BlackBull Markets vs FXTM: Which One Is Best?

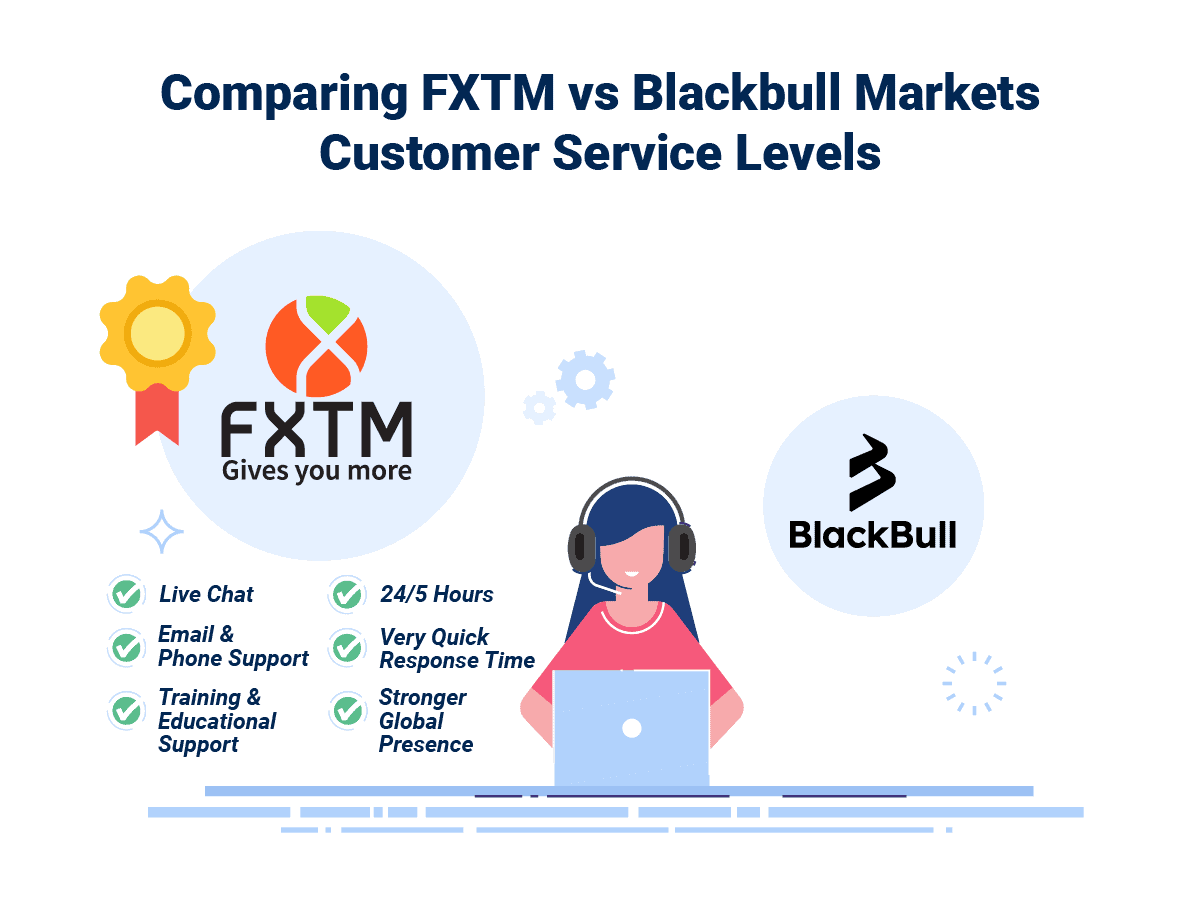

We reviewed Blackbull Markets vs FXTM and found that both have spreads from 0 pips with MetaTrader 4 and 5. BlackBull has better social trading and fast execution speed, while FXTM has a micro lot trading and low commissions. See how each broker compares.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert