Pepperstone vs TD Ameritrade: Which Broker is Better?

While Pepperstone and TD Ameritrade are very different brokers, we compared their forex and CFD offering to work out which one is best based on trading costs, platform, regulation and other broker features.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Pepperstone and TD Ameritrade are two prominent brokers in the trading industry, each with its unique offerings. Pepperstone is renowned for its forex trading services, offering a wide range of currency pairs and a choice of trading platforms. On the other hand, TD Ameritrade is a US-based broker that provides a comprehensive suite of investment options, including stocks, options, and futures.

Pepperstone allows scalping, provides better tools for forex algorithmic trading, and has a wider range of investment products than TD Ameritrade. TD Ameritrade has a more advanced desktop trading platform. Pepperstone is regulated by top-tier authorities like ASIC and FCA, while TD Ameritrade is overseen by FINRA in the U.S.

1. Tie: Lowest Spreads And Fees

Pepperstone offers two account types: Razor Account with low spreads and commission, or Standard Account with no commissions but higher spreads. TD Ameritrade offers commission-free, no-minimum pricing through several types of accounts: Standard, Retirement, Education, and Specialty.

Try the Pepperstone vs TD Ameritrade fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Spreads

Pepperstone offers competitive spreads on its standard account, with an average spread of 1.46 pips on major currency pairs. On the other hand, TD Ameritrade offers a flat rate per trade for stocks and ETFs, which can be beneficial for high-volume traders. Tight spreads are important as they reduce the cost of trading, which can significantly impact your profitability, especially if you’re a high-volume trader. You can check our unique research on standard account spreads for more information.

| Broker | Average Spread |

|---|---|

| Pepperstone | 1.46 pips |

| TD Ameritrade | Flat rate per trade |

RAW Account Spreads

Pepperstone’s RAW account offers even lower spreads, with an average spread of 0.36 pips, but it comes with a commission per trade. TD Ameritrade doesn’t offer a similar account type. For more detailed information, you can refer to our exclusive research on tightest spreads.

| Broker | Average Spread |

|---|---|

| Pepperstone | 0.36 pips |

| TD Ameritrade | N/A |

Commission Rates

Pepperstone charges a commission of $3.50 per side or $7 round turn on its RAW account, while its standard account is commission-free. TD Ameritrade offers commission-free trading for stocks, ETFs, and options trades.

| Broker | Per Side (USD) | Round Turn (USD) |

|---|---|---|

| Pepperstone | $3.50 | $7 |

| TD Ameritrade | N/A | N/A |

Other Fees

TD Ameritrade charges no account maintenance fees, but it does have a fee for broker-assisted trades. Pepperstone doesn’t charge any inactivity fees, which is a benefit for traders who don’t trade frequently.

| Criteria | Pepperstone | TD Ameritrade |

|---|---|---|

| Standard Account Spreads | 1.46 pips | Flat rate per trade |

| RAW Account Spreads | 0.36 pips + commission | N/A |

| Commission Rates | $3.50 per side, $7 round turn on RAW account | Commission-free for stocks, ETFs, options |

| Other Fees | No inactivity fees | No account maintenance fees |

Verdict

When it comes to trading costs, Pepperstone’s low spreads and commission-free standard account make it a cost-effective choice for forex traders. However, TD Ameritrade’s commission-free trading for stocks, ETFs, and options trades can be more beneficial for traders focusing on these instruments.

Review Of PepperstoneVisit Pepperstone

2. Pepperstone: Better Trading Platforms

Pepperstone offers MetaTrader 4 and 5, cTrader, and TradingView, while TD Ameritrade only offers their Thinkorswim platform.

| Criteria | Pepperstone | TD Ameritrade |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Other Platforms | No | Thinkorswim |

1. MetaTrader 4 and 5

Pepperstone offers both MetaTrader 4 and MetaTrader 5, two of the most popular trading platforms in the forex industry. These platforms offer advanced charting tools, automated trading capabilities, and a wide range of technical indicators. TD Ameritrade, on the other hand, does not offer MetaTrader platforms. You can check our comparison of the best MT4 brokers for more information.

2. cTrader and TradingView

In addition to MetaTrader, Pepperstone also offers cTrader, a platform known for its intuitive interface and advanced order capabilities. TD Ameritrade does not offer cTrader but provides its proprietary Thinkorswim platform, which is highly regarded for its powerful charting and analysis tools. For more details, you can refer to our comparison of the Best cTrader Brokers.

3. Social And Copy Trading

Pepperstone offers social and copy trading through Myfxbook and ZuluTrade, allowing traders to copy the trades of experienced traders. TD Ameritrade does not offer social or copy trading. You can check our list of the best copy trading platforms for more information.

4. VPS and Other Trading Tools

Pepperstone offers VPS hosting for traders who use automated trading strategies. They also provide a range of other trading tools, including Autochartist and API trading. TD Ameritrade offers a range of trading tools through its Thinkorswim platform, including backtesting and strategy optimization.

Verdict

Pepperstone offers a wider range of trading platforms and tools, making it a more versatile choice for different types of traders.

3. Tie: Superior Accounts and Features

Pepperstone offers two main types of accounts: Standard and Razor. The Standard account has no commissions but slightly wider spreads, while the Razor account has tighter spreads but charges a commission. TD Ameritrade offers a standard account with no commissions but wider spreads. They also offer a professional account with tighter spreads but higher minimum deposit requirements.

| Criteria | Pepperstone | TD Ameritrade |

|---|---|---|

| Standard Account | Yes | Yes |

| Commission Account | Yes (Razor) | Yes (Professional) |

| Minimum Deposit | $200 (Standard), $500 (Razor) | $0 (Standard), $3,500 (Professional) |

Verdict

Both brokers offer a variety of account types, but Pepperstone’s Razor account is particularly attractive for traders who prefer tighter spreads and don’t mind paying commissions.

4. Pepperstone: Best Trading Experience

Pepperstone has an ECN-style pricing structure ideal for trading strategies like hedging and scalping, where tight spreads can significantly impact trading costs. TD Ameritrade is a well-known brokerage firm offering ECN trading services via its thinkorswim platform.

According to research on execution speeds, Pepperstone has one of the fastest execution speeds in the industry, which can be crucial for traders who rely on quick order execution. Pepperstone achieves a 99.92% fill rate for trades executed by using tier-1 banks and institutions and avoiding partial orders.

Trades are executed through Straight Through Processing (STP), ensuring market execution without any requotes or no dealing desk intervention.

TD Ameritrade guarantees lightning-fast execution speeds of 70ms when you place an order for stocks, penny stocks, ETFs, currency pairs, or any other financial instrument. In the stock market, faster order speeds can result in savings of $2.11 per 100 shares traded.

Verdict

Pepperstone offers exceptional trading conditions, including fast execution and access to top-tier liquidity providers.

5. Pepperstone: Stronger Trust And Regulation

Pepperstone has a trust score of 81, while TD Ameritrade has 64. These scores are based on each broker’s regulations, reputation, and reviews.

Pepperstone Trust Score

TD Ameritrade Trust Score

Regulation

Pepperstone is regulated by several top-tier authorities, including the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), the Cyprus Securities Exchange Commission (CySEC), the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany, and the Dubai Financial Services Authority (DFSA).

On the other hand, TD Ameritrade is regulated by the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Commodity Futures Trading Commission (CFTC) in the United States.

| Pepperstone | TD Ameritrade | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | CFTC SEC FINRA |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

Reputation

Pepperstone was founded in 2010 in Melbourne, Australia. TD Ameritrade, on the other hand, has been around longer, with its roots dating back to 1971 in Omaha, Nebraska, USA.

Pepperstone has a fair search volume of 90,500 Google hits monthly, while TD Ameritrade seems more popular with 1,830,000 monthly searches.

Reviews

Pepperstone has a TrustPilot score of 4.4 out of 5 from 2,106 reviews. Surprisingly, TD Ameritrade only has a 1.5/5.0 score from 281 reviews despite being in the industry for a long time.

Verdict

Overall, Pepperstone scores higher in all of our factors in this category.

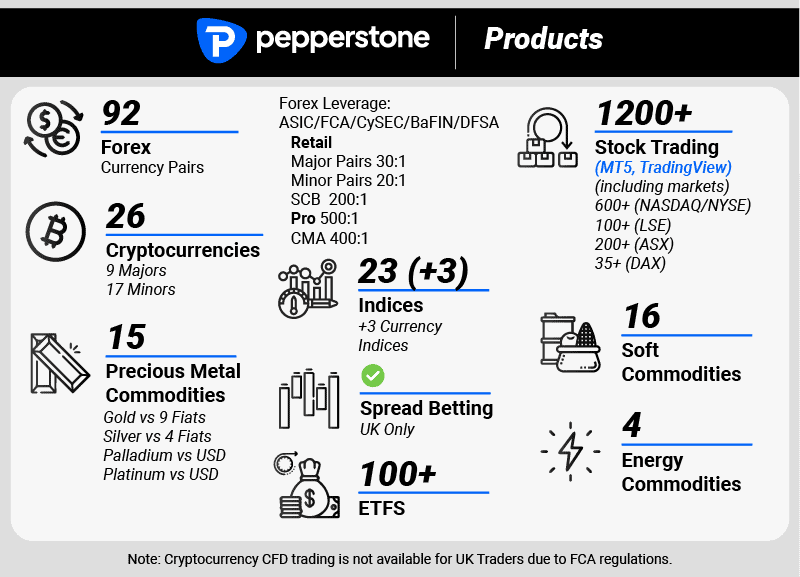

6. Pepperstone: CFD Product Range and Financial Markets

Pepperstone offers trading on 1,200+ financial markets, including forex, indices, commodities, stocks, ETFs, and cryptocurrency through CFDs. TD Ameritrade offers over 80 trading instruments, including Forex and Indices.

| Feature | Pepperstone | TD Ameritrade |

|---|---|---|

| Forex Pairs | 92 | 70 |

| Indices | 25 + 3 Currency Indicies | 13 |

| Commodities | 5 Metals, 4 Energies, 16 Softs | No |

| Stocks | 1000+ | No |

| ETFs | 100+ | 300+ |

| Cryptocurrencies | 19 (+3 Cryto indices) | 1 |

| Bonds | No | No |

| Options/Futures | No | No |

FX Trading

Pepperstone offers 92 currency pairs, including 7 major, 9 minor, 17 exotic, and 30 cross pairs. TD Ameritrade (TDA) offers over 70 currency pairs traded commission-free in increments of 10,000 units, with the broker’s compensation reflected in the bid-ask spread.

Indices

Pepperstone offers spread-only index CFDs on 6 North American indices, 7 across Australia, Asia, and Africa, and 10 across Europe and the UK, with no commission charges.

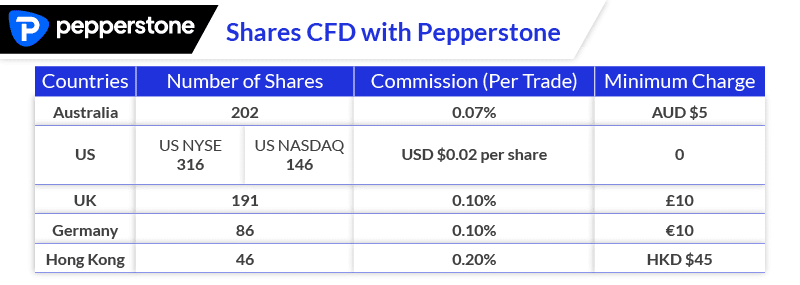

Shares

CFDs are available at Pepperstone on the Australian (ASX), US (NASDAQ and NYSE), UK (LSE), German (XETRA.DE), and Hong Kong (HKEX) stock exchanges. TD Ameritrade offers access to various US stock exchanges, including NYSE, NASDAQ, and AMEX, as well as OTC markets like OTCBB, matching its competitors E-Trade and Fidelity.

| Stocks | ETFs | Mutual Funds | Forex | Bonds | Options | Futures | Cryptocurrency | |

|---|---|---|---|---|---|---|---|---|

| Trading Cost | $6.95 for non-US listed stocks | 0$ | $49.99 | $10.6 per side | $1.0 | $0.65 per options contract | $2.25 per contract | $2.25 per contract |

Commodities

All commodity products are spread only with Pepperstone, which means you pay no commission costs.

Cryptocurrencies

There are over 19 cryptocurrency CFDs available that come with no additional commission costs, aside from the spread. TD Ameritrade Holdings Corp has made a strategic investment in ErisX, the leading exchange that offers access to spot cryptocurrency contracts and crypto futures contracts. Moreover, TD Ameritrade provides experienced traders with a unique opportunity to capitalise on Bitcoin futures.

Verdict

Pepperstone offers a wider range of trading options including currencies, currency CFDs, ETFs, equities, commodities, and cryptocurrency.

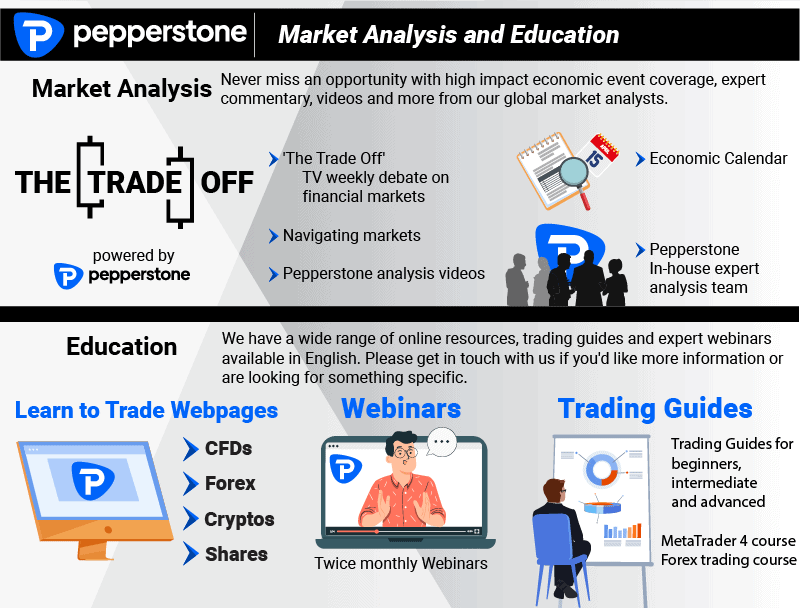

7. Tie: Superior Educational Resources

Pepperstone provides a comprehensive collection of educational resources to cater to traders at all skill levels. Novice traders can access beginner-friendly guides that explain the fundamentals of forex trading and technical analysis in simple language. For experienced traders, there are advanced webinars that delve into complex strategies and detailed market analysis.

TD Ameritrade’s online educational resources bring together various trading materials tailored for all types of investors. It has the most extensive collection of free online educational resources.

New investors can access a variety of educational resources such as online training, tutorials, articles, and live market insights from TD Ameritrade Network’s industry experts.

Verdict

Both Pepperstone and TD Ameritrade provide traders with a wide variety of news, articles, and educational resources.

TD Ameritrade ReviewVisit TD Ameritrade

8. Pepperstone: Better Customer Service

Pepperstone provides 24/7 customer support via phone, email, and live chat, WhatsApp, and it has a reputation for its responsive and helpful service. TD Ameritrade offers 24/7 customer support and multiple support channels, including phone, email, and live chat.

| Feature | Pepperstone | TD Ameritrade |

|---|---|---|

| Live chat | 24/7 | 24/7 |

| Customer Service Knowledge | Excellent | Excellent |

| FAQ Knowledge Base | Excellent | Average |

| Email/Social Media | Email, WhatsApp | |

| Multilingual Support | Yes | Yes |

Verdict

Both brokers offer excellent customer service, but Pepperstone’s WhatsApp availability and excellent FAQ knowledge base may be more convenient for some traders.

9. Pepperstone: More Funding Options

Pepperstone and TD Ameritrade offer fee-free funding methods and require no initial deposit. It’s important to note that TD Ameritrade requires a minimum of $50 for electronic funding.

Base Currencies Offered

Pepperstone offers 10 base currencies, including USD, AUD, NZD, CAD, HKD, SGD, GBP, EUR, JPY, and CHF.

The only base account currency accepted by TD Ameritrade is the US Dollar. Funding with other currencies will incur a conversion fee.

Deposit and Withdrawal Methods And Fees

Pepperstone and TD Ameritrade charge no deposit or withdrawal fees. The only exception for TD Ameritrade is fund withdrawal via wire transfer. In this case, the corresponding bank charges a $25 fee.

| Funding Option | Pepperstone | TD Ameritrade |

|---|---|---|

| Credit Card | ✅ | ❌ |

| Debit Card | ✅ | ❌ |

| Bank Transfer | ✅ | ✅ |

| PayPal | ✅ | ✅ |

| Skrill | ✅ | ❌ |

| Neteller | ✅ | ❌ |

| Crypto | ✅ | ✅ |

Verdict

Pepperstone differentiates itself by offering transparent pricing without hidden fees and providing numerous funding options to its customers.

10. Pepperstone: Lower Minimum Deposit

There is no minimum deposit requirement for Pepperstone and TD Ameritrade.

However, Pepperstone recommends that you deposit at least 200 USD/AUD or 500 GBP/EUR.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Paypal | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

For TD Ameritrade, only their cash account has no minimum, and there is a minimum of $50 via electronic funding.

| Electronic Bank Deposit (ACH) | Wire Transfer | Account Transfer from Another Firm | Check | Physical Stock Certificates | |

|---|---|---|---|---|---|

| Standard Completion Time | 5 mins | 1 business day | 1 - 3 business days | About a week | 1 business day |

| Deposit Limits | $50 - $250,000 | No limit | No limit | No limit | No limit |

| How to Start | Set up online | Contact your bank | Use mobile app or mail in | Set up online | Mail in |

Verdict

Both brokers have a no minimum deposit requirement, however, not all payment methods have this at TD Ameritrade – considering almost all funding now are done electronically.

So Is TD Ameritrade or Pepperstone the Best Broker?

Pepperstone is the winner because it consistently outperforms TD Ameritrade in several key aspects critical to forex traders. The table below summarises the key information leading to this verdict.

| Feature | TD Ameritrade | Pepperstone |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ✅ |

| Better Trading Platforms | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience | ❌ | ✅ |

| Stronger Trust And Regulation | ❌ | ✅ |

| CFD Product Range And Financial Markets | ❌ | ✅ |

| Superior Educational Resources | ✅ | ✅ |

| Better Customer Service | ❌ | ✅ |

| More Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

Best For Beginner Traders

Pepperstone is our top pick for beginner traders. With its user-friendly interface, comprehensive educational resources, and a wide range of trading platforms, it provides an ideal starting point for those new to forex trading. Pepperstone also offers competitive spreads and a $0 minimum deposit, making it accessible for beginners with varying budget levels.

Best For Experienced Traders

Pepperstone offers advanced trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, which provide sophisticated charting tools and automated trading capabilities. With Pepperstone’s extensive market offerings, experienced traders can diversify their portfolios across forex, commodities, and CFDs. Additionally, Pepperstone’s fast execution speeds and low latency make it a top choice for high-frequency traders.

FAQ

Which broker is better for forex trading, Pepperstone or TD Ameritrade?

Pepperstone is generally better for forex trading due to its lower spreads and choice of trading platforms.

Does TD Ameritrade offer better customer service than Pepperstone?

Both brokers offer excellent customer service, but TD Ameritrade provides 24/7 support, which may be more convenient for some traders.

Is Pepperstone or TD Ameritrade the Safer Broker?

Both brokers are safe to trade with, but Pepperstone has a higher overall trust score of 81, making them the safer broker.

Which Broker Offers Social Trading?

Pepperstone has a variety of social trading platforms tailored for traders of different experience levels.

Does Either Broker Offer Spread Betting?

Pepperstone provides spread betting services that are exclusively available for traders who are based in the United Kingdom. This type of derivatives trading enables UK customers to speculate on financial instrument price movements without owning them directly.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Can you trade Pepperstone in America?

No you can’t. Pepperstone don’t hold a CFTC or NFA licence which is needed to offer trading Forex trading services in the US.

Can a non US citizen have a TD Ameritrade account?

Yes but not for all countries. Residents of the UK, Canada, Thailand for example will be accepted.

Does TD Ameritrade have a cash account?

Yes, TD Ameritrade offers cash management accounts. They are integrated into their brokerage services and require a brokerage account to open. These accounts are not standalone products but are part of the broader suite of services available to TD Ameritrade customers.