Blackbull Markets vs ThinkMarkets: Which One Is Best?

This comparison between two forex brokers, BlackBull Markets vs ThinkMarkets, reveals similar trading execution, accounts, spreads and forex platforms and products for trade. Which one is fitted for you? Let’s find out.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between BlackBull Markets and ThinkMarkets:

- BlackBull Markets provides a faster execution speed and better trading platforms.

- BlackBull Markets stands out with its vast selection of tradeable assets in forex, and more versatile tooling, including cTrader and TradingView.

- BlackBull Markets offers 67 forex pairs and over 26,000 CFDs.

- ThinkMarkets boasts lower spreads/costs.

- ThinkMarkets is regulated by two Tier 1 authorities, ASIC (Australia) and FCA (UK), offering a more secure trading environment.

1. Lowest Spreads And Fees – ThinkMarkets

We found out in our forex focused assessment that, despite, both brokers having no dealing desk and straight through processing (STP) execution, ThinkMarkets offered a more cost-effective environment.

ThinkMarkets advertises a general average spread of 1.1 pips in terms of Standard Accounts, which doesn’t cover any particular currency pairs. It’s hard to determine how ThinkMarkets arrived at this average figure, but our staff member Ross Collins did some research of his own in our comparative testing process.

Ross measured, in his test of Standard Account Spreads, spreads of 6 major currency pairs over a 24-hour period for BlackBull Markets and found the overall average to be 1.82 pips. If we presume ThinkMarkets’ self-assessment of their average spreads of 1.1 to be a true reflection, then ThinkMarkets and BlackBull Markets’ average spreads are neck to neck.

Unlike with the Standard Account, Ross Collins tested the Raw Account Spreads or ECN style trading accounts (meaning with commissions) using each broker. Our tests found ThinkMarkets ThinkZero account averaged 0.46 pips and BlackBull Markets ECN Prime averaged 0.94 pips when we combined the average of 6 major currency pairs. If we use only EUR/USD (the most popular currency pair) as our measure, then ThinkMarkets trump BlackBull Markets 0.22 pips to 0.46 pips–a notable difference between similar accounts.

While spreads with ThinkMarkets are lower, it’s good to note that BlackBull Markets actually charges a slightly lower commission (USD 3.00 vs ThinkMarkets’ (USD 3.50) commission for each standard lot. With this in mind, we can unpack our findings to get a sense of the real cost:

- With ThinkMarkets, If you buy 1 lot at 0.22 pips, then your costs will be $2.20 + $3.50 = $5.70.

- With BlackBull, if you buy 1 lot at 0.46 pips, then your cost will be $4.60 + $3.00 = $7.60.

While ThinkMarkets is cheaper, the total cost difference is not as pronounced as it might seem at first glance.

| BlackBull Markets | ThinkMarkets | |

|---|---|---|

| Average Spread | ECN Standard - min 1.0 pips (1.85 pips avg) ECN Prime - min 0.0 pips (0.8 pips avg) | Standard - min 1.1 pips (avg 1.2 pips) ThinkZero - min 0.0 pips (avg 0.8 pips) |

| Commission (round-turn) 100,000 | USD $6 per lot (ECN Prime) | USD $7 per lot |

| Inactivity fees | None. | None |

| Active Trader Discount | None | |

| Minimum deposit | ECN Standard - $0 ECN Prime - $2,000 | Standard - $0 ThinkZero - USD 500 |

| Withdrawal fees | $5 withdrawal per transaction | None |

| Our Cost Score | 5 | 6 |

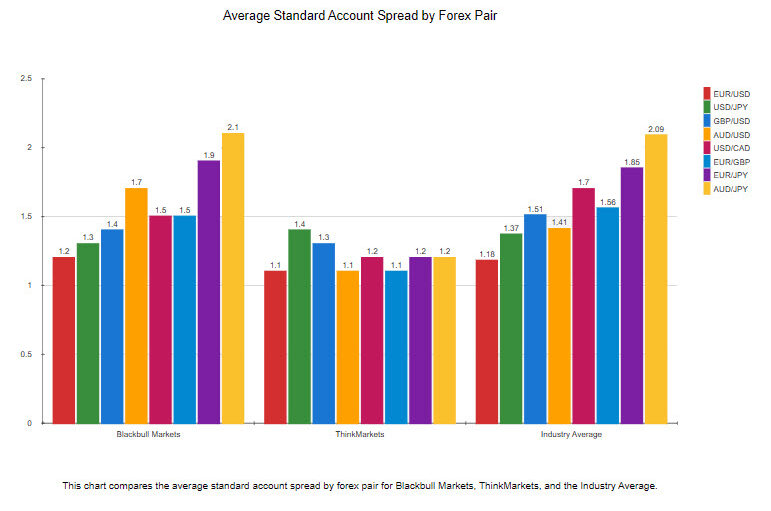

Standard Account Spreads

When it comes to forex trading, the spread is a crucial factor that can significantly impact a trader’s profitability. Let’s take a closer look at the average standard account spreads for two popular brokers: BlackBull Markets and ThinkMarkets.

BlackBull Markets offers competitive spreads across various forex pairs. For instance, the EUR/USD pair has a spread of 1.1, which is on the average rate than the industry average of 1.2. BlackBull Markets offers a spread of 1.2 for the AUD/USD pair though, which is, again, on an average rate than the industry average of 1.6. This suggests that while BlackBull Markets might be a good choice for some forex pairs, it might not be the most cost-effective option for others.

On the other hand, ThinkMarkets offers a spread of 1.1 for the EUR/USD pair, which is slightly lower than the industry average. For the AUD/USD pair, ThinkMarkets offers a spread of 1.1, which is significantly lower than the industry average. This suggests that ThinkMarkets could be a more cost-effective choice for traders who frequently trade these forex pairs.

We give an overall score of 6 for ThinkMarkets in contrast to BlackBull Markets’ 5, but we need to look beyond spreads and costs, by looking at other factors such as minimum deposits, funding fees, inactivity charges and discounts.

| Standard Account | BlackBull Markets Spreads | ThinkMarkets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.5 | 1.2 | 1.7 |

| EUR/USD | 1.10 | 1.10 | 1.2 |

| USD/JPY | 1.40 | 1.40 | 1.5 |

| GBP/USD | 1.4 | 1.3 | 1.6 |

| AUD/USD | 1.2 | 1.1 | 1.6 |

| USD/CAD | 1.4 | 1.2 | 1.9 |

| EUR/GBP | 1.7 | 1.1 | 1.5 |

| EUR/JPY | 1.8 | 1.2 | 2.1 |

| AUD/JPY | 2 | 1.2 | 2.3 |

Standard Account Analysis Updated January 2026[1]January 2026 Published And Tested Data

It’s important to remember that the spread is just one factor to consider when choosing a forex broker. Other factors that should be crucially considered are customer service, trading platform, and regulatory compliance. I would recommend doing your own research and testing out different brokers to find the one that best suits your trading needs and style.

Our Lowest Spreads and Fees Verdict

ThinkMarkets gets the ace in this category for having the lowest spreads and fees.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

2. Better Trading Platform – BlackBull Markets

| Trading Platform | BlackBull Markets | ThinkMarkets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Both brokers at heart are MetaTrader brokers, meaning their core trading platforms are MetaTrader 4 and MetaTrader 5. With these features you can automate by using expert advisors (EAs) and copy trade (using Signals), making sure most of your bases are covered as far as trading styles are concerned.

BlackBull Markets excels in forex trading with advanced features like cTrader, TradingView for technical analysis, and social trading via Myfxbook, ZuluTrade, and BlackBull Social, offering a more comprehensive platform compared to ThinkMarkets.

BlackBull Markets is ideal for traders seeking superior platforms, including charting and social trading tools like TradingView and DupliTrade. While both brokers score 7, ThinkMarkets gains points for mobile capabilities and built-in Metatrader 4 and 5, which support automation and copy trading without third-party tools.

ThinkMarkets may not have specialised automation or social trading tools, but they do have a hero feature in ThinkTrader, their award-winning trading platform built for mobiles. We think this platform is a good option that will appeal to digital nomads who rely on Android or iOS to trade.

| BlackBull Markets | ThinkMarkets | |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Desktop | Yes | Yes |

| Web app | Yes | Yes |

| Mobile app | Yes | Yes |

| Other trading plarforms | BlackBull Shares BlackBull Trade | ThinkTraders (mobile) |

| Social trading | MetaTrader Signals with MT4. MT5 Myfxbook ZuluTrade BlackBull Social | MetaTrader Signals with MT4. MT5 |

| Copy trading | Possible with social trading | Possible with social trading |

| Automated trading | Expert Advisors with MT4, MT5 | Expert Advisors with MT4, MT5 |

| Our Trading Platform Score | 7 | 7 |

Our Better Trading Platform Verdict

For rendering a better trading platform, BlackBull Markets takes the stage in this category.

3. Superior Accounts And Features – BlackBull Markets

BlackBull Markets and ThinkMarkets use no dealing desk execution with STP. BlackBull Markets refers to its approach as ECN, but is debatable. Most likely, they use STP, connecting traders to a pool of liquidity providers for the best price.

The key difference lies in leverage. BlackBull Markets might be unregulated in Australia or major jurisdictions, but offers 500:1 leverage to all clients. Unless clients have a professional account, alternatively, ThinkMarkets provides 30:1 leverage in Australia, the UK, and Europe.

| Blackbull Markets | ThinkMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Another key difference is BlackBull Markets’ exceptional execution speed. We value fast execution to secure spreads at the order price since slippage can be positive or negative.

Due to poor execution speed, ThinkMarkets still provides a satisfactory trading experience, especially with its fast and seamless account opening. Both brokers offer Standard and RAW accounts, however, BlackBull Markets requires a higher minimum deposit for the RAW account.

| BlackBull Markets | ThinkMarkets | |

|---|---|---|

| Execution Type | STP, with no dealing desk and market execution | STP, with no dealing desk and market execution |

| Demo Account | Yes | Yes |

| Standard Account | ECN Standard | Standard |

| Commission Account | ECN Prime | ThinkZero |

| Fixed-spread Account | No | No |

| Swap-free Account | On request | On request |

| # of Base Currencies | 9 | 7 |

| Maximum Forex Leverage | 1:500 | 1:30 or 1:500 |

| Execution Speed | Limit Order 72 Market Order 90 | Limit Order 161 ms Market Order 248 ms |

| Our Ease Of Account Opening Score (out of 15) | 10 | 12 |

| Our Overall Trading Experience Score | 8 | 5 |

Our Superior Accounts and Features Verdict

BlackBull Markets’ superior accounts and features stands out and is highly commendable.

4. Best Trading Experience And Ease – ThinkMarkets

Trading success often depends on experience and ease of use. As a result of our research for BlackBull Markets and ThinkMarkets, we noticed crucial differences that could impact your decision.

- ThinkMarkets shines with its ThinkTrader app, which we’ve identified as the best trading app out there.

- BlackBull Markets offers impressive leverage, being one of the brokers with the highest leverage available.

- BlackBull also stands out when it comes to execution speed, being recognised for the fastest execution.

- For those keen on automation, it’s worth noting that while BlackBull Markets has commendable social trading options like Myfxbook and ZuluTrade, it doesn’t quite match up to the Capitalise.ai offerings from brokers like Pepperstone and Eightcap.

While BlackBull provides a wide range of assets and tools for traders’ convenience, ThinkMarkets, on the other hand, offers a user-friendly interface and robust app for a better seamless trading while mobile.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| BlackBull Markets | 72ms | 1/36 | 90ms | 5/36 |

| ThinkMarkets | 161ms | 25/36 | 248ms | 35/36 |

Our Best Trading Experience and Ease Verdict

ThinkMarkets takes the top spot owing this to their best trading experience and ease.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – ThinkMarkets

A broker with stronger trust and regulation are, simply, the most reputable and competitive in the industry of forex trading. These brokers ensure a secure and transparent trading environment for traders.

ThinkMarkets Trust Score

BlackBull Markets Trust Score

Regulations

Engaging with an online broker presents two types of risks:

- Market risk.

- trustworthiness and regulatory oversight.

The first on the list is inherent to trading CFDs, stocks, or forex, which can lead to substantial gains or losses based on market movement predictions.

The second on the list is related to the broker’s trustworthiness and regulatory oversight which also can be significantly mitigated by choosing a broker licensed by a Tier 1 regulator.

Regulators like the UK’s FCA and Australia’s ASIC enforce strict rules to protect customer funds and prevent fraud. ThinkMarkets stands out with strong oversight from multiple jurisdictions, ensuring a secure and trustworthy trading environment.

| BlackBull Markets | ThinkMarkets | |

|---|---|---|

| Tier 1 regulators* | FMA (New Zealand) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) |

| Tier 2 regulators | JFSA(Japan) DFSA (Dubai) | |

| Tier 3 regulators | FSA-S (Seychelles) | FSCA (South Africa) FSA-S (Seychelles) CIMA (Cayman) FSC-M (Mauritius) |

| Negative Balance Protection | Yes | Yes |

| Guaranteed Stop Loss | No | No |

| Scalping Allowed | Yes | Yes |

| Trust Score | 3 | 6 |

In terms of trust, regulation, and risk management, BlackBull Markets falls short despite its good reputation among active traders. Unlike BlackBull Markets, which lacks Tier 1 regulation, ThinkMarkets is regulated by top-tier authorities, including ASIC (Australia) and FCA (UK). This added layer of safety makes ThinkMarkets a more secure choice, especially for traders prioritising risk management and fund security.

With these results, we have given BlackBull Markets a score of 3, compared to ThinkMarkets score of 6 out of 10 for stronger trust and regulations.

Reviews

BlackBull Markets holds a Trustpilot rating of 4.8 out of 5 from over 2,300 reviews, with 90% of users awarding it 5 stars—a strong indicator of consistent customer satisfaction. ThinkMarkets, meanwhile, has a rating of 4.3 out of 5 based on around 645 reviews.

Our Stronger Trust and Regulation Verdict

Apparently, ThinkMarkets claims the title for having stronger trust and regulation.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

6. Most Popular Broker – BlackBull Markets

BlackBull Markets gets the same Google search as ThinkMarkets. On average, BlackBull Markets and ThinkMarkets receive about 18,100 branded searches each month.

| Country | BlackBull Markets | ThinkMarkets |

|---|---|---|

| Australia | 1,900 | 320 |

| New Zealand | 1,900 | 30 |

| United Kingdom | 1,600 | 590 |

| Germany | 1,600 | 260 |

| India | 1,300 | 720 |

| United States | 880 | 1,000 |

| South Africa | 720 | 880 |

| Canada | 590 | 170 |

| Spain | 480 | 260 |

| Mexico | 480 | 110 |

| Italy | 320 | 140 |

| Netherlands | 320 | 210 |

| Pakistan | 210 | 260 |

| Thailand | 210 | 390 |

| France | 210 | 590 |

| Austria | 210 | 70 |

| Nigeria | 170 | 260 |

| Malaysia | 170 | 170 |

| Colombia | 170 | 170 |

| Cyprus | 170 | 90 |

| Argentina | 170 | 90 |

| Poland | 170 | 90 |

| United Arab Emirates | 140 | 210 |

| Indonesia | 140 | 260 |

| Sweden | 140 | 70 |

| Switzerland | 140 | 50 |

| Kenya | 110 | 140 |

| Brazil | 110 | 320 |

| Singapore | 110 | 110 |

| Turkey | 90 | 170 |

| Morocco | 90 | 390 |

| Greece | 90 | 110 |

| Vietnam | 70 | 880 |

| Bangladesh | 70 | 90 |

| Sri Lanka | 70 | 20 |

| Ecuador | 70 | 40 |

| Portugal | 70 | 50 |

| Ireland | 70 | 30 |

| Algeria | 50 | 480 |

| Philippines | 50 | 90 |

| Japan | 50 | 720 |

| Ghana | 50 | 50 |

| Venezuela | 50 | 110 |

| Uganda | 50 | 30 |

| Peru | 50 | 50 |

| Chile | 50 | 40 |

| Egypt | 40 | 1,600 |

| Saudi Arabia | 40 | 140 |

| Dominican Republic | 40 | 90 |

| Hong Kong | 30 | 140 |

| Tanzania | 30 | 40 |

| Botswana | 30 | 20 |

| Bolivia | 30 | 10 |

| Uzbekistan | 30 | 70 |

| Taiwan | 20 | 480 |

| Ethiopia | 20 | 40 |

| Jordan | 10 | 40 |

| Cambodia | 10 | 20 |

| Mauritius | 10 | 10 |

| Costa Rica | 10 | 10 |

| Panama | 10 | 10 |

| Mongolia | 10 | 10 |

1,900 1st | |

320 2nd | |

1,600 3rd | |

590 4th | |

880 5th | |

1,000 6th | |

480 7th | |

110 8th |

Similarweb shows a different story when it comes to February 2024 website visits with BlackBull Markets receiving 415,000 visits vs. 283,000 for ThinkMarkets.

Our Most Popular Broker Verdict

BlackBull Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Top Product Range And CFD Markets – A Tie

In our analysis of both brokers, BlackBull Markets shines with its vast selection of Share CFDs, while ThinkMarkets offers a diverse range of Cryptocurrency pairs and ETFs, catering to the needs of crypto traders and allowing more diversified portfolios.

| BlackBull Markets | ThinkMarkets | |

|---|---|---|

| Forex trading | 67 | 43 |

| Cryptocurrency trading | 16 | 19 |

| Share CFD trading | 26,000+ | 3670 |

| Commodities CFD trading | 9 metals 5 Energies 8 Softs | 4 Metals (3 x Golds) (3 x Silver) 3 Energies |

| ETF CFD trading | 7 | 352 |

| Indices CFD trading | 12 | 16 |

| Bonds/Treasuries CFD trading | 0 | 0 |

| Real Stocks | Yes (selected countries) | 0 |

| Other Products | No | Spread Betting (UK) |

| Our Product Score | 7 | 7 |

BlackBull Markets offers 67 forex pairs and over 26,000 CFDs, far exceeding ThinkMarkets’ 46 pairs and 3,670 CFDs. This includes more than 26,000 shares as CFDs and equities.

However, ThinkMarkets has more ETFs, indices, and offers Spread Betting for UK clients.

Our Top Product Range and CFD Markets Verdict

For having a top product range and CFD markets, both BlackBull Markets and ThinkMarkets are in a draw.

8. Superior Educational Resources – ThinkMarkets

Continuous learning is essential in trading, and both BlackBull Markets and ThinkMarkets provide various educational resources to support traders at every level. Here’s a breakdown of what each broker brings to the table:

- BlackBull Markets:

- Offers comprehensive webinars covering various trading topics.

- Features in-depth articles and tutorials for beginners and advanced traders alike.

- Provides a dedicated section for market analysis and insights.

- ThinkMarkets:

- Boasts an extensive library of video tutorials catering to traders of all experience levels.

- Provides regular market news updates and analysis.

- Offers detailed eBooks and trading guides to deepen one’s trading knowledge.

It’s important to consider the quality, depth, and accessibility of these resources and both brokers have made efforts to educate their users. Thanks to our research, we see that ThinkMarkets has a slight edge in the variety and depth of its educational content

Our Superior Educational Resources Verdict

ThinkMarkets comes out on top for their superior education resources.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

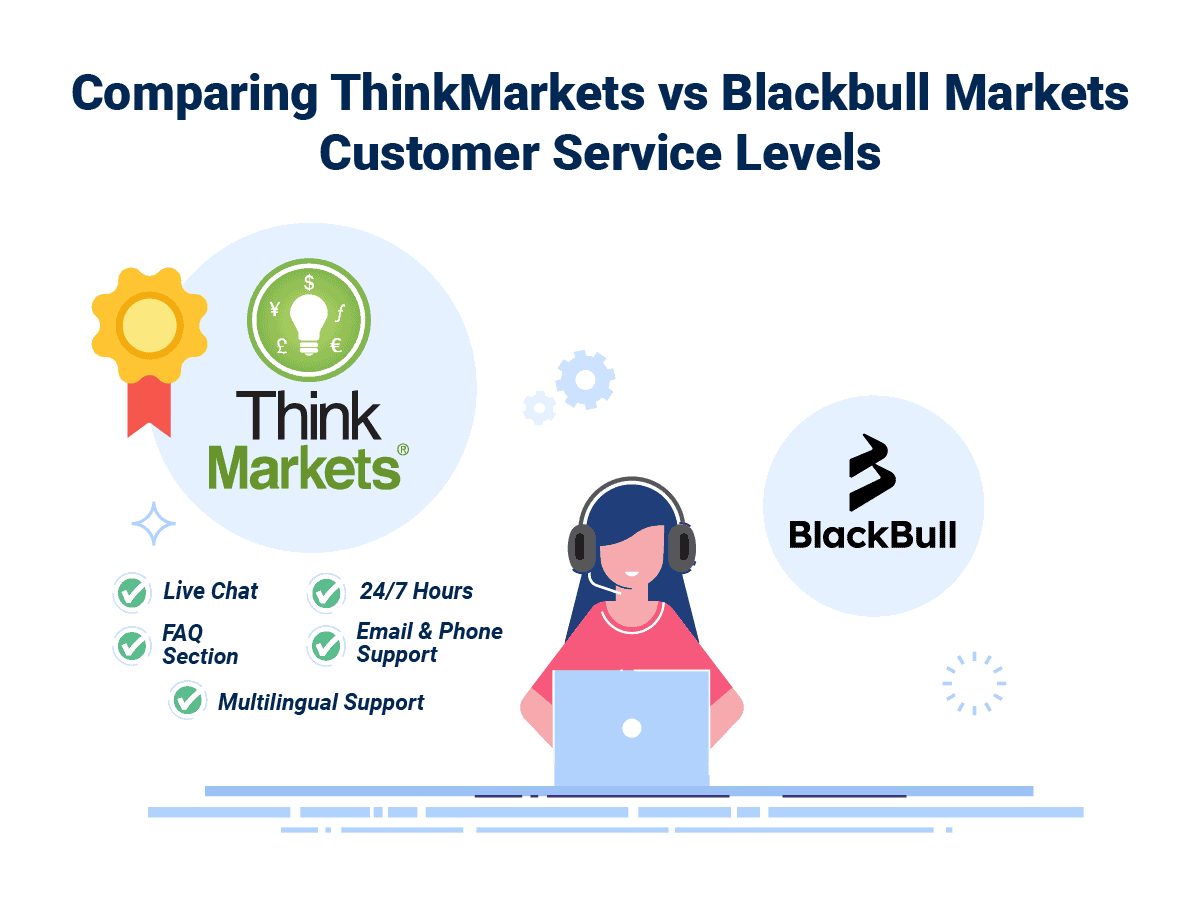

9. Superior Customer Service – ThinkMarkets

Availability and quality of educational resources, customer service responsiveness, and funding methods are key factors that shape the overall customer experience. These features provide a valuable, straightforward, and hassle-free process.

In our comparison, ThinkMarkets stands out with one key feature: 24/7 customer support, showing a strong commitment to a positive user experience around the clock.

| BlackBull Markets | ThinkMarkets | |

|---|---|---|

| Education and research tools provided | Yes 5/10 | Yes (7/10) |

| Customer Support - Live chat (bot, human) | Bot, Human | Bot, Human |

| Funding methods | Bank Transfer Credit/Debit Cards (Visa and Mastercard) Fasapay UnionPay NETELLER Discover Skrill AstroPay Interact Crypto Poli | Bank Transfer Credit/Debit Cards (Visa and Mastercard) BitPay Skrill NETELLER BPay POLi |

| Customer Support | 24/6 | 24/7 |

| Customer Service Score | 6 | 6 |

| Funding methods | 8 | 8 |

Both companies could improve their onboarding and educational resources by adding diverse options like in-house analysts, topical webinars, and more how-to guides for beginner traders.

During our testing, we had a few questions for customer service and were impressed by ThinkMarkets’ 24/7 support, truly embodying the phrase “money never sleeps.” We also found out that ThinkMarkets’ comprehensive set of resources were easier for us to access during our testing.

Read about Justin Grossbard, Head of Research at CompareForexBrokers, and his experiences opening accounts with various brokers, along with the data science behind how he scores each experience.

Our Superior Customer Service Verdict

ThinkMarkets takes the lead due to their superior customer service.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

10. Better Funding Options – ThinkMarkets

Both BlackBull Markets and ThinkMarkets offer a variety of funding options to serve their global clients, ensuring easy deposits and withdrawals. Our research reveals that while both brokers have their strengths, there are key differences in their offerings.

ThinkMarkets provides a wider range of local payment methods tailored to different countries. In contrast, BlackBull Markets focuses more on universally accepted methods, ensuring seamless transactions for clients worldwide.

And to get a clearer picture, let’s delve into a comparative table showcasing the funding options available for each broker:

| Funding Option | BlackBull Markets | ThinkMarkets |

|---|---|---|

| Bank Wire Transfer | Yes | Yes |

| Credit/Debit Card | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| UnionPay | Yes | No |

| FasaPay | No | Yes |

| Bitcoin | No | Yes |

| Local Bank Transfer | Yes | Yes |

| Other Methods | No | Yes |

Our Better Funding Options Verdict

ThinkMarkets wins this distinction due to their better funding options and comprehensive range of methods.

ThinkMarkets ReviewVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

BlackBull Markets and ThinkMarkets have a similar minimum deposit requirement of $0. ThinkMarkets does provide a slightly better funding experience with its flexible payment options, as seen below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 | $0 | €0 | $0 |

| Paypal | £0 | $0 | €0 | $0 |

| Bank Wire | £0 | $0 | €0 | $0 |

| Skrill | £0 | $0 | €0 | $0 |

BlackBull Markets

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £50 | $50 | €50 | $50 |

| Bank Wire | £0 | $0 | €0 | $0 |

| Skrill | £50 | $50 | €50 | $50 |

| Neteller | £50 | $50 | €50 | $50 |

Our Lower Minimum Deposit Verdict

BlackBull Markets and ThinkMarkets are both in a tie owing this to their lower minimum deposits.

So Is ThinkMarkets or BlackBull Markets The Best Broker?

ThinkMarkets marginal surpasses because of a majority of advantages in key areas compared to BlackBull Markets. The table below summarises the key information leading to this verdict.

| Criteria | BlackBull Markets | ThinkMarkets |

|---|---|---|

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Top Product Range And CFD Markets | Yes | Yes |

| Lowest Spreads And Fees | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

ThinkMarkets: Best For Beginner Traders

ThinkMarkets is better suited for beginner traders due to its comprehensive educational resources and user-friendly platform.

BlackBull Markets: Best For Experienced Traders

BlackBull Markets is the preferred choice for experienced traders because of its advanced trading platform and features.

FAQs Comparing BlackBull Markets Vs ThinkMarkets

Does ThinkMarkets or BlackBull Markets Have Lower Costs?

ThinkMarkets generally offers lower costs compared to BlackBull Markets. They have been recognised for their competitive spreads and low commission rates. For instance, traders can benefit from spreads as low as 0.1 pips on major currency pairs. For more detailed insights on low commissions, you can visit this comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both ThinkMarkets and BlackBull Markets offer MetaTrader 4, but ThinkMarkets is often preferred for its enhanced MT4 features and tools. They provide a seamless trading experience with custom indicators and advanced charting capabilities. If you’re keen on exploring more about the best MT4 brokers, check out this detailed review of top MT4 brokers.

Which Broker Offers Social Trading?

ThinkMarkets provides options for social trading, allowing traders to mimic strategies of successful traders. This feature is especially beneficial for beginners looking to gain insights and learn from seasoned professionals. For a deeper dive into the world of social and copy trading, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither ThinkMarkets nor BlackBull Markets offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK and some other regions, and not all brokers provide this service. If you’re specifically interested in spread betting, you might want to explore other brokers. For a comprehensive list of the best spread betting brokers, you can check out this detailed guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, ThinkMarkets has a slight edge for Australian forex traders. Both brokers are ASIC regulated, which ensures a high level of trust and security for traders. However, ThinkMarkets was founded in Australia, giving it a home advantage and a deeper understanding of the local market. BlackBull Markets, on the other hand, is based overseas. For a broader perspective on the best brokers in Australia, here’s a comprehensive review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe ThinkMarkets stands out. Both brokers are FCA regulated, ensuring a high standard of conduct and protection for UK traders. However, ThinkMarkets has established a strong presence in the UK market, offering tailored services and features for UK traders. BlackBull Markets, while offering competitive services, is not primarily based in the UK. For more insights on the best brokers in the UK, you can visit this detailed guide on the tBest Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert