RoboForex Review of 2026

RoboForex is a Belize-regulated broker offering diverse trading platforms (MT4/MT5, R WebTrader), competitive spreads and very high leverage. However, it lacks the thorough regulation of other competitors.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Roboforex Summary

| 🗺️ Regulation | FSC – Belize |

| 💰 Trading Fees | ECN Pricing, Standard Account |

| 📊 Trading Platforms | MT4, MT5, R Stocks Trader, R Mobile Trader |

| 💰 Minimum Deposit | $10 and $100 for R Stocks Trader Account |

| 💰 Deposit/Withdrawal Fee | Yes |

| 🛍️ Instruments Offered | Forex, Metals, Indices, Stocks, Futures, Energies |

| 💳 Credit Card Deposit | Yes |

Why Choose RoboForex

RoboForex offers a strong combination of low trading costs, high leverage options, and broad platform support. Spreads start from 1.3 pips on EUR/USD and are available with MetaTrader 4 and 5, R WebTrader, and the broker’s proprietary R StockTrader.

Other features you will find include flexible funding and innovative copy trading tools. RoboForex also supports high leverage promotions, with levels reaching up to 1:2000, which may appeal to more aggressive or experienced traders. Regulation is provided by Belize’s Financial Services Commission (FSC).

However, there are some limitations. While the trading conditions are competitive, educational resources are sparse. Additionally, customer support response times can be slow, and the broker is not regulated in major markets like Australia, Europe and the UK.

Roboforex Pros And Cons

- High Leverage

- Good Funding Options

- Low Trading Costs

- Only Regulated by FSC

- Limited Education Content

- Long Response Times From Support

The overall rating is based on review by our experts

Trading Fees

Trading costs are undoubtedly one of the most important metrics when choosing a broker as a trader. In my opinion RoboForex offers good value with most of its account types for forex trading.

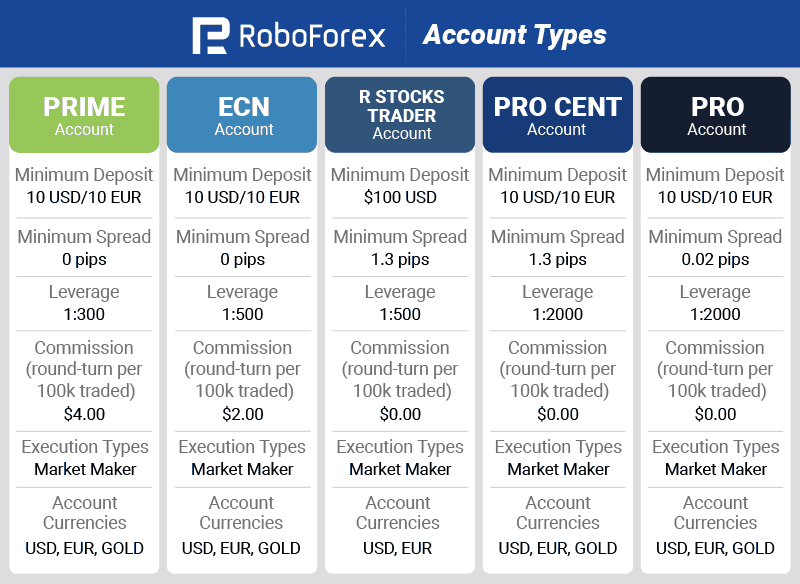

RoboForex offers traders five different account types, each with unique trading fees and spreads. Here is a brief overview of all the account types:

- Raw (ECN/Prime) Accounts: Tight spreads (from 0.0 pips) but charge commissions (e.g., 1.5–20 per lot).

- Standard (Pro/ProCent) Accounts: Wider spreads (from 1.3 pips) with no commissions

- R StocksTrader Account: Fixed spreads (from $0.02) for stock/ETF trading, no commissions

Raw Account Spreads

I’ve always valued spreads as the primary cost component for short‑term strategies and high‑frequency trading.

The ECN account offers raw spreads starting at 0.0 pips on major pairs like EUR/USD during peak liquidity. Generally you will find spreads to be 0.16 pips on average or 0.57 pips if you include the commission costs. Spreads tend to be tightest during London and Tokyo sessions.

While the minimum is zero, average spreads dipped slightly higher during our review, reflecting normal market volatility. Below is a snapshot of average spreads and commission costs for three of the most heavily traded currency pairs on ECN and Prime accounts.

Average Spreads & Commissions for Major Pairs With RoboForex

| Currency Pair | Min Spread (pips) | Avg. Spread (pips) | Commission (per lot) Side ways Prime | Commission (per lot) Side ways ECN |

|---|---|---|---|---|

| EUR/USD | 0.0 | 0.1 | $1 | $2 |

| GBP/USD | 0.0 | 0.4 | $1 | $2 |

| USD/JPY | 0.0 | 0.2 | $1 | $2 |

Average Spreads Major Pairs – RoboForex vs Competitors

The below table captures the average spreads brokers publish on their websites. If the lowest possible spread is your priority, then you may wish to consider Pepperstone and IC Markets but it really depends on the currency pair.

These spreads however don’t factor in the commission costs. Given RoboForex commissions are lower than many brokers, you may find RoboForex to be better value overall.

RAW Account Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.12 | 0.30 | 0.60 | 0.40 | 0.20 |

| 0.10 | 0.10 | 0.90 | 0.20 | 1.10 |

| 0.00 | 0.20 | 1.10 | 0.70 | 0.80 |

| 0.02 | 0.03 | 0.50 | 0.27 | 0.30 |

| 0.06 | 0.27 | 0.49 | 0.30 | 0.59 |

| 0.08 | 0.35 | 7.60 | 3.50 | 0.73 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.50 | 0.60 | 1.10 | 0.80 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Raw Account Commission Rate

RoboForex’s ECN and Prime accounts operate on a “raw spread + commission” basis, with spreads from 0.0 pips and a fixed commission. These commissions are 1$ per standard lot each way with Prime account and 2$ each way with ECN account.

This flat fee applies regardless of the currency pair, so whether you trade EUR/USD, GBP/USD or USD/JPY, you’ll know exactly what you’ll pay every time you open and close a standard lot.

Standard Account Fees

On the Pro and ProCent (Standard) accounts, no commission is charged for order execution. Your trading costs are built entirely into the floating spread.

Spreads on these accounts typically start at 1.3 pips for major currency pairs like EUR/USD under normal market conditions. These spreads fluctuate depending on market liquidity and volatility.

Because there’s no separate commission, your cost is simply the spread you see in-platform. Including commissions in the spread makes budgeting more straightforward for trading strategies that aren’t highly sensitive to sub-pip differences.

Average Spreads Major Pairs – RoboForex vs Competitors

Unlike the ECN account, RoboForex generally performs poorly vs other brokers for the Standard account. An Average spread of 1.40pips for EUR/USD makes RobotForex one of the worst performing brokers in the market in my tests.

This result is somewhat surprising given RoboForex uses a market maker trading model.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.30 | 1.70 | 1.20 | 1.50 | 1.90 |

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 0.18 | 0.60 | 0.36 | 0.14 | 0.35 |

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 0.89 | 1.37 | 1.41 | 1.54 | 1.75 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.20 | 1.40 | 1.40 | 1.50 | 1.30 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 1.00 | 1.00 | 1.50 | 2.00 | 1.00 |

| 0.83 | 0.83 | 1.08 | 1.14 | 1.19 |

| 0.80 | 0.90 | 1.40 | 1.00 | 1.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Prime Account

The Prime account takes raw spreads further, offering 0.0 pips on EUR/USD with even lower commissions (up to 10% reductions compared to ECN) for traders.

Swap-Free Account

The Swap Free account replaces overnight interest (swaps) with a fixed commission. This charge depends only on the instrument traded and the number of lots open, not on interbank rates.

You can open a Swap-Free account (also called Islamic accounts) with MetaTrader 4 Pro and ProCent accounts. Once activated, all other trading conditions such as spreads, execution speed, and leverage remain the same as your base account type.

Other Fees

RoboForex keeps its fee structure very lean, and does not charge any inactivity or dormancy fees, regardless of how long your account remains unused. You won’t see any monthly “maintenance” deductions for inactivity.

As usual with other brokers, currency conversion fees for funding or withdrawal may apply if your base currency differs from the payment currency; these rates are set by your bank/payment system.

My Verdict on RoboForex Trading Costs

From my perspective, RoboForex offers competitive trading costs, particularly with its Raw accounts. The tight spreads are attractive, but you need to factor in the commission. If you prefer commission-free trading, the Standard accounts are an option, but the spreads are wider. Overall I give RoboForex a score of 8.5 out of 10 for the category of trading costs.

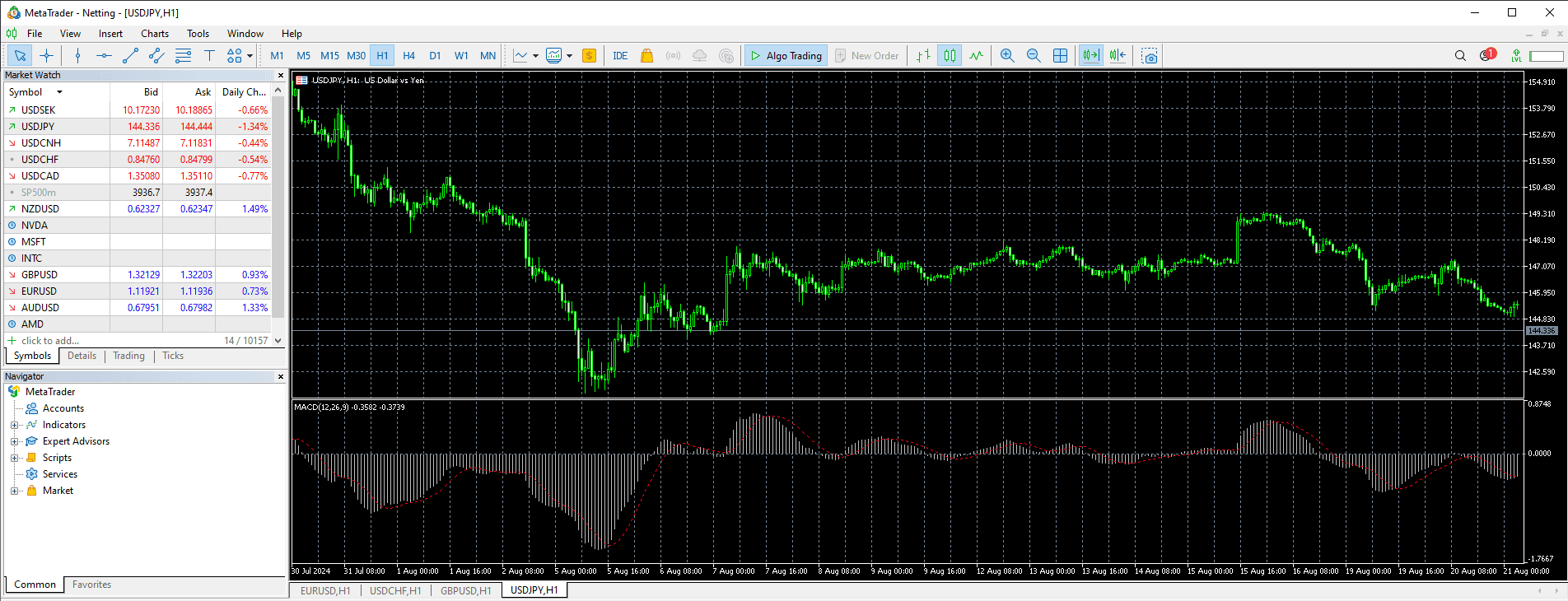

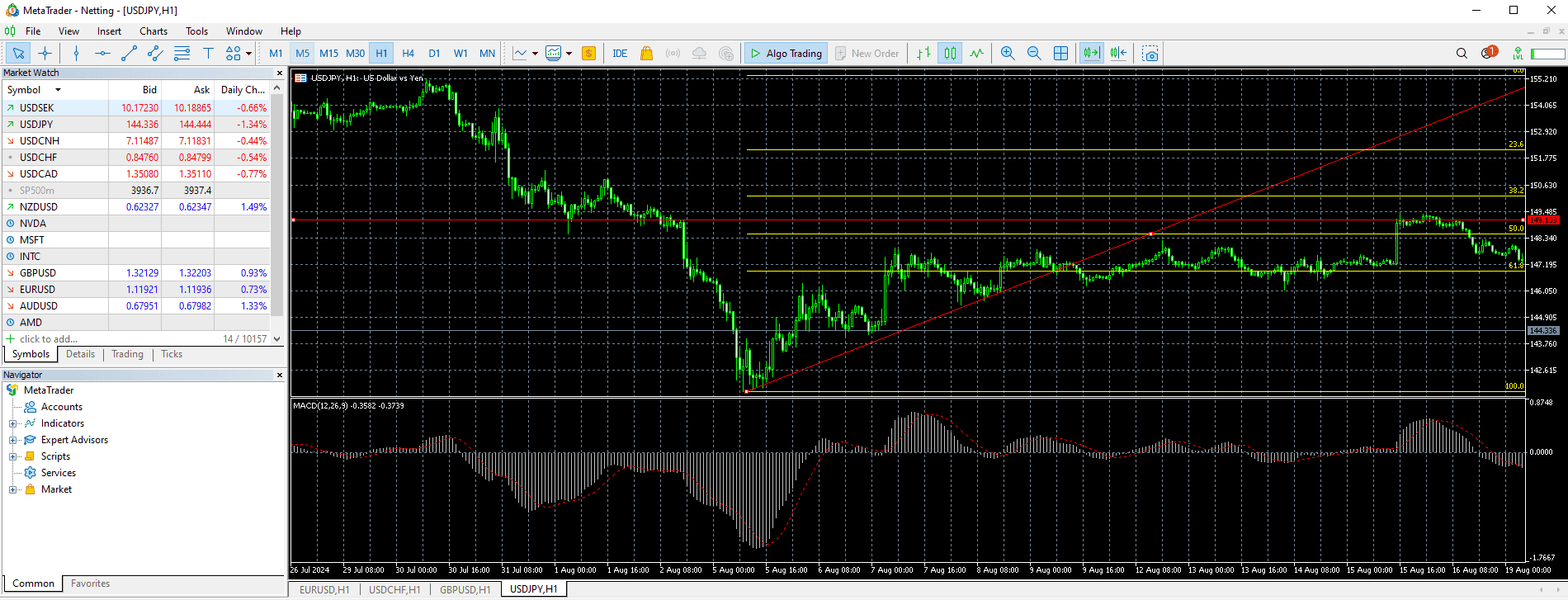

Trading Platforms

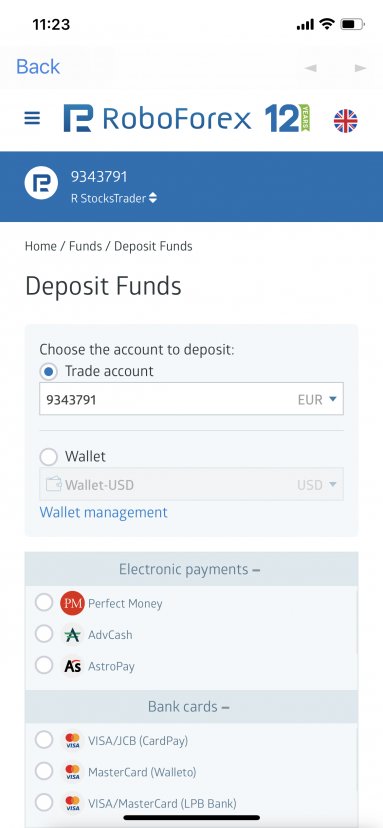

RoboForex offers you as a trader the option to choose between these trading tools:

- MetaTrader 4 – The most popular forex trading platform globally, ideal for Forex trading and automated forex trading strategies.

- MetaTrader 5 – Offers the same automated trading features as MT4 but a wider range of tradable products including share CFDs. It also has a richer set of charts and technical analysis tools.

- R Stocks Trader – Mainly used to trade indices, CFDs on stocks, Oil, and Metals.

- R Mobile Trader – Great proprietary tool to monitor your positions or open new positions in a pinch, supports MT4 accounts to log in.

My team members at CompareForexBrokers created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5-step questionnaire which will help you determine your most suitable forex platform.

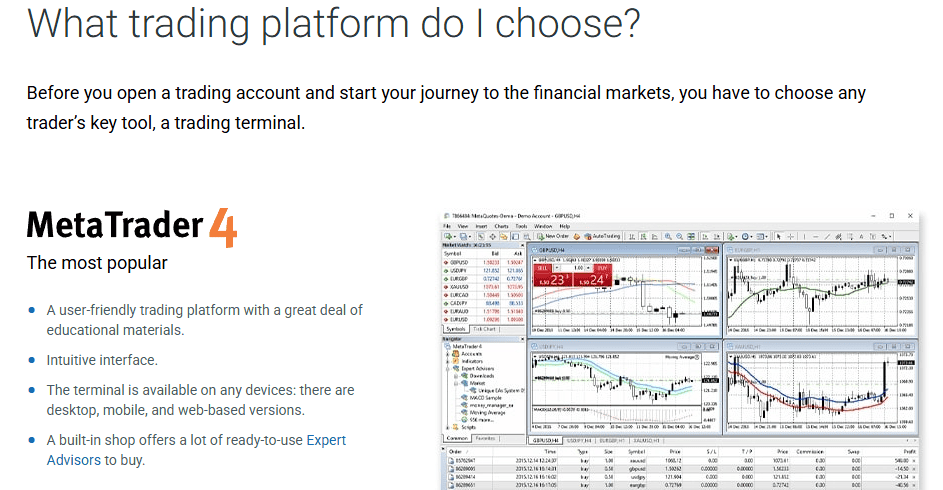

MetaTrader 4

I’ve often gravitated toward MT4 throughout my trading journey because its streamlined interface strikes the right balance between simplicity and functionality.

Created by MetaQuotes, MT4 remains one of the oldest, and most widely adopted, retail trading platforms on the market.

Why I prefer MT4:

- Its clean, user‑friendly layout makes navigation straightforward, even for newcomers.

- A vast user community means heaps of custom indicators, Expert Advisors (EAs), and support forums are readily available.

- Robust charting capabilities: 31 analytical objects, 30 built‑in technical indicators, and 9 timeframes.

- Four pending order types (buy‑stop, buy‑limit, sell‑limit, sell‑stop) plus three execution modes.

- Full MQL4 support lets you code your own EAs and indicators for true automation.

- A thriving EA marketplace offers countless ready‑made trading robots.

- Unmatched device flexibility: trade on Android, iOS, Windows, Mac, or directly in your browser via MT4 WebTrader, perfect for busy traders who need to manage positions on the go.

Potential drawbacks:

- Primarily geared toward forex and indices, with limited direct access to stock CFDs.

- Feels dated compared to newer platforms (for example, MT5) that boast more advanced features.

- With MetaQuotes having ceased active development of MT4, MT5 is poised to supersede it entirely in the years ahead.

Overall, MT4’s simplicity and customisation keep it relevant, but forward-looking traders should weigh its limitations against newer platforms (like MT5).

MetaTrader 5

MT5 builds on the foundation of MT4 with significantly expanded capabilities; more charts, a broader suite of analytical tools, faster processing, and support for a wider array of assets. Whereas MT4 is primarily tailored to decentralised forex markets, MT5 is a true multi‑asset platform, unlocking access to centrally traded instruments like stock CFDs.

Although MT5’s interface echoes MT4’s familiar layout, the added features can take some time to master. If you’re an intermediate or advanced trader, the learning curve is well worth it (MT5 essentially offers a more modern, powerful version of MT4).

Key enhancements in MT5 over MT4 include:

- Advanced charting: 44 analytical objects, 38 built‑in indicators, and 21 timeframes, ideal for scalpers who need granular data.

- Additional order types: Two extra pending orders, buy‑stop‑limit and sell‑stop‑limit; for greater execution flexibility.

- True volume data: Access to real (tick) volume, rather than the limited tick‑count volume in MT4.

- Enhanced programming: MQL5’s cleaner, more powerful codebase makes developing EAs and indicators smoother compared to MQL4.

- 64‑bit backtesting means faster, more comprehensive strategy testing across multiple currency pairs, whereas MT4’s 32‑bit engine is limited to one pair at a time.

Who I won’t suggest MT5 to:

- MT5’s extra order types (stop‑limit, fill‑or‑kill), netting vs. hedging modes, and advanced depth‑of‑market tools can overwhelm newcomers.

- If you are into programming and automation, MQL5 is not backwards-compatible with MQL4.

Overall, if you value custom indicators, the community support with MT4 boasts a massive, decades‑old foundation with countless free custom indicators, EAs, and support forums. MT5’s user/developer base, while growing, remains smaller.

R Stocks Trader

In addition to MT4 and MT5, RoboForex offers two proprietary platforms designed to broaden your trading toolkit.

R StocksTrader is a cloud‑based, multi‑asset terminal that provides access to over 12,000 instruments via a no‑code strategy builder, template strategies and free back‑testing, with all data and strategies securely stored online.

Here are the features I like about R Stocks Trader:

- Automated Strategy Builder: Create and run trading robots without programming skills, using intuitive drag‑and‑drop rule setup or pre‑built templates to get started in minutes.

- You can use this tool via a web browser as well.

- Template Strategies & Quick Testing: Choose from built‑in strategies, edit and optimise them, then back‑test instantly on historical data to validate performance before going live, at no extra cost.

- One‑Click Trading & Order Execution: Enjoy high‑speed order execution directly on RoboForex servers, with minimal latency compared to desktop‑based robots

If you are into trading stocks, it’s worthwhile checking this tool, but if you want to stick to forex trading, I suggest you try MT4 or MT5 depending on your exact needs.

R MobileTrader

R Mobile Trader delivers a full‑featured trading environment in your pocket, optimised for both Android and iOS devices. In 2023 it was recognised as the “Best Mobile Trading App” by industry peers, but I would take this award with a grain of salt.

The best part of their app is that it supports MetaTrader 4 accounts, which means you don’t have additional steps to register if you already have MT4.

Here is what their mobile platform offered that I enjoyed the most:

- Easy Start: Begin trading with a minimum of $100 directly from the app, choosing from FX, commodities, indices, stocks and metals

- Copy Trading – only available if you open a hedging account and use the mobile version.

- Real‑Time Charts & Quotes: Access interactive charting tools and live price feeds, with one‑touch order entry and modification to keep pace with fast markets

- Integrated News & Analysis: Stay informed with built‑in market news, economic calendar updates and push notifications for key events – all within the app interface

As with any broker’s mobile trading tool I suggest you keep its use to monitoring positions or trading if you don’t have access to your main setup.

My Verdict on RoboForex Trading Tools

Overall, I rate RoboForex’s suite of trading tools a 6 out of 10, reflecting a solid foundation but notable limitations compared with more feature‑rich brokers. While MetaTrader 4 and 5 remain industry standards and R StocksTrader plus R Mobile Trader add some proprietary flair, there’s little innovation beyond the basics.

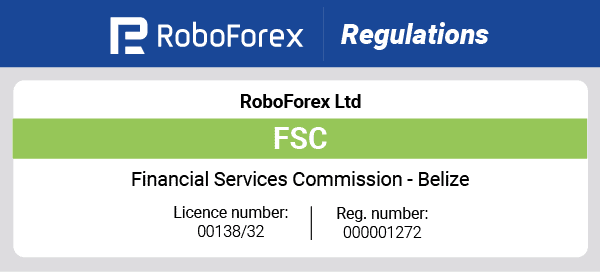

Trust

RoboForex operates in a regulatory grey zone. While it’s licensed by Belize’s Financial Services Commission (FSC), a common offshore jurisdiction for brokers prioritising leverage flexibility, it lacks oversight from stricter authorities like the ASIC or FCA.

1. Regulation

FSC License: Allows RoboForex to offer leverage up to 1:2000 (vs. 1:30 under EU rules), appealing to aggressive traders. However, Belize’s FSC provides minimal client fund protection compared to Tier-1 regulators.

With the current FSC license, your funds are held in top-tier banks (e.g., Barclays), but the FSC doesn’t mandate compulsory segregation, raising counterparty risk during insolvency.

2. Reputation

RoboForex was established in 2009, so they have already had quite a few years in operation. In my research, I found no major regulatory penalties against RoboForex since 2020 a positive sign, though you have to remember that offshore brokers face less scrutiny in general.

The table below highlights RoboForex’s regional search interest in 2025.

| Country | 2025 Monthly Searches |

|---|---|

| Uzbekistan | 14,800 |

| Germany | 9,900 |

| Malaysia | 9,900 |

| Brazil | 5,400 |

| Poland | 4,400 |

| United Kingdom | 3,600 |

| Italy | 3,600 |

| India | 2,900 |

| France | 2,900 |

| United States | 2,400 |

| Spain | 2,400 |

| South Africa | 2,400 |

| Colombia | 1,900 |

| Austria | 1,900 |

| Netherlands | 1,600 |

| Thailand | 1,600 |

| Mexico | 1,300 |

| Indonesia | 1,300 |

| Argentina | 1,000 |

| Switzerland | 1,000 |

| Nigeria | 880 |

| Turkey | 880 |

| Vietnam | 880 |

| United Arab Emirates | 720 |

| Portugal | 720 |

| Kenya | 720 |

| Peru | 720 |

| Morocco | 720 |

| Pakistan | 590 |

| Bangladesh | 590 |

| Ecuador | 590 |

| Philippines | 590 |

| Venezuela | 590 |

| Canada | 480 |

| Sweden | 480 |

| Singapore | 480 |

| Saudi Arabia | 390 |

| Chile | 390 |

| Algeria | 390 |

| Egypt | 320 |

| Bolivia | 320 |

| Australia | 260 |

| Cyprus | 260 |

| Greece | 210 |

| Japan | 210 |

| Ireland | 210 |

| Dominican Republic | 210 |

| Botswana | 210 |

| Hong Kong | 140 |

| Taiwan | 140 |

| Uruguay | 140 |

| Ghana | 110 |

| Cambodia | 110 |

| Panama | 110 |

| Costa Rica | 110 |

| Sri Lanka | 90 |

| Uganda | 90 |

| Ethiopia | 90 |

| Jordan | 90 |

| Tanzania | 70 |

| Mongolia | 70 |

| New Zealand | 30 |

| Mauritius | 30 |

14,800 1st | |

9,900 2nd | |

9,900 3rd | |

5,400 4th | |

4,400 5th | |

3,600 6th | |

3,600 7th | |

2,900 8th | |

2,900 9th | |

2,400 10th |

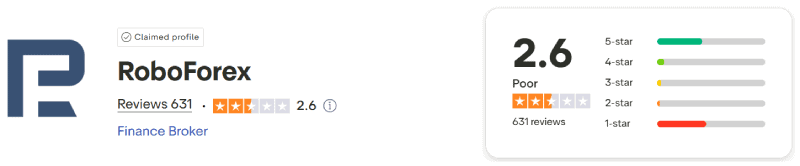

3. Reviews

When it comes to customer reviews, RoboForex did way below average, with one of the lowest average review scores I’ve seen after reviewing countless brokers. Out of 631 reviews as of checking in 2025, they average just 2.6 out of 5.

Going through the comments, most customers complained about platform stability issues, withdrawal issues and inaccurate spreads. If you compare this to reviews of competitors such as Pepperstone, which has 5 times more reviews with a near-perfect score, it becomes hard to recommend RoboForex to beginners.

My Verdict on RoboForex Trustworthiness

RoboForex is not the safest, but it is tailored for experienced traders who understand offshore risks and prioritise cost-efficiency. Its lack of Tier-1 regulation and slower support make it less ideal for beginners or those handling large capital. The poor customer reviews also didn’t give me any assurance. For these reasons I give them a low rating of 4.0 out of 10 for trust.

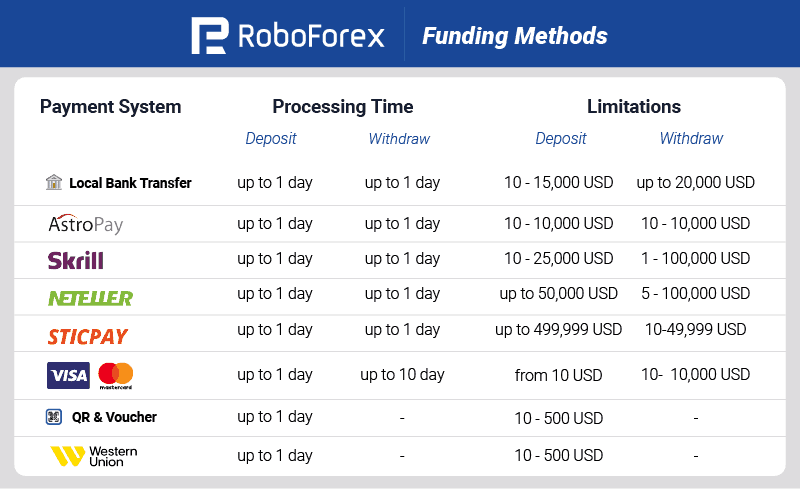

Deposit and Withdrawal

Overall, RoboForex offers very competitive funding terms with low deposit requirements and multiple monthly free withdrawals, making it an attractive choice if you value cost‑efficient capital flows.

What is The Minimum Deposit at RoboForex?

The minimum initial deposit at RoboForex varies depending on the account type. For Pro, ProCent, Prime, and ECN accounts, the minimum is $10 USD. The R StocksTrader account requires a higher minimum deposit of $100 USD.

Account Base Currencies

The base currencies offered are very limited, and one of the most restrictive I’ve seen in any brokers so far. RoboForex supports USD, EUR, and Gold as the base currencies for trading accounts.

Deposit Options and Fees

RoboForex offers a variety of deposit methods. Fees vary depending on the payment system. Visa and Mastercard incur a fee of 2.6% plus a fixed amount, while UnionPay charges 1.8%. Perfect Money deposits are free. Note that these fees might vary based on your region and country.

Other methods include Bank Transfer, AstroPay, Skrill, Neteller, Sticpay, QR & Vouchers, and Western Union, each with its own fee structure.

Withdrawal Options and Fees

Withdrawal methods include Visa and Mastercard (1.5% + fixed amount), UnionPay (0.8%), and Perfect Money (0.5%).

Bank Transfer fees range from 0% to 4%, while AstroPay charges 0.5%, Skrill 1%, Neteller 1.9%, and Sticpay 2.5% plus a fixed amount. Fees for QR & Vouchers and Western Union withdrawals are not specified.

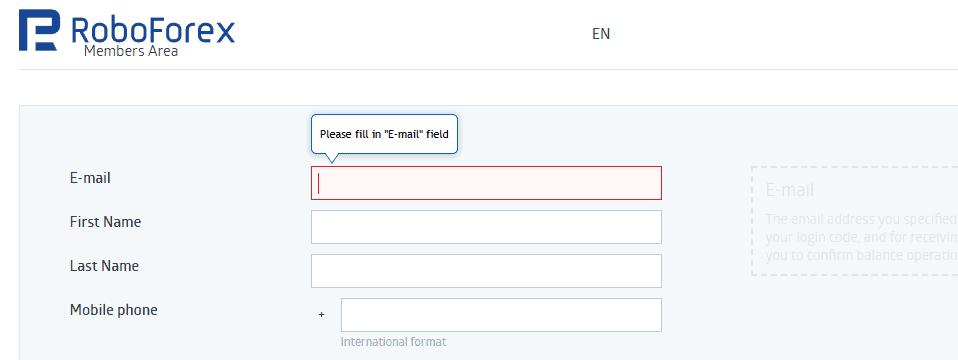

Ease of Opening an Account

Opening an account with RoboForex is straightforward. Prospective traders begin by clicking the ‘Open an Account’ or ‘Open Trading Account’ button, which is usually located prominently on the RoboForex website.

This action directs them to a registration page where they need to provide essential personal details, including their full name, a valid email address (which will serve as their login credentials), and a mobile phone number in international format.

The final crucial step in the account opening process is verification. These typically include proof of identity, such as a passport or national ID card, and proof of address, such as a recent utility bill or bank statement.

Verdict on RoboForex Funding

RoboForex has some great funding methods, and low fees, which nets them a high score of 8/10 for the funding category. The availability of a wide variety of deposit and withdrawal methods, exceeding 20 options for deposits and multiple choices for withdrawals is all great in making the user experience smooth.

Product Range

RoboForex offers a wide array of over 12,000 trading instruments across eight asset classes, accessible via MetaTrader 4, MetaTrader 5, and its proprietary R StocksTrader platform.

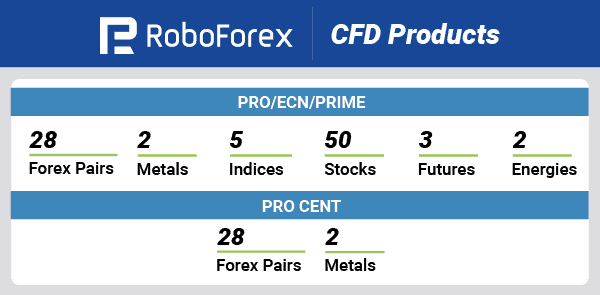

CFDs

In 2026, RoboForex provides access to a diverse spectrum of financial markets, encompassing eight primary asset classes: Stocks, Indices, Futures, ETFs, Soft Commodities, Energies, Metals, and Currencies.

FX Trading

RoboForex offers trading in more than 40 currency pairs via CFDs in 2026. The trading conditions for these currency CFDs include institutional spreads starting from 0 points.

These currency pairs are accessible through the MetaTrader 4, MetaTrader 5, and R StocksTrader platforms.

Indices

RoboForex provides CFD trading on over 10 instruments. This includes CFDs on major global benchmarks such as US indices (US30Cash, US500Cash, USTECHCash, US30, US500, NAS100), the German index (DE40Cash, GER40), and the Japanese index (JP225Cash, J225).

The trading conditions for index CFDs are characterised by tight spreads with no additional markup.

Commodities

RoboForex’s commodity CFD offerings in 2026 are categorised into Energies, Metals, and Soft Commodities:

- Energies: Traders can access CFDs on energy products such as oil, natural gas, heating oil, and ethanol.

- Metals: The metals CFD category includes popular precious metals like gold, platinum, palladium, and silver, as well as Gold/Dollar and Silver/Dollar pairs.

- Soft Commodities: RoboForex offers CFD trading on various soft commodities, including ETFs on grown commodities such as coffee, cocoa, sugar, corn, wheat, soybean, and fruit, with over 100 instruments available in this category.

Cryptocurrencies

During my research I didn’t see any cryptocurrency CFDs available for RoboForex users.

ETFs

You can access over 1,000 ETF CFDs on the R StocksTrader platform, requiring a minimum deposit of 100 USD.

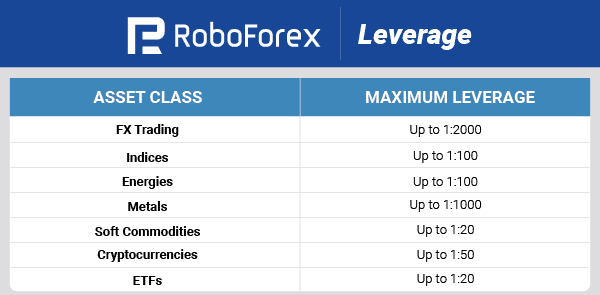

Leverage

Leverage levels at RoboForex in 2026 vary by asset class and account type:

- FX Trading: Up to 1:2000 (may vary by account, with Prime at 1:300 and ECN potentially at 1:500).

- Indices: Up to 1:100.

- Energies: Up to 1:100.

- Metals: Up to 1:1000.

- Soft Commodities: Up to 1:20.

- Cryptocurrencies: Up to 1:50 (based on older data; current leverage may differ).

- ETFs: Up to 1:20.

Higher leverage (up to 1:2000) is typically available on ProCent and Pro accounts with equity below 10,000 USD, automatically reducing to 1:1000 if equity exceeds this. Leverage may also be temporarily reduced on weekends.

My Verdict on RoboForex Product Range

I give RoboForex a score of 7.0/10 for their trading range and CFD offering. Moving forward, I’d like to see more forex pairs and the addition of cryptocurrencies, or at least for popular options like Bitcoin or Ethereum.

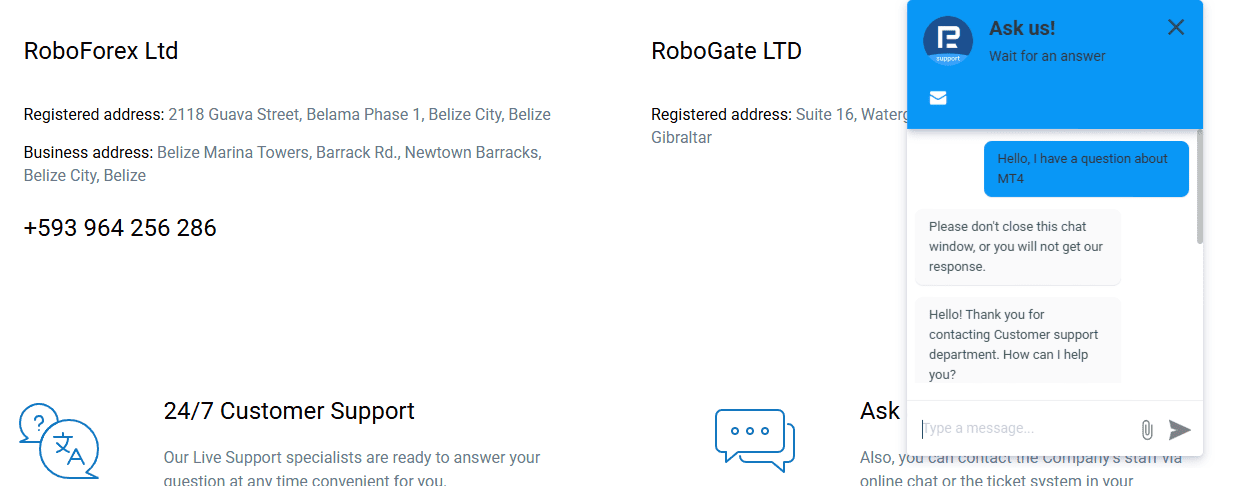

Customer Service

After trading on RoboForex for the sake of testing, over that time I’ve come to rely on their support team more than once. For languages, they spoke English, Czech, Chinese, German, Spanish, Thai but their support told me they also have a few others.

Here are the support channels available:

- Live Chat: Available 24/7 directly on roboforex.com, tap the “Start live chat” button in the footer and you’re connected to a specialist in under 30 seconds.

- Email: You can email support (at) roboforex.com for less urgent inquiries; responses typically arrive within 2 hours during active trading days.

- Phone Hotline: A global call line is staffed around the clock for immediate assistance by phone. Be careful with fees, as the area code starts with +593.

To test the live chat support with RobotForex,I asked a technical question about MT4. I wanted guidance on setting up options for different account types and clarification on a withdrawal I’d submitted late Friday evening.

My experience was that the response time was very long. I found it frustrating to keep checking the chat box for activity. When someone from the customer support team got back to me, the responses tended to be very generic, and seemed to ignore my initial ticket question. In short, I felt the agent’s knowledge seemed to vary between chats, sometimes responding quickly and other times incredibly slowly.

My Verdict on RoboForex Customer Service

I give RoboForex a score of 4.0/10 for customer service, mainly because of the slow speed and lack of depth in the responses. For 24/7 customer support, I expect to get my issue resolved or at least answered in a much more reasonable time frame.

Research and Education

RoboForex provides minimal educational content, primarily aimed at beginner traders and not intermediate or advanced traders. Their resources include articles covering fundamental and technical analysis, risk management, and trading strategies.

I would have liked them to have a more in-depth market analysis with a better organised overview. RobotForex has a list of articles, such as “Top 3 trade ideas for 16 May of 2025” which give you actual take profit or stop loss targets.

The articles have some spelling mistakes, and the logic behind the trades is very dubious, or at least was unsound to me as a seasoned forex trader. After looking through, they have the same five recycled articles every month, so I have to dock some major points there.

They also offer a Forex course, which is available on their website. For beginners, RoboForex provides guides on how to start trading, explaining financial markets, trading terminals, and account types like the ProCent account designed for smaller deposits.

My Verdict on RoboForex Research and Education

I gave RoboForex a score of 3.5/10 for education since their information was incredibly limited, and it read more like a promotional summary of their products. I would like them to add a fully outfitted dedicated education page with more videos, analytics and better-structured info.

FAQs

What is the minimum deposit to open a live account?

The minimum deposit for Pro, ProCent, Prime and ECN accounts is 10 USD (or 10 EUR), while the proprietary R StocksTrader account requires 100 USD (or 100 EUR) to start trading

Is RoboForex well-regulated?

RoboForex Ltd is currently only regulated by the Belize Financial Services Commission (FSC), and lacks oversight of any other entities.

Which trading platforms can I use with RoboForex?

You can trade on MetaTrader 4, MetaTrader 5, R Mobile Trader and R StocksTrader.

Final Verdict on RoboForex

After weighing all the segments and scores for different categories, I give RoboForex an overall score of 62/100. While they have a good range of markets and funding options, they have incredibly limited regulatory oversight. Further negatives were the lack of education, having subpar trading tools and platforms and very low 3rd party reviews.

Overall I have a hard time suggesting this broker to beginner or advanced traders, as many competitors have much better offerings in all categories. I would suggest that if you are a very experienced trader looking for a high-risk broker with very high offshore levels of leverage to give it a try.

Alternatives to Roboforex

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Products Range

Products Range  Support

Support  Market Research

Market Research

Ask an Expert