What Are Forex Signals

Forex signals provide indications for a good time to enter or exit a position when trading forex currency pairs. This guide looks at the best trading signals and how to best use the signals for successful forex trading.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

How To Choose The Best Forex Signals

Forex signals help forex traders to identify trading opportunities in a timely manner. By using signals, traders are able to direct their focus to the best buy and sell targets as part of their trading strategy.

Trading signals can be best described as trading ideas for a particular trading instrument (a Major Forex Pairs, Crypto, Stock Index, Commodity, etc.) for you to consider and can execute:

Trading signals can be best described as trading ideas for a particular trading instrument (a Major Forex Pairs, Crypto, Stock Index, Commodity, etc.) for you to consider and can execute:

- at a specified price level

- and, at a specified time.

Given the fast-changing dynamics of the foreign exchange market, trading signals or notifications need to be sent to forex traders in a timely fashion from forex signals providers. These signals can use a number of channels to reach Forex traders such as by email, SMS, or push notifications. In some cases, the signals can be found directly in the trading platform by installing add-ons.

In the article, we will take a closer look at how forex signals work, what types of signals traders can use, and how to choose the best forex signals providers.

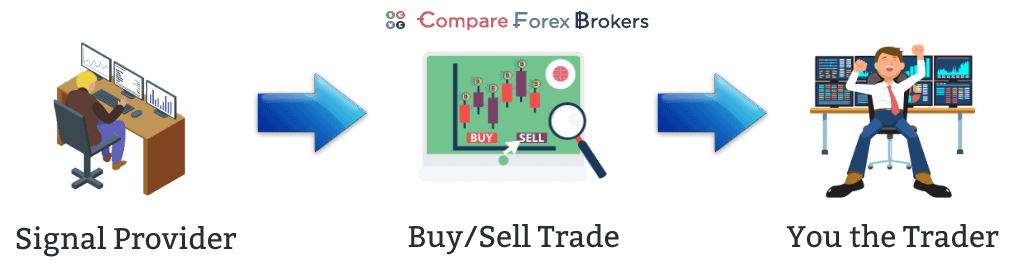

How Do Forex Signals Work?

Forex signals contain insights such as entry and exit points for a particular forex pair so that traders can make decisions from the ideas the signal suggests.

When signal providers determine the right moment to go long or short a particular forex pair, a trading signal is sent to traders via the traders’ preferred communication channels (email, RSS feed, tweet, SMS, WhatsApp message, etc.).

These forex signals can be set to a range of timeframes from intraday to weekly or monthly signals. Most signals will allow you to choose between one timeframe or multiple timeframes when tracking for signals to analyse and track your trade.

Since the foreign exchange market is active 24/5, all trading signals are sent in real-time. Every single forex trading day comprises four sessions – Australian, Asian (more precisely Tokyo), European (London), and North American (New York), some of which may overlap depending on the current time of the year – summer or winter period.

Trading signals can be considered the forerunner of social trading. With signals, traders have the freedom to decide whether to act on trade ideas or not. With social trading, they simply replicate the trading activity of a successful trader directly into their trading account. Copy trading is an automated process, meaning once a top-performing trader is selected, his/her active positions will be automatically duplicated into the users’ trading accounts.

The Advantages Of Forex Trading Signals

Perhaps the greatest advantage of forex trading signals is that they are meant to optimise a trader’s profitability, as they contain precise information presented in a timely fashion.

Some forex traders may prefer to use trading signals as their sole source of research. In this case, choosing a reputable, trustworthy signal provider is essential to enhancing profitability. A scam provider may turn out to be very costly.

Other forex traders may prefer to use trading signals in addition to their own research of market conditions. In other words, once they have finished researching the market and have come to a conclusion regarding the entry price, that conclusion may be confirmed by a third-party signal provider, which adds weight to the trade idea.

Another advantage of forex signals is that they help traders spot trading opportunities in currency pairs they may not be currently analysing. For example, currency pairs are different from EUR/USD or USD/JPY, but instead some exotic pairs such as USD/SGD, EUR/SEK, or SGD/JPY. In this case, forex signals simply add other trade ideas to investors’ watchlists.

Are Forex Signals Legal?

There has been an ongoing debate about whether trading signals actually constitute investment advice from a signal provider to a signal receiver and therefore may have shaky legal standing.

To be considered investment advice regarding the purchase or sale of a particular trading instrument, trading signals must be provided by a licensed and regulated financial services provider. If the signals provider has the appropriate licensing for the jurisdiction or the country in which the trader is located in the, Top Forex Trading Countries, then signal providers can be considered legal.

However, there is another possibility. Trading signals may not be considered investment advice at all and would rather serve receivers for educational or information purposes only. In this case, signal providers are obligated to state this circumstance in a disclaimer on their website.

However, there is another possibility. Trading signals may not be considered investment advice at all and would rather serve receivers for educational or information purposes only. In this case, signal providers are obligated to state this circumstance in a disclaimer on their website.

There are also a lot of cases of scams in the forex trading space. This can be particularly valid for forex signals providers that offer such a service for free. Scam forex signals providers tend to be more focused on how fast their number of subscribers increases rather than on whether their forex trading signals are actually accurate and can benefit the receiving party.

Consequently, forex traders need to conduct very profound research on a particular signal provider before deciding to take its trade ideas into account and risk their hard-earned money based on those signals.

Types Of Forex Signals

Forex signals can be classified as follows:

- Paid and Free Forex signals

- Entry Forex signals and Exit Forex signals

- Manual and Automated Forex signals

Paid And Free Forex Signals

While in some cases free Forex signals can have dubious legitimacy and accuracy, there are also reputable, trustworthy providers that will offer free-of-charge trading signals for a certain trial period. But most reliable and accurate trading signals will require a purchase. Some signal providers may charge a one-time fee for their service, while others may operate a subscription-based model.

Entry And Exit Trading Signals

Trading signals can be classified as entry and exit trading signal depending on how many details they contain. There are Forex signals providers that may offer entry Forex signals only or suggestions to open a position in the market based on a certain entry price.

Other Forex signals providers may offer exit Forex signals only, or suggestions to close a relevant active position. Exit trading signals are usually long-term and are provided on trading instruments that trend for longer stretches of time.

Yet, we should note that short-term trading signals usually contain both entry and exit points.

Manual And Automated Forex Signals

Manual trading signals are usually provided by a team of analysts or successful traders after they have done an in-depth analysis of market price action. Automated trading signals are generated through an algorithm and computer software that analyses market conditions on behalf of human traders. Because of their coded algorithm, however, automated trading signals may lack the flexibility to respond to any price fluctuations driven by fundamental factors.

Difference Between Technical And Fundamental Signals

Forex signals providers generally use two different approaches to analyse and interpret market data:

- Fundamental analysis

- Technical analysis

Signals For Fundamental Traders

Fundamental analysis focuses on macroeconomic, political, and social factors, which may affect the valuation of different currencies. Analysts will usually look for signs of economic outperformance of one country in relation to another, which could favour its own currency against another currency in a forex pair. Global trade flows, capital flows as well as central bank monetary policies are key factors that tend to affect the Forex market in the longer term.

Short-term factors, on the other hand, may include month-to-month changes in business conditions in manufacturing, services, or construction sectors within one economy, changes in consumer sentiment, and changes in unemployment numbers among others.

Government bond yields also tend to affect the forex market. Countries, where yields are rising, will usually lure more international investors who will buy the local currency and, as a result, its value will increase because of higher demand. Meanwhile, countries with ultra-accommodative central bank monetary policies will usually have the value of their currency depreciating over time.

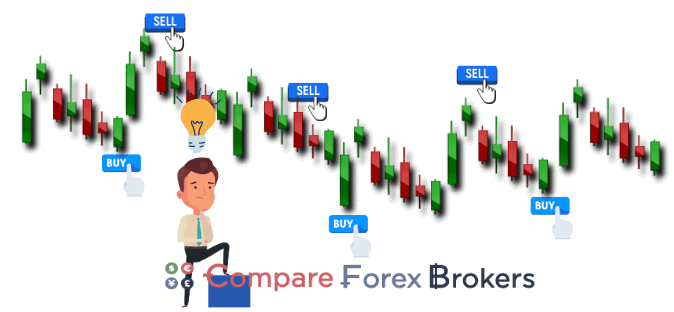

Signals For Technical Traders

Technical analysis focuses on the price performance of a particular forex pair and is based on the belief that the market tends to move in Forex Patterns that repeat themselves over time. Therefore, a solid analysis of past performance with the help of technical indicators coupled with short-term and long-term pattern recognition models and support and resistance levels allows analysts to project future price movements.

Some signal providers will look for circumstances known as divergences between the price of a currency pair and the readings of a given technical indicator (the Relative Strength Index, for instance) in order to predict market movement and base their signals on that prediction. Others will look for technical patterns such as wedges, triangles, flags, or pennants to project future market direction.

There are also signal providers who will look for shorter-term price action patterns (“Inverted Hammer”, “Dark Cloud Cover”, “Three Black Crows”, “Abandoned Baby”, volatility patterns, and so on) to predict market movement and base their signals on that forecast.

How To Find The Best Forex Signals Providers

The quality of services offered by Forex signals providers can vary greatly. Therefore, it is essential for traders to make their choice of a provider by taking into account the following factors:

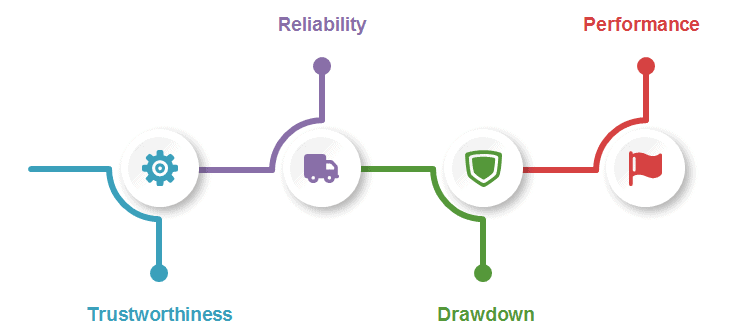

Trustworthiness

First, is a signal provider actually trustworthy? Traders may look for information about the provider and the leading analyst behind the service on Google. They may look at the provider’s performance record which contains details of all issued trades. Traders may also determine the quality of the provider’s information by joining its email newsletter or Telegram group (if one is available). Lastly, they may sign up for a Forex signals trial. It is a practice among providers to offer 1 or 2-week trials so that traders can get a sense of their service.

Reliability

Second, how reliable a provider actually is. Some people tend to believe that reliability is equal to a high success rate. But that is not the case, because the win rate by itself is not enough to determine if the provider’s trading strategy can be trusted. Some providers may disclose an 80% or 90% success rate, but their strategy will actually lose money, and there are providers with a 30% or 40% success rate, but their trading strategy can actually generate profits.

What is important here is the signal provider’s risk-to-reward ratio! The reliable providers will deliver consistent results over time, as they will only open a position with an appropriate risk-to-reward ratio (for example, 1:2 or 1:3). In contrast, “reliable” providers with exceptionally high success rates may actually take an enormous amount of risk (100+ pips) per position in order to generate insignificant profits (10-15 pips). This is not the right way to remain consistently profitable in the Forex market!

A reliable signal provider will also use a good platform (MetaTrader 4 or MetaTrader 5) to send out trade ideas and offer multiple channels (Telegram, WhatsApp, Signal, Discord, etc.) via which traders can receive the signals.

Lastly, a reliable provider will offer detailed information with their buy or sell signals – take profit and stop loss levels, not just an entry price.

Drawdown

Third, traders should bear in mind that even the best strategy can experience periods of negative returns. In other words, drawdowns are a natural part of trading. Therefore, good signal providers need to keep the drawdown at a minimum.

Performance

And fourth, traders may check the signal provider’s overall performance to obtain useful information about its track record. Traders should pay attention to gains in pips rather than gains as a percentage, because the latter may be misleading due to the varying Leverage ratios used.

Traders may compare the average number of pips earned per position with the average number of pips lost per position, the number of months on average with positive returns with the number of months on average with negative returns. Additionally, traders may check how many trades on average are being issued by the forex signals service.

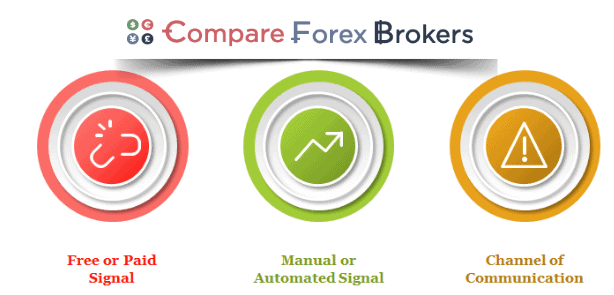

Criteria To Look For When Choosing A Signal

There are certain considerations Forex traders need to pay attention to when they choose a trading signal:

- First, whether traders should select a free-of-charge Forex signals service or opt for a paid subscription-based service. Traders who put relatively small amounts of money at risk may decide to use a free Forex signals service. On the other hand, traders who operate with larger capital and look for a more reliable service may choose to subscribe for paid signals. Paid signal service providers will often offer free trials, allowing traders to get a sense of their service on a risk-free demo account.

- Second, whether traders should use manual signals or automated signals. In case they prefer to trade during a particular Forex trading session, they may check out the service of a signal provider offering manual signals.

- Third, what communication channel to use in order to receive Forex signals. In case traders prefer to get the signals via a personal message, then Forex signals providers that automate the service via social media platforms may not be an appropriate choice.

Things The Best Signals Should Include

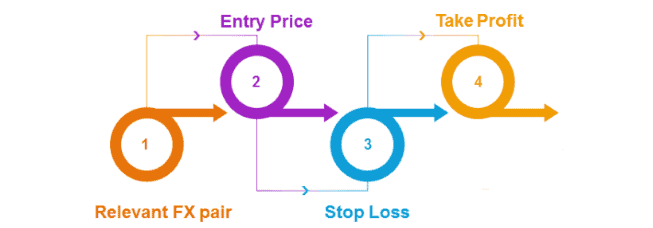

The best Forex signals should always include relevant data that could help traders make an informed decision:

- First, traders should check the signal’s relevance to them, or whether it refers to the Forex pair of their interest, what market direction it projects (whether to go long or to go short) as well as whether it is “active” or “closed” (since signals are received in real-time, traders should check their validity for the current Forex trading session).

- Second, the trading signal needs to pinpoint an entry price, or the minimum amount required to invest in the trade. Usually, the entry price is set just above relevant support and resistance levels or immediately after a moving average crossover.

- Third, the trading signal needs to pinpoint a Guaranteed Stop Loss level. This is the price level at which the trade will be automatically closed in case the market sentiment shifts so that the trader’s long-term profitability is maintained. Depending on the direction of the trade, Stop Loss Orders levels usually take into account relevant support and resistance levels.

- Fourth, the trading signal needs to pinpoint a Take Profit level. This is the price level at which the trade will be automatically closed in case of the market moves as expected and reaches the desired profit. Take Profit and Stop Loss levels are determined in accordance with the signal provider’s risk-to-reward specifications.

The Best Forex Signal Providers

Finally, we will provide a list of Forex signals providers that are worth checking out:

1. 1000pip Builder

1. 1000pip Builder

1000pip Builder – a provider that offers fundamental- and technical analysis-based manual signals via email and SMS. Traders can sign up for three paid membership plans – $97 for 1 month, $227 for 3 months or $697 for 12 months.

2. ForexSignals.com

2. ForexSignals.com

ForexSignals.com – a provider that offers fundamental- and technical analysis-based manual trading signals in real-time. This company shares trade ideas on different CFDs, Bitcoin, and other cryptocurrencies. Traders can try a 7-day free trial or subscribe to three paid membership plans – EUR 79 for 1 month, EUR 41.50 for 6 months or EUR 39 for 12 months.

3. FXLeaders

3. FXLeaders

FXLeaders – a provider that offers real-time trading signals in Forex, Cryptocurrencies, Commodities, and Stock Indices. Traders can receive free Forex signals and can also subscribe to a premium Forex signals service to get email and mobile alerts. The provider has a 1-month subscription plan for $39 and a 1-year subscription plan for $9.80 per month.

4. Zero to Hero FX Signals

4. Zero to Hero FX Signals

Zero to Hero FX Signals – a provider that offers fundamental- and technical analysis-based signals via email and SMS in real-time. Traders can receive between 4 and 10 manual signals each day for a fee of $97 per month.

5. Zero to Pro

5. Zero to Pro

Zero to Pro – a provider that offers manual Forex signals via email. Traders are able to subscribe to the service for a period of 1, 3, 6, or 12 months by paying a fee within the range of $97 to $497.

Conclusion On Forex Signals

Make sure the forex signals you choose suits your trading style and that you feel comfortable risking your money with that signal provider. Choosing a suitable Best Forex Brokers In Australia (or UK-based broker) is another critical factor to successfully trading the market.

The information provided in this article is for educational purposes only. Forex traders should make sure to do their due diligence before purchasing a forex signal provider.

Risk Disclaimer: Our team of experts at Compare Forex Brokers doesn’t endorse any of the forex trading signals providers mentioned here. Relying on forex signals doesn’t give you control of your financial income. Additionally, forex trading carries a substantial risk of losing money rapidly.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert