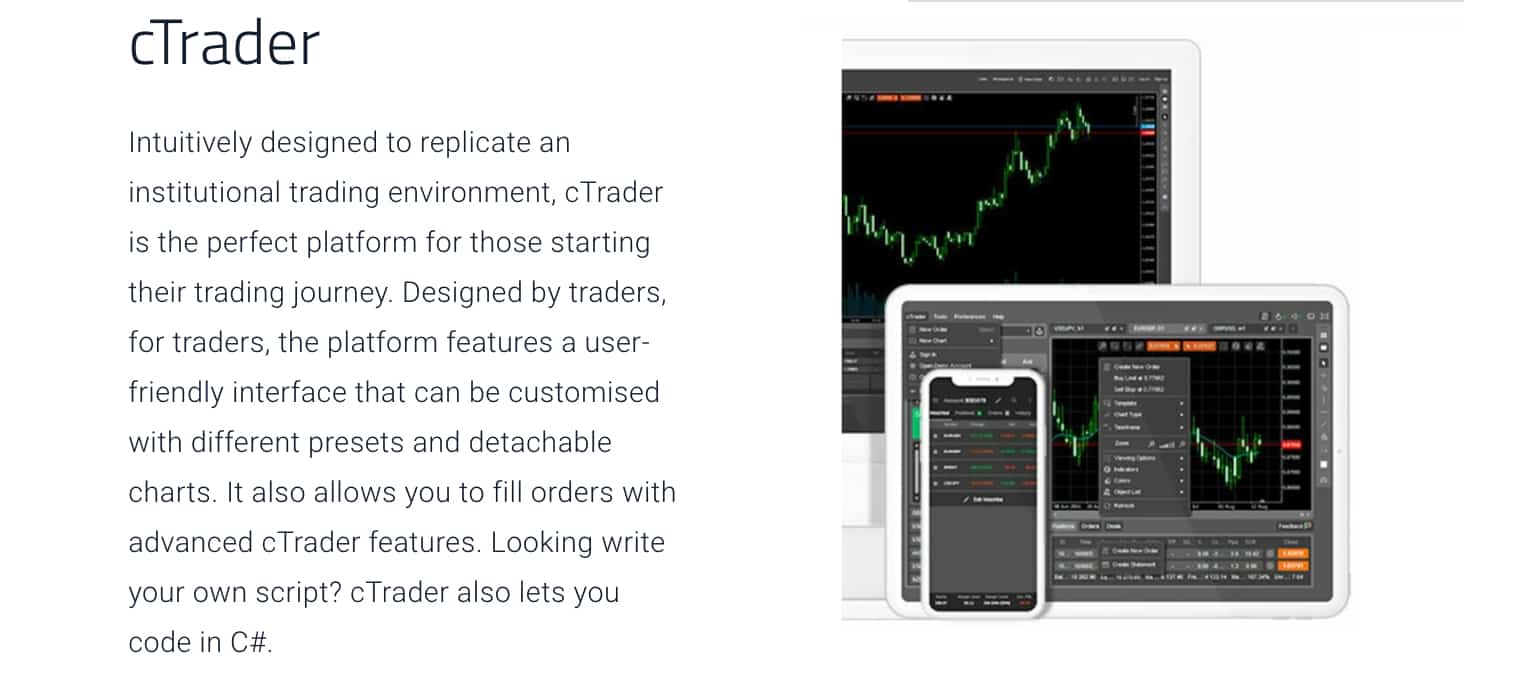

cTrader

cTrader is a user-friendly forex trading platform suited to those wanting an institutional-grade trading environment. As with MetaTrader platforms, algorithmic trading strategies known as cBots can be developed using the C# programming language. cTrader trading tools and features include:

- Automated trading with cTrader Automate and cBots

- Level 2 Depth of Market pricing

- A large range of technical analysis tools with 70 inbuilt indicators

- Different order types to manage risk

XTB Trading Platforms

As an XTB customer, traders can choose between MetaTrader 4 (MT4) and the broker’s proprietary platform, xStation 5.

XTB MT4

XTB’s MetaTrader 4 offering is very similar to Pepperstone’s, with the same charting and automated trading tools available. As Pepperstone’s Smart Trader Tools is a proprietary package of add-ons, XTB customers cannot install these additional EAs and technical indicators.

As MT4 is predominately a forex, index and commodity CFD trading platform, XTB customers are restricted to a limited CFD range when using the platform, with no stocks or ETFs available.

XTB xStation 5

XTB’s proprietary software, xStation 5, is an easy-to-use trading platform with full access to the broker’s extensive product range, including shares and ETFs. As well as customisable charting and analysis tools, xStation 5 users can utilise the following features when trading:

- An inbuilt calculator allows users to forecast profits, losses and costs prior to entering a trade.

- Risk management tools with the ability to edit take profit and stop loss levels directly on charts.

- Market sentiment data can be searched by asset class or individual instruments.

- An economic calendar plus XTB’s in house team of analysts frequently providing market news.

- Email, SMS and push alerts.

Verdict

While both brokers offer excellent trading platforms, Pepperstone is the only broker to offer MetaTrader 5 (MT5). As well as the ability to trade shares and cryptocurrency, MT5 users gain access to a wider range of technical analysis features and enhanced algorithmic trading tools. With multi-currency backtesting for EAs, greater market access and more order types, MT5 and Pepperstone win this round.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Superior Accounts And Features: Pepperstone

XTB and Pepperstone offer a similar choice of account types, with a commission-free or commission account type available. As well as standard and ECN-style accounts, both brokers allow traders of Islamic faith to sign up to XTB’s Islamic account or Pepperstone’s Swap-Free Account.

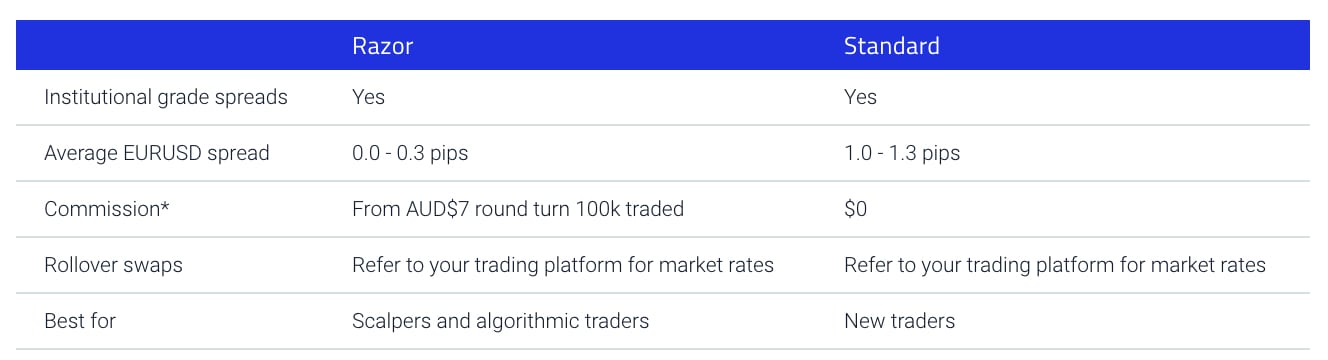

Pepperstone: Standard And Razor Accounts

- Standard Account: Minimum spreads from 1.0 pip with no commission fees

- Razor Account: Minimum spreads from 0.0 pips and round turn commission fees of AUD 7

Apart from spreads and commission fees, Pepperstone Razor vs Standard Accounts offer similar features in terms of minimum deposit requirements, leverage limits and account fees.

Minimum Deposit

Regardless of account type, no minimum deposit is enforced by Pepperstone, although the broker recommends depositing $200 initially. When setting up your Razor or Standard Account, you can choose one of the following base currencies: GBP, EUR, USD, AUD, NZD, JPY, CAD, CHF, SGD and HKD.

Leverage

As a Pepperstone customer, the maximum leverage you can trade with depends on the subsidiary you are registered with:

- The ASIC-regulated Australian Pepperstone subsidiary offers a maximum leverage of 30:1 when trading forex, the broker’s Dubai DFSA branch follows ASIC trading rules

- UK traders are restricted to 30:1 leverage on major and 20:1 on minor and exotic currency pairs

- European traders signed up to the CySEC or BaFin-regulated branches are restricted to 30:1 for majors and 20:1 for minor forex pairs

- Pepperstone Kenya (CMA) offers 400:1

- Pepperstone the Seychelles (FSA) provide a higher maximum leverage of 500:1

Account Fees

- Swap Fees: Also known as overnight financing fees, swap fees are incurred (or received) when positions are held open for longer than a day. Swap rates are derived from the interest rate differential between the two forex pairs involved in the trade.

- Admin Charges: Traders pay admin fees for positions held open longer than 10 days, with admin charges incurred for every 10 days the trade is open.

- Inactivity Fees: Pepperstone does not charge any inactivity fees; traders can leave accounts dormant for any length of time

XTB: Standard And Pro Accounts

- Standard Account: No commission with minimum spreads of 0.6 pips

- Pro Account: €/£/$7 round turn commission fee with minimum spreads of 0.1 pips

As with Pepperstone, the key differences between XTB’s Standard and Pro account types are spreads and commission costs.

Minimum Deposit

XTB minimum deposit requirements differ depending on where you are located. UK traders are required to make an initial minimum deposit of £250, after which they can deposit any amount.

XTB customers located elsewhere are not required to initially deposit a specific amount. When setting up your XTB trading account, only four base currencies are available, being the EUR, GBP, USD and HUF.

Forex Leverage

As mentioned above, the XTB subsidiary you are trading determines the leverage you can use when trading forex. Those registered with XTB’s UK, European, Spanish or Polish branches will be offered a maximum leverage of 30:1 while international traders signed up to the IFSC-regulated branch are offered up to 500:1.

Account Fees

- Swap Fees: Similarly to Pepperstone, XTB customers will receive or pay swap rates if they hold a position open overnight.

- Inactivity Fees: If you have not made a trade for a year or deposited funds in the last 90 days, then XTB will charge a monthly inactivity fee of EUR/GBP/USD 10

Islamic Account Options

Traders following Islamic finance practises where the interest cannot be accrued or paid may require swap-free or Islamic account types when trading forex and CFDs. Both brokers offer a swap-free account type, with XTB charging flat-rate fees to Islamic traders and Pepperstone providing a no commission swap-free option.

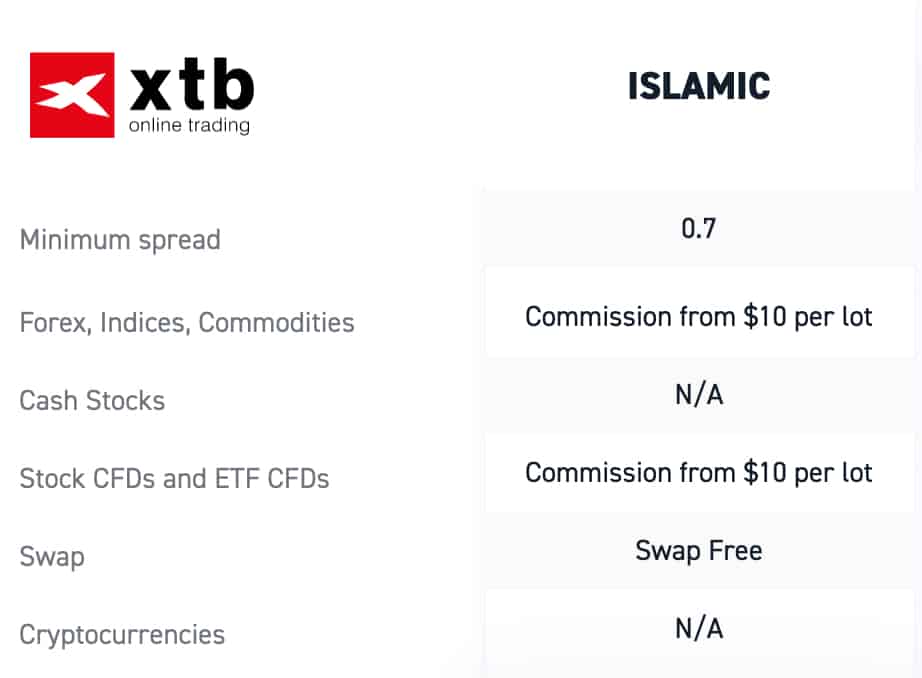

XTB’s Islamic Account

XTB offers an Islamic Account option, although spreads are wider and commission fees are much higher than Standard and Pro account types. While Islamic traders incur no swap rates, commission fees are $10 per side, significantly higher than the broker’s Pro account type. Likewise, minimum spreads start from 0.7 pips, wider than the XTB’s no commission standard spreads. As well as high trading costs, XTB’s Islamic account holders face the restriction of not being able to trade Cryptocurrencies.

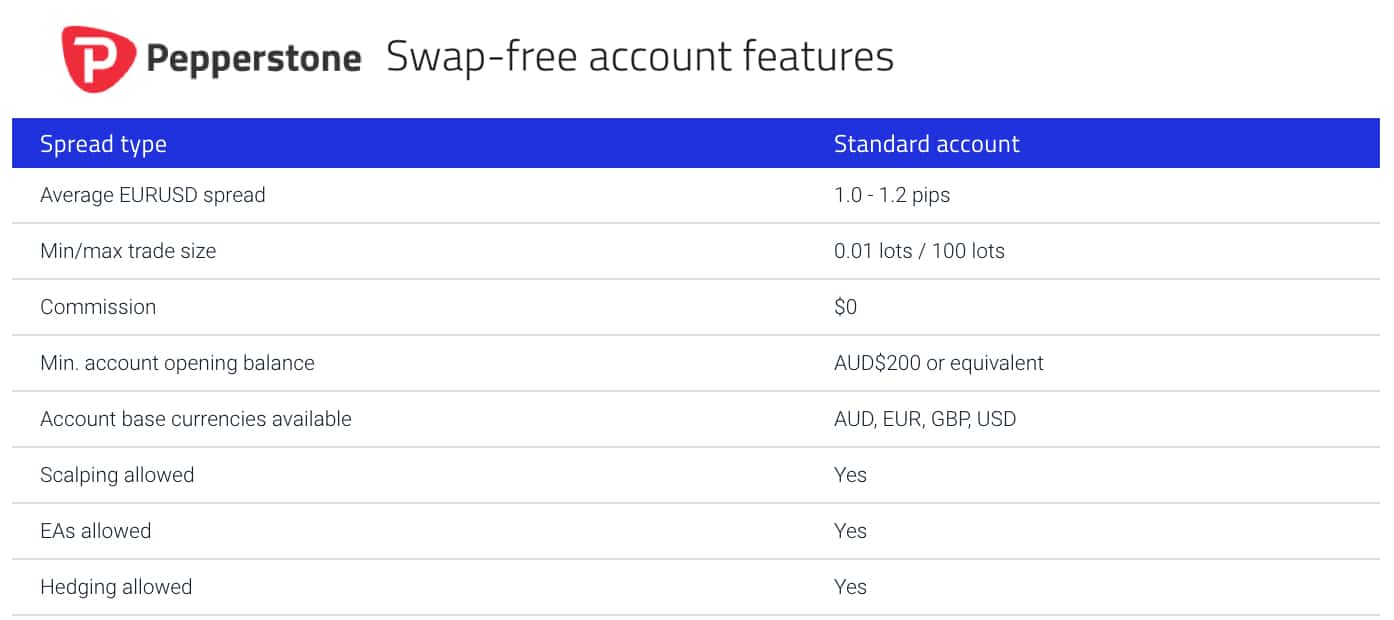

Pepperstone’s Swap Free Account

Pepperstone’s Swap Free account type was designed for those who cannot pay or receive swap rates for religious reasons. Similar to the broker’s Standard pricing, the interest-free account offers average spreads of 1.0-1.2 pips and no commission fees.

When setting up a swap-free account, traders can choose from fewer base currencies than Pepperstone’s other accounts, with only AUD, GBP, USD and EUR available. As with Pepperstone’s Standard and Razor accounts, swap-free accounts incur admin charges when positions are held open for longer than 10 days.

Spread Betting For UK And EU Traders

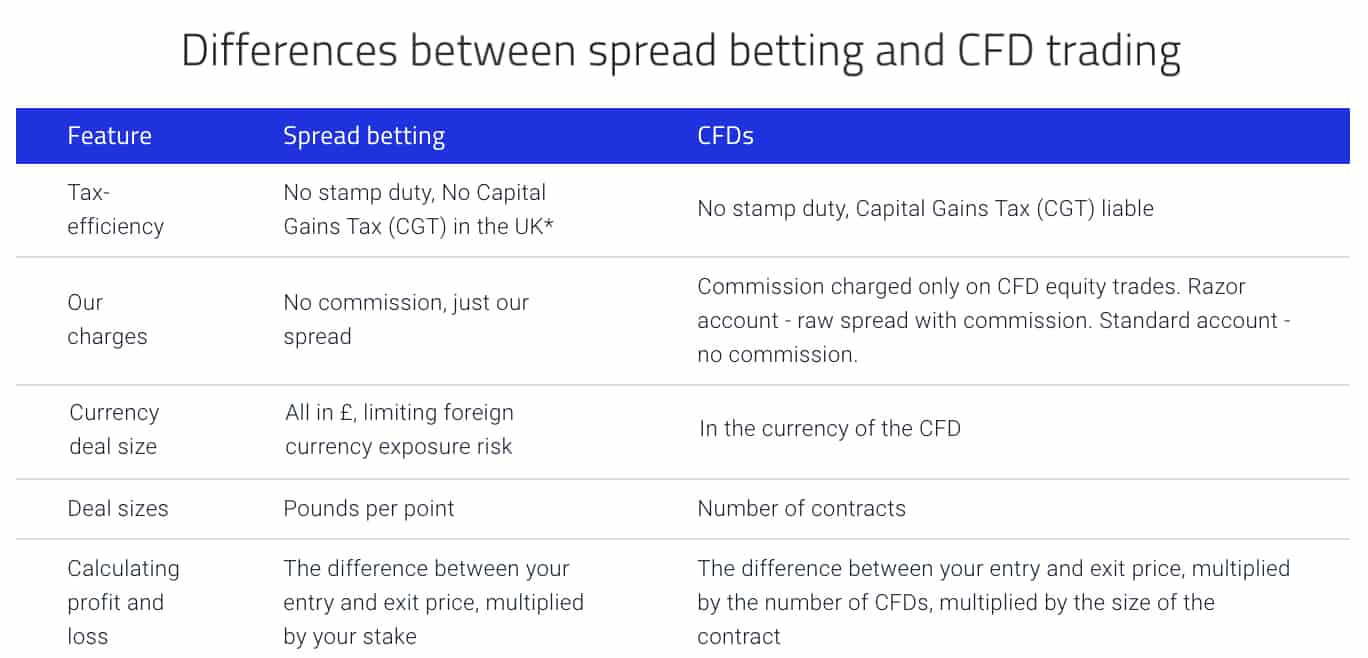

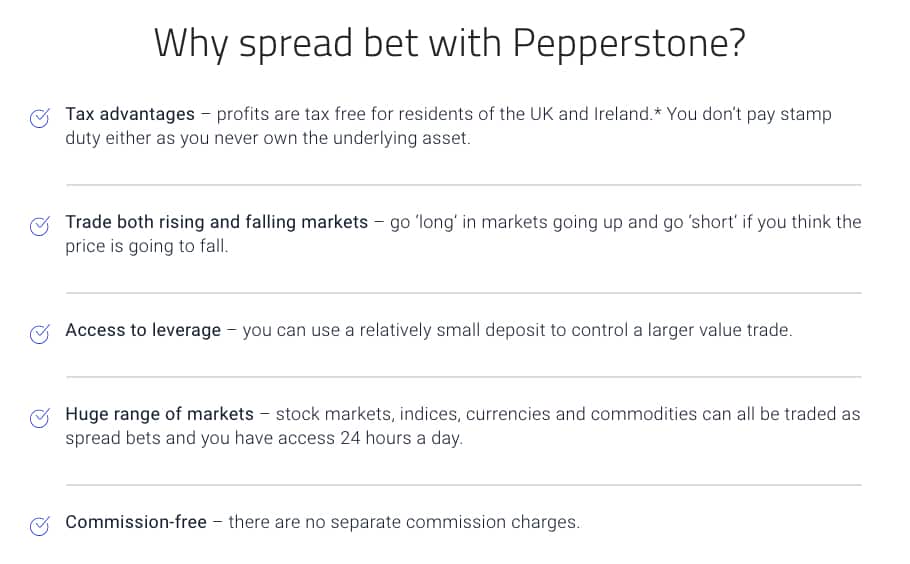

Pepperstone traders based in Europe or the United Kingdom have the option of spread betting rather than trading CFDs. At this stage, XTB fails to offer any spread betting services.

Spread betting is a form of speculation where you bet on a range of different outcomes regarding whether an asset’s price will increase or decrease. When spread betting, you decide on the stake you want to take along with how much you want to bet per price movement.

Although both CFD trading and spread betting involve speculating on whether an asset’s price will rise or fall, one of the key differences between trading styles is tax liabilities. While both trading styles are exempt from stamp duties, profits from trading CFDs are subject to Capital Gains Tax (CGT), while spread betting is not CGT liable and, therefore, more tax efficient.

Spread Betting With Pepperstone

Pepperstone’s FCA-regulated subsidiary offers spread betting to those residing in Europe and the UK. Trading conditions are similar to CFD trading with low spreads and fast execution, with MT4, MT5 and cTrader available as trading platform options. When spread betting with Pepperstone, traders pay no commission fees on top of the spread. As well as forex, spread betting is commission-free for indices, shares and commodities.

Pepperstone: No Commission Spread Betting

While XTB does not offer spread betting, UK and European Pepperstone customers can execute forex, share, commodity, and index spread betting strategies. Spread betting with Pepperstone is commission-free, with profits exempt from Capital Gains Tax (CGT), making it a tax-efficient style of trading.

| Pepperstone | XTB | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Verdict

For those wanting tight ECN-like spreads with low commission fees, Pepperstone’s Razor account is a great option. Whether you want to run EAs, implement scalping strategies or take advantage of 0.0 pip minimum spreads, Pepperstone offers institutional-style trading conditions and pricing.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: Pepperstone

When it comes to trading, the experience and ease of use are paramount. We’ve spent countless hours testing both Pepperstone and XTB on various platforms, and here’s what we found:

- Pepperstone shines with its MT4 platform, which is renowned for its user-friendly interface and advanced trading tools.

- XTB, on the other hand, didn’t make the top spot in our tests, but it’s worth noting that many traders appreciate its unique features.

- Our tests also revealed that Pepperstone stands out for automation, with tools like Capitalise.ai enhancing the trading experience.

- While neither broker clinched the top spot for the best trading app, it’s evident that both have invested in mobile trading solutions.

Now, after all the rigorous testing and analysis, it’s time to give our verdict.

Verdict

Based on our extensive research and hands-on testing, Pepperstone offers a slightly superior trading experience in terms of ease and functionality.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: Tie

Pepperstone Trust Score

XTB Trust Score

Both XTB and Pepperstone are overseen by multiple top-tier regulators around the globe. While the level of investor protection you receive varies between jurisdictions, trading with a regulated broker is strongly recommended to reduce the high risk of trading.

Most financial authorities in countries such as the United Kingdom, Dubai, Australia, and Europe require brokers to follow strict guidelines, i.e. segregating client funds, to ensure retail traders’ account balances are protected while brokerage services are fair and competitive.

Pepperstone: Regulated By Top-Tier Financial Authorities

Traders are able to register with one of three Pepperstone subsidiaries:

- European traders: Pepperstone UK – regulated by the Financial Conduct Authority, UK (FCA).

- Middle-Eastern traders: Pepperstone Dubai, overseen by the Dubai Financial Services Authority (DFSA).

- Traders based elsewhere can sign up to the Australian Pepperstone branch, regulated by the Australian Securities and Investments Commission (ASIC).

The level of investor protection you receive depends on the subsidiary you are trading with. European Union traders receive protection via the FCA’s investor protection fund, where retail investor accounts receive up to £85,000 in the unlikely event Pepperstone becomes insolvent.

XTB: Financial Regulators

Overseen by five financial authorities, XTB is viewed as a highly regulated broker with additional transparency due to the broker being listed on the Warsaw Stock Exchange. XTB regulators include:

- The United Kingdom: FCA

- Europe: CySEC (Cyprus Securities and Exchange Commission)

- Poland: KNF (The Polish Securities and Exchange Commission)

- Spain: CNMW (The National Securities Market Commission)

- International: IFSC (Belize International Financial Services Commission)

As with Pepperstone, the level of investor protection you receive depends on where you reside and the XTB entity you are trading CFDs with:

- Those based in the UK receive up to £85,000 in accordance with FCA regulation.

- CySEC regulation requires those living in Italy, Cyprus or Hungary to receive up to €20,000.

- Clients residing elsewhere in Europe are protected up to €20,100 in line with the KNF’s regulation in Poland.

- Retail investor account holders outside of Europe (excluding China), receive no investor protection.

| Pepperstone | XTB | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | DFSA (Dubai) CMNV (Spain) KNF (Poland) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSC-BZ |

Verdict

With oversight from multiple top-tier financial authorities and investor protection for many regions, XTB and Pepperstone are both viewed as safe, trusted brokers and, therefore, tie this round.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. Most Popular Broker – XTB

XTB gets searched on Google more than Pepperstone. On average, XTB sees around 368,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 70% fewer.

| Country | Pepperstone | XTB |

|---|---|---|

| Poland | 720 | 135,000 |

| Portugal | 480 | 40,500 |

| Spain | 1,900 | 27,100 |

| France | 1,000 | 18,100 |

| Germany | 3,600 | 12,100 |

| Brazil | 6,600 | 9,900 |

| Vietnam | 720 | 5,400 |

| Chile | 1,000 | 5,400 |

| Italy | 1,900 | 4,400 |

| United Kingdom | 5,400 | 4,400 |

| Colombia | 3,600 | 3,600 |

| Thailand | 4,400 | 2,400 |

| United States | 4,400 | 2,400 |

| Peru | 1,600 | 2,400 |

| Mexico | 3,600 | 1,900 |

| United Arab Emirates | 1,000 | 1,900 |

| Netherlands | 880 | 1,600 |

| India | 2,900 | 1,300 |

| Switzerland | 320 | 1,300 |

| Argentina | 1,300 | 1,300 |

| Morocco | 720 | 1,000 |

| Saudi Arabia | 260 | 1,000 |

| Austria | 320 | 1,000 |

| Algeria | 390 | 880 |

| Ecuador | 1,000 | 880 |

| Egypt | 390 | 720 |

| Canada | 720 | 720 |

| Bolivia | 1,300 | 720 |

| Turkey | 1,600 | 480 |

| Nigeria | 1,300 | 480 |

| Sweden | 390 | 480 |

| Ireland | 260 | 480 |

| Japan | 480 | 390 |

| South Africa | 2,900 | 390 |

| Jordan | 260 | 390 |

| Malaysia | 4,400 | 320 |

| Indonesia | 1,600 | 320 |

| Philippines | 880 | 320 |

| Australia | 8,100 | 320 |

| Venezuela | 390 | 320 |

| Dominican Republic | 880 | 320 |

| Costa Rica | 480 | 320 |

| Cyprus | 480 | 260 |

| Pakistan | 1,300 | 210 |

| Greece | 210 | 210 |

| Cambodia | 320 | 170 |

| Hong Kong | 3,600 | 170 |

| Taiwan | 1,000 | 140 |

| Singapore | 1,600 | 140 |

| Uzbekistan | 140 | 110 |

| Bangladesh | 390 | 110 |

| Sri Lanka | 320 | 90 |

| Kenya | 4,400 | 70 |

| Ghana | 260 | 70 |

| Tanzania | 720 | 70 |

| Panama | 320 | 70 |

| New Zealand | 170 | 50 |

| Uganda | 390 | 40 |

| Ethiopia | 390 | 30 |

| Botswana | 390 | 20 |

| Mauritius | 110 | 20 |

| Mongolia | 1,900 | 10 |

2024 Monthly Searches For Each Brand

XTB - Poland

XTB - Poland

|

135,000

1st

|

Pepperstone - Poland

Pepperstone - Poland

|

720

2nd

|

XTB - Portugal

XTB - Portugal

|

40,500

3rd

|

Pepperstone - Portugal

Pepperstone - Portugal

|

480

4th

|

XTB - Spain

XTB - Spain

|

27,100

5th

|

Pepperstone - Spain

Pepperstone - Spain

|

1,900

6th

|

XTB - Brazil

XTB - Brazil

|

9,900

7th

|

Pepperstone - Brazil

Pepperstone - Brazil

|

6,600

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with XTB receiving 7,682,000 visits vs. 1,273,000 for Pepperstone.

Verdict

XTB is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: Tie

Both brokers offer a wide range of financial instruments with the ability to trade forex, cryptocurrencies* and shares, among other asset classes. The maximum leverage offered by XTB and Pepperstone varies depending on the financial instrument you are trading as well as where you reside (certain financial authorities such as ASIC, the FCA and CySEC enforcing leverage caps).

*NOTE: Under new FCA guidelines, UK retail traders are no longer able to trade cryptocurrencies.

Pepperstone’s CFD Range

Pepperstone offers low-cost trading on a number of asset classes. With over 150 financial instruments to choose from, traders can easily develop well-diversified trading strategies that can include forex, index, commodity, cryptocurrency and share CFDs.

Currency Pairs

For those wanting to focus on forex trading, Pepperstone provides over 61 major, minor and exotic currency pairs. As discussed above, maximum leverage depends on your location, while spreads differ between Pepperstone account types.

In addition to standard currency pairs, customers gain market access to three currency index CFDs (US Dollar Index, Euro Dollar Index and Japanese Yen Index) that are measured against a basket of currencies. For instance, the US Dollar Index (USDX) is measured against six major currencies such as the EUR, JPY and GBP.

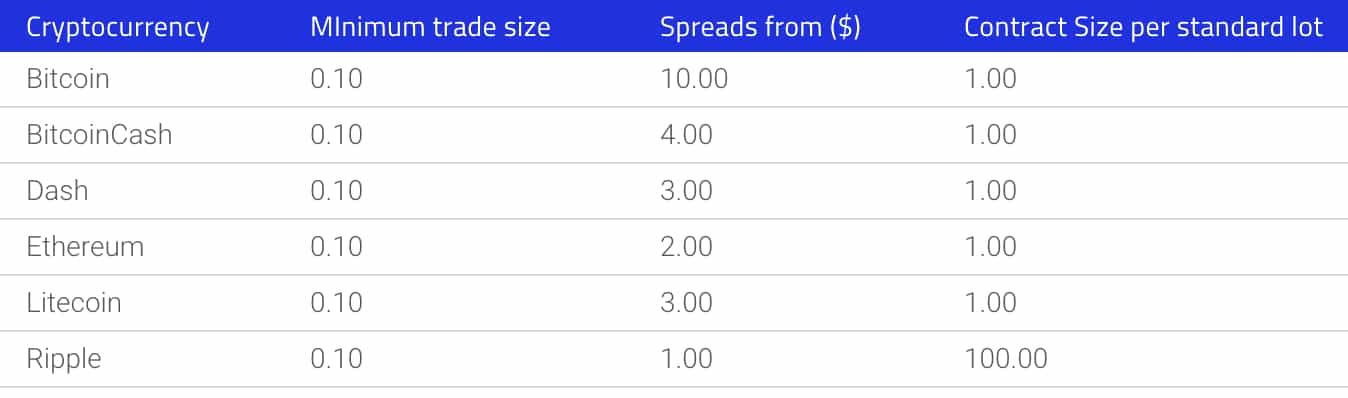

Cryptocurrency CFDs

Pepperstone offers six major cryptocurrencies with no commission fees. When trading Bitcoin, spreads start from $10.00, while minimum spreads for Bitcoin Cash, Ripple, Litecoin, Ethereum and Dash range from $1.00-4.00.

Share Trading

MetaTrader 5 users gain access to over 60 share CFDs. As the broker doesn’t widen bid/ask prices for stock CFDs, traders pay a low commission fee of USD 0.02 per side per share when opening or closing a position.

Other CFDs

As well as forex, share and cryptocurrency CFDs, Pepperstone clients can trade commodities such as precious metals, soft commodities, energy products and indices from global stock exchanges.

In particular, Pepperstone’s precious metal offering is excellent. As well as gold and silver against the USD, customers can also trade gold and silver cross against the EUR, AUD, GBP and CHF.

XTB’s Market Access

XTB offers impressive market access with over 1,500 financial instruments. Although XTB offers an extensive number of CFDs, the broker provides significantly fewer forex pairs compared to the best brokers.

Currency Pairs

XTB offers a limited selection of forex products, with only 49 currency pairs available. Unlike Pepperstone, the broker does not offer any currency index CFDs.

Cryptocurrencies

XTB traders gain impressive access to Cryptocurrency markets with nine crypto CFDs and 16 crypto crosses available. Individual cryptocurrencies include Bitcoin, EOS, Stellar, Litecoin, Dash, Ethereum, Ripple Etherclassic and Bitcoin Cash, while examples of crosses are Tron/Ethereum, Litecoin/Bitcoin and Bitcoin Coin/Bitcoin.

Share And ETF Trading

Through xStation 5, XTB customers can access a wide range of equities and exchange-traded funds (ETFs) in the form of CFDs. Over 1772 share CFDs and 60 ETF CFDs are available, with commission costs starting from 0.08%. XTB clients using MT4 will not be able to trade share or ETF asset classes.

Other CFDs

In addition to forex, cryptocurrencies, shares and ETFs, XTB offers 22 commodities and 42 indices. Commodity CFDs are derived from products such as oil, gas, softs, metals and t-notes, while index CFDs include the US500, FTSE and AUS200, among many others.

Verdict

Pepperstone and XTB both provide excellent market access to a range of asset classes, yet XTB’s extensive collection of cryptocurrency and share CFDs means they offer the best CFD product range. Although XTB offers a larger collection of CFDs overall, if you want to focus on forex trading, Pepperstone is better suited as it provides access to a greater number of currency pairs.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

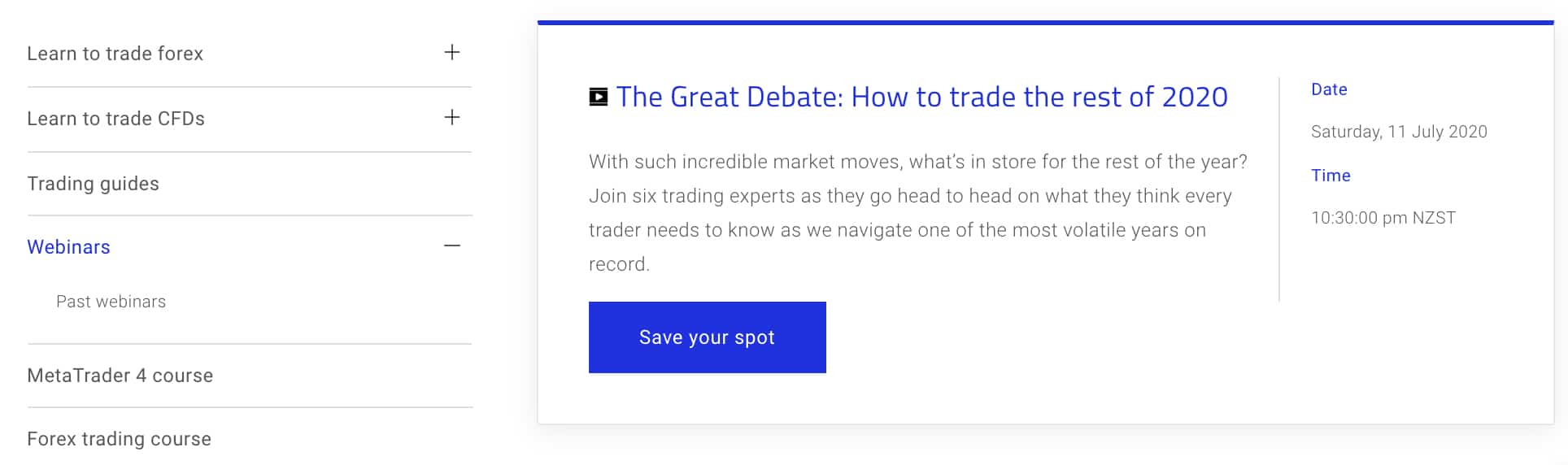

8. Superior Educational Resources: Pepperstone

Pepperstone:

- Webinars: Regularly hosts webinars for traders of all levels.

- Courses: Offers comprehensive courses tailored for beginners and advanced traders.

- E-books: Provides a variety of e-books covering different trading topics.

- Tutorials: Detailed video tutorials to guide traders through their platform and trading strategies.

- Market Analysis: Daily market analysis to keep traders informed.

- Customer Support: 24/7 customer support to assist with educational queries.

XTB:

- Webinars: Frequent webinars with industry experts sharing insights.

- Courses: In-depth courses focusing on both basic and complex trading concepts.

- E-books: A wide range of e-books available for traders.

- Tutorials: Step-by-step tutorials on platform navigation and trading techniques.

- Market Analysis: Regular updates on market trends and news.

- Customer Support: Dedicated support team for educational assistance.

Verdict

Based on our team’s testing, Pepperstone scores slightly higher in educational resources, making it the preferred choice for traders seeking comprehensive educational materials.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

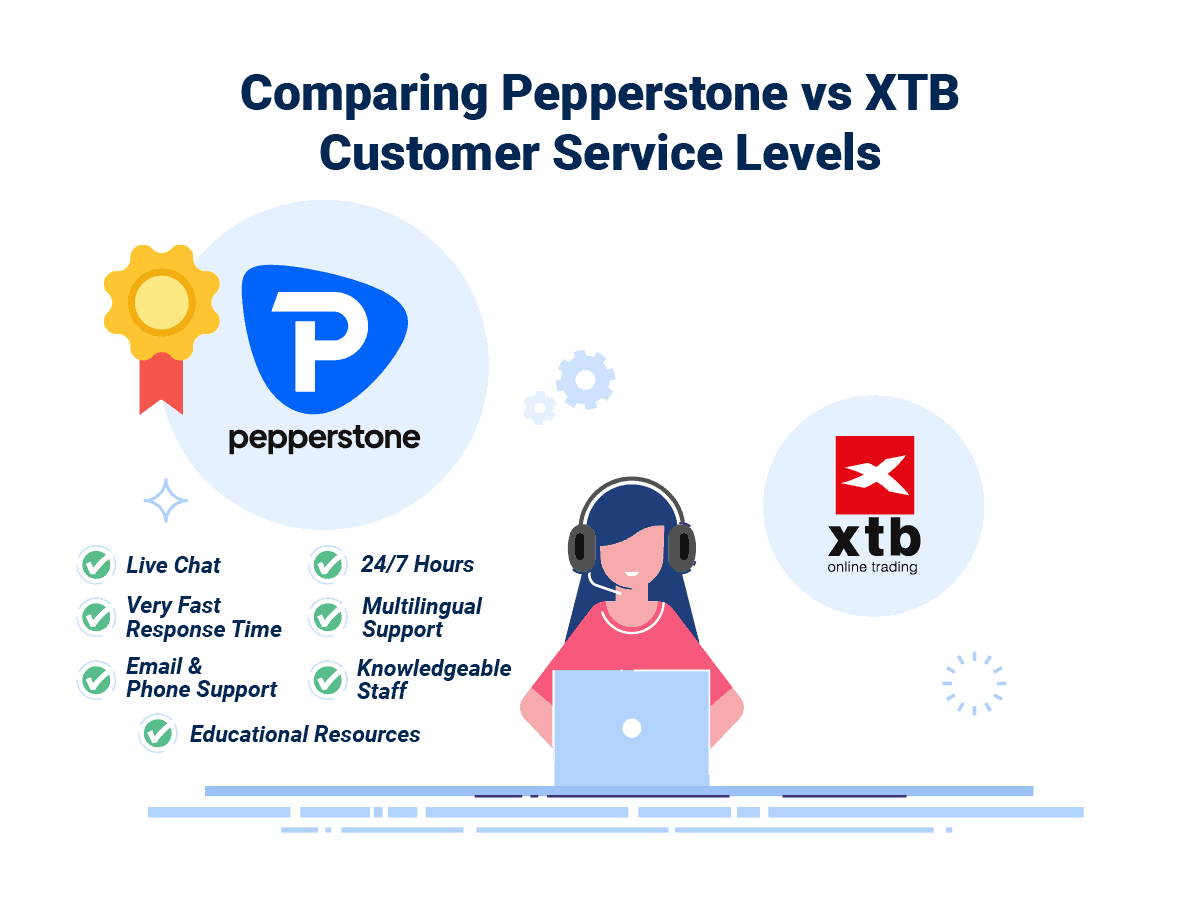

9. Superior Customer Service: Pepperstone

Pepperstone Customer Support

Pepperstone offers award-winning customer that is available 24 hours a day, Sunday to Friday. You can contact Pepperstone via live chat, email and phone, with the multilingual customer service team consistently providing quick and relevant responses.

XTB Customer Support

Email, phone and live chat contact methods can be used to get in touch with XTB, as well as social media platforms such as Facebook and Twitter. Although phone and live chat are efficient, emails are not often replied to. If you are based in Europe, customer support is restricted to 24/5, while anyone outside of Europe can contact the broker 24/7.

Pepperstone Educational Resources

To expand your forex trading knowledge, Pepperstone offers live webinars, tutorials, extensive articles and a trading glossary. Live webinars are frequently uploaded to the broker’s YouTube channel, covering topics such as technical analysis, strategy development and risk management.

For those new to trading, an introductory MetaTrader 4 course is freely available online, The MT4 course explains how to use the platform, place orders, and install the broker’s Smart Trader Tools.

As well as an excellent collection of educational resources, Pepperstone offers tools for fundamental analysis, such as an economic calendar, market news and financial market analysis conducted by the broker’s in-house analysis team.

XTB Education

XTB’s online ‘Trading Academy’ consists of a wide range of educational resources. Trading platform tutorials, webinars, ebooks, articles and videos are available and designed for beginner and intermediate traders, with advanced resources coming soon.

As with Pepperstone, XTB offers fundamental analysis and research resources such as an economic calendar as well as market sentiment and news.

Verdict

When Pepperstone and XTB’s customer support and education are compared, Pepperstone offers the best customer service overall. As well as award-winning and efficient customer support, the broker offers an extensive range of educational resources, including webinars, training courses and articles developed by experts.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

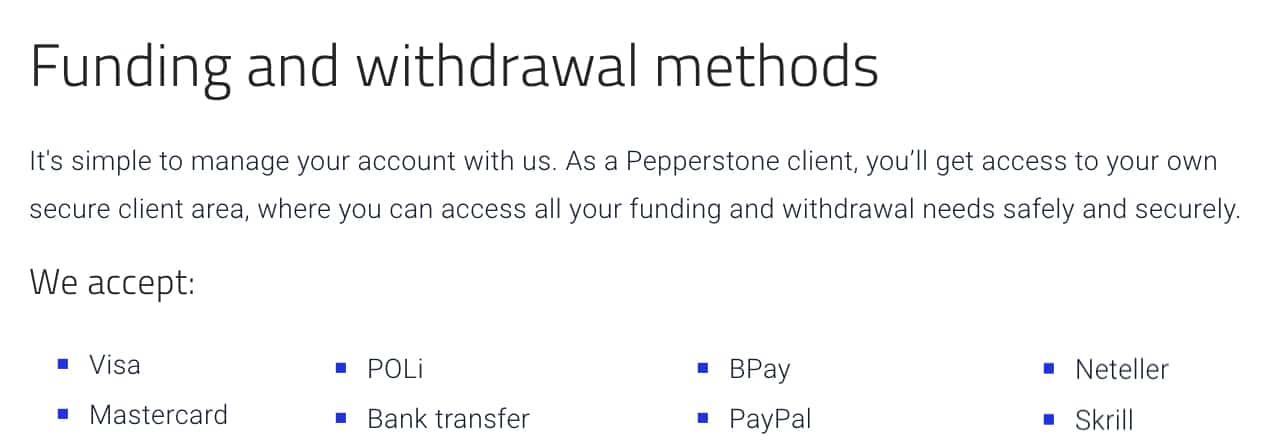

10. Better Funding Options: Pepperstone

Payment Methods: Pepperstone

Pepperstone charges no deposit fees for bank transfers, credit cards, debit cards and e-wallet payment methods. Depending on where you reside – Visa, Mastercard, bank transfer, Neteller, Skrill, PayPal, POLi, BPay, and UnionPay payment options are available. The same methods are available for withdrawing funds, yet if you are based outside Australia or Europe, a $20 withdrawal fee will apply.

Funding Methods: XTB

XTB offers credit card, e-wallet and bank transfer payment options when depositing and withdrawing funds from your trading account. Depending on the deposit method you choose, the following fees will apply:

- Bank transfers are free of charge.

- Deposits can be made with Master Card, Maestro and Visa credit cards fee-free.

- E-Wallets such as PayPal, PayU, SafetyPay, Paysafe/Skrill, Neteller, ECOMMPAY and Paydoo incur a fee equal to 0-2% of your deposited amount, depending on your location and payment method.

When funding your XTB trading account, certain e-wallet payment methods may not be available.

![]()

Verdict

Both XTB and Pepperstone offer a great range of traditional and e-wallet payment methods to make deposits and withdrawals. As funding via e-wallets is fee-free when trading with Pepperstone, while XTB incurs funding fees, Pepperstone offers the best funding methods overall.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit: Tie

When it comes to starting your trading journey, the initial deposit can be a significant factor. For many, a lower minimum deposit means easier access to the world of trading without a hefty upfront commitment. Both Pepperstone and XTB understand this sentiment and have set their minimum deposit requirements to be as inclusive as possible.

Interestingly, both brokers have taken a step further in ensuring that traders, regardless of their financial capacity, can begin trading with them. Here’s a quick glance at their minimum deposit requirements:

| Broker | Minimum Deposit |

|---|---|

| Pepperstone | $0 |

| XTB | $0 |

This gesture by both brokers is commendable as it lowers the barriers to entry, especially for novice traders. It’s evident that both Pepperstone and XTB are focused on providing an inclusive trading environment, ensuring that everyone has an opportunity to explore the financial markets.

Verdict:

Both Pepperstone and XTB offer a minimum deposit of $0, making them equally accessible for traders looking for a low-entry threshold.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: XTB or Pepperstone?

Pepperstone is the winner because of its comprehensive offerings, superior educational resources, and overall better trading experience. The table below summarises the key information leading to this verdict:

| Criteria | Pepperstone | XTB |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ✅ |

Best For Beginner Traders

Pepperstone is the ideal choice for beginner traders due to its user-friendly platform and extensive educational resources.

Best For Experienced Traders

For seasoned traders, XTB offers a more advanced platform and a wider range of CFD markets, making it the preferred choice.

FAQs Comparing Pepperstone Vs XTB

Does XTB or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to XTB. On average, Pepperstone’s spreads are more competitive, especially with pairs like EUR/USD. For a more detailed breakdown of spreads and commissions, you can refer to our comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both XTB and Pepperstone offer MetaTrader 4, but Pepperstone is often preferred for its enhanced MT4 features and tools. Their version of the platform is more streamlined and offers a wider range of plugins. For traders specifically looking for the best MT4 experience, our list of top MT4 brokers provides a deeper insight.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to social or copy trading. They have integrated platforms that allow traders to follow and replicate the strategies of professionals. If you’re keen on exploring the world of social trading further, our guide on the best social trading platforms is a great resource.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for its UK clients. This form of trading is tax-free in the UK and is becoming increasingly popular among traders. XTB, on the other hand, does not have a spread betting offering. For those interested in diving deeper into spread betting, our guide on the best spread betting brokers in the UK provides comprehensive insights.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it’s also an Australian-founded company, which gives it a home-ground advantage. Their deep understanding of the local market dynamics, coupled with their robust platform offerings, makes them a top pick. XTB, while a reputable broker, is based overseas. For a broader perspective on the best brokers in Australia, you can check out our list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe XTB has a slight edge. They are FCA regulated and have a strong presence in the UK market. While Pepperstone is also FCA regulated, it was founded overseas, which might not resonate as strongly with some local traders. XTB’s platform offerings and customer service tailored for the UK market make them stand out. For more insights on the best brokers in the UK, our comprehensive guide on UK forex trading is a valuable resource.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is XTB insured?

Yes, funds for all client with an account balance of at least 20,000 USD are insured by LLOYD’S in event of bankruptcy for up to 1 million USD.