Forex Trading Software In 2026

Having the right software for forex trading is critical in getting the best trading experience. I compared the best forex trading platforms and the forex brokers offering the software based on features, 2026 brokerage and execution speeds.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

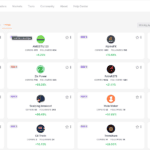

The best software for forex trading with the best trading tools are

- Pepperstone - Highly Recommended Forex Broker With MT4

- IC Markets - Has Low Spreads and a Large Product Range With MT5

- BlackBull Markets - My Best TradingView Broker

- GO Markets - My Top cTrader Broker

- eToro - Leading Social Trading Broker

- Eightcap - Offers Great Automated Crypto Trading

- AvaTrade - Social Trading With MetaTrader 4 and 5

What is the best software for forex trading in Australia?

Pepperstone offers the best software for forex trading in Australia with our rating of 98/100 rating, providing MT4, MT5, cTrader, TradingView and Capitalise.ai platforms. With a 77ms execution speed and RAW spreads from 0.10 pips, Pepperstone delivers competitive $3.50 commissions across 94 currency pairs. We also shortlisted other Australian brokers based on their platform features and automation capabilities.

1. PEPPERSTONE - Best MT4 Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

Pepperstone’s trading softwares exceeded my expectations from a no-dealing desk style platform. The broker offers the four major trading platforms that beginner and professional traders look for: MetaTrader4, MetaTrader5, cTrader, and TradingView. The MT4 is an absolute standout, coming with 18 extra indicators.

On top of that, Pepperstone has lightning-fast limit order execution speeds and competitive spreads, which make a genuine difference in a market where every millisecond counts. It’s no surprise that the broker bagged the Investment Trends award in 2022 for client satisfaction and trading experience, cementing reputation as a leader in the field.

I found Pepperstone to be a great choice for forex traders looking for a comprehensive trading experience by combining competitive pricing with enhanced trading tools.

Pros & Cons

- Competitive MT4 spreads

- Fast MT4 execution speeds

- Easiest MT4 account opening

- Commission-based Raw Account

- Does not offer guaranteed-stop loss

- DMA access exclusively on cTrader and MT5.

Broker Details

Founded in Australia in 2010, Pepperstone is known for having diverse trading platforms and excellent trading conditions on MetaTrader 4 (MT4).

I found that the broker enhances MT4’s functionality with Smart Trader Tools, with 28 free Expert Advisors and indicators. These tools improve trade management features when doing algorithmic trading. For example, the Trade Terminal EA gives a picture of current open positions, and if you are looking to close all of your trades quickly when scalping, then know that this platform is available on Pepperstone.

Another set of features I enjoyed are High-Low and Pivot indicators which automate drawing key support and resistance levels daily. This will save you a lot of time when you day trade breakouts on your trading strategies.

I am impressed to find that Pepperstone has a wide range of assets, including 94 currency pairs, 24 indices, 1,000+ share CFDs, 33 commodities, and 44 cryptocurrencies. This will be excellent if you like trading different assets at once. On the other hand, it’s worth noting that share CFDs are only available on MT5 or TradingView platforms, and not on MT4.

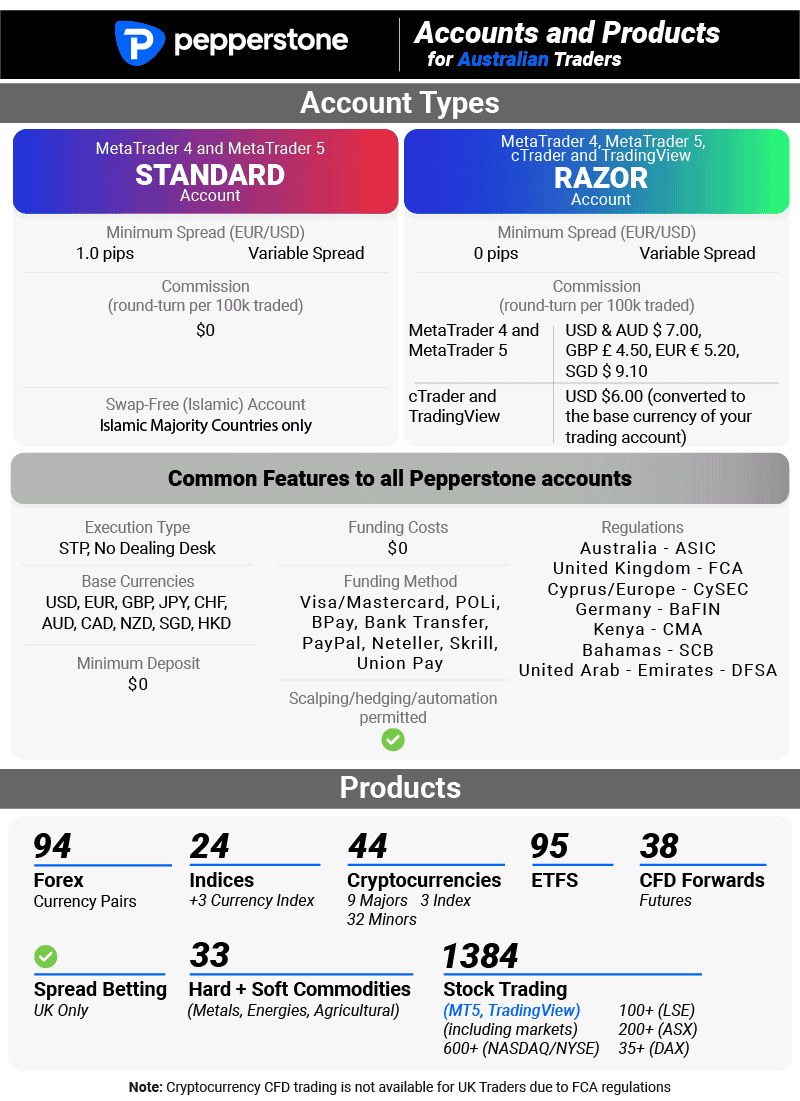

Pepperstone offers two main account types: Standard and Raw. The Standard account features low spreads, and my tests showed an average of 1.12 pips on EUR/USD with no commissions. If you are seeking even lower costs, you will be delighted to know that the Razor account offers 0.0 pip spreads on major currency pairs.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

| Axi | 82.61% |

| CMC Markets | 81.88% |

Zero pip spreads are excellent if you’re a scalper or automate your trades with an EA, as you’ll be effectively only paying the commission, which is $3.50 per lot traded. With the fixed commission, you won’t have to worry about trading around volatile times or price spikes, as you’ll be paying the same commission.

2. IC MARKETS - Best MT5 Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

I like IC Markets for its exceptionally low spreads, which can make a real difference to the trading experience. On top of that, the broker’s selection of platforms and trading tools is what really rounds out the offering.

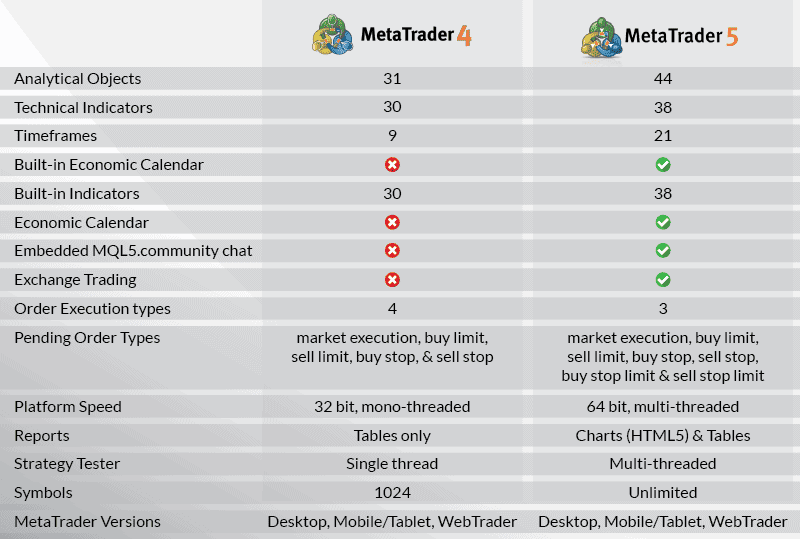

With IC Markets, MetaTrader5 comes with more technical indicators and timeframe options, including a built-in economic calendar that can be helpful for avoiding opening positions during volatile periods. For me, having these additions enhances flexibility in strategy implementation, and this can allow your trading strategies to adapt to different market conditions easily.

For these two main reasons, I did not hesitate to name IC Markets as a top pick for those after low spreads and a broad product offering on MetaTrader5.

Pros & Cons

- Low no-commission spreads

- Competitive overall trading costs

- Extensive MT5 product offerings

- High minimum deposit

- Lacks educational resources

- Could have more market analysis content

Broker Details

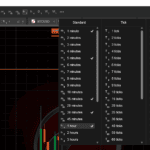

If you are into MetaTrader5, IC Markets offers the trading platform with several enhancements over the standard version. The broker has maintained MT4’s user-friendly interface while expanding technical indicators to 38+, with a built-in economic calendar that labels high-impact events in the financial markets for better risk management.

MT5 also comes with more timeframe options, including 10-minute charts, which offer greater flexibility whether you are scalping, day trading, swing trading, or investing long-term.

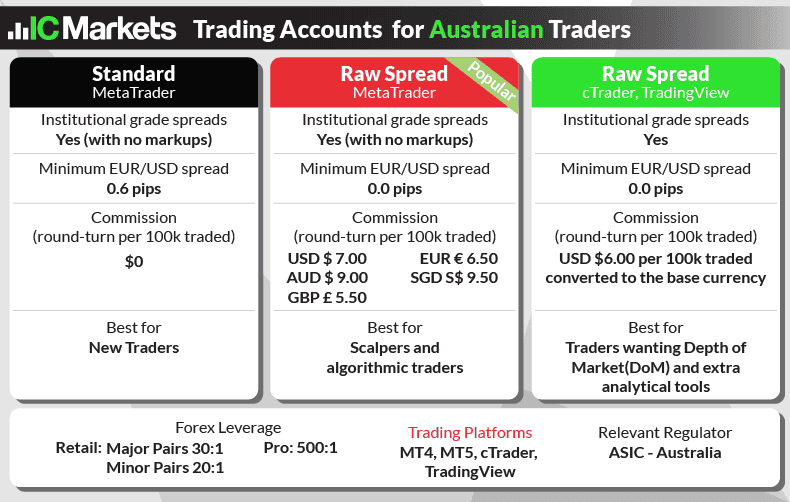

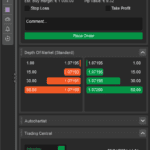

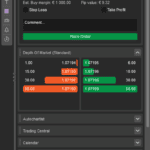

Now with the retail investor account, IC Markets offers two types: Standard and Raw. The Raw account, an ECN-style offering, provides access to another novel tool called the Depth of Market (DOM). This comes with real-time order book data from liquidity providers which I find particularly useful for scalping and analyzing market flow and strength.

In terms of pricing, IC Markets’ Raw account offers competitive spreads, averaging 0.19 pips on EUR/USD on my tests on different market conditions. Based on my observation, this combination of enhanced features, diverse market access, and competitive pricing makes IC Markets attractive to a good range of trader types.

IC Markets also offers wide range of markets, including 1,600+ stock CFDs, 61+ currency pairs, 26+ commodities, 25+ indices, and 18+ cryptocurrencies. Using MetaTrader5 with the broker allows charting of stock CFDs which is not available on MT4, and this expands trading opportunities available to you when on MT5.

| Broker | EUR/USD Average Spread | Broker | GBP/USD Average Spread |

|---|---|---|---|

| TMGM | 0.15 | CityIndex | 0.17 |

| Tickmill | 0.15 | Fusion Markets | 0.21 |

| Fusion Markets | 0.16 | IC Markets | 0.27 |

| IC Markets | 0.19 | FP Markets | 0.31 |

| Pepperstone | 0.19 | TMGM | 0.35 |

| FP Markets | 0.2 | Pepperstone | 0.41 |

| EightCap | 0.2 | EightCap | 0.44 |

| Admiral Markets | 0.21 | Blueberry Markets | 0.44 |

| CityIndex | 0.22 | Go Markets | 0.59 |

| ThinkMarkets | 0.22 | Tickmill | 0.59 |

| Blueberry Markets | 0.27 | ThinkMarkets | 0.62 |

| Go Markets | 0.38 | Admiral Markets | 0.73 |

| Axi | 0.43 | CMC Markets | 0.9 |

| CMC Markets | 0.44 | Axi | 0.95 |

3. BLACKBULL MARKETS - Best TradingView Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why I Recommend BlackBull Markets

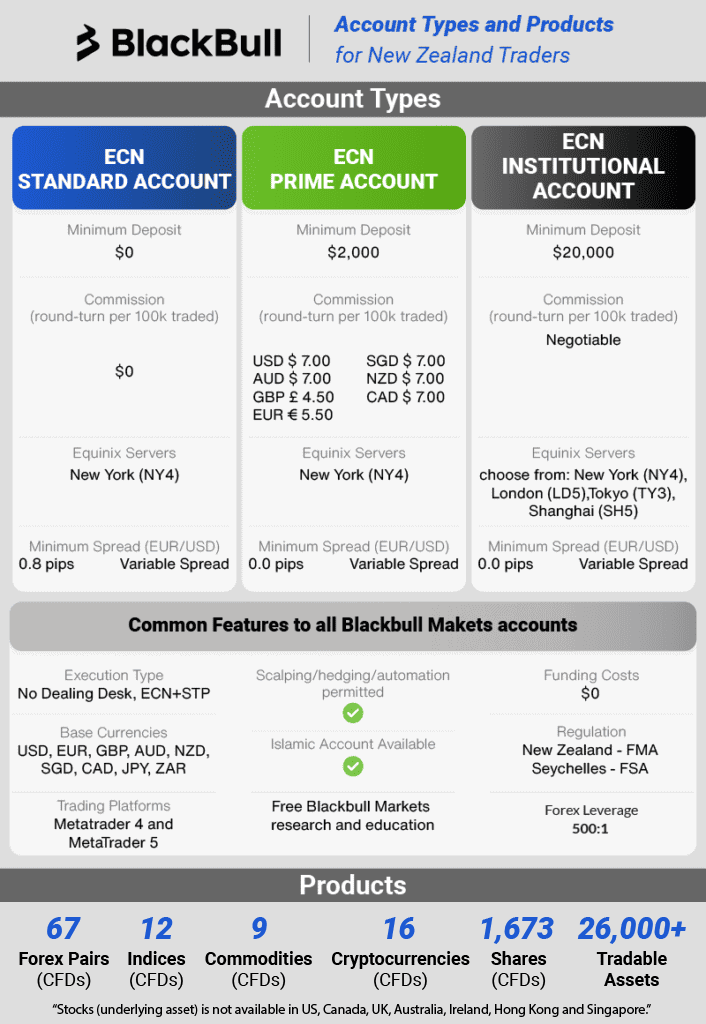

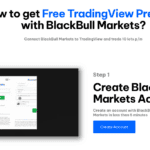

For those prioritizing TradingView integration and practice opportunities, BlackBull Markets stands out as a top choice. This New Zealand-based broker offers 110+ indicators and drawing tools on TradingView, and comes with one of the best forex demo accounts I’ve used. This makes BlackBull an ideal starting point for skill development before live trading. Moreover, the broker impressed me with consistently quick spreads during my tests.

Pros & Cons

- Fastest execution speeds

- Offers 1:500 leverage on forex

- Solid choice of trading products

- Basic auto-trading features

- Has a withdrawal fee

- Lacks in-house market analysis tools

Broker Details

As a trader who relies heavily on technical analysis, I’ve found that BlackBull Markets offers free TradingView premium subscriptions if I place regular trades. This upgrade has been fantastic, and you’ll appreciate having access to more data and indicators when refining analysis, all at no cost.

TradingView is my go-to for technical analysis and trading signals for many years now, with its 110+ indicators and drawing tools. This extensive offer gives everything needed to spot trading opportunities accurately and quickly.

I also love that the charting platform allows accessing of charts and drawings on any device. It’s a game-changer, and once you try it, you’ll understand my fascination. You will not have to worry about forgetting important support levels or redrawing analysis again.

Admittedly, I can’t fully automate my strategies on TradingView like I could with MT4 or MT5 (which BlackBull also offers). However, I actually prefer setting up alerts for when my conditions are met. This gives me a chance to double-check before entering a trade, and such a measure can potentially save you from making some bad calls.

But it’s not just about the platform. I was impressed to learn that BlackBull has some of the fastest execution speeds out there. The broker’s limit order speed of 72ms means that pending orders, stop losses, and take profits are executed lightning-fast.

Overall, I’ve found BlackBull Markets to be a great choice, especially if you’re a technical trader like me who values both powerful analysis tools and quick order execution.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| OANDA | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

| Trading.com | 13 | 98 | 14 | 138 | 15 |

| FBS | 14 | 135 | 17 | 118 | 12 |

| Axi | 15 | 90 | 8 | 164 | 25 |

4. GO MARKETS - Best cTrader Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Go Markets Trading App

Minimum Deposit

$200

Why I Recommend GO Markets

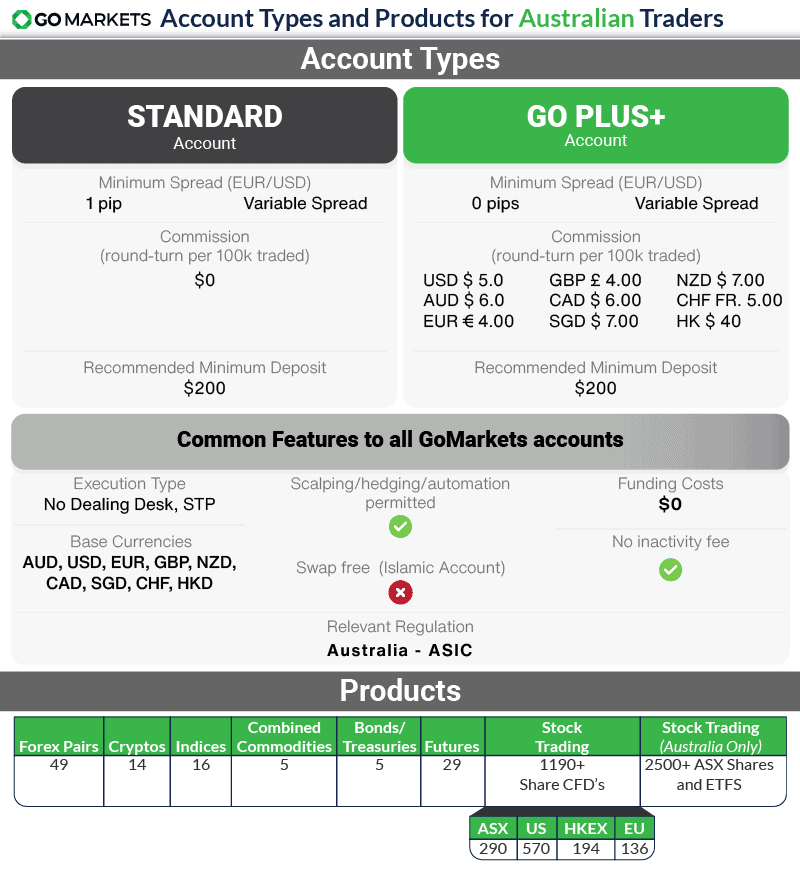

I am quite pleased with my trading experience using GO Markets, mainly because of the low commissions and ease of trading with cTrader. The platform felt like a perfect and less complicated mix of TradingView and the MetaTraders, offering fast execution speeds, a user-friendly interface, and automated trading capabilities.

In my analysis, GO Markets consistently offered the lowest commissions for a No Dealing Desk, ECN-style setup, which could be a massive win if you are into low-cost trading. Also, if you like equities, you’ll be chuffed to know that the broker offers access to more than 2,500 ASX stocks, all with competitive spreads.

Pros & Cons

- Lowest commissions

- Over 2500 ASX stocks

- Competitive spreads

- Learning curve for beginners

- Limited social trading tools

- Lacks 24/7 customer support

Broker Details

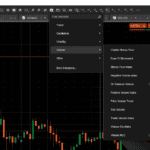

I’ve been using cTrader with GO Markets, and I’m really impressed with my overall experience. It feels like using perfect mix of TradingView and MetaTrader 4 — charting tools are excellent and trade automation is allowed right on the platform.

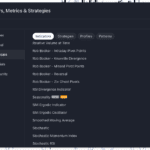

What I love about cTrader is its 65 indicators and over 100 advanced timeframes, including Renko charts. I can automate my strategies using cBot, which is similar to MT4’s Expert Advisors. If you like using EAs with MetaTraders, then you will have no problem using this feature on cTrader. It’s great that I can either program these myself or download them from the marketplace.

It is also big plus for me that cTrader works natively on all devices, including on my Mac. I get full functionality without needing emulators, which is a common complain when using MT5 on Mac.

I would like to mention that the depth of market feature in cTrader works fantastic. It’s built right into the order ticket which allowed me to keep an eye on order flow. If I am being honest, I find this implementation much more convenient than MT5’s.

Here’s the real kicker – GO Markets offers lower commissions on cTrader than other brokers. At $2.50 per lot traded, it’s $1 lower than the industry average. If you are into scalping and high-volume trading, that will be a good value for your buck in there.

| Broker | USD |

|---|---|

| Go Markets | $2.50 |

| Blackbull Markets | $3.00 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

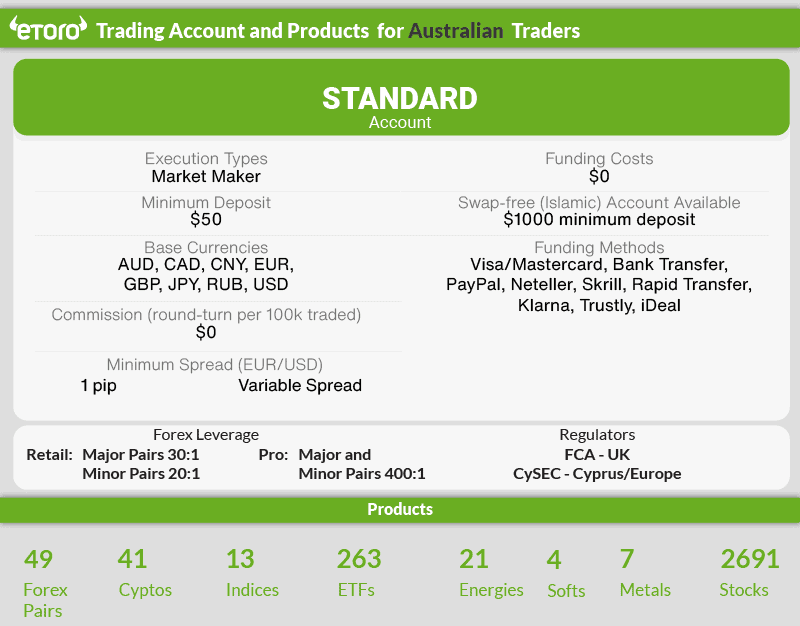

5. eToro - Best Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1 GBP/USD = 2 AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

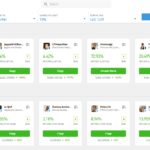

When it comes to social trading, eToro undoubtedly leads the pack. The broker has been one of early proponents of this idea since launching in 2007. Now with over 25 million members globally, eToro has built a solid community where traders can share and benefit from each other’s expertise.

I also found eToro CopyTrader, the broker’s copy trading platform, to be a standout. I highly recommended this if you are just starting out with copy trading since you are up for a great selection. eToro also offers a list of recommended traders ranked based on performance and popularly, making the selection process easier.

Pros & Cons

- Intuitive platform for copy trading

- Extensive range of products to copy trade

- No commission trading

- Limited account type

- Only one trading platform

- Has fees when withdrawing

Broker Details

After testing various social trading platforms, eToro CopyTrader has stood out as the best choice for me. It is perfect for using experienced traders’ knowledge without needing to learn everything myself.

If you’re worried about user-friendliness, the platform is easy to navigate and comes with a list of recommended traders based on performance and popularity. I found this list very useful even as an expert trader, all the more if you are new to copy trading and want to access the best traders on the platform without exploring it thoroughly.

There is an advanced search feature that will allow you to filter through 2 million active traders using 14 different metrics, with categories like “Copy AUM” (Assets Under Management) and “Number of Copiers”. These two categories show detailed statistics on each trader, and helps to vet them thoroughly before selection.

Surprisingly, copy trading on eToro is very cost-effective. In my tests, the average spread on EUR/USD was 1.00 pip, which beats the industry average and similar platforms like ZuluTrade. With this, eToro CopyTrader has become my go-to platform for social trading, offering a great balance of features, ease of use, and cost-effectiveness.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.62 |

| Eightcap | 1 |

| Go Markets | 1 |

| eToro | 1 |

| Pepperstone | 1.12 |

| Blackbull Markets | 1.2 |

| Industry Average | 1.24 |

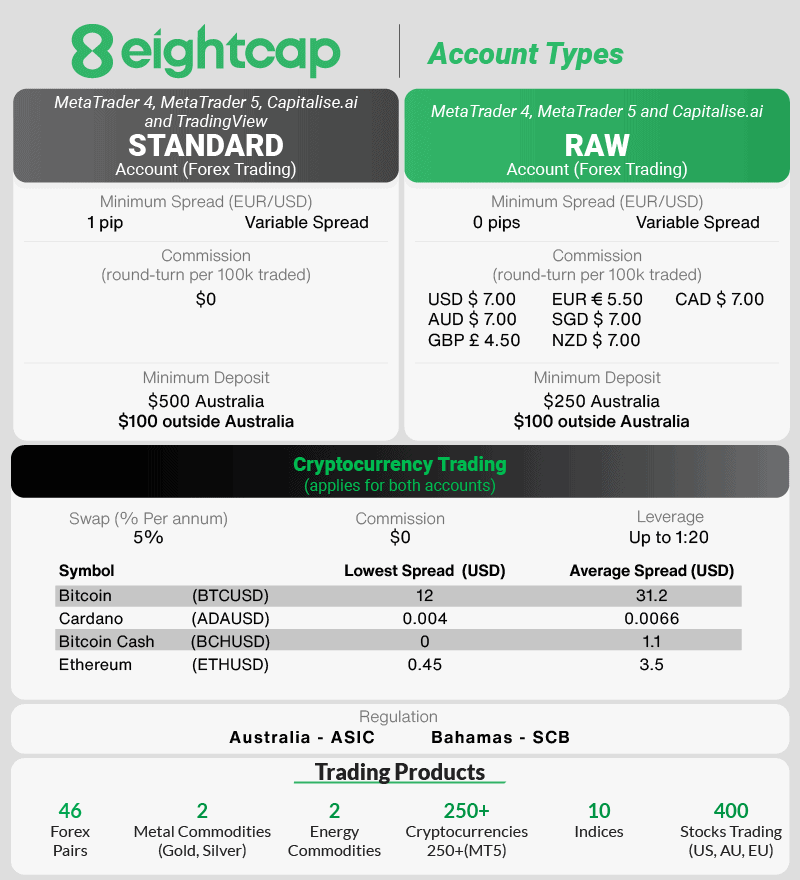

6. EIGHTCAP - Best Automated Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.23 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why I Recommend Eightcap

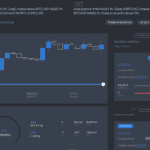

I found Eightcap to be a great choice if you’re keen on automated crypto trading. This broker differentiates itself by offering Capitalise.ai integration, which is top-notch for setting up your automated crypto strategies.

Eightcap’s extensive range of cryptocurrency products also adds value to the broker, offering 79 pairs on MT4 and 95 pairs on MT5.

Pros & Cons

- No-commission trading

- Over 250 cryptocurrencies

- Automation via Capitalise.ai

- Slow execution speeds

- Limited range of products

- Customer support is not 24/7

Broker Details

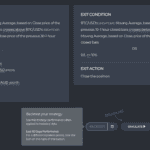

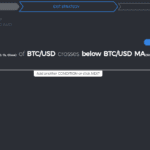

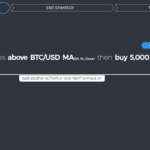

MetaTrader 4 is undoubtedly a popular choice for automating trades. However, I found that Eightcap’s Capitalise AI can be an excellent alternative for automating crypto strategies. The tool allows has allowed me to automate my strategy without coding skills, opening up new opportunities for those who are in a similar situation.

I have never seen as similar offer from other brokers, and since I am intrigued, I wanted to see how easy it is to generate a strategy on Capitalise AI. Impressively, I simply typed my entry and exit strategies, and the tool developed the strategy instantly. In comparison, the results are significantly faster than coding an Expert Advisor on MetaTrader 4, not to mention, cheaper.

I also liked the Eightcap it allowed me to backtest my strategy to test its performance in the next 90 days. When you use this feature, you will be allowed to see trade outcomes and find optimization opportunities.

In addition, you can forward the test by “simulating” the strategy on a demo account to see the strategy perform in real time. For me, testing the strategy this way is both cost and time saving.

Aside from Capitalise AI, Eightcap offers 95 crypto CFDs to trade on MT5, over two times the amount eToro offers. This makes this broker a decent choice if you want to automate your strategies across a range of cryptocurrencies.

| Broker | Crypto Markets |

|---|---|

| Eightcap | 95 |

| eToro | 41 |

| Pepperstone | 19 |

| IC Markets | 18 |

| GO Markets | 14 |

| BlackBull Markets | 11 |

A bonus of trading crypto with Eightcap is that they are regulated by the Australian Securities and Investments Commission (ASIC), offering protection for your funds should anything happen. This protection is something you may not find with a crypto exchange.

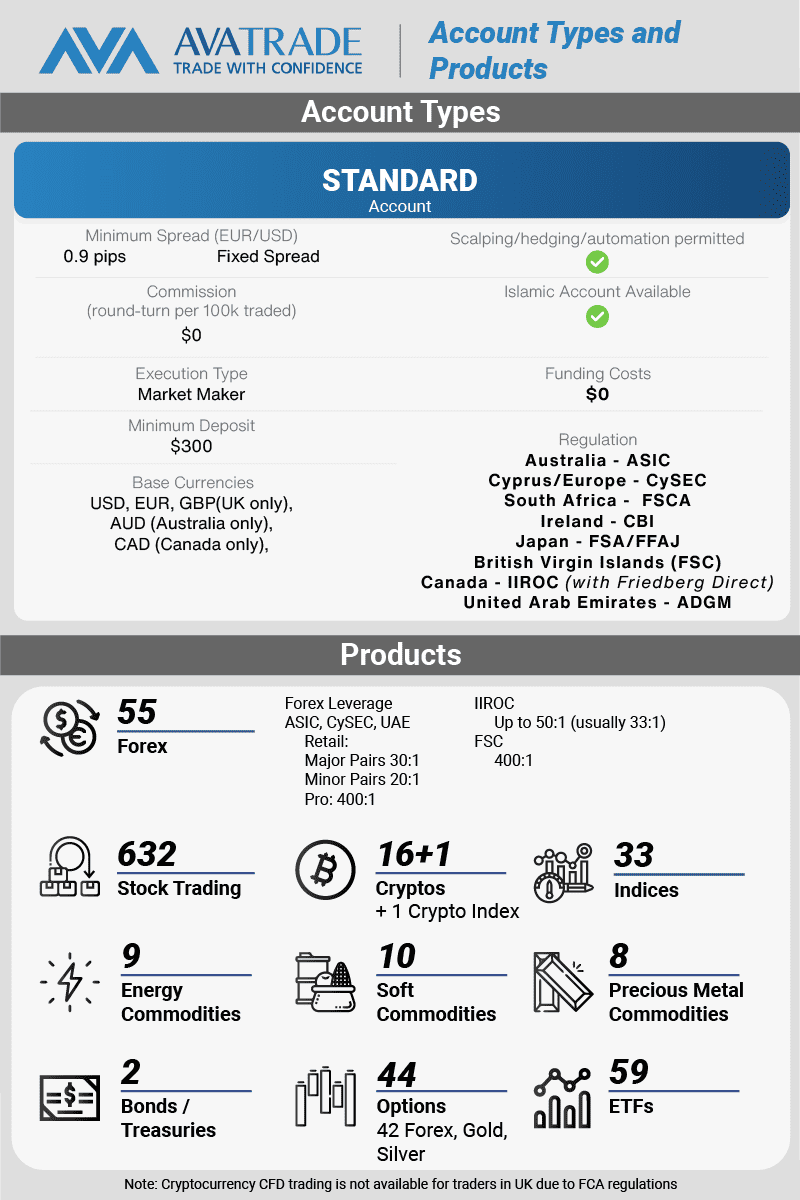

7. AVATRADE - Best Social Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why I Recommend AvaTrade

I found AvaTrade a standout choice for those interested in social trading, mainly with MT4 and MT5 platforms. Their collaboration with third-party services ZuluTrade and DupliTrade, along with their proprietary AvaSocial platform, offers successful traders a robust selection of social and copy trading options.

Pros & Cons

- Exceptional proprietary platforms

- A wide array of tradeable instruments

- Social trading with ZuluTrade

- Wider-than-average spreads

- Market maker model

- Limited to spread-only trading account

Broker Details

AvaTrade is founded in Dublin, Ireland, in 2006 offering multiple social trading platforms, including ZuluTrade, DupliTrade, and AvaSocial. Personally, I wanted to try ZuluTrade because it allows finding and mirror other traders, copying their profitable (and losing) trades.

I liked how simple ZuluTrade works. I found that the web platform can be used to find traders available to copy and allocate funds to each trader. Once invested in a trader, the MetaTrader 4 (or MT5) platform will automatically mirror the trades, and you will profit when they profit and lose when they do.

During my test, I used the dedicated search tool to find traders who matched my trading criteria. You will get 25+ settings to filter traders who don’t match your needs. The depth you can use to filter copy traders is better than eToro’s overall, allowing to narrow the selection based on risk management, trading style, and how many follow them. However, in my opinion, this tool can be overwhelming for a new trader with the wealth of choices, and eToro’s platform is easier to use.

With spreads, variable spread brokers with ZuluTrade may charge wider spreads during volatile times or when there is less liquidity. I found AvaTrade performing exceptionally in this, providing fixed spreads that do not widen (or narrow) based on market volatility. After testing the broker, I found that the average fixed spreads for EUR/USD are only at 0.90 pips, lower than other low-cost brokers such as eToro and Eightcap.

Using fixed spreads can ensure that you always get the same spreads throughout the trading day and keeps your trading costs low. If you are someone that prefers stability above all, AvaTrade can give that to you.

| Broker | Spread | Variable/Fixed |

|---|---|---|

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| GO Markets | 1.00 | Variable |

| Pepperstone | 1.12 | Variable |

| BlackBull Markets | 1.20 | Variable |

Ask an Expert

How much is your software?

Hi Jason

We don’t sell software ourself, we are a referral website. If you click on the link, you will be taken to the publishers website for you to buy directly through the publisher. Even though we do get a referral fee, you pay the same price as all clients of the publisher

As a beginner, is eToro the best choice?

Depends on your point of view, some say copy trading is good for beginners since you can simply copy other trades. No need to learn to trade yourself but be careful as a traders past performance does not mean their future performance will be any good. On the other hand, if you want to learn to trade, eToro are not the best choice since their education and risk management tools are limited but they do have a good demo account.

Is $100 enough to star forex?

Yes but you might need to trade using mini or micro lots or with lower leverage which may or may not suit your trading plan.

Is $100 enough to start forex?

Yes, as long as the margin requirements is below $100. The margin will depend on the size of your trade.