IG Group vs eToro 2024

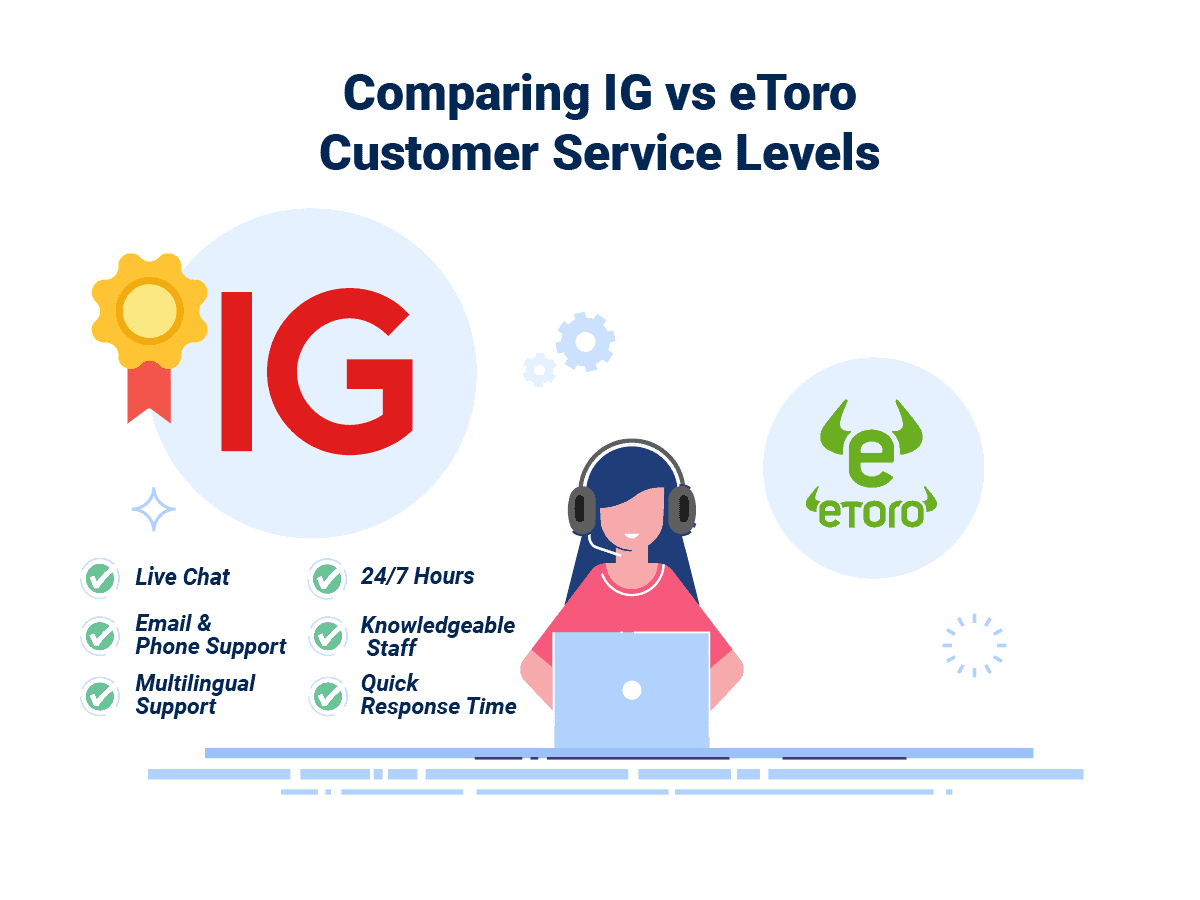

IG is one of the most trusted brokers worldwide, while eToro is a specialist broker focusing on its social trading niche. While these are very different CFD brokers, we compared them based on spread, trading platform and features.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert