If you’re researching the market or new to forex trading, the below statistics are designed to give you an overview of the size, turnover, and regulation.

Top 5 Forex Facts

- The total value of the forex industry is $2.73 quadrillion, increasing from $1.93 quadrillion in 2019.

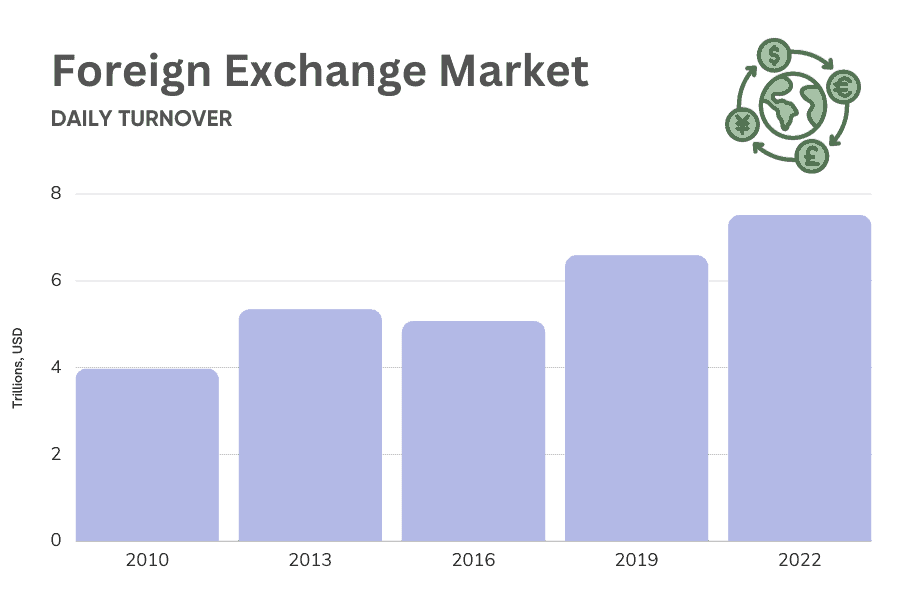

- Daily global forex trading volume was $7.5 trillion dollars in April 2022, up from $6.6 trillion in 2019.

- Forex is the only financial market in the world to operate 24 hours a day and comprises over 170 different currencies.

- Seven currency pairs make up 85% of forex markets trading volume.

- 85% of traders use MetaTrader 4 (MT4) making it the most popular trading platform worldwide, while MT5 ranks second globally.

1. Foreign Exchange Market Turnover

How Much is the Forex Market Worth?

The most recent data shows the global foreign exchange market is worth $2.73 quadrillion, up from $1.93 quadrillion in 2019, making it the largest financial market globally. It was found in 2022 the average daily turnover had increased by 14% from $6.6 trillion to $7.5 trillion in a three-year period.

The forex market is the largest financial market in the world in terms of trading volume, liquidity, and value.

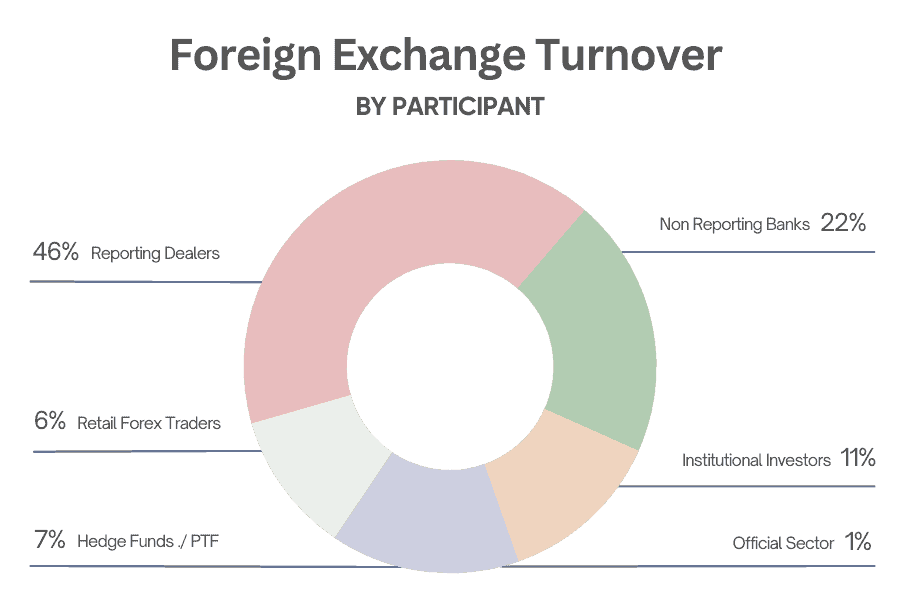

Together, FX swaps and spots account for the majority of daily turnover in the forex markets. $2.1 trillion worth of spot FX and $3.8 trillion of forex swaps are traded daily. Other popular assets include:

- Forwards: $1.1 trillion

- Retail trading

- Options and other products: $304 billion

- Currency swaps: $123 billion

Retail trading accounts for only 6% of the total foreign exchange market worldwide.

Global Liquidity in 2025

Into 2025, we are seeing the landscape of global liquidity defined by rising bond shares, a decrease in the dollar’s share, and variable shares of Emerging Market Economies (EME), signalling a significant shift in the dynamics of global finance. These trends reflect a shift towards bonds as safe havens and a diversification away from the dollar, heavily impacting the forex trading industry and liquidity worldwide.

Insights from the latest Bank for International Settlements (BIS) Quarterly Review reveals the past three distinct phases of global liquidity, each carrying profound implications for currency markets and forex trading practices.

| Global Liquidity | Phase 1 (Q1 2003–Q1 2009) | Phase 2 (Q2 2009–Q2 2021) | Phase 3 (Q3 2021–Current) |

|---|---|---|---|

| Bond Share (%) | Falling | Rising | Rising |

| Dollar Share (%) | Rising | Rising | Falling |

| EME Share (%) | Falling | Rising | Falling |

Phase 1: Q1 2003–Q1 2009

- Increased Volatility: This period saw heightened market volatility, creating more trading opportunities, especially in EME currency pairs.

- Dollar Diversification: A decline in the dollar’s dominance led to better prospects for trading non-USD pairs, emphasising the need for adaptable strategies.

Phase 2: Q2 2009–Q2 2021

- Bond Market Attraction: There was a noticeable shift towards liquid assets, with bond shares increasing as traders moved away from traditional safe havens.

- Dollar’s Resurgence: The rising dollar share made USD pairs more attractive, requiring traders to adapt strategies to the stronger dollar.

Phase 3: Q3 2021–Current

- Bond Interest Rises: The ongoing increase in bond shares, coupled with a falling dollar share, indicates a shift back to bonds as safe havens and away from the dollar.

- Opportunities in Diverse Pairs: This phase offers chances in less dollar-correlated and EME currency pairs, benefiting from global liquidity changes.

Implications for Forex Traders

The evolution of global liquidity, marked by shifts in bond, dollar, and Emerging Market Economies (EME) shares, plays a significant role in shaping the forex trading industry. These changes not only influence currency values but also redefine trading dynamics and opportunities within the market.

- Diversification: The industry is expanding its focus to include EME currency pairs, responding to global liquidity shifts and emphasising the need for broader market engagement.

- Volatility Management: With increased market volatility, the industry is adopting more sophisticated risk management strategies, including advanced stop-loss orders and precise position sizing.

- Market Analysis: There’s a heightened focus on detailed market analysis, leveraging global economic indicators and liquidity trends to anticipate currency movements and refine strategies.

Forex Market Hours and Trading Sessions

When are Forex Markets Open?

The continuous trading environment is made possible by the interplay of four global trading sessions, ensuring fx markets are open 24 hours a day during weekdays.

Forex is a 24 hour market, except for weekends and holidays.

What are the Four Forex Trading Sessions?

Trading sessions are divided into four major times: New York session (US, EST), London session (UK, GMT), Tokyo session (Japan, JST), and the Sydney session (Australia, AEST).

| Session Name and Location | Open Time (Local / UTC) | Close Time (Local / UTC) |

| Sydney Session – Australia (AEST) | 08:00 AEST / 22:00 UTC | 16:00 AEST / 06:00 UTC |

| Tokyo Session – Japan (JST) | 09:00 JST / 00:00 UTC | 18:00 JST / 09:00 UTC |

| London Session – UK (GMT) | 08:00 GMT / 08:00 UTC | 16:00 GMT / 16:00 UTC |

| New York Session – US (EST) | 08:00 EST / 13:00 UTC | 17:00 EST / 22:00 UTC |

You can learn more about the best forex trading hours for Australians using our Time Zone Converter.

History of the London Trading Session

The London Stock Exchange (LSE) was eventually formed in 1801. Today, London remains the world’s largest forex trading centre. Often considered the original forex trading session, London has been a major financial hub since the Middle Ages, and was the birthplace of the foreign exchange market in its current form.

History of the New York Trading Session

The New York session emerged as US markets grew in significance, with Wall Street being a financial hub since the late 18th century. In 1792, the New York Stock Exchange (NYSE) was established, making it the oldest stock exchange in the United States.

At present, New York is the second largest forex trading session, and considered the unofficial close of the forex trading day.

History of the Tokyo Trading Session

The Tokyo session gained prominence after World War II as Japan rebuilt its economy and become a major player in the global finance world. The Tokyo Stock Exchange (TSE) was first established in 1878, but was temporarily closed during the Second World War.

Tokyo is the financial hub for the Asian session, which is the third largest of the four key trading sessions.

History of the Sydney Trading Session

The Sydney session is by far the youngest, with the Australian Securities Exchange (ASX) only being founded in 1987, following a merger of six independent stock exchanges in Australia.

The Australian session is the smallest of the key trading trading sessions, but still a significant session in the Pacific region.

When is the Best Time to Trade Forex?

Due to high liquidity and volatility, the best time to trade forex is when the London and New York sessions overlap, between 1:00 pm and 4:00 pm BST. For Australian traders, the overlapping period where volatility is at its peak is between 10:00 pm and 1:00 am AEST.

The UK is the leader in terms of trading volume, which peaks during the London trading session.

The Asian session is more suitable for flat strategies, while quieter periods during the New York and London sessions are suitable for trading strategies that require stable price movement.

In terms of the best day to trade forex, Thursday and Friday are the most volatile weekdays.

The exception to this is short-term fluctuations following the release of key news (i.e. interest rate decisions, announcements regarding budget and trade deficits, elections, trade wars, global crises, and so on).

Forex Session Time Zone Converter Tool

The Forex Time Zone Converter above is a useful tool to learn more about the different forex trading sessions and opening hours worldwide. It shows the four primary trading sessions, being Sydney, New York, London, and Tokyo, each of which corresponds to a major financial hub, as well as the current average trading volume.

Forex Market Time Zone Converter

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

Sydney

(UTC +10)

Tokyo

(UTC +9)

London

(UTC +1)

New York

(UTC -4)

Trading Volume is usually

at this time of day.

By sliding the draggable clock, you can view how each trading session corresponds with the time zone you have selected, as well as the trading volume for that period.

Forex Trader Demographics

Who Trades Forex?

Participants in the foreign exchange market are mainly financial institutions such as hedge funds, investment managers, and multinational corporations, along with commercial, investment, and governments

How Many Forex Traders Are There?

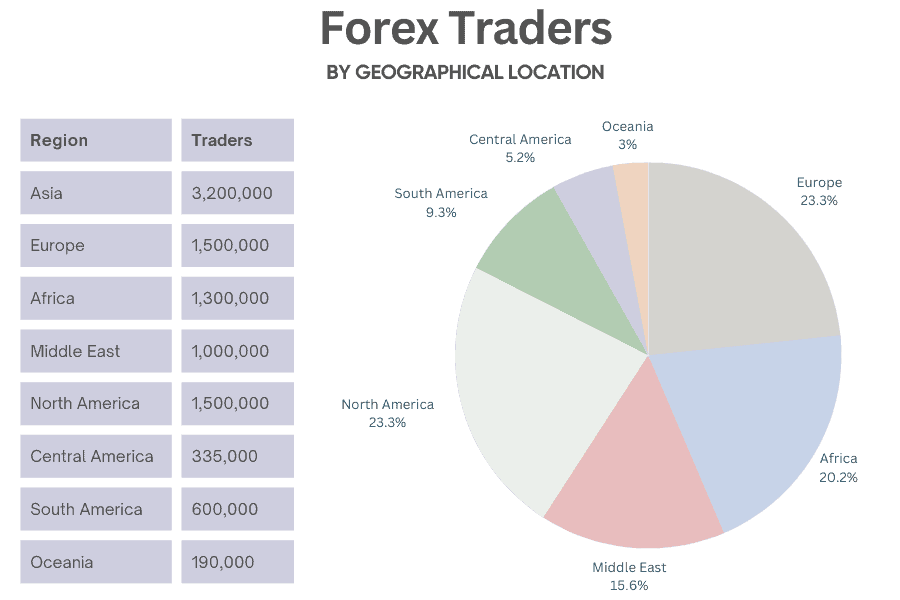

There are approximately 10 million forex traders in the world today. This figure encompasses a diverse range of participants, from beginner traders who are just getting started to seasoned institutional investors.

Where is Forex Trading Most Popular?

The majority of people making forex trades – 3.2 million in total – live in Asia, followed by Europe and North America, which claim 1.5 million each. Africa boasts 1.3 million forex traders, and the Middle East 1 million. 600,000 call South America home. Central America has around 335,000 traders, while Oceania brings up the rear with 190,000.

Who Are Forex Traders?

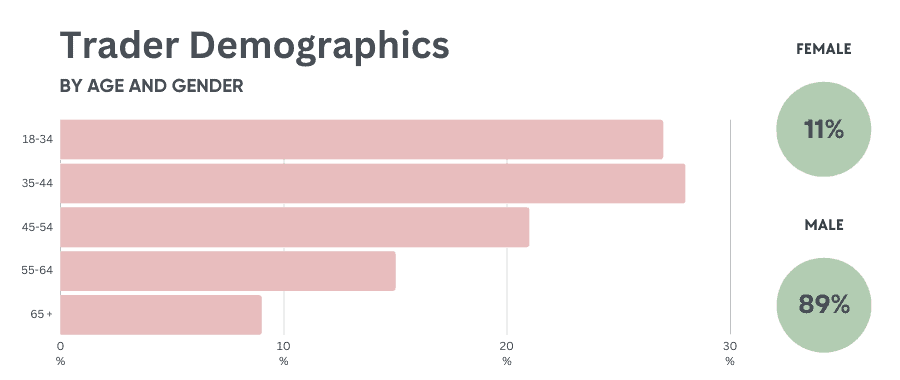

Men make up 89% of all forex traders worldwide, while only 11% of traders are women. A study by Warwick Business School found that women outperform men by 1.8%, due to a preference for long-term strategies over short-term risk.

In terms of age, forex traders are perhaps younger than you’d expect – 27% of forex traders fall into the 18-34 age group. The 35-44 age group represents 28% of traders, while the 45-54 age group accounts for 21% of traders. Only 24% of traders are older than 55, and only 9% are older than 65.

2. Forex Currency Statistics

Major Currency Pairs

The seven major currency pairs are the most frequently traded currency pairs in the forex market and include:

- Euro vs US Dollar (EUR/USD)

- US Dollar vs Japanese Yen (USD/JPY)

- Great British Pound vs US Dollar (GBP/USD)

- Australian Dollar vs US Dollar (AUD/USD)

- US Dollar vs Swiss Franc (USD/CHF)

- US Dollar vs Canadian Dollar (USD/CAD)

- NZ Dollar vs US Dollar (NZD/USD)

Known as the “majors” because they involve the currencies of the world’s largest and most influential economies, these currencies are typically characterised by high liquidity and low spreads.

As a result, they enjoy great popularity among traders and are often used as benchmarks for other fx pairs.

What are the Most Traded Currency Pairs?

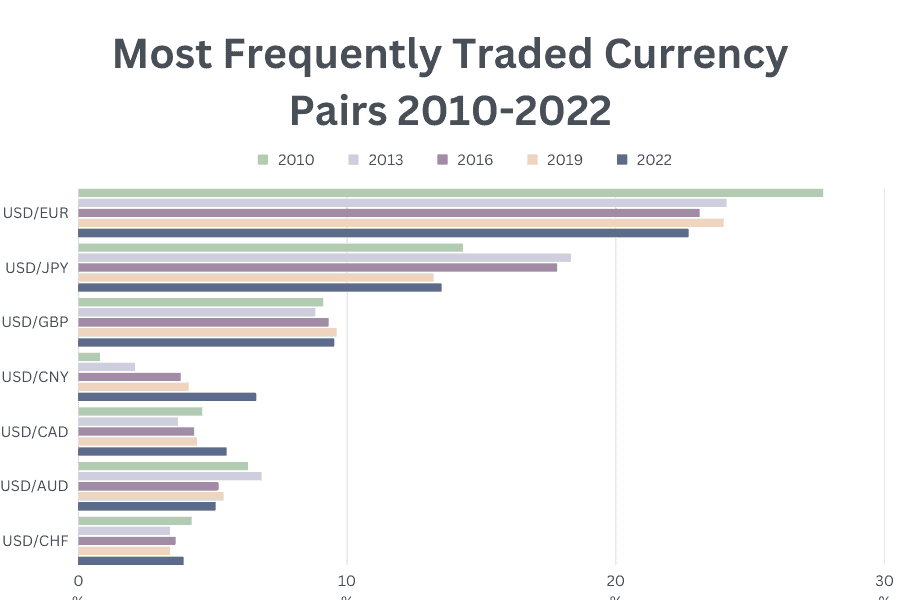

In 2022, the seven most frequently traded currency pairs were:

- Euro vs US Dollar 22.7%

- United States Dollar vs Japanese Yen 13.5%

- Great British Pound vs US Dollar 9.5%

- United States Dollar vs Chinese Yuan 6.6%

- United States Dollar vs Canadian Dollar 5.5%

- Australian Dollar vs United States Dollar 5.1%

- United States Dollar vs Swiss Franc 3.9%

Percentage share calculated by share of the over-the-counter (OTC) derivatives market

The global forex market comprises over 170 different major, minor, and exotic currencies.

Of these, seven major pairs make up 85% of global foreign exchange transactions.

The most commonly traded fx pair is the EUR/USD, accounting for 22.7% of global forex turnover. The second most traded currency pair is the USD/JPY, making up 13.5%. The third most traded currency pair is the GBP/USD, which accounts for 9.5% of turnover.

From 2010 to 2022, traditional currency pairs continue to dominate global fx turnover, but emerging pairs like USD/CNY are on the rise.

Analysis of average daily trading volume of different fx pairs from 2010 to 2022 shows that majors like EUR/USD and USD/JPY continue to make up the bulk of global forex turnover. Yet, the rising stars such as USD/CNY, offer forex traders both opportunities and challenges in crafting their trading strategies.

1. USD/EUR

Although still dominant, its share has decreased from 27.7% in 2010 to 22.7% in 2022. Nevertheless, the amount has generally increased over the years, reaching $1,705 billion in 2022.

2. USD/CNY

The significant gain in both volume and market share reflects China’s growing influence in the global economy. The 677% market share increase in USD/CNY from 2010 to 2022 signals a seismic shift in forex trading.

3. USD/JPY

This pair saw a significant jump from 2010 to 2013 but has since settled to a stable share of around 13.5% in 2022. The amount, however, has increased to $1,013 billion.

4. USD/GBP

Consistently popular, the share has remained stable at around 9%, and the amount has increased steadily, reaching $714 billion in 2022.

5. USD/AUD

The share has declined from 6.3% to 5.1%, even though the amount has seen a moderate increase over the years.

6. USD/CHF

Despite a slight dip in the middle years, the share and amount have somewhat increased, with the pair clocking $293 billion in 2022.

| Forex Pair | 2010 (%) | 2013 (%) | 2016 (%) | 2019 (%) | 2022 (%) |

| USD/EUR | 27.7 | 24.1 | 23.1 | 24.0 | 22.7 |

| USD/JPY | 14.3 | 18.3 | 17.8 | 13.2 | 13.5 |

| USD/GBP | 9.1 | 8.8 | 9.3 | 9.6 | 9.5 |

| USD/CNY | 0.8 | 2.1 | 3.8 | 4.1 | 6.6 |

| USD/CAD | 4.6 | 3.7 | 4.3 | 4.4 | 5.5 |

| USD/AUD | 6.3 | 6.8 | 5.2 | 5.4 | 5.1 |

| USD/CHF | 4.2 | 3.4 | 3.6 | 3.4 | 3.9 |

While traditional pairs like USD/EUR and USD/JPY still dominate, other currency pairs like USD/CNY are rapidly gaining ground. This offers a broader range of options for traders but also calls for more nuanced strategies.

Minor and Exotic Pairs

Minor forex pairs involve currencies less frequently traded than the majors, while exotic pairs pair a major currency with a currency from an emerging or smaller economy.

The landscape for minor and exotic pairs showcases different dynamics, with some like EUR/CNY gaining traction and others like USD/TRY losing ground due to varying economic factors.

Emerging market economies often experience more volatility, influenced by economic factors such as political instability, fluctuating interest rates, as well as budget and trade deficits.

USD/TRY

The daily turnover of the USD/TRY was not available in 2010, but in 2022 it had decreased from $64 billion in 2016 to $24 billion. The forex pair also only accounted for 0.3% of forex activity in 2022, down from 1.3% in 2016. A significant drop in both volume and market share, possibly due to economic instability in Turkey.

EUR/GBP

The daily turnover of EUR/GBP increased from $109 billion in 2010 to $154 billion in 2022. Despite Brexit uncertainties, this pair has seen a steady increase in volume while maintaining a stable market share of 2%.

EUR/CNY

The value of EUR/CNY traded increased from $1 billion per day in 2013 to $10 billion in 2022, while market share increased from 0.0% to 0.1%. Though still a minor player, the rapid growth indicates increasing interest in trading between the Eurozone and China.

JPY/AUD

JPY/AUD average daily turnover rose from $24 billion in 2010 to $37 billion in 2022, while their percentage share decreased from 0.6% to 0.5%. The forex pair saw a moderate increase in volume but a slight dip in market share, indicating it’s not growing as fast as other pairs.

Significant changes have occurred in the trading volumes and market shares of various minor and exotic fx pairs between 2010 and 2022. These shifts range from the USD/TRY’s notable decline in both volume and market share to the EUR/CNY’s rapid growth, indicating varying levels of forex trader interest and economic factors at play.

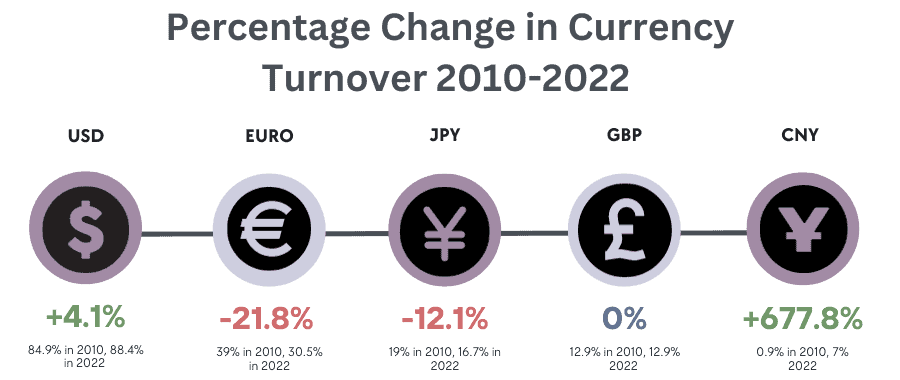

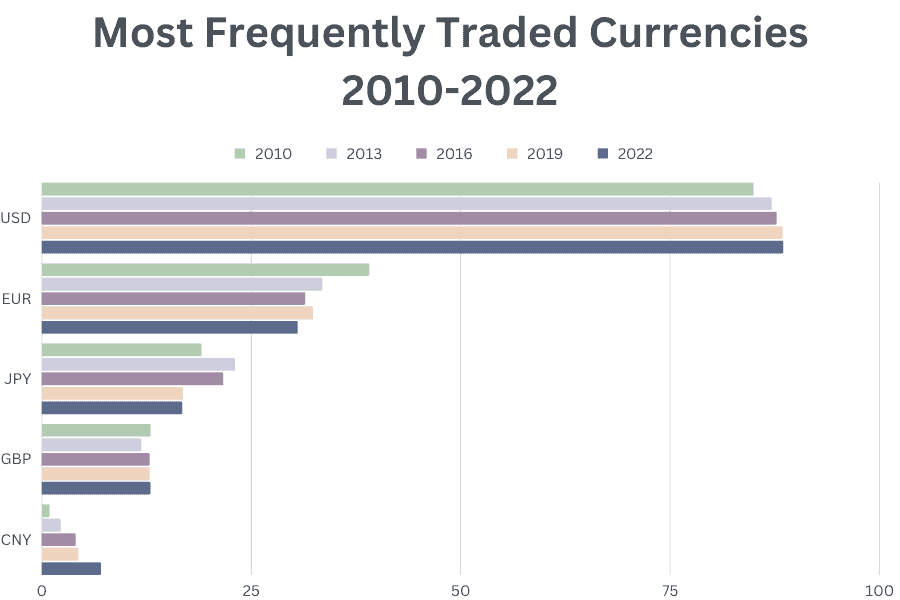

What Are the Most Popular Currencies?

The most popular and influential currencies are the:

- US Dollar (USD)

- EUR (Euro)

- JPY (Japanese Yen)

- GBP (Great British Pound)

- CNY (Chinese Yuan)

While 38% of all forex transactions take place in the UK, 88% of global foreign exchange transactions involve the dollar.

Data from 2010 to 2022 provides a snapshot of how the landscape has evolved. The USD has consistently maintained its dominance, seeing a slight uptick over the years. On the other hand, the EUR has experienced a decline, albeit still holding a significant share. The JPY and GBP have remained relatively stable, while the CNY has shown a remarkable rise, albeit from a low base.

This not only reflects the shifting power dynamics in the global economy but also offers valuable insights for traders looking to diversify their portfolios.

1. USD (United States Dollar)

The USD has strengthened its grip as the world’s most traded currency, increasing its share in OTC foreign exchange turnover from 84.9% to 88.4% over the last 12 years.

2. EUR (Euro)

While still the second most traded currency, the EUR has lost forex market share, sliding from a 39.0% share in 2010 to 30.5% in 2022, despite an increase in its OTC turnover amount.

3. JPY (Japanese Yen)

The JPY saw a significant spike in 2013, reaching a 23.0% share, but has since declined to 16.7% in 2022, reflecting its fluctuating appeal in the forex market.

4. GBP (British Pound)

The GBP has shown remarkable stability, maintaining a nearly constant share of 12.9% in both 2010 and 2022, while nearly doubling its OTC turnover amount.

5. CNY (Chinese Yuan)

The CNY has been the star performer, skyrocketing its share from just 0.9% in 2010 to 7.0% in 2022, marking a staggering 677% increase in its forex market share.

Changes in global monetary policy, coupled with inflation, are likely driving forex traders to more reliable fx pairs. Outside of the main currencies, the average daily turnover for emerging market currencies decreased slightly from 19% to 18%.

| Currency | 2010 (%) | 2013 (%) | 2016 (%) | 2019 (%) | 2022 (%) |

| USD | 84.9 | 87.0 | 87.6 | 88.3 | 88.4 |

| EUR | 39.0 | 33.4 | 31.4 | 32.3 | 30.5 |

| JPY | 19.0 | 23.0 | 21.6 | 16.8 | 16.7 |

| GBP | 12.9 | 11.8 | 12.8 | 12.8 | 12.9 |

| CNY | 0.9 | 2.2 | 4.0 | 4.3 | 7.0 |

3. Forex Statistics: Brokers

What are the Largest Forex Brokers?

The largest online brokers by volume is Australian brokerage IC Markets with $22.68 billion in daily turnover. US-based Forex.com gained popularity and is now the second largest broker, with XM in third.

IC Markets

Founded in Australia and regulated by ASIC (Australia), CySEC (Europe), and the FSA (offshore), IC Markets has carved a niche for itself as one of the largest forex brokers by volume. The forex broker operates on an ECN model and offers top trading technology and incredibly low spreads, making it a favourite among forex traders. With a daily turnover of $22.68 billion, it’s no surprise that our IC Markets Review found them to be one of the most popular brokers.

Forex.com

Established in 2001 and regulated by multiple financial bodies like the FCA (UK), CFTC (US), and CySEC, Forex.com has risen to prominence in the forex trading world. The broker operates on both a dealing desk and STP model, offering a range of platforms and tight spreads. Our Forex.com Review rated the broker highly for their no-commission trading account.

XM

Established in 2009 and regulated by ASIC, CySEC, and the FCA, XM is a no dealing desk broker that has gained traction in the forex trading community. The online broker is known for its no requotes policy and fast execution speeds. You can view the 2025 XM Review.

4. Global Forex Trading Statistics

Which Countries Have the Most Forex Turnover?

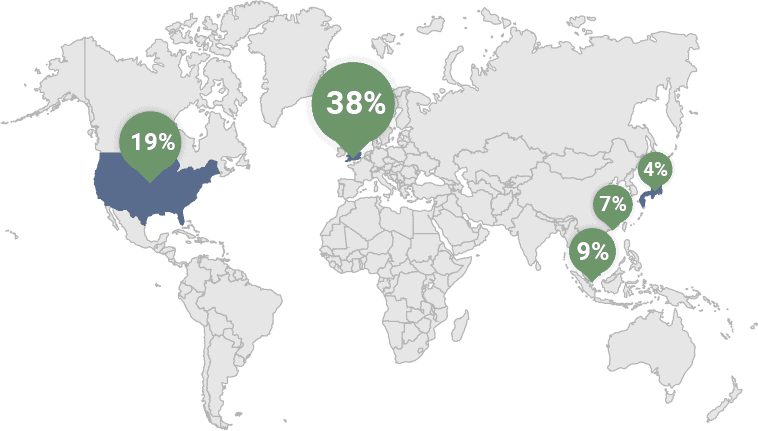

In terms of global forex trading, the United Kingdom is by far the largest foreign exchange trading centre, accounting for 38% of global turnover, followed by the US at 19%. Singapore has the third highest level of forex turnover with turnover rising from 8% in 2019 to 9% in 2022. Hong Kong SAR is the fourth highest but declined to 7% from 8%, while Japan fell from 5% to 4% and has the fifth highest forex turnover globally.

78% of global foreign exchange turnover takes place in one of the five major financial centres around the world: the UK, the US, Hong Kong, Singapore, and Japan.

- United Kingdom: London’s status as a financial hub makes it a hotspot for forex traders, contributing significantly to the global daily trading volume.

- United States: Known for its robust markets, the US is contributes greatly to the worlds average daily turnover.

- Singapore: The country is becoming a signifiant player in the forex world and has seen a steadily riding trend in its forex market share.

- Hong Kong: Despite strong financial infrastructure, Hong Kong has seen a slight dip in its contribution to global turnover lately.

- Japan: Although the Yen is a frequently traded currency, the Japanese forex market has seen a decrease in average daily trading volume recently.

Australian Forex Trading Statistics

How Popular is Forex Trading in Australia?

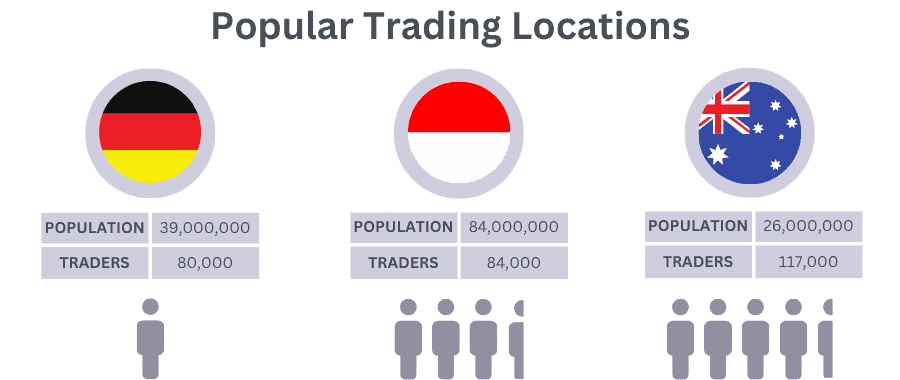

According to the most recent edition of Investment Trends, Australia has the largest penetration of CFD/FX trading in the world on a per-capita basis. In 2021, over 100,000 Australians executed one or more FX or CFD transactions. There are also the most forex brokers in Australia based on a per capita basis.

After Australia, the next largest countries in terms of the number of active trades are Germany (84,000) and Poland (80,000). To put this in perspective, Australia’s population of 26 million is significantly lower than Germany (84 million) and Poland (38 million) but Australia still has more active traders.

CFD/FX trading continues to gain popularity in Australia. In 2017, 61,00 Australians had an FX account that was active, in 2018 and 2019 this grew to between 75,000 and 79,000, respectively. Numbers continued to climb in the following years, reaching 117,000 in 2020.

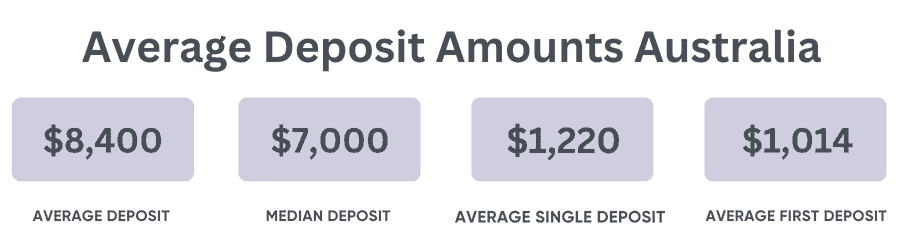

What Is the Average Deposit in Australia?

Between January and October 2021, the average deposit by Australian traders into their forex trading account was $8,400.

The average median for the same period was $7,000 while the average single deposit was $1,220. This deposit is similar to the average first deposit of $1,014 ($642 median), according to cPattern data.

5. Forex Statistics: The History of Forex Markets

Forex History Statistics

The forex market has transformed significantly over centuries, evolving from traditional currency exchange to a sophisticated, technology-driven global trading environment. Here are some key statistics that illustrate foreign exchange markets evolution:

- People have been trading fx for hundreds of years. The first forex market in history was established in Amsterdam nearly 500 years ago.

- Forex trading popularity saw a rise in popularity in the early 20th century, between 1903-1913 the number of trading firms in London increased from 3 to 71.

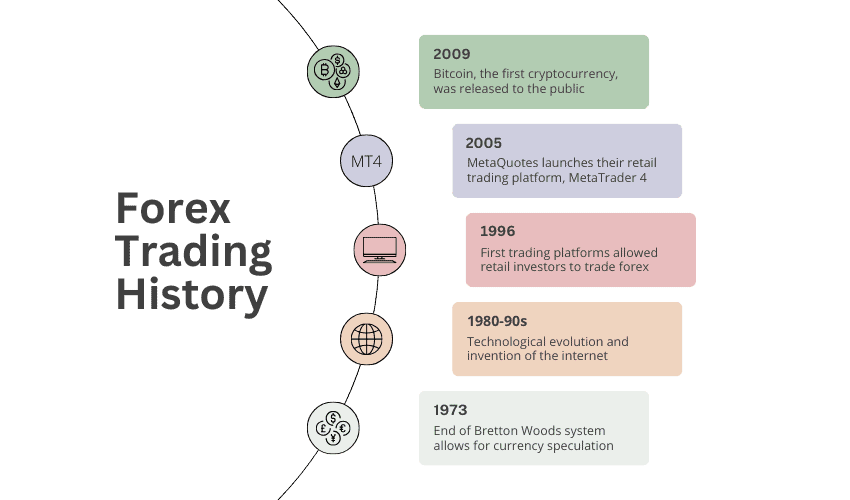

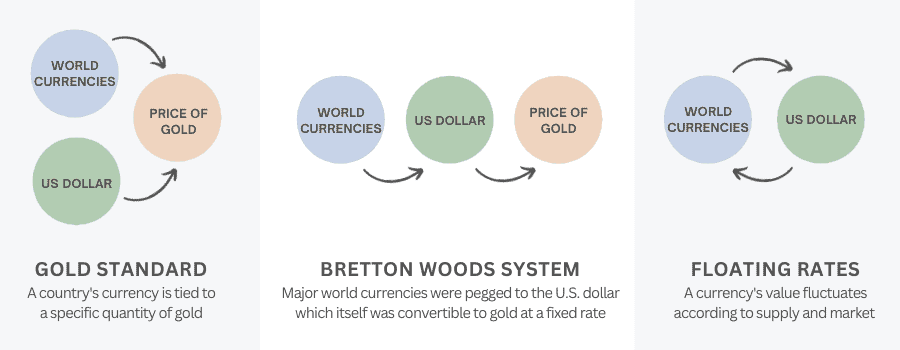

- Prior to 1973 speculating on currency movements was not possible due to central banks monetary policy (the gold standard and Bretton Woods agreement). When the Bretton Woods system collapsed in 1973, floating exchange rates were introduced, enabling speculative trading.

- A key change that aided retail forex trading was the technological wave in the 1980s-1990s and the invention of the internet.

- From 1996, retail forex traders were able to enter the market with the first trading platforms released and the market became even more accessible in 2005 when MetaQuotes released MetaTrader 4 (MT4).

How Did Retail Forex Trading Start?

The Gold Standard and the Bretton Woods system worked to control global monetary policy and currency valuation. As Central Banks tightly regulated exchange rates, traders could not speculate on foreign currency movements.

After the collapse of the Bretton Woods system in 1973, floating exchange rates opened the door for modern-day forex trading.

Prior to the 1970s, forex trading as we know it today did not exist.

History of Forex Trading Platforms

The history of forex trading software dates back to 1996 when the first trading platforms were introduced to retail investors, allowing them to participate in fx markets for the first time. Following the introduction of retail traders to fx markets, MetaQuotes began releasing software designed for non-professional traders.

In 2005, the company launched MetaTrader 4 (MT4), which remains the gold standard and most popular retail forex platform to date. Although MetaQuotes released MetaTrader 5 in 2010, MT4 still remains the most popular retail platform in the world.

Today, 10 million traders around the world use either the MetaTrader 4 or MetaTrader 5 platforms.

History of Cryptocurrency

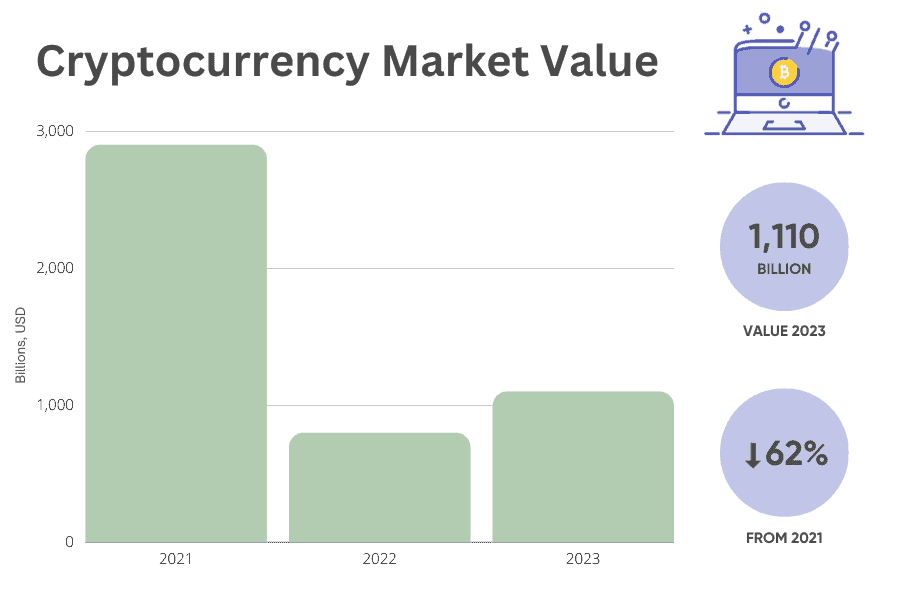

Since the 2009 release of Bitcoin (the world’s first decentralised currency) the crypto market has expanded to include over 6,600 other cryptocurrencies.

In 2022, the total value of the global cryptocurrency market plummeted to $798 billion from a peak of $2.9 trillion in 2021. Throughout the last year, crypto markets have strengthened again reaching a value of $1.1 trillion in 2023.

Highly volatile (and highly profitable) cryptos are usually traded against the USD (US dollar), EUR (Euro), GBP (British pound sterling), or AUD (Australian dollar).

6. Forex Trading During COVID

Did COVID Increase the Global Interest in Forex Trading?

The COVID-19 pandemic led to the fx industry undergoing transformative changes, with interest in forex trading peaking in May 2020. Volatility spiked, particularly in major currency pairs like EUR/USD and GBP/USD. Heightened activity led to a surge in trading volumes, reaching a staggering $6.6 trillion in 2020, up from $5.1 trillion in 2016.

Retail participation also soared during COVID, with some brokers witnessing a 30% plus uptick in active clients during 2020.

Regulatory bodies like the Financial Conduct Authority (FCA) in the UK have ramped up their oversight, issuing new guidelines to safeguard retail traders from the risks associated with high volatility. On the technological front, brokers have been investing in advanced trading platforms to manage the increased trading volume effectively. This has been a boon for brokers, many of whom reported record profits.

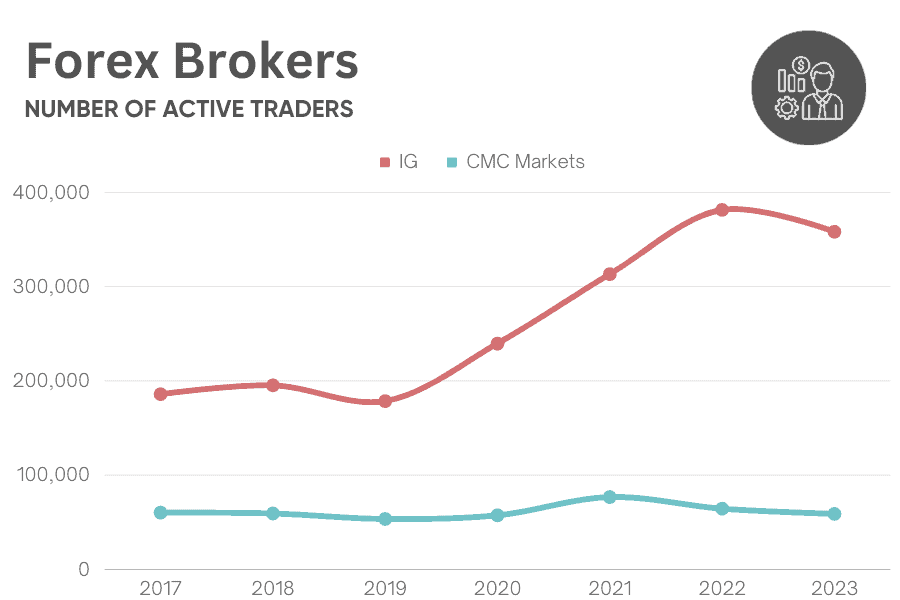

Case Study: Forex Brokers During COVID

The impact of the Covid-19 pandemic on the trading industry is undeniable, especially when examining key metrics from publicly listed brokers IG and CMC Markets. A review of the past six years reveals stark shifts in Profit After Tax and the number of Active Clients, with both brokers experiencing surges in 2020 and 2021, only to face declines in subsequent years.

These fluctuations not only highlight the pandemic’s role in driving trading activity but also pose questions about market dynamics in a post-pandemic world.

Case Study: After Tax Profits

IG saw a significant spike of 51-54% in profits during 2020-2021 likely attributed to increased trading activity during the Covid-19 pandemic.

CMC Markets showed a staggering increase in Profit After Tax during the pandemic period. In 2020, the brokers profit after tax skyrocketed by 1372.88%.

The following year, profit after tax saw a 105.08% increase. Yet, in recent years, CMC Markets have experienced a 42-59% decrease in profit after tax, showing the significant effect the Covid-19 period had on brokerage profitability.

| Year | IG (mil, GBP) | % Change (IG) | CMC Markets (mil, GBP) | % Change (CMC Markets) |

| 2023 | 363.7 | -8.19% | 41.4 | -42.07% |

| 2022 | 396.1 | 6.51% | 71.5 | -59.88% |

| 2021 | 371.9 | 54.72% | 178.1 | 105.08% |

| 2020 | 240.4 | 51.92% | 86.9 | 1372.88% |

| 2019 | 158.3 | -30.08% | 5.9 | -88.13% |

| 2018 | 226.4 | 33.81% | 49.7 | 26.78% |

| 2017 | 169.2 | – | 39.2 | – |

Case Study: Number of Active Clients

Both IG Group and CMC Markets saw a significant increase in active clients during the pandemic years (2020 and 2021), suggesting that more individuals turned to trading during this period.

The subsequent decline in 2023 for both brokers could indicate forex market saturation or reduced trading enthusiasm post-pandemic.

| Year | IG | % Change (IG) | CMC Markets | % Change (CMC Markets) |

| 2023 | 358,300 | -6.08% | 58,737 | -8.46% |

| 2022 | 381,500 | 21.81% | 64,243 | -16.08% |

| 2021 | 313,300 | 30.73% | 76,591 | 33.84% |

| 2020 | 239,600 | 34.20% | 57,202 | 7.30% |

| 2019 | 178,500 | -8.56% | 53,308 | -10.07% |

| 2018 | 195,200 | 5.06% | 59,165 | -1.53% |

| 2017 | 185,800 | – | 60,082 | – |

The COVID-19 pandemic appears to have significantly impacted trading activities, leading to a spike in both net operating income and the number of active clients for IG and CMC Markets in 2020 and 2021.

IC Markets Insights

Over the COVID period, IC markets saw their brand popularity increase by 21%.

In 2023 their brand health has been consistent with the UK attracting the highest number of searches on Google.

The main source of interest from the top 8 locations is within the United Kingdom where 29.8% of interest came from in June 2022. Australia where the broker originated from now only accounts for 6.1% of the top 8 country traffic sources. The broker is known for its automated trading platforms and other ECN-style functions.

7. Forex Technology Statistics

What is the Most Popular Trading Platform?

MetaTrader 4 (MT4) remains the most popular platform by the number of users according to data from the MetaQuotes website (the company behind the MetaTrader 4 and MetaTrader 5 platforms).

85% of traders use MetaTrader 4, making it the most popular platform worldwide, while MT5 is used by 6% and ranks second.

As of 2021, over 80% of online brokers globally offered MT4 to customers, and the trading platform had an estimated user base of over 8 million traders. MT5, on the other hand, can claim only 2 million traders and is offered by just 20% of brokers.

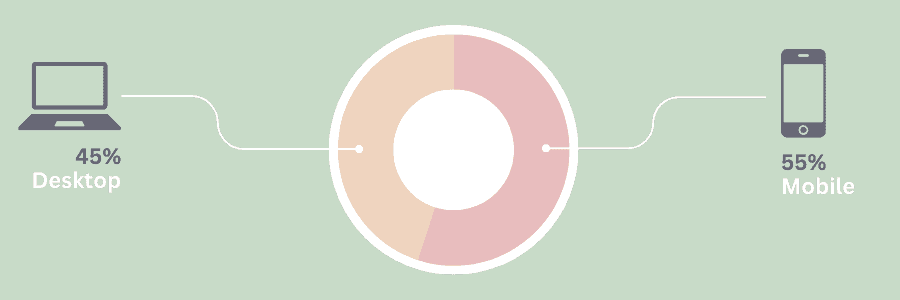

How do people trade?

55% of forex traders prefer to use a mobile device and trading app, versus 45% who use a desktop computer or web app.

8. Forex Trading Popularity By Country

In 2025 we have made a list of the most searched term for each country and the average search volume over 2025 to indicate the popularity of trading forex.

| Country | Search Term | Google Monthly Searches |

|---|---|---|

| India | Best Forex Broker India | 4,400 |

| Thailand | โบรกเกอร์ forex | 4,400 |

| Vietnam | sàn forex uy tín | 2,900 |

| UK | Best Forex Broker UK | 1,900 |

| South Africa | Best Forex Broker South Africa | 1,300 |

| USA | Best Forex Broker USA | 1,300 |

| UAE | Best Forex Broker UAE | 1,300 |

| Australia | Best Forex Broker Australia | 1,000 |

| Mexico | mejores brokers en mexico | 720 |

| Malaysia | Best Forex Brokers Malaysia | 720 |

| Singapore | Best Forex Broker Singapore | 720 |

| New Zealand | Forex Broker New Zealand | 550 |

| Canada | Best Forex Broker Canada | 260 |

9. Forex Risk

As a retail investor, speculating on forex involves a very high risk of losing money due to high leverage and volatile fx markets. According to the financial body of the UK, the Financial Conduct Authority (FCA), about 80% of retail fx traders lose money.

Although 29% of retail investors achieve capital gains, 99% of fx traders fail to make profits for more than 4 continuous quarters.

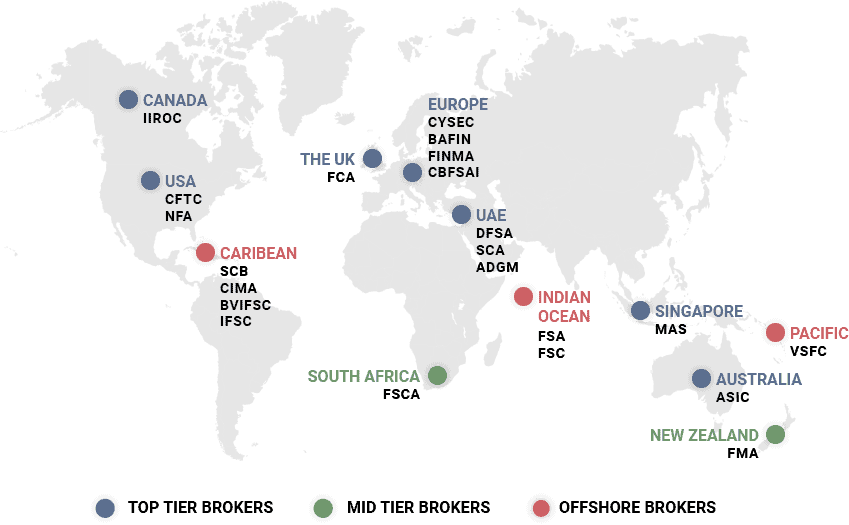

Who Regulates Forex Brokers?

Forex brokers are regulated by various financial authorities worldwide, each with distinct levels of oversight, ranging from stringent top-tier regulators to more lenient offshore bodies.

At CompareForexBrokers, we recommend trading exclusively through a fully licensed and regulated brokerage in your jurisdiction. There are different tiers of regulatory bodies depending on the framework enforced.

Top-tier Regulators

While top-tier financial regulators exist around the world and reflect national mores, all share several key characteristics: a strong legal framework and regulatory powers; stringent licensing and registration requirements for brokers; robust investor protection measures to prevent fraud; transparent dispute resolution procedures; and, regular audits and inspections.

Mid-tier Regulators

A mid-tier financial regulator may not offer the same regulatory powers and investor protection measures as a top-tier regulator, yet it still has a solid legal framework and enforces strict licensing and registration requirements for CFD brokers operating within its jurisdiction.

However, the quality and effectiveness of financial regulation can vary significantly between different mid-tier regulators, and forex traders should always conduct research before choosing a forex broker.

Offshore Regulators

Offshore regulators are generally less stringent than the stricter, top-tier regulators, yet the regulatory environments can vary significantly between different countries.

Some offshore regulators may have strong legal frameworks and robust investor protection measures in place, while others offer weaker regulations as well as licensing and registration requirements.

Disclaimer: Cryptocurrencies carry more risk than forex and other CFDs due to the historically high volatility of crypto markets. For this reason, all top forex brokers in the UK regulated by the FCA have been banned from trading cryptocurrencies for retail investors from 2020.

There is a high risk of losing money forex trading. For example, City Index (owned by GAIN Capital Holdings), warns 70% of CFD traders lose money trading forex. To reduce the risk of losing money when making forex trades, its recommended forex traders sign up to a regulated broker, practise forex trades on a demo account, make forex transactions with secure payment methods, and read all terms and conditions before trading.

Registering with a regulated broker will ensure you receive certain protections designed for retail forex traders, such as segregated client funds, leverage caps, and negative balance protection in some jurisdictions. These are designed to protect traders from losing significant amounts of money trading forex.

Note: Forex currency pairs and fx are used interchangeably throughout this article.

Sources

- BIS Triennial Central Bank Survey

- Warwick Business School

- Forex Trading Stats for Marketers

- BIS: Sizing up Global Foreign Exchange Markets

- Analysis: Australia Has the Largest FX/CFD Market Per Capita in the World (Finance Magnates)

Bank for International Settlements (BIS)

The majority of the forex trading statistics referenced in this article are sourced from the Bank of International Settlements (BIS) Triennial Central Bank Survey 2022. The survey conducted by BIS is the largest global analysis of financial markets, focusing on OTC derivatives and currency markets.