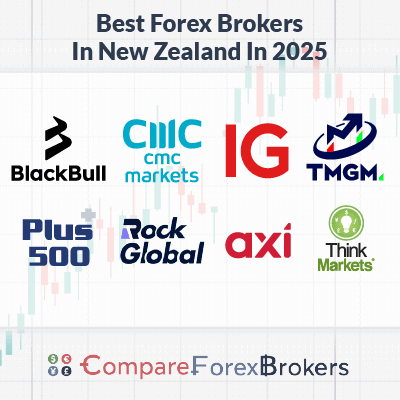

Best Forex Brokers In New Zealand

For the 5th year running, the CompareForexBrokers team compared all eight FMA-regulated forex brokers in NZ and gave them a ranking. The criteria we judged the brokers on are their spreads, trading platform, customer service and overall trading experience including execution speeds.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the best NZ forex trading platforms in 2025 is:

- BlackBull Markets - Best Forex Brokers In NZ

- CMC Markets - Widest Range For CFD And Forex Brokers

- IG Group - Most Trusted Forex Broker

- TMGM - Lowest Spread NZ Forex Broker

- Plus500 - Best Forex Broker for Beginners

- RockGlobal - Top Share + Forex Broker

- Axi - Good MetaTrader 4 Broker Offering

- ThinkMarkets - Best Swap Free Islamic Account

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

68 |

ASIC,FCA ,DFSA,FMA |

0.2 | 0.5 | 0.5 | $3.50 | 1.2 | 1.3 | 1.3 |

|

|

|

90ms | $0 | 72 | 37 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Who Are The Best NZ Forex Brokers?

The best New Zealand forex brokers offer a combination of competitive trading costs, excellent trading conditions and a wide variety of assets to trade. We’ve chosen BlackBull Markets as the best forex broker for NZ traders due to its top execution speeds, high leverage and powerful trading tools.

1. BlackBull Markets - THE BEST FOREX BROKER IN NZ

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, TradingView, cTrader, BlackBull CopyTrader

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We recommend BlackBull Markets for excellent leverage, and some of the fastest execution speeds worldwide. In our tests, BlackBull topped the list for both market and limit order execution, averaging less than 100ms and 50ms. This broker also offers excellent leverage of 500:1, the maximum allowed by the FMA.

While BlackBull limits its selection of trading platforms to MetaTrader 4 and MetaTrader 5, it also offers a wide variety of third-party trading tools and add-ons to increase functionality.

Pros & Cons

- Fast execution speeds

- Excellent selection of third-party trading tools

- Social trading and copy trading allowed

- Only two platforms from which to choose

- Still waiting on additional licenses from Tier-1 jurisdictions

- Average trading costs

Broker Details

Blackbull is an Auckland-based, NZ forex broker regulated by the Financial Markets Authority (FMA).

Blackbull was the best NZ broker in 2025 because of their:

Blackbull was the best NZ broker in 2025 because of their:

- The choice of MT4, MT5, cTrader or TradingView Platform

- 23,000 tradeable CFD instruments (including 64 forex pairs)

- The lowest spreads of any NZ-regulated brokers

- No fees on deposits or withdrawals

- 24/6 customer support based in NZ

BlackBull Markets is also authorized and regulated by the Financial Services Authority in Seychelles (“FSA”) under license number SD045 for the provision of investment services.

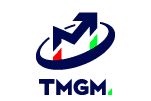

Trading Accounts and Platforms

This online broker offers two retail investor accounts and access to over 23,000 tradable Contracts for Difference (CFDs). If you are a high-volume trader, you can also opt for an institutional account with electronic communication network (ECN) execution.

BlackBull Markets offers ‘true ECN’ trading conditions for Kiwi traders. Individuals can place orders with straight-through-processing (STP) execution, allowing you to trade directly with liquidity markets. According to TravelandLeisure.com, ECN execution clocks in at a blistering 300ms – 25% faster than standard execution.

BlackBull’s liquidity providers include the Bank of America, Credit Suisse and HSBC. To help you get the best possible spreads, BlackBull’s proprietary aggregation system is designed to ensure liquidity providers are competing.

Standard Account

The standard account is designed for beginners with just a spread charged and no commissions. This more straightforward cost structure makes it easier to calculate trading costs for novice traders. In addition, because the broker charges no commissions on trades, spreads are typically wider than other account types.

“I decided to trade with BlackBull because of speed. The direct connection to the Equinix NY4 server really makes a difference. I also like that I have the choice of MT4 or MT5 to trade, even with a standard account.” – Sean T., Aukland

BlackBull does not require a minimum deposit to open an ECN Standard account.

ECN Prime Account

This account is best for experienced retail traders looking for low trading costs. Spreads start as low as 0.0 pips, and BlackBull charges just NZ$7 in commissions per 100k traded. This account also suits high-volume traders and scalpers.

BlackBull requires a minimum deposit of NZ$2000 to open an ECN Prime account.

To help you understand BlackBull’s competitiveness, the table below shows how BlackBull spreads are superior to other brokers for specific forex pairs. Please note spreads are updated monthly and sourced directly from brokers’ websites to ensure accuracy.

ECN Institutional Account

For active traders that deposit at least $20,000, you can receive some of the best spreads BlackBull offers. In addition, spreads for this account start from 0.0 pips, and commissions can be negotiated with your BlackBull client relationship manager, to whom you have access 24/7, another benefit of being an active trader.

While NZ$20,000 is a significantly higher minimum deposit to qualify for an institutional-grade trading account, you receive a tailor-made trading experience with custom server options and negotiable trading costs.

Islamic Account

BlackBull also offers a swap-free Islamic account that fully complies with Sharia Law, given that paying or receiving interest is prohibited in Islam. This account is available in the ECN Standard and ECN Prime formats with the same tradeable instruments, swap-free.

Forex Trading Platforms

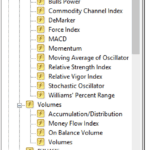

BlackBull offers the two best forex trading platforms based on popularity: MetaTrader 4 and MetaTrader 5. The image below shows that while MetaTrader 4 (MT4) is the older trading software, it remains the choice for forex trading vs MetaTrader 5 (MT5), which is better suited for CFD trading.

We rate BlackBull as the best MetaTrader broker due to its superior MT4 infrastructure. This includes using the New York Equinix data centre for faster connections with liquidity providers. Depending on proximity, however, BlackBull can also connect you with fully functional servers in London, Tokyo, Hong Kong and Shanghai for optimal execution speed.

Other enhancements to their forex trading platform include the add-ons of ZuluTrade, Myfxbook and the recent partnership with HokoCloud for social trading. In addition, BlackBull traders can also access Virtual Private Servers (VPS) through VPS Trading, NYC Servers or Beeks FX. This enhances the trading execution speed to as low as 1 ms.

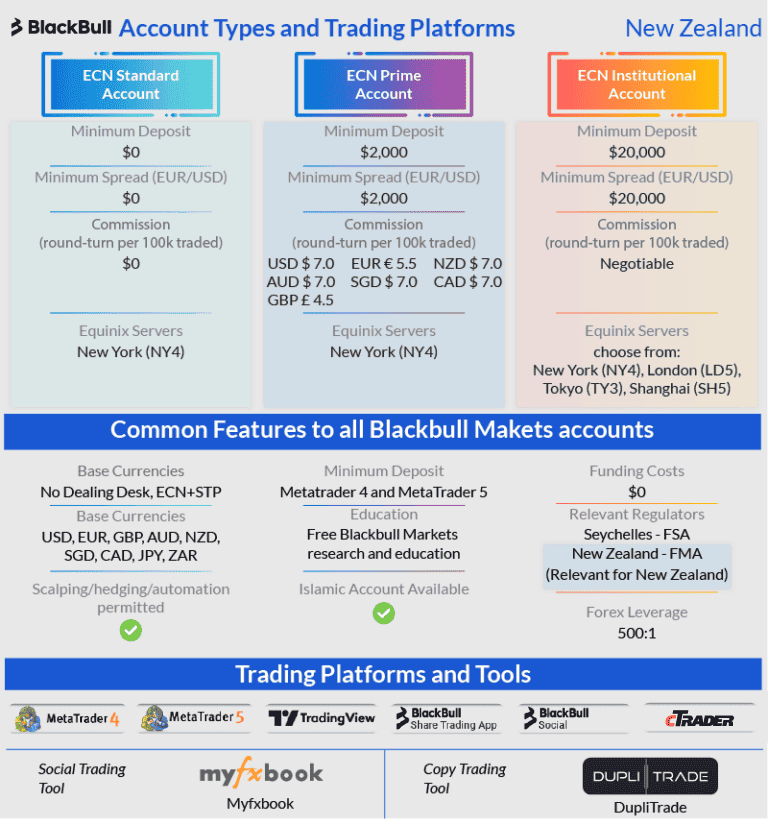

Trading Products Available

BlackBull Markets doesn’t skimp on tradable products, and New Zealand traders hoping to build a diverse portfolio across a range of markets will appreciate the diversity of financial instruments.

BlackBull Markets account holders can experiment with the following financial instruments:

- 80+ Global Share Markets

- 15 Indices

- 19 Commodities

- Oil and Gas

- Gold and Silver

Award-Winning Customer Support

With headquarters based in the Auckland CBD, BlackBull also has its main customer support centre here, which is open during regular New Zealand business hours. To ensure the Asia-Pacific region is catered to, the New Zealand base is complemented by a Malaysian office for customer support outside business hours. When you open a Forex trading account, BlackBull will provide you with a dedicated account manager to assist with any customer service needs.

Key points of contact include:

- New Zealand Toll-Free Number

- E-mail Support

- Live Chat

- In-Office Support

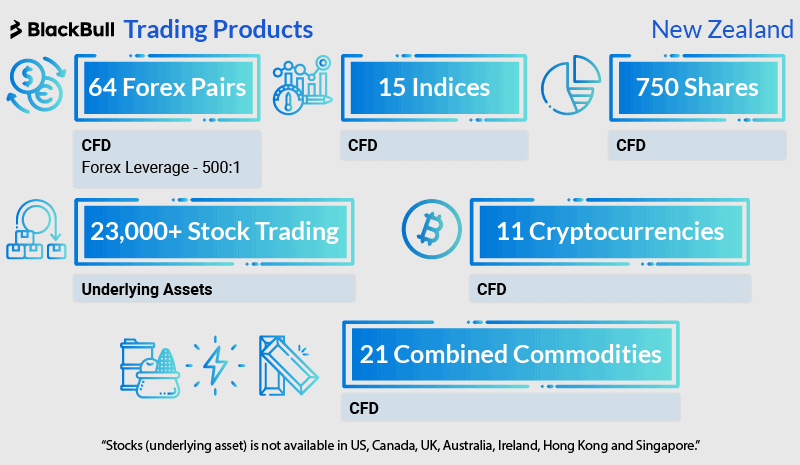

Easy Account Opening with No Minimum Deposit

Opening a live account with BlackBull takes less than 24 hours and requires minimal information sharing. Once approved and verified, clients can begin trading immediately with as little or as much money as they like – BlackBull Markets doesn’t require a minimum deposit for the ECN Standard account.

The brokerage also goes the extra mile to make funding a trading account straightforward and cost-efficient. In addition to a bank transfer, account holders can deposit money via credit card, debit card, Skrill, UnionPay and Neteller.

Black Bull Group Limited (aka BlackBull Markets) is registered and incorporated in New Zealand (NZBN 9429041417799). The broker holds a Derivative Issuer License (Financial Services Provider – FSP403326) and a Share Trading Licence (Financial Services Provider – FSP403326).

Our Verdict: BlackBull Markets

As a locally-based FMA-regulated forex broker, BlackBull Markets offers the best forex trading platforms and the lowest spreads. With a low minimum deposit starting from NZ$200 and superior customer service, we recommend this broker to New Zealand forex traders in the intermediate to advanced trading bracket.

2. CMC Markets - BEST RANGE OF CFD AND FOREX MARKETS

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

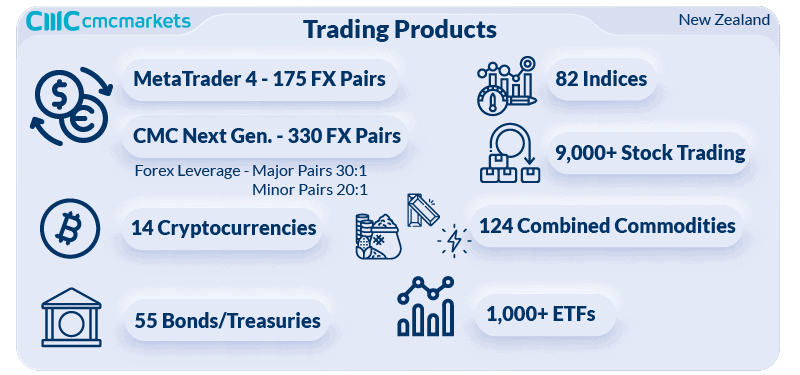

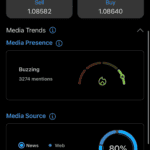

We recommend CMC Markets for New Zealand traders interested in creating a diversified portfolio with multiple financial instruments. This broker offers retail investors access to up to 330 currency pairs, 9,000 stocks, 1,000 ETFs, 124 commodities and 14 cryptocurrencies for a truly impressive collection of derivatives.

CMC Markets also offers low trading fees: the average spread for the top five currency pairs sits at 1.35 pips, according to our tests, and 1.11 pips for the popular EUR/USD pair.

Pros & Cons

- Licensed in five Tier-1 jurisdictions

- Proprietary platform offers 12,000 trading products

- Great trading experience with powerful charting, technical analysis tools and a mobile app

- Educational content is limited

- Fewer trading instruments on MT4

Broker Details

CMC Markets Is The Most Well Known NZ Broker

With 330 forex pairs to trade and six other asset classes such as indices, cryptos, and bonds, CMC Markets should appeal to traders building diverse portfolios. A guaranteed stop loss is available if you choose the CMC NGEN trading platform.

Key Strengths

- Largest range of forex pairs

- No Commissions

- Guaranteed Stop loss

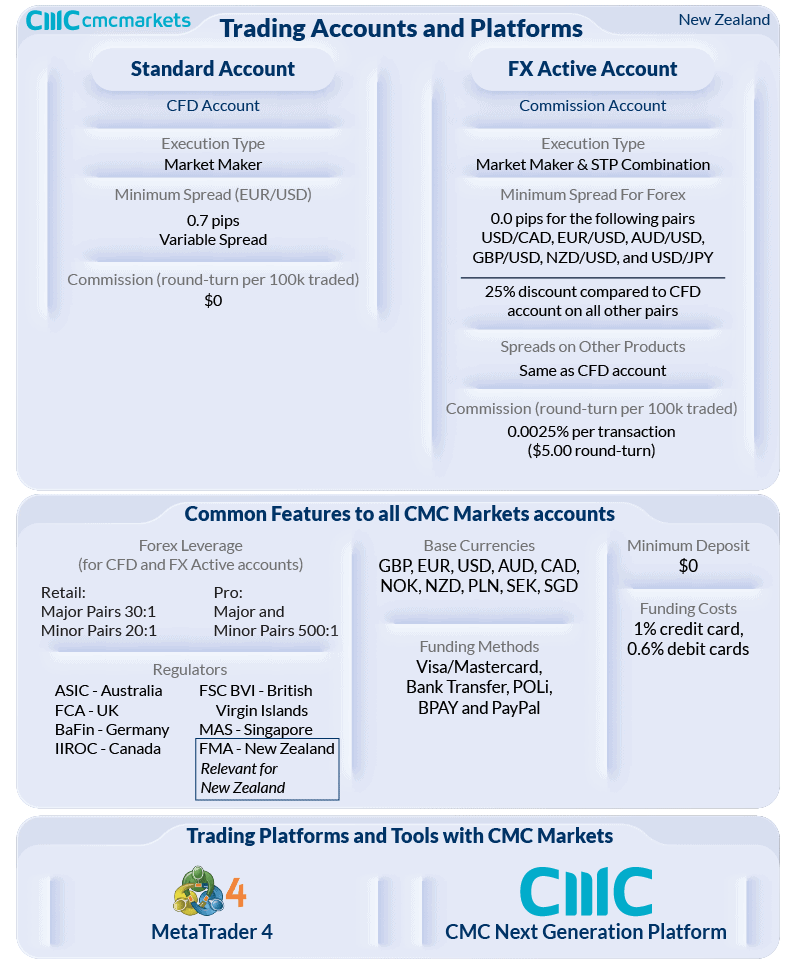

CMC Markets Trading Accounts and Platforms

Most CFD products with CMC Markets have trading costs included in the spread with no additional commission fees. Spreads for most major currency pairs start from 0.7 pips, and you can choose from over 300 currency pairs. Other trading instruments with no commission fees include indices, cryptocurrencies, hard and soft commodities and treasuries.

“I like trading more than just forex, so I really like that CMC has so many shares and markets available. I use the CMC platform, which means I have better control over my exposure than I would with other brokers.” – Paul F., Wellington

If you do wish to purchase share CFDs, then you can choose over 9000 shares across 23 markets, including New ZealandX, ASX, NYSE and LSE. The commission will vary for each market but if you trade on the New ZealandX (New Zealand Exchange), the fee is 0.10% with a minimum charge of NZ$7.00. Trading on the ASX will cost you 0.09%, while the US stock exchange charges 2 cents (min. USD$10.00).

Trading Platforms (including NGEN with a guaranteed stop-loss)

CMC offers a choice of two different trading platforms: NGEN or Next Generation, the broker’s proprietary trading platform, and the ever-popular MetaTrader 4 (MT4) platform. Both platforms are available via a desktop trading platform, web trader platform or mobile trading apps for Android and iOS devices.

While most proprietary platforms lack advanced technical analysis tools, NGEN is on par with third-party options like MT4. The platform offers 115 in-built technical indicators and over 70 chart patterns across 12 types of charts to help you develop robust trading strategies.

Perhaps the most interesting feature is the availability of a guaranteed stop-loss order (GSLO), a feature not available with MT4 or with most brokers. A GSLO is the same as a stop-loss order, but CMC will guarantee to close out of the trade at the price you set for a small premium. This means you don’t need to worry about being caught out during slippage or market volatility. Best of all, if you close your trade without needing to use the GSLO, then the entire GSLO cost will be refunded.

Advanced risk management and comprehensive tools helped CMC Markets snag a top spot despite the limited number of platforms available with this broker.

CMC Markets: Trading Products

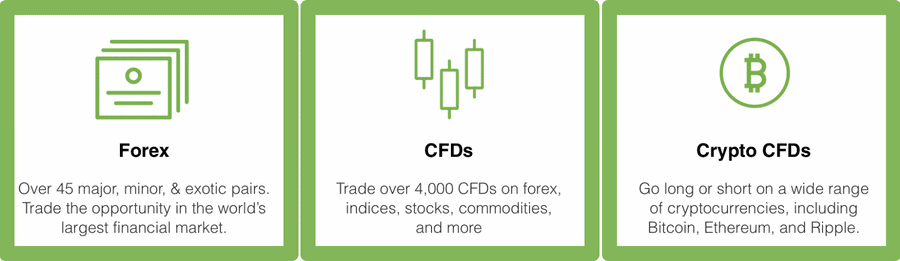

Within New Zealand, the broker provides CFDs and countdowns across various asset classes.

We appreciate the number of instruments available to trade, in particular, we note that there are 330 Forex pairs which far exceeds what other brokers offer. This large range appears because they include Forex pairs each way i.e. NZD/USD and USD/NZD. Other products include:

- Forex markets

- Index markets

- Shares CFD markets

- Commodity markets

- Treasuries and bond markets

- Cryptocurrency markets

Having said that, the discrepancy between FX pairs available on MT4 as compared to the broker’s platform gives us pause.

Minimum Deposit and Funding

There is no minimum deposit to open an account with CMC, meaning you can open a trading account with as little as $1. To get started, you can deposit trading funds using a credit card, direct deposit or Paypal.

Who Regulates CMC Markets?

CMC Markets NZ Limited (aka CMC Markets) holds company registration number 1705324 in New Zealand. The broker operates using a Derivatives Issuer Licence from FMA (FSP No: FSP41187).

CMC Markets: Our Verdict

While CMC Markets gets high marks for its powerful proprietary platform, we don’t appreciate feeling pushed to adopt it to access the full extent of the broker’s forex offering.

3. IG Group - MOST TRUSTED FOREX BROKER

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why We Recommend IG Group

We recommend IG Group for its stellar reputation, earned over nearly four decades of providing financial services to retail investors. This broker pioneered CFD trading around the world and invented spread betting in the UK, making it among the most experienced and trustworthy options on this list.

Beyond international recognition, we like IG Group for its superior trading environment, suitable for both beginner and experienced traders. Its award-winning proprietary platform, available in webtrader and mobile trading app formats – offers all the tools you need for advanced strategies. This broker also stands out for its DMA Account option for professional traders, which offers low commissions for high-volume traders.

Pros & Cons

- Award-winning proprietary platform

- Flexible funding and withdrawal methods, including debit and credit cards, bank transfers and PayPal

- Well capitalised

- Limited MT4 functionality

- No copy trading or social trading

- No MT5 trading platform

Broker Details

IG is one of the largest FX brokers worldwide, marketing itself as an all-in-one trading solution provider. They provide stockbroking, currency, and CFD trading services across several forex platforms.

Key Strengths

- A most diverse range of trading products

- Choice of 4 trading platforms

- Has guaranteed stop loss on IG Trading

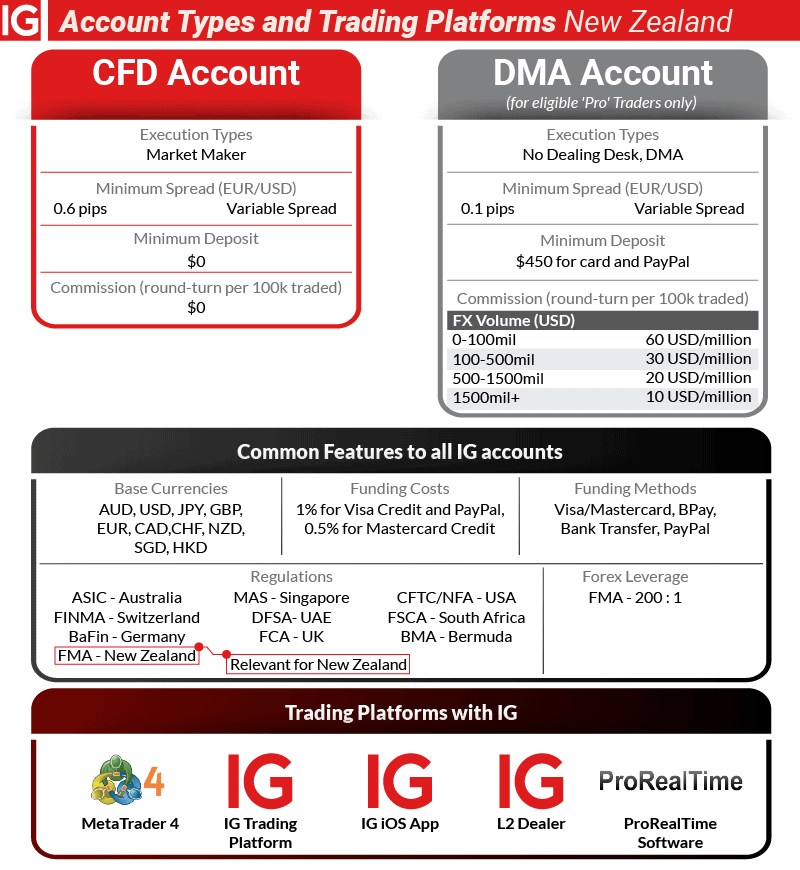

Trading Accounts and Platforms

IG Markets is a market maker, meaning they use internal liquidity to fill your orders and act as the counterparty to your trade (compared to no dealing desk brokers that connect you to external liquidity providers).

Market maker brokers like IG offer commission-free spreads, making them a good option for traders looking for a simpler cost structure. Traders also benefit from various risk management tools and industry-leading educational resources. You can find more about IG with our in-depth review here.

Regarding forex, you can choose from over 100 currency pairs, including AUD/USD and EUR/USD CFDs, with competitive average spreads sitting around 0.6 pips.

IG also offers a huge range of 12,000 shares across a wide range of markets for New Zealand traders, with market-based spreads and a 0.09% commission per side (minimum of NZ$7).

Overall, while spreads and commissions do vary for CFDs, some more competitive than others, the broker does offer enough competitive alternatives to be recommended. There are also lower trading costs for high-volume traders with DMA (Direct Market Access) pricing available through Forex Direct, with lower average minimum spreads, starting at 0.1 pips.

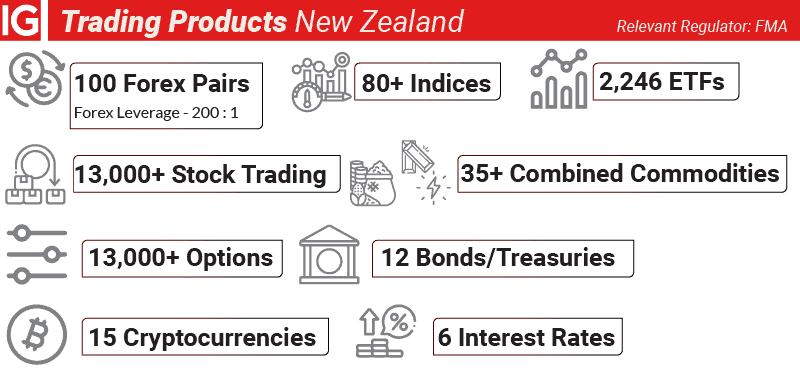

IG’s Trading Products

IG Markets offers a large and diverse range of products for trading across over 17,000 markets, making it a great option for portfolio diversification.

Very few brokers offer the range of products that IG Markets does. In addition to common CFD products such as Forex, Shares, Indices and ETFs, unique products available to IG account holders include:

- Bonds

- Options

- Interest Rates

- Sectors (i.e. banks, beverages, chemicals, general retailers)

- Digital 100s (binary trading)

- Knock-out options

Interestingly, IG limits leverage to 200:1 for Forex trading, far less than the 500:1 other brokers on this page offer. While this does encourage more responsible trading to some extent, it is also slightly surprising given a guaranteed stop loss is available if you are using the IG trading platforms which can protect you from excessive risk.

Regulation Behind IG

IG operates in NZ out of its Australian office (IG Australia Pty Ltd) but is a registered company in New Zealand (NZBN 9429047618251). The broker holds a Derivatives Issuer Licence in New Zealand with FMA (FSP No. 684191).

IG Markets also holds trading licence jurisdictions such as the UK (FCA), Germany (BaFin), and even the UAE (DFSA).

Final Verdict Of IG

With a low minimum deposit requirement and access to multiple trading platforms, IG Markets is an excellent choice for beginners and experienced traders. It also offers a range of educational resources and excellent customer support, making it a solid choice for those seeking to improve their trading skills.

4. TMGM - LOW SPREAD NEW ZEALAND FOREX BROKER

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.42

AUD/USD = 0.21

Trading Platforms

MT4, MT5

Minimum Deposit

$100

Why We Recommend TMGM

We recommend TMGM for New Zealand traders hoping to control their trading costs with tight spreads. This broker averaged 1.16 pips across the five major currency pairs, coming in eighth out of more than 50 brokers we tested. TMGM also performed well across individual forex pairs, averaging 1.32 pips for the GBP/USD pair and 1.0 pips for the EUR/USD pair.

TMGM offers tight spreads due to an excellent network of top liquidity providers around the world, including in major financial centres like Singapore and London. The broker uses ECN-style processing with no dealing desk also ensures top execution speeds – this broker placed fifth overall in our tests.

Pros & Cons

- Very tight spreads

- Multiple account types for all experience levels and budgets

- IRESS trading platform

- Inactivity fee

- Higher commissions – AUD 7 for Edge and AUD 8 for IRESS accounts

- A limited number of forex pairs

Broker Details

TMGM Has The Lowest Raw Spread Account

TradeMax Global Markets (TMGM) recently acquired an FMA license in New Zealand. The forex and CFD broker was founded in Australia in 2013 and is well known for its competitive no-dealing desk (NDD) execution and ECN trading environment.

Key Strengths

- STP/ECN style broker

- Option of Tokyo TY3 equinox data central for faster execution

- Focus on security

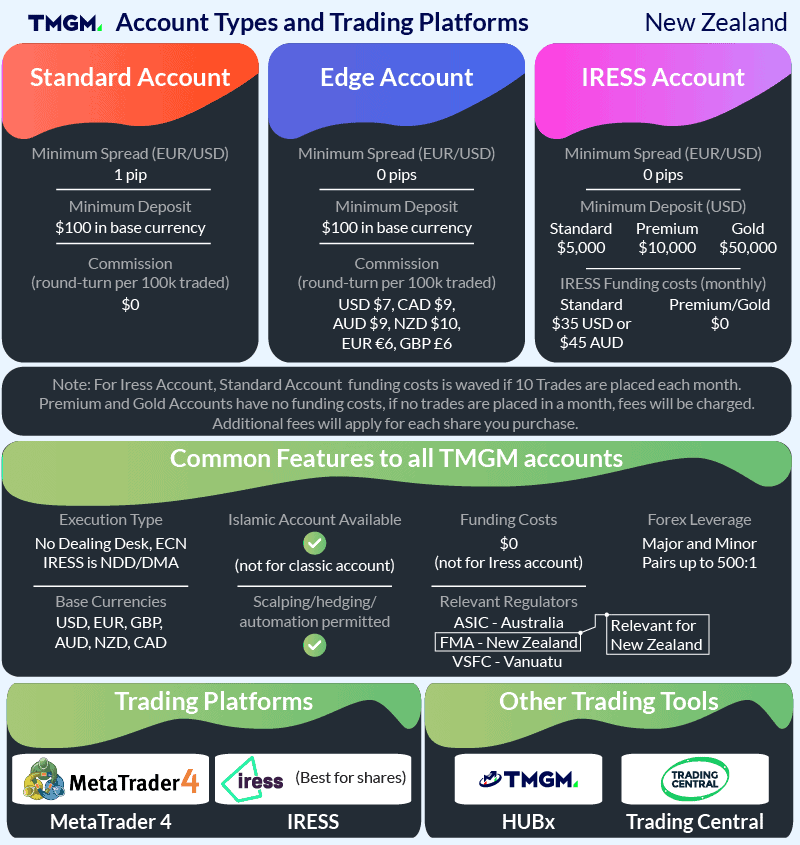

TMGM: Trading Accounts and Platforms

TMGM offers commission and commission-free pricing structures across three different accounts. The popular Edge and Classic trading accounts require a minimum deposit of NZ$100 and use fast ECN execution methods.

One feature worth noting is the broker’s use of the Ty3 data centre for its servers. With data being significantly closer to New Zealand, execution speeds may be ever-so-slightly faster. This can make a difference when it comes to slippage. For example, one industry report found that trades routed through data centres less than 200km from the trader experienced 50% less slippage.

Edge Account

Raw spreads from 0.0 pips and a NZ$5 commission fee per side

Classic Account

Raw spreads from 1.0 pip and no commission

IRESS Account

Raw spreads from 0.0 pips and commissions ranging from NZ$6 to NZ$8, depending on the trade volume.

TradeMax Global Markets also offers a swap-free version of the Edge account for customers in majority-Muslim countries or who provide evidence of a need.

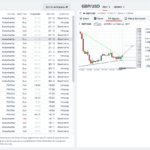

Forex Trading Platforms

As well as economical trading costs and low spreads, TMGM offers customers a choice of three popular trading platforms:

- MetaTrader 4 (MT4) – Good for all TMGM products but shares only available business hours

- IRESS – for share trading using DMA (Direct Market Access) only

Regardless of your trading platform, TMGM utilises diverse liquidity sources to achieve ultra-tight spreads and fast execution speeds. For those interested in trading shares, we recommend the IRESS platform, which provides market access at all hours.

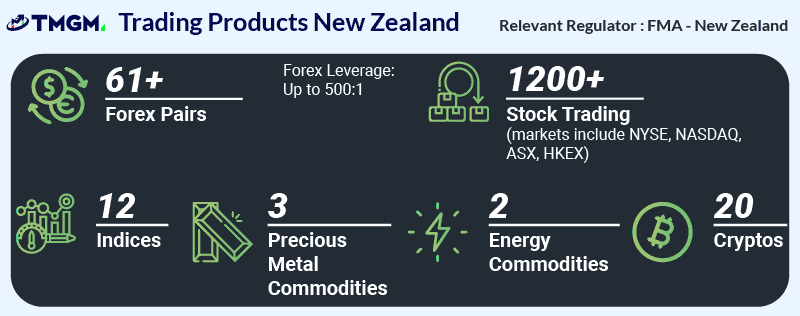

TMGM Trading Products

In total, thousands of CFDs can be traded with TMGM.

We gave high marks to this broker due to the sizable number of available currency pairs and its extensive crypto and equities offering. All told, TMGM gives clients the following:

- 61 forex pairs

- 12 indices

- Three precious metal commodities

- Two energy commodities

- 1,200 shares

TMGM has Good Security

All your funds are held in a segregated bank account (as required for all FMA-regulated brokers, TMGM stores your funds with the big 4 NZ banks – ANZ Bank New Zealand (ANZ), ASB Bank (ASB), Bank of New Zealand (BNZ) and Westpac New Zealand (WBC). This means you can be confident your funds are safe.

TMGM also use a liabilities program with a limit of $6,000,000 to cover situations that may lead to financial loss to its clients. This liability insurance covers professional indemnity, statutory liability, crime cover and director and officer liability, among others.

Regulation Behind The Broker

Trademax Global Markets (NZ) Limited (or TMGM) is a company registered and incorporated in New Zealand (NZBN: 9429046269300). TMGM is the licensed derivatives issuer with FMA (FSP 569807).

5. Plus500 - BEST FOREX BROKER FOR BEGINNERS

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

We recommend Plus500 to beginner traders in New Zealand due to its straightforward and intuitive trading platform designed to grow with you. If you’re just entering the world of forex or CFDs, some of the more popular platforms can feel intimidating. Plus500 offers a more gentle learning curve without sacrificing excellent trading conditions or important functionality.

Pros & Cons

- Straightforward, accessible trading platform

- Demo account available

- Easy-to-use mobile app for iOS and Android

- No market research or analysis

- The trading platform lacks features for advanced technical analysis

Broker Details

Plus500 is the easiest-to-use trading platform

CFD provider Plus500’s in-house trading platform is user-friendly, with a wide range of CFD products and a guaranteed stop-loss, making it our pick as the top CFD trading platform for new forex traders.

Key Strengths

- Easy-to-use trading platform

- Risk management tools

- A low minimum deposit of just $100

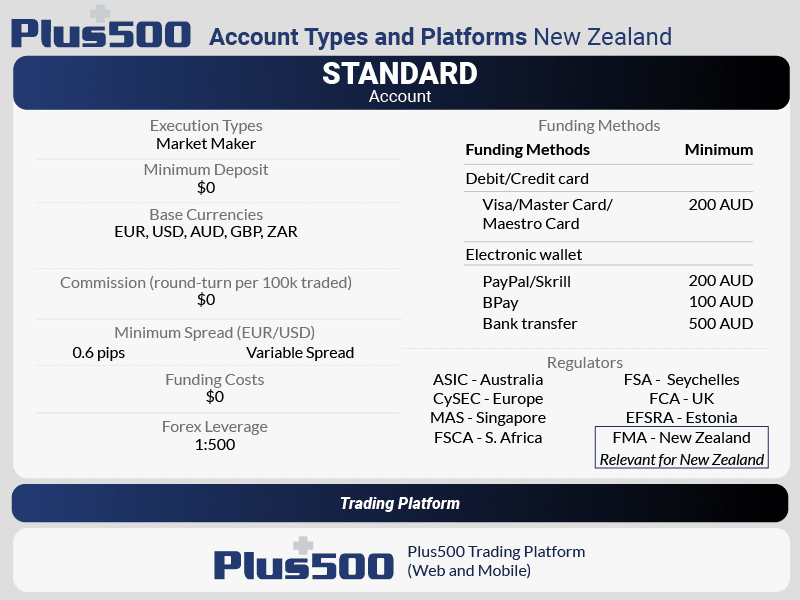

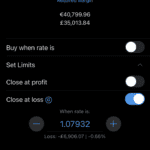

Plus500 Trading Accounts and Platforms

Rather than overwhelm new traders with multiple options, Plus500 keeps things simple with a single account type with no commissions when trading forex.

Standard Account

Like IG Markets, Plus500 acts as a market maker. While account holders won’t pay commissions on trades, they must factor in a minimum spread of 0.6 pips.

Trading Platforms

Plus500’s proprietary trading platform offers a range of useful trading tools not always found with other brokers. These include:

- Stop-loss order

- Trailing-stop loss

- Stop-limit functionality

- Guaranteed stops for an additional fee that ensures a trader can’t lose more than a specified amount on a CFD trade.

- Negative balance protection

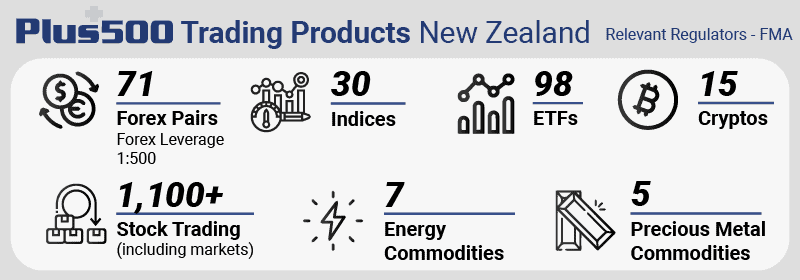

Plus500 CFD Trading Products

Plus500 ensures that novices can experiment with different asset classes with its solid if not terribly extensive, range of financial instruments to trade.

Among the standard trading products Plus500 offers are:

- Indices – 30 indices including Cannabis Stocks, Crypto 10, Real Estate Giants

- Forex – Over 70 major, minor and exotic currency pairs

- Commodities – All the popular commodities plus some unique options like Low Sulphur Gasoil, Lean Hogs Cattle

- Cryptocurrencies – 15 currency pairs including Tron, Monero, Cardano and Crypto 10 Index

- Shares/Stocks – Choice of 24 international markets such as Australia, Germany, Singapore, the US, UK

- Options – including selected stocks like Amazon and Alphabet and Indices such as US 500 and UK 50

- ETFs – Over 90 ETFs

Regulation Behind Plus500

Plus500 is not only FMA regulated; the broker is licensed in several financial jurisdictions such as Australia (ASIC), South Africa (FSCA), Singapore (MAS) and Europe (CySEC). One weakness of choosing Plus500 is that the broker does not have an office in New Zealand as the broker operates out of their Australian subsidiary Plus500AU Pty Ltd. With this in mind, it is possible, issues should occur should you wish to engage with the CFD provider in person.

Plus500AU Pty Ltd is the issuer and seller of all financial products for NZ clients. It is a registered company in New Zealand with NZBN 9429041831816. The broker holds a derivatives issuer licence FSP No. 486026 from FMA

Final Verdict Behind Plus500

While experienced traders and MetaTrader fans may find Plus500 too limited for their needs, we think it’s the ideal broker for those new to day trading.

6. RockGlobal - TOP SHARE + FOREX BROKER

Forex Panel Score

Average Spread

0.9

Trading Platforms

MT4, TWS

Minimum Deposit

$0

Why We Recommend RockGlobal

Rockwell is the only CFD broker in NZ offering Trader Workstation (TWS). This CFD trading platform has over 100 markets internationally. What really impressed us with TWS is that NZ traders can save money on foreign exchange conversion thanks to its ability to convert funds at fractions of a pip. If this is the platform you’re looking for then RockGlobal is the best (and only) FMA regulated broker.

Pros & Cons

- Truly New Zealand broker

- Choice of MT4 and TWS platform

- TWS platform provides access to NinjaTrader, Multicharts

- STP execution

- Excellent education resources

- Quick and easy account opening

- Commission based account has $2000 minimum deposit

- Inactivity fees

- Limited funding methods

Broker Details

RockGlobal offers both forex and share trading services

RockGlobal Markets offers a wider range of products to trade as either CFDs or physical assets than most brokerages. How much you’ll pay to trade them depends on your account type. The broker is also strong in the way of customer service.

Key Strengths

- New Zealand broker

- Shares and CFD products

- Dedicated account manager

- Active customer service

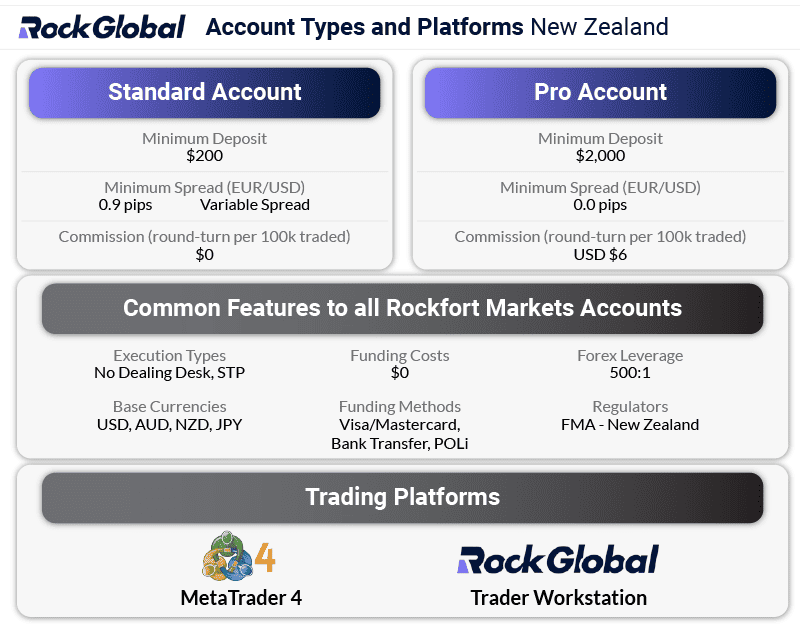

RockGlobal Markets Trading Accounts and Platforms

Similar to other top forex brokerages, RockGlobal gives customers a choice between two account types. The Standard account does not charge commissions, however, the wider spreads – 0.9 pips – may prove off-putting for some traders. Spreads for the Pro account are slightly tighter at 0.6 pips, however, each trade carries a USD $6.00 commission.

MT4 Standard Account

Forex spreads start from 0.9 pips with no commission fees.

MT4 Pro Account

Forex spreads from 0.0 pips, plus round-turn commission from USD$6 per lot

Trading Platforms

The broker’s proprietary platform, Trader Workstation, offers competitive pricing. Commission fees start from USD$6 per side. Active Trader rates are available.

Otherwise, RockGlobal account holders should brush up on their MSQL4 skills – MT4 is the only alternative.

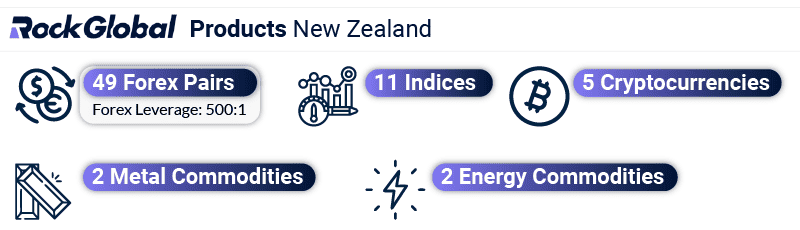

RockGlobal Trading Products

As well as CFDs, longer-term investment opportunities include trading shares, options, futures and ETFs as physical assets.

Along with forex trading, the online broker offers the following asset classes to trade as CFDs:

- Five cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Ripple

- Two precious metals: Gold and silver

- Two commodities: Brent and Crude Oil

- 11 indices: including the UK 100, US SPX 500 and Australian 200

- 8,800 single-share CFDs

Share Trading

RockGlobal provides access to thousands of different stocks to trade from 14 different countries. Brokerage fees are competitive:

- Australian Shares: Whichever is greater than AUD$18.95 or 0.1895%

- US Shares: Whichever is greater than USD$9.95 or USD$0.02 per share

Regulation BehindRockGlobal Markets?

RockGlobal is a company registered in New Zealand (NZBN 9429042010807). The broker registered Financial Service Provider (FSP509766) with a Derivative Issuer Licence from the FMA.

Final Verdict On RockGlobal Markets

Overall, RockGlobal may be well-suited if you are looking to trade a range of CFDs alongside a selection of longer-term investments such as stocks and ETFs.

The limited number of trading platforms available, however, severely limits this broker’s appeal.

7. Axi - GOOD METATRADER 4 BROKER OFFERING

Forex Panel Score

Average Spread

EUR/USD = 0.44

GBP/USD = 0.85

AUD/USD = 0.42

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

We recommend Axi for an excellent MetaTrader 4 experience. If you’re planning to focus on forex and are committed to the popular trading platform, this broker offers a collection of integrations and add-ons that take the MetaTrader trading experience to the next level. With Axi, you have access to ZuluTrade for copy trading and MyFxBook for social trading, as well as several other advanced charting tools and in-depth analysis functions.

Pros & Cons

- Excellent customer support

- Great MT4 experience with plenty of add-ons

- Straight-through processing

- Limited customer support – 24/5

- Average trading costs

Broker Details

Axi is a leading choice for the MetaTrader 4 forex trading platform

Founded in 2007, Axi offers Kiwi forex traders access to various trading instruments across multiple markets, making it a versatile choice for beginners and experienced traders. The broker’s commitment to MT4 sets it apart from other New Zealand forex brokers; Axi offers only MetaTrader 4, but with powerful integrations to support social trading and copy trading.

Key Strengths

- Over 70 currency pairs to trade

- Tight forex spreads

- Enhanced MT4 platform experience

- Award-winning customer support

AXI: Trading Accounts and Platforms

AXI customers can choose between two account types: Standard and Pro. Both claim low trading costs and tight spreads, particularly the Standard account, which starts at 0.4 pips.

This brokerage uses NDD execution with STP to provide customers with speedy trading and access to deep liquidity.

Standard Account

Spreads from 0.4 pips and no commissions make this an attractive choice. This account has no minimum deposit.

Pro Account

Spreads start at 0.0 pips, however, traders will pay a NZ$7 commission per round-turn trade. This account requires a NZ$500 minimum deposit to begin trading.

Trading Platforms

Forex traders devoted to MetaTrader 4 will appreciate AXI’s commitment to the beloved trading platform. Customers can access the full suite of built-in MT4 technical indicators and drawing tools, as well as the Expert Adviser (EA) marketplace. Myfxbook can be integrated with MT4 for those wanting to social trade.

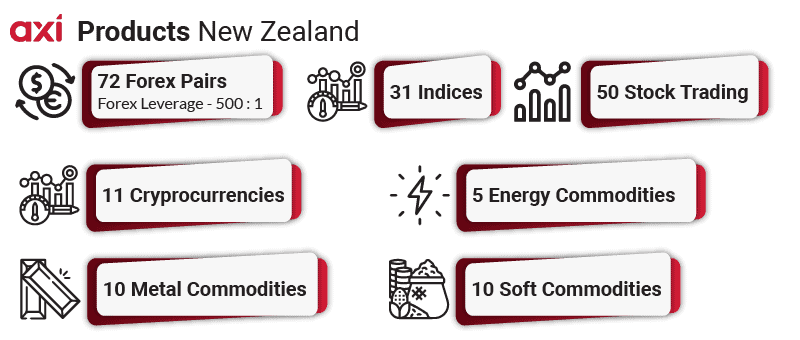

AXI: Trading Instruments

While not as extensive as some of the New Zealand brokers we reviewed, AXI still fields a perfectly suitable range of assets that include stocks, indices and crypto in addition to forex.

Where AXI stands out? Commodities. This broker offers more commodity CFDs to trade than any other FMA-regulated brokerage. Account holders can choose from:

- Five energy commodities

- Ten metal commodities

- Ten soft commodities

Regulation Of Axi (formally AxiTrader)

AxiCorp Financial Services is a registered company in New Zealand with registered number NZBN 9429042567608), the broker operated with the trading name AXI. AXI hold a New Zealand Derivatives Issuer Licence (NZ FSP 518226) with FMA.

Note that AXI (formally AxiTrader) temporarily lost its Financial Markets Authority license in 2019. The FMA lifted the suspension in 2021.

Final Verdict On Axi

With a solid collection of assets to trade, low trading costs and a well-known trading platform, AXI has plenty to recommend for New Zealand forex traders. The restoration of its licence by the FMA suggests all is well, but we remain cautious in our recommendation.

8. ThinkMarkets - BEST SWAP FREE ISLAMIC ACCOUNT

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.1

Trading Platforms

MT4, MT5, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

We recommend ThinkMarkets to any New Zealand forex traders in need of a halal trading account. This broker doesn’t charge fees to hold positions overnight, which means observant Muslim traders needn’t worry about violating rules against interest. We also like that this broker offers MetaTrader 4 and MetaTrader 5 trading platforms with some attractive add-ons, as well as competitive trading costs.

Pros & Cons

- Competitive spreads

- Social and copy trading with ZuluTrade

- A solid collection of trading platforms

- Users report unreliable trading terminals

- No cent accounts

- Minimal selection of forex pairs

Broker Details

ThinkMarkets Offers the Best Islamic Swap-Free Trading Account

ThinkMarkets offers an Islamic account type for Muslim forex traders. This account type avoids traditional interest-based swap fees to comply with Islamic finance principles. Instead of interest-based charges, ThinkMarkets imposes a flat rate fee, aligning with Sharia law.

Trading Costs

The account’s fee structure involves a weekly administration fee for any positions held over seven days. This means no fees for the first six days, offering a cost-effective option for traders adhering to Islamic financial practices.

The Islamic account allows you to trade no commission spreads starting from 1.1 pip for major currency pairs, with ThinkMarkets as your trading platform option.

ThinkMarkets Trading Platforms

While ThinkMarkets NZ’s offering is more limited than in overseas jurisdictions where ECN pricing, MT4, and MT5 are available, the brokers swap-free structure is ideal for Islamic traders.

You can use the broker’s proprietary trading platform, ThinkTrader. Features include

- 80 technical indicators, 50 drawing tools and numerous chart types

- Up to 200 alerts and notifications available on the desktop platform and mobile trading apps

- TrendRisk scanner to identify potential trading opportunities

- One-click trading

- Order types to manage risk with take profit and stop losses

- Demo account with virtual funds to practice trading strategies

CFD Range

As a ThinkMarkets trader, you can access foreign exchange, stocks, indices, precious metals, commodities, and cryptocurrencies.

For NZ traders, over 27 cryptos are available to trade, ranging from the ever-popular Bitcoin and Ethereum to more obscure coins like Cosmos and Avalanche.

Regulation

ThinkMarkets (TF Global Markets (Aust) Pty Ltd) is licensed in New Zealand to facilitate derivatives trading for retail investors. The registered Financial Service Provider (FSP 623289) is headquartered in Melbourne (Australia), London (UK), Johannesburg (South Africa), and Tokyo (Japan).

Ask an Expert

Are there any NZ forex brokers regulated by the Financial Markets Authority outside of this list?

Our page lists all of the FMA regulated brokers with Axitrader no longer listed as they lost their regulation in 2021. Each month we review the FMA website to see if any further brokers are regulated with several licences pending.

Does New Zealand have leverage restrictions for forex trading?

Brokers in NZ limit leverage to 500:1 forex. This is higher than found in Europe and Australia

Can I use an overseas CFD broker to trade currency like one regulated in Australia?

New Zealand Brokers Should use a broker regulated by the Financial Markets Authority (FMA) of New Zealand. This ensures the broker is legally able to offer their services to New Zealand residents and complies with the regulatory requirements of needed to offer financial services in the country.

Do I need to open a trading account in NZD or are their other more popular base currency options which may have lower spreads?

You can trade with any currency but when you deposit or withdraw it will convert with NZ and there will be conversion costs.

For example if you have a trading account with USD and you deposit with NZ it will convert to the USD it depends on the exchange rate.

What trading software do you recommend for trading CFDs in New Zealand? Does this impact which broker I should choose?

I think the key is to find a broker you like…then look for what platforms they offer for trading with. We suggest looking for a broker with MetaTrader 4, MetaTrader 5 and TradingView

What is the alternative to eToro in NZ?

If you are looking for a true social trading platform in a similar vein to etoro then there you won’t find one but brokers like BlackBull Markets offer 3rd party copy trading like Myfxbook, DupliTrade and MetaTrader Signals.

Is forex trading taxable in NZ?

Any earnings made through Forex trading in New Zealand is considered to be income. Taxes are as follows

In New Zealand, income is taxed as follows (indicative guide only):

1. $0- $14,000 – 10.5% tax rate

2. $14,001- $48,000 – 17.5% tax rate

3. $48,001- $70,000 – 30% tax rate

4. 70,001- $180,000 – 33% tax rate

5. More than $180,000 – 39% tax rate