Free Forex Trading Platform

There are plenty of free forex trading platforms available with online brokers, but not all are good choices. I looked at the best trading platforms for CFD and currency trading you can use for free.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of free forex trading platforms with a demo account is:

- Pepperstone - The Best MetaTrader 4 Experience

- IC Markets - My Top Low Spread MT5 Broker

- BlackBull Markets - Great TradingView Broker

- FxPro - My Best cTrader Broker

- eToro - The Broker With the Largest Social Trading Community

- CMC Markets - The Top Free Proprietary Platform

- IG Group - Offers Good Trading Tools

- OANDA - OANDA Trade Has Good Charting

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

What Are The Top Forex Free Trading Platforms?

Our original best forex trading broker list includes some accounts that require a paid account only. If you’re looking for a free environment, you can either open an account with the brokers we have shortlisted on this page.

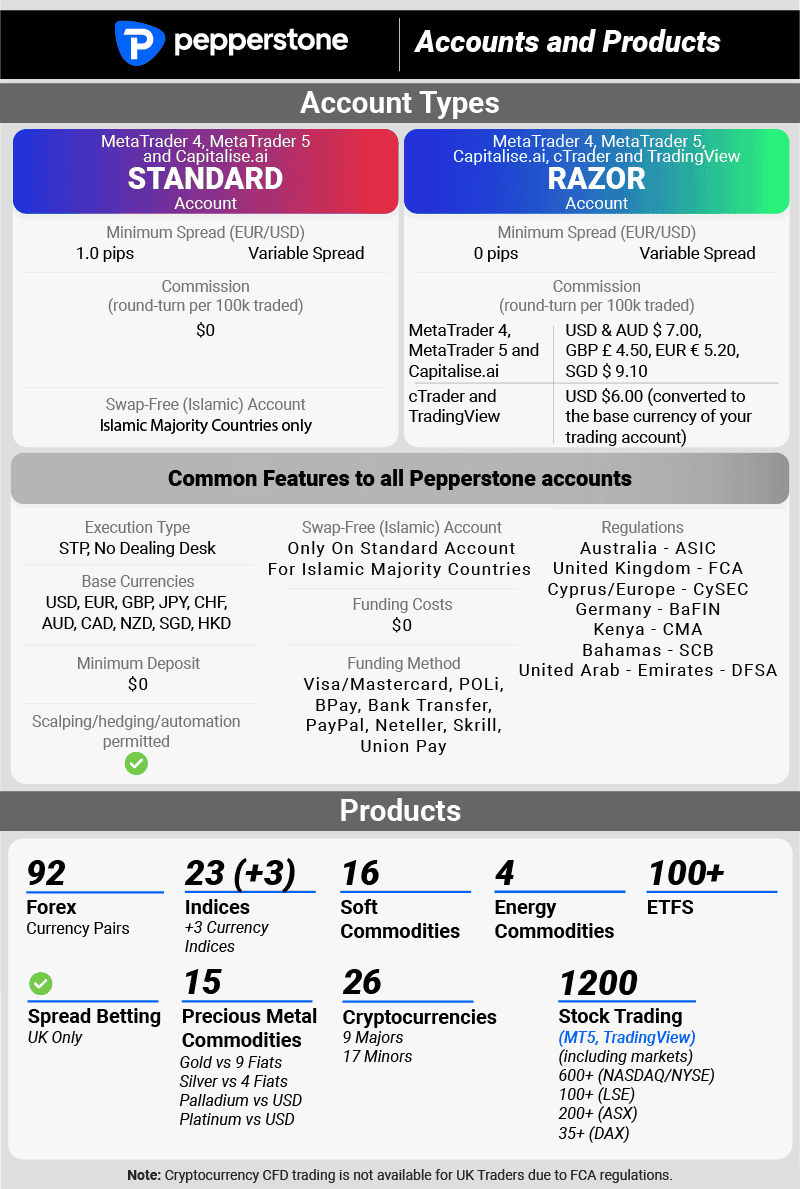

1. Pepperstone - The Best MetaTrader 4 Experience

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

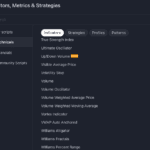

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

I highly recommend Pepperstone as the top all-around free trading platform, particularly for its outstanding MetaTrader 4 offering. In my experience, this broker consistently goes above and beyond to support MT4 forex traders.

The addition of the Smart Trader Tools package grants access to 28 additional apps and indicators to enhance technical analysis. You will also get Autochartist for advanced charting, Captialise.ai for no code automation along with Myfxbook and DupliTrade for copy trading.

Pros & Cons

- 4 Top trading platforms

- Fast execution speed

- Multi-regulated

- Good 3rd party software tools

- Education could be improved

- No fixed spreads

- Islamic account not in all countries

Broker Details

Pepperstone Trading Platforms

Pepperstone has 4 trading forms that are free to use: MetaTrader 4, MetaTrader 5, TradingView (but subscription needed for advanced features) and cTrader. Among these, MetaTrader 4 is the most popular.

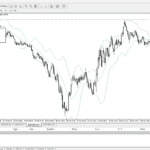

I opened a Pepperstone RAW trading account to test the MetaTrader 4 platform and see why it’s the most popular. The first thing I noticed is how easy it is to customise the platform; with a simple right click, I could change the properties to fit my preferences and trading style.

I was able to customise the Market Watch only to show the markets I wished to trade and find great trading opportunities. I did this below by hiding all markets except the forex majors, and I feel like this cuts the unimportant details out and allow you to focus on the markets that matter.

While exploring the MetaTrader 4 platform, I found that it had 30+ indicators, three chart types, and nine timeframes. Honestly, this is not the most extensive range of tools built compared to TradingView, but you can customise your indicators or download new ones from the MetaQuotes marketplace.

Also, for those planning to automate trades, I discovered that MetaTrader 4 allows you to do this with its Expert Advisors.

In addition to the EAs, I took note of the platform providing the Strategy Tester feature which allows you to backtest your strategies. It includes an optimisation tool to help find the optimal trade sizes, stop loss, or take profit levels.

As for the broker, I selected Pepperstone as best suited for the MetaTrader 4 platform. This is thanks to having low spreads, which I find perfect for various trading styles, from scalping to day trading.

Pepperstone Has 0 pips spreads

The spreads on Pepperstone’s Standard account average 1.12 pips on EUR/USD with no commission, but the RAW account averages 0.1 pips with a small commission of $3.50 per lot traded.

While executing my trades, I noticed that my RAW account spreads were zero-pips, so I asked our analyst Ross Collins to see how often Pepperstone offered them this low.

Ross’ tests found that Pepperstone provided their RAW account spreads at 0.0 pips 100% of the time on the major pairs during the test. Impressively, the broker outperformed other popular providers like IC Markets, which offered them 97.38% of the time.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

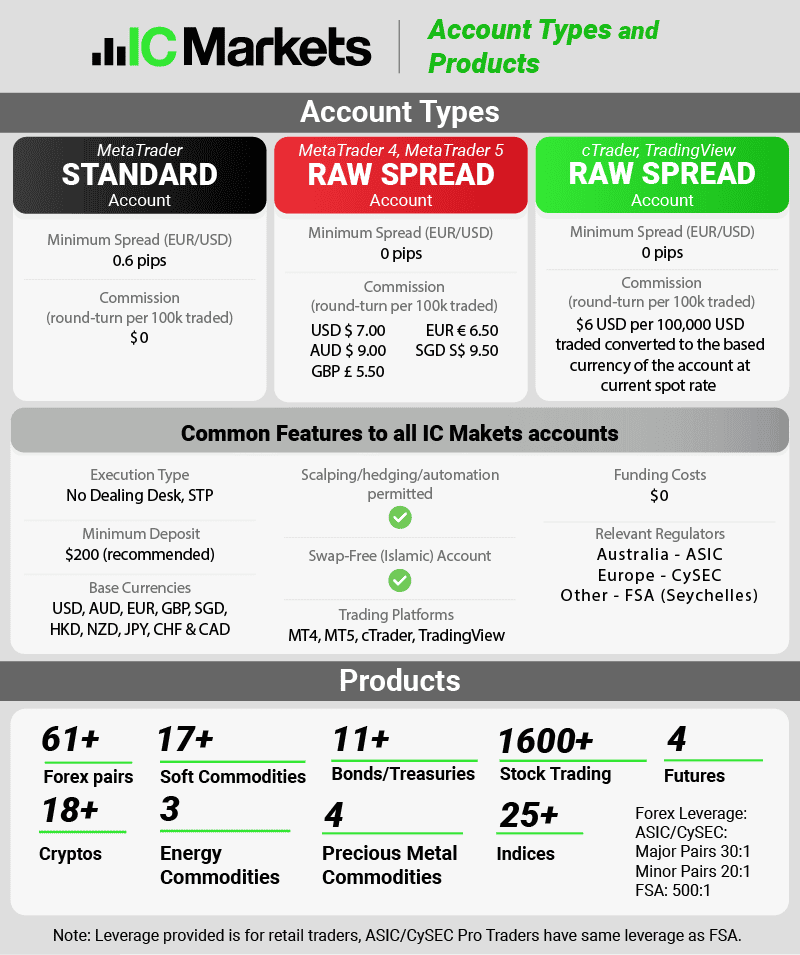

2. IC Markets - My Top Low Spread MT5 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

I recommend IC Markets for having exceptionally tight spreads. During my testing, the broker’s spreads averaged just 0.32 pips for the EUR/USD on the Raw Spread account. Meanwhile, my results showed 1.03 pips using the Standard account. This has landed IC Markets in the second spot for tightest spreads among the brokers I tested.

I also appreciate the broker’s comprehensive MT5 offering, incorporating top trading tools into a user-friendly interface with access to more financial markets than MT4.

Pros & Cons

- Winner for low spreads for RAW and Standard Accounts

- Fast account opening

- Free deposit and withdrawal

- Live chat is slow

- Not regulated by FCA

Broker Details

Testing MetaTrader 5 With IC Markets

While IC Markets also has MetaTrader 4, cTrader, and TradingView, for me, the standout offer is the MetaTrader 5.

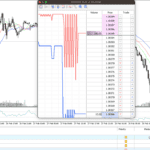

During my test of MT5 with the broker, I found that the platform now includes 35+ indicators and 21 timeframes, but the biggest additions are the Depth of Market and native economic calendar tools.

The economic calendar is now natively installed with MetaTrader 5, something TradingView has had for a while now. I appreciate how it highlights the announcement times and color-codes them in red or blue based on the results. This has made identifying events easier in my experience.

You can also filter the announcements to include only high-impact events, which I found more effective than the default setup. This spares your chart from being cluttered with less important events.

As more brokers offer ECN-style services, more traders can now benefit from MT5’s depth of market tool, which provides Level II pricing. I appreciate this feature because it lets you see all the open orders for each price level on the liquidity provider’s order books.

In a nutshell, such a transparency gives you valuable insights into where other traders are placing their money, allowing you to fine-tune your trading decisions accordingly.

Spreads With IC Markets

Speaking of ECN brokers, I consider IC Markets as a solid choice for MetaTrader 5 due to having low average spreads.

Based on the results of my testing, the broker’s RAW account spreads are impressive, with EUR/USD averaging 0.06 pips — lower than the industry average of 0.22 pips. In my live fee testing, I found their major crosses to have some of the lowest spreads. I compared the average spreads with 40 other brokers.

From this comparison, IC Markets impressively had the joint lowest average RAW spreads across the major pairs, averaging 0.16 pips and beating the industry average of 0.44 pips. Only Tickmill matched their spreads, as shown in the table below.

| Tested Raw Spreads | |

|---|---|

| Broker | Major Pair Average Spread |

| IC Markets | 0.16 |

| Fusion Markets | 0.17 |

| ThinkMarkets | 0.20 |

| FP Markets | 0.22 |

| FXTM | 0.22 |

| TMGM | 0.26 |

| HYCM | 0.26 |

| Tested Average | 0.44 |

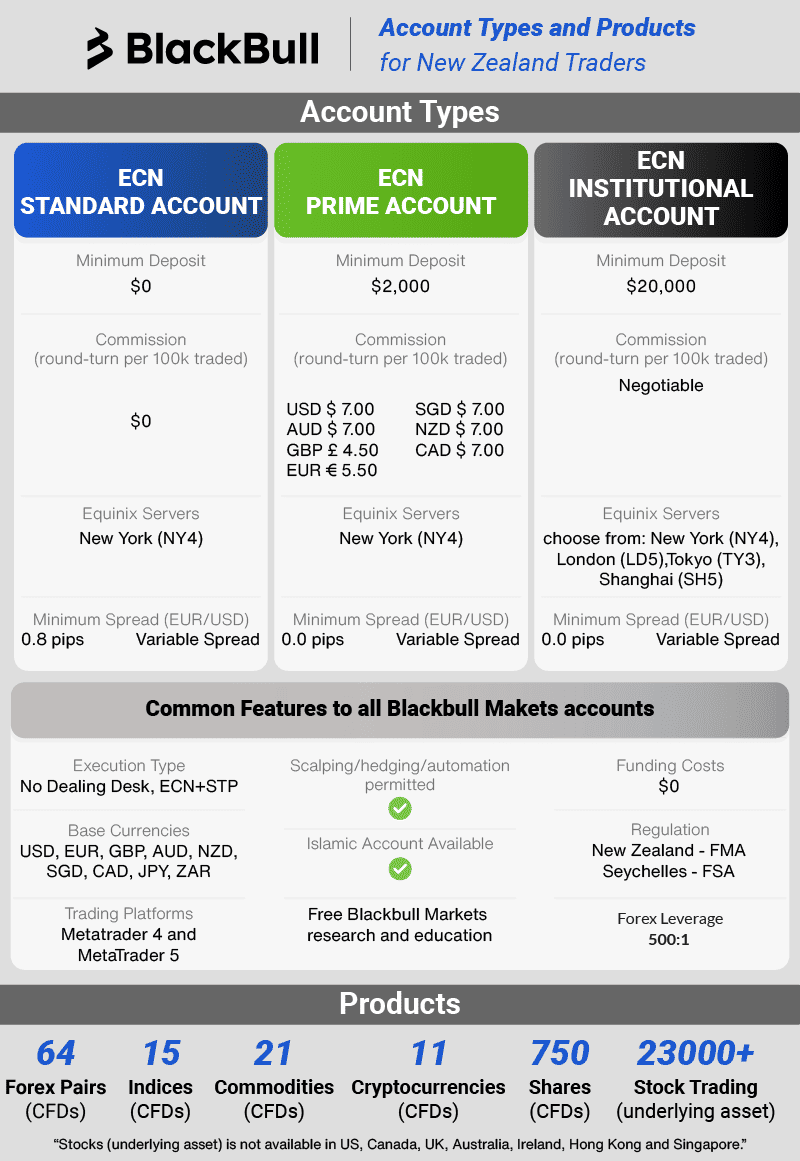

3. BlackBull Markets - Great TradingView Broker

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlakcBull Trade

Minimum Deposit

$0

Why I Recommend BlackBull Markets

I recommend BlackBull Markets to any forex trader who prefers the TradingView platform, as the broker is dedicated to offering alternative tools. Additionally, they provide excellent trading conditions, making them a strong choice overall.

With 13 million charts available, TradingView caters to experienced traders on the lookout for sophisticated charting features, such as specialised drawing tools and numerous timeframes.

Combine this powerful platform with BlackBull’s competitive costs and chart-topping execution speeds, you’ll get a great TradingView broker.

Pros & Cons

- Winner for fast execution

- Competitive spreads

- 1:500 Leverage

- Top range of trading platforms

- Spreads could be better

- $2000 minimum deposit for ECN account

- Not regulated in Australia, UK or Europe

Broker Details

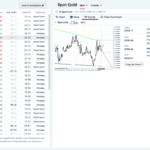

BlackBull Markets TradingView

I opened up a BlackBull Markets account to test out the TradingView platform. The first thing I tested is the charting package as it is popular with many traders. I discovered that TradingView offers over 100 indicators, more than 15 chart types (such as Kagi and Renko), and over 25 drawing tools. These features are incredibly useful for technical analysis, including tools like Fibonacci retracement and linear regression.

I also noticed that TradingView updates and adds new indicators to their charts frequently, which MetaTrader 4&5 and cTrader do not do — that’s a unique and standout feature in my opinion.

With its many offers, BlackBull Markets became the choice for TradingView in my books, complemented by the broker’s fast execution speeds and free access to TradingView premium subscriptions. What this means is that you can maximise TradingView’s capabilities with more technical indicators on the chart. Plus, there are 20 more price alert slots, which is useful if you like to wait for a reaction from the market, like breakout trading.

Other trading platforms with BlackBull Markets include MetaTrader 4, MetaTrader 5, and cTrader. I discovered that you can also automate using Capitalise.ai with your MT4 account and social trade with BlackBull Social, Myfxbook and ZuluTrade.

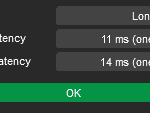

I asked our analyst Ross to test the average execution speed of BlackBull Markets and compare them with 14 other brokers. He tested the broker for limit order and market speeds to help give me a clear indicator of which broker is the fastest overall.

Based on Ross’ findings, BlackBull Markets achieved a limit order speed of 72ms and a market order speed of 90ms, achieving faster results than the industry average speeds. This placed the broker in the number one spot, followed by Fusion Markets and Pepperstone.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| HugosWay | 4 | 104 | 7 | 94 | 3 |

| TMGM | 5 | 94 | 5 | 129 | 7 |

| FXCM | 6 | 108 | 8 | 123 | 6 |

| City Index | 6 | 95 | 6 | 131 | 8 |

| Axi | 8 | 90 | 4 | 164 | 16 |

| Eightcap | 9 | 143 | 12 | 139 | 10 |

Another standout feature is BlackBull Markets allows up to 1:500 leverage, which is normally reserved for elective professional traders. This is made available because they are regulated by the Seychelles Financial Services Authority (FSA).

4. FXPRO - My Best cTrader Broker

Forex Panel Score

Average Spread

EUR/USD = 1.32

GBP/USD = 1.7

AUD/USD = 1.95

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why I Recommend FxPro

If you’re a big fan of cTrader platform, then FxPro is my top recommendation. cTrader is a popular alternative to MetaTrader 4 since it has Depth of Market, 26 timeframes (17 more than MT4), a better user interface and an economic calendar.

Particularly, I appreciate the drag-and-drop stop loss and limit order setup and the one-click trading from charts.

Pros & Cons

- Wide choice of trading platforms

- Fixed spreads available

- Instant execution option

- Good customer service

- Spreads can be high

- Not regulated in Australia

- Range of markets slightly limited

Broker Details

For my first impression of the cTrader platform, I was impressed to find that it gave a more modern look at trading compared to reviewing MetaTrader 4 & 5. The platform is aesthetically pleasing with its bold block colours and round edges which help me see the charts clearer.

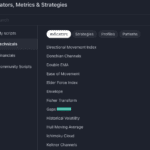

I am convinced that cTrader is a decent alternative to MetaTrader 4 & 5, offering 70+ technicals, 11 chart types, and depth of market access. The desktop version also offers automated trading through cBots and custom indicators, although the marketplace isn’t as popular as MetaTrader’s.

What stood out for me is the cTrader Proxy Cloud. This aims to reduce your latency connection to the platform, ensuring you get the fastest execution from the platform regardless of the broker location. This is a great feature, especially if you automate your trades via cTrader Automate or scalp the markets.

During my review, I was connected to a London proxy, which cTrader determined would provide the best connection to the platform.

To utilise cTrader’s suite of impressive features, you will need a broker that offers Straight-Through Processing with low spreads (averaging 0.32 pips EUR/USD), and there’s no other broker that matches this best except for FxPro.

While reviewing the broker’s cTrader account, I found that they offer a solid choice of markets, including 69 currency pairs, 2031 shares, 19 indices, 11 commodities, and 30 crypto markets. I also like that FxPro provides Trading Central, which plugs natively into cTrader, helping you find new trading ideas daily through automated chart pattern signals.

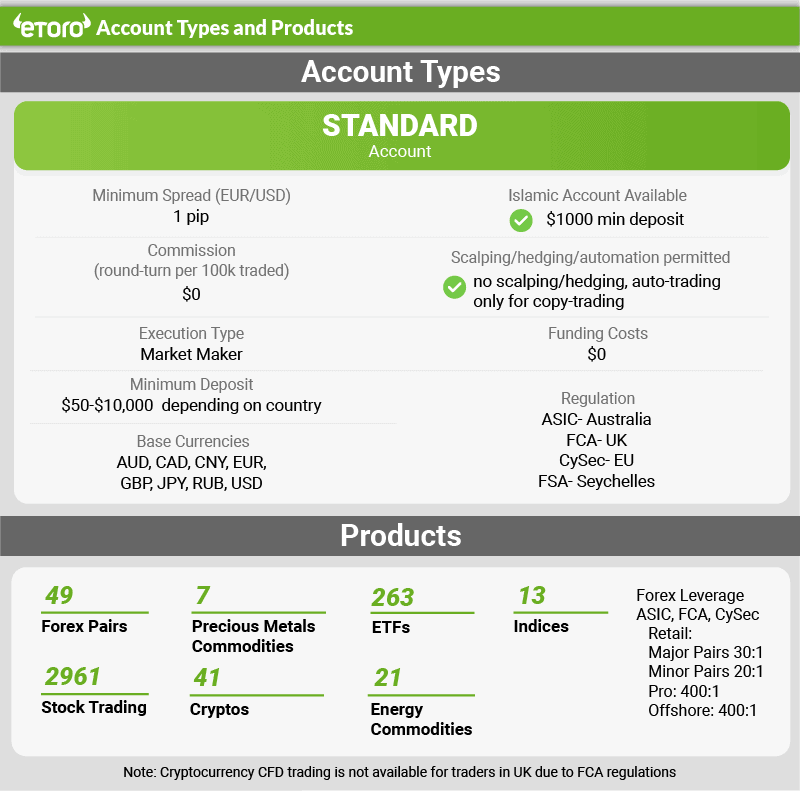

5. eToro - The Broker With the Largest Social Trading Community

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

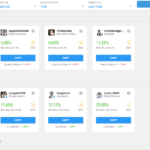

I recommend eToro to forex traders who are curious about social trading or copy trading and would like to crowdsource their trading knowledge.

Based on my experience, I like the SmartPortfolios and CopyTrader features, which allow you to engage with unfamiliar financial markets and trading strategies without time-consuming research or backtesting.

eToro also stands out for its cryptocurrency trading products which are more than most other broker I reviewed.

Pros & Cons

- Largest social trading community

- Impressive range of markets to trade

- UNique social trading tools

- Currency conversion fees

- No live chat

- Withdrawal fees

Broker Details

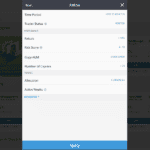

eToro has CopyTrader, one of the best copy trading platforms available, used by 30 million traders. I found this to be a great platform for beginners, so I went ahead and tested its features to see how easy it is to navigate around.

Firstly, I appreciate that the CopyTrader platform is web-based, making it easier to access and allowing me to load the CopyTrader tool in less than 6 seconds. This also means you can access the platform on any device without the need to download an app — a convenient feature, especially when you need a quick update while on the go.

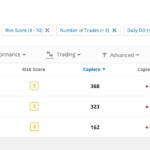

You receive recommendations from top-performing copy traders, which is a nice feature, but they may not always align with your personal trading preferences. I found some of the suggestions to be too high risk. Instead, you can use the “Advanced filter” to set criteria based on performance and narrow down your choice of copy traders.

In my test, the platform returned a list of traders that meet my preferences, narrowing my search from a whopping 2 million to just 3.

On top of this, the eToro covers a great range of markets to choose from in the filter: 49 forex pairs, 2961 stocks, 13 indices, 41 indices, 263 ETFs, and 41 crypto markets.

For me, being able to choose traders to copy who specialise in different markets is a top feature, allowing you to pick the best of the best for each market and copy their trades.

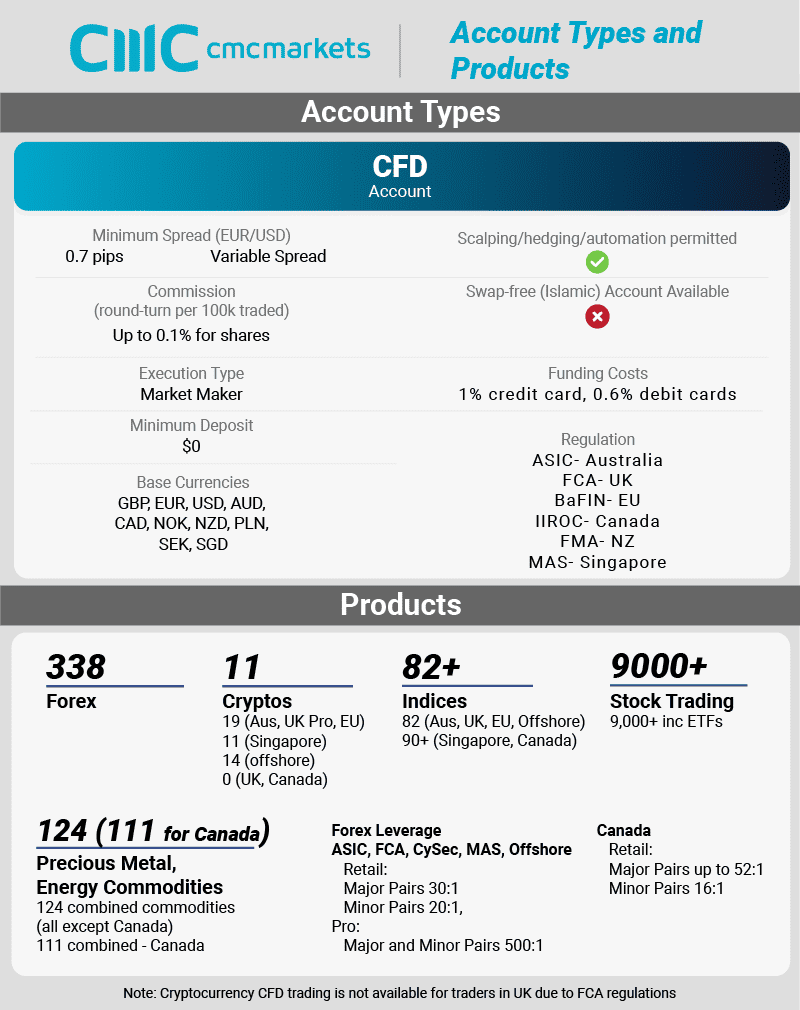

6. CMC Markets - The Top Free Proprietary Platform

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why I Recommend CMC Markets

I recommend CMC Markets because of the in-house Next Generation platform. I thought the broker developed this with both beginner and experienced traders in mind.

The platform offers a sleek, modern design with an easy-access advanced order panel, 115 indicators, 70 chart patterns and a guaranteed stop loss.

I also liked that CMC Markets allows scalping and offers an impressive 338 forex pairs plus 12,000 other instruments.

Pros & Cons

- 30 currency pairs

- 12,000 markets to trade

- Competitive pricing

- Next Generation platform is good

- No 3rd party tools for copy and social trading

- MT4 product range is smaller than with Next Generation

- Some funding costs

Broker Details

The Next Generation (NGEN) platform is CMC Market’s proprietary platform, offering various trading tools and features that compete with MetaTrader and TradingView.

While using the platform, I found the default interface cluttered with market news widgets and tools that most traders wouldn’t use. The good news is you can customise this by removing those widgets, which I think is a positive development for the platform.

You’ll find that the charting is decent. You can add up to 30 indicators on a chart at once from a selection of 80+ indicators.

One thing that impressed me is that 60+ special pattern indicators scan the markets for different chart & candlestick formations and highlight them on your chart. It will even give you entry levels and take profit targets if you hover over them, which is an excellent feature for risk warning.

In my live trading cost tests, the broker gave me competitive spreads averaging 1.12 pips on EUR/USD, below the industry average of 1.24 pips.

If you specialise in trading forex, I recommend the FX Active account as this is a low commission and tight spread account on six currency pairs. You can get spreads as low as 0.0 pips with the FX Active account.

During my live testing, I averaged 0.44 pips on EUR/USD, which was above the industry average. Based on my research, they only charge $2.50 per lot traded, much lower than the industry average of $3.48.

| Broker | USD |

|---|---|

| FXTM | $2.00 |

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| City Index | $2.50 |

| Blackbull Markets | $3.00 |

| FP Markets | $3.00 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

| FxPro | $3.50 |

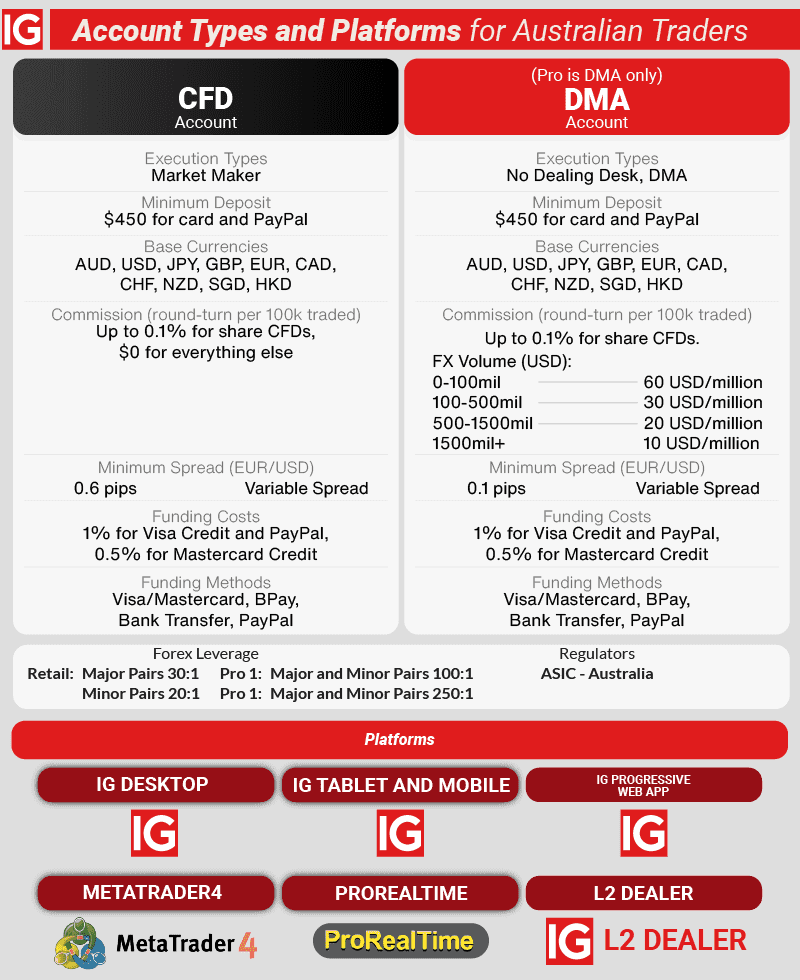

7. IG Group - Offers Good Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why I Recommend IG

I recommend IG Group to anyone looking for a top-tier trading platform with excellent trading tools. Available as both a web trader and a mobile trading app, the broker’s in-house platform includes 28 indicators, 19 drawing tools and signals for chart recognition.

IG Group also stands out for the number of tradable assets available. They have 17,000 markets which is more than any other broker I tested.

Pros & Cons

- 17,000 markets to trade

- IG Platform has guaranteed stop loss

- Regulated in 13 jurisdictions

- High trust

- No 3rd party social and copy trading tools

- IG WebTrader has layout limitations

- No MT5

Broker Details

While reviewing IG Group, I found that their platform offered a solid range of integrated trading tools. These included trading signals generated by AutoChartist and PIA First, two regulated signal services, and guaranteed stop-loss orders, both helpful tools if you are starting to trade.

On the IG Group Trading Platform, I went around with the Signals Centre, this is where you’ll find all the technical analyses provided by AutoChartist and PIA First. I like how direct the information is published, giving me the market, source of the signal, buy/sell signal, and the duration of the signal.

It’s also amazing to see that the information expands to a full analyst commentary and a chart with the analysis so you can review the signal in more detail. For me, adding the “Copy to Order” feature is a nice touch, allowing traders to act on the signal quickly.

On top of the excellent trading tools, the platform has plenty of customisation, offering 28+ indicators, 19+ drawing tools, eight chart types, and 15 timeframes.

A small quality-of-life feature I liked is that chart settings and technical indicators are automatically applied to each asset you switch to, a feature missing in other platforms like MetaTrader 4.

IG Group has an extensive range of 17,000+ financial instruments — the largest I’ve reviewed. These markets cover 100 currency pairs, 12,000 share CFDs, 130 indices, 41 commodities, 6,000+ fixed-income markets, and 7,000+ options markets.

Based on my testing, the broker’s spreads are fairly competitive, averaging 1.13 pips on EUR/USD with no commission. This puts IG Group in line with CMC Market’s Standard account spreads and below the 1.24 pips industry average.

| Broker | Total Range of CFD Markets |

|---|---|

| IG Group | 17,000+ |

| CMC Markets | 13,000+ |

| eToro | 3,500+ |

| BlackBull Markets | 2,000+ |

| FxPro | 2,000+ |

| IC Markets | 1,700+ |

| Pepperstone | 1,200+ |

| OANDA | 100+ |

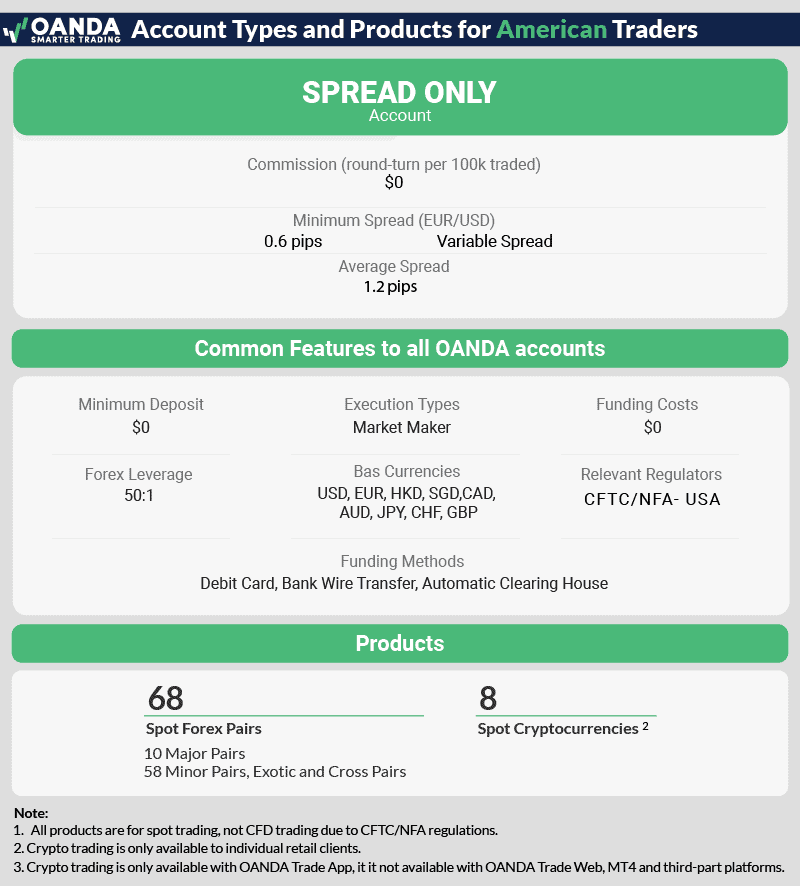

8. OANDA - OANDA Trade Has Good Charting

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, Oanda Trade (FxTrade)

Minimum Deposit

$0

Why I Recommend OANDA

I recommend OANDA’s proprietary platform, OANDA Trade, for having excellent charting capabilities. It comes with advanced charts from TradingView, 11 customisable chart types, 65+ indicators and Autochartist.

I awarded OANDA a score of 100/100 for trust and reputation since they are regulated in 7 regions. Most retail traders will opt for OANDA’s Spread Pricing account, which offers an average spread of 0.6 pips for EUR/USD — a very low rate.

Pros & Cons

- Our most trusted broker

- OANDA Trade, TradingView, MT4

- Top research tools

- Algorithmic options

- No CFD shares

- Limited CFD cryptos

- Education tools needs refresh

Broker Details

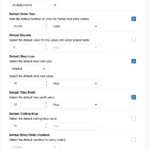

After opening my account with OANDA, I noticed the OANDA Trade platform leverages TradingView’s charting. This is a bonus as, based on my experience, TradingView’s charts are the best for technical analysis.

You get access to 80+ indicators, including MACD, Ichimoku, and Bollinger Bands. However, I did notice there was less choice compared to TradingView’s full 100+ indicators.

On feature that stood out for me is the ability to set default trade settings, which I find helpful it you want to execute your orders quicker while preventing mistakes. For example, I set my trade default to ensure I always placed a lot size of 0.5, with a default take profit of 20 pips and a stop loss of 10 pips. When I executed the trades to test this, the deal ticket was automatically populated, which is an excellent feature, although not many platforms include it by default.

While testing the platform, I noticed that OANDA’s spreads are low, averaging 0.6 pips on EUR/USD with no commission. This is lower than most brokers I’ve tested and 50% lower than the industry average of 1.24 pips.

To get a better picture of OANDA’s spreads, I captured the average spreads of major pairs to see how expensive it is to trade compared to 40 other brokers. Based on my results, OANDA offered the lowest average spreads across the majors, with an average of 0.7 pips.

| Top 5 Most Traded Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| OANDA | 0.70 |

| IC Markets | 0.76 |

| Fusion Markets | 0.99 |

| Admirals | 1.04 |

| Eightcap | 1.06 |

| Go Markets | 1.08 |

| OctaFX | 1.10 |

| TMGM | 1.16 |

| FIBO Group | 1.18 |

| Trading212 | 1.22 |

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| City Index | 1.24 |

| HYCM | 1.24 |

| Industry Average | 1.52 |

Ask an Expert

is it possible to start forex with no capital

You can with a demo account as these use virtual currency however if you want to do proper trading then you will need capital