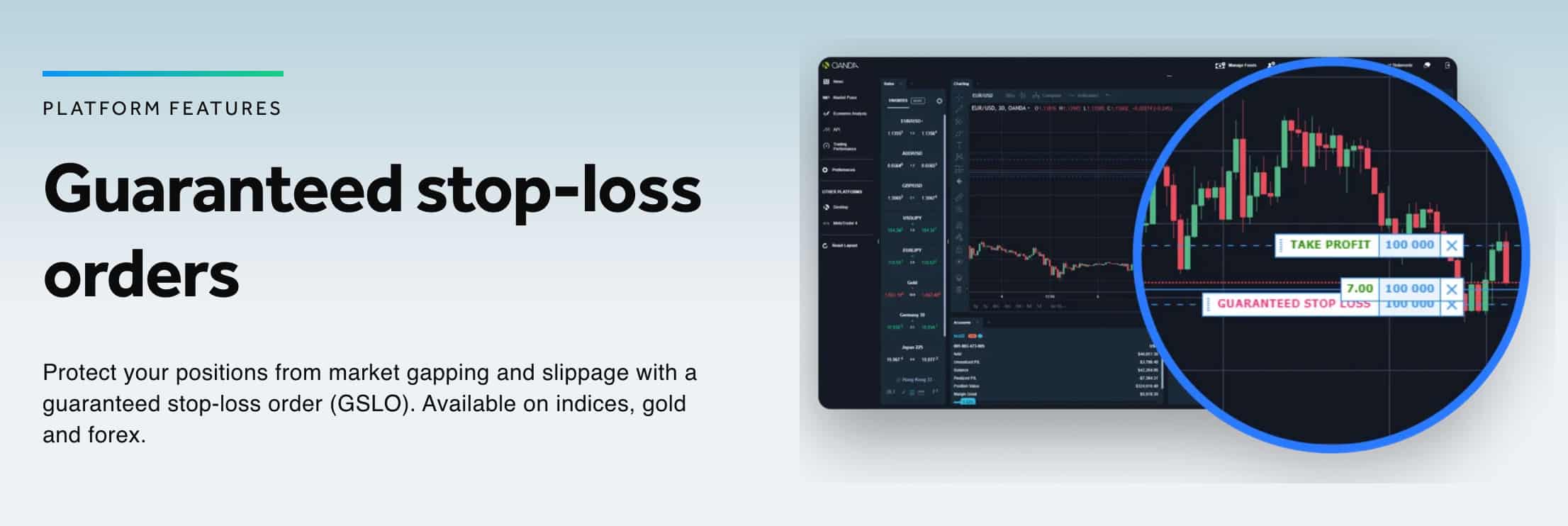

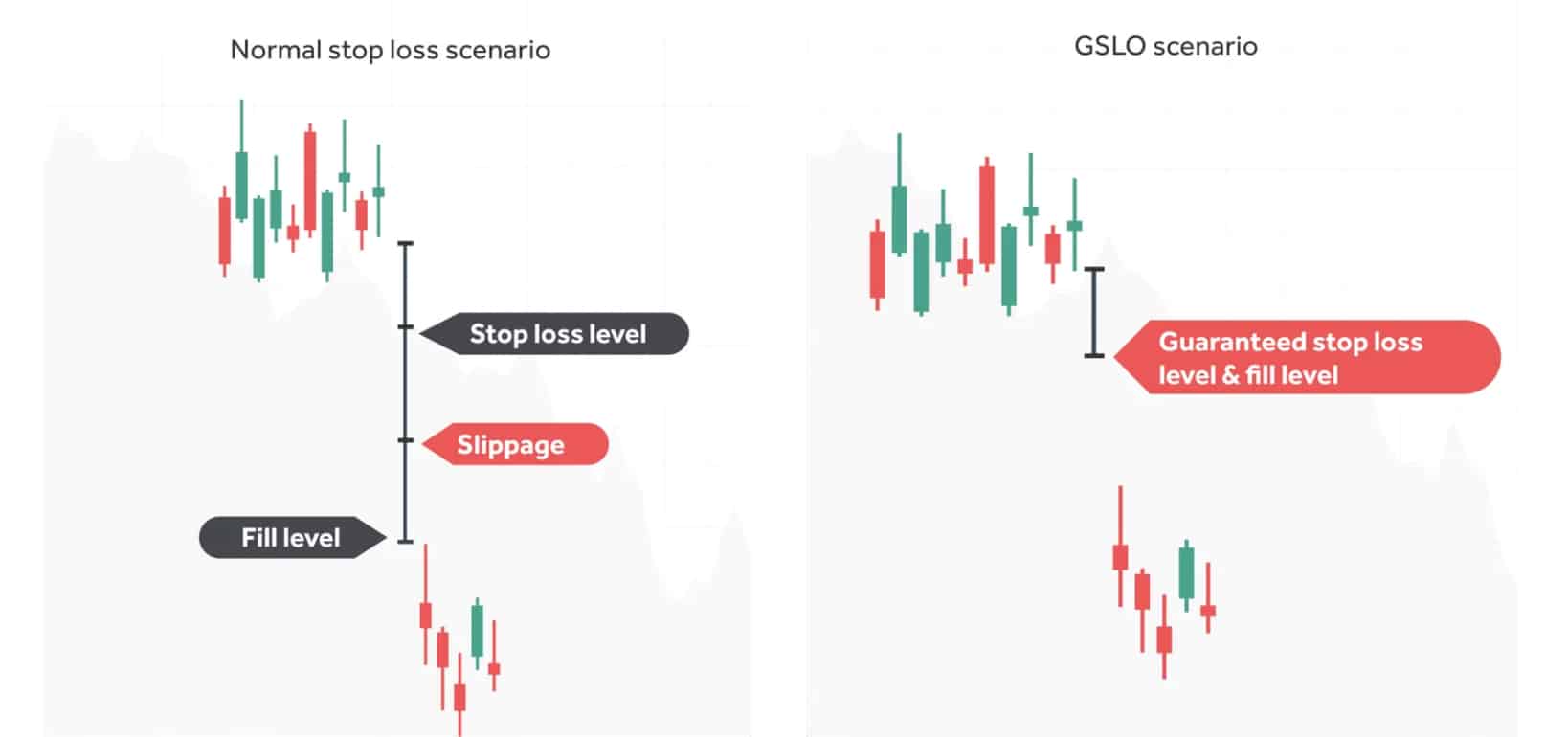

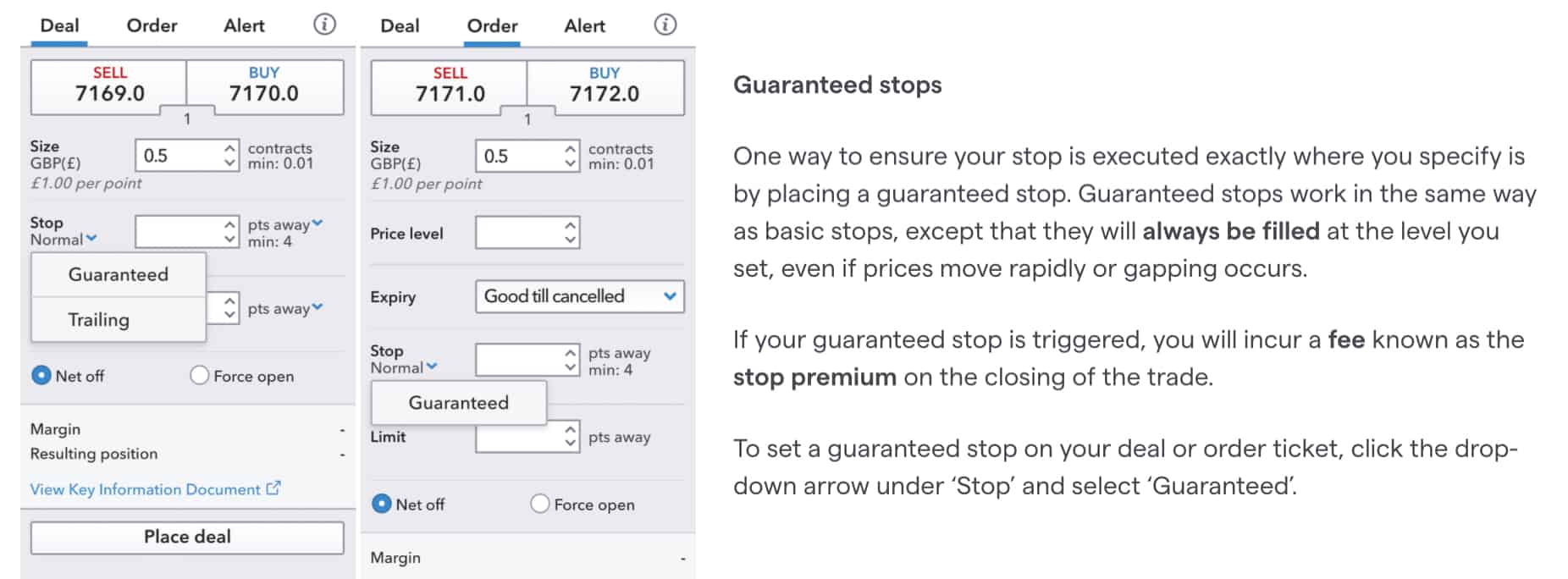

Forex Brokers With Guaranteed Stop-Loss Orders

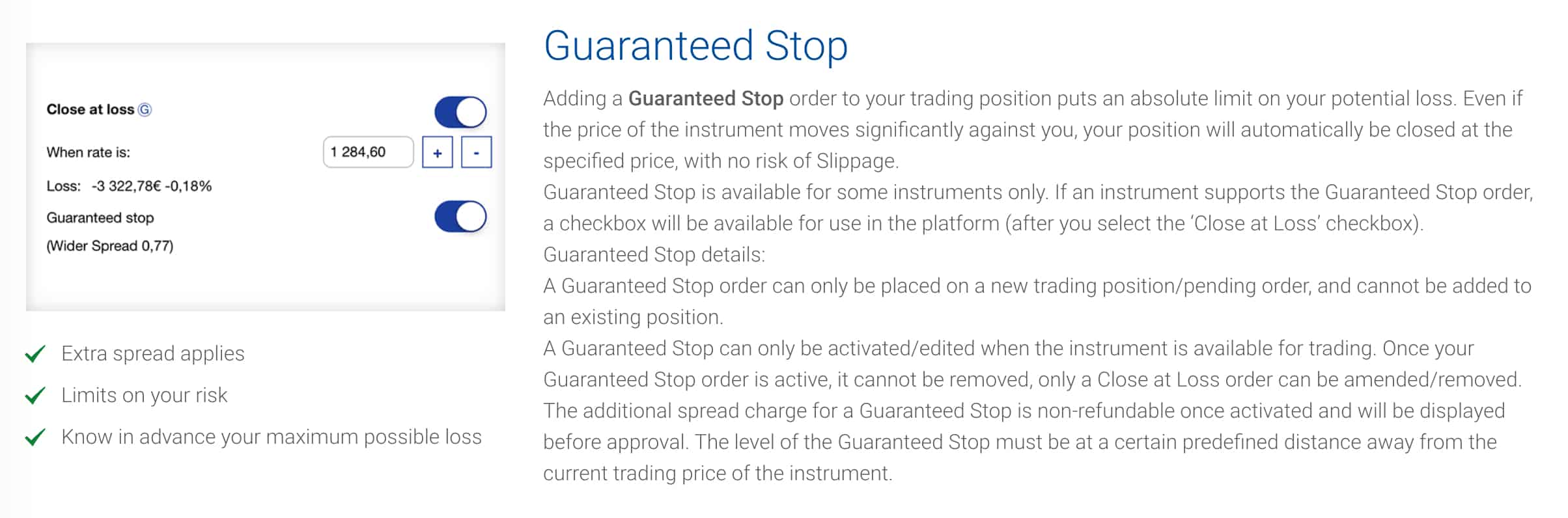

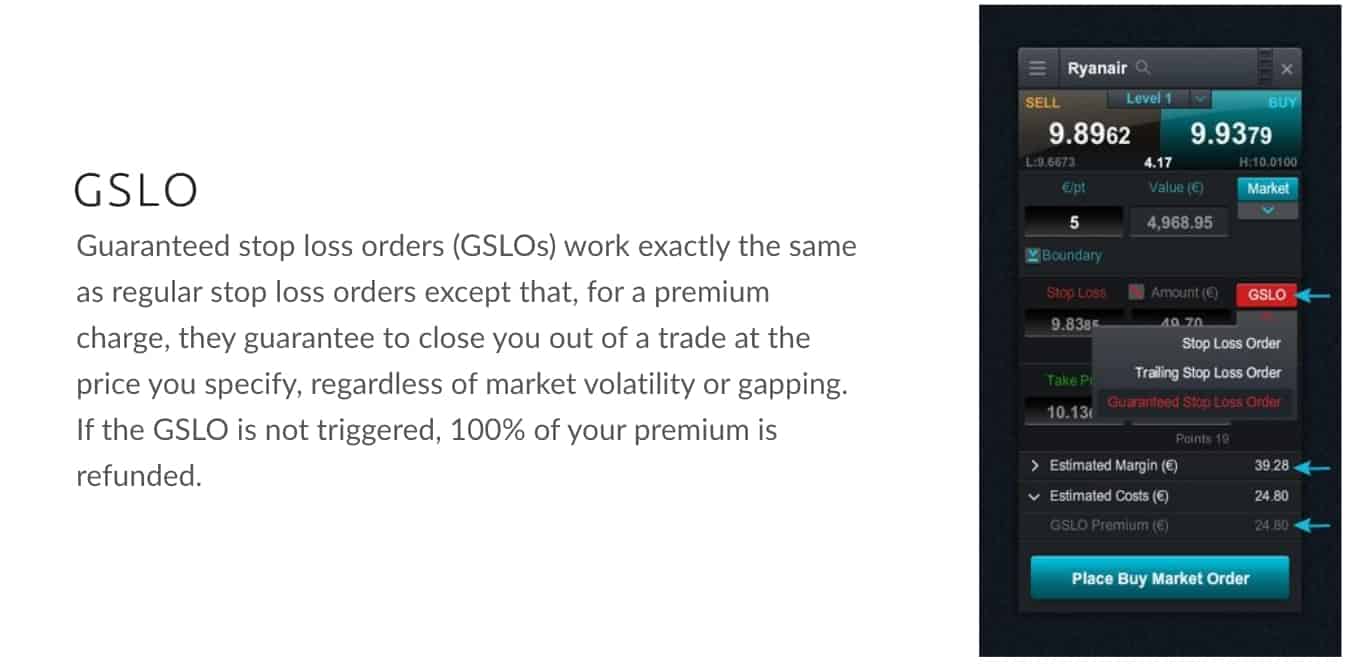

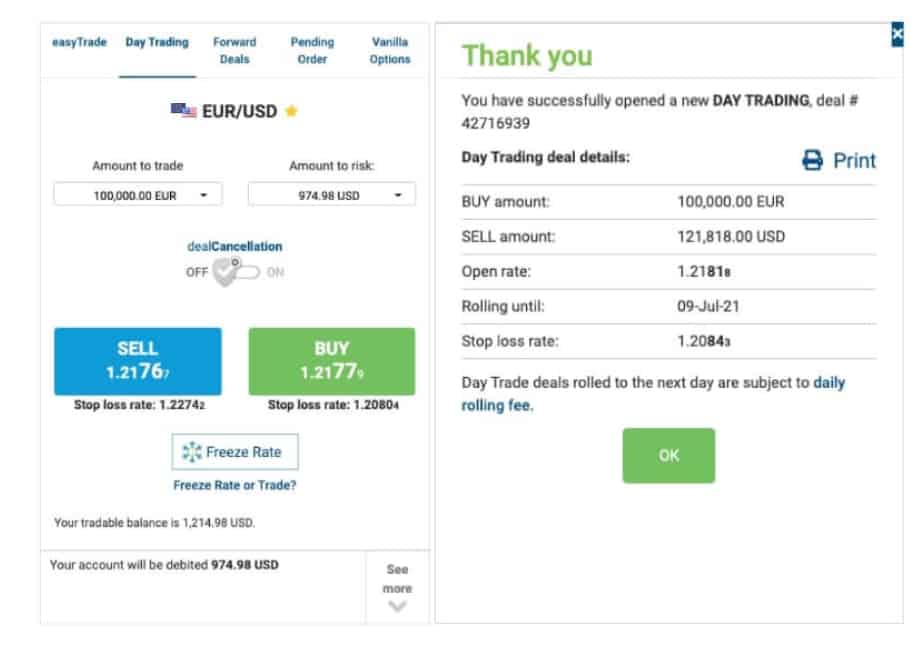

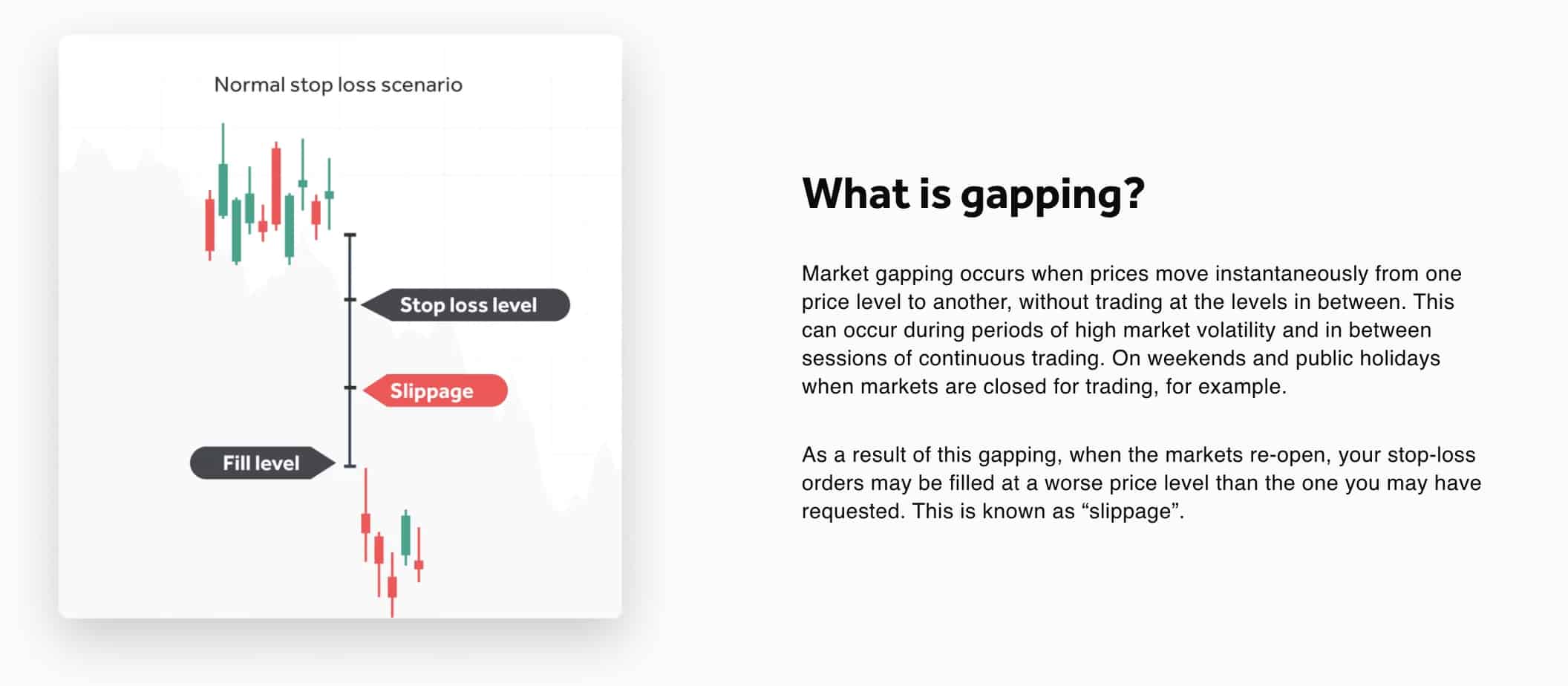

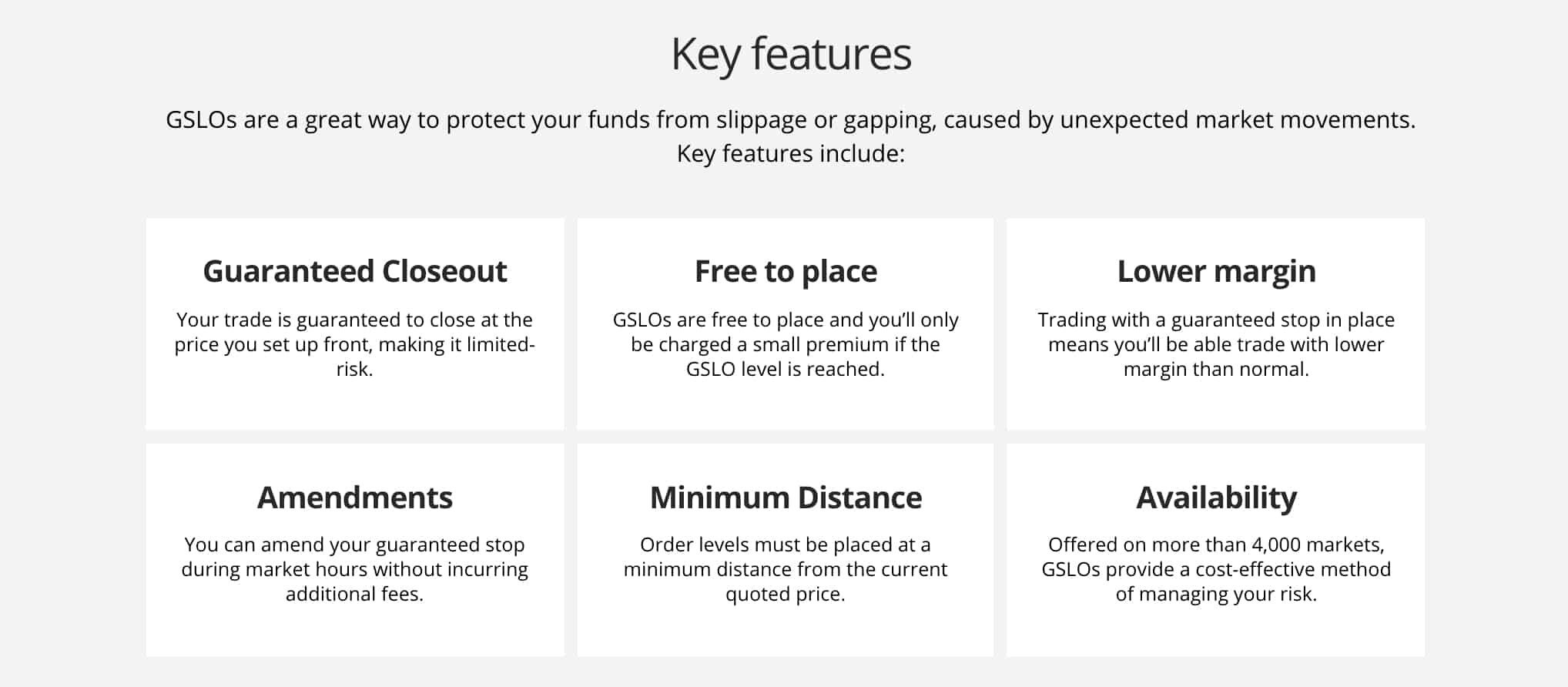

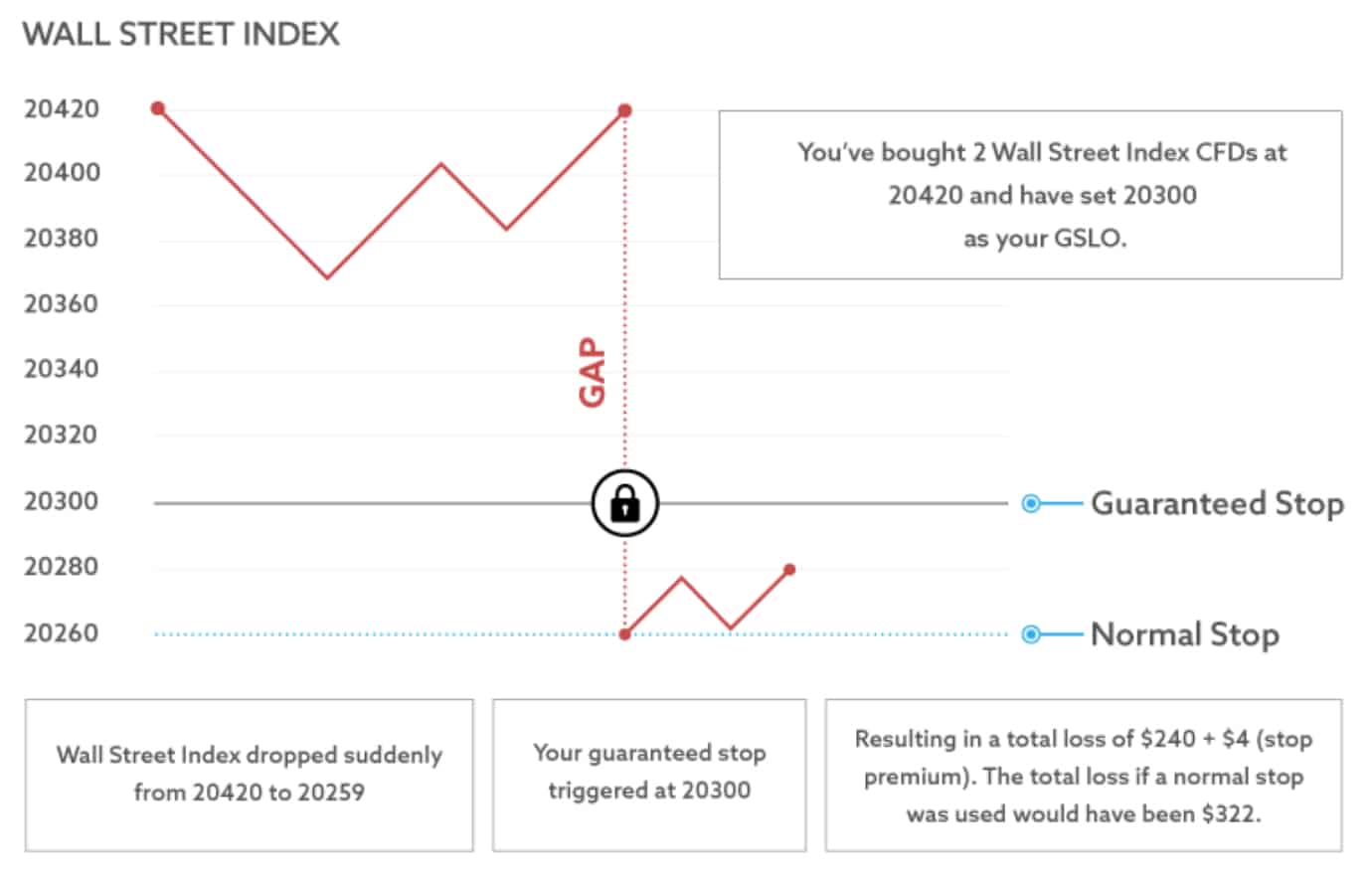

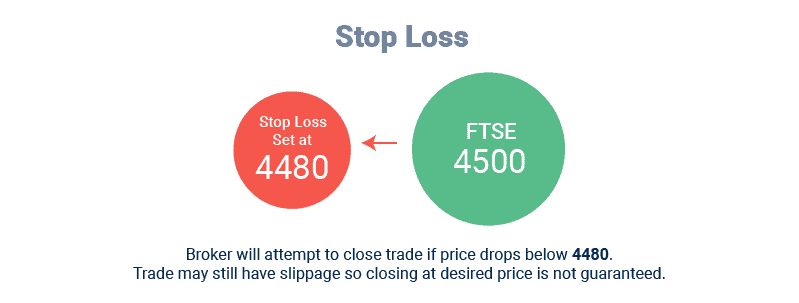

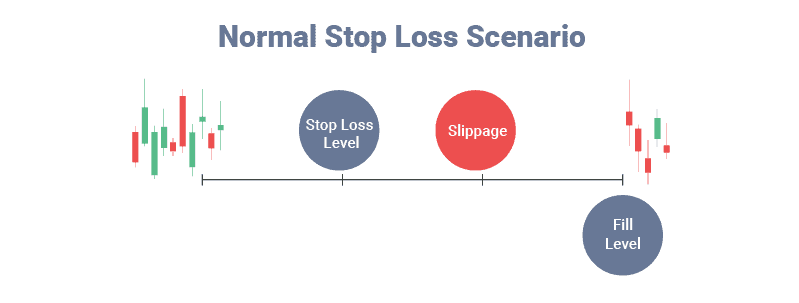

Guaranteed stop-loss orders (GSLOs) are a premium risk management tool that provides protection against large losses caused by gapping and slippage. Below we review the best GSLO brokers plus their features and costs.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

Does Thinkmarkets have a guaranteed stop loss?

No, unfortunately they don’t. ThinkMarkets is a no dealing desk broker. You will find it is mostly market makers that have no dealing desk

Can I ask you which broker has the largest risk capital committed to guaranteed stop orders? I am using IG at the moment and I am hitting their limits for a single stop loss trigger at about £3,000,000 nominal. Many thanks.

Hi Mark, This isn’t something we have ever looked into, nor is it something we plan to look into. What we can suggest is that you hop onto a live chat with brokers and ask them directly.