OTC Forex Brokers (2026)

Over-the-counter (OTC) forex brokers connect you with a network of liquidity providers using ECN or STP that can lead to spreads as low as 0.0 pips. OTC Brokers also offer the benefit of 24-hour trading as hours.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

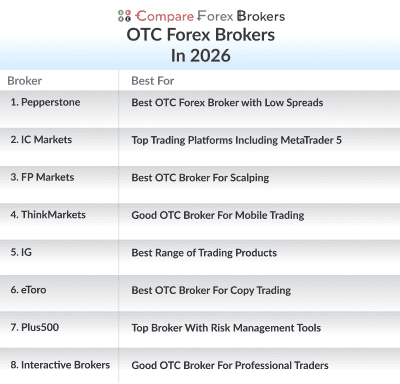

Our list of the top over-the-count brokers are:

- Pepperstone - Best OTC Forex Broker with Low Spreads

- IC Markets - Top Trading Platforms Including MetaTrader 5

- FP Markets - Best OTC Broker For Scalping

- ThinkMarkets - Good OTC Broker For Mobile Trading

- IG Group - Best Range of Trading Products

- eToro - Best OTC Broker For Copy Trading

- Plus500 - Top Broker With Risk Management Tools

- Interactive Brokers - Good OTC Broker For Professional Traders

What is the best OTC forex broker?

Pepperstone offers the best OTC forex broker, providing straight-through processing with a 77ms execution speed and zero-pip spreads on EUR/USD. With RAW spreads from 0.10 pips and $3.50 commissions across 94 currency pairs, Pepperstone delivers decentralized trading with 24/5 market access. We also shortlisted other OTC brokers based on their liquidity provider networks and execution models.

1. Pepperstone - Best OTC Forex Broker with Low Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone as the number 1 OTC broker because it offers the lowest RAW spreads on the market — starting at just 0.1 pips for the EUR/USD pair. This, combined with the 0 pips spread (which is active for 100% of the time outside the rollover period) makes Pepperstone the most cost-effective option if you’re a retail investor.

Our tests also found Pepperstone also has the fastest execution speed of just 77 ms for limit orders which reduces your risk of slippage.

Pros & Cons

- Low RAW spreads

- Responsive customer support

- Fast execution speed6

- 90-day demo account limit

- No guaranteed stop-loss

- Islamic account not in Australia, The UK

Broker Details

Best Execution Speeds Broker With Low Spreads

Pepperstone is among the best OTC forex brokers based on:

- Trading volume

- Ultra-fast execution speed

- Low spread

- Access to a diverse list of derivative products

Pepperstone sees on average USD 9.2 billion worth of client trades every single day that can speculate on 180 OTC derivatives, with spreads starting from 0.0 pips and trades executed under 30ms. Pepperstone is a true global FX and CFD broker with over 110,000 clients worldwide and licences in tier-1 jurisdictions (ASIC, FCA, CySEC, BaFin and DFSA).

OTC trading means there is no central exchange, instead, trading is done using a network of liquidity providers such as dealers banks and brokers with STP, ECN or DMA Forex Brokers. Pepperstone uses deep pool liquidity providers who compete with each other to bring you the Lowest Spread Forex Brokers. As these providers are spread across the world, it also means 24-hour trading is possible.

Pepperstone OTC Market Share

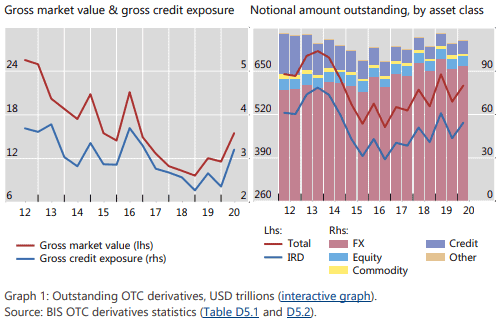

Based on the latest statistics from the Bank of International Settlements (BIS), the size of the OTC market grew to USD 15.5 trillion from USD 11.6 trillion at the end of 2020. The gross market value of the over-the-counter derivatives is huge. At the same time, the forex market reached USD 6.6 trillion in daily turnover.

Pepperstone a global leader in online trading services handles USD 9.2 billion in daily turnover. Only IC Markets handles larger trading volumes of over USD 15 billion of trades processed daily.

| Largest Global Forex Brokers | Broker | Average Trading Vol. Per Day |

|---|---|---|

| 1. | IC Markets | USD 15.0 billion |

| 2. | Pepperstone | USD 9.2 billion |

| 5. | IFC Markets | USD 9.1 billion |

| 6. | AvaTrade | USD 7.8 billion |

| 7. | FX Pro | USD 6.5 billion |

| 8. | Instaforex | USD 5.8 billion |

Pepperstone Lightning Fast Execution

Pepperstone uses one of the most advanced trading technologies, which allows retail traders to enter and exit the market with ultra-fast execution speeds. With Pepperstone, market orders are submitted in under 30 milliseconds, without any manual intervention which reduces latency and slippage.

We evaluated the order execution speed across multiple forex brokers by testing the time it takes for a market order to travel from the desktop terminal (MetaTrader 4) to the broker’s server and found that Pepperstone is leading with split-second execution.

Pepperstone can boost 85ms execution speed closely followed by FP Markets with 95ms execution speed. On the other hand, FXCM is the slowest brokerage trading firm with a 150ms execution speed.

OTC Trading With Low Spreads

At Pepperstone, all retail investor accounts can access over 180 financial instruments and over 90 currency pairs with spreads starting from 0.0 pips – accessible through the Pepperstone Razor account. Pepperstone directly connects forex traders to dozens of liquidity providers and financial institutions increasing your opportunity to receive lower spreads.

The average EUR/USD spread has been lowered to 0.09 pips down from 0.10 pips from a year ago. See how Pepperstone’s spreads compare to other industry-leading forex brokers in the table below.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

The same as with forex trading, CFDs are derivatives that are also traded in the over-the-counter market. This means that the CFD provider is using the market maker model to settle trades. Pepperstone offers CFDs on 7 asset classes: Spot Indices, Shares, Commodities, Cryptocurrencies, Currency Indices, Spot Metals and Spot Energies

Conclusion – Best OTC Forex Broker

Overall, Pepperstone comes in as the most reliable OTC forex broker. You can start trading today with a minimum deposit of USD 200 or give Pepperstone a drive-test on their free demo account available on the most popular trading platform – MetaTrader 4 (MT4).

2. IC Markets - Top Trading Platforms Including MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets received an overall score of 90/100 from us for being the best MT5 broker due to its low trading cost. The broker has an average RAW spread of just 0.02 pips according to our tests. This allows traders like ourselves to reduce trading expenses and maximise our profit potential when trading.

Plus, if MT5 isn’t to your liking, you can always choose between the MT4, cTrader and TradingView platforms.

Pros & Cons

- No minimum deposit

- Supports MT4, MT5, and cTrader

- No deposit or withdrawal fee

- Different commissions on cTrader

- Not regulated by FCA in the UK

- Execution speed could be better

Broker Details

The Broker With A Top Range Of Platforms Including MetaTrader 4

IC Markets is the best online OTC broker for the range of trading platforms based on:

- 3 powerful trading platforms (MT4, MT5 and cTrader)

- Over USD 15 billion in daily turnover

- Collocated servers in Equinix NY4 data centre

- 25 Tier 1 liquidity providers

With more than a decade of business history, IC Markets is one of the best Forex brokers because it is the largest Forex CFD provider globally in terms of Forex volume. With IC Markets, traders can access the OTC market through a variety of powerful trading platforms, including MetaTrader 4, MetaTrader 5, cTrader and TradingView.

The two main regulators that oversee IC Markets’ online trading activities are the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

OTC Trading On MetaTrader Platforms

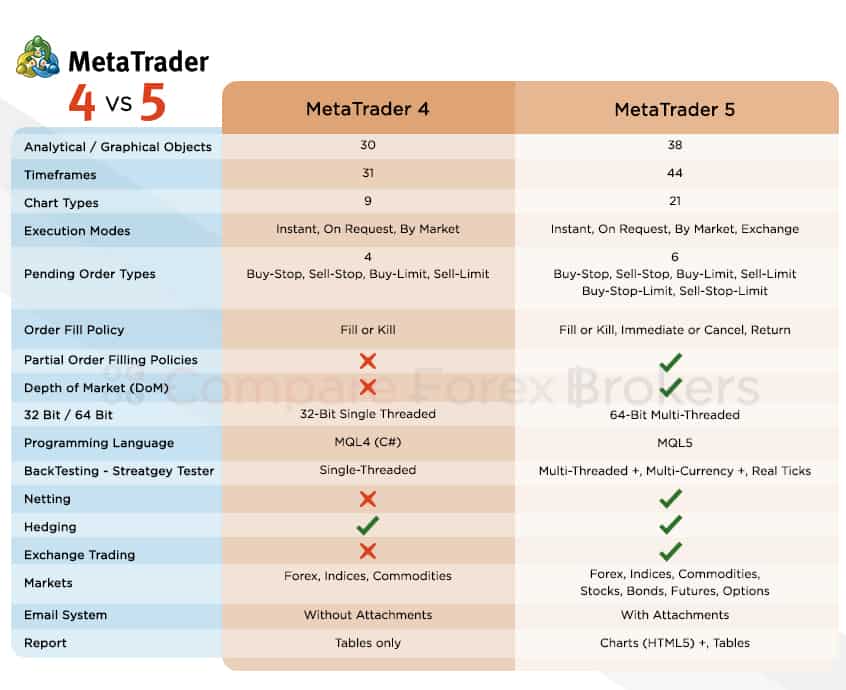

IC Markets offers its services and features on two of the industry’s leading trading platforms – MT4 and MT5. MetaTrader 4, already a standard for Forex trading, brings an array of features and benefits for IC Markets clients.

Trading on MetaTrader 4 comes with:

- No limits on trade sizes, with clients being able to trade micro-lots.

- No restrictions on limit orders – clients can place their Stop Loss and Take Profit orders at the closest possible pip distance from the current market quote.

- Hedging capabilities due to no “first in first out” rule with IC Markets.

The IC Markets trading accounts can also give you access to 20 exclusive advanced trading tools, previously unavailable on MetaTrader 4, including Correlation Matrix, Sentiment Trader, Tick Chart Trader, Stealth Orders etc.

IC Markets MetaTrader 5 software offers even more in terms of charting technology and order management tools, as clients can take advantage of an expanded set of technical indicators, drawing objects, time frames as well as order types.

OCT Trading On cTrader Platform

CFD and Forex traders who crave advanced analytics combined with high-speed performance and deep liquidity will probably find IC Markets’ cTrader trading platform as a solution best suiting their preferences.

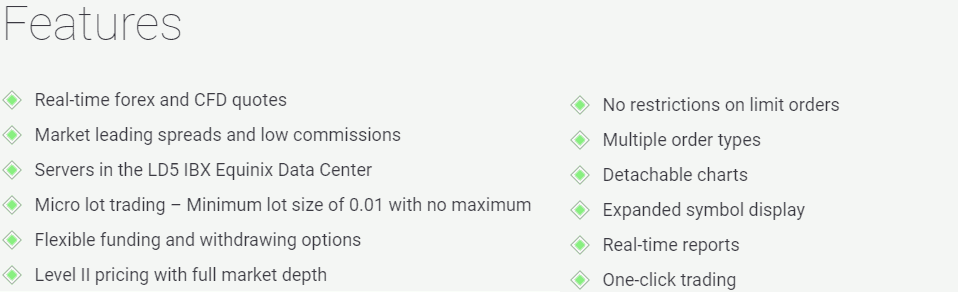

With its unique design and user-friendly interface, this trading platform brings several key benefits, including:

- Access to a good range of order types

- Micro lots are available to trade, while there is no maximum order size

- Charts can be detached and there is a multitude of customization options available

- Expanded symbol display

- One-click trading feature

- Smart Stop Out ensures maximum protection for clients’ trading accounts – if a client’s margin level drops below the Smart Stop Out level, his/her active positions will be closed partially until the margin level is brought back above the Smart Stop Out level

Collocated Server For OTC Market

IC Markets trading servers are collocated in the world’s largest financial hubs New York and London. The MetaTrader 4 and MetaTrader 5 servers are located in the Equinix NY4 data centre. At the same time, cTrader servers are located in the LD5 IBX Equinix Data Centre in London. IC Markets’ dedicated servers can boast low latency and ultra-fast order execution of 40 ms.

Conclusion – Best Online Trading Platforms For OTC Markets

Overall, IC Markets offers the best online trading platforms for beginner and professional clients. IC Markets clients have flexible deposit and withdrawal options – 15 different payment options, including credit and debit cards, Skrill, bank wire transfer etc. Click the button below and fund your trading account today by using one of the 10 different base currencies (USD, EUR, GBP, AUD etc.).

3. FP Markets - Best OTC Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets is our top choice for scalping as it has one of the lowest trading costs with an average 0.1 pips RAW spread for EUR/USD and AU$3.50 commission. From our experience, this reduced cost gave us an advantage of minute market movements to make a profit when scalp trading.

We also recommend FP Markets for its support of 11,000+ different markets and MetaTrader 4, MetaTrader 5, cTrader and TradingView trading platforms.

Pros & Cons

- A large range of markets

- Supports MetaTrader 4, 5, cTrader and TradingView

- Offers zero spread trading

- Has a minimum deposit

- No support TradingView

- Not regulated in the UK

Broker Details

A Great Broker To Save With Low Spreads

FP Markets is the best online OTC broker to save with low spreads based on:

- 0.05 pips spread on EUR/USD – lowest spread in the FX industry

- Leading forex liquidity providers

- Access to the biggest global exchanges (NYSE, NASDAQ, ASX)

- CFD indices spread starting from 0.2 points respectively 0.01 points on metals

FP Markets is an award-winning, global Forex and CFD provider, regulated by some of the most respected industry regulatory bodies – ASIC and CySEC. With FP Markets, traders can choose from two live trading account types to gain access to global financial markets:

- Standard account – variable spread pricing model with fees being included in the spread

- Raw account – ECN account type with spreads starting from 0.0 pips plus a fixed commission

Since the brokerage aggregates pricing from a deep pool of top-tier liquidity providers, it can offer extremely low spreads across its entire product list, which is a huge advantage for clients, as they can save on trading costs and optimize their overall trading results.

Forex Trading With Variable Spreads

FP Markets grants access to the Forex market through several trading platforms (MetaTrader 4, MetaTrader 5, cTrader, TradingView and IRESS) without charging any trading commissions on its Standard trading account. Clients need to pay an all-inclusive spread only, which starts from 1.0 pip on major currency pairs.

The average spreads offered also tend to be quite competitive (see table below).

| EUR/USD | AUD/USD and GBP/USD | USD/JPY | Spot Gold | Spot Silver | |

|---|---|---|---|---|---|

| Average Spread | 1.15 pips | 1.31 pips | 1.22 pips | 0.43 points | 0.03 points |

Forex Trading With Ultra-Low Spreads

The broker will charge a small commission for trading Forex and Spot Metals on its Raw account depending on the base account currency chosen. Forex trading on a USD-denominated Raw account will incur a charge of $3.00 per side ($6.00 per round turn) per 1 Standard Lot. MetaTrader charges for other base currencies are presented below.

The Raw account grants access to ultra-thin spreads on currency pairs and Spot Metals, which can fall to as low as 0.0 pips during the most liquid times. But what is more, the broker’s diverse liquidity mix allows it to keep the average spreads very low as well.

| EUR/USD | AUD/USD and GBP/USD | USD/JPY | Spot Gold | Spot Silver | |

|---|---|---|---|---|---|

| ECN Average Spread | 0.05 pips | 0.21 pips | 0.12 pips | 0.25 points | 0.02 points |

Low Spreads On Other OTC Products

FP Markets also offers competitive spreads on other OTC products such as Commodity, Cryptocurrency or Stock Index CFDs (see table below).

| AUS200 | UK100 | WTI | XBRUSD | Bitcoin Cash | Etherium | |

|---|---|---|---|---|---|---|

| Average Spread | 2.21 points | 1.64 points | $0.04 | $0.05 | $4.39 | $4.21 |

| Min. Spread | 0.2 points | 0.3 points | $0.02 | $0.03 | $4.0 | $4.0 |

Conclusion – Lowest Spread OTC Broker

Overall, FP Markets offers the most competitive trading costs on over 10,000 financial markets including, forex, indices, shares, commodities and cryptocurrencies. Click the button below to drive test FP Markets via their free demo account with USD 100,000 in virtual funds.

4. ThinkMarkets - Good OTC Broker For Mobile Trading

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets primarily stood out to us because of its low RAW spread of just 0.1 pips for EUR/USD. Their in-house platform, ThinkTrader, includes “Cloud-based alerts” with 200 real-time trading signals, ideal for gathering information and predicting market conditions.

All these features are also accessible on ThinkTrader’s mobile app, making it perfect for traders always on the move.

We also appreciate ThinkMarkets’ for its 24/7 customer support and range of markets, which is why we gave them a respectable score of 70/100.

Pros & Cons

- Low RAW spreads

- Vast payment method support

- Robust mobile app

- $500 minimum deposit

- Slow execution speed

- No cTrader or TradingView

Broker Details

A Broker Good For Mobile Trading On The Go

ThinkMarkets offers the best mobile trading App based on:

- Proprietary trading App ThinkTrader

- Access to intelligent trading tools

- 100 powerful technical indicators

- In-app deposits and withdrawals option

ThinkMarkets is a global Forex and CFD provider, authorized to offer OTC trading services in two tier-1 jurisdictions, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA).

ThinkMarkets Technical Indicators

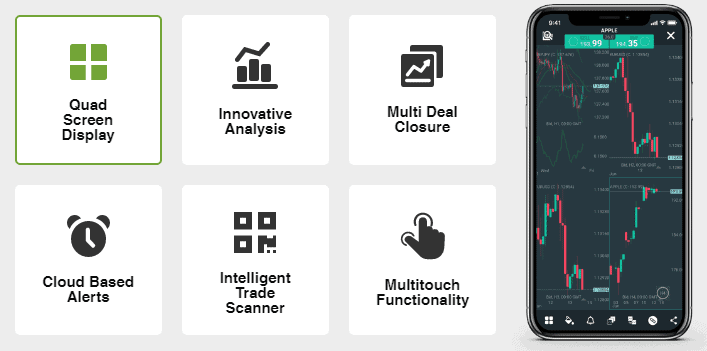

ThinkMarkets’ ThinkTrader Mobile represents innovative proprietary software, which allows seamless access to OTC products such as CFDs at any time at any location. What makes this mobile trading platform unique is a set of valuable features.

Clients can trade the OTC market with the help of a full suite of technical analysis tools including:

- More than 125 technical indicators,

- 50 drawing tools,

- And 20 chart types.

Single multi-device login is also available so ThinkMarkets clients can use a single login and similar interface on their mobile phone or tablet.

ThinkTrader Mobile Tools

ThinkTrader is a fully functional mobile charting app available on iPhone and Android. One of the best analytical features is the Quad Screen Display feature, which allows traders to analyse four real-time charts simultaneously on any mobile device.

The intelligent TrendRisk Scanner – a market scanner that will automatically search several tradable assets across several time frames to find the most promising trading opportunities.

Cloud-Based Alerts and Triggers – clients can set up to 200 alerts and triggers, which will notify them of particular developments in the OTC market even when they are logged out of their trading account.

Cloud-Based Alerts and Triggers – clients can set up to 200 alerts and triggers, which will notify them of particular developments in the OTC market even when they are logged out of their trading account.

Additional real-time news from FX Wire Pro and the multitouch functionality complement the app to offer one of the best mobile trading experiences.

Conclusion – ThinkTrader Best Forex Trading App

Our review has found that ThinkMarkets deserves admiration for its unique mobile trading app. If you want to enjoy access to customizable trading history reports or have the ability to close active positions in a particular trading instrument all from a single tap, give ThinkTrader a try and click the button below.

5. IG Group - Best Range of Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

IG Group offers over 17,000 markets, the largest range we have come across. Markets include common options like Forex, Gold, Indices and Shares and less common like options, futures and sectors.

You can trade these markets on the IG Trading Platform, MetaTrader 4 and ProRealTime with no commission spreads, averaging 1.13 pips for the EUR/USD pair.

We also found the customer support of IG Markets to be quite responsive and another factor why we gave IG Group a score of 71/100.

Pros & Cons

- Responsive 24/7 customer support

- Oldest and largest broker

- Good trading platforms

- DMA account for Professional traders only

- $450 minimum deposit

- No MT5 or cTrader

Broker Details

A Broker With The Best Range Of Trading Products

IG Markets offers the best range of OTC financial markets based on:

- Over 100 major, minor and exotic currency pairs

- Over 13,000 OTC stocks

- Cryptocurrency trading + Crypto 10 Index

- OTC derivatives for stock indices, bonds, interest rates, currency ETFs, etc.

With over 17,000 OTC markets, IG is a leading CFD and Forex brokerage with several decades of business history, regulated in 9 jurisdictions worldwide, including the UK’s FCA, Australia’s ASIC and in the United States by the CFTC and NFA.

Our review has found that IG offers the widest and most diverse range of OTC products among the top brokerages we took into consideration.

Disclaimer: Derivatives such as CFDs are complex instruments that involve a high level of risk for clients to incur rapid capital losses due to High Leverage Forex Brokers trading. Therefore, traders need to be fully aware of how these derivative instruments work before they start trading CFDs on retail investor accounts with the use of leverage.

With IG, clients can access more than 17,000 financial instruments grouped in multiple asset classes as follows.

Forex Currency Pairs

IG offers over 100 major, minor and exotic currency pairs with a tiered margin system for retail traders. Professional clients can access leverage of up to 1:200. The minimum spread offered on EUR/USD and AUD/USD is 0.6 pips, while that on USD/JPY is 0.7 pips.

The average bid-ask spread is 1.04 pips – based on price data “for the 12 weeks ending 8th January 2021.” In addition, financial spread betting is also available to IG clients.

Stock Indices

IG stock index trading allows you to access over 80 contracts traded with a tiered margin system for retail clients, while professional traders can access max leverage of 1:200. The minimum spread offered on AUS 200 Index and UK 100 Index is 1.0 points, while that on S&P 500 is 0.4 points.

Stock CFDs

IG offers over 13,000 individual Stocks across multiple regions of the world, with trading commissions on US shares being 2 cents per side and 0.18% per side on Hong Kong shares. The minimum margin requirement for most markets is 10%.

Cryptocurrencies

Cryptocurrencies – 15 digital currencies (Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Stellar (XLM), NEO, and EOS) plus the Crypto 10 Index traded with a tiered margin system for retail clients, while professionals can access max leverage of 1:20. The minimum spread on Bitcoin is $38.0, while that on Ethereum is $1.2.

Commodities

CFDs on Soft Commodities, Metals and Energies – 35+ contracts traded with a tiered margin system for retail clients. The typical spread on Spot Gold is $0.3, while that on US Crude Oil is $2.8.

Additional OTC Markets

IG clients can also trade CFDs on Bonds (13 contracts), Interest Rates (6 contracts), Sectors (35 UK and Australian sectors such as banking, mining, general retailers etc.), Options as well as Index, Sector, Commodity and Currency ETFs.

Conclusion – IG Biggest OTC Broker

Overall, IG Markets comes at the top of our list based on the huge selection of OTC markets. IG clients are also offered extended trading hours and 24/7 trading on selected instruments. Click the button below and start practising trading on a risk-free demo account.

6. eToro - Best OTC Broker For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1 GBP/USD = 2 AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

From our experience, eToro’s web and mobile trading platform is a solid choice if you want to copy trade from the broker’s large community of 30 million registered users.

We like their Smart Portfolios which use AI to create indices of the best-performing eToro traders or shares based on themes or sectors. Indices are a good way to spread your risk when trading.

eToro is one of the most reliable brokers we’ve reviewed with low average standard spreads of 1 pips for EUR/USD.

Pros & Cons

- Creative indices

- Commission free trading

- Robust copy trading

- No RAW account

- No support for MT4 or MT5

- $50 minimum deposit

Broker Details

The Best Broker For Copying The Best Traders

eToro offers the best copy trading platform based on:

- Proprietary CopyTrader platform

- Popular Investor Program

- Wide social network with 13 million active traders

- Copy up to 100 traders simultaneously

Founded in 2006, eToro has become renowned for its global social trading network. Our review has found that eToro offers the best social trading conditions on its platform among OTC Forex brokers.

Largest Social Trading Network

Clients with little or no trading experience who feel insecure with a trading strategy of their own as well as those who simply do not have the time to closely keep track of market developments can earn a passive income by following other traders.

eToro accommodates over 13 million active traders, which trade in multiple asset classes (forex, cryptocurrencies, ETFs, stocks, indices and commodities.)

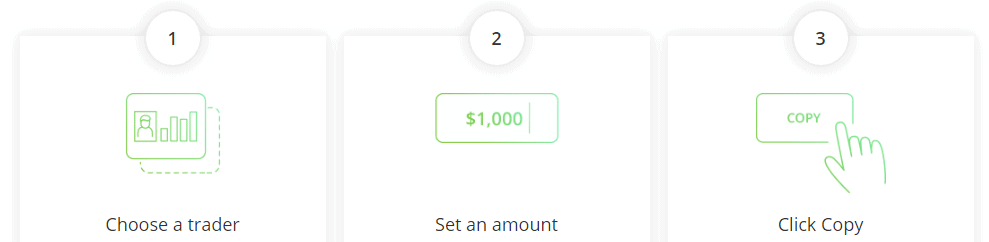

CopyTrader Platform

eToro’s CopyTrader, the broker’s most popular feature allows retail traders to connect and directly replicate the trading activity of top-performing traders on eToro’s network.

To do so, clients need to choose a trader on eToro’s platform, input the amount from the account balance they wish to allocate to that trader and click on “Copy”. The selected trader’s positions will be replicated automatically in real-time and in direct proportion, similar to traditional Automated Trading Platforms.

Clients can filter through users on the broker’s platform with the help of criteria such as risk score, return for the past 12 months, number of copies etc.

Copy Up To 100 Trades Simultaneously With No Fees

What is important to note is that clients will never have to pay any management fees or other hidden costs when copy trading. They only need to ensure a minimum deposit of $200 to enter the OTC market and also to make sure they meet the minimum required value of every copied position ($1.00).

eToro’s CopyTrader technology allows users to copy up to 100 traders simultaneously, with clients also being able to pause or stop the copy, to add or remove funds at any time.

eToro’s Popular Investor Program

On the other hand, traders with a proven strategy can earn a second income with eToro’s Popular Investor program. To join the program, they have to meet certain requirements:

- Minimum equity of $1000,

- At least two full months of stats on the broker’s platform,

- A maximum risk score lower than 7 for at least two months,

- Info of at least 150 characters (full name and biography) added to their profile,

- An active feed.

| Cadet | Champion | Elite | Elite Pro | |

|---|---|---|---|---|

| Monthly Payment | - | $400 or $800 | 1.5% or 2.0% | 2.0% or 2.5% |

| Minimum AUM | $500 | $50k | $500k | $10M |

| Minimum Equity | $1,000 | $5,000 | $25,000 | $50,000 |

The program features four different tiers, each with its requirements and benefits. To become eligible for a Champion rank and start earning a monthly income paid by eToro, every trader will need to ensure a minimum equity of $5,000, have at least 10 copiers and ensure the minimum value of allocated funds by copiers (Assets under Management) of $50,000.

Conclusion – eToro Best Copy Trading Platform

Overall, it’s safe to trade with eToro as it’s regulated in 4 tier-1 jurisdictions including NFA, ASIC, FCA and CySEC. Click the button below and start copy trading today with a minimum deposit of USD 1,000.

7. Plus500 - Top Broker With Risk Management Tools

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

From our time trading with Plus500, we found Its risk management features quite helpful. These include guaranteed stop loss and a negative balance protection policy, which enables setting limits on potential losses without additional fees.

Pros & Cons

- Good standard spreads

- Best risk management features

- 24/7 customer support

- No RAW account

- $100 minimum deposit

- No automation or social tools

Broker Details

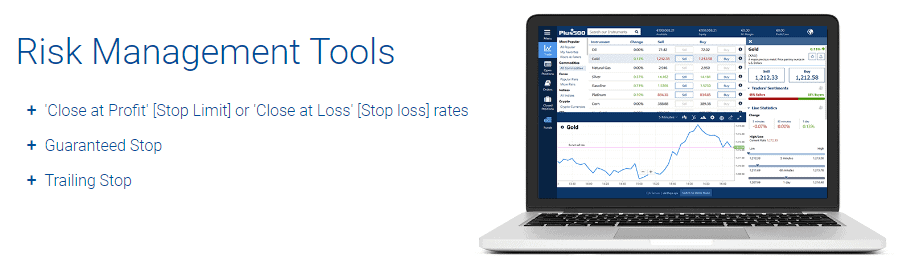

The Broker With Top Guaranteed Stop Loss

Plus500 offers the best range of OTC risk management tools based on:

- Guaranteed stop-loss order (GSLO)

- Segregated bank accounts

- Advanced risk management tools

As required by regulation, Plus500 also provides negative balance protection for retail traders.

Founded in 2008, Plus500 is a trusted CFD and Forex provider, listed on the London Stock Exchange (LSE). The main regulators that supervise Plus500’s trading operations are the UK’s FCA, Australia’s ASIC and Cyprus’ CySEC – all tier-one regulatory agencies.

Guaranteed Stop Loss For OTC Trading

Since trading OTC products such as CFDs carries a high level of risk of losing money due to an array of factors, retail clients require proper risk management tools to safeguard their active positions. One such tool is the guaranteed Stop Loss, which sets an absolute limit on potential losses and also reduces the risk of slippage.

We should note that not every OTC Forex broker offers this tool. Among the leading OTC brokers we reviewed, Plus500 stands out when it comes to managing risk in CFD trading.

| Plus500 | Pepperstone | IC Markets | eToro | FP Markets | IG | |

|---|---|---|---|---|---|---|

| Guaranteed SL | ✔ | ✘ | ✘ | ✘ | ✘ | ✘ |

| Negative Balance Protection | ✔ | ✘ | ✘ | ✔ | ✘ | ✔ |

| Segregated Bank Accounts | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Along with the traditional Stop Limit and Stop Loss orders, the brokerage has also provided tools such as Trailing Stop and Guaranteed Stop for clients to use on its trading platform. By using a Guaranteed Stop, if clients have made an incorrect prediction of market movement, their active position will be automatically closed by Plus500’s software at the specified price level. This way, clients will know in advance what their (potential) maximum loss can be.

GSLO Available On Limited CFDs

The Guaranteed Stop tool is available on a selection of trading instruments only and Plus500 will apply an extra spread, which will be visible before the order is confirmed.

Note* Plus500 doesn’t charge any fees for the GSLO, but their remuneration comes in the form of a wider spread.

Traders can place a Guaranteed Stop only on new positions/pending orders, while they will not be able to use this tool on existing positions. We should also note that once a Guaranteed Stop order has become active, clients will not be able to modify or remove it, unlike the traditional Stop Loss order.

Plus500 complies with regulatory requirements by providing negative balance protection for all retail traders.

Conclusion – OTC Broker With Best Risk Management Tools

Overall, Plus500 offers powerful risk management tools that enable retail traders to limit their losses. The GSL order is also complemented by additional risk tools like real-time alerts. Click the button below and test drive their risk management tools with a risk-free demo account.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

8. Interactive Brokers - Good OTC Broker For Professional Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

As experienced traders, we recommend Interactive Brokers (IB) as the ideal OTC broker for advanced professionals. IB offers over 100 order types and algorithms with their IBKR platform. has a fairly low trading cost with a $2.25 commission and spreads starting from 0.1 pips for EUR/USD.

We tried the in-house IBKR Trading Workstation and appreciate the Paper Trading feature which is like a demo account. Here you can test new strategies in a simulated trading environment and see scenarios for how your strategy may play out.

Pros & Cons

- No minimum deposit

- Top educational resources

- Advanced trading platforms

- No credit card support

- Weekday-only customer support

- No RAW account

Broker Details

A Broker Good For Advanced Traders

Interactive Brokers is the best online OTC broker for professional traders based on:

- Low commission trading

- Price improvement technology

- Lowest margin loan interest rates on the market

- Advanced order types

With more than 40 years of business history and multiple industry awards, Interactive Brokers Group is a global brokerage that provides direct access to asset classes such as Stocks, Options, Futures, Foreign Exchange, Bonds, Mutual Funds, ETFs and Spot Commodities. With IB, clients can also access derivatives such as CFDs on some of the above-mentioned underlying assets.

Interactive Brokers Low Commissions

What makes IB a good choice for advanced traders are, first, the broker’s transparent low commissions, which allow professionals to maximize their returns. With the IBKR Pro plan, professional clients can take advantage of ultra-low Foreign Exchange spreads that start from 0.1 pips, since the broker’s pricing is aggregated from 16 leading liquidity providers. Additionally, sophisticated traders will be charged very competitive commissions for:

- Shares and ETF trading – $0.0005 – $0.0035 per share, plus exchange, regulatory clearing and transaction fees,

- Options trading – $0.15 – $0.65 per contract,

- Futures trading – $0.25 – $0.85 per contract.

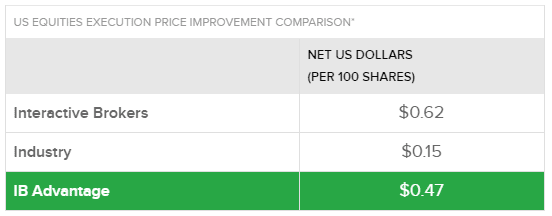

Interactive Brokers SmartRouting

Second, the IBKR Pro plan allows professional clients to receive the best price execution due to IB’s SmartRouting technology. The latter ensures a $0.47 per 100 shares price improvement compared to the industry overall.

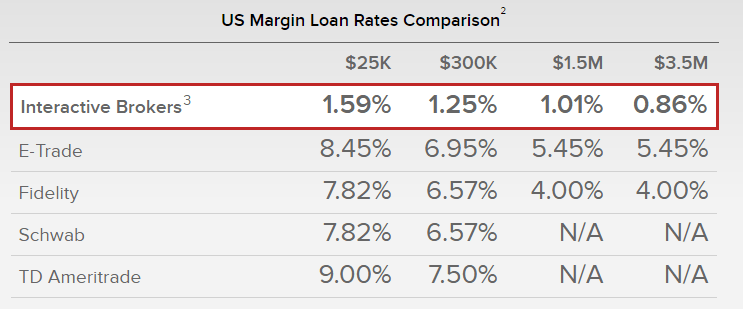

Lowest Margin Loan Interest Rates On The Market

Third, with IB, professionals can take advantage of the lowest margin loan interest rates on the market, according to Barron’s 2020 online broker review. The following table compares the annual percentage rates on USD margin loan balances between IB and some of its major competitors.

Interactive Brokers Advanced Order Types

Fourth, professional clients can access 135 markets by using more than 100 order types and algorithms (from limit orders to complex algorithmic trading) and comprehensive trading tools on IB’s powerful flagship desktop platform, Trader Workstation. The software also allows real-time access to news, research, fundamentals as well as market data on specific exchanges.

Last but not least, IB offers flexible trading API solutions for professionals.

Conclusion – Best OTC Broker For Advanced Traders

Overall, Interactive Brokers has a lot to offer for advanced traders. When we’re looking at Interactive Brokers from the advanced trader perspective, it’s all about low commissions, SmartRouting technology, Trader Workstation and API solutions. Click the button below to enjoy a fully-featured trading experience.

Ask an Expert

Is OTC trading the same as ECN trading?

Over-the-counter trading (OTC) and Electronic Communication Networks trading are two different concepts. OTC trading means you are trading in decentralized markets, these markets have no central exchange or broker. Forex is a good example of a decentralised product since you are trading directly with the liquidity providers. Stocks by contrast will usually have a central exchange and use an auction market system.

ECN trading is the means that allows you to connect with liquidity providers so you can make the trade.

How safe is my money with these brokers — do they have strong regulations and protections that give me peace of mind as a new trader?

This depends on who the regulator is. While offshore regulators are not as stringent as those in first world economies, some still have an acceptable level of protection.