TMGM vs FOREX.com 2025

Explore the comprehensive comparison between TMGM and FOREX.com. From trustworthiness to trading platforms, account types, customer support, and other factors, find the broker that fits your trading style.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Futures 6.25:1

Minor Pairs 17:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do FOREX.com Vs TMGM Compare?

Our full comparison covers the 10 most important trading factors, but here are five key differences between TMGM and FOREX.com:

- TMGM offers an average spread of 1.16 for the top 5 most traded forex pairs, narrower than FOREX.com’s 1.66.

- TMGM’s average raw spread is 0.26, which is highly competitive, whereas FOREX.com’s raw spread data is not available.

- TMGM is regulated by ASIC, VFSC, and FMA, while FOREX.com holds regulation from FCA, NFA/CFTC, CIRO, MAS, JFSA, and CIMA.

- FOREX.com provides both MetaTrader 4 and MetaTrader 5, while TMGM currently offers only MetaTrader 4.

- TMGM requires a minimum deposit of $100 to open an account, identical to FOREX.com’s requirement.

1. Lowest Spreads And Fees: TMGM

When it comes to choosing the best forex broker, pricing is a critical factor. Let’s explore the pricing details of TMGM and FOREX.com, focusing on different aspects such as Standard Account Spreads, RAW Account Spreads, RAW Account Commission Rates, deposit and withdrawal fees, and other fees to consider.

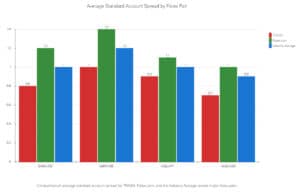

1. Standard Account Spreads

When looking at Standard Account (or no commission) spreads, TMGM offers an average spread of 1.2 for the top 5 most traded forex pairs, while FOREX.com offers a wider average spread of 1.9. The industry average spread for the top 5 most traded pairs is 1.6. When we look at the “Top 5 Most Traded Average Spread,” TMGM has a competitive edge over FOREX.com, too.

Here’s a table showing the spread for each forex pair and the industry average, with TMGM comparing favourably to the industry average for each major forex pair:

| Standard Account | TMGM Spreads | FOREX.com Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.2 | 1.9 | 1.6 |

| EUR/USD | 1.2 | 1.4 | 1.2 |

| USD/JPY | 1.4 | 1.6 | 1.4 |

| GBP/USD | 1.2 | 1.8 | 1.5 |

| AUD/USD | 1 | 1.6 | 1.5 |

| USD/CAD | 1.2 | 2.6 | 1.8 |

| EUR/GBP | 1.2 | 1.8 | 1.5 |

| EUR/JPY | 1.2 | 2.5 | 1.9 |

| AUD/JPY | 1.2 | 1.9 | 2.2 |

Our head of technology research, Ross Collins, tested standard accounts, and the results show that TMGM’s spreads are competitive and in line with the industry standards.[1]December 2025 Published And Tested Data

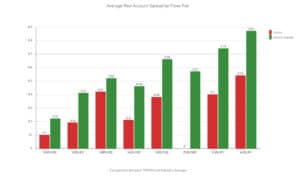

2. RAW Account Spreads

TMGM’s average spread for the top 5 most traded forex pairs is 0.26. Unfortunately, FOREX.com’s data is not available for comparison. FOREX.com does, however, feature live spreads for its RAW pricing account, available on its website.

Ross Collins also tested Raw accounts, and TMGM scored 0.32 for EUR/USD, with a time at minimum spread of 97.83%. The higher the value, the better, as explained on the Zero Pip page.

Our Lowest Spreads and Fees Verdict

Based on the available data, TMGM appears to have superior Standard and Raw account spreads. The detailed comparison and testing results favour TMGM, making it a more cost-effective option for traders. Having limited published and testing spread data for FOREX.com does make it a slightly imperfect comparison, however.

2. Better Trading Platform: FOREX.com

Trading platforms are the gateway to the financial markets. Let’s compare the trading platforms offered by TMGM and FOREX.com to find out which broker provides a superior trading experience.

| Trading Platform | TMGM | FOREX.com |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

1. MetaTrader 4 and MetaTrader 5

Both TMGM and FOREX.com offer MetaTrader 4, while only FOREX.com also offers MetaTrader 5, with TMGM still stating that MT5 is “coming soon” on the broker’s website. Offering MT5 with more features, advanced trading tools, and the ability to trade a wider range of products gives FOREX.com an edge over TMGM.

2. cTrader and TradingView

Neither broker offers cTrader, while FOREX.com does offer TradingView integration through its proprietary platform. This means that FOREX.com offers a superior charting experience with more tools for technical analysis.

3. Social Trading And Copy Trading

Both brokers offer a fairly basic social/copy trading offering with MetaTrader Signals and Expert Advisors (EAs) that come standard with the MetaTrader platforms.

4. Proprietary and Other Trading Platforms

FOREX.com offers a solid proprietary platform, which has a user-friendly mobile app, a more advanced (although not as smooth) desktop platform, Advanced Trading, while its Web trading platform has TradingView integration. TMGM, on the other hand, offers the IRESS platform, which is optimised to trade TMGM’s over 12,000 shares.

5. VPS and Other Trading Tools

Both brokers offer VPS, while FOREX.com also offers advanced trading tools such as Trading Central, Smart Signals and Performance Analytics to analyse the markets, further enhancing the trading experience for its clients. FOREX.com also offers NinjaTrader for U.S. clients. TMGM, on the other hand, offers Trading Central as well as tools such as Market Sentiment and HUBx, which is a bespoke platform for fund managers.

Our Better Trading Platform Verdict

Overall, FOREX.com just edges out TMGM here, given it offers both MetaTrader platforms and an excellent proprietary platform. TMGM scores points for share trading with access to the IRESS platform and a whopping 12,000 shares to trade. Other than that, both brokers offer limited social and copy trading tools.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

3. Superior Accounts And Features: TMGM

Choosing the right account type is crucial for traders. Let’s compare the trading accounts and base currencies offered by TMGM and FOREX.com.

1. Trading Accounts

TMGM offers Edge and Classic accounts, while FOREX.com offers a Standard or MT4 account (no commission), STP Pro/DMA account or RAW Pricing (commission-based) account. Please note that FOREX.com’s RAW Pricing account is only available in the U.S. and Canada.

2. Base Currencies

TMGM offers slightly more flexibility with 6 base currencies, while FOREX.com offers 3.

| TMGM | FOREX.com | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

4. Best Trading Experience And Ease: FOREX.com

When it comes to the trading experience, we’ve taken the time to explore both TMGM and FOREX.com platforms in-depth. TMGM’s platform is incredibly user-friendly, which is a huge plus for those just starting out in forex trading. The MetaTrader 4 integration is seamless, and the platform’s design is clean and straightforward, making it easy to navigate and execute trades. It’s clear that TMGM has put a lot of thought into the user experience, ensuring that everything from chart analysis to trade execution is as intuitive as possible.

On the flip side, FOREX.com offers a more varied experience with the inclusion of both MetaTrader 4 and MetaTrader 5. This is a significant advantage for traders who are looking for more advanced features and analytics. During our testing, we found that FOREX.com’s platforms cater to a wider range of trading styles and preferences, which can be a game-changer for more experienced traders. Here are some key points from our hands-on testing:

- TMGM’s platform is ideal for beginners, offering an uncomplicated interface and essential trading tools.

- FOREX.com caters to a broader audience by providing both MetaTrader 4 and MetaTrader 5 with advanced tools for seasoned traders.

- Both brokers deliver reliable and timely trade execution, a critical factor for traders of all levels.

- Customer support is commendable for both, with each broker providing prompt and effective assistance when it’s needed most.

Our Best Trading Experience and Ease Verdict

FOREX.com edges out TMGM in providing the best trading experience, especially for those who value a comprehensive set of tools and the flexibility of multiple trading platforms.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: FOREX.com

FOREX.com Trust Score

TMGM Trust Score

Regulations

Trust is paramount in the world of forex trading. Let’s dive into the regulatory aspects of TMGM and FOREX.com to determine which broker you can trust more.

1. TMGM Markets Regulation

TMGM is regulated by several authorities, including the Australian Securities and Investments Commission (ASIC), the Vanuatu Financial Services Commission (VFSC), and the Financial Markets Authority (FMA) in New Zealand.

2. FOREX.com Regulation

FOREX.com is regulated by top-tier regulators such as the Financial Conduct Authority (FCA) in the United Kingdom, the Commodity Futures Trading Commission (CFTC) in the United States, and the Investment Industry Regulatory Organization of Canada (IIROC).

3. Trust Comparison

Based on the regulation information, FOREX.com seems to be more trustworthy due to its regulation by top-tier authorities. TMGM, although regulated by reputable bodies, doesn’t match the trust score of FOREX.com. We must mention, however, that being regulated in fewer jurisdictions doesn’t make TMGM untrustworthy. It simply means TMGM doesn’t offer its trading services in as many regions as FOREX.com does.

| TMGM | FOREX.com | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FMA (New Zealand) | FCA (UK) CIRO (CANADA) NFA/CFTC (USA) CYSEC (Cyprus) |

| Tier 2 Regulation | JFSA (Japan) | |

| Tier 3 Regulation | VFSC FSC-M (Mauritius) | CIMA (Cayman) |

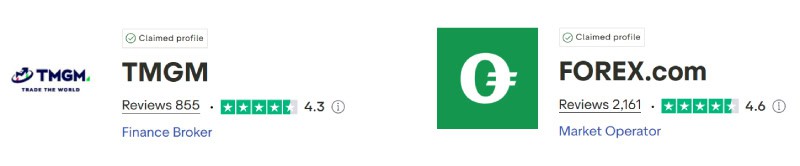

Reviews

As shown below, FOREX.com has a slightly higher Trustpilot score of 4.6 out of 5 based on over 2,100 reviews, compared to TMGM’s 4.3 out of 5 rating based on around 900 reviews, indicating stronger user satisfaction and broader feedback for FOREX.com.

Our Stronger Trust and Regulation Verdict

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

6. Most Popular Broker – FOREX.com

FOREX.com gets searched on Google more than TMGM. On average, FOREX.com sees around 22,200 branded searches each month, while TMGM gets about 18,100 — that’s 18% fewer.

| Country | TMGM | FOREX.com |

|---|---|---|

| United States | 880 | 6,600 |

| India | 260 | 1,900 |

| Canada | 590 | 1,000 |

| United Kingdom | 720 | 880 |

| Germany | 140 | 720 |

| Pakistan | 170 | 720 |

| South Africa | 40 | 590 |

| Japan | 260 | 590 |

| Nigeria | 70 | 480 |

| Indonesia | 320 | 390 |

| United Arab Emirates | 90 | 320 |

| Turkey | 90 | 320 |

| Kenya | 20 | 320 |

| France | 210 | 260 |

| Australia | 1,900 | 210 |

| Mexico | 30 | 210 |

| Bangladesh | 20 | 210 |

| Spain | 110 | 170 |

| Malaysia | 2,400 | 170 |

| Poland | 50 | 170 |

| Philippines | 90 | 170 |

| Vietnam | 1,600 | 170 |

| Italy | 90 | 140 |

| Netherlands | 170 | 140 |

| Colombia | 30 | 140 |

| Thailand | 1,600 | 140 |

| Saudi Arabia | 20 | 140 |

| Argentina | 20 | 110 |

| Austria | 10 | 110 |

| Brazil | 70 | 110 |

| Morocco | 40 | 110 |

| Ethiopia | 10 | 110 |

| Uzbekistan | 10 | 110 |

| Sweden | 20 | 90 |

| Singapore | 590 | 90 |

| Egypt | 20 | 90 |

| Hong Kong | 1,000 | 90 |

| Algeria | 10 | 90 |

| Ghana | 10 | 90 |

| Switzerland | 20 | 70 |

| Peru | 10 | 70 |

| Dominican Republic | 70 | 70 |

| Uganda | 10 | 70 |

| Greece | 20 | 50 |

| Chile | 20 | 50 |

| Venezuela | 10 | 50 |

| Sri Lanka | 10 | 50 |

| Taiwan | 2,400 | 40 |

| Portugal | 10 | 40 |

| Ireland | 10 | 40 |

| Ecuador | 10 | 40 |

| Cambodia | 70 | 40 |

| Tanzania | 10 | 40 |

| Cyprus | 70 | 30 |

| New Zealand | 110 | 30 |

| Jordan | 10 | 30 |

| Botswana | 10 | 30 |

| Bolivia | 10 | 20 |

| Costa Rica | 10 | 20 |

| Mauritius | 50 | 20 |

| Panama | 10 | 10 |

| Mongolia | 10 | 10 |

880 1st | |

6,600 2nd | |

260 3rd | |

1,900 4th | |

720 5th | |

880 6th | |

260 7th | |

590 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with FOREX.com receiving 1,779,000 visits vs. 100,000 for TMGM.

Our Most Popular Broker Verdict

FOREX.com is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: TMGM

Diving into the range of products and markets available through TMGM and FOREX.com, it’s clear that both brokers offer a diverse array of options to cater to various trading strategies and preferences. From our extensive testing and direct experience, we’ve gathered that TMGM boasts an impressive selection, particularly when it comes to share CFDs, with over 12,000 available. This is a staggering number that provides traders with unparalleled access to global equity markets.

FOREX.com, while not matching TMGM in share CFDs, still offers a robust selection of forex pairs. With 91 forex CFDs, traders have the opportunity to engage with a wide variety of currency markets. Additionally, FOREX.com provides a solid range of indices, commodities, and other CFD markets, which are essential for traders looking to diversify their portfolios.

| CFDs | TMGM | FOREX.com |

|---|---|---|

| Forex Pairs | 61 | 91 |

| Indices | 12 | 17 |

| Commodities | 3 Metals 2 Energies | 2 Metals (6 Gold crosses (2 Silver crosses) 2 Energies 2 Softs |

| Cryptocurrencies | 12 | 8 |

| Shares CFDs | 12000+ | 220 |

| ETFs | No | No |

| Bonds | No | No |

| Futures | No | No |

| Treasuries | No | No |

| Investment | No | No |

It’s evident from the table that each broker has its strengths in different areas of the CFD and forex markets. TMGM stands out with its vast array of share CFDs, while FOREX.com offers a broader forex and futures market.

Our Top Product Range and CFD Markets Verdict

TMGM offers the best range of CFDs and Markets, especially for traders focused on share CFDs, with an extensive selection that is hard to match.

8. Superior Educational Resources: FOREX.com

When assessing the educational resources of TMGM and FOREX.com, it’s crucial to consider the breadth and depth of materials provided to enhance the learning journey of traders. Our team has meticulously tested and reviewed the educational content available on both platforms, focusing on the quality, accessibility, and relevance to traders at all levels.

TMGM offers a solid range of educational materials, including webinars, seminars, and a trading glossary that can be particularly beneficial for newcomers to the forex market. Their resources are designed to be accessible and easy to understand, providing a good foundation for those starting their trading journey. FOREX.com, on the other hand, boasts a comprehensive suite of educational tools, including advanced trading strategies, risk management techniques, and in-depth market analysis. Here’s a breakdown of what we found:

- TMGM provides free educational webinars and seminars, which are great for interactive learning.

- FOREX.com offers a more extensive collection of on-demand video tutorials covering a range of topics.

- Both brokers have a dedicated section for educational articles and insights, with FOREX.com providing more in-depth analysis.

- TMGM’s trading glossary is a handy tool for beginners to get acquainted with trading terms.

- FOREX.com has a demo account that comes with educational resources to practice trading strategies.

- Both brokers offer educational e-books, but FOREX.com’s selection is more comprehensive and advanced.

Our testing has shown that both TMGM and FOREX.com value trader education and provide a wealth of resources to support their clients. However, the depth and variety of materials differ between the two.

Our Superior Educational Resources Verdict

FOREX.com offers the best educational resources, scoring higher in our testing due to its extensive range of in-depth materials that cater to both beginner and experienced traders.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

9. Superior Accounts And Features: TMGM

TMGM offers superior customer support through excellent customer service knowledge, 24/7 support hours and the option of a dedicated account manager. FOREX.com, on the other hand, provides more limited customer support, with 24/5 support hours, no email support and good but not great customer service knowledge. This is why we scored TMGM an excellent 8/10 and FOREX.com an average 6/10 for customer support.

| Feature | TMGM | FOREX.com |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

10. Better Funding Options: TMGM

When it comes to funding options, traders look for flexibility, security, and speed. Both TMGM and FOREX.com understand this need and offer a range of methods to fund your trading account. Our comprehensive testing has shown that both brokers provide several mainstream funding options, but there are differences in terms of the variety and the ease of transactions.

TMGM prides itself on offering a variety of instant deposit methods with no fees, which is a significant advantage for traders who need to move funds quickly. FOREX.com, while also providing a range of funding options, may have different processing times and potential fees depending on the method used. It’s important for traders to consider not just the availability of a particular funding method but also the associated costs and processing times.

| Funding Methods | TMGM | FOREX.com |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

TMGM offers better funding options, with a broader range of methods and generally quicker processing times, making it easier for traders to manage their financial transactions.

11. Lower Minimum Deposit: Tie

The minimum deposit requirement is a crucial factor for many traders, especially those who are new to the forex market and are not willing to risk a large amount of capital from the outset. TMGM and FOREX.com both cater to this demographic by offering accounts with a minimum deposit of $100, which is considered relatively low and accessible for most traders. This low barrier to entry makes both brokers attractive options for novice traders or those looking to test the waters with a new broker without significant financial commitment.

However, when we look at the premium account options, the differences become more pronounced. TMGM’s IRESS account requires a minimum deposit of $5,000, which is tailored towards more experienced traders who require a more sophisticated trading platform and direct market access. In contrast, FOREX.com’s DMA account demands a substantial $25,000 minimum deposit, which is significantly higher and positions it as an option for high-volume professional traders.

Here’s a quick comparison of the minimum deposit requirements for each broker:

| Broker | Minimum Deposit | Recommended Deposit |

| TMGM | $100 | $500 |

| FOREX.com | $100 | $1,000 |

Our Lower Minimum Deposit Verdict

Both TMGM and FOREX.com offer a lower minimum deposit for their standard accounts, making them equally accessible for traders with a lower risk appetite or those just starting out. However, for premium accounts, TMGM provides a more affordable entry point compared to FOREX.com’s DMA account.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: FOREX.com or TMGM?

TMGM is the winner because it offers a competitive balance across various critical aspects, such as lower spreads and fees, a comprehensive product range, and better funding options. While FOREX.com excels in providing superior educational resources, a better trading platform, and stronger trust and regulation, TMGM’s overall offerings make it a more attractive choice for a broad spectrum of traders.

The table below summarises the key information leading to this verdict:

| Categories | TMGM | FOREX.com |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ✅ |

Best For Beginner Traders

TMGM is better for beginner traders, offering a more accessible platform with lower minimum deposits and extensive educational resources.

Best For Experienced Traders

FOREX.com is better for experienced traders, providing a robust trading platform with advanced features and superior regulatory trust.

FAQs Comparing TMGM Vs FOREX.com

Does FOREX.com or TMGM Have Lower Costs?

TMGM has lower costs, offering more competitive spreads on average. For instance, TMGM’s average spread for major pairs like EUR/USD can be as low as 0.1 pips with an Edge account, compared to FOREX.com, where spreads start a bit higher. This difference can be significant for active traders who trade large volumes frequently. For traders looking to minimise their trading costs, it’s essential to consider not only the spreads but also any potential commissions or fees associated with trading. For more detailed spread data, traders can refer to our lowest spread forex brokers comparison.

Which Broker Is Better For MetaTrader 4?

Both TMGM and FOREX.com offer MetaTrader 4, but FOREX.com also provides the advanced MetaTrader 5 platform. TMGM’s integration with MetaTrader 4 is seamless, offering a user-friendly experience for traders. However, for those seeking a platform that supports both MT4 and its more advanced successor, MT5, FOREX.com is the better choice. Traders interested in exploring the benefits of MetaTrader platforms can find more information on the best MT4 forex brokers.

Which Broker Offers Social Trading?

FOREX.com offers social trading options, allowing traders to follow and copy the trades of experienced traders. This feature is particularly beneficial for beginners who are still learning the ropes or for those who wish to leverage the expertise of more seasoned traders. Social trading can be a powerful tool for learning and earning simultaneously, and for those interested in exploring this further, additional insights are available on the best copy trading platforms.

Does Either Broker Offer Spread Betting?

FOREX.com offers spread betting, while TMGM does not. Spread betting is a tax-efficient way of speculating on the price movement of financial instruments, available exclusively to UK and Ireland residents. It’s a popular choice for traders looking to capitalise on market movements without taking ownership of the underlying asset. For those interested in spread betting, especially if you’re a beginner, you can learn more about the best brokers for this trading style at best broker for beginners in spread betting.

What Broker is Superior For Australian Forex Traders?

In my opinion, TMGM is superior for Australian forex traders. Both TMGM and FOREX.com are ASIC-regulated, which is reassuring for Australian traders. However, TMGM was founded in Australia, giving it a home advantage with a deeper understanding of the local market. Additionally, TMGM’s competitive spreads and extensive CFD offerings make it a compelling choice for Aussies. For traders down under looking to compare brokers further, check out the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, FOREX.com appears to be the superior broker. Both brokers are regulated by the FCA, ensuring a high standard of conduct and protection for UK traders. However, FOREX.com’s spread betting option and its robust platform offerings, including advanced charting and analysis tools, give it an edge in the UK market. As someone who values regulatory oversight and advanced trading features, I find FOREX.com’s services to be more aligned with the needs of UK traders. For more information on trading in the UK, interested individuals can visit best UK forex brokers.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Raw account spreads (no commission) published on each broker's website (updated monthly) plus our proprietary tests by Ross Collins.

Raw Account Spreads

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What is the stop out level in TMGM?

TMGM will impose a stop-out when the margin level percentage equals or falls to below 40%.